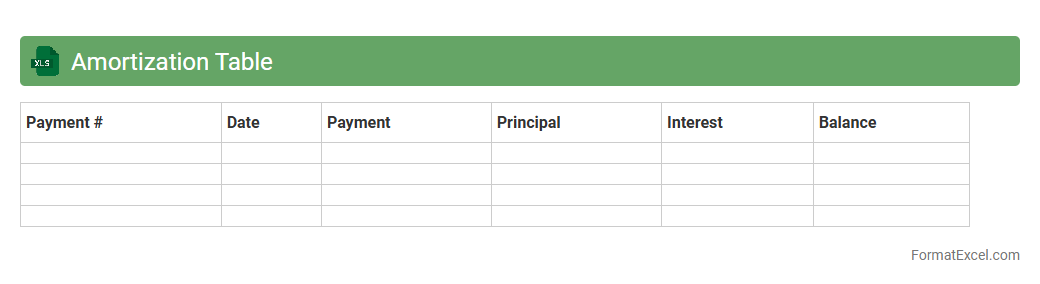

Amortization Table

An

Amortization Table Excel document systematically breaks down loan payments into principal and interest components over the loan term, allowing users to visualize payment schedules clearly. It is useful for managing mortgage, car loans, or any installment-based debt by tracking remaining balances and interest costs precisely. This tool enhances financial planning by helping users anticipate future payments and assess the total cost of borrowing.

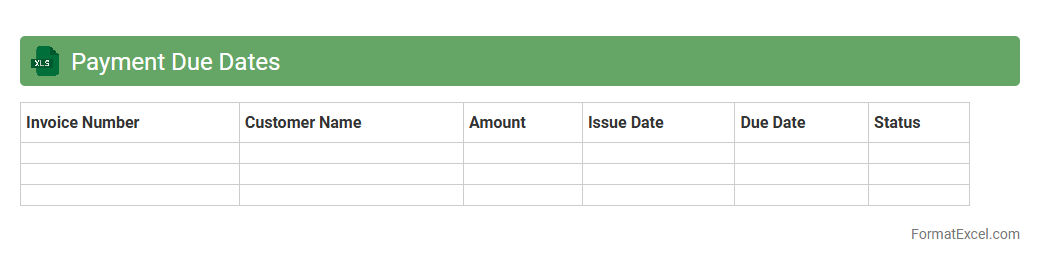

Payment Due Dates

The

Payment Due Dates Excel document is a structured spreadsheet designed to track and manage upcoming payment deadlines efficiently. It helps users avoid late fees by organizing bill due dates, payment amounts, and creditor information in one easily accessible location. This tool improves financial planning and ensures timely payment management for both personal and business expenses.

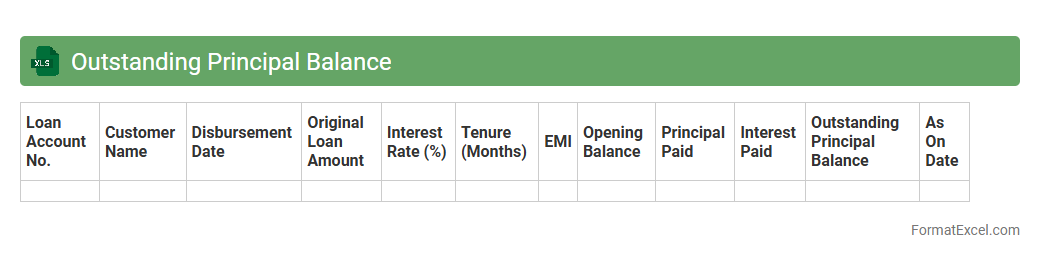

Outstanding Principal Balance

An

Outstanding Principal Balance Excel document tracks the remaining loan amount yet to be paid after accounting for principal repayments. It helps borrowers and lenders monitor loan progress, calculate interest accurately, and plan financial decisions effectively. This spreadsheet simplifies loan management by providing clear, updated insights into the current debt status.

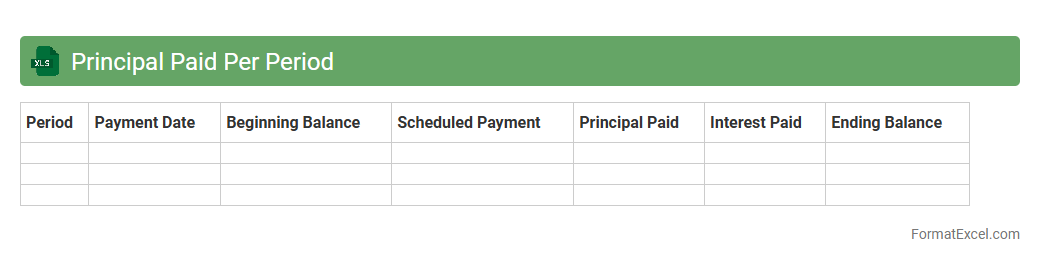

Principal Paid Per Period

The

Principal Paid Per Period Excel document calculates the portion of each loan payment that goes toward reducing the loan's principal balance during each payment period. This tool is essential for tracking loan amortization schedules, helping users understand how much equity they build over time and how interest costs decrease. By clearly differentiating principal payments from interest, it supports better financial planning and informed decision-making regarding loan management.

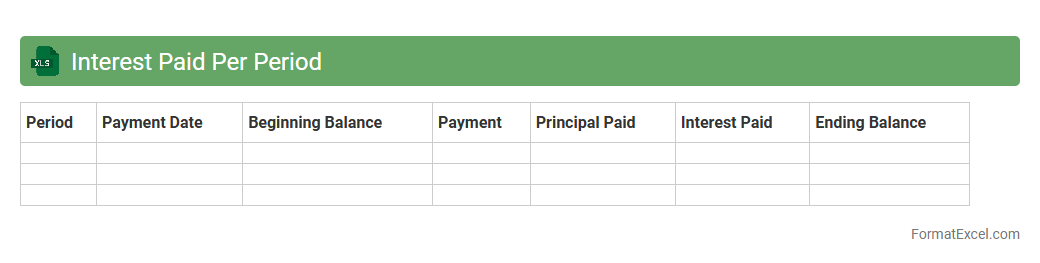

Interest Paid Per Period

An

Interest Paid Per Period Excel document calculates the amount of interest paid during each payment period of a loan or investment, enabling users to track financial obligations accurately. This tool helps in budgeting by breaking down payments into principal and interest components, providing clear insights into how much of each payment reduces the loan balance versus the interest cost. Users can optimize loan repayment strategies and make informed financial decisions by analyzing interest trends over time.

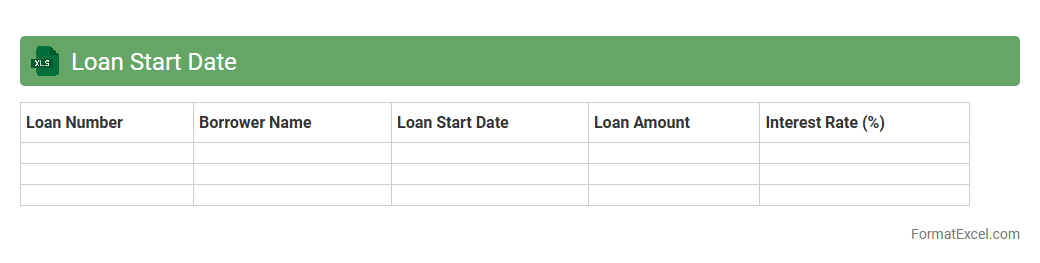

Loan Start Date

The

Loan Start Date Excel document is a structured spreadsheet designed to track the commencement dates of various loans, enabling precise management of repayment schedules and interest calculations. By maintaining accurate loan start dates, this tool helps users monitor loan durations, calculate amortization periods, and schedule timely payments, thereby preventing missed deadlines and financial penalties. Its organized format supports better financial planning and decision-making for individuals, businesses, or financial institutions managing multiple loan accounts.

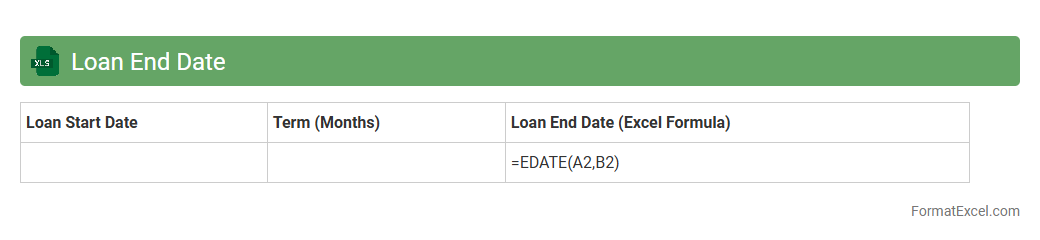

Loan End Date

The

Loan End Date Excel document is a spreadsheet that tracks the maturity or payoff dates of various loans, allowing users to manage repayment schedules efficiently. It helps individuals and organizations monitor when loans are due, avoid missed payments, and plan financial obligations ahead of time. By providing clear visibility into loan timelines, this document supports better budgeting and financial decision-making.

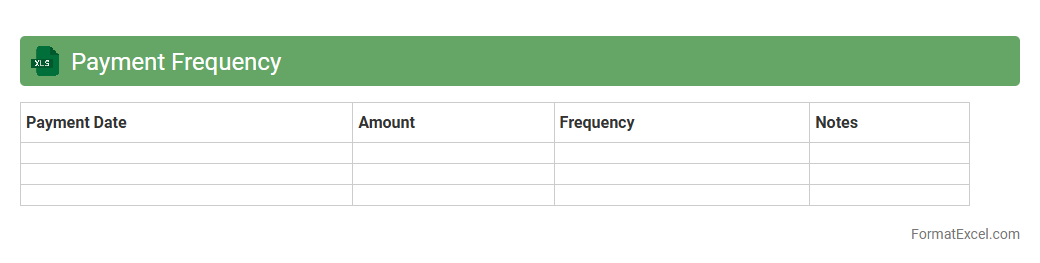

Payment Frequency

A

Payment Frequency Excel document is a spreadsheet designed to track and manage the timing of payments, such as monthly, quarterly, or annual transactions. It helps users organize cash flow, schedule payments accurately, and avoid missed deadlines by providing clear visibility into payment intervals. This tool is essential for budgeting, financial planning, and ensuring consistent payment cycles in both personal and business finance management.

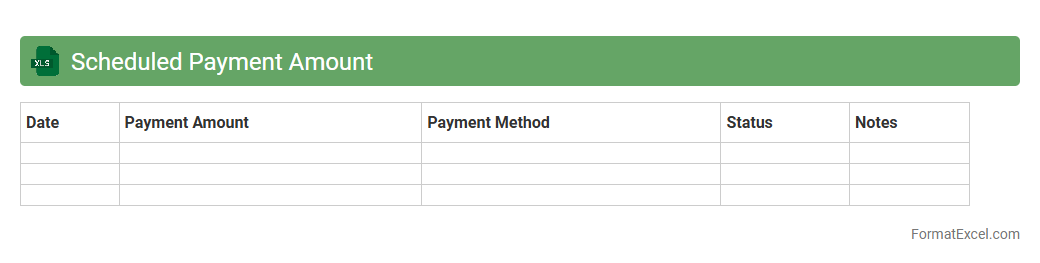

Scheduled Payment Amount

The

Scheduled Payment Amount Excel document is a structured spreadsheet designed to track and manage payments over a specified period. It enables users to organize payment dates, amounts, and recipients efficiently, ensuring timely financial planning and budgeting. This tool is crucial for maintaining clear payment schedules, reducing missed payments, and improving overall financial management.

Early Repayment Tracking

The

Early Repayment Tracking Excel document is a specialized spreadsheet designed to monitor and manage loan repayments made ahead of schedule. It helps users identify early payments, calculate interest savings, and update outstanding balances efficiently. This tool enhances financial control by providing clear visibility into repayment patterns and potential benefits from reducing the loan term.

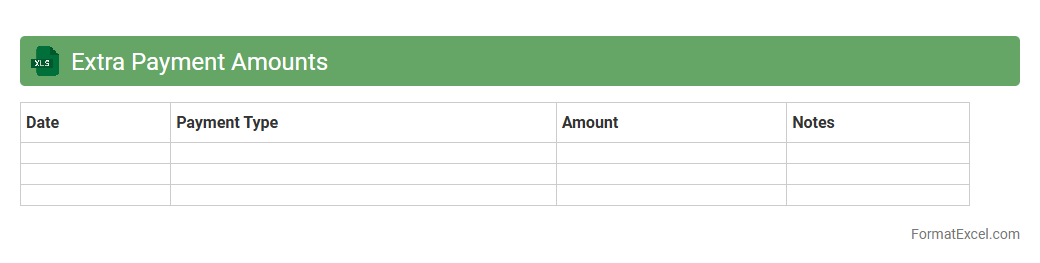

Extra Payment Amounts

The

Extra Payment Amounts Excel document is a spreadsheet designed to track and calculate additional payments made towards loans, mortgages, or debts. It helps users visualize how extra payments reduce the principal balance faster, potentially saving significant interest costs over time. By organizing payment data clearly, it enables precise financial planning and faster debt repayment strategies.

Payment Status Tracker

A

Payment Status Tracker Excel document is a tool designed to monitor and manage payment transactions efficiently by recording details such as payment dates, amounts, methods, and statuses. This tracker helps businesses maintain accurate financial records, reduce errors, and ensure timely follow-ups on pending payments, improving cash flow management. By providing clear visibility into outstanding and completed payments, it enhances transparency and aids in decision-making for accounts payable and receivable processes.

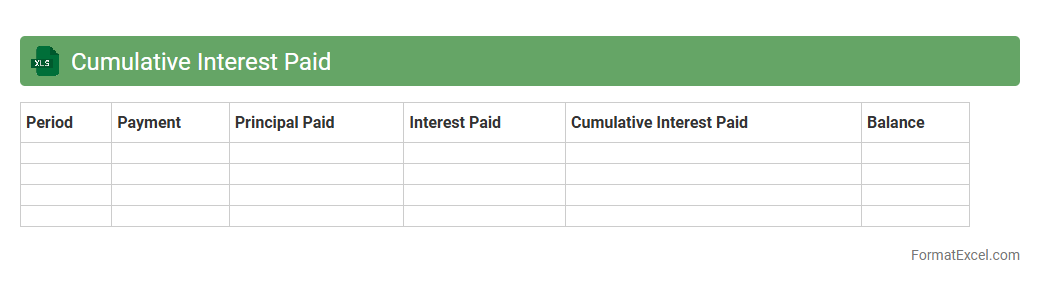

Cumulative Interest Paid

The

Cumulative Interest Paid Excel document tracks the total interest paid over the life of a loan, helping users visualize how payments reduce principal over time. It provides detailed schedules that break down each payment into principal and interest components, enabling better financial planning and loan management. This tool is essential for borrowers aiming to understand their debt cost and strategize early repayment or refinancing.

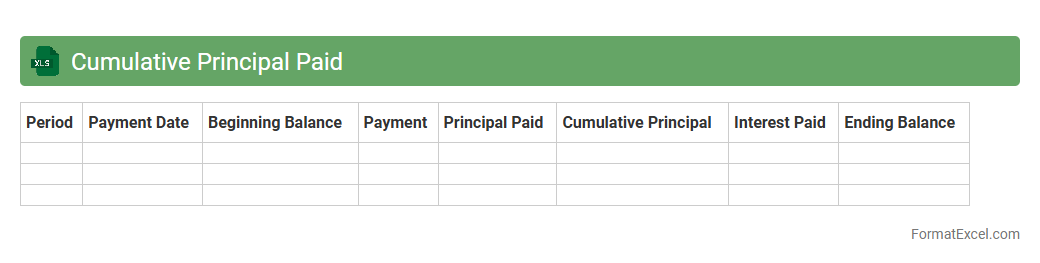

Cumulative Principal Paid

A

Cumulative Principal Paid Excel document tracks the total amount of principal repaid over the life of a loan, providing a clear summary of debt reduction at any point in time. This tool is essential for borrowers and financial analysts to monitor loan amortization, forecast remaining balances, and manage repayment schedules effectively. By visualizing cumulative payments, users can make informed decisions about refinancing, prepayments, or budgeting for future financial planning.

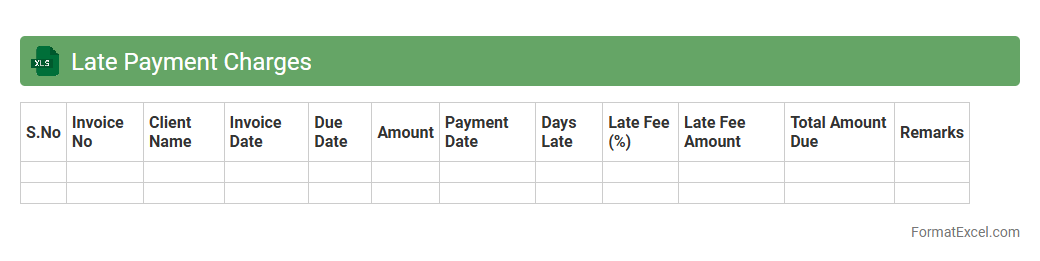

Late Payment Charges

A

Late Payment Charges Excel document is a specialized spreadsheet designed to calculate, track, and manage penalties incurred from overdue payments in financial transactions. It automates the process of identifying outstanding invoices, applying appropriate late fees based on pre-set terms, and generating reports for effective cash flow management. This tool is essential for businesses aiming to reduce delayed payments, maintain accurate financial records, and enhance overall accounts receivable efficiency.

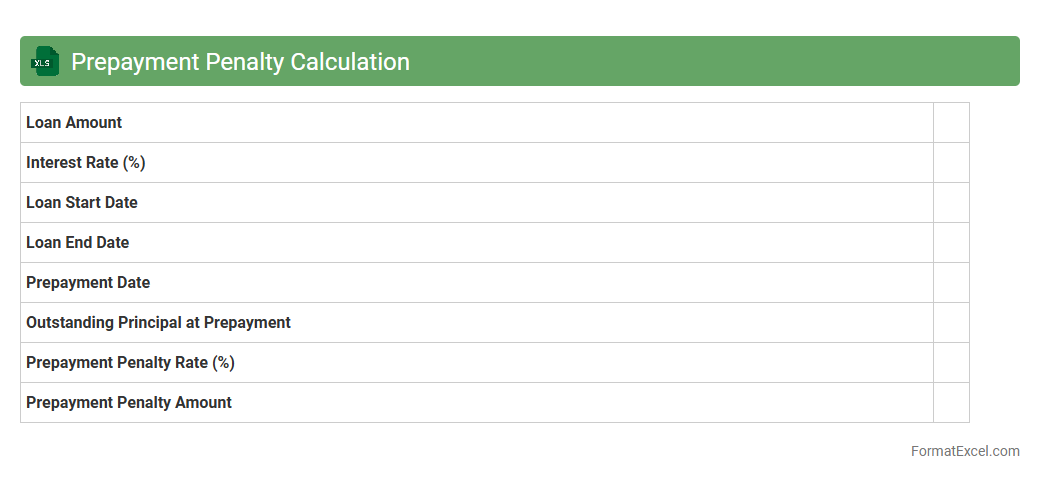

Prepayment Penalty Calculation

A

Prepayment Penalty Calculation Excel document is a tool designed to accurately compute penalties incurred when a loan is paid off before its scheduled maturity date. It helps borrowers and lenders quantify the financial impact of early loan repayment by applying specific penalty formulas based on loan terms, interest rates, and remaining balances. This document is useful in financial planning, ensuring transparency, and facilitating informed decision-making related to early loan settlements.

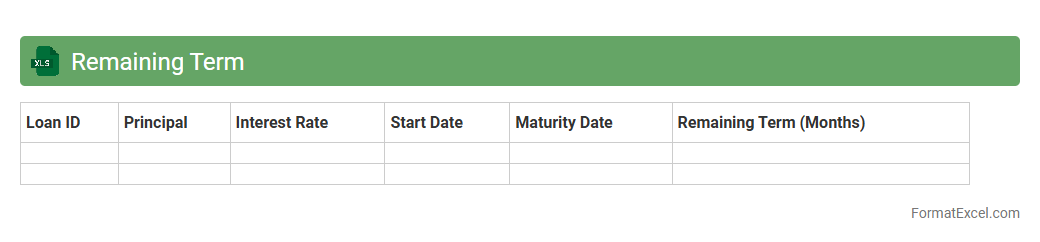

Remaining Term

The

Remaining Term Excel document is a tool designed to track and calculate the remaining duration of loans, insurance policies, or contracts, enabling precise financial planning and management. By inputting start dates, end dates, and payment schedules, users can efficiently monitor outstanding periods and forecast liabilities or benefits. This document enhances decision-making by providing clear visibility of time-sensitive obligations and ensuring timely renewals or settlements.

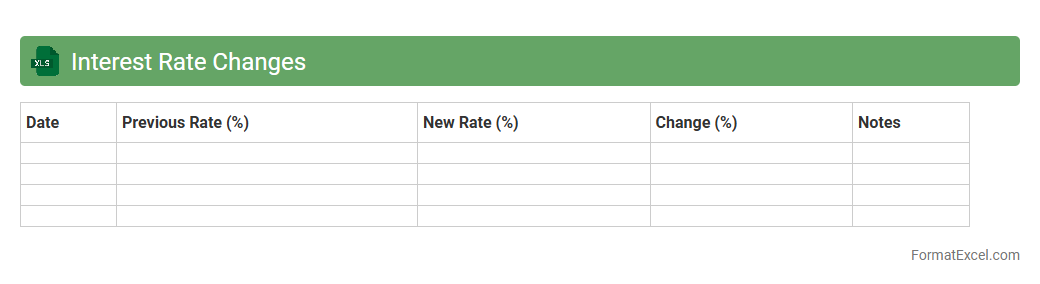

Interest Rate Changes

The

Interest Rate Changes Excel document tracks historical and projected fluctuations in interest rates, providing essential data for financial planning and investment analysis. It enables users to assess the impact of rate shifts on loans, mortgages, and savings, aiding in informed decision-making. This tool is invaluable for predicting economic trends and optimizing financial strategies.

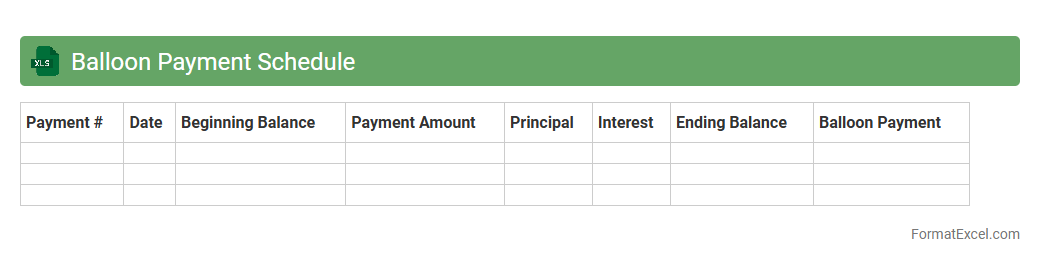

Balloon Payment Schedule

A

Balloon Payment Schedule Excel document outlines the timeline and amounts of periodic payments leading up to a final large payment on a loan or mortgage. It helps borrowers and lenders clearly visualize payment structures, manage cash flow, and plan for the significant last installment effectively. This tool simplifies complex financial planning by providing a customizable, easy-to-update schedule that enhances loan repayment transparency.

Escrow Account Tracking

An

Escrow Account Tracking Excel document is a tool designed to monitor and manage funds held in escrow during financial transactions, ensuring transparency and accuracy. It helps users record deposit dates, withdrawal requests, balances, and transaction statuses in one organized spreadsheet, reducing errors and discrepancies. This tool is useful for individuals and businesses to maintain clear records, facilitate audits, and improve trust between parties in contractual agreements.

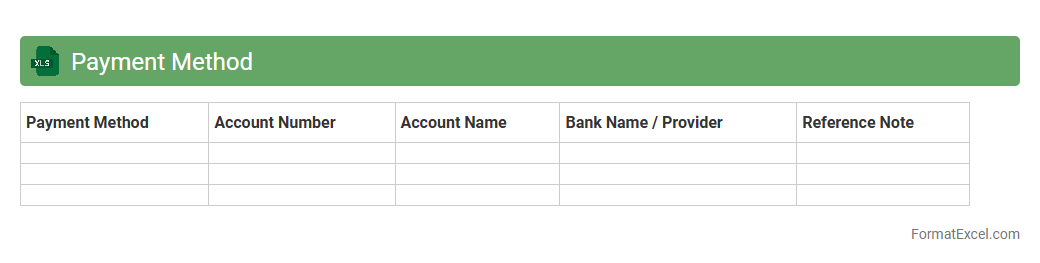

Payment Method

A

Payment Method Excel document is a structured spreadsheet used to organize and manage various payment options, including credit cards, bank transfers, and digital wallets. It enhances financial tracking by providing clear records of payment types, transaction dates, and related costs, facilitating accurate budgeting and reconciliation processes. Utilizing this document improves efficiency in payment management and supports better decision-making for business or personal finances.

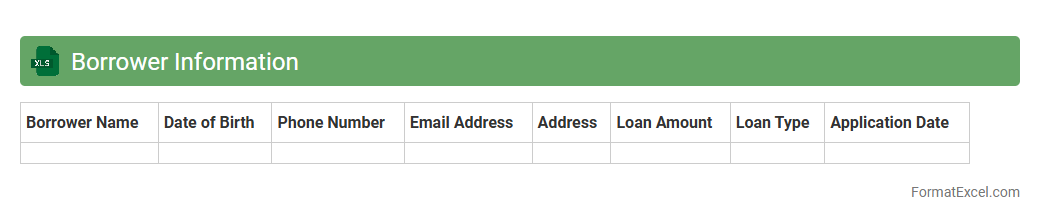

Borrower Information

The

Borrower Information Excel document is a structured file containing detailed data about loan applicants, including personal details, credit history, loan amounts, and repayment status. It facilitates efficient data management and quick access to borrower profiles, enabling informed decision-making and risk assessment. This document is essential for tracking loan performance and streamlining communication between lenders and borrowers.

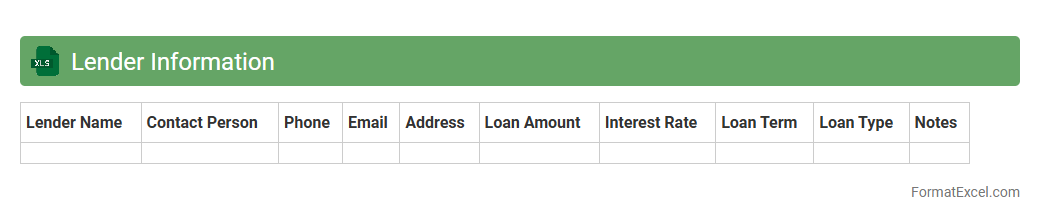

Lender Information

The

Lender Information Excel document is a structured file that consolidates critical data about various lenders, including contact details, loan terms, interest rates, and eligibility criteria. This document streamlines the comparison and selection process for borrowers by providing a clear overview of available financing options. It enhances decision-making efficiency and accuracy, helping users secure the best lending arrangements quickly.

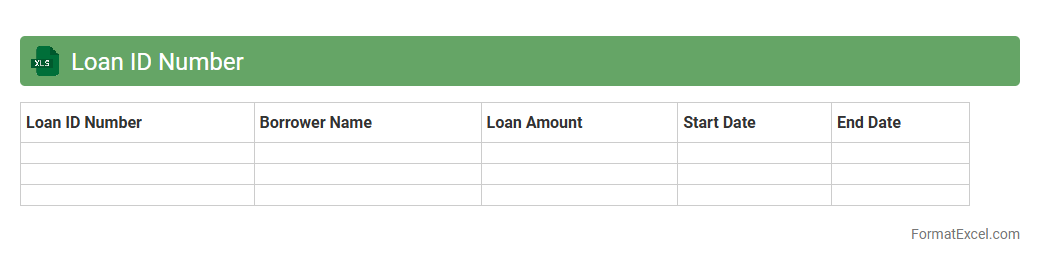

Loan ID Number

A

Loan ID Number Excel document serves as a centralized repository for tracking and managing multiple loan accounts by assigning unique identification numbers to each loan. This organization enables quick retrieval and analysis of loan details such as borrower information, payment schedules, and outstanding balances. Utilizing this document enhances efficient loan portfolio management, minimizes errors, and supports reporting and auditing processes.

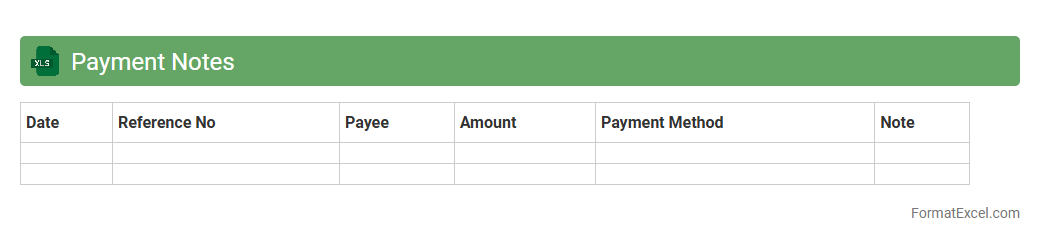

Payment Notes

A

Payment Notes Excel document is a structured spreadsheet used to record and track payment details, including dates, amounts, payees, and transaction references. This document enhances financial organization by providing a clear overview of payment histories, facilitating reconciliation, and ensuring accountability in expense management. Utilizing Payment Notes in Excel helps streamline auditing processes and improves accuracy in financial reporting.

Introduction to Loan Repayment Schedules

A loan repayment schedule outlines the timeline and amounts for repaying a loan systematically. It helps borrowers visualize the breakdown of principal and interest over time. This schedule is essential for managing finances effectively.

Importance of a Structured Repayment Plan

Having a structured repayment plan ensures timely payments and avoids default. It promotes financial discipline and aids in budgeting. Lenders and borrowers benefit from clear expectations.

Key Components of a Loan Repayment Schedule

The schedule typically includes the payment date, amount, interest portion, principal portion, and remaining balance. These elements provide clarity on how each payment affects the loan balance. Transparency is crucial for effective loan management.

Advantages of Using Excel for Repayment Schedules

Excel offers flexibility and ease in creating and modifying loan repayment schedules. It automates calculations and enables customization for different loan terms. Excel's accessibility makes it ideal for both lenders and borrowers.

Essential Columns for Your Loan Schedule Sheet

Include columns such as Payment Number, Payment Date, Total Payment, Interest Paid, Principal Paid, and Loan Balance. These columns capture all necessary data for tracking loan progress. Proper organization enhances readability and tracking.

Setting Up an Excel Loan Repayment Template

Begin by inputting loan details such as amount, interest rate, and term. Create headers for essential columns and format cells for accurate calculations. A template streamlines the repayment planning process.

Step-by-Step Guide to Building the Schedule in Excel

Start with loan parameters, then calculate monthly interest and principal payments using formulas. Fill down the rows to project payments across the loan term. This step-by-step build ensures an accurate repayment schedule.

Useful Excel Formulas for Loan Amortization

Key formulas include PMT for payment calculation and IPMT for interest portion per period. The PPMT formula calculates principal repayment, supporting detailed amortization schedules. Using these formulas automates payment breakdowns.

Customizing the Repayment Schedule for Different Loan Types

Adjust formulas and structure to fit fixed-rate, variable-rate, or interest-only loans. Customization caters to unique loan terms and repayment conditions. This flexibility helps manage diverse borrowing scenarios.

Downloadable Excel Loan Repayment Schedule Templates

Free and premium templates are available online for quick use and customization. These templates save time and reduce errors in loan repayment planning. They are suitable for personal and professional financial management.