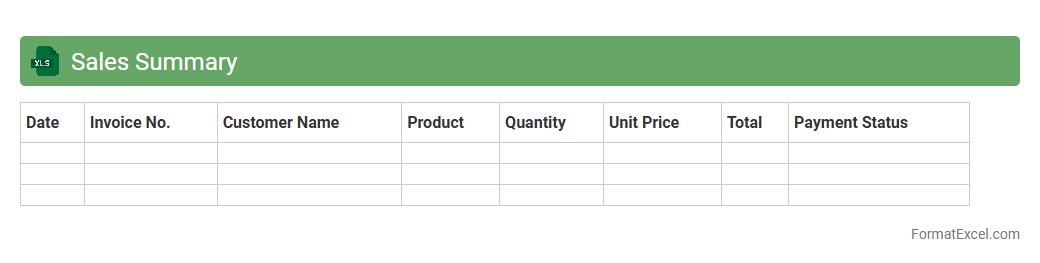

Sales Summary

A

Sales Summary Excel document is a consolidated tool that compiles sales data, including totals, dates, products, and customer information, into a clear and organized format. It enables businesses to track performance, identify trends, and make data-driven decisions by providing quick access to critical sales metrics. Using this document improves forecasting accuracy, streamlines reporting, and supports strategic planning for revenue growth.

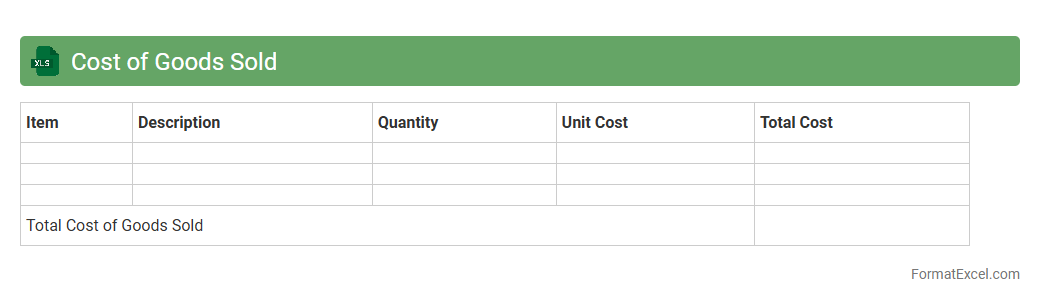

Cost of Goods Sold

A

Cost of Goods Sold (COGS) Excel document is a spreadsheet tool designed to track and calculate the direct costs associated with producing goods sold by a business, including materials and labor expenses. It helps companies accurately determine gross profit by subtracting COGS from total sales, enabling better financial analysis and inventory management. Using this document improves budgeting, pricing strategies, and overall profitability assessment.

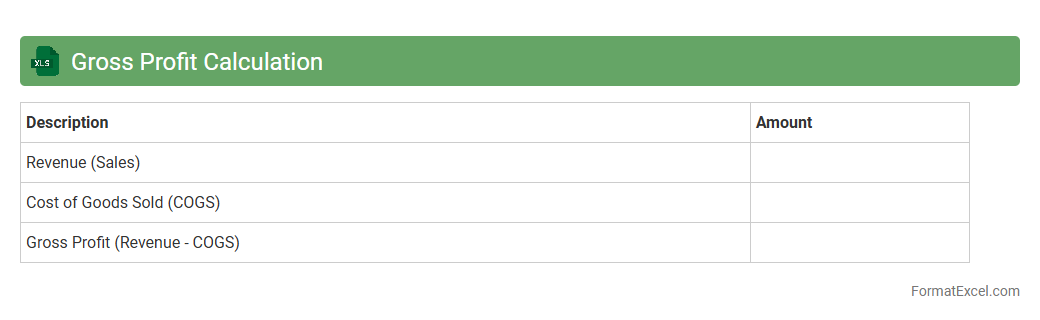

Gross Profit Calculation

A

Gross Profit Calculation Excel document is a spreadsheet tool designed to compute the difference between total revenue and the cost of goods sold (COGS) efficiently. It helps businesses quickly assess profitability at the core operational level by automating calculations and organizing financial data. Utilizing this Excel document enhances decision-making, budget planning, and financial analysis by providing clear insights into gross profit margins.

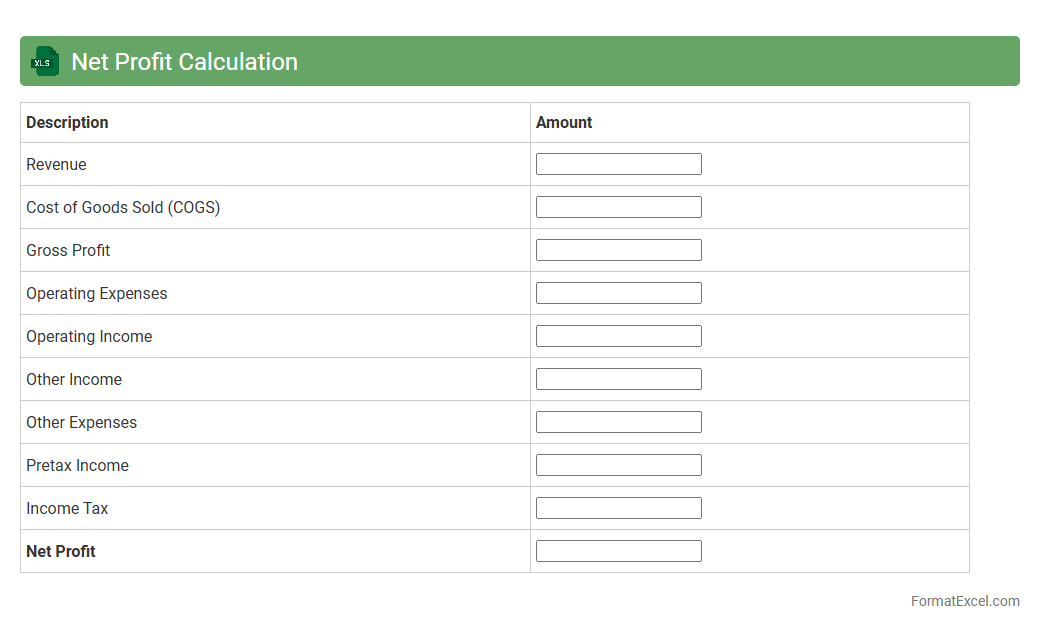

Net Profit Calculation

A

Net Profit Calculation Excel document is a spreadsheet tool designed to track and compute the net profit by subtracting total expenses from total revenue. It helps businesses and individuals analyze financial performance accurately, enabling informed decision-making and efficient budget management. Using this document streamlines profit analysis, reduces errors, and provides clear financial insights for strategic planning.

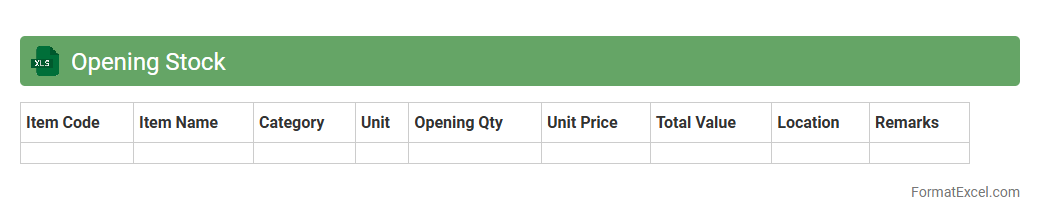

Opening Stock

An

Opening Stock Excel document is a spreadsheet used to record the quantity and value of inventory at the beginning of an accounting period. It helps businesses track initial inventory levels, ensuring accurate cost calculation and seamless inventory management throughout the period. This document is essential for financial reporting, budgeting, and maintaining control over stock movement.

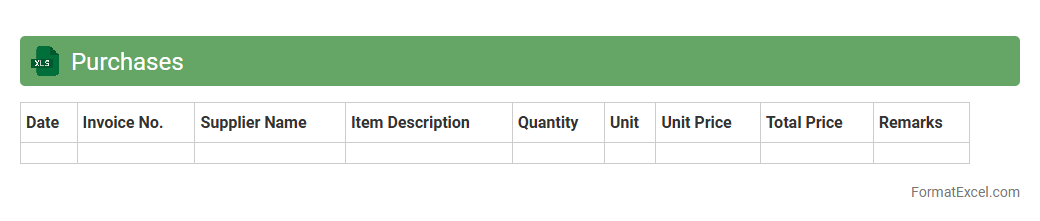

Purchases

A

Purchases Excel document is a structured spreadsheet that records all buying transactions, including supplier details, item descriptions, quantities, prices, and dates. It is useful for tracking expenses, managing inventory levels, and analyzing purchasing patterns to optimize budget allocation. This document enhances financial accuracy and supports strategic decision-making by providing clear visibility into procurement activities.

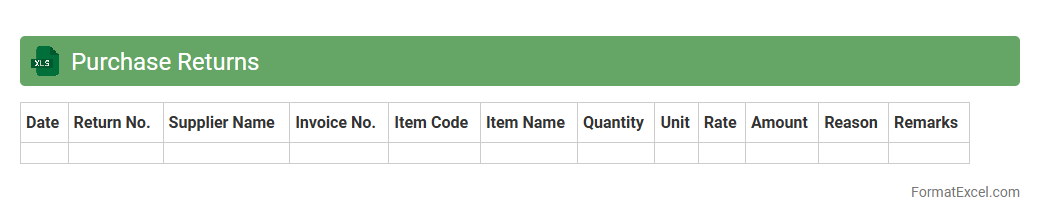

Purchase Returns

A

Purchase Returns Excel document is a spreadsheet designed to record and track products returned to suppliers, including details such as return dates, quantities, reasons, and refund status. It helps businesses maintain accurate inventory records, manage supplier relationships efficiently, and monitor financial adjustments related to returned goods. By analyzing purchase returns data, companies can identify recurring issues with suppliers or products, ultimately improving procurement decisions and reducing losses.

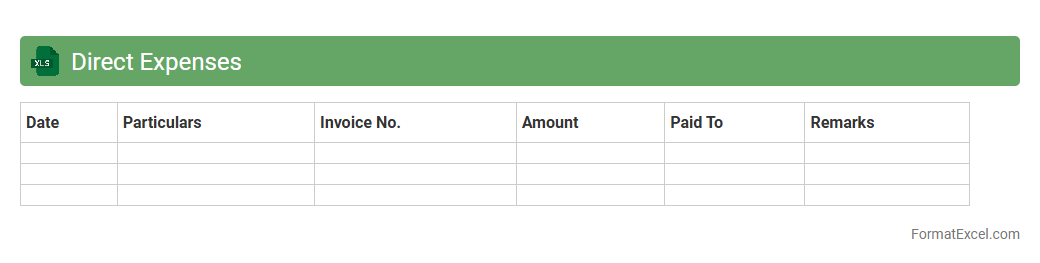

Direct Expenses

A

Direct Expenses Excel document is a financial tool designed to track and categorize costs directly associated with the production of goods or services, such as raw materials, labor, and manufacturing supplies. This document enables efficient expense management by providing clear visibility into spending patterns, facilitating budget control and accurate cost allocation. Businesses use it to improve profitability analysis, streamline accounting processes, and support informed decision-making regarding resource utilization.

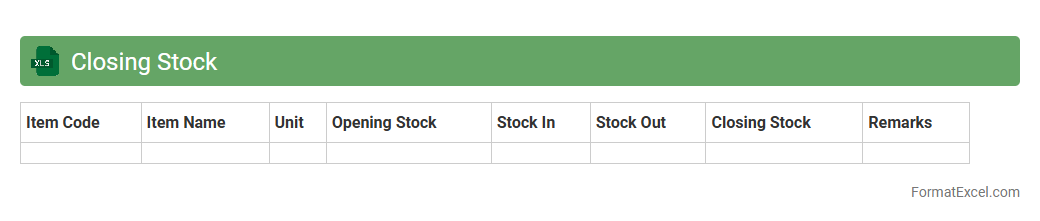

Closing Stock

A

Closing Stock Excel document is a spreadsheet used to record and calculate the value of inventory remaining at the end of an accounting period. It helps businesses accurately track stock levels, manage inventory costs, and prepare financial statements by providing detailed data on quantities and unit costs. This document is essential for optimizing stock control, ensuring accurate profit calculation, and supporting effective decision-making in inventory management.

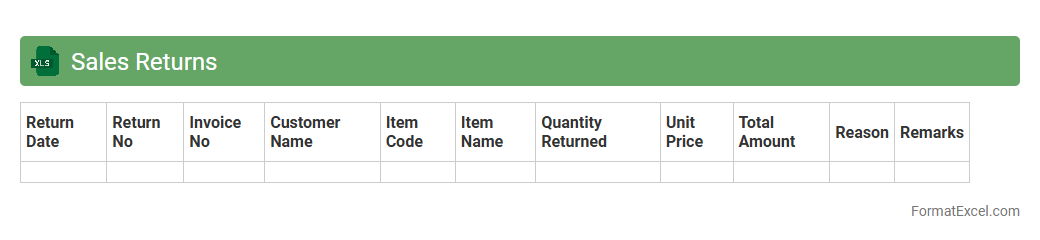

Sales Returns

A

Sales Returns Excel document is a spreadsheet designed to track and manage products returned by customers after purchase. It helps businesses monitor return reasons, calculate refunds or replacements, and analyze return trends to improve customer satisfaction and inventory management. Utilizing this document enhances accuracy in financial reporting and supports decision-making processes related to sales and product quality.

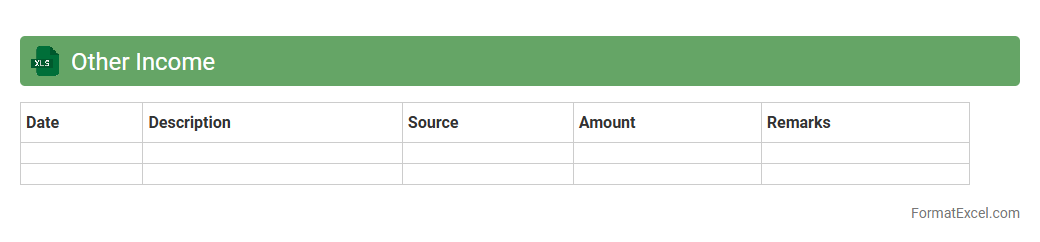

Other Income

The

Other Income Excel document is a financial tool designed to track and categorize miscellaneous revenue streams that do not fall under primary business income. It helps organizations maintain accurate financial records by clearly isolating secondary income sources, facilitating better financial analysis and reporting. Using this document enhances budgeting accuracy and ensures compliance with accounting standards by providing detailed insights into all additional earnings.

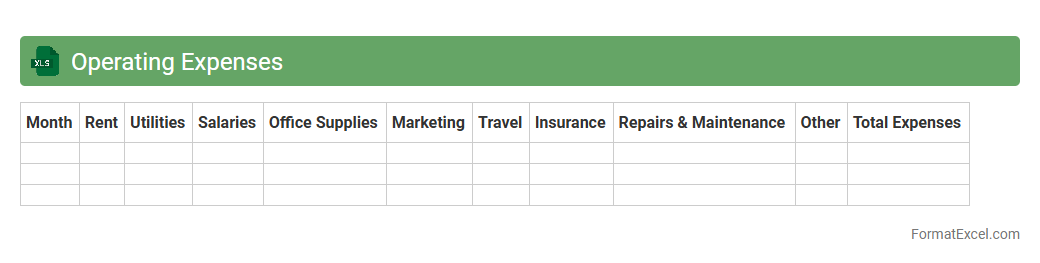

Operating Expenses

An

Operating Expenses Excel document is a structured spreadsheet used to track and manage a company's day-to-day costs such as rent, utilities, salaries, and office supplies. It provides clear visibility into expenditure patterns, enabling better budgeting and cost control. By organizing expenses in a detailed format, businesses can identify areas for savings and improve overall financial planning.

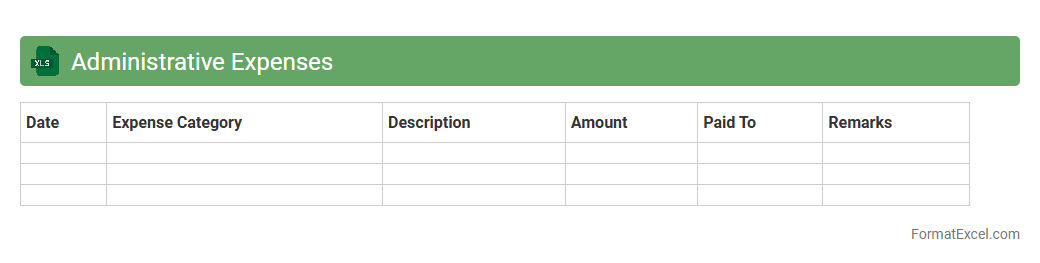

Administrative Expenses

An

Administrative Expenses Excel document is a spreadsheet designed to track and manage costs related to the day-to-day operations of a business, such as salaries, office supplies, utilities, and rent. It helps organizations monitor spending patterns, control budgets, and ensure financial accuracy by providing clear visibility into overhead expenses. Using this document enhances decision-making by enabling a detailed analysis of administrative costs, ultimately supporting efficient resource allocation and cost reduction.

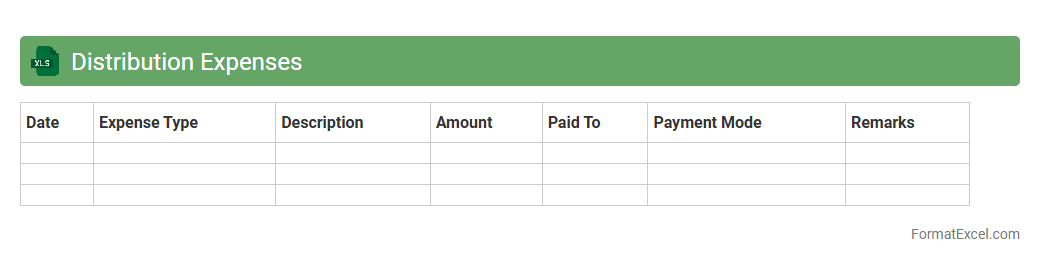

Distribution Expenses

A

Distribution Expenses Excel document is a financial tool designed to track and manage costs associated with the delivery and distribution of goods or services. It allows businesses to itemize expenses such as transportation, packaging, and logistics fees, providing clear visibility into spending patterns. By analyzing this data, companies can optimize their distribution strategy, reduce costs, and improve overall profitability.

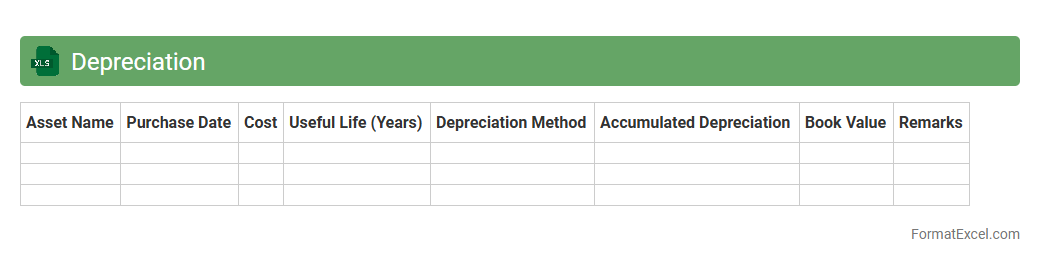

Depreciation

A

Depreciation Excel document is a spreadsheet tool designed to calculate and track the reduction in value of assets over time. It helps businesses manage financial records by providing detailed schedules for asset depreciation using methods like straight-line or declining balance. This document enhances budgeting accuracy, tax reporting, and asset management by automating complex depreciation calculations.

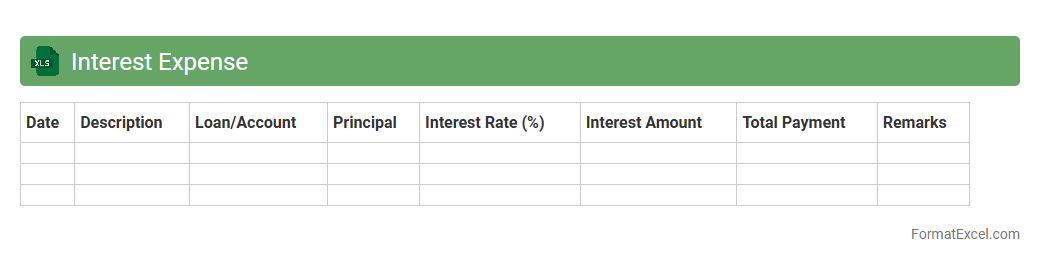

Interest Expense

An

Interest Expense Excel document is a financial tool designed to calculate and track the cost of borrowing funds over a specific period. It helps users accurately manage and forecast interest payments on loans or debts, improving budgeting and financial planning. By organizing interest expenses systematically, it enhances decision-making for businesses and individuals aiming to optimize their debt management strategies.

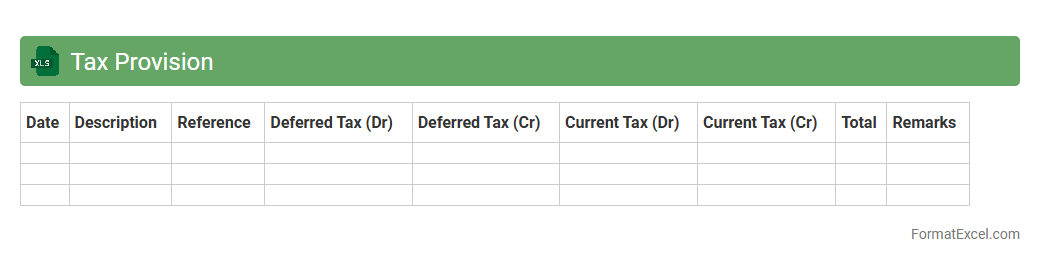

Tax Provision

The

Tax Provision Excel document is a comprehensive tool designed to calculate and record an organization's tax liabilities accurately based on financial data. It streamlines the process of tax expense recognition, ensuring compliance with accounting standards like ASC 740 or IAS 12. This document enhances financial reporting by providing clear, organized data for tax planning, auditing, and decision-making purposes.

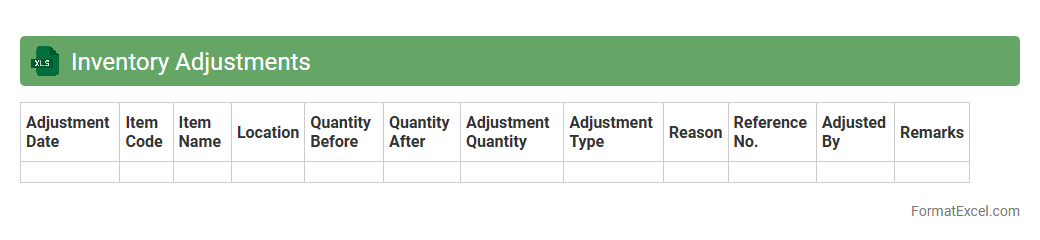

Inventory Adjustments

Inventory Adjustments Excel document is a tool used to track and record changes in stock levels due to errors, damages, or discrepancies. It helps businesses maintain accurate inventory records by documenting increases or decreases in quantities, ensuring financial and operational accuracy. Using this document improves inventory management and supports informed decision-making through precise stock level monitoring.

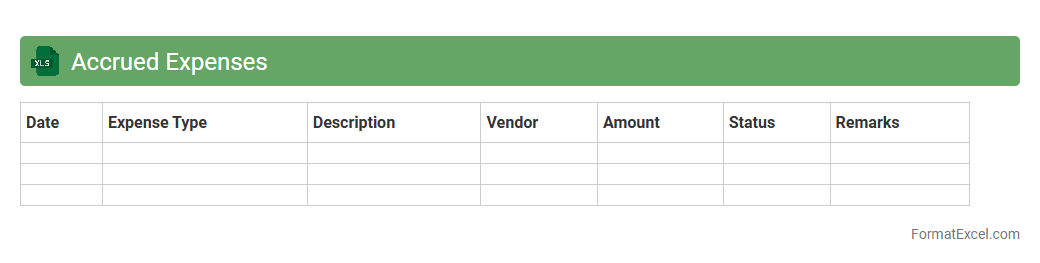

Accrued Expenses

An

Accrued Expenses Excel document is a financial tool designed to track expenses that have been incurred but not yet paid within a specific accounting period. It helps businesses maintain accurate records of liabilities, ensuring compliance with accounting principles such as the matching principle. Utilizing this document improves financial reporting, cash flow management, and budgeting accuracy by providing a clear overview of outstanding obligations.

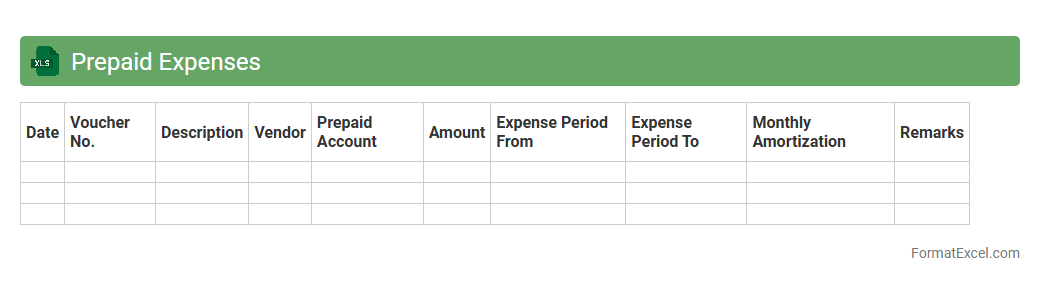

Prepaid Expenses

A

Prepaid Expenses Excel document is a financial tool used to track and manage expenses paid in advance, such as insurance premiums or rent, which are recorded as assets until they are incurred. This document helps businesses accurately allocate expenses over time, improving budget forecasting and financial reporting. By organizing prepaid expenses systematically, it ensures compliance with accounting principles and enhances cash flow management.

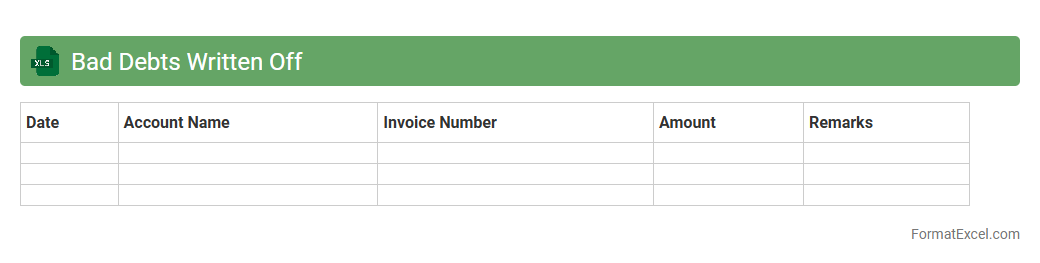

Bad Debts Written Off

The

Bad Debts Written Off Excel document is a financial tool designed to track and manage uncollectible receivables that a business has decided to remove from its accounts. This spreadsheet helps organizations maintain accurate financial records by clearly documenting the amounts and reasons for writing off bad debts, aiding in better cash flow management and financial reporting compliance. It streamlines the review process for outstanding debts, enabling businesses to analyze trends and improve credit control strategies effectively.

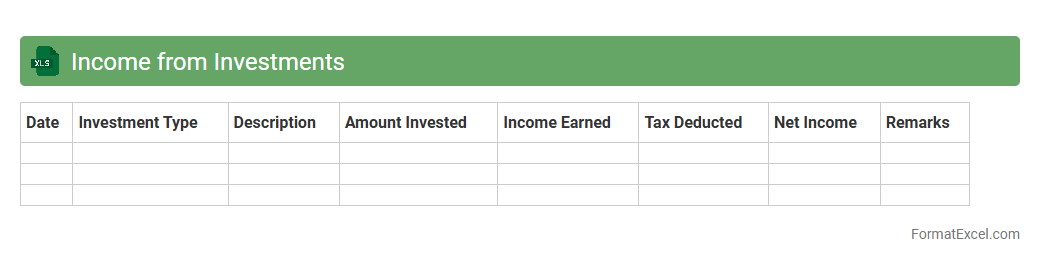

Income from Investments

An

Income from Investments Excel document is a financial tool designed to track and analyze earnings generated from various investment sources such as dividends, interest, and capital gains. It helps investors monitor portfolio performance, calculate returns, and plan future investment strategies with accuracy. Utilizing this document enhances financial decision-making by providing clear, organized data for evaluating income streams and optimizing investment growth.

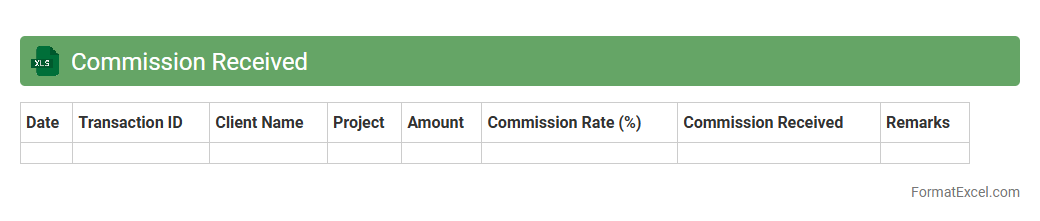

Commission Received

The

Commission Received Excel document is a structured file that tracks and records commission payments received from various sources, such as sales or partnerships. It consolidates data on payment amounts, dates, and client details, enabling efficient financial analysis and timely reconciliation. This document is essential for accurate commission management, ensuring transparency and facilitating performance evaluation for individuals or teams.

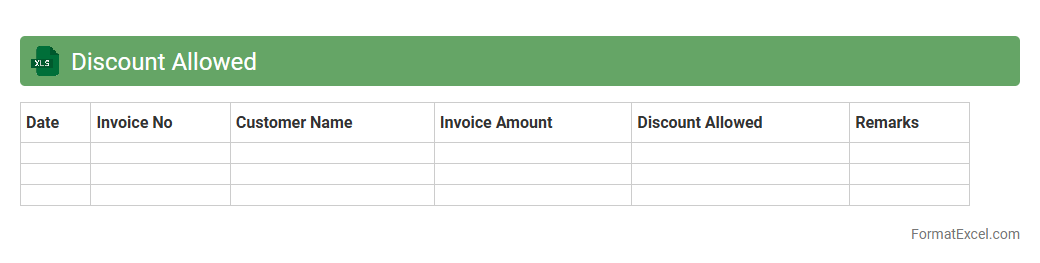

Discount Allowed

A

Discount Allowed Excel document is a spreadsheet used to record and calculate discounts given to customers during sales transactions. It helps businesses track discount amounts, monitor their impact on revenue, and ensure accurate financial reporting. Utilizing this document improves transparency and aids in managing pricing strategies effectively.

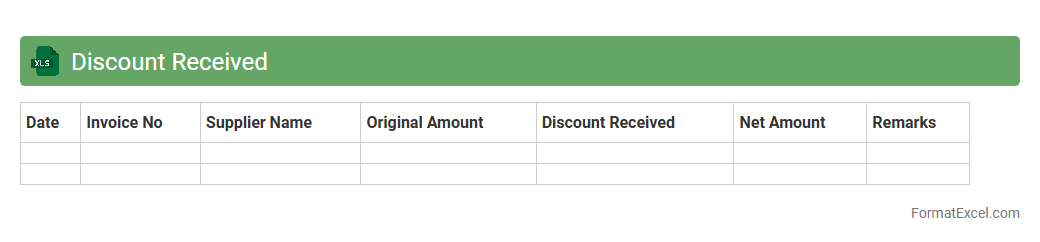

Discount Received

The

Discount Received Excel document is a specialized spreadsheet designed to track and manage discounts obtained from suppliers or vendors during purchases. It helps businesses monitor savings, calculate net costs accurately, and improve financial planning by providing clear visibility into discount details. This tool enhances budgeting efficiency and supports more informed decision-making in procurement processes.

Introduction to Trading Statements

A Trading Statement summarizes the financial performance of trading activities over a specific period. It highlights revenue, cost of goods sold, and gross profit. Understanding this statement is crucial for analyzing business profitability.

Key Components of a Trading Statement

The main components include Sales Revenue, Cost of Goods Sold (COGS), and Gross Profit. Each element provides insight into the operational efficiency of a business. Accurate recording of these parts ensures reliable financial analysis.

Importance of Using Excel for Trading Statements

Excel offers powerful tools for organizing and analyzing financial data efficiently. It allows for real-time updates and complex formula integration. Excel's flexibility makes it ideal for customized trading statements.

Basic Structure of an Excel Trading Statement

A typical structure includes headers for Sales, COGS, Gross Profit, and Net Profit. Rows represent different categories of income and expenses. This layout ensures clear visualization of financial performance.

Step-by-Step Guide to Creating a Trading Statement in Excel

Begin by setting up headers and inputting sales data. Next, calculate COGS using the formula SUM of purchases and adjustments. Finally, apply formulas to derive Gross Profit and other key figures for accuracy.

Essential Formulas for Trading Statements

Key formulas include =SUM() for totals and =Sales - COGS for Gross Profit. Use conditional formatting to highlight critical values. These formulas automate calculations and reduce errors.

Sample Templates for Trading Statement Excel Format

Templates provide a pre-formatted structure to save time in data entry. They typically include built-in formulas for instant calculations. Utilizing sample templates ensures consistency in reporting.

Common Mistakes to Avoid in Trading Statements

Avoid omitting expenses or misclassifying revenues. Inaccurate data entry leads to erroneous financial insights. Always double-check figures and formula references for precision.

Tips for Customizing Your Trading Statement in Excel

Customize by adding relevant income categories and adjusting formulas accordingly. Use charts for better data visualization. Tailoring the statement improves usability for specific business needs.

Downloadable Trading Statement Excel Template

A downloadable template allows quick setup with ready-made formulas and formats. It reduces preparation time and enhances accuracy. Accessing these templates online can simplify financial tracking significantly.