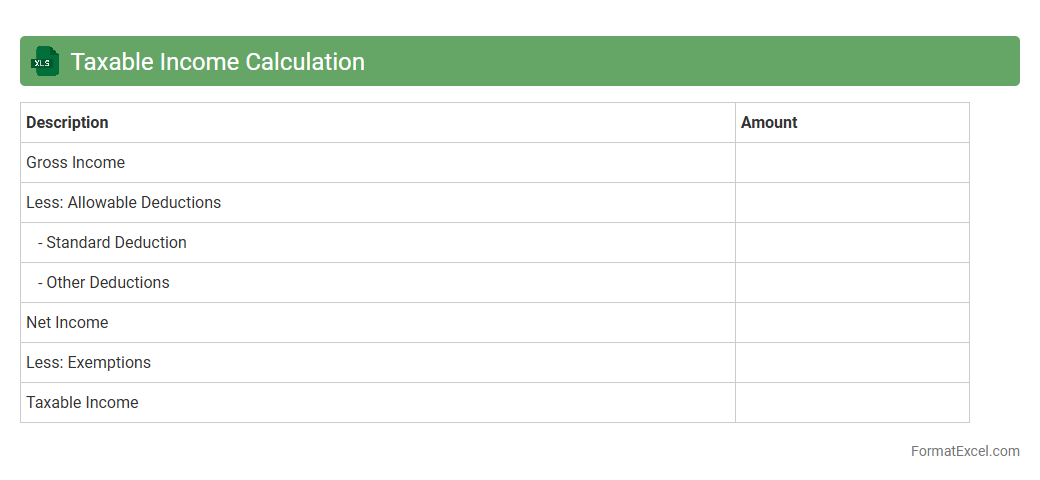

Taxable Income Calculation

A

Taxable Income Calculation Excel document is a financial tool designed to systematically compute taxable income by organizing income sources, deductions, and credits in one place. It streamlines tax preparation by reducing errors and saving time in calculating accurate taxable amounts for individuals or businesses. This document helps users ensure compliance with tax regulations while maximizing legitimate deductions and tax benefits.

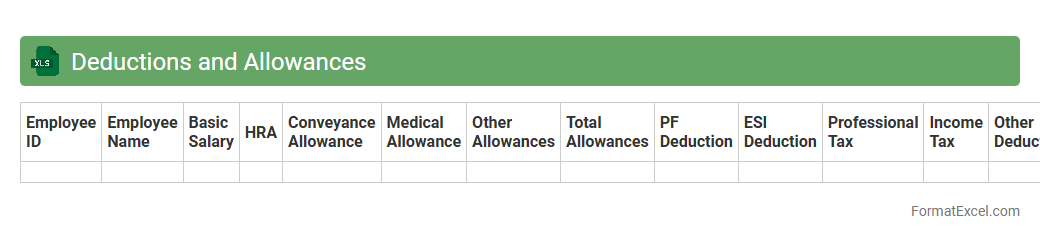

Deductions and Allowances

The

Deductions and Allowances Excel document is a structured spreadsheet designed to systematically calculate and track various financial deductions and allowances relevant to tax, payroll, or budgeting processes. It helps users organize data such as tax exemptions, personal allowances, business expense deductions, and other financial reliefs, ensuring accurate computations and compliance with relevant regulations. Utilizing this tool enhances financial planning, streamlines record-keeping, and supports efficient decision-making by providing clear visibility into deductible amounts and allowable expenses.

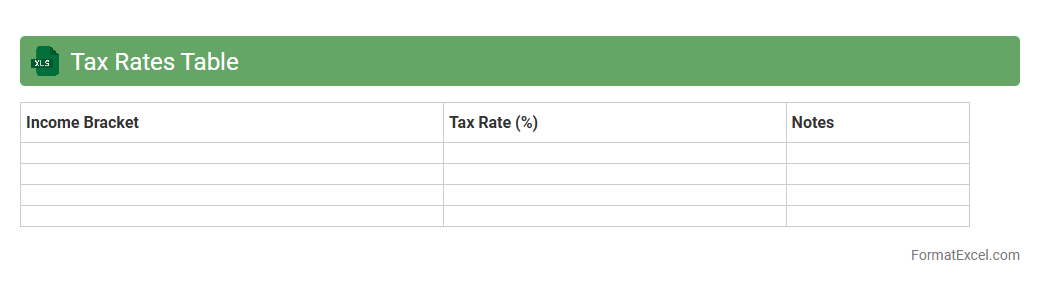

Tax Rates Table

A

Tax Rates Table Excel document organizes various tax percentages applicable to different income brackets, products, or services in a clear, structured format. It enables quick calculation and comparison of tax liabilities, improving financial planning and compliance accuracy for individuals and businesses. Using this tool streamlines tax management by automatically updating values based on input data, saving time and reducing errors.

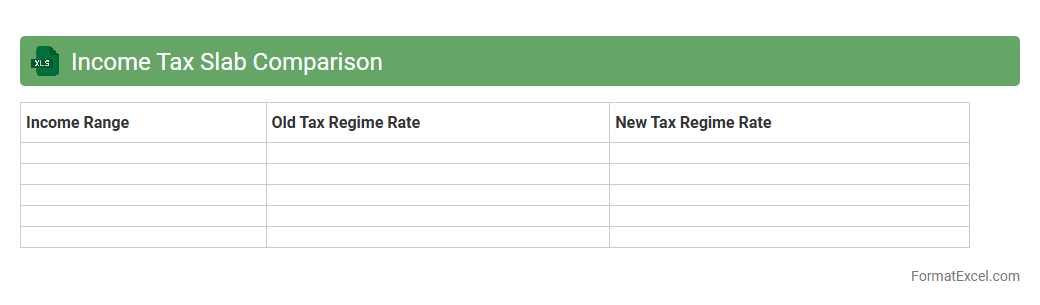

Income Tax Slab Comparison

The

Income Tax Slab Comparison Excel document provides a structured format to compare different tax slabs across financial years or various income brackets, helping individuals and businesses understand their tax liabilities quickly. It simplifies complex tax calculations by allowing users to input their income and instantly see the applicable tax rates and amounts, enabling better financial planning and tax optimization. This tool is essential for taxpayers aiming to maximize savings and comply accurately with tax regulations.

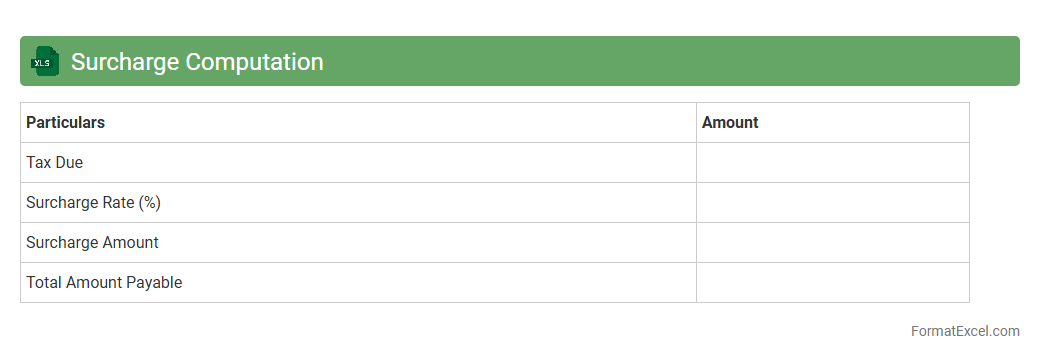

Surcharge Computation

The

Surcharge Computation excel document is a specialized tool designed to calculate additional fees or penalties based on predefined rules, such as late payments or excess usage. It helps businesses accurately determine surcharge amounts by automating complex calculations, reducing errors, and saving time. This document is essential for financial management, billing accuracy, and ensuring compliance with contractual or regulatory requirements.

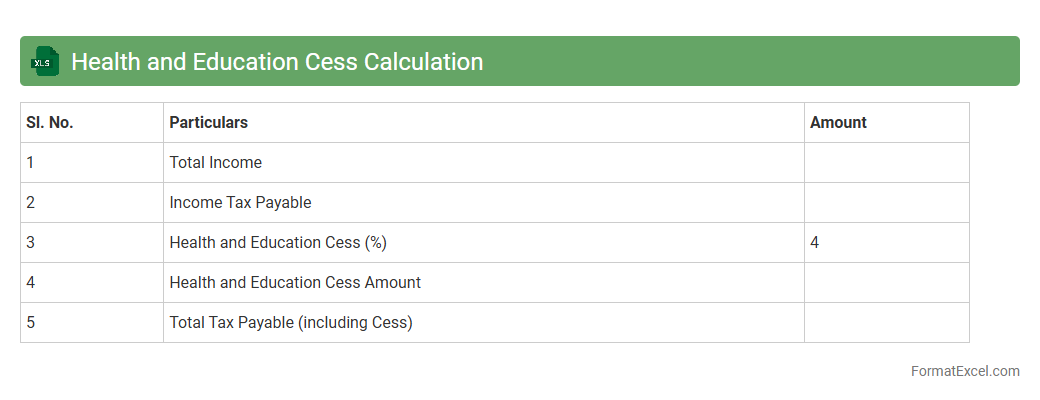

Health and Education Cess Calculation

The

Health and Education Cess Calculation Excel document is a specialized tool designed to accurately compute the additional cess levied on income tax to fund health and education initiatives. It streamlines the process by automatically applying the correct cess rates on taxable income, ensuring compliance with government regulations. This document is useful for individuals and businesses to quickly and error-free calculate their tax liabilities, optimizing financial planning and reporting.

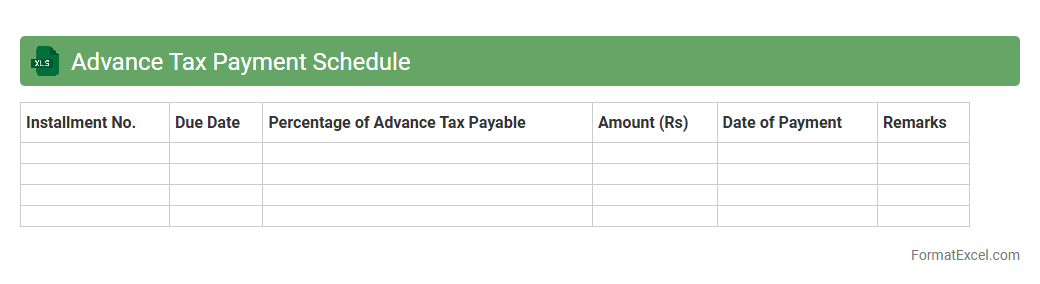

Advance Tax Payment Schedule

The

Advance Tax Payment Schedule Excel document is a structured tool designed to track and manage tax installment deadlines and amounts payable throughout the fiscal year. It helps individuals and businesses plan cash flows effectively, ensuring timely compliance with tax authorities and avoiding penalties. By organizing payment dates and amounts, users gain clear visibility of tax obligations, facilitating better financial planning and budget management.

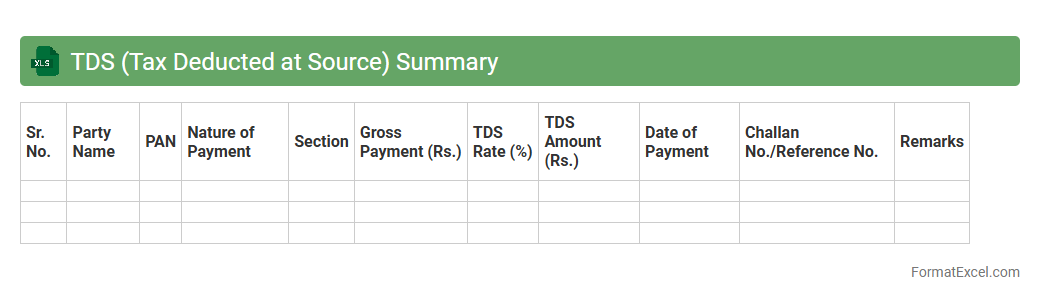

TDS (Tax Deducted at Source) Summary

A

TDS (Tax Deducted at Source) Summary excel document consolidates all tax deduction details from various transactions, providing a clear overview of amounts deducted and remitted to tax authorities. This summary assists businesses and individuals in tracking their tax liabilities, ensuring compliance with government regulations, and simplifying the process of filing income tax returns. By maintaining accurate TDS records, the document enables efficient reconciliation and reduces errors during audits or financial reviews.

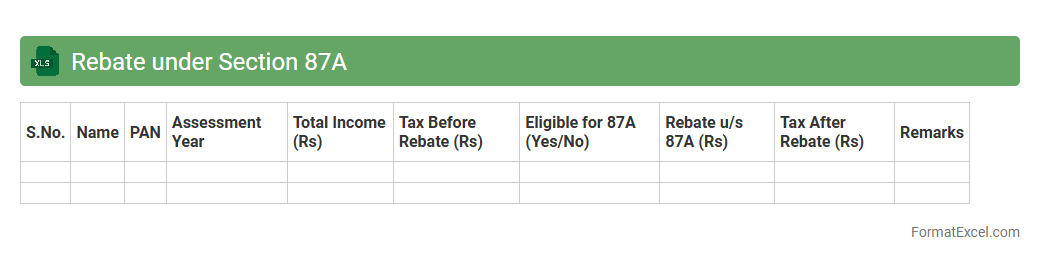

Rebate under Section 87A

Section 87A offers a valuable

tax rebate that reduces the tax liability of individual taxpayers with an income up to Rs5 lakh, allowing them to save up to Rs12,500 in taxes. This rebate is automatically calculated in the Excel document by entering eligible income details, simplifying tax planning and ensuring accurate computation of tax benefits. Utilizing this feature in Excel enhances financial efficiency by providing clear visibility on savings, thereby helping individuals optimize their overall tax payments.

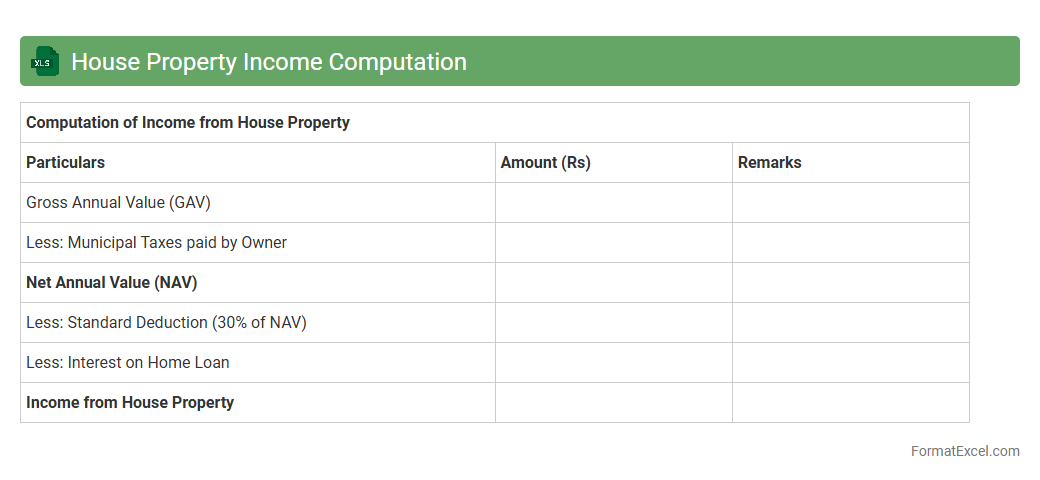

House Property Income Computation

The

House Property Income Computation Excel document is a structured tool designed to calculate taxable income from house property by organizing rental income, municipal taxes, and standard deductions. It streamlines the complex process of assessing income under Section 22 of the Income Tax Act, ensuring accuracy and compliance with tax regulations. Using this Excel sheet helps individuals efficiently determine their tax liability and maintain clear financial records for property-related income.

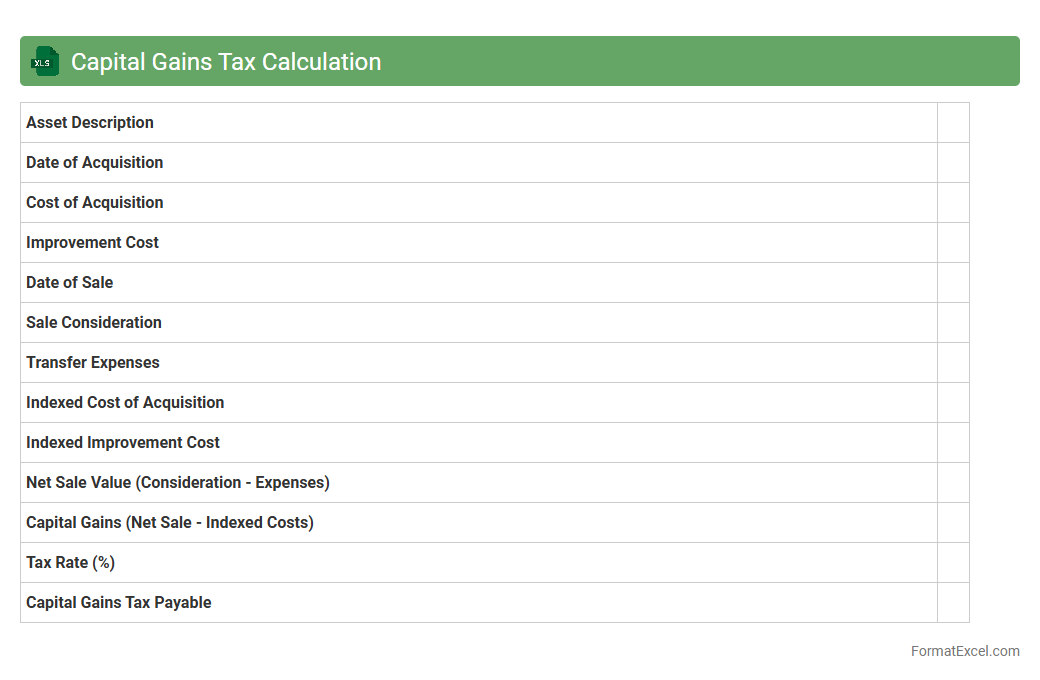

Capital Gains Tax Calculation

A

Capital Gains Tax Calculation Excel document is a financial tool designed to accurately compute taxes owed on profits from the sale of assets, such as stocks, property, or investments. It streamlines complex calculations by automatically applying relevant tax rates, holding periods, and exemptions, ensuring compliance with tax regulations. This document is useful for investors and taxpayers to efficiently manage tax liabilities, plan financial strategies, and avoid potential penalties.

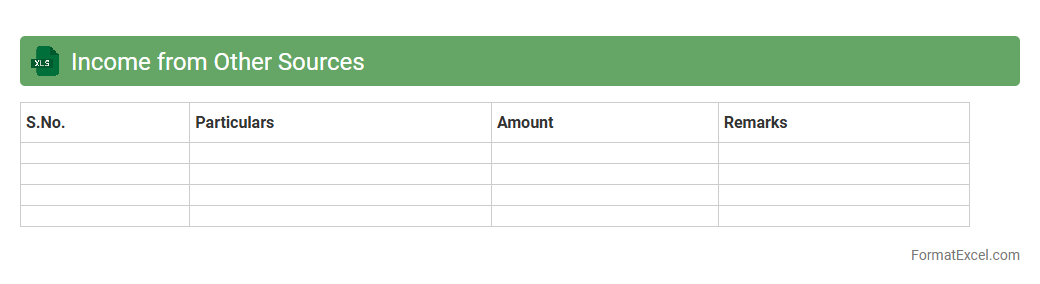

Income from Other Sources

The

Income from Other Sources Excel document is a detailed financial tracker designed to record and categorize income streams outside of primary business or employment earnings, such as interest, dividends, and rental income. It helps users maintain organized records for tax filing and financial planning, ensuring accurate computations and compliance with tax authorities. By providing a clear overview of miscellaneous income, this tool simplifies budgeting and enhances overall financial management.

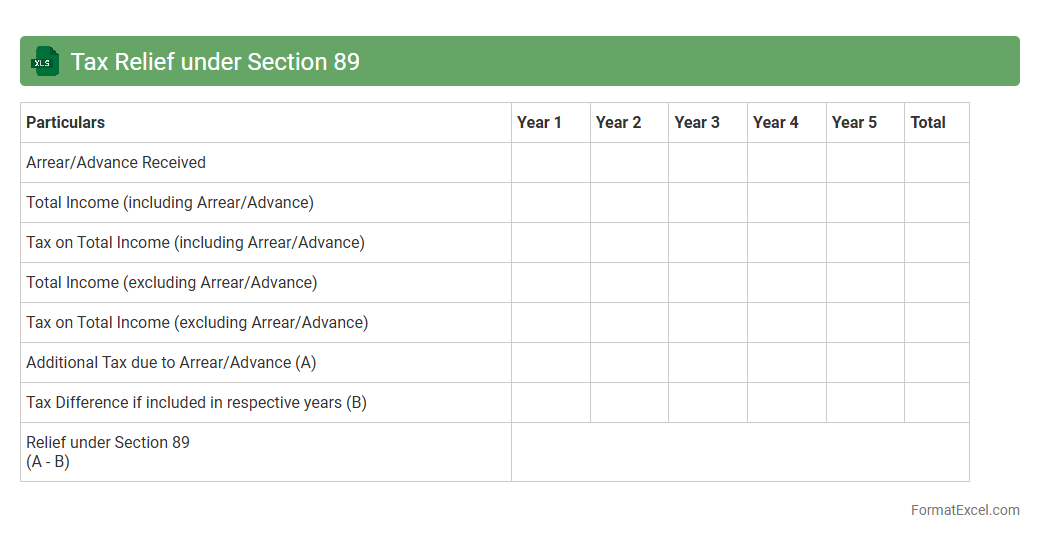

Tax Relief under Section 89

Tax Relief under Section 89 of the Income Tax Act helps taxpayers reduce the burden of tax arising due to salary arrears or advance salary received in a particular financial year. This relief recalculates the tax by spreading the arrears over the years they belong to, thereby lowering the taxable income for the year and preventing a steep increase in tax liability. Using an

Excel document to calculate Section 89 relief allows for accurate computation and easy adjustments, ensuring taxpayers can maximize their benefit efficiently.

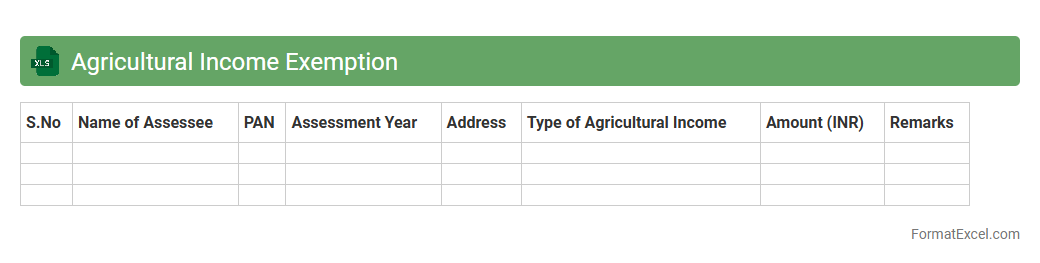

Agricultural Income Exemption

The

Agricultural Income Exemption Excel document is a specialized spreadsheet designed to calculate and track income exempt from taxation under agricultural income laws. It helps farmers, tax consultants, and financial planners accurately determine eligible exempt earnings, ensuring compliance with tax regulations while maximizing benefits. This tool simplifies complex calculations and provides a clear record for financial analysis and audit purposes.

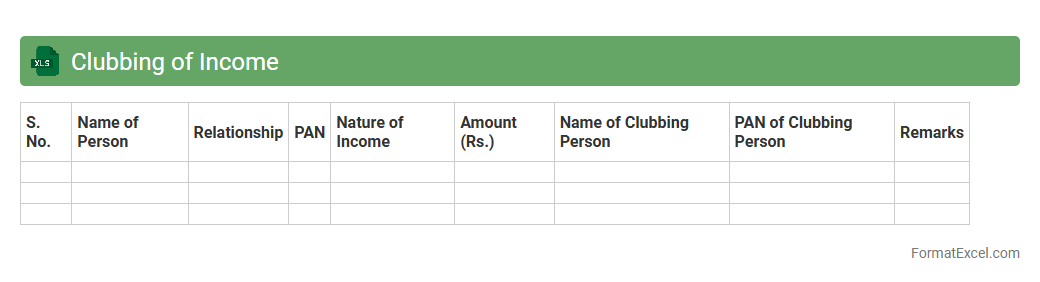

Clubbing of Income

The

Clubbing of Income Excel document is a financial tool designed to track income that is combined under tax laws to a single taxpayer, such as income of spouses, minor children, or transferred assets. It helps users systematically categorize and calculate combined incomes to ensure accurate tax reporting and compliance with income tax regulations. This document streamlines tax planning by providing clear insights into who bears tax liabilities for various income sources, thereby minimizing errors and optimizing tax savings.

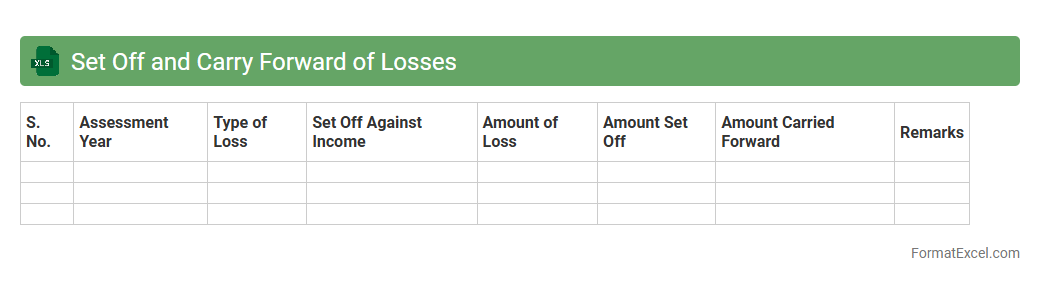

Set Off and Carry Forward of Losses

The

Set Off and Carry Forward of Losses Excel document is a financial tool designed to help businesses and individuals track and manage their tax losses efficiently. It enables users to systematically record losses from various sources, set off current year losses against income, and carry forward unadjusted losses to future years for tax deduction purposes. This document simplifies complex tax computations, ensuring compliance with tax regulations while optimizing tax liabilities and improving financial planning.

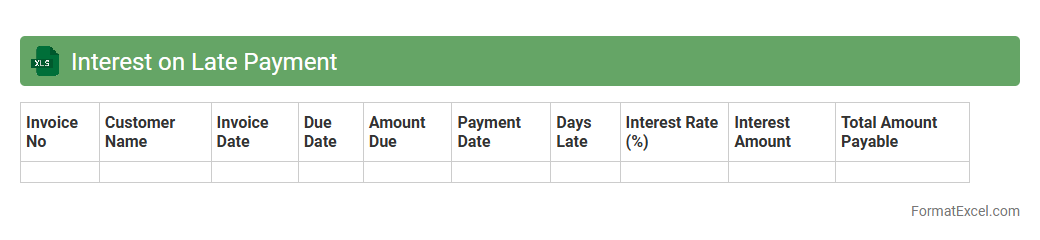

Interest on Late Payment

An

Interest on Late Payment Excel document calculates the additional charges incurred when payments are delayed beyond their due dates, ensuring accurate tracking of financial penalties. It automates the interest computation process based on predefined rates and payment timelines, reducing manual errors and saving time. Businesses use this tool to maintain transparency with clients, enforce timely payments, and improve cash flow management.

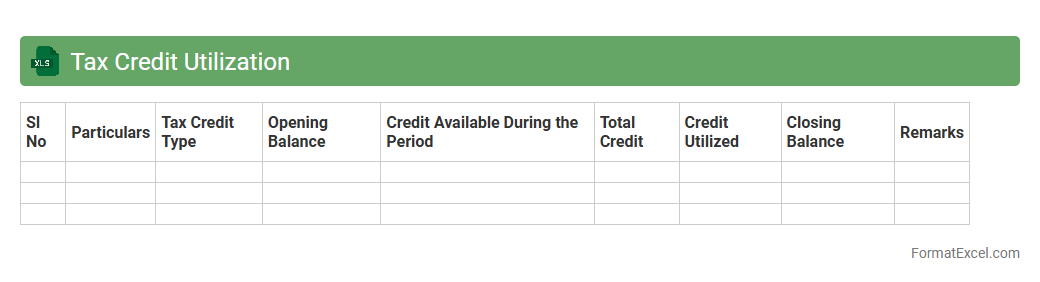

Tax Credit Utilization

A

Tax Credit Utilization Excel document is a tool designed to track and manage the application of tax credits against tax liabilities. It helps businesses and individuals maximize their tax benefits by providing a clear overview of available credits, their expiration dates, and how they have been applied over time. This organized approach ensures accurate tax reporting and aids in strategic financial planning to optimize tax savings.

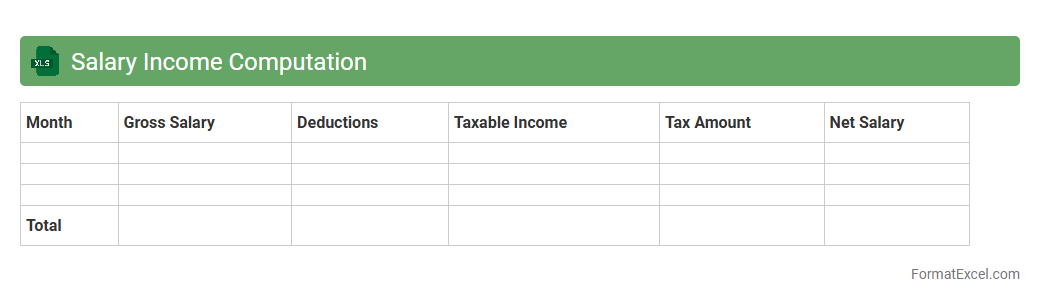

Salary Income Computation

The

Salary Income Computation Excel document is a structured spreadsheet designed to calculate and summarize an individual's or employee's salary components, including basic pay, allowances, deductions, and tax liabilities. It streamlines the process of income tax calculation by automating computations based on current tax laws and personal income details, ensuring accurate and efficient financial management. This tool is useful for both employers and employees to track monthly earnings, compute taxable income, and prepare documents for tax filing and compliance purposes.

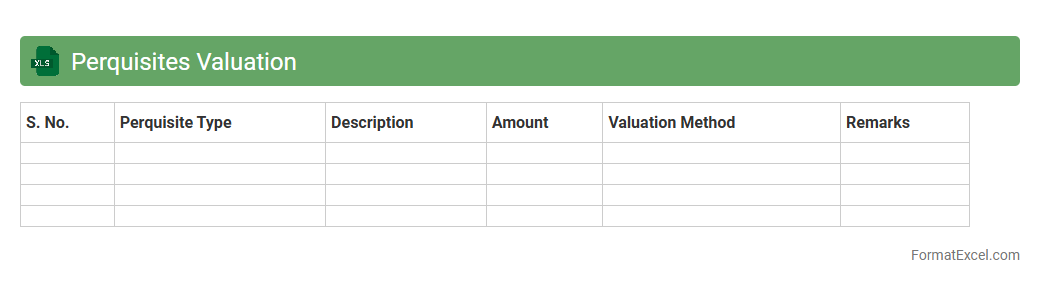

Perquisites Valuation

The

Perquisites Valuation Excel document is a specialized tool designed to calculate the monetary value of employee perks or non-cash benefits, as mandated by tax regulations. It helps organizations comply with taxation laws by accurately assessing the taxable value of perquisites like company cars, housing, or loans provided to employees. Utilizing this document streamlines payroll processing, ensures precise tax deductions, and supports financial transparency in employee compensation management.

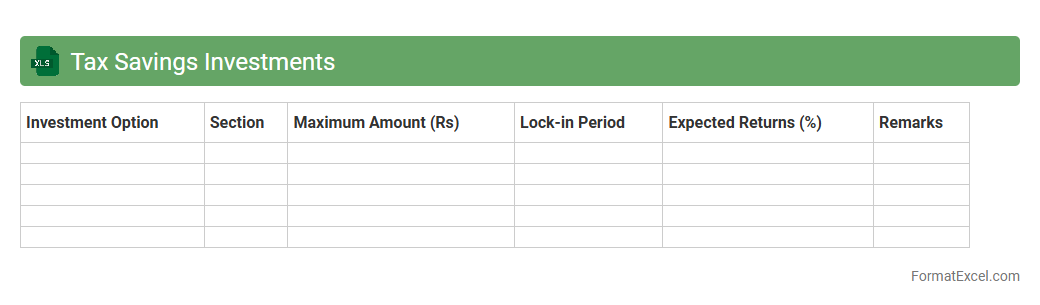

Tax Savings Investments

A

Tax Savings Investments Excel document is a structured spreadsheet designed to organize and track various investment options aimed at reducing taxable income. It helps individuals systematically plan investments like PPF, ELSS, and NPS, ensuring they maximize deductions under sections like 80C of the Income Tax Act. By maintaining accurate records, users can easily analyze their portfolio's performance and optimize tax benefits efficiently.

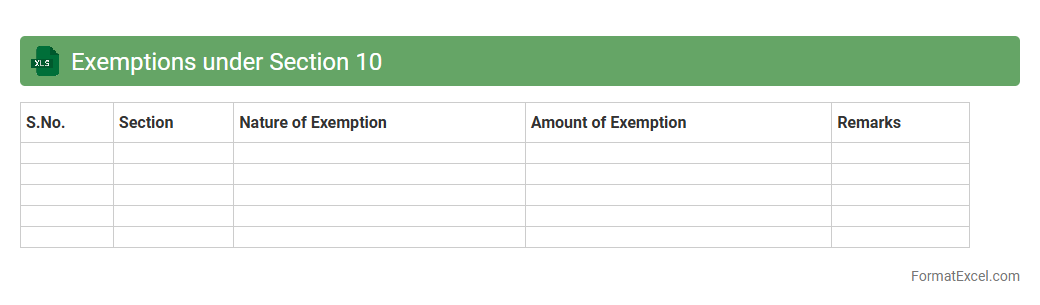

Exemptions under Section 10

The

Exemptions under Section 10 Excel document systematically categorizes various income types exempt from tax under Section 10 of the Income Tax Act, facilitating easy reference and compliance. It helps taxpayers and professionals quickly identify exempt income sources such as agricultural income, allowances, and dividends, ensuring accurate tax calculations and optimized financial planning. This organized format enhances efficiency in tax management by reducing errors and saving time during the filing process.

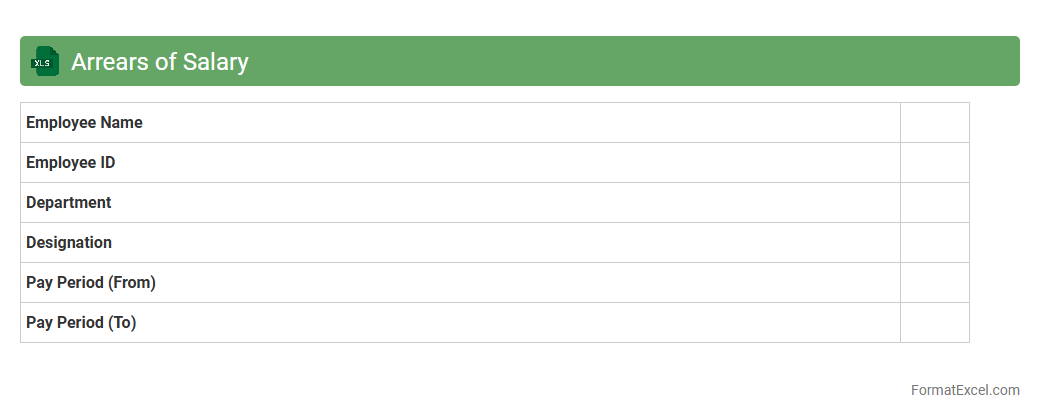

Arrears of Salary

An

Arrears of Salary Excel document is a spreadsheet used to track and calculate overdue salary payments owed to employees due to delayed salary disbursements or salary revisions. This document helps organizations accurately compute the total arrears amount by considering factors such as backdated salary hikes, bonuses, or missed payments, ensuring transparent payroll management. It is useful for maintaining clear financial records, facilitating timely salary settlements, and ensuring compliance with labor laws and internal accounting practices.

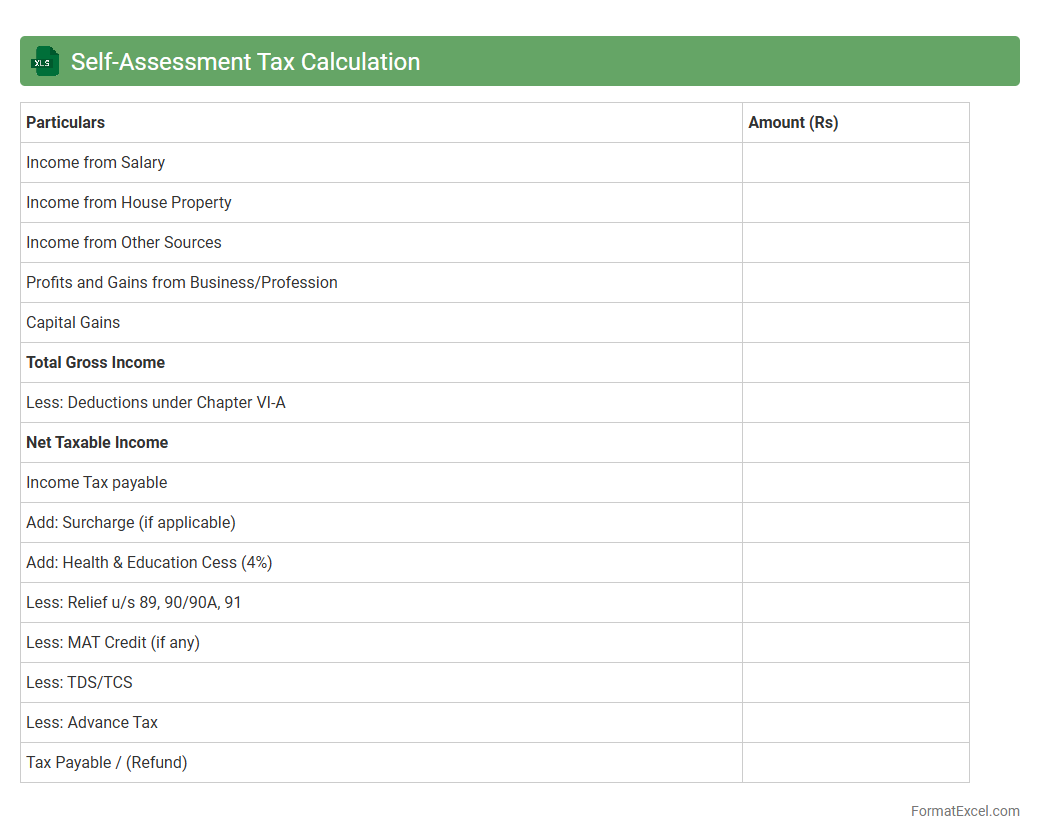

Self-Assessment Tax Calculation

The

Self-Assessment Tax Calculation Excel document is a practical tool designed to help individuals and businesses accurately compute their tax liabilities based on income, expenses, and applicable deductions. It simplifies complex tax rules by organizing financial data and automatically calculating tax owed, reducing errors and saving time during tax filing. This document is essential for ensuring compliance with tax authorities and optimizing tax payments through precise, user-friendly calculations.

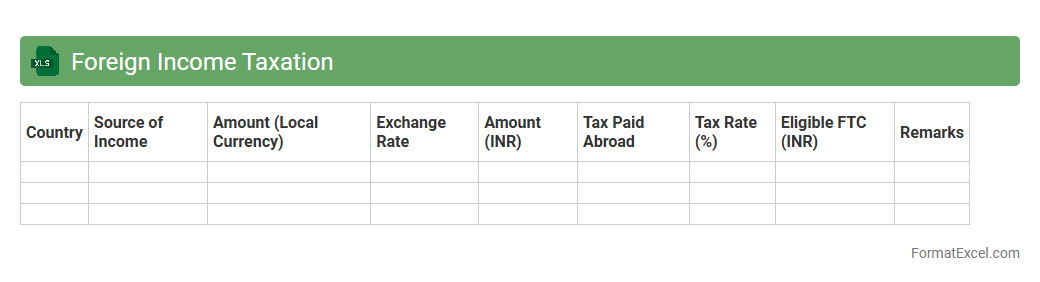

Foreign Income Taxation

A

Foreign Income Taxation Excel document is a specialized spreadsheet designed to calculate, track, and manage taxes on income earned from international sources. It helps individuals and businesses ensure compliance with varying tax regulations across countries by organizing foreign income details, tax rates, and credits efficiently. This document streamlines the complex process of foreign tax reporting, minimizing errors and optimizing tax liabilities.

Introduction to Income Tax Computation

Income tax computation is the systematic process of calculating tax liability based on taxable income. Using an organized format helps ensure accuracy and compliance with tax regulations. The computation format lays the foundation for effective tax planning and reporting.

Benefits of Using Excel for Tax Calculations

Excel provides a flexible and user-friendly platform for automating tax calculations efficiently. It minimizes manual errors and speeds up the process through built-in functions. The automation capabilities of Excel make it ideal for dynamic tax scenarios.

Key Components of Income Tax Computation Format

Essential components include gross income, deductions, exemptions, taxable income, and tax rates. Properly organizing these elements ensures clarity and ease of understanding. The taxable income section is critical for accurate computation.

Step-by-Step Guide to Creating the Excel Sheet

Start by outlining income sources and enter them in designated cells. Next, add rows for deductions and exemptions before applying tax slabs for calculation. This structured approach ensures the complete workflow is captured clearly.

Essential Formulas for Accurate Tax Calculation

Use SUM to aggregate incomes, IF for conditional tax slabs, and VLOOKUP for fetching tax rates. These formulas streamline the tax calculation process within Excel. Implementing correct formulas is key to precision.

Sample Income Tax Computation Excel Template

A well-designed template includes predefined sections for income, deductions, and tax calculations. It simplifies data entry and instantly updates tax payable based on inputs. Using a template saves time and ensures consistency.

Customization Tips for Different Income Sources

Adjust the format to accommodate salary, business income, capital gains, and other sources. Adding specific deduction categories helps tailor the computation to individual needs. Customizing the income breakdown enhances relevancy.

Common Errors to Avoid in Tax Computation

Beware of incorrect income classification, missing deductions, and formula errors. Double-check all entries and calculations to prevent discrepancies. Avoiding common errors ensures compliance and accuracy.

Tips for Data Validation and Accuracy

Use Excel's data validation tools to restrict input types and ranges. Regularly audit formulas and use conditional formatting to highlight anomalies. Maintaining data accuracy is crucial for trustworthy results.

Downloadable Income Tax Computation Excel Format

Downloadable templates provide an immediate starting point for tax calculation. Look for formats that are regularly updated to reflect the latest tax laws. A reliable downloadable format helps save effort and improves efficiency.