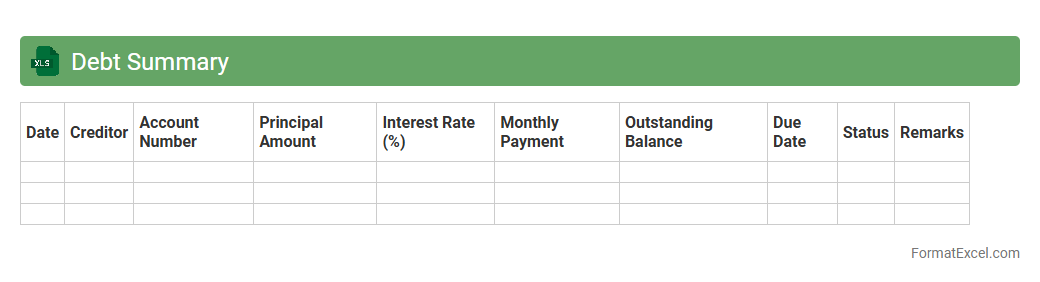

Debt Summary

A

Debt Summary Excel document consolidates all outstanding debts into a single spreadsheet, allowing clear visualization of balances, interest rates, and payment schedules. This tool assists in tracking loan repayment progress, prioritizing high-interest debts, and planning budgets effectively to avoid financial pitfalls. It enhances decision-making by providing a comprehensive snapshot of liabilities, improving debt management and financial health.

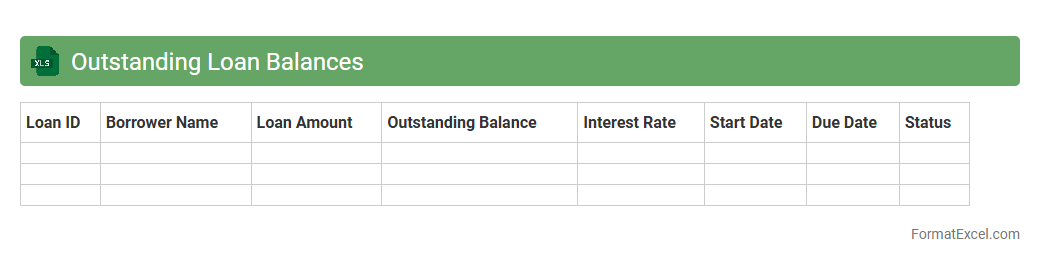

Outstanding Loan Balances

An

Outstanding Loan Balances Excel document is a detailed spreadsheet that tracks the remaining loan amounts borrowers owe to lenders, helping organizations monitor financial obligations efficiently. This document is essential for managing cash flow, assessing credit risk, and ensuring timely repayments by providing a clear snapshot of all active loan balances. By consolidating loan data in an organized manner, businesses can streamline loan management processes and improve financial decision-making.

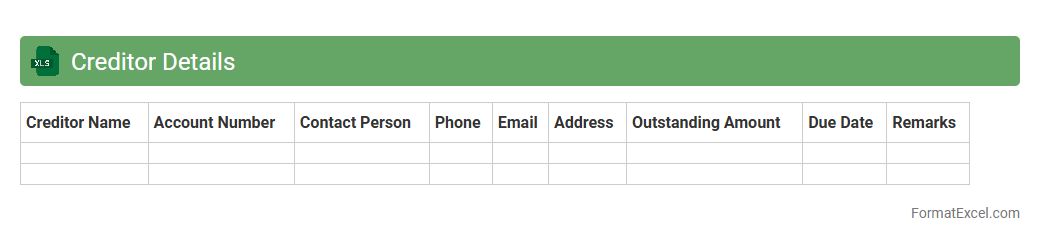

Creditor Details

The

Creditor Details Excel document is a structured spreadsheet that organizes comprehensive information about creditors, including names, contact details, credit terms, and outstanding balances. This document enhances financial management by providing clear visibility into payables, enabling effective tracking of debts and timely payments. Utilizing this tool helps businesses maintain accurate records, improve cash flow planning, and ensure smoother vendor relationships.

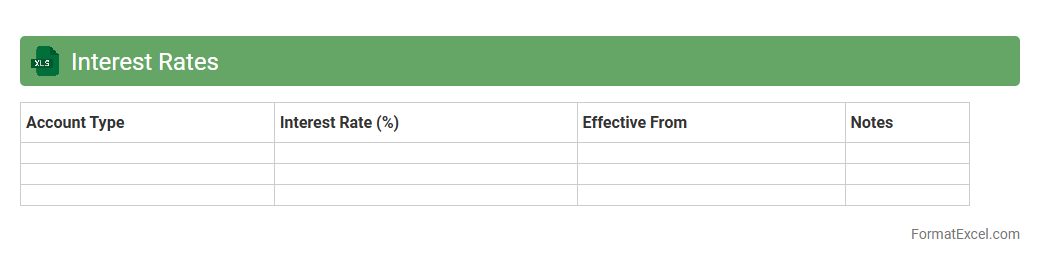

Interest Rates

An

Interest Rates Excel document is a spreadsheet tool designed to track, analyze, and compare various interest rates over time, including loans, savings, and investments. It enables users to calculate compound interest, forecast future earnings or payments, and make informed financial decisions based on dynamic market data. By organizing rates systematically, it enhances financial planning accuracy and helps in optimizing loan repayments or investment growth strategies.

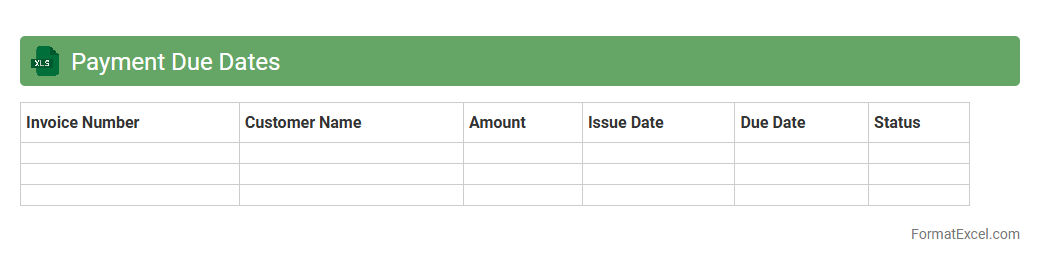

Payment Due Dates

A

Payment Due Dates Excel document is a structured spreadsheet designed to track and manage upcoming payment deadlines efficiently. It helps users prevent late fees and maintain healthy financial relationships by providing clear visibility of all owed amounts and their respective due dates. This tool enhances financial planning and cash flow management by consolidating payment information in one accessible location.

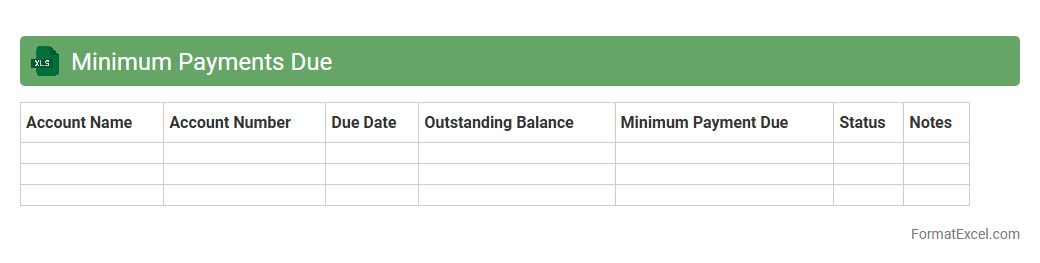

Minimum Payments Due

The

Minimum Payments Due Excel document is a financial tool designed to track and calculate the minimum payment required on various debts or bills each month. It helps users manage their cash flow by providing a clear overview of payment deadlines, amounts, and outstanding balances. This document is essential for avoiding late fees, maintaining good credit scores, and planning effective debt repayment strategies.

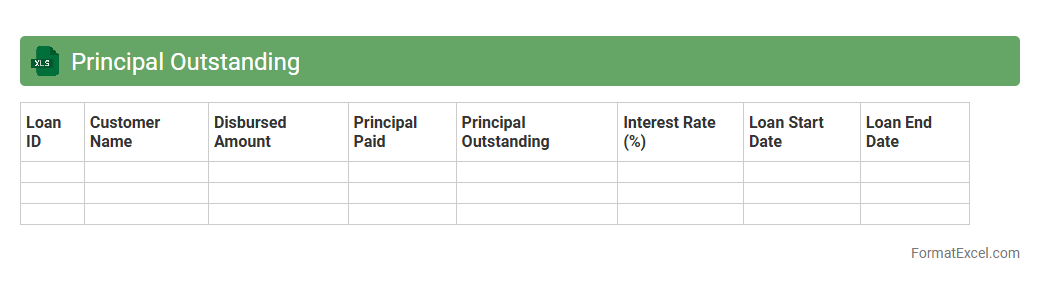

Principal Outstanding

The

Principal Outstanding Excel document is a financial tool used to track and manage the remaining balance on loans or debts over time. It provides clear visibility into the unpaid principal amount, helping individuals and businesses monitor repayment progress and plan future payments efficiently. This document is essential for accurate financial analysis, loan amortization, and ensuring timely debt servicing.

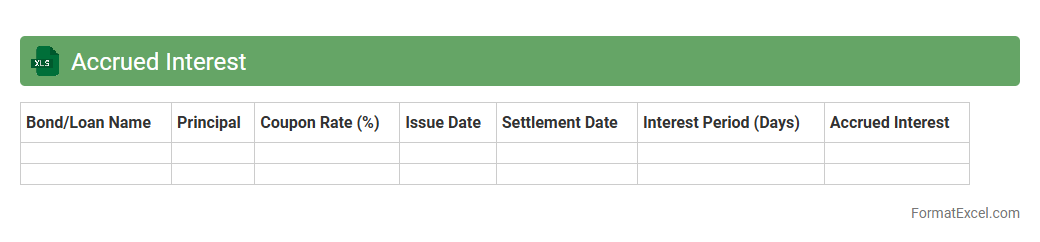

Accrued Interest

An

Accrued Interest Excel document is a spreadsheet tool designed to calculate the interest accumulated on loans or investments over a specific period but not yet paid. It helps users track and manage interest earnings or expenses accurately, providing clear schedules for financial planning and reporting. This document is invaluable for accountants, investors, and financial analysts to ensure precise interest calculations and improved cash flow management.

Last Payment Date

The

Last Payment Date Excel document is a spreadsheet that tracks the most recent payment dates for invoices, bills, or financial transactions. It helps businesses and individuals monitor payment schedules, ensuring timely settlements and improving cash flow management. By maintaining accurate payment records, this document minimizes late fees and supports effective budgeting and financial planning.

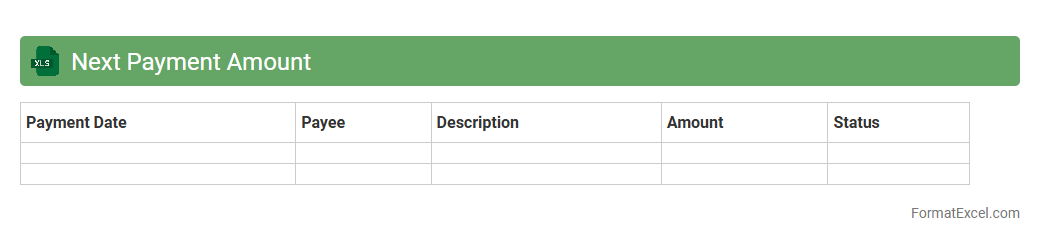

Next Payment Amount

The

Next Payment Amount Excel document is a financial tool designed to track and calculate upcoming payment obligations accurately. It helps businesses and individuals manage cash flow by providing clear visibility into the amounts due for the next payment cycle, ensuring timely payments and avoiding late fees. By automating payment schedules and integrating relevant data, this document enhances financial planning and budgeting efficiency.

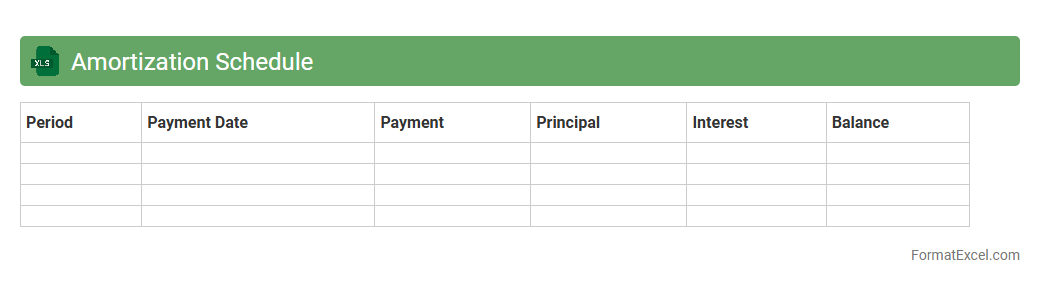

Amortization Schedule

An

Amortization Schedule Excel document breaks down loan repayments into principal and interest components over the loan term, providing a clear view of payment timelines. It helps users track remaining balances, manage budgets, and plan financial obligations effectively. This tool is essential for understanding loan costs and optimizing repayment strategies.

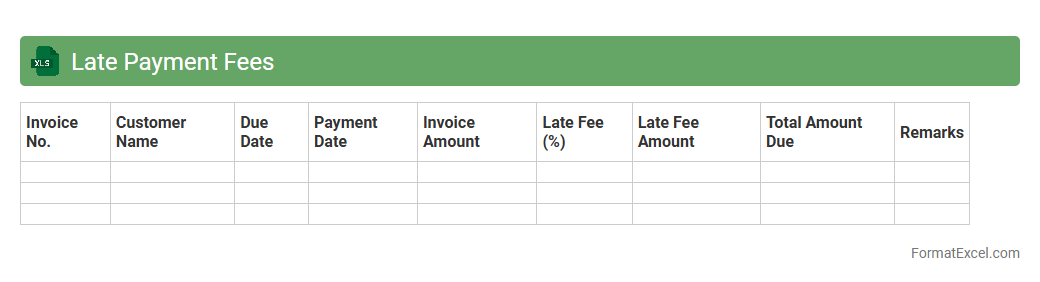

Late Payment Fees

A

Late Payment Fees Excel document is a structured spreadsheet designed to track and calculate penalties for overdue invoices or bills. It automates the computation of fees based on customizable interest rates or fixed amounts, reducing manual errors and saving time. This tool helps businesses maintain accurate financial records and encourages timely payments from clients, improving cash flow and financial management.

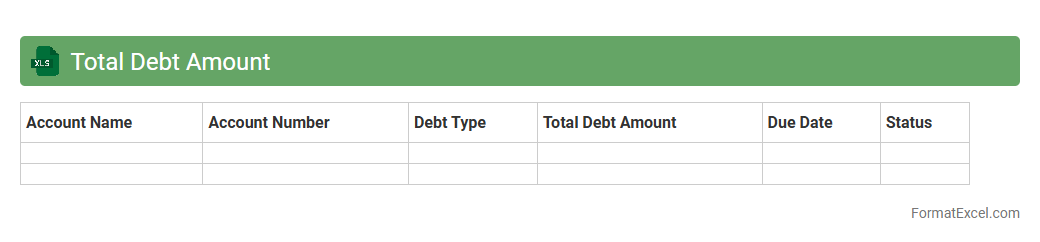

Total Debt Amount

The

Total Debt Amount Excel document is a financial tool designed to consolidate and track all outstanding debts, including loans, credit cards, and other liabilities. It helps users analyze their total financial obligations, calculate interest payments, and monitor repayment schedules for better budgeting and financial planning. This document is essential for maintaining clear visibility of debt levels and making informed decisions to improve financial health.

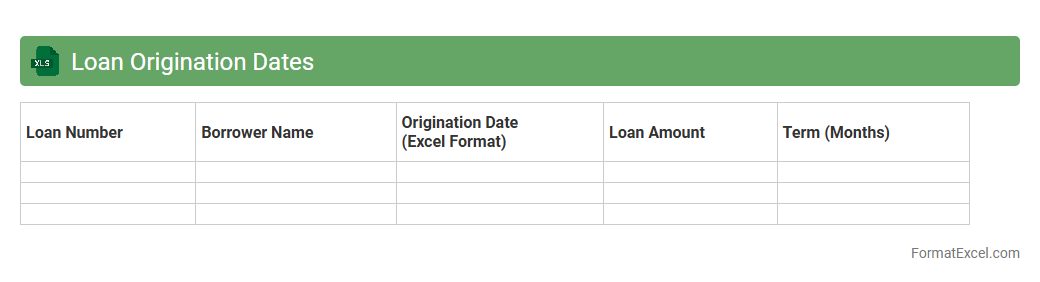

Loan Origination Dates

The

Loan Origination Dates Excel document records the exact dates loans are initiated, enabling precise tracking of loan lifecycles and payment schedules. This data is indispensable for financial analysts and lenders to monitor loan performance, manage risk, and forecast cash flows effectively. Accurate origination dates enhance compliance reporting and improve loan servicing efficiency by ensuring timely due date calculations.

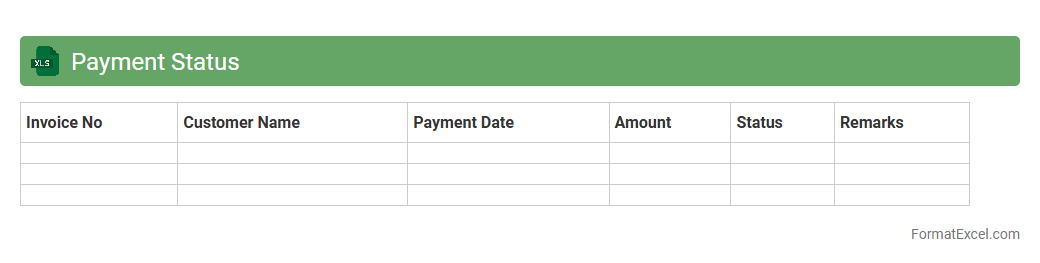

Payment Status

A

Payment Status Excel document is a structured spreadsheet designed to track and monitor payments made or received, including details such as payment dates, amounts, payees, and outstanding balances. This document helps businesses maintain accurate financial records, streamline cash flow management, and ensure timely follow-ups on overdue invoices. Utilizing this tool enhances transparency in financial operations and supports efficient decision-making processes.

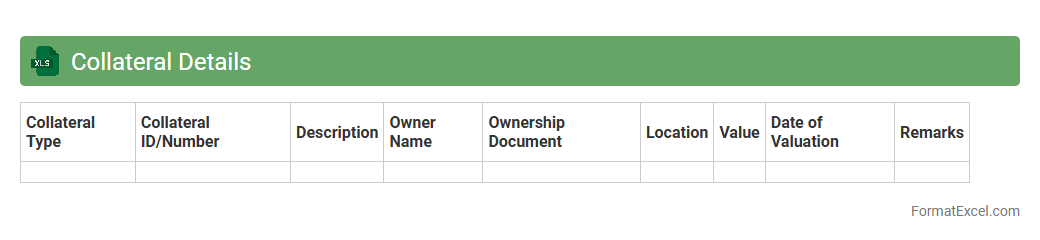

Collateral Details

Collateral Details excel document is a comprehensive record that captures critical information about assets pledged as security for loans or obligations, including asset type, value, ownership, and lien status. This document enhances financial management by providing clear visibility into collateral portfolios, aiding risk assessment, and facilitating compliance with lending requirements. Maintaining an accurate and up-to-date

Collateral Details spreadsheet supports informed decision-making and efficient asset tracking across various financial transactions.

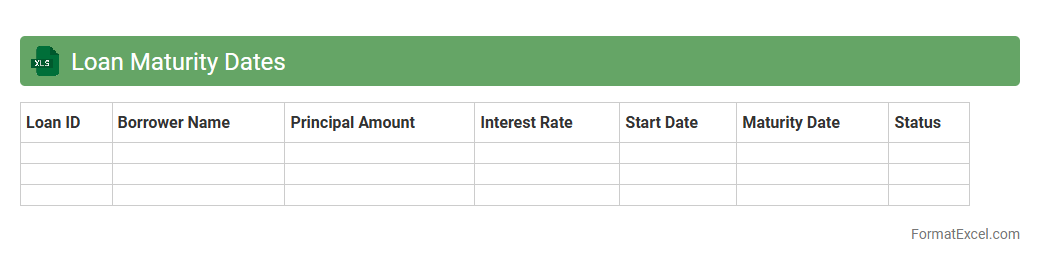

Loan Maturity Dates

A

Loan Maturity Dates Excel document is a spreadsheet used to track the due dates when loans must be fully repaid. It helps individuals and businesses manage multiple loan obligations by organizing payment schedules and preventing missed deadlines. This document is crucial for maintaining financial planning accuracy and ensuring timely loan settlements.

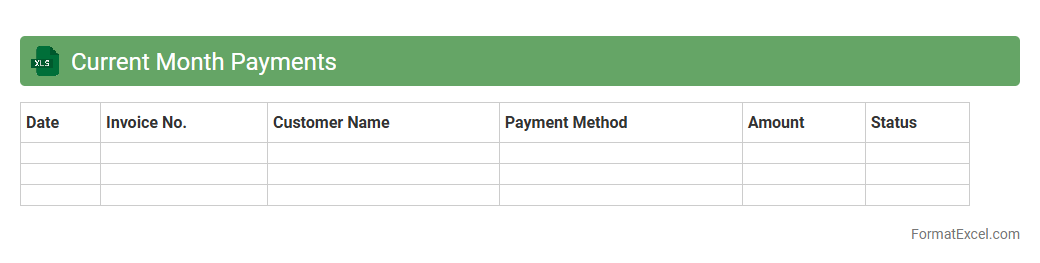

Current Month Payments

The

Current Month Payments Excel document is a detailed financial record that tracks all payments made within the current month, including vendor payments, employee salaries, and other operational expenses. It provides a clear snapshot of cash outflows, helping businesses monitor liquidity and ensure timely disbursements. This document is essential for budgeting, financial analysis, and maintaining accurate accounting records.

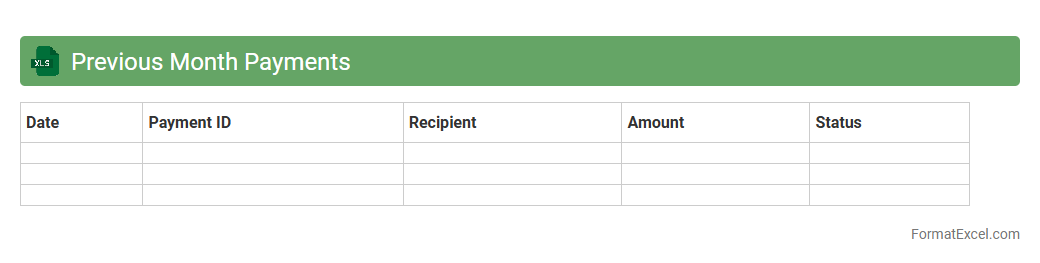

Previous Month Payments

The

Previous Month Payments Excel document is a detailed financial record that tracks all payments made in the prior month, including dates, amounts, payees, and payment methods. It helps businesses monitor cash flow, verify transaction accuracy, and identify outstanding payments efficiently. By analyzing this document, companies can improve budgeting, streamline accounting processes, and ensure timely financial reporting.

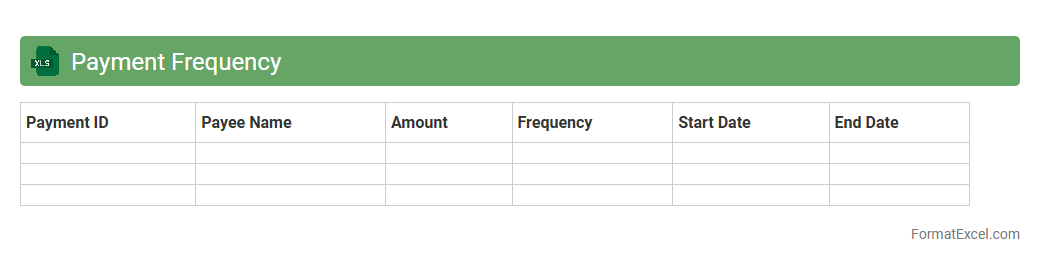

Payment Frequency

A

Payment Frequency Excel document tracks the intervals at which payments are made, such as weekly, bi-weekly, or monthly, providing clarity on cash flow schedules. This tool enhances financial management by allowing users to forecast expenses, budget effectively, and ensure timely payments. It is particularly valuable for businesses and individuals aiming to organize payment cycles and maintain consistent financial records.

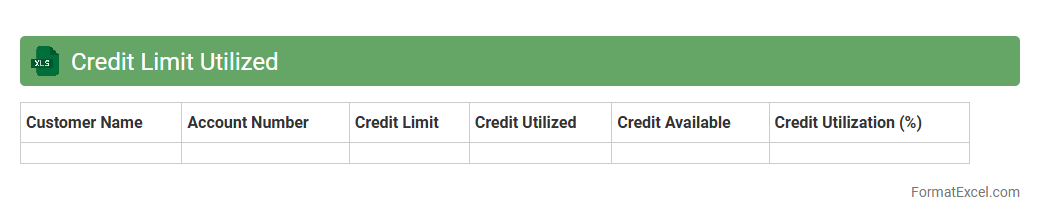

Credit Limit Utilized

The

Credit Limit Utilized Excel document tracks the percentage of credit used against the total available credit limit for individuals or businesses. It helps monitor spending behavior, manage credit risk, and optimize financial planning by highlighting how much credit is currently being consumed. This tool is essential for maintaining healthy credit utilization ratios, which directly impact credit scores and borrowing capacity.

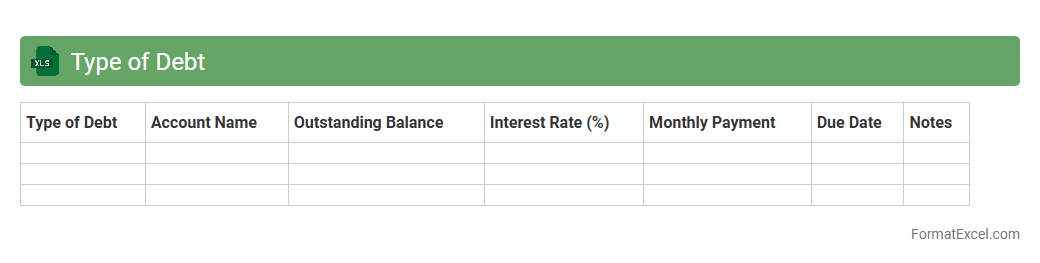

Type of Debt

The

Type of Debt Excel document categorizes various debt instruments such as credit card debt, student loans, mortgages, and personal loans, providing clarity on financial obligations. It helps users analyze their debt portfolio by tracking interest rates, balances, and repayment timelines, enabling better financial planning. This structured overview supports informed decision-making to manage and reduce debt effectively.

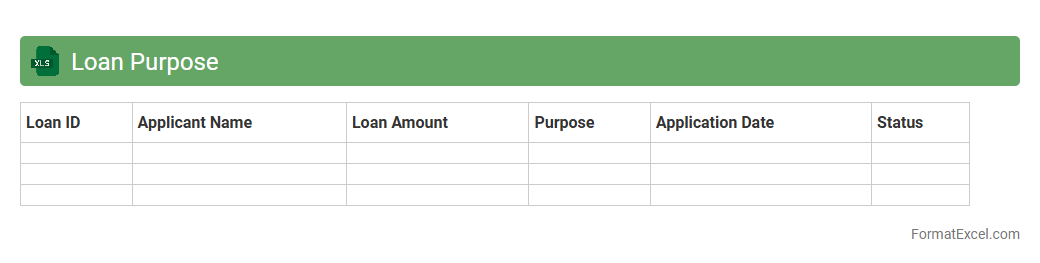

Loan Purpose

A

Loan Purpose Excel document organizes and categorizes the specific reasons borrowers request loans, facilitating efficient data management and analysis. It helps lenders assess risk by clearly identifying the intent behind each loan application, improving decision-making accuracy. This tool enhances tracking of loan distributions across different purposes, aiding in compliance reporting and strategic planning.

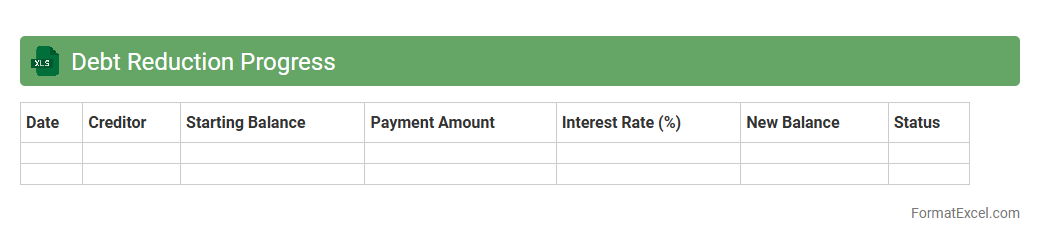

Debt Reduction Progress

The

Debt Reduction Progress Excel document is a powerful financial tool designed to track and manage debt repayment efficiently. It allows users to input payment amounts, interest rates, and outstanding balances to visualize progress over time, motivating consistent reduction of debt. This organized approach helps improve budgeting decisions and accelerates financial freedom by providing clear insights into debt payoff strategies.

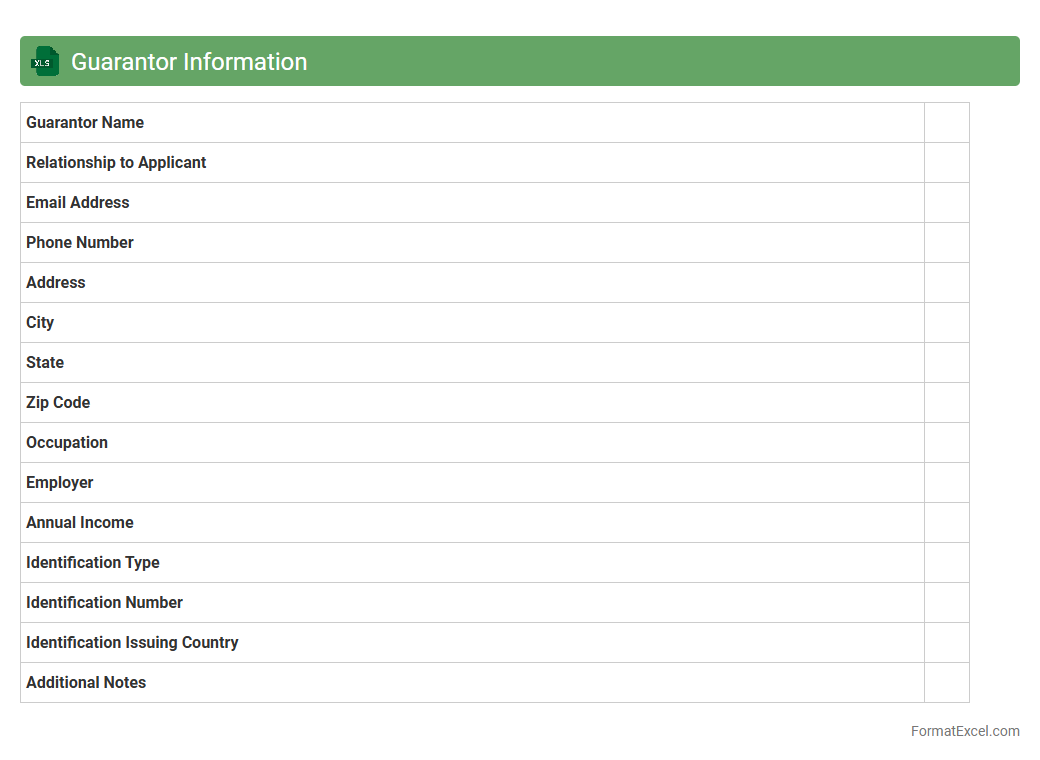

Guarantor Information

The

Guarantor Information Excel document is a structured spreadsheet designed to collect and organize detailed data about guarantors, including their personal identification, financial status, and contact information. This document is crucial for verifying the credibility and financial reliability of guarantors, aiding in risk assessment and decision-making processes for loans, leases, or contractual agreements. By maintaining accurate guarantor data in an Excel format, organizations can streamline background checks, monitor guarantor obligations, and ensure compliance with internal policies and regulatory requirements.

Introduction to Debt Statement Formats

A debt statement format is a structured template that organizes financial liabilities clearly. It helps individuals and businesses monitor outstanding debts efficiently. Using a standard format ensures consistency and ease of understanding.

Importance of Using Excel for Debt Statements

Excel provides powerful features like formulas and data sorting that simplify managing debts. It allows dynamic updates and easy customization of debt statements. Using Excel reduces errors and saves time in financial tracking.

Key Components of a Debt Statement

A typical debt statement includes creditor names, principal amounts, interest rates, and payment schedules. These key components provide a complete view of all obligations. Accurate components ensure effective debt analysis and planning.

Step-by-Step Guide to Creating a Debt Statement in Excel

Start by setting up columns for creditor, amount, interest rate, due date, and balance. Use Excel formulas to calculate interest and track payments dynamically. This step-by-step process ensures a functional and reliable debt statement.

Essential Columns for Debt Tracking in Excel

Important columns include Creditor, Principal Amount, Interest Rate, Payment Due Date, Amount Paid, and Outstanding Balance. Adding a Status column helps track payment progress. These essential columns make debt tracking comprehensive.

Customizing Debt Statement Templates in Excel

Adjust templates by adding conditional formatting to highlight overdue payments or high-interest debts. Incorporate charts for visual debt analysis and customize formulas for unique financial situations. Customization enhances the usability of debt statements.

Tips for Organizing Debt Data Effectively

Keep debt records updated regularly and double-check for accuracy to avoid discrepancies. Group debts by category or priority to improve clarity. Effective organization of debt data leads to better financial management.

Sample Debt Statement Format in Excel

A sample format typically includes columns like Creditor, Original Loan Amount, Interest Rate, Start Date, Payment Schedule, and Balance Remaining. Visual elements such as color coding assist quick status identification. This sample format serves as a practical guide for beginners.

Common Mistakes to Avoid in Debt Statement Formats

Avoid missing critical data like interest rates or payment dates, which can cause inaccurate calculations. Overlooking regular updates and failing to backup files are also frequent errors. Being cautious about these common mistakes improves statement reliability.

Downloadable Debt Statement Excel Templates

Many websites offer free and premium downloadable debt statement templates designed for ease of use. These templates save time by providing ready-made structures that can be customized. Downloading reliable templates ensures professional and accurate debt tracking.