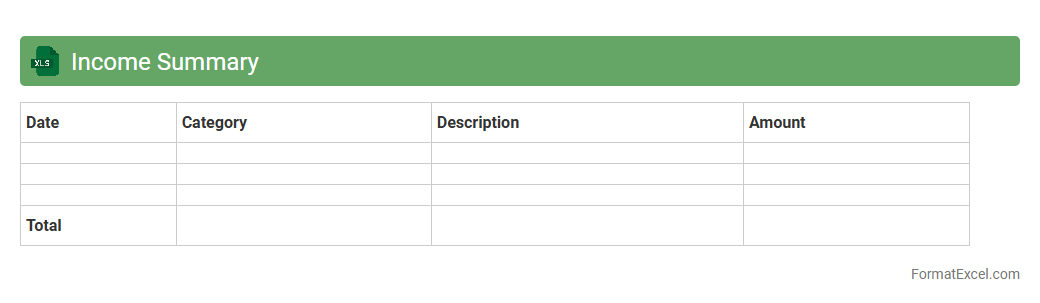

Income Summary

An

Income Summary Excel document is a financial tool used to compile and analyze revenue and expense data over a specific period, helping businesses track net income efficiently. It consolidates income statements into an organized format, allowing users to review profitability, identify trends, and make informed budgeting decisions. Utilizing this document enhances financial transparency and supports strategic planning by presenting clear summaries of earned income and incurred costs.

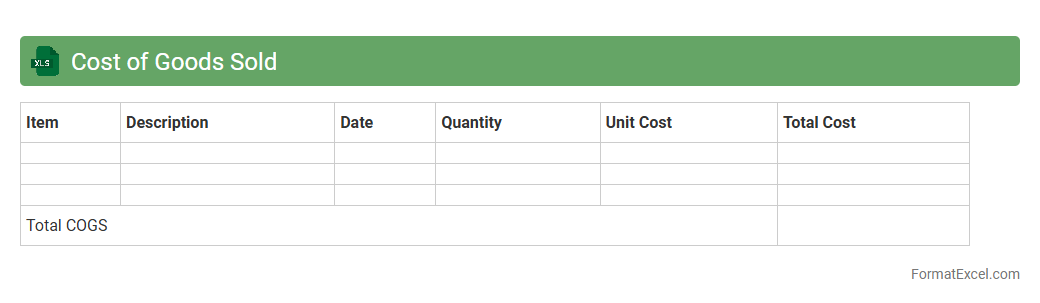

Cost of Goods Sold

A

Cost of Goods Sold (COGS) Excel document is a financial tool that helps calculate the direct costs associated with producing goods sold by a company, including materials and labor. This document is essential for businesses to track expenses accurately, manage inventory, and determine gross profit margins. Using a COGS Excel sheet allows for efficient data organization, easy updates, and clear financial analysis to support better decision-making.

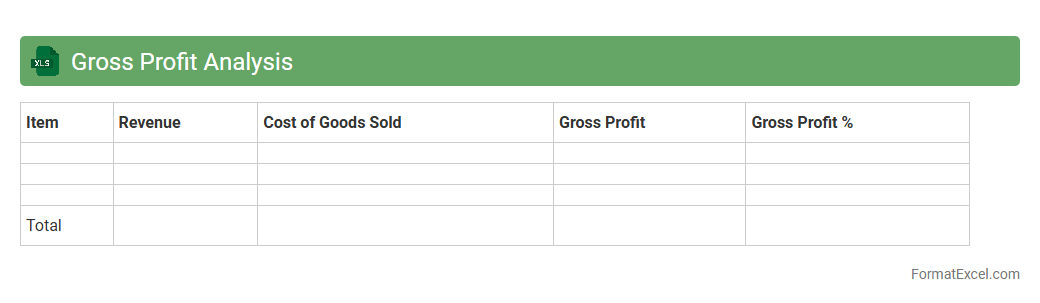

Gross Profit Analysis

A

Gross Profit Analysis Excel document calculates the difference between total revenue and cost of goods sold, providing a clear view of a company's profitability. It helps identify trends in profit margins, enabling better pricing strategies and cost control. Businesses use this analysis to make informed financial decisions and improve overall operational efficiency.

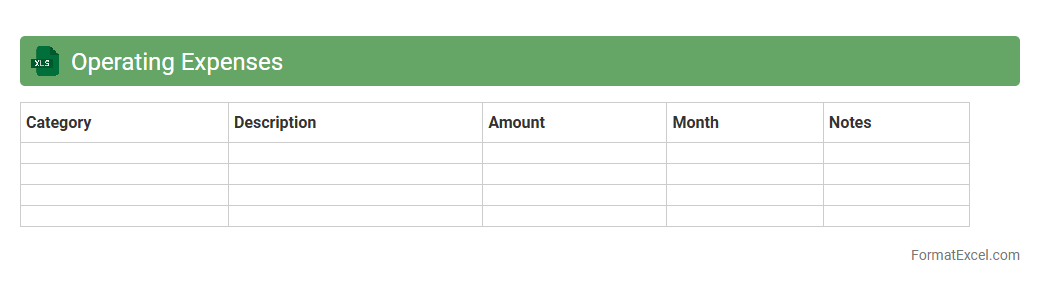

Operating Expenses

An

Operating Expenses Excel document is a financial tool designed to track and analyze the costs associated with running a business, such as rent, utilities, salaries, and supplies. It helps organizations maintain budget control and identify areas for cost reduction by providing clear, organized data that can be easily updated and reviewed. Using this document enhances decision-making and financial planning by offering accurate insights into ongoing operational expenditures.

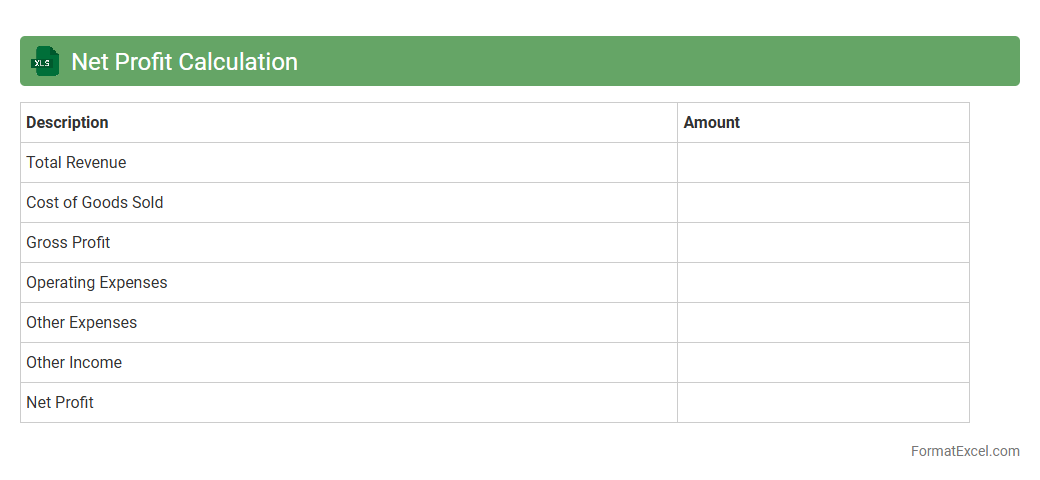

Net Profit Calculation

A

Net Profit Calculation Excel document is a spreadsheet tool designed to accurately compute the net profit of a business by subtracting total expenses from total revenue. It helps financial analysts and business owners track profitability, analyze cost efficiency, and make informed decisions to improve financial performance. Utilizing this Excel document streamlines data entry, automates calculations, and provides clear visual summaries for effective financial management.

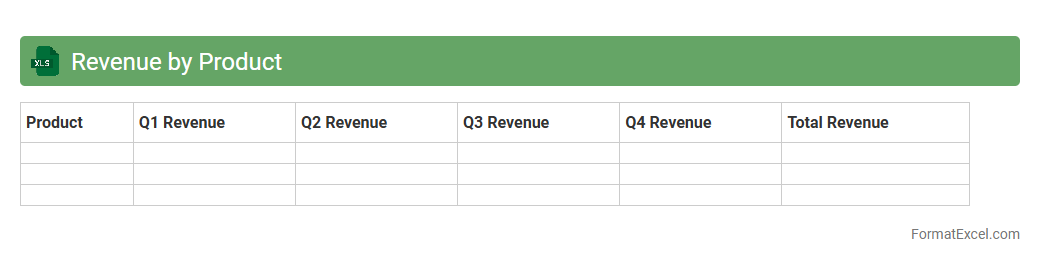

Revenue by Product

The

Revenue by Product Excel document is a detailed spreadsheet that tracks and analyzes sales revenue generated from each product offered by a business. It helps in identifying top-performing products, detecting sales trends, and informing inventory or marketing strategies to maximize profitability. This document serves as a critical tool for financial planning, performance evaluation, and strategic decision-making within a company.

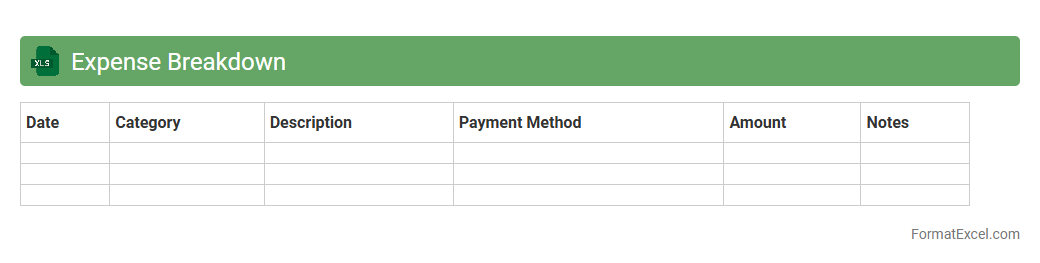

Expense Breakdown

An

Expense Breakdown Excel document is a detailed spreadsheet that categorizes and tracks all expenses, enabling clear visibility into spending patterns. It allows users to organize costs by categories such as utilities, rent, salaries, and supplies, facilitating budget management and financial analysis. This tool is essential for identifying areas of overspending, optimizing resource allocation, and ensuring accurate financial reporting.

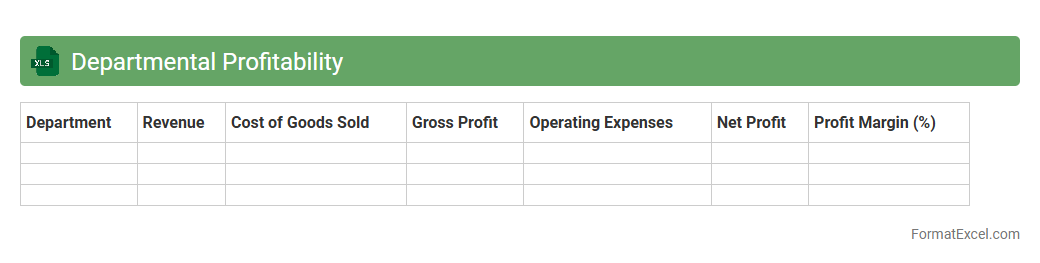

Departmental Profitability

The

Departmental Profitability Excel document is a financial tool designed to analyze and track the revenues, costs, and profits of individual departments within an organization. It enables precise identification of high-performing and underperforming units, facilitating informed decision-making and resource allocation. Using this document helps improve overall business efficiency by highlighting areas for cost reduction and revenue enhancement at the departmental level.

Monthly Profit Trends

The

Monthly Profit Trends Excel document is a comprehensive tool designed to track and analyze profit fluctuations over time, offering visual charts and detailed data breakdowns. It enables businesses to identify patterns, monitor key financial metrics, and make data-driven decisions to improve profitability. By providing clear insights into revenue and expense trends, the document supports strategic planning and enhances financial forecasting accuracy.

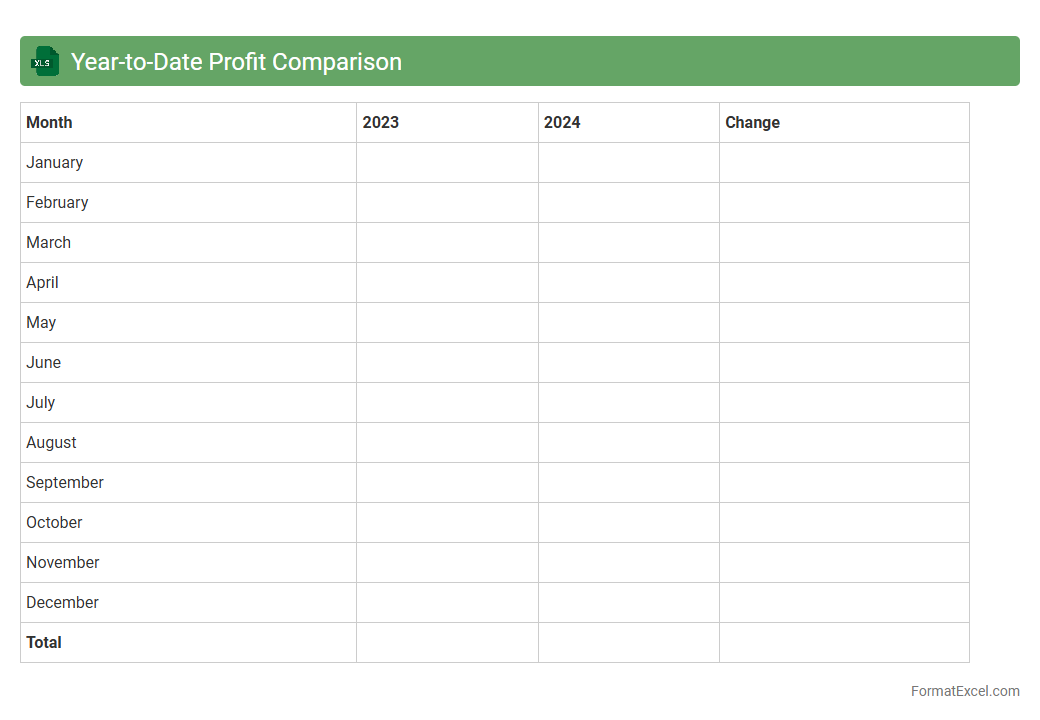

Year-to-Date Profit Comparison

A

Year-to-Date Profit Comparison Excel document tracks and compares profit figures from the beginning of the fiscal year to the current date across multiple periods. It allows businesses to analyze financial performance trends, identify growth patterns, and make informed budgeting decisions. This tool is essential for monitoring profitability, forecasting future earnings, and optimizing resource allocation effectively.

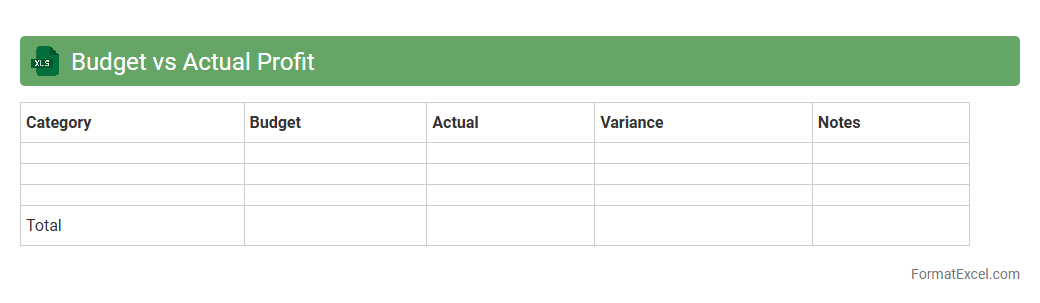

Budget vs Actual Profit

The

Budget vs Actual Profit Excel document is a financial tool that compares projected earnings with actual profits over a specific period. It allows businesses to identify variances, analyze performance against financial goals, and make informed decisions to optimize budgeting and profitability. This document enhances financial accuracy and accountability, driving strategic planning and resource allocation.

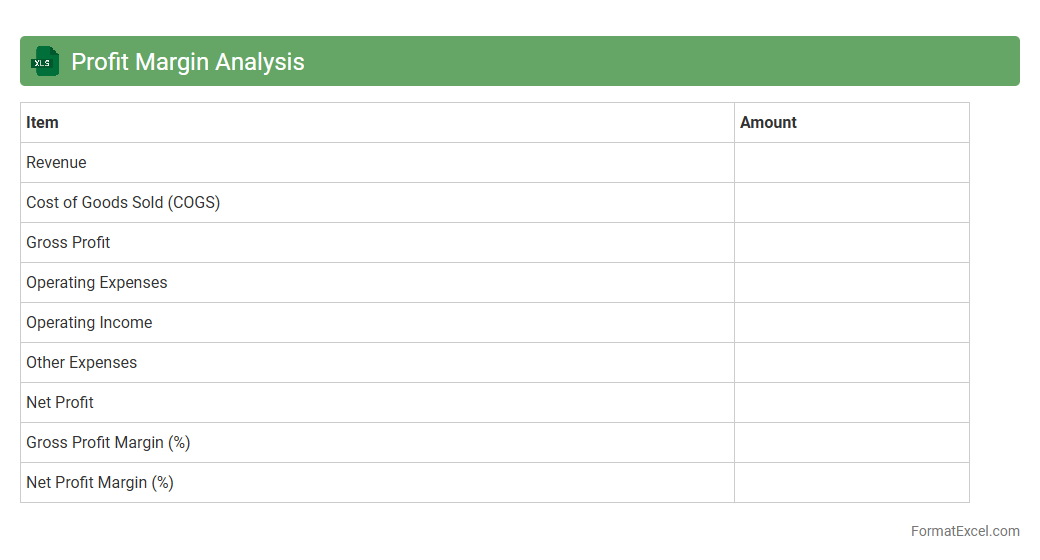

Profit Margin Analysis

Profit Margin Analysis Excel document is a powerful tool designed to calculate and visualize profit margins across different products, services, or business units, enabling precise financial performance evaluation. It helps businesses identify profitable areas, control costs, and make informed decisions to enhance overall profitability by providing clear insights into gross, operating, and net profit margins. Using this

Profit Margin Analysis tool, companies can optimize pricing strategies, improve resource allocation, and drive sustainable growth.

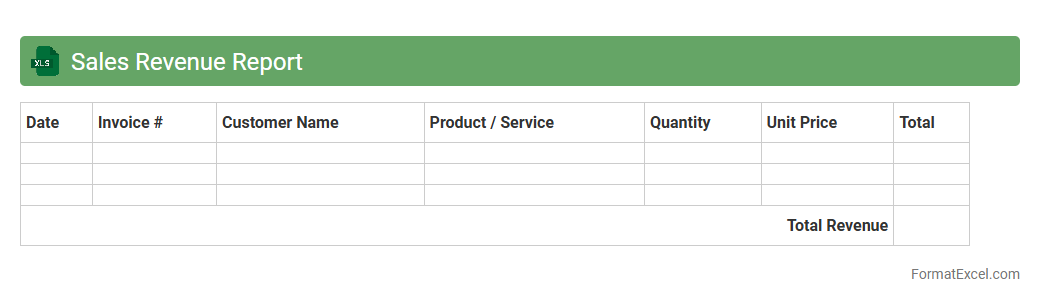

Sales Revenue Report

A

Sales Revenue Report Excel document is a detailed spreadsheet that tracks and analyzes the total income generated from sales activities over a specific period. It consolidates data such as product sales, customer transactions, and revenue trends, enabling businesses to monitor financial performance and make informed decisions. This report is essential for identifying growth opportunities, managing budgets, and optimizing sales strategies for increased profitability.

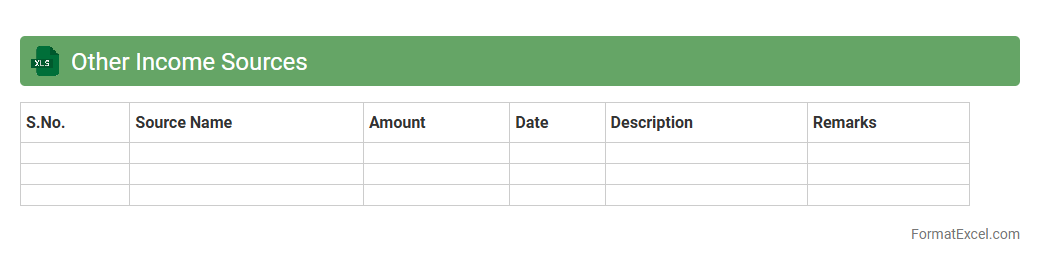

Other Income Sources

The

Other Income Sources Excel document is a structured tool designed to track and manage various non-primary income streams such as dividends, rental income, freelance earnings, and interest payments. It provides detailed categorization and consolidation of additional revenue sources, enhancing financial visibility and accuracy in budgeting or tax preparation. This document is useful for individuals and businesses to gain a comprehensive overview of their total income, optimize cash flow management, and ensure thorough financial planning.

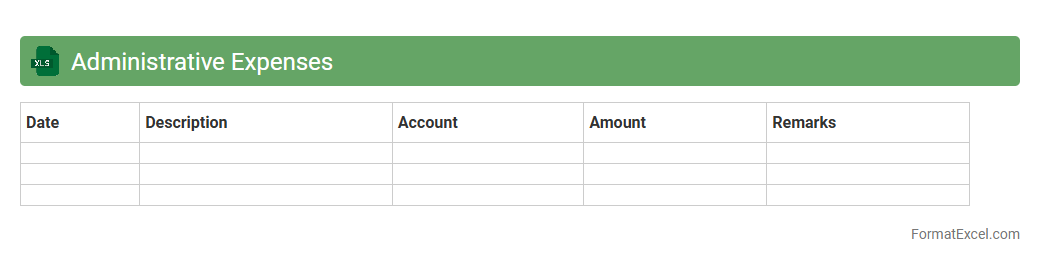

Administrative Expenses

An

Administrative Expenses Excel document is a spreadsheet designed to track and manage overhead costs such as salaries, office supplies, and utilities. This tool helps businesses monitor spending patterns, maintain budget control, and generate detailed financial reports. By organizing expenses systematically, it supports better decision-making and accurate financial forecasting.

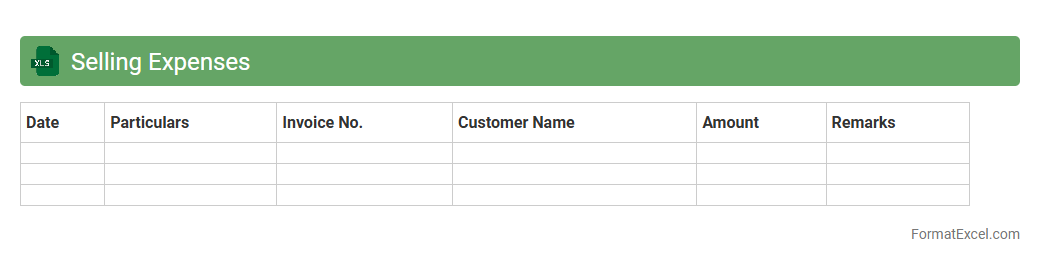

Selling Expenses

A

Selling Expenses Excel document is a financial tool designed to track and analyze all costs associated with the selling process, including advertising, sales commissions, and distribution expenses. It helps businesses monitor spending patterns, control budgets, and improve profitability by identifying areas where expenses can be optimized. Using this document allows for accurate reporting and informed decision-making regarding sales strategies and cost management.

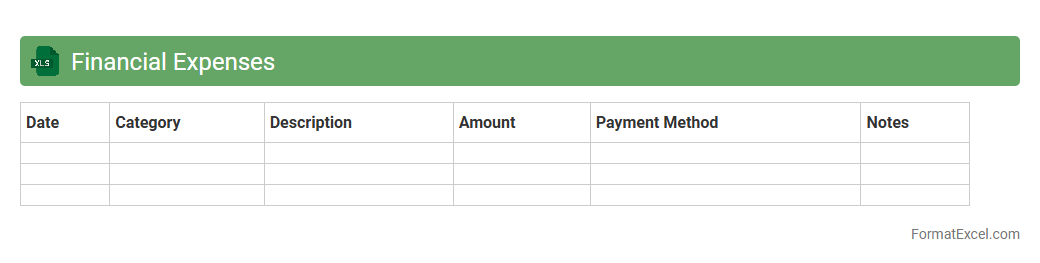

Financial Expenses

A

Financial Expenses Excel document is a structured spreadsheet used to track, categorize, and analyze all business or personal expenditures over time. It helps in budgeting by providing clear visibility into spending patterns, enabling informed decisions to control costs and improve cash flow management. Using Excel's formulas and charts, users can efficiently monitor expenses against income, forecast future financial needs, and prepare accurate financial reports.

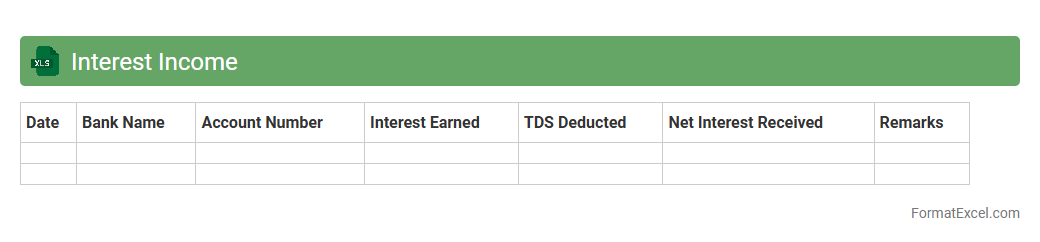

Interest Income

An

Interest Income Excel document is a financial tool designed to track and calculate income earned from various interest-bearing accounts such as savings, fixed deposits, and bonds. It helps users organize interest payments over time, enabling efficient financial analysis and accurate tax reporting. This document is essential for monitoring cash flow and optimizing investment strategies by providing clear insights into earned interest.

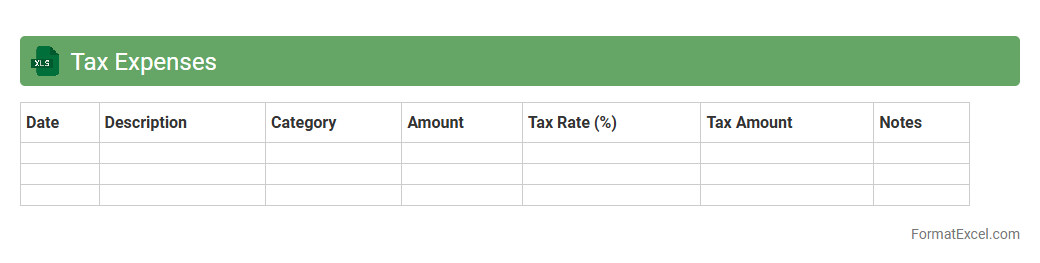

Tax Expenses

A

Tax Expenses Excel document is a detailed spreadsheet used to record, track, and analyze all tax-related expenditures for individuals or businesses. It helps organize tax payments, deductions, and credits systematically, ensuring accurate tax reporting and compliance with fiscal regulations. This tool enhances financial planning by providing clear insights into tax liabilities and opportunities for savings.

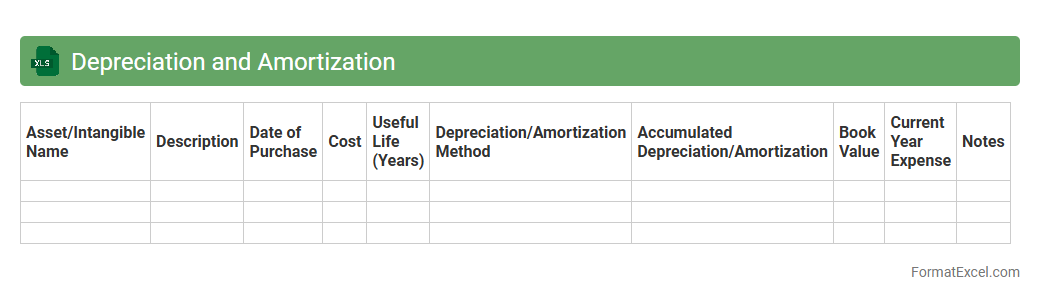

Depreciation and Amortization

A

Depreciation and Amortization Excel document is a financial tool designed to track the allocation of asset costs over time, reflecting the decrease in value of tangible and intangible assets. It helps businesses accurately calculate expenses for fixed assets and intangible assets, ensuring compliance with accounting standards and tax regulations. Utilizing this document enhances financial reporting accuracy, budgeting, and asset management by providing clear schedules and automated calculations.

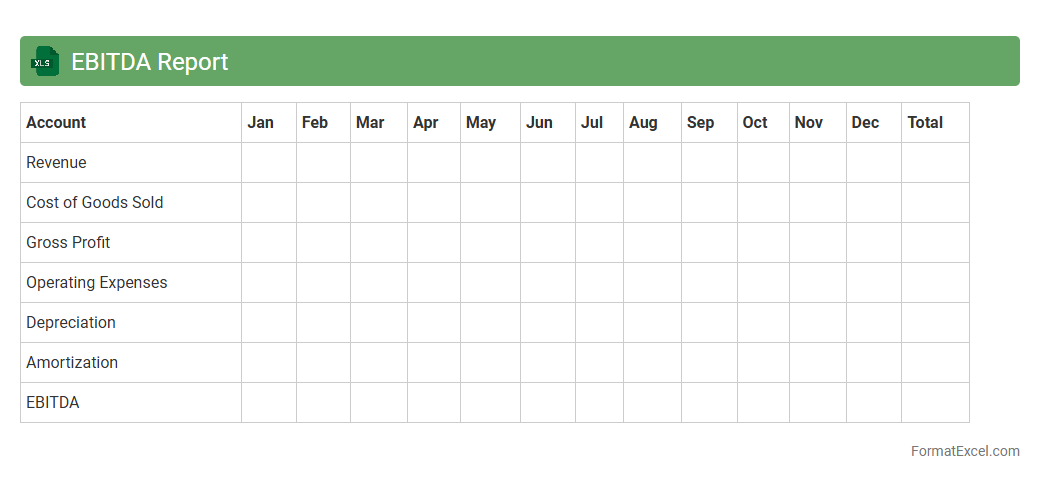

EBITDA Report

An EBITDA Report Excel document is a financial tool that calculates and presents Earnings Before Interest, Taxes, Depreciation, and Amortization to assess a company's operational profitability. This report provides stakeholders with clear insights into cash flow and core business performance by excluding non-operational expenses. Utilizing an

EBITDA Report Excel document helps in making informed investment decisions, budgeting, and benchmarking against industry peers.

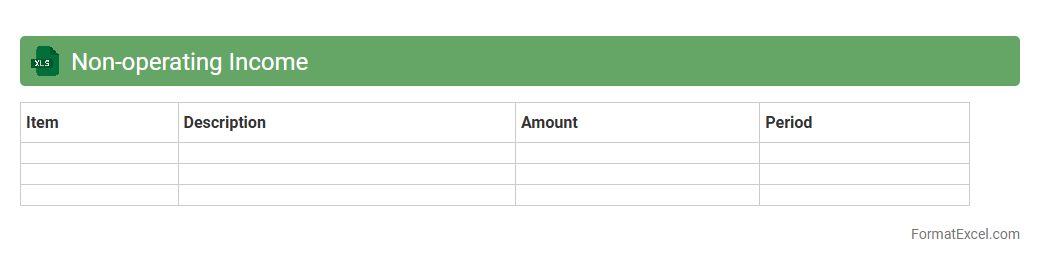

Non-operating Income

A

Non-operating Income Excel document is a financial tool used to track and analyze income generated from sources outside a company's core operations, such as investments, interest, or asset sales. This document helps businesses separate operational profits from incidental earnings, providing clearer insights into overall financial health. Utilizing it allows for better decision-making, accurate financial reporting, and enhanced forecasting of cash flows and profitability.

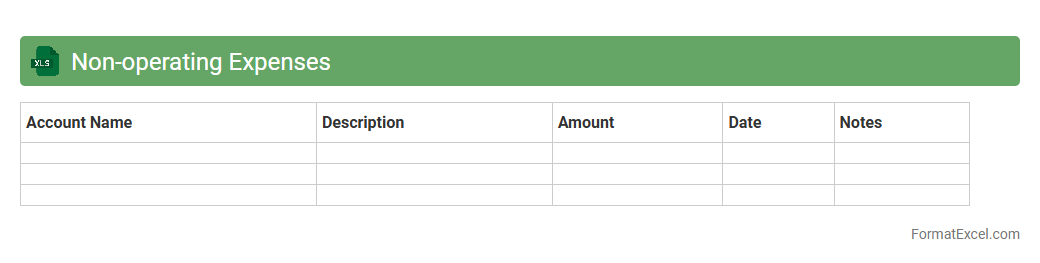

Non-operating Expenses

A

Non-operating Expenses Excel document is a financial tool designed to track costs not related to core business operations, such as interest payments, losses on asset sales, and legal settlements. It helps businesses analyze overall profitability by isolating expenses that fall outside regular operating activities, offering clearer insights into financial health. Utilizing this document enables accurate budgeting, forecasting, and strategic decision-making based on comprehensive expense categorization.

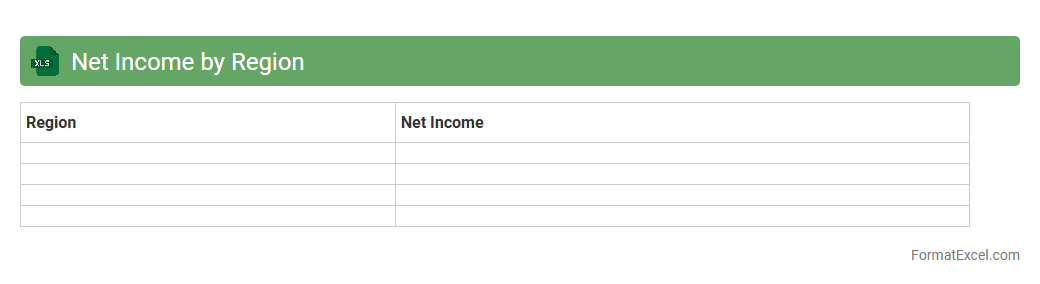

Net Income by Region

The

Net Income by Region Excel document organizes financial data to show the profitability of different geographic areas, allowing businesses to pinpoint which regions generate the highest net income. It is useful for identifying trends, allocating resources efficiently, and making informed strategic decisions to maximize overall company performance. This document supports targeted market analysis and helps in optimizing regional marketing and operational efforts.

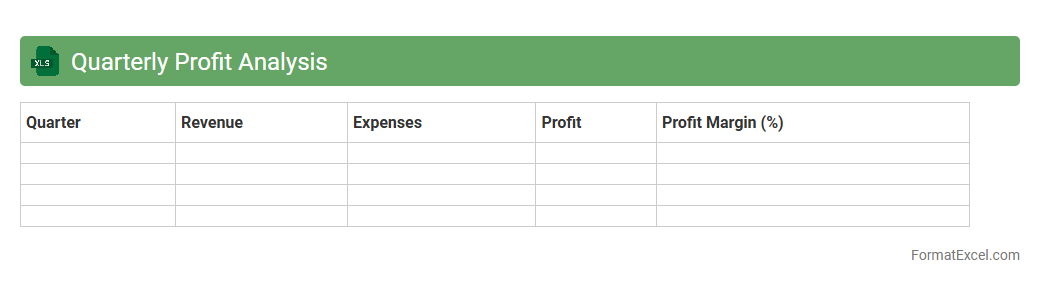

Quarterly Profit Analysis

A

Quarterly Profit Analysis Excel document systematically tracks and evaluates a company's financial performance over three-month periods, highlighting revenue streams, expenses, and net profit margins. This tool enables businesses to identify trends, compare results against previous quarters, and make data-driven decisions to improve profitability. By organizing financial data in an accessible format, it supports strategic planning and financial forecasting.

Introduction to Profit and Loss Reports

A Profit and Loss report summarizes revenues, costs, and expenses incurred during a specific period. It helps businesses assess their financial performance and profitability. This report is crucial for decision-making and financial planning.

Importance of Profit and Loss Statements

The Profit and Loss statement provides a clear picture of a company's financial health by showing net profit or loss. It enables stakeholders to evaluate operational efficiency and profitability trends. Accurate P&L statements support strategic business adjustments.

Key Components of a Profit and Loss Report

Essential components of a P&L report include revenue, cost of goods sold, gross profit, operating expenses, and net profit. Each section helps analyze specific financial aspects of the business. Understanding these key components ensures accurate financial evaluation.

Benefits of Using Excel for Financial Reporting

Excel offers a flexible platform for creating and customizing financial reports. It enables dynamic data analysis with formulas, charts, and pivot tables. Excel simplifies maintaining accurate and up-to-date Profit and Loss statements for businesses.

Step-by-Step Guide to Creating a Profit and Loss Report in Excel

Start by inputting revenues and expenses into designated columns, then apply formulas to calculate totals and net profit. Organize data logically to enhance readability and accuracy. Following a step-by-step process ensures an efficient and error-free report.

Essential Columns and Rows in the Excel Format

Columns typically include date, description, category, amount, and totals. Rows represent individual revenue and expense items, summarized by type. Properly structured columns and rows improve clarity and data management in Excel.

Sample Profit and Loss Report Template in Excel

A sample template outlines predefined rows and columns for quick and easy report creation. It includes formulas for automatic calculations of gross and net profit. Using a sample template saves time and minimizes mistakes in financial reporting.

Tips for Customizing Your Excel P&L Report

Customize reports by adding relevant categories, using conditional formatting, and integrating charts for visual insights. Tailoring the report to your business needs enhances understanding and usability. Effective customization makes financial data more actionable.

Common Mistakes to Avoid in Excel Profit and Loss Reports

Avoid errors such as incorrect formulas, inconsistent data entry, and lack of documentation. These mistakes can lead to inaccurate financial analysis. Maintaining accuracy and consistency is critical for reliable Profit and Loss reports.

Downloadable Profit and Loss Report Excel Templates

Many websites offer free and premium downloadable Excel templates for Profit and Loss reports. These templates provide structured formats, saving time and enhancing report quality. Using professionally designed templates ensures best practices in financial reporting.