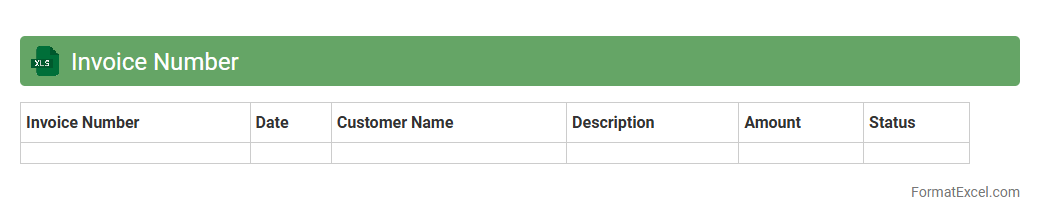

Invoice Number

An

Invoice Number Excel document is a spreadsheet used to systematically record and track invoice numbers for financial transactions. It helps businesses maintain organized billing records, ensuring easy retrieval and verification of invoices for accounting and auditing purposes. By using this document, companies can improve payment tracking, reduce errors, and enhance overall financial management efficiency.

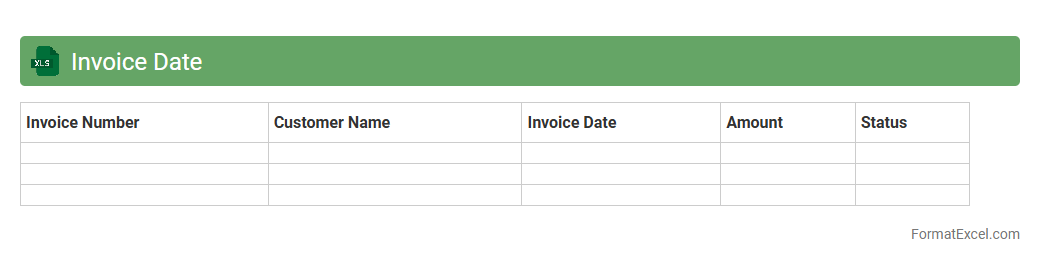

Invoice Date

The

Invoice Date in an Excel document refers to the specific date when an invoice is issued, providing a critical timestamp for financial transactions and accounting records. This date helps businesses track payment deadlines, manage cash flow, and organize billing cycles effectively. Utilizing the Invoice Date in Excel enables improved accuracy in financial reporting and streamlined accounts receivable processes.

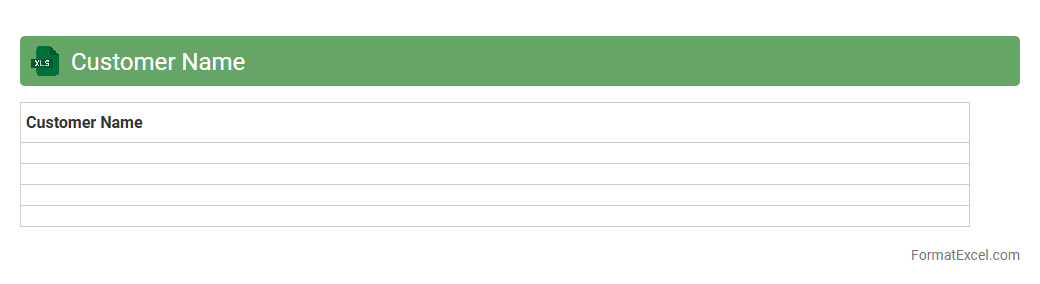

Customer Name

A

Customer Name Excel document is a spreadsheet that organizes and stores detailed information about customers, such as names, contact details, purchase history, and preferences. This document is useful for businesses to efficiently manage customer data, streamline communication, and enhance marketing strategies through targeted campaigns. By maintaining accurate and accessible customer records, companies can improve customer relationship management and drive sales growth.

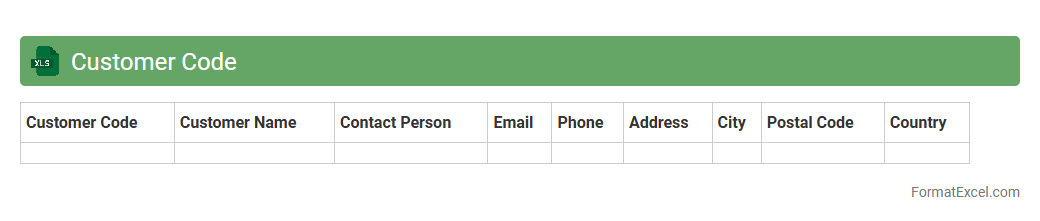

Customer Code

A

Customer Code Excel document is a spreadsheet that organizes and stores unique identifiers assigned to customers, facilitating efficient tracking and management of customer data. It streamlines processes such as order processing, customer service, and marketing analysis by enabling quick lookup and segmentation. This tool enhances data accuracy and supports better decision-making through centralized and easily accessible customer information.

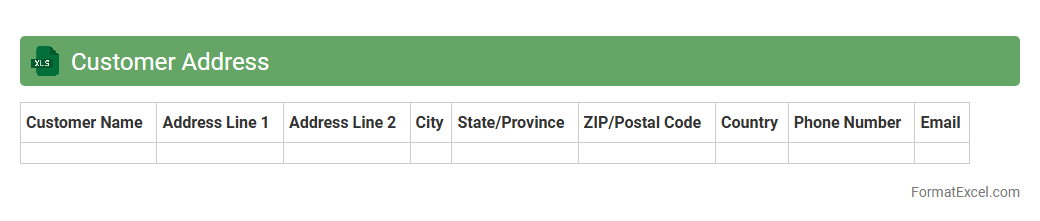

Customer Address

A

Customer Address Excel document is a structured spreadsheet that organizes customer contact information, including names, street addresses, cities, states, and postal codes. This document is essential for efficient customer relationship management, enabling easy access to shipping details, targeted marketing campaigns, and accurate invoice distribution. Maintaining an up-to-date address database enhances communication, reduces delivery errors, and improves overall business operations.

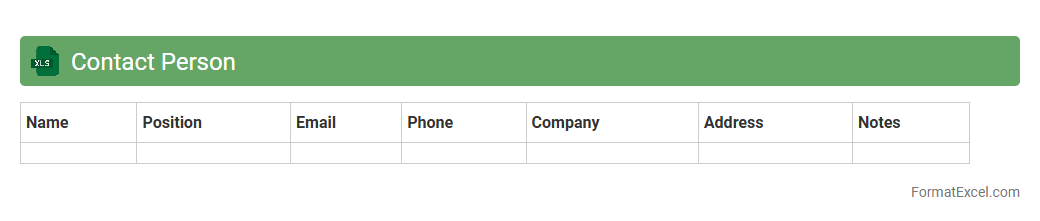

Contact Person

A

Contact Person Excel document is a structured spreadsheet designed to store and organize essential contact details such as names, phone numbers, email addresses, and company affiliations. It enhances communication efficiency by providing quick access to vital information, facilitating networking, and streamlining follow-ups. This tool is especially valuable for businesses, event coordinators, and customer service teams to maintain accurate and accessible contact records.

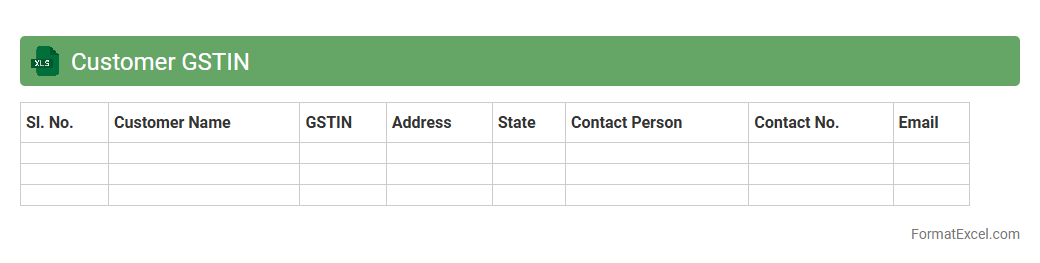

Customer GSTIN

A

Customer GSTIN Excel document is a spreadsheet that contains the Goods and Services Tax Identification Numbers (GSTIN) of customers, along with their associated details such as names, addresses, and contact information. This document is essential for businesses to accurately track and manage tax compliance, streamline invoice generation, and ensure smooth reporting to tax authorities. Maintaining this organized record aids in easy verification during audits and helps prevent errors in GST filings.

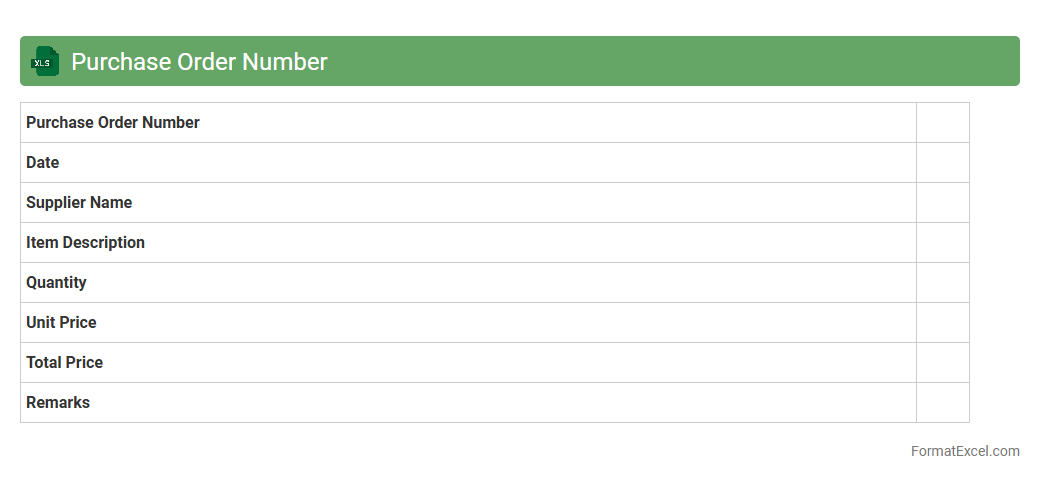

Purchase Order Number

A

Purchase Order Number Excel document is a structured spreadsheet designed to track and organize purchase order numbers systematically, facilitating easy reference and management of procurement transactions. This document enhances operational efficiency by allowing businesses to monitor order status, streamline communication with suppliers, and ensure accurate financial record-keeping. Using a Purchase Order Number Excel sheet minimizes errors and supports audit compliance by maintaining a clear and accessible log of all purchase orders.

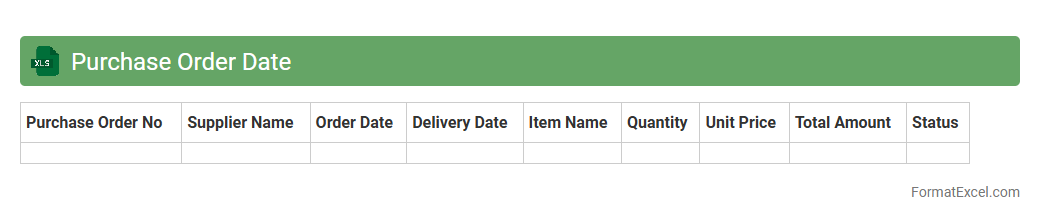

Purchase Order Date

A

Purchase Order Date Excel document records the specific dates when purchase orders are issued, enabling efficient tracking and management of procurement timelines. It helps businesses monitor order processing, ensure timely deliveries, and align inventory levels with demand. This structured data supports financial auditing, supplier performance analysis, and enhances overall operational efficiency.

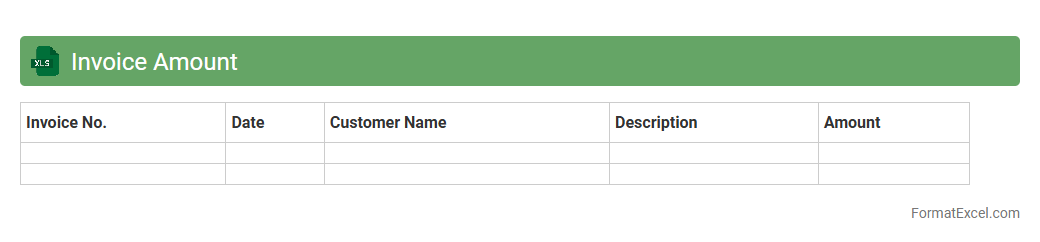

Invoice Amount

An

Invoice Amount Excel document is a spreadsheet that tracks the total amounts billed for goods or services in a structured format. It helps businesses monitor outstanding payments, analyze cash flow, and maintain accurate financial records for budgeting and auditing purposes. By consolidating invoice data, it streamlines accounting processes and improves financial decision-making.

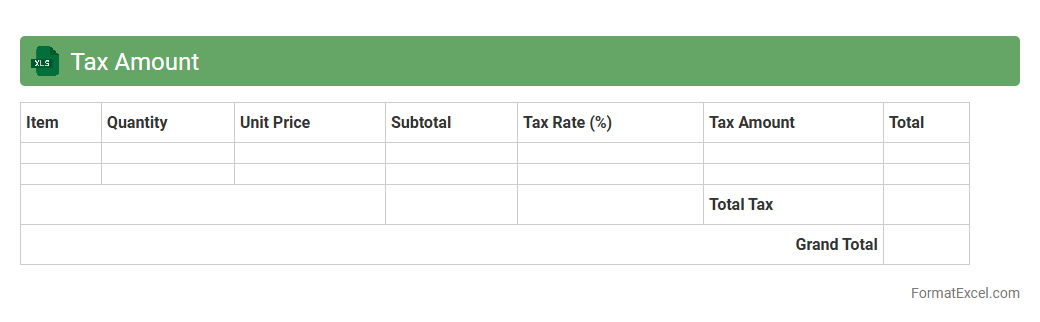

Tax Amount

The

Tax Amount Excel document is a spreadsheet tool designed to calculate, organize, and track tax liabilities based on income, expenses, and applicable tax rates. It streamlines complex tax computations, ensuring accuracy and compliance with tax regulations, which saves time during tax preparation and filing. This document is essential for individuals and businesses to monitor their tax obligations, plan budgets effectively, and maintain clear financial records for audits or reviews.

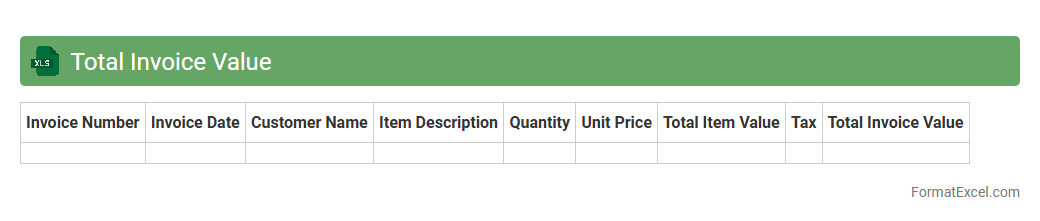

Total Invoice Value

The

Total Invoice Value Excel document consolidates all invoice amounts into a single, easy-to-read spreadsheet, enabling efficient tracking of payments and outstanding balances. It helps businesses monitor cash flow, analyze sales performance, and ensure accurate financial reporting. By organizing invoice data systematically, it reduces errors and streamlines the billing process.

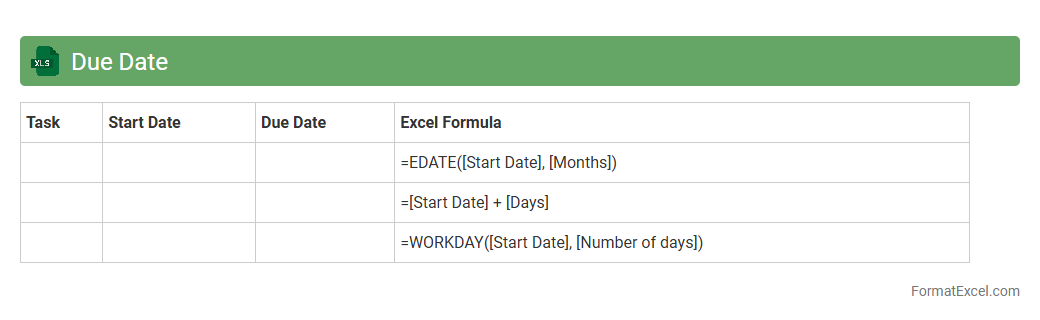

Due Date

A

Due Date Excel document is a spreadsheet designed to track deadlines for tasks, projects, or payments, helping users organize and prioritize their responsibilities effectively. It allows for automatic calculations, reminders, and sorting based on due dates to enhance time management and ensure timely completion. Businesses and individuals use these documents to streamline workflow, reduce the risk of missed deadlines, and improve overall productivity.

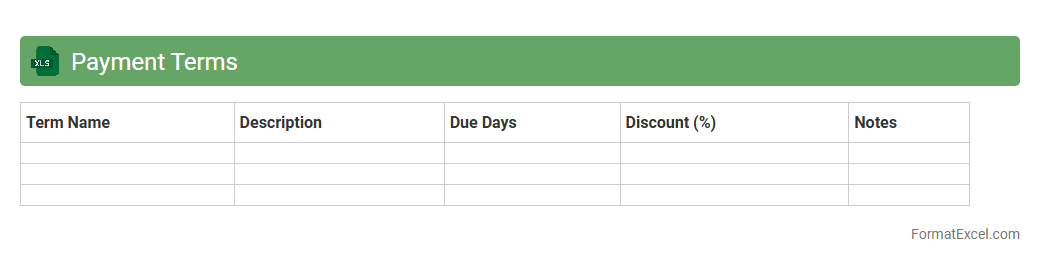

Payment Terms

A

Payment Terms Excel document is a spreadsheet used to outline and manage the conditions under which payments must be made between buyers and sellers, detailing due dates, discounts, penalties, and installment schedules. This document enhances financial planning by providing clear timelines and facilitating efficient cash flow management, minimizing payment disputes and delays. Organizations use it to track outstanding invoices and ensure compliance with agreed payment conditions, improving overall accounts receivable and payable processes.

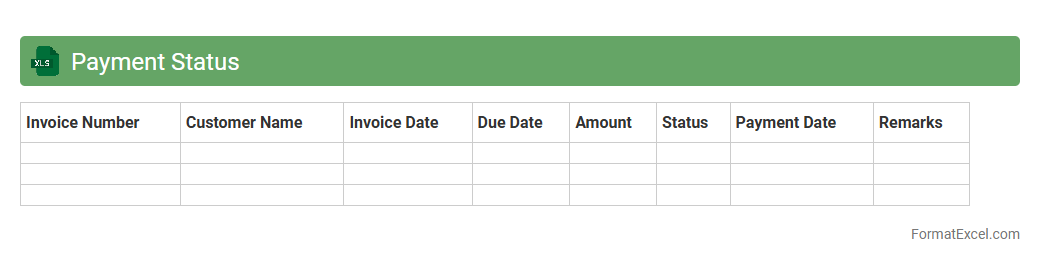

Payment Status

A

Payment Status Excel document is a digital spreadsheet used to track and manage payments, including amounts, dates, and payment methods. It enables businesses and individuals to monitor outstanding invoices, ensure timely payments, and maintain organized financial records. This tool enhances transparency and efficiency in financial management by providing a clear overview of payment statuses at a glance.

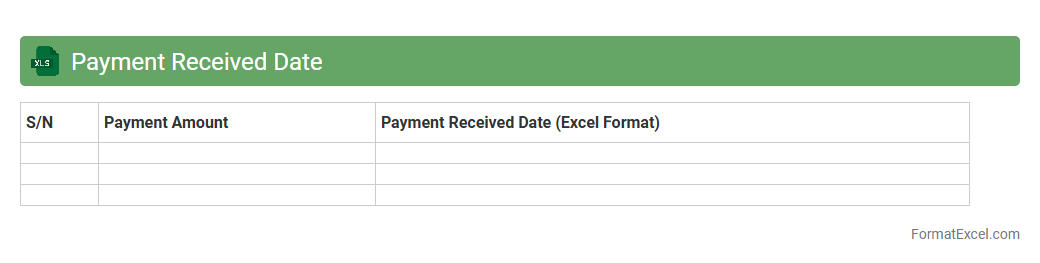

Payment Received Date

The

Payment Received Date Excel document tracks the exact dates when payments are received, enabling efficient monitoring of cash flow and outstanding balances. It helps businesses reconcile accounts, manage invoicing timelines, and improve financial reporting accuracy. Using this document ensures timely follow-up on late payments and supports strategic decision-making based on payment trends.

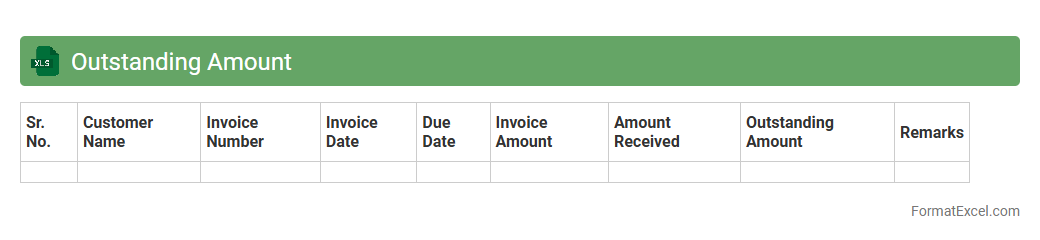

Outstanding Amount

An

Outstanding Amount Excel document tracks unpaid balances and pending invoices for individuals or businesses, providing a clear overview of financial obligations. It helps in timely follow-ups on payments, improving cash flow management and avoiding overdue accounts. By organizing outstanding amounts systematically, it enhances financial transparency and aids in accurate budgeting and forecasting.

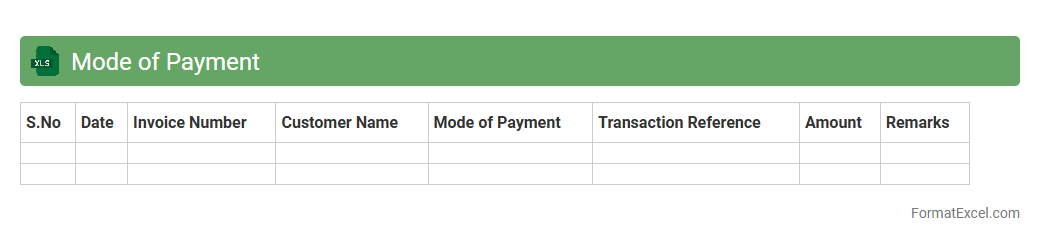

Mode of Payment

A

Mode of Payment Excel document is a structured file used to record, track, and analyze various payment methods such as cash, credit card, bank transfer, and mobile payments. It helps businesses maintain accurate financial records, streamline transaction processing, and enhance budgeting by categorizing payments efficiently. This tool provides valuable insights into cash flow and payment trends, supporting better financial decision-making and reporting.

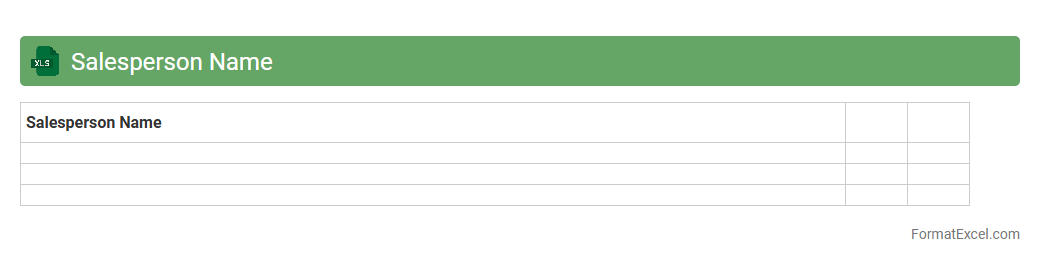

Salesperson Name

The

Salesperson Name Excel document is a structured spreadsheet designed to organize and track sales personnel details, such as names, contact information, and sales performance metrics. This document enhances sales management by enabling easy analysis, comparison, and performance monitoring of individual sales representatives. Using this tool improves team accountability, supports strategic decision-making, and helps optimize sales efforts for higher revenue generation.

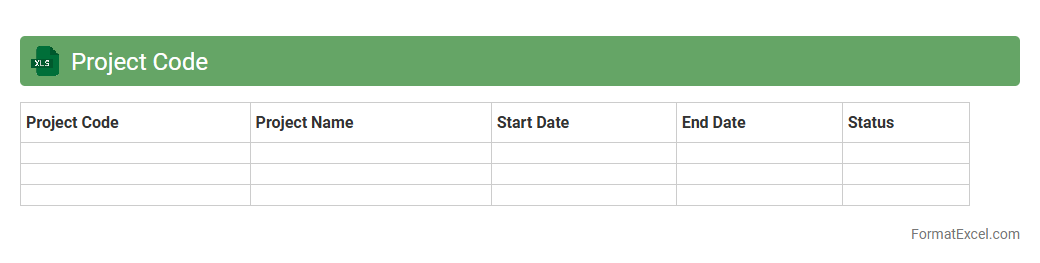

Project Code

The

Project Code Excel document is a structured spreadsheet that organizes project identifiers, timelines, budgets, and milestones in a centralized format. It streamlines project tracking by allowing easy access to key data, enabling efficient monitoring and reporting throughout the project lifecycle. Using this document improves collaboration, reduces errors, and enhances decision-making by providing clear visibility into project progress and status.

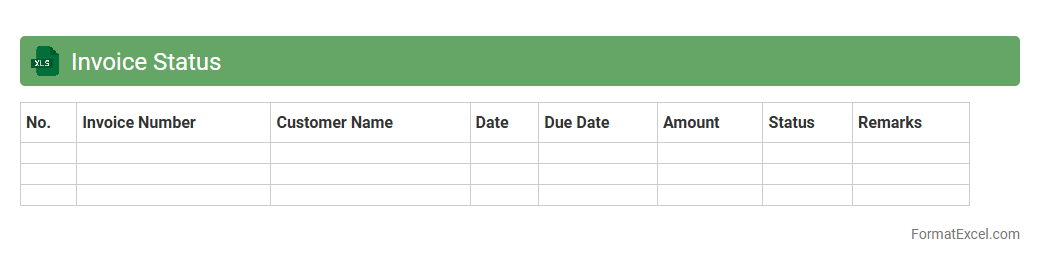

Invoice Status

The

Invoice Status Excel document is a spreadsheet designed to track and manage the payment status of invoices, including details such as due dates, amounts, and client information. It helps businesses monitor outstanding payments, identify overdue invoices, and maintain accurate financial records for better cash flow management. This tool streamlines the invoicing process, enabling timely follow-ups and improved financial organization.

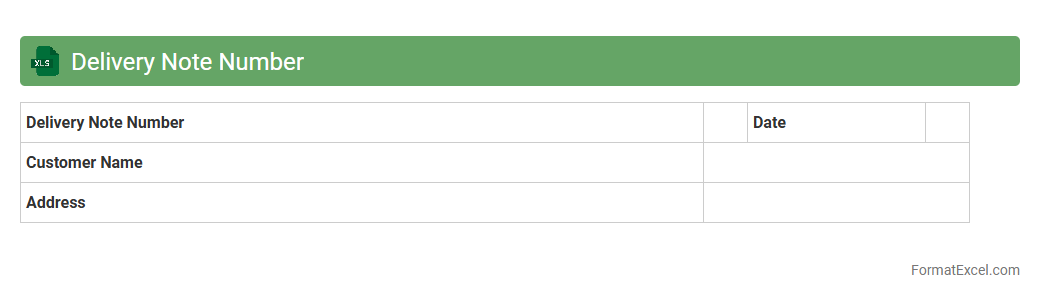

Delivery Note Number

A

Delivery Note Number Excel document is a digital record used to track shipment details by assigning unique numbers to each delivery note for easy reference and verification. This document streamlines order fulfillment processes and ensures accurate inventory management by providing a clear audit trail of shipments. It helps businesses maintain organized records, reduce errors, and improve customer service efficiency.

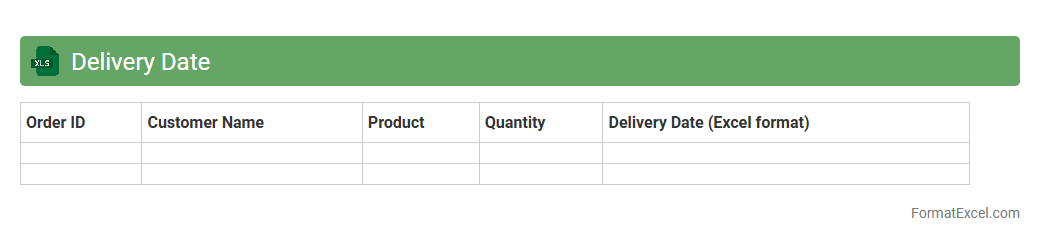

Delivery Date

The

Delivery Date Excel document is a structured spreadsheet used to track and manage shipment schedules, ensuring timely order fulfillment. It helps businesses monitor expected delivery times, reduce delays, and optimize supply chain efficiency by providing clear visibility into order timelines. This tool is essential for improving customer satisfaction and maintaining smooth operational workflows.

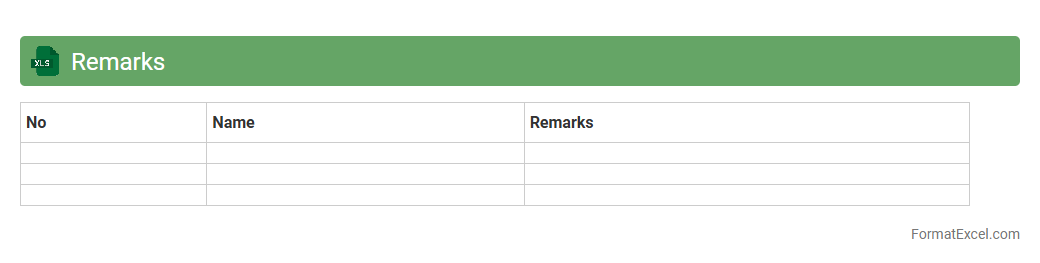

Remarks

A

Remarks Excel document is a spreadsheet specifically designed to record comments, observations, or feedback related to data entries, projects, or tasks. It helps organize and track qualitative information alongside quantitative data, enhancing clarity and facilitating efficient communication within teams or between stakeholders. This document proves useful for maintaining detailed records, ensuring accountability, and supporting data-driven decision-making processes.

Currency

A

Currency Excel document is a spreadsheet designed to manage, track, and analyze foreign exchange rates and currency conversions efficiently. It allows users to perform real-time currency calculations, monitor fluctuations, and automate financial reporting for multinational transactions. This tool is essential for businesses and individuals dealing with international finance, ensuring accuracy and saving time in currency management.

Introduction to Invoice Register Format in Excel

An invoice register in Excel is a systematic way to record and manage invoices efficiently. It helps businesses track payments, due dates, and invoice statuses with ease. Using Excel makes it customizable and accessible for various business sizes.

Importance of Maintaining an Invoice Register

Maintaining an invoice register ensures accurate financial records and timely payment tracking. It helps avoid missed payments and improves cash flow management. A well-organized invoice register acts as a reliable reference for audits and financial analysis.

Key Components of an Invoice Register

Essential components include invoice number, date, client details, amount, payment status, and due date. These key elements help maintain clarity and streamline invoice tracking. Proper detailing reduces errors and improves data accuracy.

Setting Up the Excel Spreadsheet

Start by creating columns for each critical invoice detail, using clear headers for easy understanding. Use Excel's formatting tools to enhance visibility and navigation. Structuring the spreadsheet effectively sets the foundation for efficient invoice management.

Essential Columns for Invoice Tracking

Typical columns include Invoice ID, Date Issued, Client Name, Amount, Tax, Total, Payment Status, and Due Date. Each column plays a role in providing a comprehensive overview of invoices. Including a comments section can capture additional important details.

Sample Invoice Register Template in Excel

A sample template offers a practical layout featuring all necessary columns and calculated fields for totals. Utilizing templates saves time and ensures consistency across invoice records. Templates often incorporate formulas to automate calculations like tax and balance.

Step-by-Step Guide to Creating the Register

Begin by entering headers and formatting cells, followed by inputting invoice information row by row. Next, add formulas for totals and payment status updates. Regularly updating the register ensures accurate and current data for decision-making.

Tips for Automating Calculations and Totals

Use Excel formulas like SUM, IF, and VLOOKUP to automate totals and status updates. Conditional formatting can highlight overdue invoices for quick attention. Automation reduces manual errors and enhances register efficiency.

Common Mistakes to Avoid in Invoice Registers

Avoid duplicate entries and incorrect data input, which compromise register integrity. Neglecting to update payment statuses leads to inaccurate financial tracking. Consistent data validation helps prevent these common errors.

Best Practices for Managing Invoice Data in Excel

Regularly back up the register and use data validation to ensure accuracy. Keep the register organized by sorting and filtering based on payment status or due dates. Applying these best practices optimizes invoice management and reporting quality.