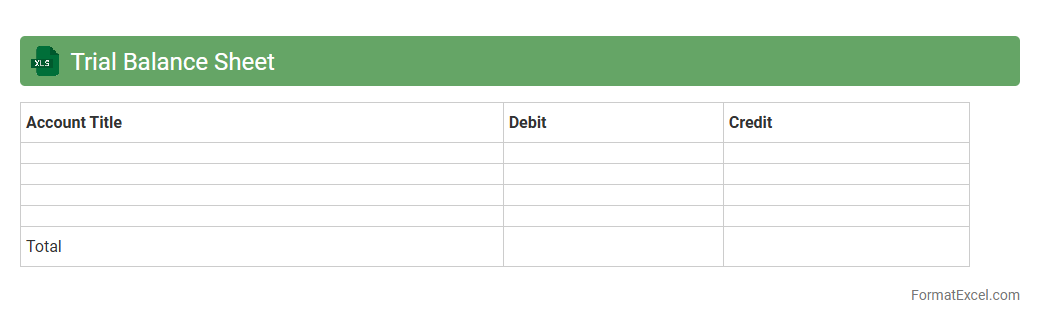

Trial Balance Sheet

A Trial Balance Sheet Excel document is a financial report that lists all ledger account balances in one place, ensuring that total debits equal total credits, which helps in detecting discrepancies. This tool is useful for accountants and business owners to verify the accuracy of bookkeeping entries before preparing financial statements. Using a

Trial Balance Sheet in Excel enables streamlined data organization, easy error identification, and efficient financial analysis.

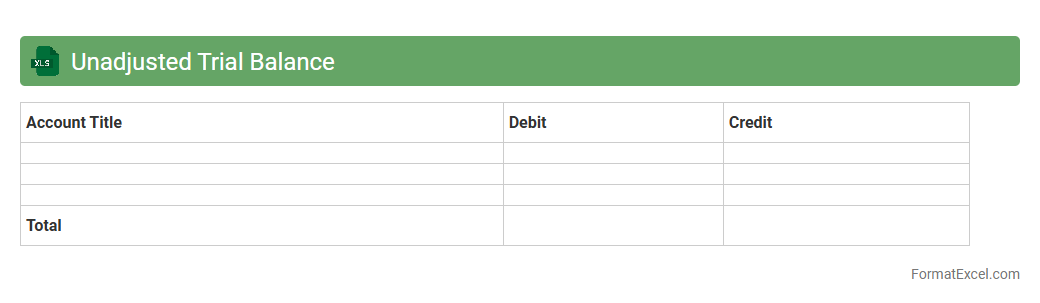

Unadjusted Trial Balance

An

Unadjusted Trial Balance Excel document is a spreadsheet that lists all the general ledger accounts and their balances before any adjusting entries are made. It helps ensure the accuracy of bookkeeping by verifying that total debits equal total credits, highlighting potential errors early in the accounting cycle. This tool is essential for accountants to prepare financial statements and maintain accurate records efficiently.

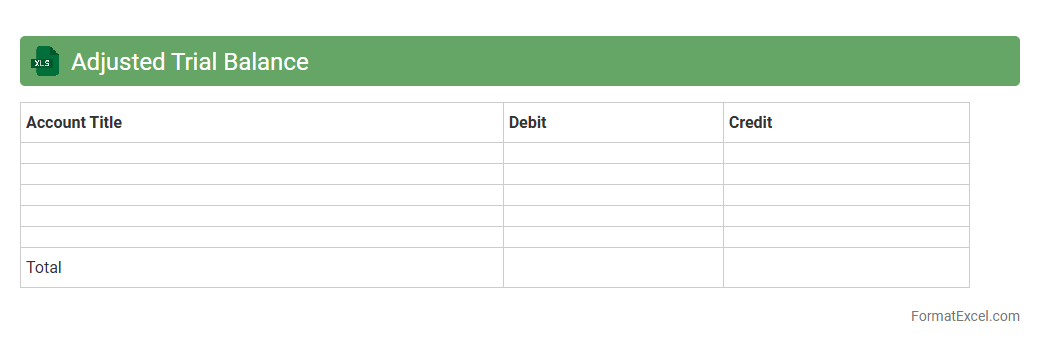

Adjusted Trial Balance

An

Adjusted Trial Balance Excel document compiles all ledger account balances after adjusting entries are made, ensuring the accounting records reflect accurate financial data. This tool helps verify that total debits equal total credits, maintaining the integrity of the accounting equation. It is essential for preparing accurate financial statements, enabling businesses to identify errors and make informed decisions.

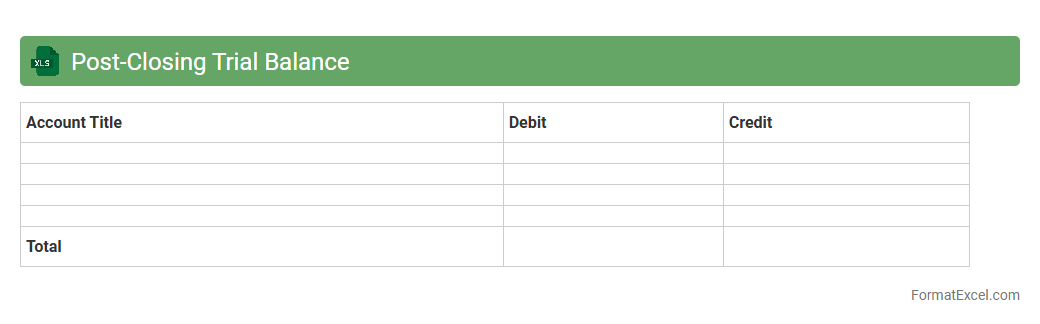

Post-Closing Trial Balance

A

Post-Closing Trial Balance Excel document is a financial spreadsheet used to verify that all temporary accounts have been closed and permanent accounts are correctly balanced after the closing entries. It ensures the ledger is ready for the next accounting period by confirming that debits equal credits, preventing errors in financial statements. This document is useful for accountants and auditors as a final checkpoint to maintain accurate and compliant financial records.

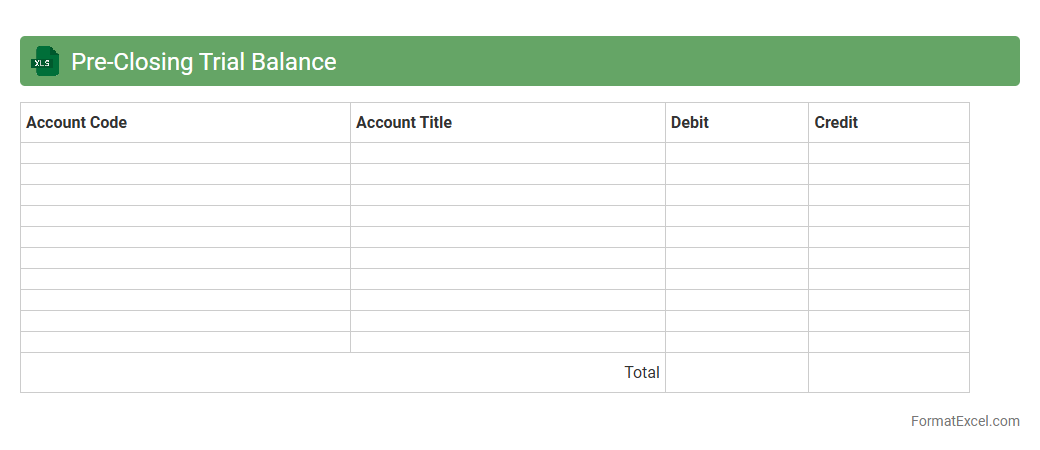

Pre-Closing Trial Balance

A

Pre-Closing Trial Balance Excel document is a financial report listing all ledger account balances before the closing entries are made at the end of an accounting period. It helps ensure accuracy by identifying discrepancies and verifying that total debits equal total credits, facilitating error detection in financial records. This tool streamlines the closing process, enabling accountants to prepare accurate financial statements and maintain proper compliance.

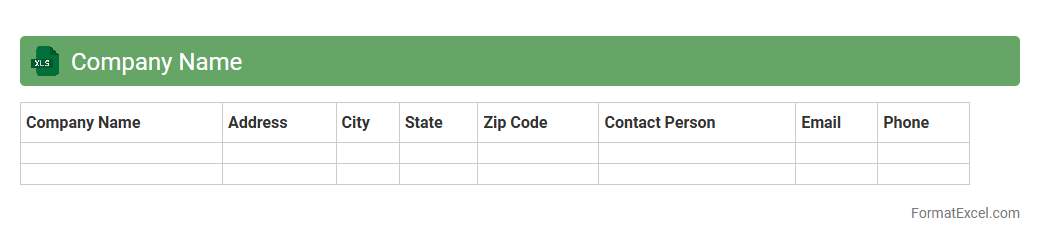

Company Name

A

Company Name Excel document serves as a comprehensive spreadsheet that organizes vital business information such as client details, financial data, or project tracking in a structured format. It enhances decision-making by providing clear visibility into key metrics and allows for efficient data analysis through sorting, filtering, and formula-based calculations. Utilizing this document supports improved collaboration, streamlined reporting, and accurate record-keeping across teams.

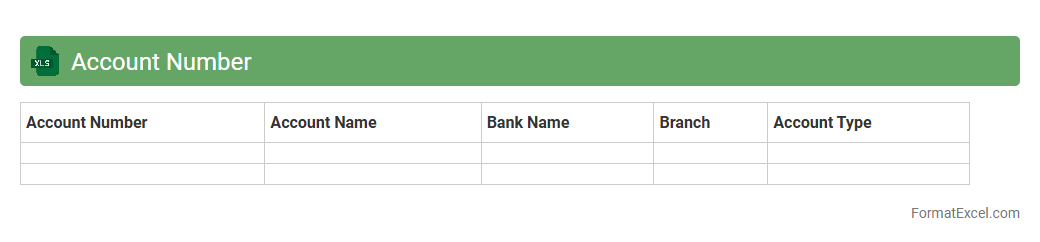

Account Number

An

Account Number Excel document is a structured spreadsheet used to organize and manage unique identifiers assigned to individual accounts, enabling streamlined tracking and easy reference of financial or customer data. It helps businesses efficiently analyze transactions, perform audits, and generate reports by consolidating account numbers alongside relevant details in one accessible format. This tool enhances accuracy in data management and supports improved decision-making processes.

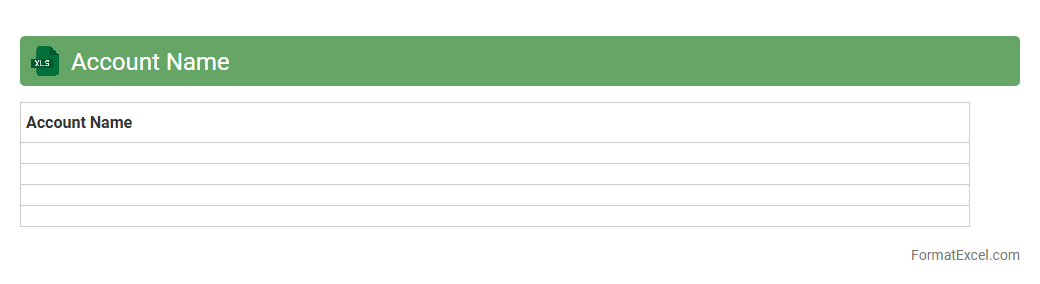

Account Name

An

Account Name Excel document serves as a structured digital ledger to organize and track various financial accounts. It helps businesses and individuals maintain clear records of transactions, balances, and account details, enabling efficient financial management and reporting. By centralizing account information, it enhances accuracy, saves time during audits, and supports informed decision-making.

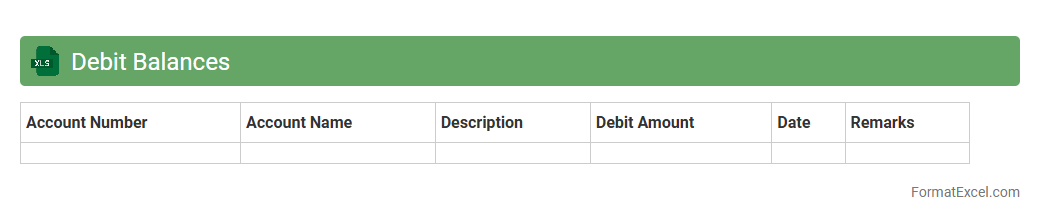

Debit Balances

The

Debit Balances Excel document is a financial record that tracks outstanding debit amounts across various accounts, enabling efficient monitoring of liabilities and receivables. It helps businesses quickly identify overdue payments and manage cash flow by consolidating all debit entries in a structured, easily analyzable format. Utilizing this document improves accuracy in financial reporting and supports timely decision-making for credit control and budgeting processes.

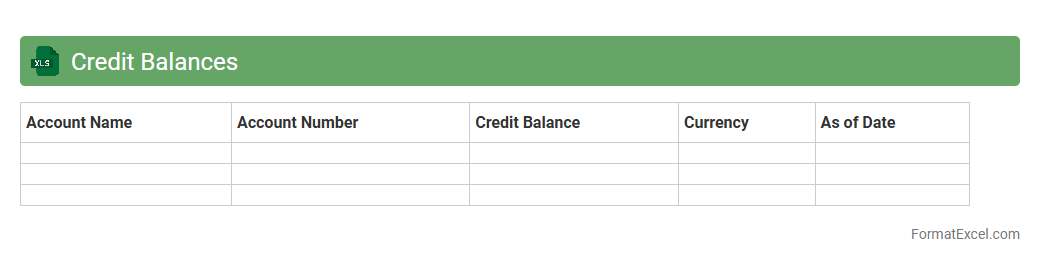

Credit Balances

A

Credit Balances Excel document is a financial tool used to track and manage credit balances across multiple accounts or customers. It helps businesses monitor outstanding credits, ensuring accurate reconciliation and preventing errors in financial reporting. This document enhances decision-making by providing clear insights into credit statuses, improving cash flow management and customer account handling.

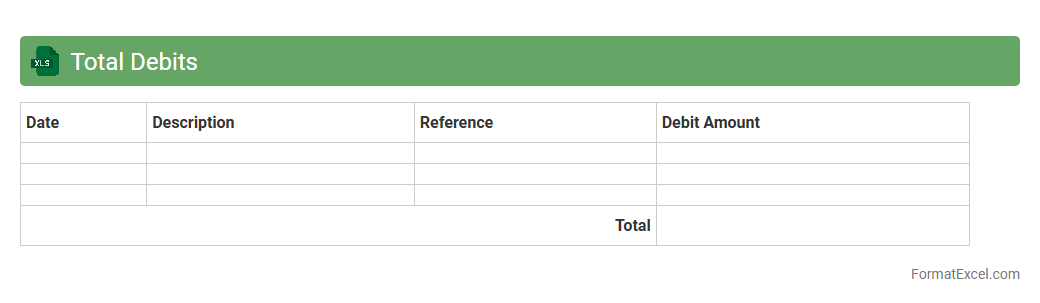

Total Debits

The

Total Debits Excel document is a financial tool that consolidates and summarizes all debit transactions within a specific period, providing a clear overview of outgoing cash flows. This document helps businesses and individuals monitor spending, manage budgets effectively, and maintain accurate accounting records. Utilizing a Total Debits Excel sheet enhances financial transparency and aids in identifying trends or discrepancies in debit entries.

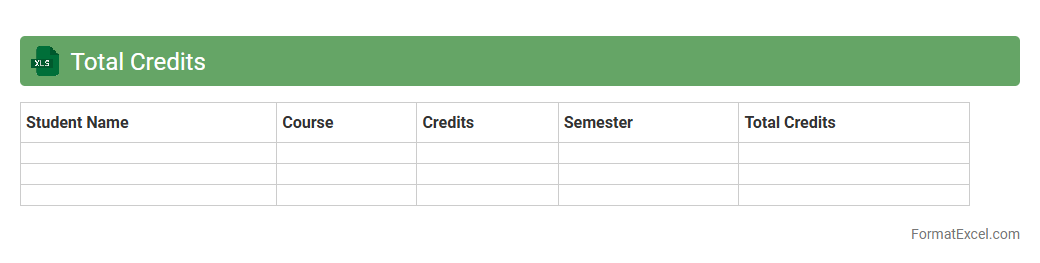

Total Credits

The

Total Credits Excel document is a comprehensive tool designed to track and calculate the cumulative credits earned across various courses or projects. It allows users to efficiently manage academic or professional credit data, ensuring accurate record-keeping and easy access to progress reports. Utilizing this document helps streamline credit verification processes and enhances decision-making for academic planning or credit evaluations.

Difference in Balances

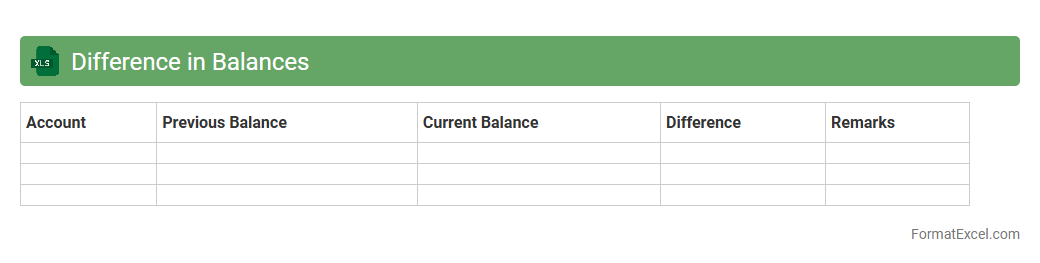

The

Difference in Balances Excel document is a powerful tool designed to compare and analyze numerical discrepancies between two sets of financial balances, such as bank statements and ledger accounts. It automates the detection of inconsistencies, making reconciliation processes faster and more accurate, ensuring financial integrity. This document is essential for accountants, auditors, and finance professionals to identify errors, prevent fraud, and maintain accurate financial records.

Date of Trial Balance

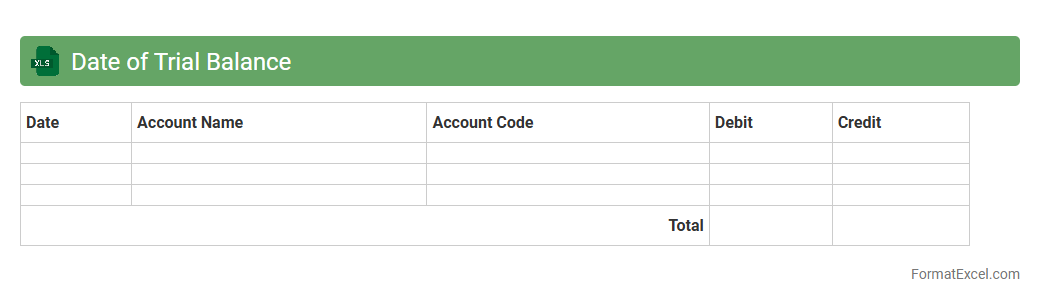

The

Date of Trial Balance Excel document records the balances of all ledger accounts at a specific date, providing a snapshot of an organization's financial position. It helps in verifying the accuracy of bookkeeping entries by ensuring that total debits equal total credits, which is essential for preparing accurate financial statements. This document streamlines the auditing process and supports timely financial analysis and decision-making.

Prepared By

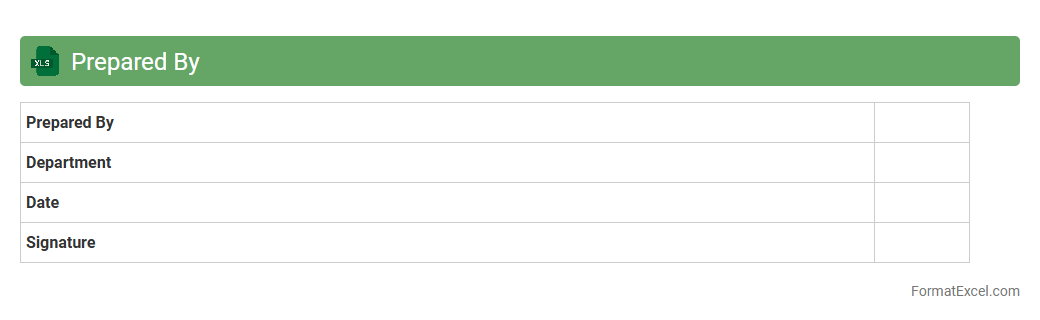

The

Prepared By Excel document serves as a detailed record that identifies the creator or author of a specific Excel file, enhancing accountability and traceability in data management. It is particularly useful in collaborative environments where multiple users access and modify spreadsheets, ensuring clarity about the source of data and easing version control. By clearly indicating the preparer, this documentation supports efficient auditing processes and improves communication among team members.

Reviewed By

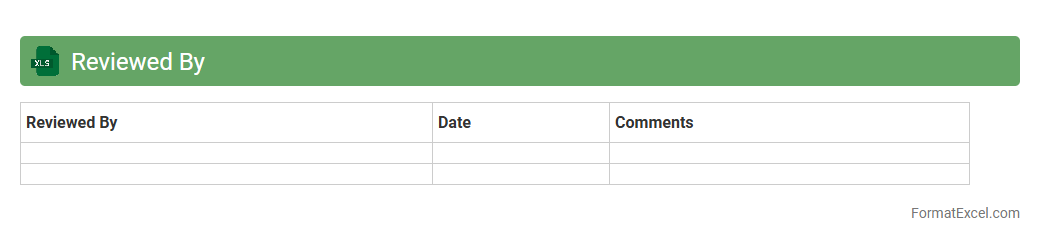

The

Reviewed By Excel document is a tool that records and tracks feedback, comments, and approvals from various reviewers on a specific project or dataset. It streamlines the collaboration process by consolidating all review inputs in one place, enhancing transparency and accountability. This document is useful for ensuring accurate data validation, improving decision-making, and maintaining a clear audit trail of who reviewed which sections and when.

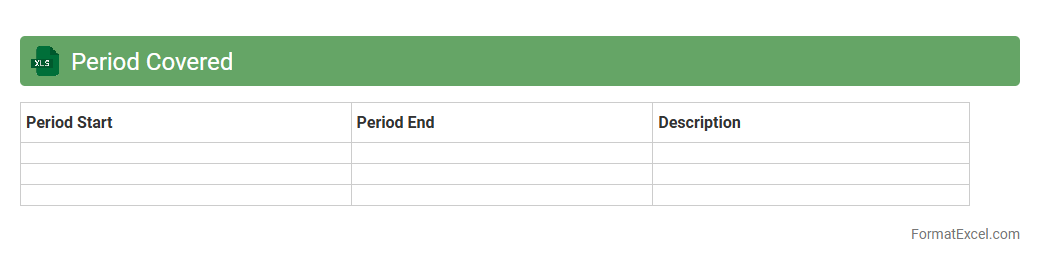

Period Covered

The

Period Covered Excel document is a structured spreadsheet used to record and analyze data across specific time frames, such as weekly, monthly, or quarterly periods. It facilitates tracking progress, comparing performance metrics, and managing deadlines effectively within businesses or projects. This tool enhances decision-making by providing clear insights into trends and variations over designated periods.

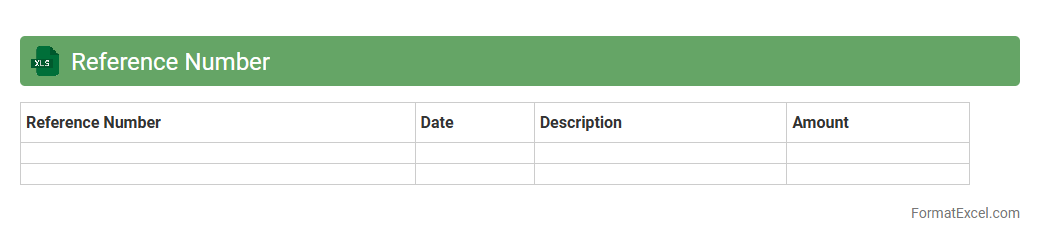

Reference Number

A

Reference Number Excel document is a spreadsheet that systematically organizes unique identifiers for transactions, products, or records, enabling efficient tracking and retrieval of information. This tool enhances data accuracy by reducing errors in manual entry and streamlining audit processes. Utilizing reference numbers in Excel supports improved inventory management, customer service, and financial reporting by linking related data points clearly and consistently.

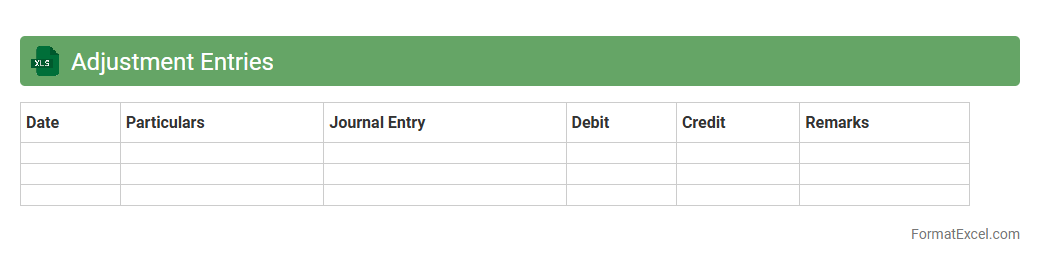

Adjustment Entries

An

Adjustment Entries Excel document is a spreadsheet designed to record and manage accounting adjustments, ensuring accurate financial statements by correcting errors and reflecting true account balances. It helps streamline the tracking of accruals, deferrals, prepaid expenses, and depreciation, maintaining compliance with accounting standards. This tool is invaluable for accountants and financial analysts to organize data efficiently and support precise financial reporting.

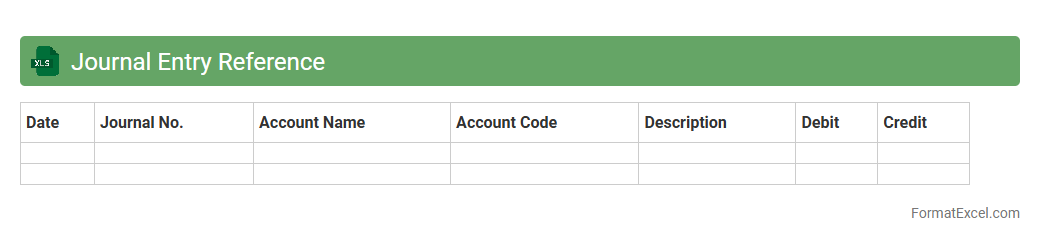

Journal Entry Reference

A

Journal Entry Reference Excel document is a structured spreadsheet used to record and track financial transactions systematically within accounting systems. It provides clear documentation by including essential details such as transaction dates, account names, debit and credit amounts, and reference numbers, ensuring accurate bookkeeping. This document enhances audit readiness, improves financial transparency, and streamlines the reconciliation process in accounting workflows.

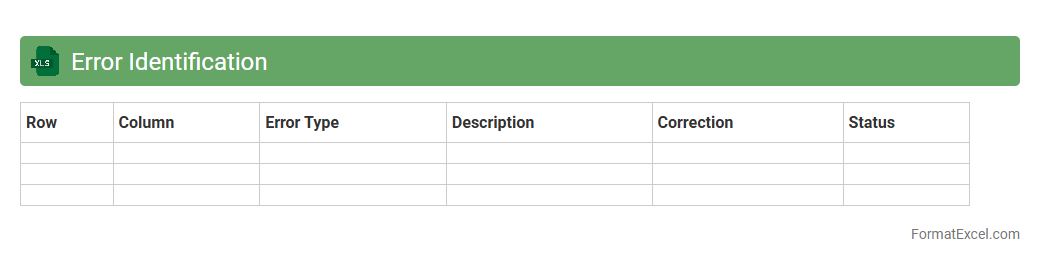

Error Identification

An

Error Identification Excel document is a structured spreadsheet designed to detect, categorize, and track errors in data sets or processes. It helps organizations systematically identify discrepancies, enhance data accuracy, and streamline quality control by highlighting inconsistencies for timely resolution. Utilizing this tool improves overall efficiency, reduces costly mistakes, and supports informed decision-making based on reliable information.

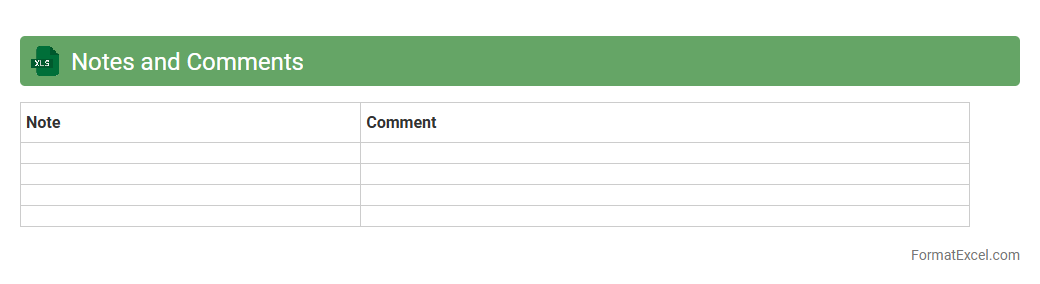

Notes and Comments

Notes and Comments in Excel are features that allow users to add contextual information or feedback directly within cells, enhancing collaboration and data interpretation. Notes typically provide explanations or reminders related to the cell content, while Comments facilitate discussions, making it easier to track changes or suggestions. These tools improve document clarity, support team communication, and aid in data analysis by embedding valuable insights without altering the actual data.Supporting Documents

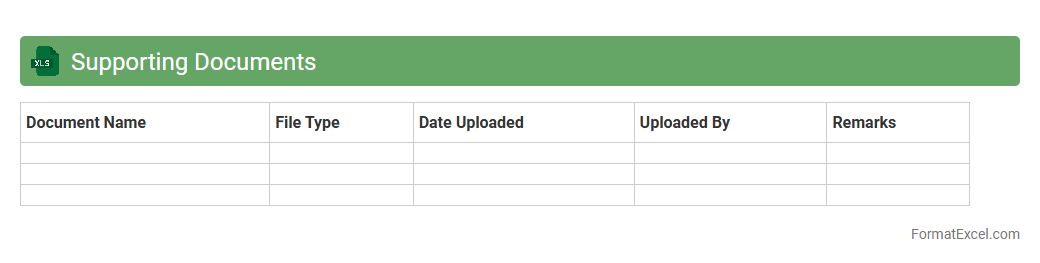

The

Supporting Documents Excel document serves as a centralized repository for tracking essential files related to projects, transactions, or processes. It streamlines organization by categorizing and linking important documents, ensuring easy access and verification during audits or reviews. This tool enhances transparency and efficiency by maintaining a clear record of all necessary documentation in a structured and searchable format.

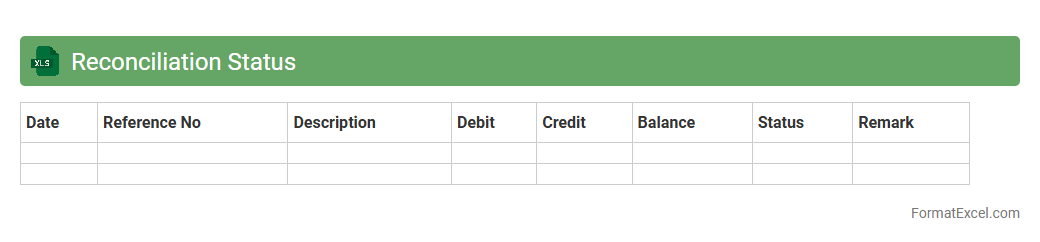

Reconciliation Status

A

Reconciliation Status Excel document is a tool used to track and verify financial transactions by comparing different sets of records to ensure accuracy and consistency. It helps identify discrepancies, errors, or missing data between accounts, facilitating timely resolution and maintaining financial integrity. This document is essential for auditors, accountants, and finance teams to streamline the reconciliation process and enhance financial reporting accuracy.

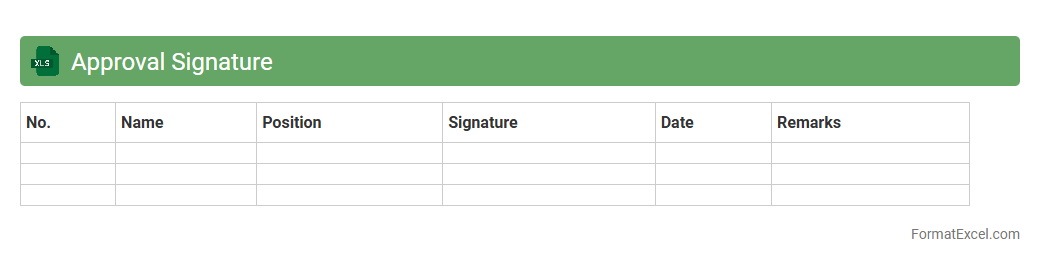

Approval Signature

An

Approval Signature Excel document is a digital file designed to collect and track authorized signatures for approvals on various tasks or projects. It streamlines the validation process by providing a clear, organized format that ensures accountability and boosts efficiency in workflows. This document serves as a reliable record for audit trails, reducing errors and enhancing communication within teams or organizations.

Introduction to Trial Balance

A trial balance is an accounting report that lists the balances of all general ledger accounts to ensure that total debits equal total credits. It serves as a fundamental step in verifying the accuracy of bookkeeping entries before preparing financial statements. Understanding its structure is essential for accountants and finance professionals.

Importance of Using Excel for Trial Balance

Excel offers a flexible and powerful platform to create and manage a trial balance, enabling quick calculations and easy data organization. It helps reduce manual errors through formulas and provides the ability to customize reports to specific business needs. Excel also facilitates real-time updates and analysis, improving efficiency in financial processes.

Key Components of a Trial Balance

The main elements of a trial balance include account names, debit balances, and credit balances. Each account's total balance is recorded under either the debit or credit column to confirm that they balance out. This balance validates the accuracy of the accounting entries before proceeding to financial statement preparation.

Step-by-Step Guide to Creating a Trial Balance in Excel

Start by listing all general ledger accounts in the first column, followed by their debit balances and then credit balances. Use Excel formulas to sum the debit and credit columns, ensuring they are equal for a balanced trial balance. Formatting with headers and borders enhances readability and professional presentation.

Standard Trial Balance Format in Excel

A standard trial balance format in Excel consists of four columns: Account Name, Account Number, Debit, and Credit. The accounts are typically listed in the order of assets, liabilities, equity, revenues, and expenses. Consistency in this format facilitates easier review and analysis of account balances.

Tips for Designing an Effective Excel Template

Design your Excel template with clear headers, consistent font styles, and color coding to differentiate debit and credit columns. Incorporate dropdown lists for account selection to minimize data entry errors. Protect formula cells to maintain template integrity while allowing input in designated areas.

Common Formulas Used in Excel Trial Balance

Essential formulas include =SUM() to add debit and credit columns and =IF() for conditional checks to highlight discrepancies. Using =ABS() helps in comparing absolute values when verifying balance equality. These formulas automate error detection and ensure the trial balance remains accurate.

Sample Trial Balance Template Download

Providing a sample trial balance template in Excel offers a practical starting point for accountants to customize according to their needs. Templates typically include pre-set formulas and structured layouts that simplify data entry and analysis. Downloadable templates save time and enhance accuracy.

Troubleshooting Common Errors in Excel Trial Balance

Common errors include unbalanced debit and credit totals, incorrect formulas, and missing account entries. Review each transaction carefully and validate formulas to identify and correct inconsistencies. Using Excel's auditing tools like Trace Precedents helps locate errors within the worksheet.

Best Practices for Maintaining Trial Balance Accuracy in Excel

Regularly update and reconcile your trial balance to reflect accurate financial data. Backup your Excel files frequently and use version control to track changes over time. Implement cross-verification procedures and maintain consistency in account classifications to ensure reliable financial reporting.