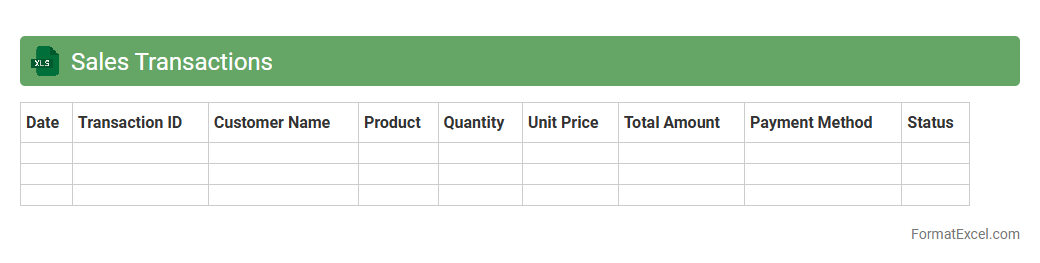

Sales Transactions

A

Sales Transactions Excel document is a spreadsheet that records details of every sale, including date, product, quantity, price, and customer information. It is useful for tracking revenue, analyzing sales trends, managing inventory, and generating reports for informed business decisions. Businesses rely on this document to improve financial accuracy and streamline sales operations effectively.

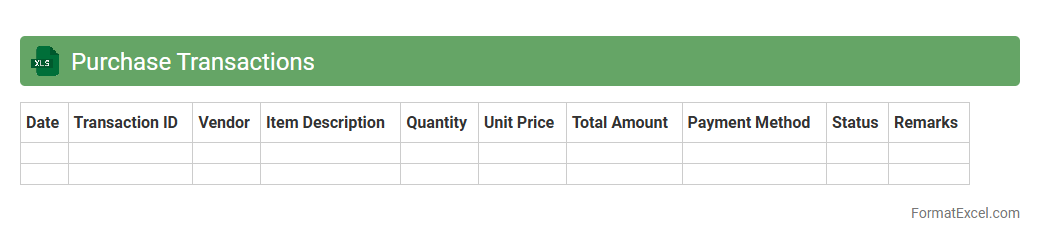

Purchase Transactions

The

Purchase Transactions Excel document is a structured spreadsheet that records all purchase activities, including item details, quantities, prices, dates, and vendor information. It helps businesses track expenses, manage inventory, analyze spending patterns, and maintain accurate financial records for budgeting and auditing purposes. By organizing purchase data efficiently, it enables improved decision-making and operational transparency.

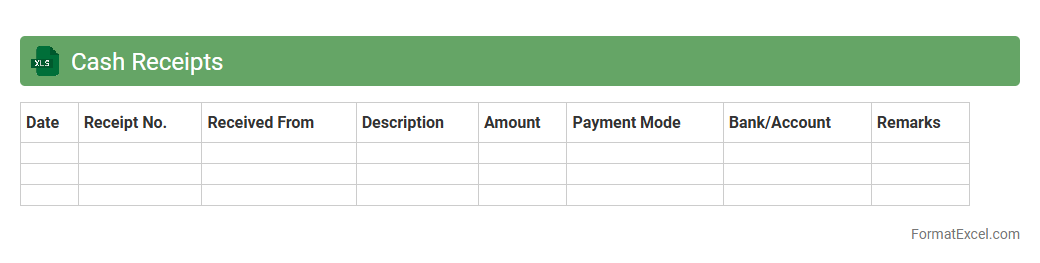

Cash Receipts

A

Cash Receipts Excel document is a digital tool designed to record and track all incoming cash transactions systematically. It helps businesses maintain accurate financial records by organizing sales, payments, and deposits in a structured format, enabling easy reconciliation and audit readiness. Using this document improves cash flow management and supports timely financial decision-making.

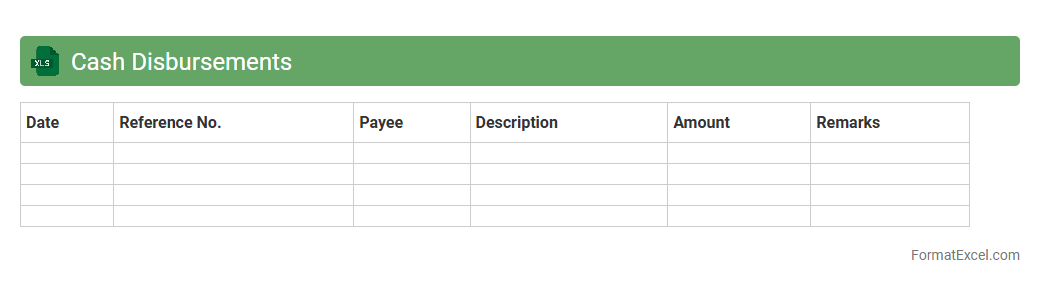

Cash Disbursements

A

Cash Disbursements Excel document is a structured spreadsheet used to record and track all outgoing cash payments made by a business or individual. It helps maintain accurate financial records, ensuring transparency and effective cash flow management. By systematically organizing payment details, dates, and amounts, it simplifies budget monitoring and supports decision-making processes.

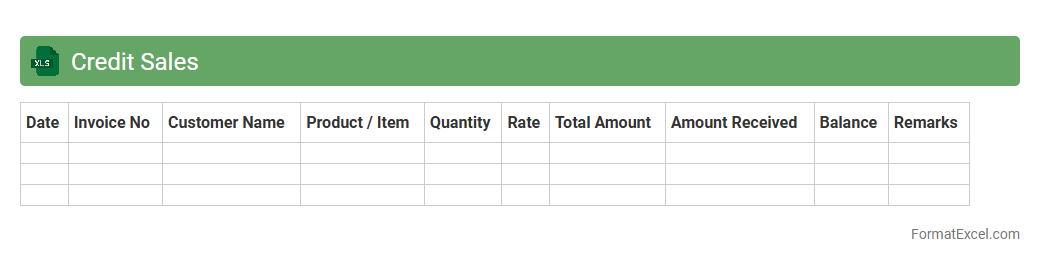

Credit Sales

A

Credit Sales Excel document is a spreadsheet designed to track and manage sales made on credit, including customer details, payment terms, outstanding balances, and due dates. It helps businesses monitor receivables effectively, ensuring timely follow-ups and improved cash flow management. Utilizing this tool increases financial accuracy and supports better decision-making in credit control processes.

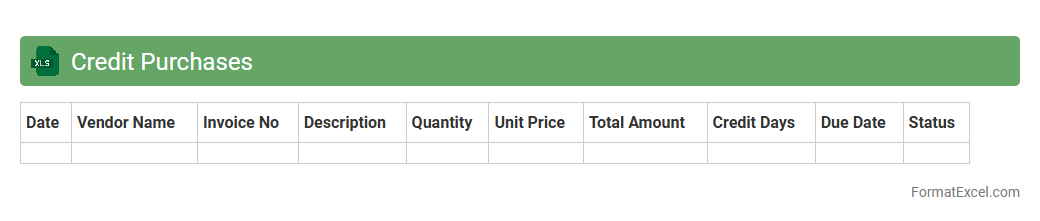

Credit Purchases

The

Credit Purchases Excel document is a detailed spreadsheet used to record and track all transactions where goods or services are bought on credit. It helps businesses maintain an organized log of payables, monitor outstanding debts, and manage cash flow efficiently. By providing clear visibility into credit purchase patterns, this document supports better financial planning and vendor relationship management.

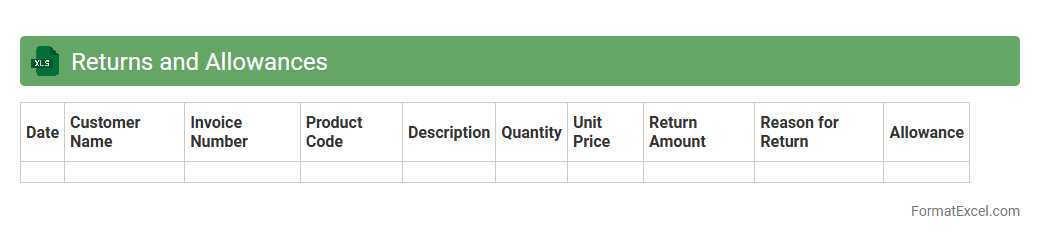

Returns and Allowances

A

Returns and Allowances Excel document is a spreadsheet used to track and manage product returns, discounts, and customer allowances efficiently. It helps businesses monitor return rates, identify patterns, and adjust inventory or pricing strategies accordingly. Using this document enables improved financial accuracy and customer satisfaction by providing clear records for analysis and reporting.

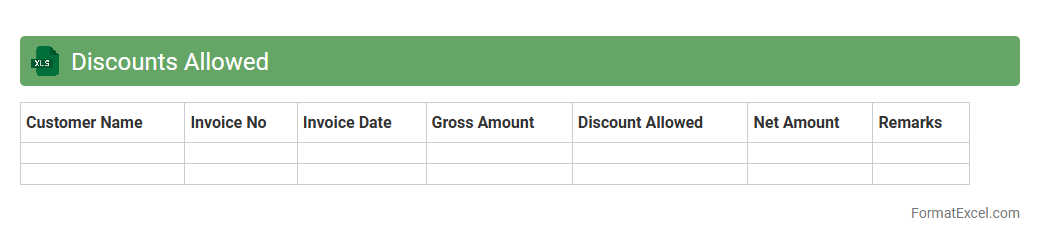

Discounts Allowed

The

Discounts Allowed Excel document is a financial tool used to record and track the discounts a business grants to customers on sales transactions. It helps streamline accounting processes by accurately capturing discount data, enabling better analysis of sales performance and cash flow impact. Utilizing this document improves financial management by providing clear insights into customer incentives and overall revenue adjustments.

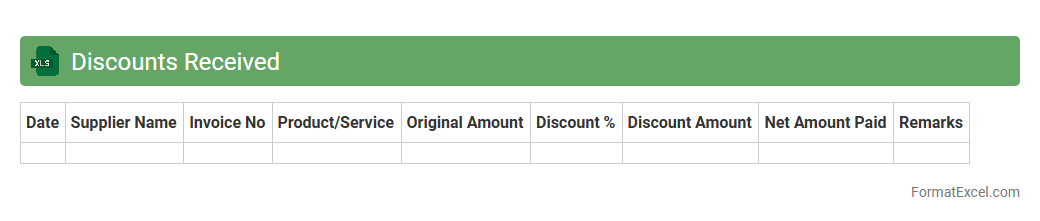

Discounts Received

The

Discounts Received Excel document tracks all reductions in purchase prices obtained from suppliers, facilitating accurate financial management and budgeting. It enables businesses to monitor savings efficiently, analyze vendor performance, and optimize procurement costs. This organized record supports informed decision-making and enhances overall expense control.

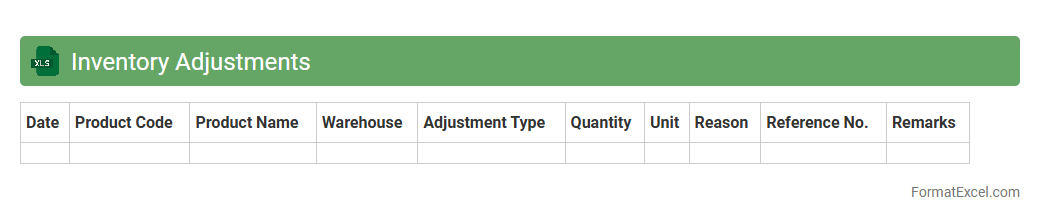

Inventory Adjustments

An

Inventory Adjustments Excel document is a structured spreadsheet designed to track changes in stock levels due to various reasons such as damages, returns, or stocktaking discrepancies. It helps businesses maintain accurate inventory records by documenting additions, subtractions, and corrections, ensuring data integrity and reducing losses. Using this tool improves inventory management efficiency and supports better decision-making in supply chain operations.

Accounts Receivable Tracking

An

Accounts Receivable Tracking Excel document is a financial tool designed to monitor outstanding customer balances and payment statuses efficiently. It helps businesses maintain accurate records of invoices issued, due dates, and collections, improving cash flow management and reducing the risk of bad debts. By providing a clear overview of receivables, this spreadsheet supports timely follow-ups and informed decision-making for credit control and financial planning.

Accounts Payable Tracking

An

Accounts Payable Tracking Excel document is a spreadsheet tool designed to monitor and manage outstanding bills and vendor payments efficiently. It helps businesses keep detailed records of due dates, payment statuses, and amounts owed, ensuring timely payments and avoiding late fees. This tool streamlines financial operations by improving cash flow management and enhancing vendor relations through organized tracking.

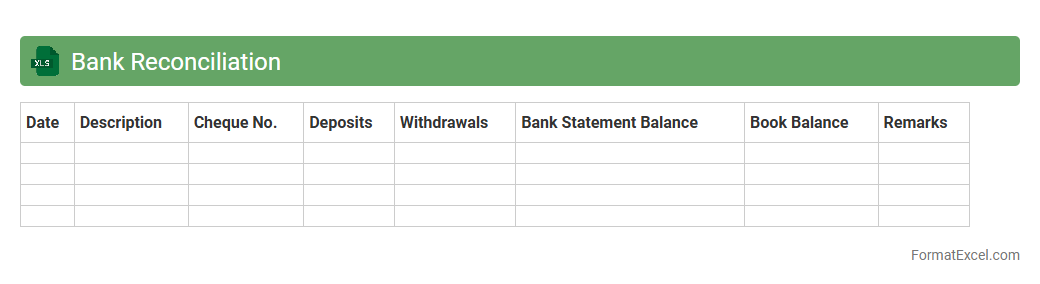

Bank Reconciliation

A

Bank Reconciliation Excel document is a tool used to compare an organization's financial records with its bank statements to identify discrepancies. It helps ensure accuracy in accounting by detecting errors, unauthorized transactions, or missed entries. This process is essential for maintaining financial integrity and improving cash flow management.

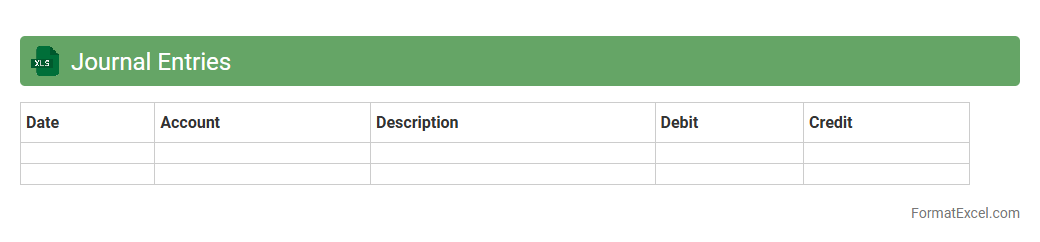

Journal Entries

A

Journal Entries Excel document is a structured digital ledger that records financial transactions systematically, ensuring accurate bookkeeping and compliance with accounting standards. It allows businesses to track debits and credits efficiently, facilitating easy reconciliation, auditing, and financial analysis. This tool enhances data organization, reduces manual errors, and streamlines the preparation of financial statements.

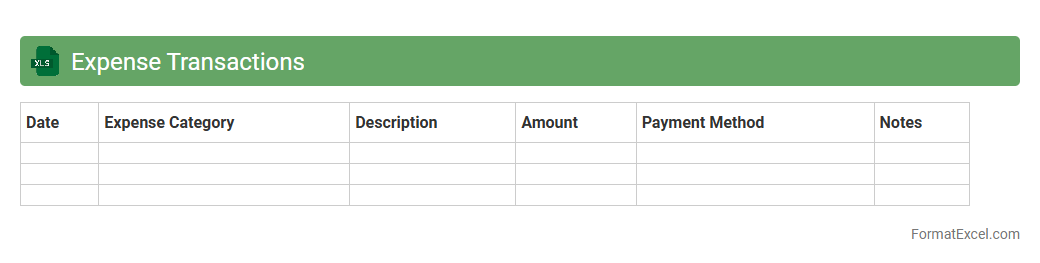

Expense Transactions

An

Expense Transactions Excel document is a structured spreadsheet used to record, track, and analyze individual expense entries, including dates, amounts, categories, and payment methods. It enables efficient financial management by providing clear visibility into spending patterns, aiding in budget adherence and cost control. The document's organized format facilitates accurate reporting, auditing, and forecasting, making it essential for both personal and business financial planning.

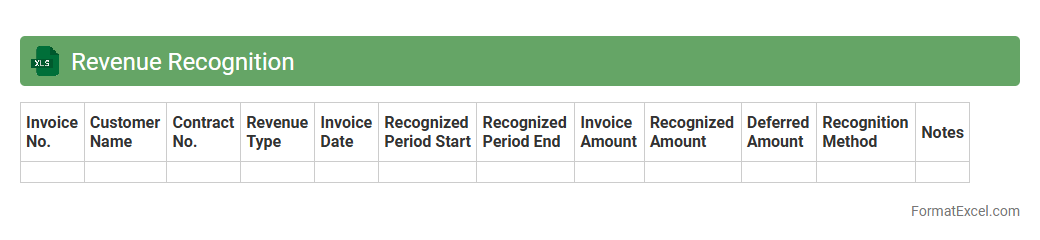

Revenue Recognition

A

Revenue Recognition Excel document systematically tracks when and how revenue is recorded in financial statements, ensuring compliance with accounting standards like GAAP or IFRS. It helps businesses accurately match income with the corresponding period, improving financial transparency and audit readiness. This tool is essential for managing complex contracts, subscription services, or multi-deliverable arrangements, providing clear visibility into recognized and deferred revenue.

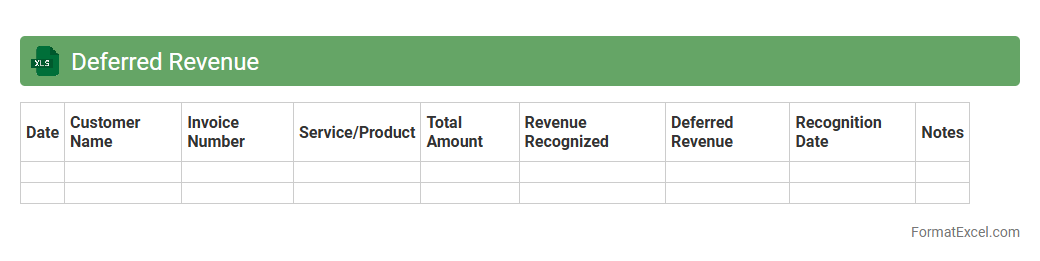

Deferred Revenue

A Deferred Revenue Excel document is a spreadsheet tool designed to track and manage payments received for goods or services that have yet to be delivered, representing a company's

liability until the service is performed or product is delivered. It helps businesses accurately record and recognize revenue over time in compliance with accounting standards, ensuring financial statements reflect true earnings. This document is essential for forecasting cash flow, improving revenue recognition accuracy, and maintaining transparent financial reporting.

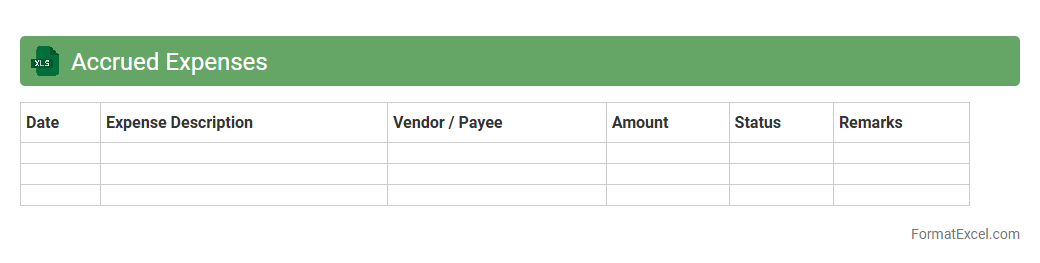

Accrued Expenses

An

Accrued Expenses Excel document is a financial tool designed to record and track expenses that have been incurred but not yet paid. It helps businesses accurately reflect their liabilities and ensures proper matching of expenses to the correct accounting period. Using this document improves financial reporting accuracy and supports better budget management and cash flow forecasting.

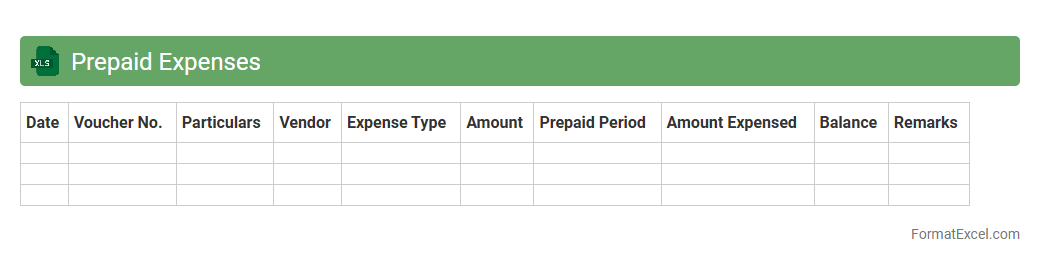

Prepaid Expenses

A

Prepaid Expenses Excel document is a financial tool designed to track and manage payments made in advance for goods or services, ensuring accurate accounting and budgeting. It helps businesses monitor the allocation of these expenses over time, preventing errors in financial reporting and improving cash flow management. Using this document enhances visibility into future costs and aids in aligning financial planning with actual expenditure timelines.

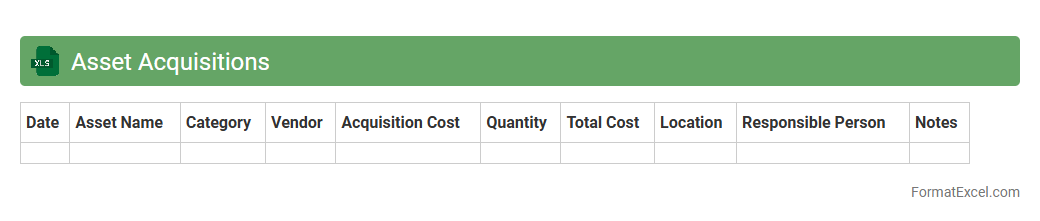

Asset Acquisitions

An

Asset Acquisitions Excel document serves as a structured tool for tracking the purchase, valuation, and integration of assets within a company. It helps streamline financial analysis and supports decision-making by consolidating detailed information on acquisition costs, depreciation schedules, and asset categories. This document enhances transparency and ensures efficient management of asset portfolios, aiding in budget control and compliance reporting.

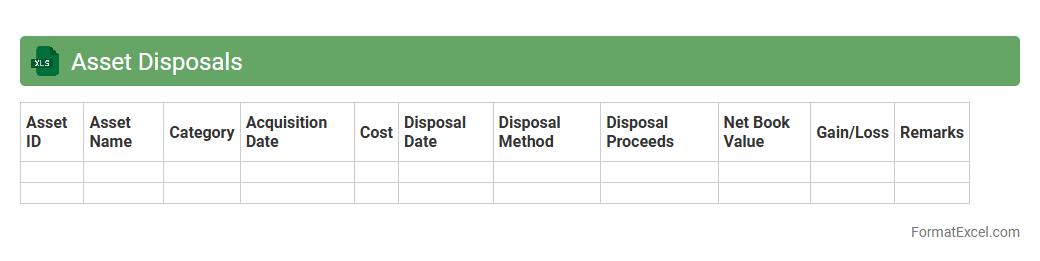

Asset Disposals

An

Asset Disposals Excel document is a structured spreadsheet designed to track and manage the sale, retirement, or disposal of company assets. It provides detailed records of asset values, disposal dates, and depreciation, enabling accurate financial reporting and compliance with accounting standards. This tool helps businesses streamline asset management processes, avoid errors in asset valuation, and improve decision-making for future capital investments.

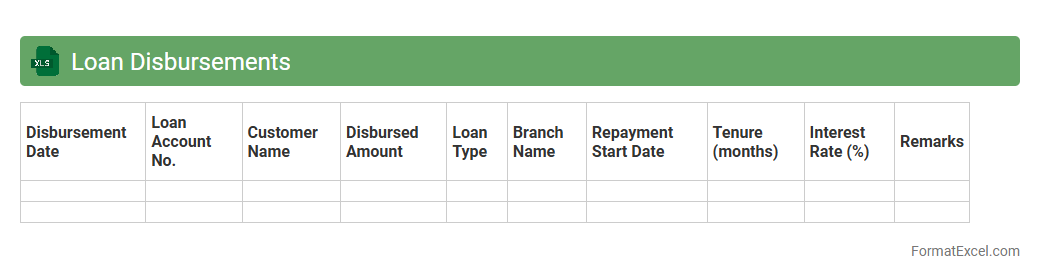

Loan Disbursements

A

Loan Disbursements Excel document is a structured spreadsheet used to track the release of loan funds to borrowers over time. It helps in organizing data such as loan amounts, disbursement dates, borrower details, and remaining balances, enabling efficient monitoring of loan distribution and repayment schedules. This document is useful for lenders and financial institutions to maintain transparency, ensure accurate record-keeping, and streamline the loan management process.

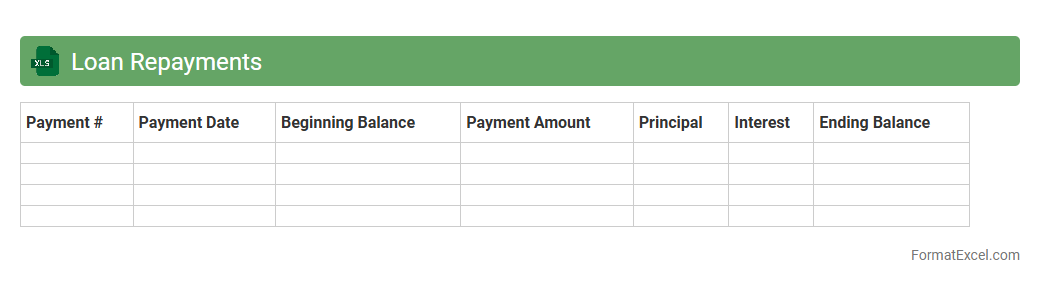

Loan Repayments

A

Loan Repayments Excel document is a structured spreadsheet designed to track and manage the repayment schedule of loans, including principal, interest, due dates, and outstanding balances. It helps users accurately monitor payment progress, calculate amortization, and ensure timely repayments, reducing the risk of defaults. This tool enhances financial planning by providing clear visibility into loan liabilities and cash flow management.

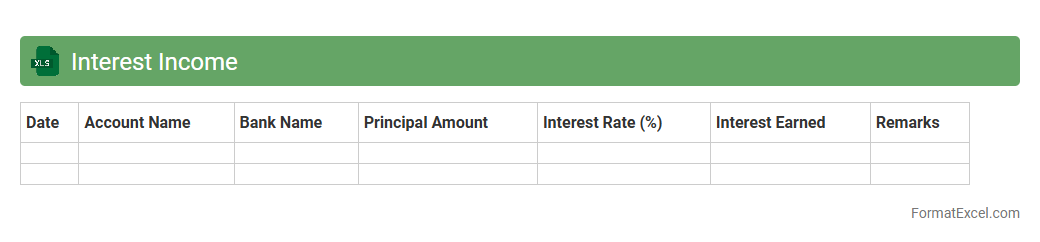

Interest Income

An

Interest Income Excel document is a spreadsheet designed to track and calculate interest earned from various financial investments such as savings accounts, bonds, or loans. It helps individuals and businesses monitor their income streams accurately, ensuring precise financial reporting and tax compliance. By organizing interest details systematically, it simplifies financial analysis and aids in forecasting future earnings.

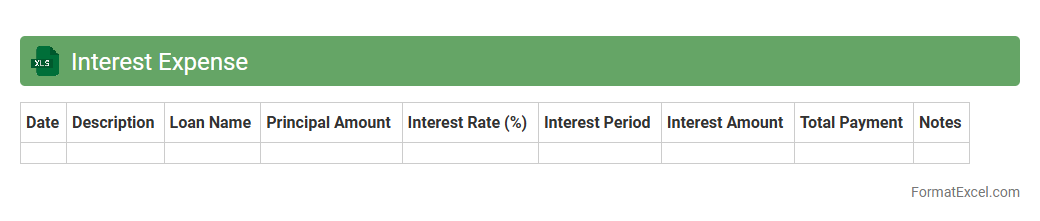

Interest Expense

An

Interest Expense Excel document is a financial tool used to calculate and track the cost of borrowing over time, including loan interest payments and accrued interest. It helps businesses and individuals analyze their debt obligations, forecast future interest costs, and manage cash flow more effectively. This document is essential for budgeting, financial planning, and ensuring accurate expense reporting in accounting records.

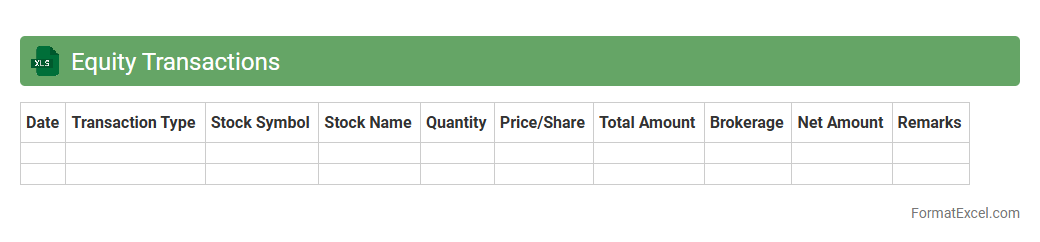

Equity Transactions

An

Equity Transactions Excel document is a specialized spreadsheet designed to track and record all equity-related activities such as stock purchases, sales, dividends, and stock splits. It provides detailed insights into ownership changes, helps in accurate calculation of capital gains, and supports informed decision-making for investors or financial analysts. This tool enhances transparency, simplifies complex data management, and ensures compliance with accounting and regulatory standards.

Introduction to Transaction Analysis in Excel

Transaction analysis in Excel involves recording and evaluating financial activities systematically. Excel provides a flexible platform to organize, track, and analyze transactions efficiently using spreadsheets. Mastering this method enhances your financial management skills significantly.

Importance of Structured Transaction Records

Structured transaction records ensure accuracy and clarity in financial reporting. They facilitate easy auditing and trend analysis, reducing errors and discrepancies. Maintaining a well-organized ledger is critical for effective decision-making.

Key Components of an Excel Transaction Analysis Format

Essential components include columns for date, description, transaction type, amount, and balance. Including categories or tags improves data sorting and filtering. This structure supports a comprehensive financial overview.

Step-by-Step Guide to Setting Up the Format

Start by creating headers for each key component in a worksheet. Enter sample data to test formulas and formatting rules. Incorporate drop-down lists and conditional formatting to enhance user interaction and usability of the spreadsheet.

Essential Columns for Transaction Analysis Spreadsheets

Include Date, Description, Debit, Credit, Balance, and Category for complete records. The Balance column typically uses formulas to auto-calculate running totals. Proper column setup ensures efficient and accurate transaction tracking.

Best Practices for Data Entry and Validation

Consistently use correct formats for dates and monetary values. Implement data validation rules to prevent incorrect entries and maintain data integrity. These practices help sustain a reliable dataset for analysis.

Using Excel Formulas for Automatic Calculations

Utilize SUM, IF, and VLOOKUP functions to automate totals and conditional checks. Formulas can dynamically update balances and categorize transactions. This automation streamlines the analytical process and saves time.

Tips for Customizing Transaction Analysis Templates

Customize templates based on business needs by adding specific columns or pivot tables. Use charts and graphs to visualize spending patterns and cash flow. Tailored templates make the analysis more insightful and user-friendly.

Common Mistakes to Avoid in Transaction Tracking

Avoid inconsistent category naming and neglecting regular updates. Misentries and missing validation compromise data quality. Ensuring disciplined entry habits prevents errors and inaccurate reporting.

Downloadable Excel Transaction Analysis Format Templates

Ready-made Excel templates provide a quick start for transaction analysis projects. Many online platforms offer free and customizable formats that suit various financial tracking needs. Utilizing downloadable templates saves time and ensures accuracy.