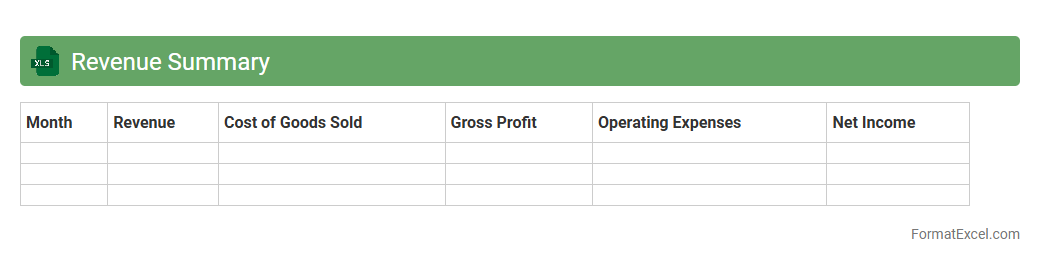

Revenue Summary

A

Revenue Summary Excel document is a comprehensive spreadsheet designed to track and analyze an organization's income streams over a specific period. It consolidates sales data, revenue sources, and financial metrics into a clear format, enabling businesses to monitor performance, identify trends, and make data-driven decisions. This tool enhances financial visibility and supports strategic planning by providing accurate insights into revenue generation and growth opportunities.

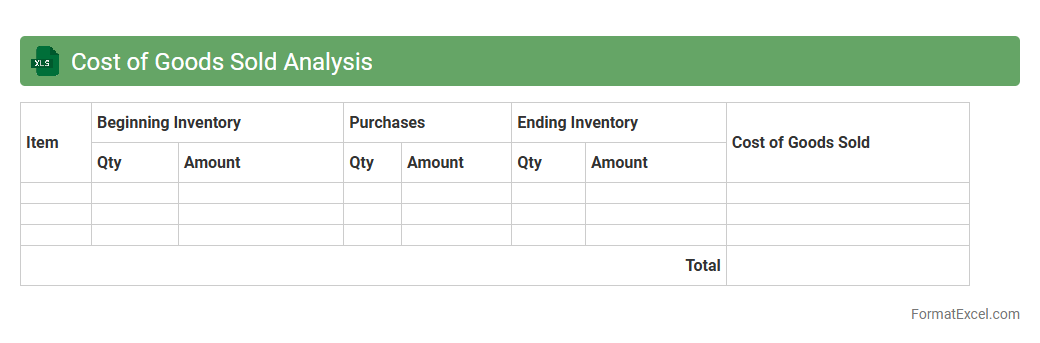

Cost of Goods Sold Analysis

Cost of Goods Sold Analysis excel document is a structured spreadsheet designed to track, calculate, and analyze the direct costs associated with producing goods sold by a company. This tool helps businesses accurately determine their

gross profit margins by providing detailed insights into expenses like raw materials, labor, and manufacturing overhead. Utilizing this analysis enables companies to optimize pricing strategies, control production costs, and improve overall financial performance.

Gross Profit Calculation

A

Gross Profit Calculation Excel document is a spreadsheet tool designed to systematically compute gross profit by subtracting the cost of goods sold (COGS) from total revenue. This document helps businesses analyze profitability at a fundamental level, enabling clearer financial insight and informed decision-making. Utilizing this Excel file streamlines financial tracking, improves accuracy, and supports effective budget planning.

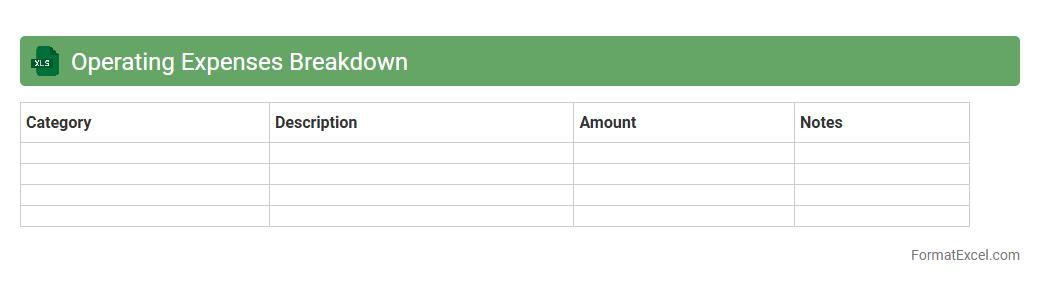

Operating Expenses Breakdown

An

Operating Expenses Breakdown Excel document itemizes all the costs associated with running a business, such as rent, utilities, salaries, and marketing expenses. This detailed categorization helps businesses monitor spending patterns, identify potential cost-saving areas, and ensure more accurate budgeting. Access to a clear breakdown enhances financial decision-making and supports efficient resource allocation.

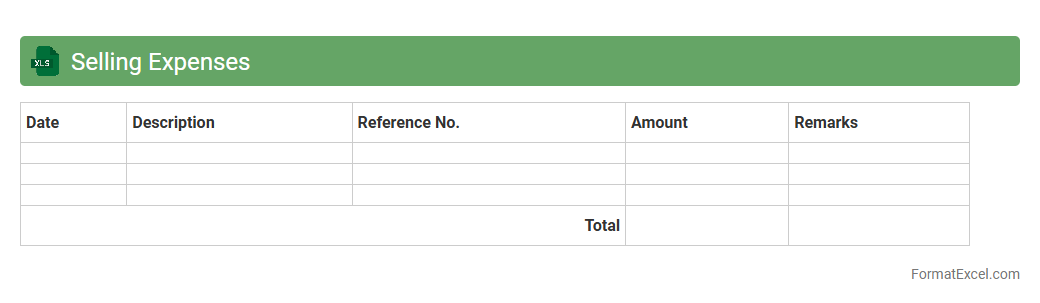

Selling Expenses

A

Selling Expenses Excel document is a financial tool used to systematically track and analyze all costs related to the selling process, including advertising, sales commissions, and shipping fees. It helps businesses monitor sales expenditure, improve budgeting accuracy, and identify cost-saving opportunities by organizing data in a clear, accessible format. By utilizing this document, companies can enhance financial transparency and optimize their overall sales strategy.

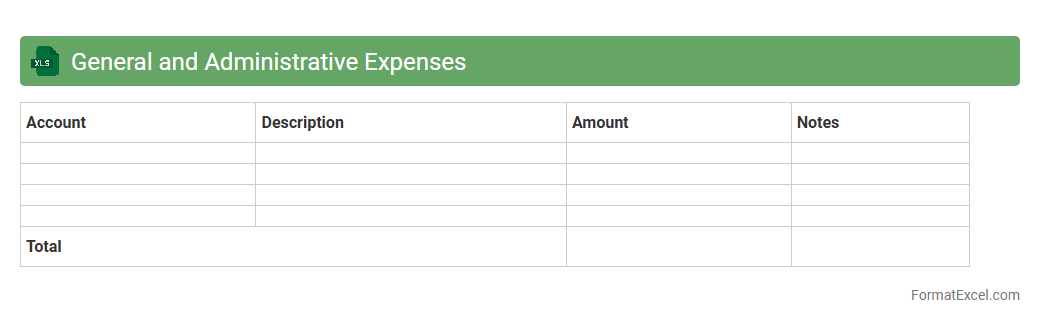

General and Administrative Expenses

A

General and Administrative Expenses Excel document is a detailed financial spreadsheet that tracks costs related to the organization's day-to-day operations, such as salaries, rent, utilities, and office supplies. This document enables businesses to monitor spending patterns, control overhead costs, and improve budgeting accuracy. Efficient management of these expenses through the Excel tool helps enhance financial transparency and supports strategic decision-making.

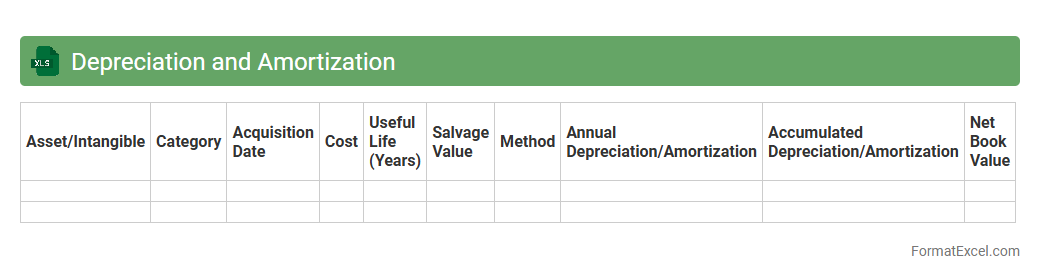

Depreciation and Amortization

A

Depreciation and Amortization excel document is a financial tool designed to calculate and track the allocation of asset costs over their useful life. It helps businesses manage and visualize the gradual expense recognition of tangible and intangible assets, ensuring accurate financial reporting. This document is essential for budgeting, tax planning, and understanding the true value of assets on the balance sheet.

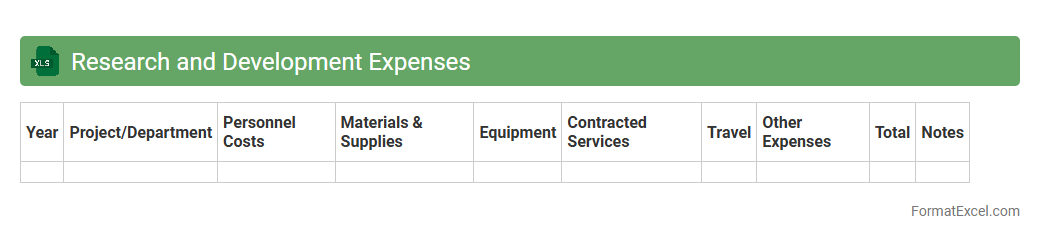

Research and Development Expenses

The

Research and Development Expenses Excel document is a structured spreadsheet that tracks and analyzes costs associated with R&D activities, including salaries, materials, and project-specific investments. It provides companies with a clear overview of expenditures, enabling better budgeting, financial planning, and compliance with accounting standards. This tool is essential for optimizing resource allocation, improving project management, and supporting strategic decisions related to innovation and product development.

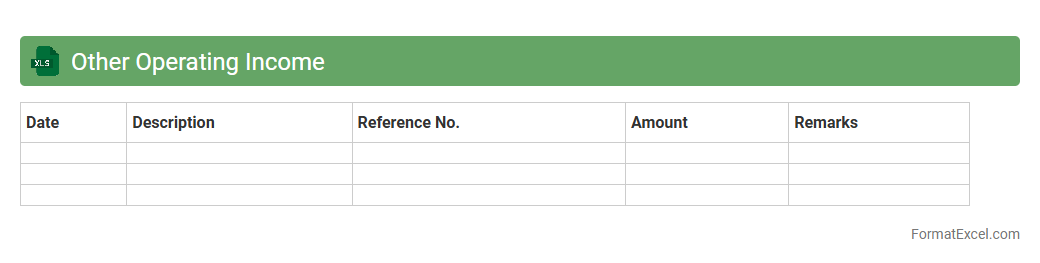

Other Operating Income

The

Other Operating Income Excel document tracks secondary revenue streams that fall outside primary business operations, such as rental income, royalties, or gains from asset sales. This detailed record enables accurate financial analysis, helping businesses assess total income and identify areas contributing to profitability beyond core activities. Utilizing this data supports informed decision-making, budget planning, and comprehensive financial reporting.

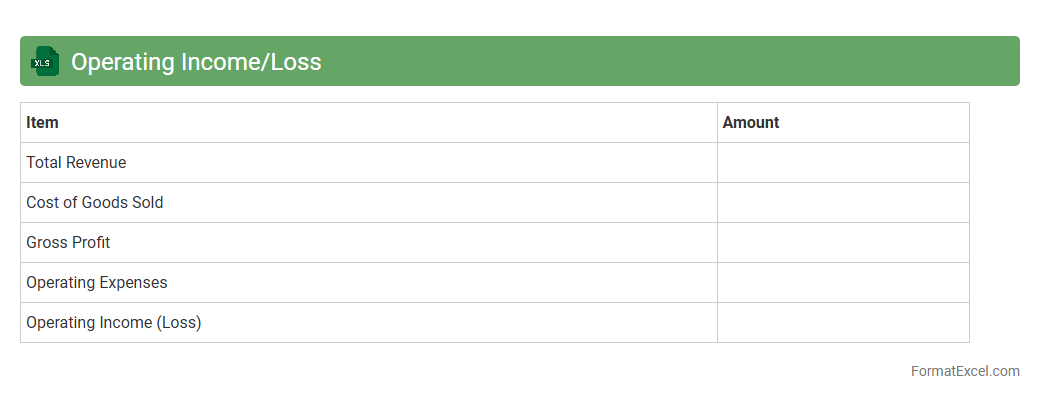

Operating Income/Loss

An

Operating Income/Loss Excel document is a financial tool designed to calculate and analyze a company's core business profitability by subtracting operating expenses from gross revenue. It helps users quickly identify periods of operational efficiency or inefficiency, enabling informed decision-making and strategic planning. This document is essential for tracking performance trends, budgeting, and projecting future financial health without the noise of non-operating items.

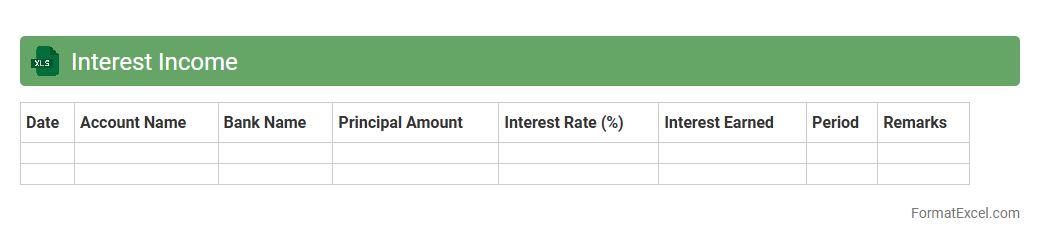

Interest Income

An

Interest Income Excel document is a structured spreadsheet used to track and calculate earnings generated from interest on investments, savings, or loans. It helps individuals and businesses efficiently monitor cash flow, assess income sources, and make informed financial decisions. The clear organization and automated calculations within the file ensure accurate reporting and simplify tax preparation processes.

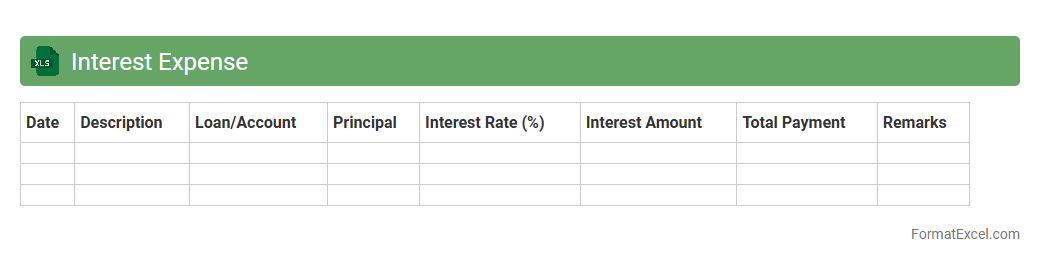

Interest Expense

An

Interest Expense Excel document is a financial tool used to calculate and track interest costs on loans and other borrowings over time. It helps businesses and individuals manage their debt by providing a clear view of interest payments, enabling better budgeting and financial planning. Using this document enhances accuracy in recording expenses and supports informed decision-making about cash flow and loan management.

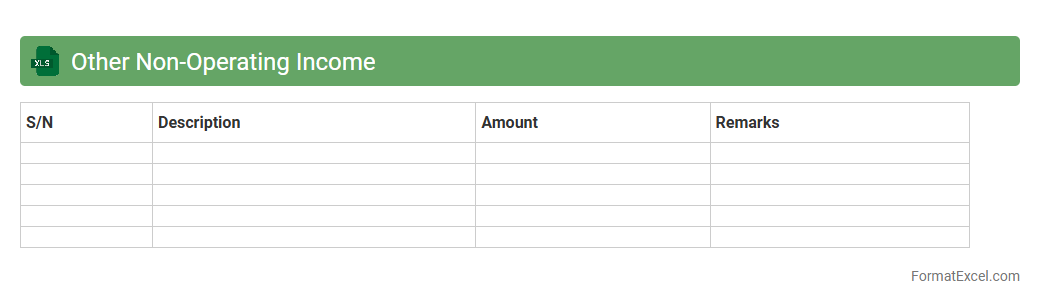

Other Non-Operating Income

The

Other Non-Operating Income Excel document categorizes and tracks income generated from activities unrelated to a company's core operations, such as investment gains, rental income, or asset sales. This detailed record enhances financial analysis by isolating non-operational revenue streams, allowing for clearer insight into the true profitability of core business functions. It is useful for investors and management to accurately assess financial performance and make informed strategic decisions.

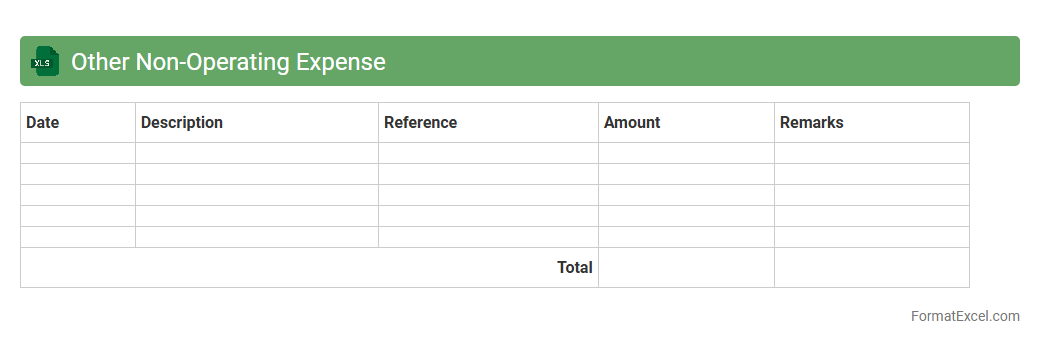

Other Non-Operating Expense

The

Other Non-Operating Expense Excel document records expenses that are not related to the core business operations, such as interest payments, losses on asset sales, or legal settlements. This document helps businesses track and analyze these costs separately from operating expenses, providing clearer insights into overall financial health. Accurate tracking of non-operating expenses supports better budgeting, financial reporting, and decision-making for strategic growth.

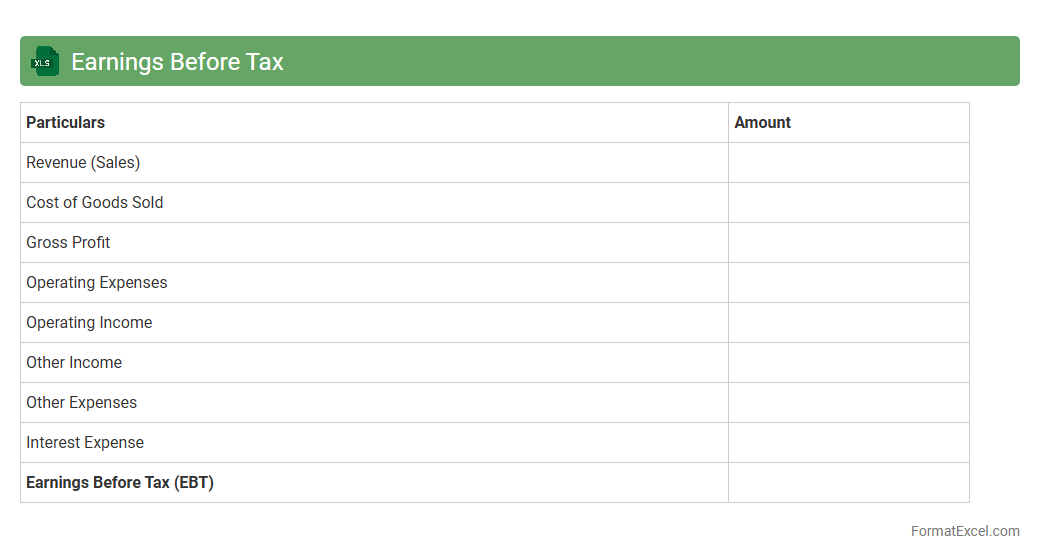

Earnings Before Tax

An

Earnings Before Tax (EBT) Excel document is a financial spreadsheet that calculates a company's profit before tax expenses are deducted, providing clear insight into operational performance. This document is useful for analyzing profitability by isolating earnings from tax impacts, enabling investors and managers to make informed decisions. It also serves as a tool for forecasting tax liabilities and evaluating financial health across different periods.

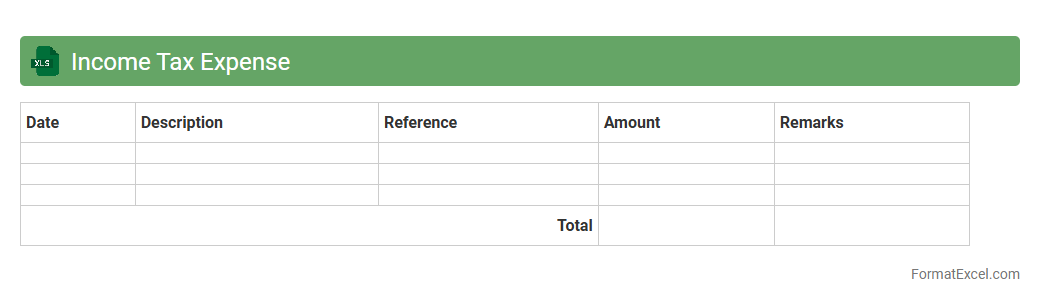

Income Tax Expense

The

Income Tax Expense Excel document is a detailed spreadsheet used to calculate and track income tax liabilities based on financial data and applicable tax rates. It helps businesses and individuals organize tax-related information, ensuring accurate computation of tax expenses and compliance with tax regulations. This document is essential for effective financial planning and simplifies the process of tax filing by providing clear insights into tax obligations and expenses.

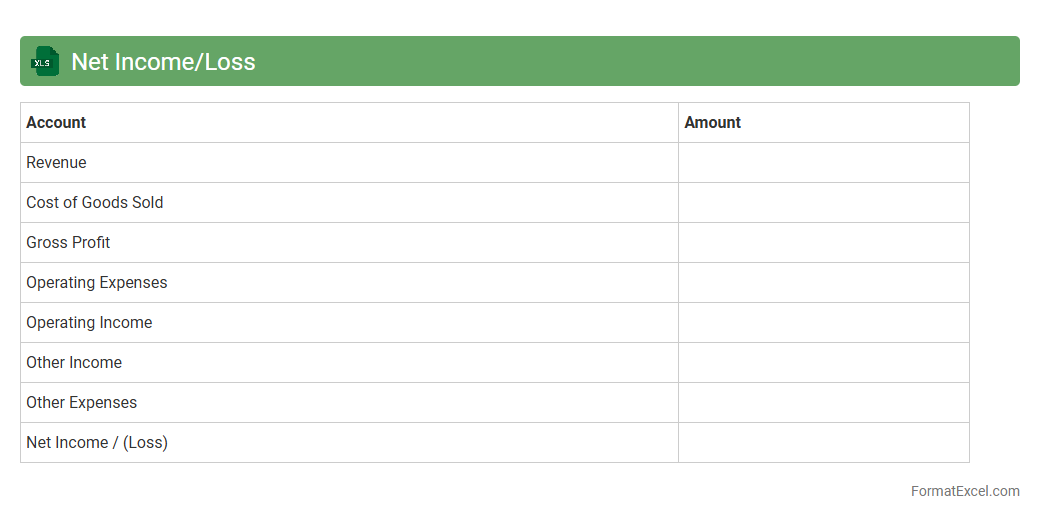

Net Income/Loss

The

Net Income/Loss Excel document is a financial tool that calculates the difference between total revenues and total expenses over a specific period, providing a clear snapshot of a business's profitability. It allows users to input detailed income and expense data, automatically computing net profit or loss to facilitate accurate financial analysis. This document is essential for budgeting, financial planning, and making informed decisions to improve business performance.

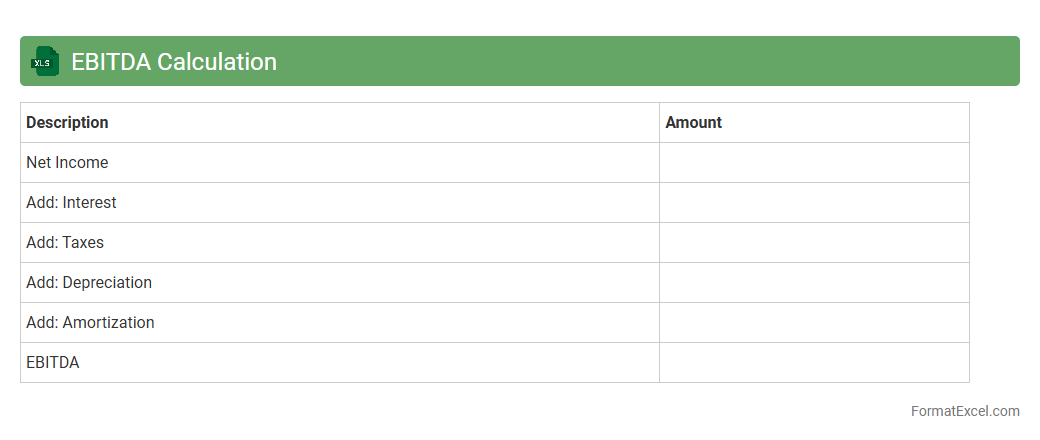

EBITDA Calculation

An

EBITDA Calculation Excel document is a financial tool designed to compute Earnings Before Interest, Taxes, Depreciation, and Amortization using customizable inputs from income statements. It streamlines the analysis of operational profitability by allowing users to quickly assess financial performance without the impact of non-operating expenses. This document is useful for investors, analysts, and business owners seeking clear insights into cash flow generation and comparative company valuation.

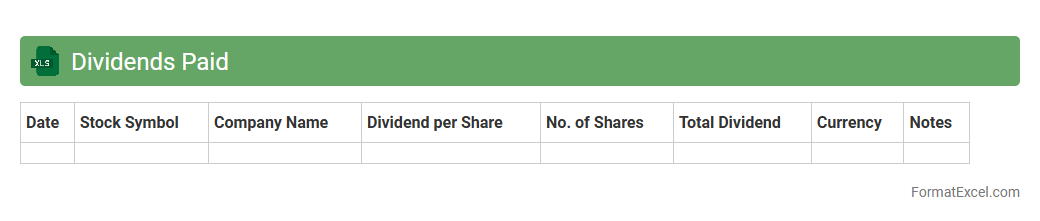

Dividends Paid

A

Dividends Paid Excel document is a financial spreadsheet used to record and track dividend payments made by a company to its shareholders. It helps investors and analysts monitor dividend history, calculate yields, and forecast future income, enhancing investment decision-making. This document streamlines financial management by organizing payment dates, amounts, and shareholder details for accurate analysis and reporting.

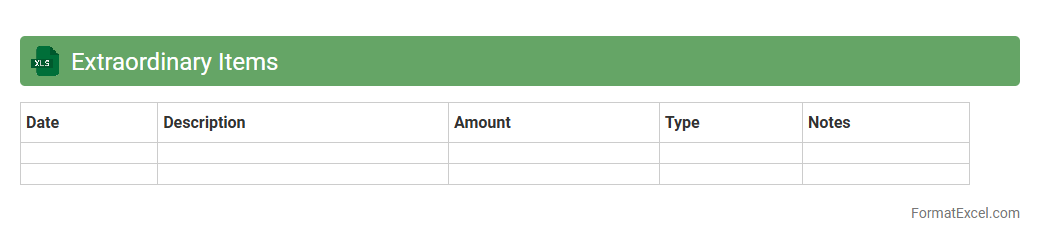

Extraordinary Items

The

Extraordinary Items Excel document is a specialized spreadsheet designed to record and analyze non-recurring financial events that impact a company's financial statements. It helps identify unusual gains or losses, enabling accurate assessment of a business's core operating performance. Utilizing this document enhances financial reporting accuracy and supports better decision-making by isolating extraordinary items from regular business activities.

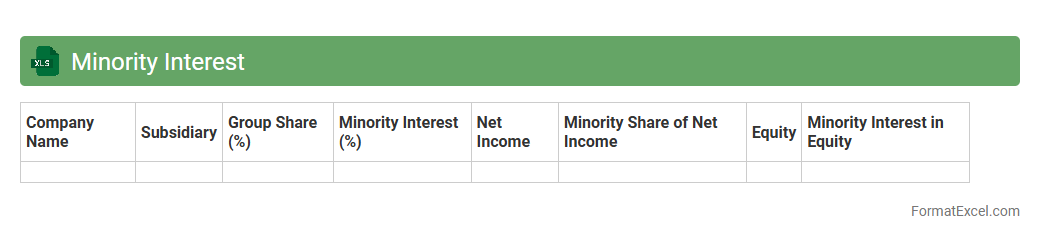

Minority Interest

A

Minority Interest Excel document is a financial tool used to track and analyze the portion of a subsidiary company's equity not owned by the parent company. It helps in accurately assessing the consolidated financial statements by segregating minority shareholders' stakes. This document is crucial for investors and analysts to evaluate the true value and financial health of multi-entity corporations.

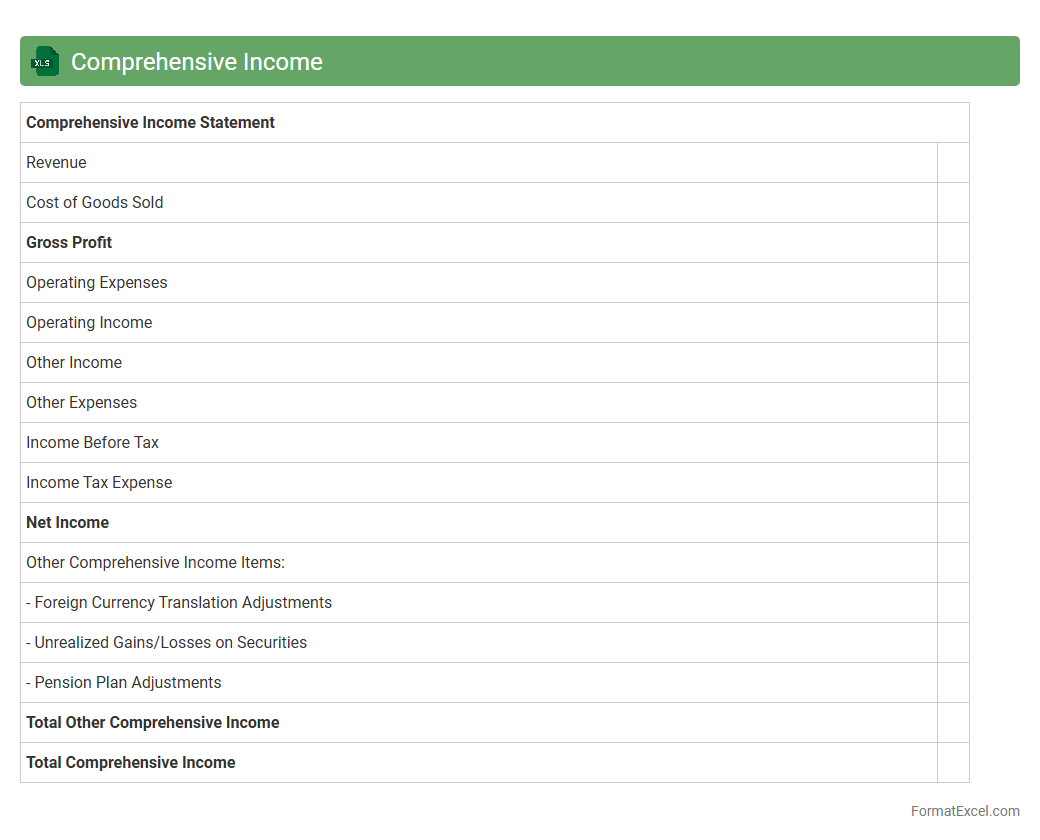

Comprehensive Income

A

Comprehensive Income Excel document is a financial tool designed to track and analyze all components of comprehensive income, including net income and other comprehensive gains or losses such as foreign currency adjustments, unrealized gains on investments, and pension plan adjustments. This document helps users consolidate diverse income sources in a structured format, facilitating accurate financial reporting and decision-making. It is useful for investors, accountants, and financial analysts to assess the complete profitability and financial health of a business beyond traditional income statements.

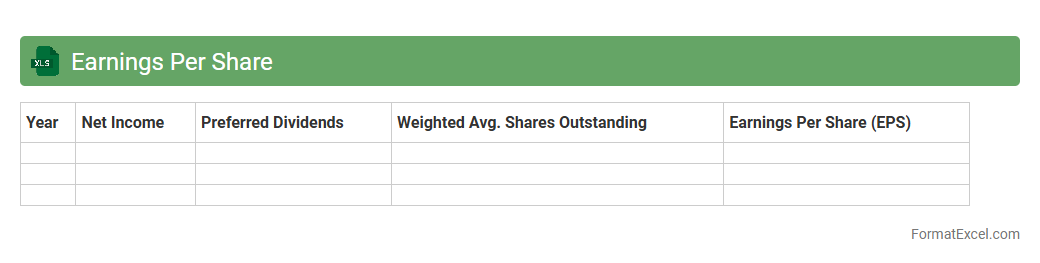

Earnings Per Share

An

Earnings Per Share (EPS) Excel document is a structured spreadsheet that calculates and tracks a company's profitability on a per-share basis by dividing net income by the total outstanding shares. This tool is essential for investors and analysts to assess a company's financial health, compare performance over time, and make informed investment decisions. It streamlines complex financial data into clear, actionable insights, facilitating accurate valuation and forecasting.

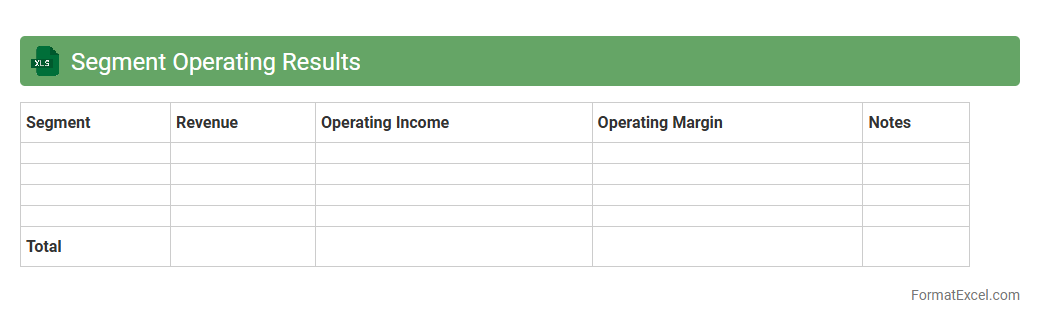

Segment Operating Results

The

Segment Operating Results Excel document presents detailed financial performance data for different business segments, allowing users to analyze revenue, expenses, and operating income by division. This tool is essential for identifying profitable segments, monitoring operational efficiency, and making informed strategic decisions. By breaking down performance metrics, it enables precise resource allocation and targeted growth initiatives.

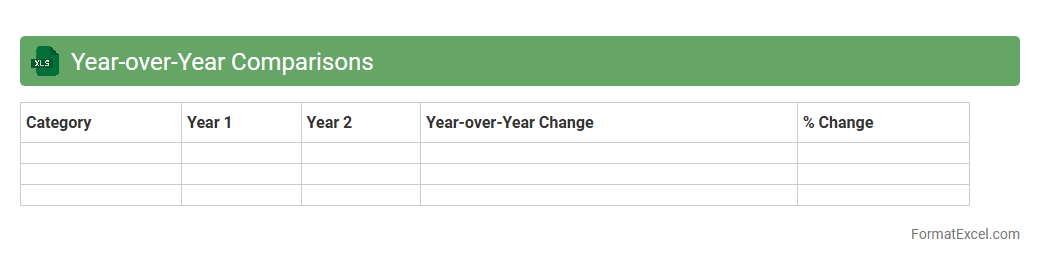

Year-over-Year Comparisons

A

Year-over-Year Comparisons Excel document is a spreadsheet designed to analyze and compare data from the same period across different years, allowing users to identify trends, growth patterns, and seasonal variations. This tool helps businesses and analysts make informed decisions by highlighting changes in key metrics such as sales, revenue, or expenses over time. It improves financial forecasting, performance evaluation, and strategic planning by providing a clear visual representation of year-to-year progress.

Introduction to Statement of Operations in Excel

The statement of operations in Excel, also known as the income statement, provides a financial snapshot of a company's performance over a specific period. It helps track revenues, expenses, and profits systematically. Using Excel enables dynamic analysis and easy updates for ongoing financial tracking.

Importance of Proper Statement Format

A well-organized statement format ensures clarity and accuracy in presenting financial data. Proper formatting aids stakeholders in understanding business profitability and supports better decision-making. Incorrect formatting can lead to misinterpretations and financial mismanagement.

Key Sections of a Statement of Operations

The main sections include revenue, expenses, and net income or loss. Revenue lists all income sources, expenses cover operational costs, and net income calculates profitability. Clear segregation of these parts improves readability and precision.

Setting Up Your Excel Worksheet

Start by creating headers for each section with clearly labeled columns and rows. Utilize Excel's grid to separate revenue from expenses and summarize totals. Structured worksheet setup streamlines data entry and analysis.

Listing Revenue Sources

Identify all potential income streams such as sales, services, or other revenue categories. Record each source on separate lines under the revenue section for detailed tracking. Accurate listing is crucial for comprehensive financial reporting.

Detailing Expenses Categories

Categorize expenses into fixed and variable costs, like salaries, rent, utilities, and supplies. Using expense categories helps in better monitoring and controlling business costs. Proper detailing enhances financial transparency and budget management.

Calculating Net Income or Loss

Subtract total expenses from total revenues to determine the net income or loss. Excel formulas like SUM and simple arithmetic streamline this calculation. This final figure reflects the business's profitability during the reporting period.

Formatting Tips for Clarity and Accuracy

Use bold fonts, borders, and shading to emphasize critical data such as totals and subtotals. Consistent number formatting with currency symbols enhances clarity. Aligning numbers and text improves overall readability and reduces errors.

Common Mistakes to Avoid in Excel Statements

Avoid omitting important revenue or expense items and errors in formulas. Mislabeling categories or inconsistent formatting can lead to inaccurate financial statements. Double-check all entries and calculations for correctness before finalizing.

Downloadable Statement of Operations Excel Template

Utilize a pre-built Excel template to save time and ensure proper structure. Many templates come with pre-set formulas and formatting suitable for various industries. Downloading one provides a starting point for creating accurate financial statements.