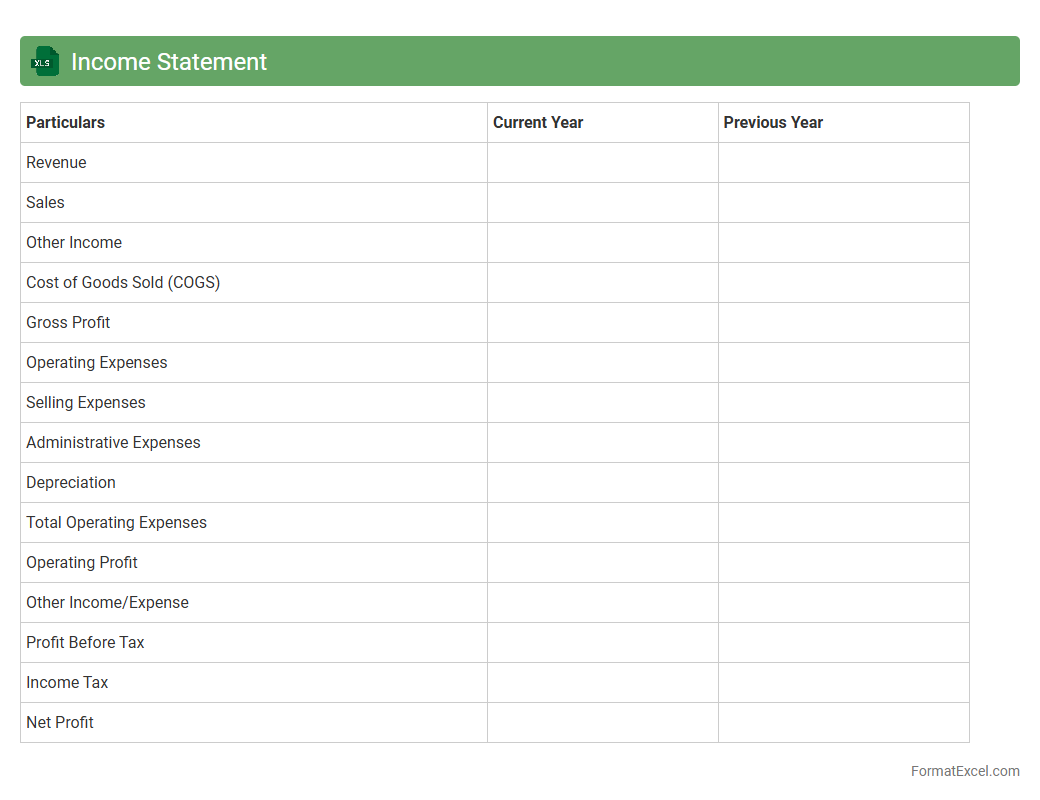

Income Statement

An

Income Statement Excel document is a financial report template that tracks revenues, expenses, and profits over a specific period. It helps businesses analyze their financial performance, identify cost management opportunities, and make informed decisions based on accurate profit and loss data. Using Excel enables easy customization, automated calculations, and clear visualization of financial results for effective business planning.

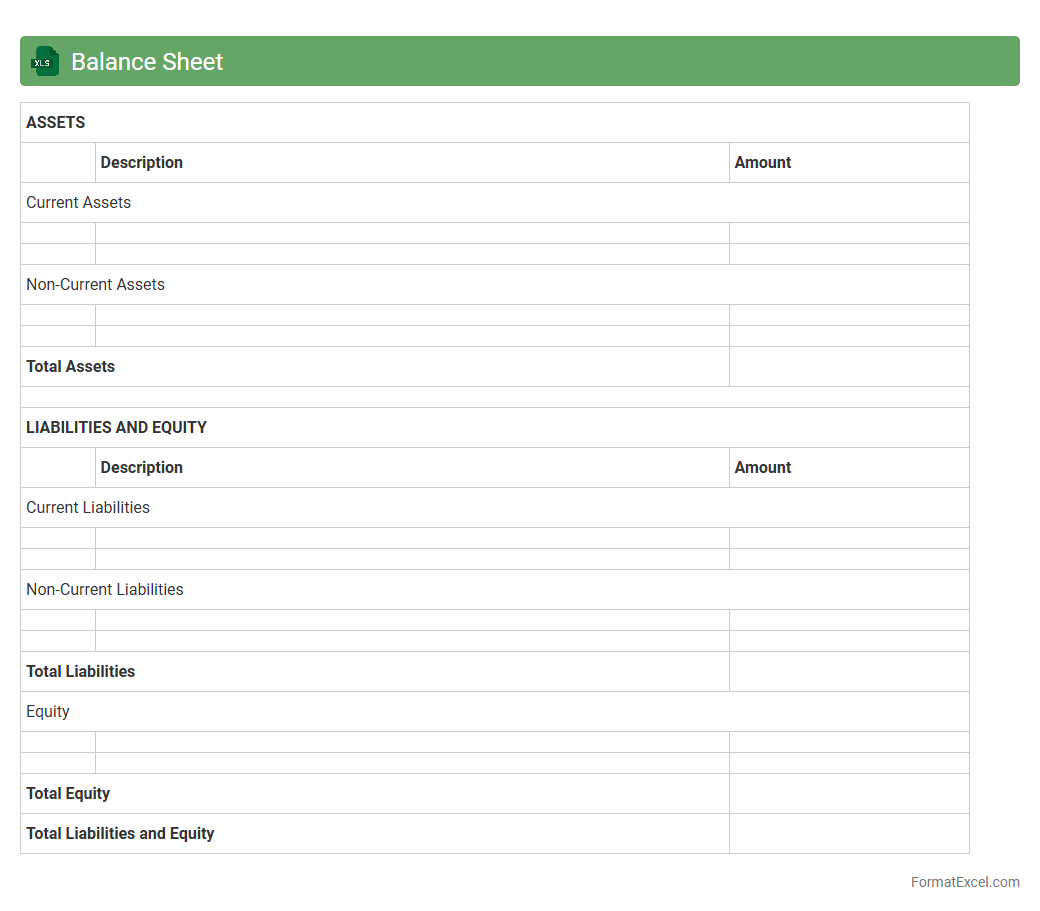

Balance Sheet

A

Balance Sheet Excel document is a digital financial statement template that organizes a company's assets, liabilities, and equity at a specific point in time. It allows users to easily input data, perform real-time calculations, and generate visual financial insights for effective decision-making. Utilizing this tool enhances accuracy, saves time in financial reporting, and supports strategic planning by providing a clear snapshot of business financial health.

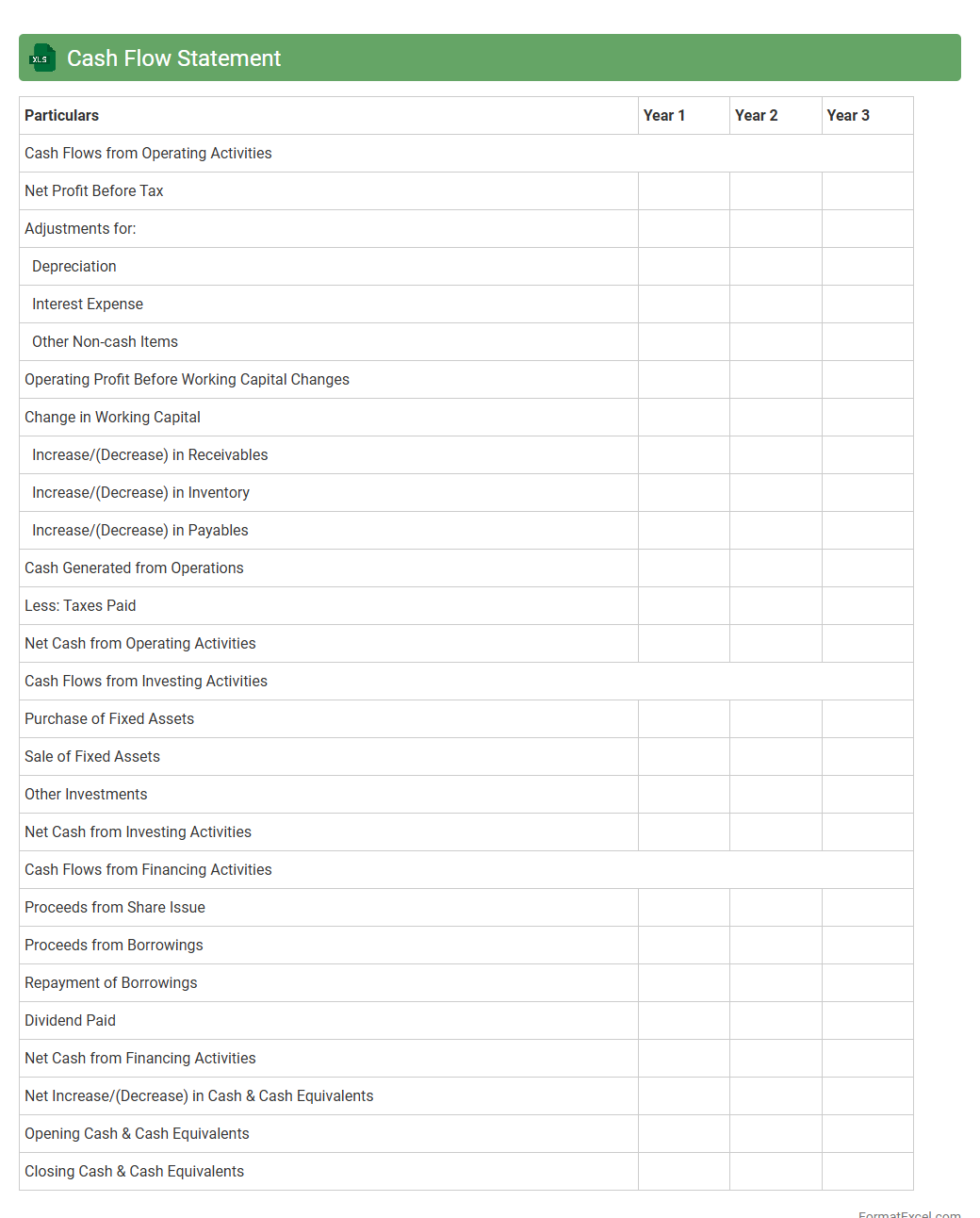

Cash Flow Statement

A

Cash Flow Statement Excel document is a financial tool that organizes and tracks the inflows and outflows of cash within a business over a specific period. This document helps monitor liquidity, ensuring that a company maintains enough cash to meet its obligations and forecasts future cash position accurately. Using Excel for this purpose provides customizable templates and automated calculations, enhancing financial analysis and decision-making efficiency.

Accounts Payable Ledger

The

Accounts Payable Ledger Excel document is a detailed record of all outstanding payments a business owes to its suppliers and creditors, organized in a spreadsheet format for easy tracking and management. It allows companies to monitor due dates, payment statuses, and vendor details, ensuring timely payments and maintaining good supplier relationships. This tool enhances financial control, reduces errors, and provides a clear overview of liabilities to improve cash flow management.

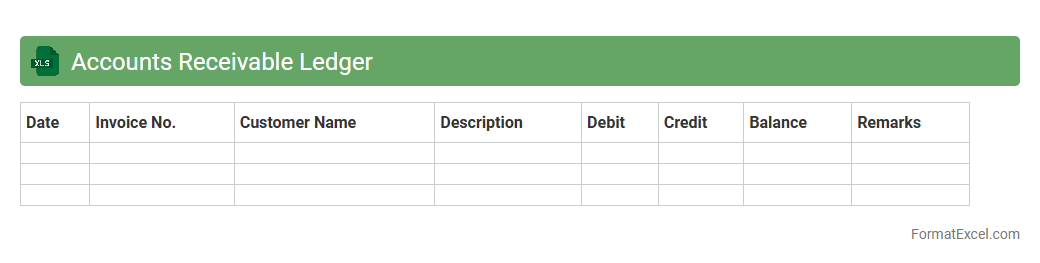

Accounts Receivable Ledger

An

Accounts Receivable Ledger Excel document is a detailed record that tracks all outstanding invoices and payments owed to a business by its customers. It helps monitor credit sales, manage cash flow, and identify overdue accounts efficiently. This tool provides a clear overview of customer balances, improving financial analysis and aiding in timely collection efforts.

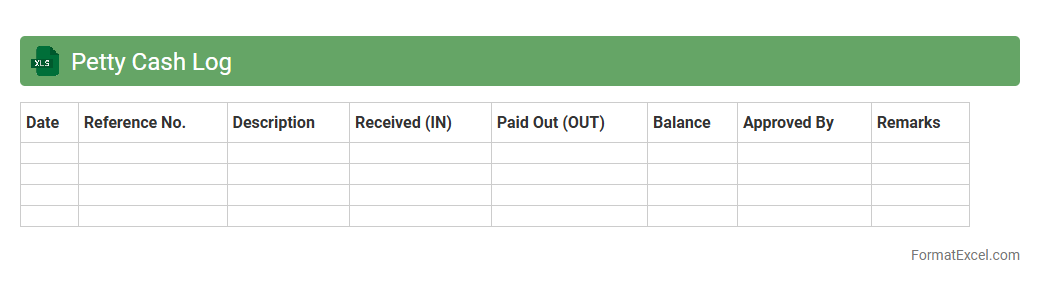

Petty Cash Log

A

Petty Cash Log Excel document is a spreadsheet tool designed to track small cash transactions within an organization, ensuring accurate record-keeping of minor expenses. It helps maintain transparency and control over petty cash usage by documenting the date, amount, purpose, and recipient of each disbursement. By using this log, businesses can easily reconcile cash on hand, simplify auditing processes, and prevent mismanagement of funds.

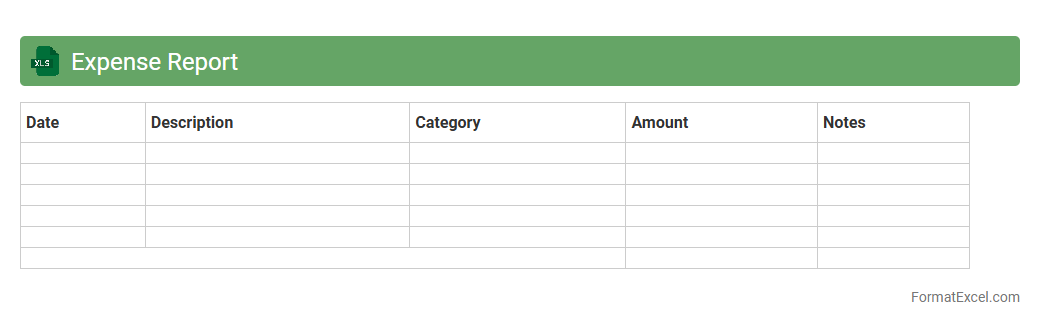

Expense Report

An

Expense Report Excel document is a structured spreadsheet used to record, categorize, and track business or personal expenses systematically. It enables efficient management of financial data by allowing users to input amounts, dates, expense categories, and payment methods, facilitating accurate budgeting and reimbursement processes. Utilizing this tool helps organizations monitor spending patterns, ensure compliance with financial policies, and streamline expense auditing and reporting workflows.

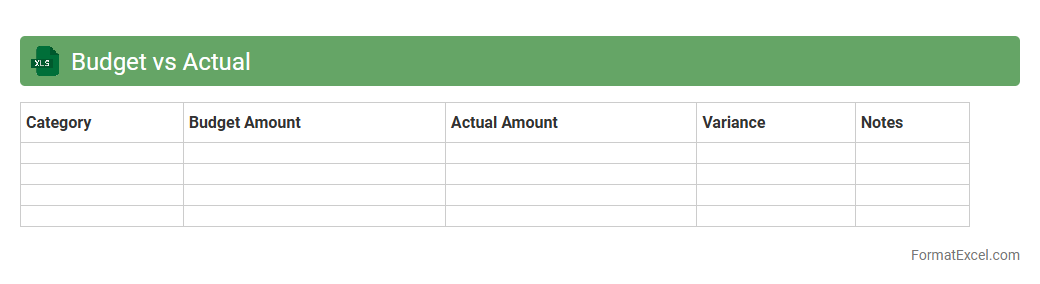

Budget vs Actual

A

Budget vs Actual Excel document compares planned financial expenses and revenues against the actual figures, providing a clear overview of financial performance. It helps businesses identify variances, monitor cash flow, and make informed decisions to control costs and optimize resource allocation. This tool is essential for effective financial management and strategic planning.

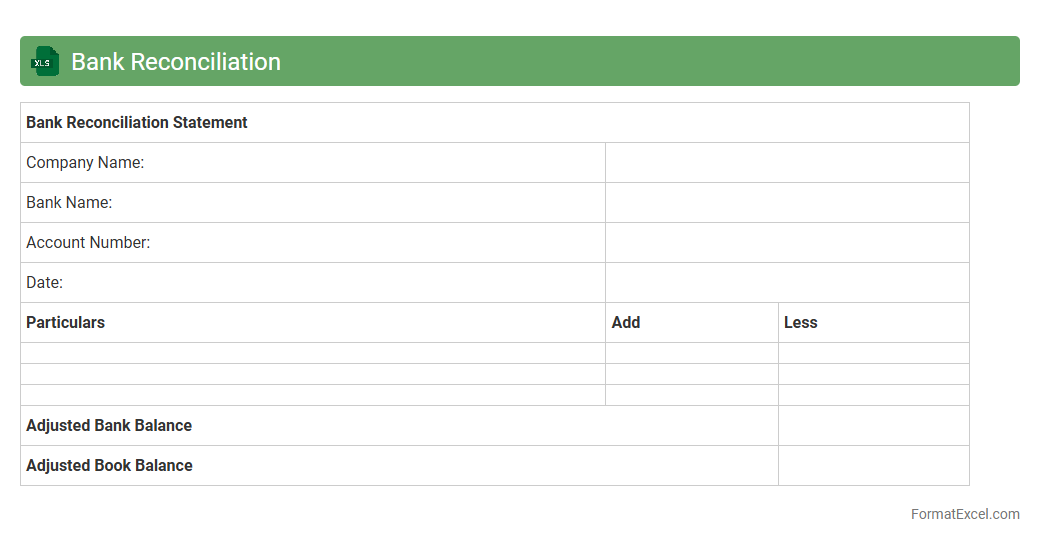

Bank Reconciliation

A

Bank Reconciliation Excel document is a tool used to compare an organization's cash records with bank statements to identify discrepancies and ensure accuracy. It helps track outstanding checks, deposits in transit, and errors, facilitating accurate financial reporting and cash flow management. This document is essential for detecting fraud, preventing overdrafts, and maintaining up-to-date financial records for audit purposes.

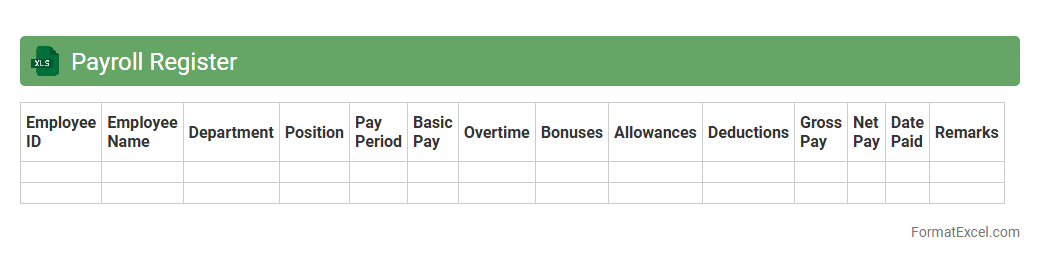

Payroll Register

A

Payroll Register Excel document is a detailed record that tracks employees' earnings, deductions, and net pay over a specific period. It helps businesses maintain accurate payroll data, ensures compliance with tax regulations, and facilitates efficient financial reporting. This document simplifies payroll management by consolidating employee compensation information in an easily accessible and customizable format.

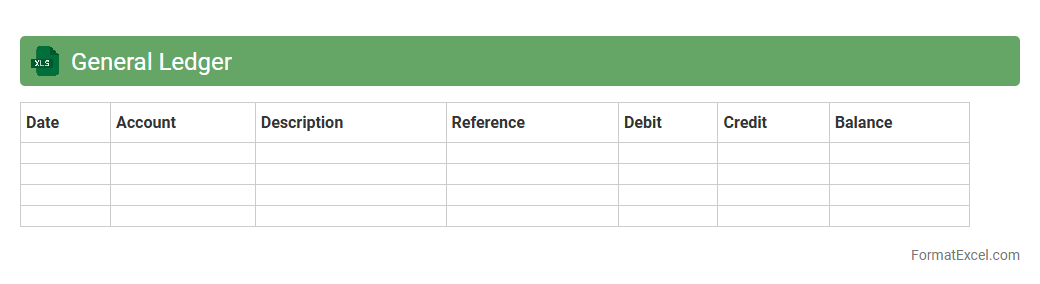

General Ledger

A

General Ledger Excel document is a structured spreadsheet used to record and organize all financial transactions of a business systematically. It helps track debits and credits across accounts, ensuring accuracy in financial statements and simplifying the reconciliation process. Businesses rely on it for efficient budgeting, auditing, and financial analysis, improving overall financial management.

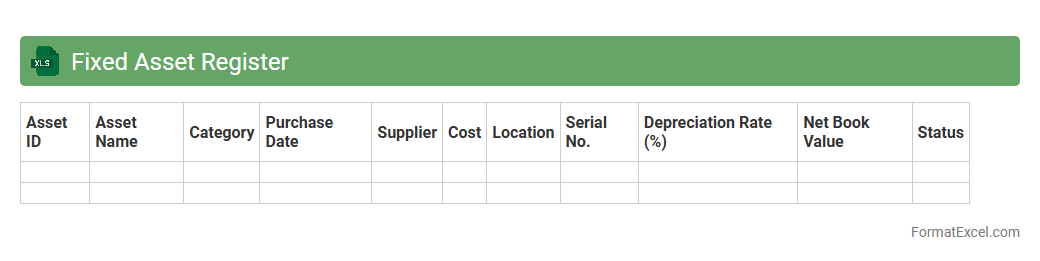

Fixed Asset Register

A

Fixed Asset Register Excel document is a detailed spreadsheet used to record and track an organization's fixed assets, including machinery, equipment, and property. It helps businesses monitor asset values, depreciation, and maintenance schedules, ensuring accurate financial reporting and compliance with accounting standards. This tool enhances asset management efficiency by providing a clear overview of asset lifecycle and facilitating informed decision-making.

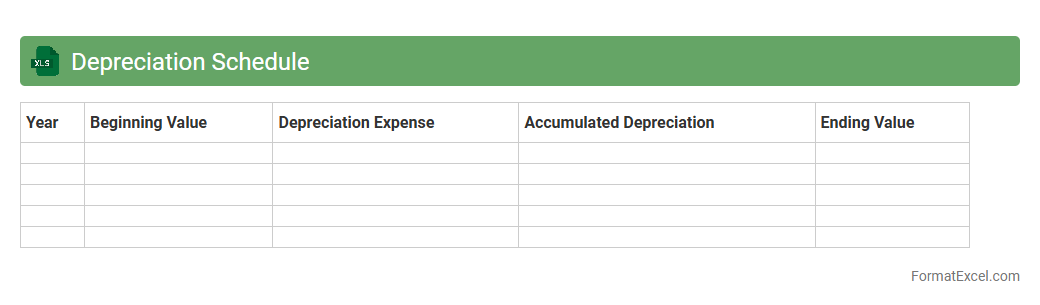

Depreciation Schedule

A

Depreciation Schedule Excel document is a financial tool that tracks the reduction in value of assets over time, helping businesses calculate accurate depreciation expenses. It organizes asset details, acquisition costs, useful life, and depreciation methods like straight-line or declining balance, providing clear insights into asset value and tax deductions. This schedule enhances budgeting, financial reporting, and compliance by ensuring precise asset valuation and informed decision-making.

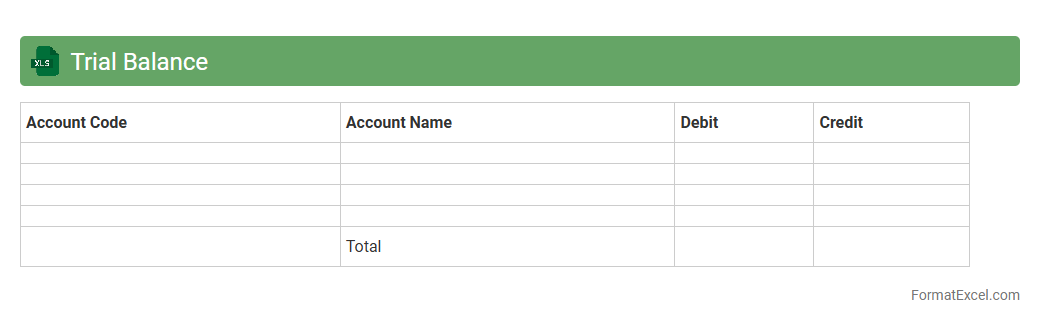

Trial Balance

A

Trial Balance Excel document is a spreadsheet used to compile and summarize all ledger account balances to verify that total debits equal total credits. It helps identify discrepancies in financial records, ensuring accuracy before preparing financial statements. This tool streamlines the auditing process and supports effective financial management by providing a clear overview of an organization's accounting accuracy.

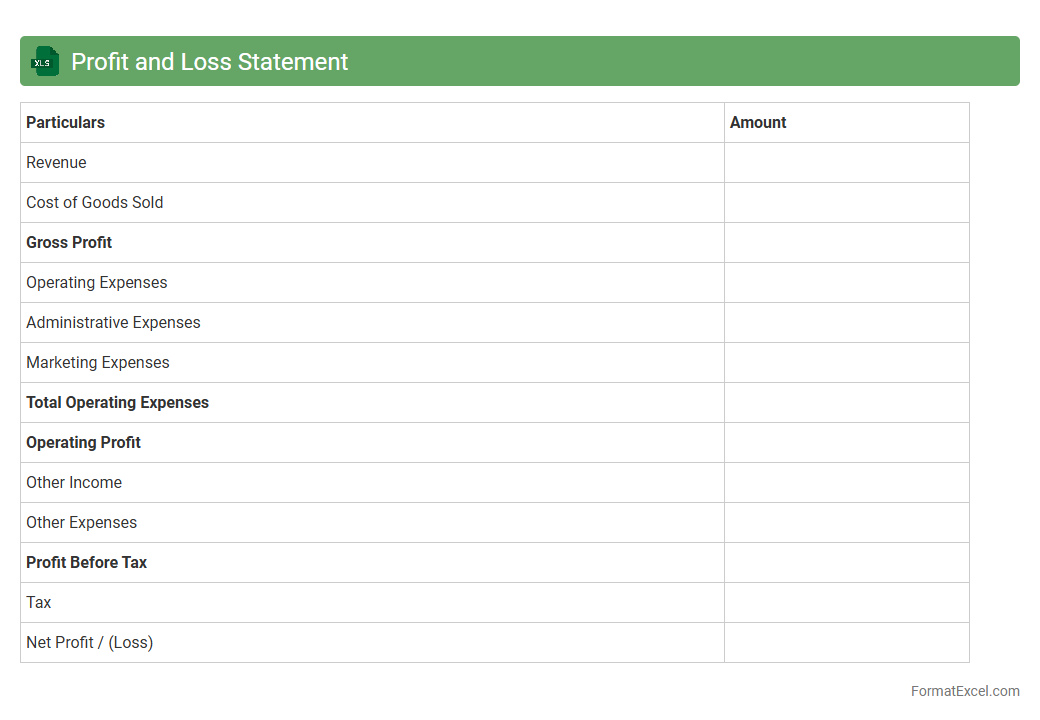

Profit and Loss Statement

A

Profit and Loss Statement Excel document is a financial reporting tool that summarizes revenues, costs, and expenses over a specific period, providing a clear view of a business's profitability. It helps track income and expenditures, enabling better budget management and financial decision-making. By analyzing this statement, businesses can identify trends, control costs, and strategize for growth.

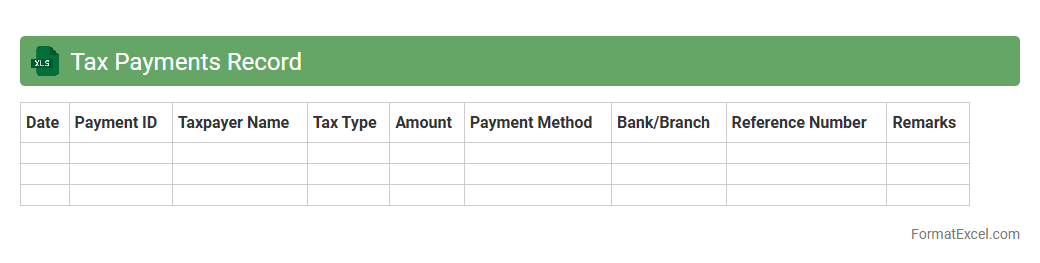

Tax Payments Record

A

Tax Payments Record Excel document is a structured spreadsheet used to track and manage all tax-related transactions, including payment dates, amounts, and tax types. This document helps ensure accuracy in tax reporting, simplifies filing processes, and provides a clear audit trail for financial accountability. Maintaining an organized tax payments record reduces errors and supports compliance with tax regulations efficiently.

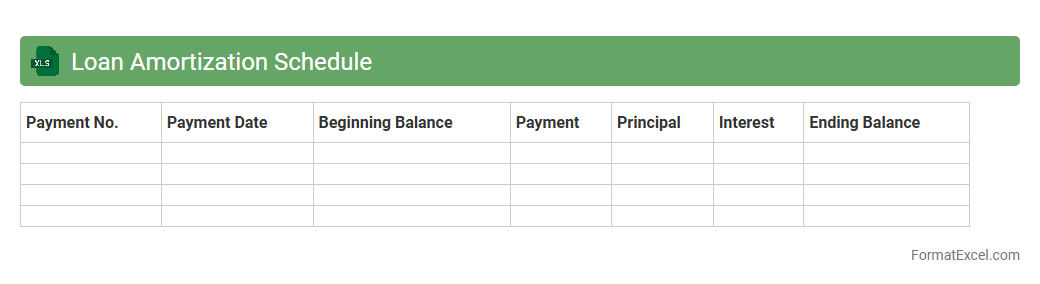

Loan Amortization Schedule

A

Loan Amortization Schedule Excel document is a detailed spreadsheet that breaks down each loan payment into principal and interest components over the loan term. This tool helps users track outstanding loan balances, anticipate future payments, and better manage financial planning by clearly showing how much of each payment reduces debt versus interest. By providing a transparent payment timeline, it improves budgeting accuracy and aids in making informed decisions about loan prepayments or refinancing.

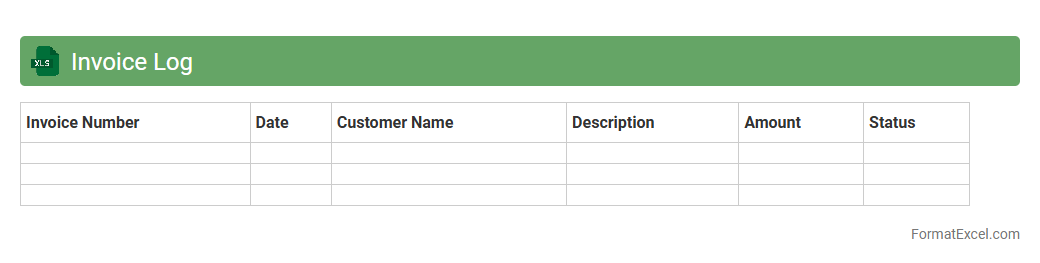

Invoice Log

An

Invoice Log Excel document is a structured spreadsheet used to record and track all invoices issued or received by a business. It helps maintain organized financial data, ensuring accurate monitoring of payment statuses, due dates, and amounts, which streamlines accounting processes and improves cash flow management. By providing a centralized and easily accessible record, it supports timely decision-making and effective financial reporting.

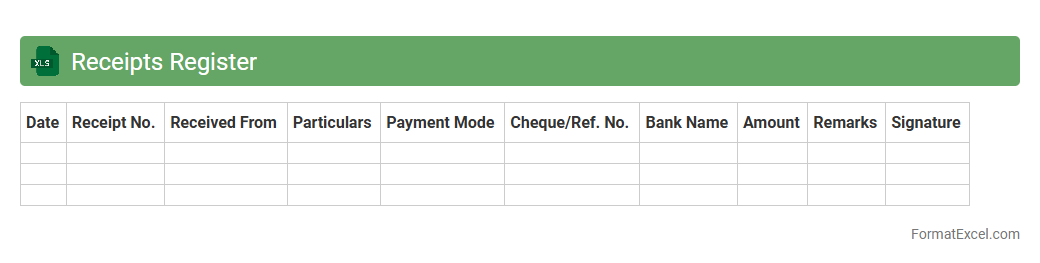

Receipts Register

A

Receipts Register Excel document is a digital ledger used to systematically record all incoming payments and receipts within a business or organization. It helps track cash flow, monitor financial transactions, and ensure accurate accounting by organizing dates, amounts, payer details, and payment modes in a structured format. This tool aids in maintaining transparency, simplifying audits, and improving financial planning and decision-making.

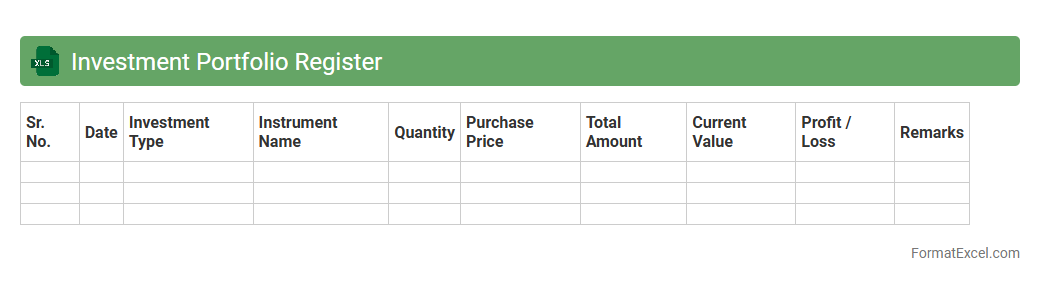

Investment Portfolio Register

An

Investment Portfolio Register Excel document systematically records all investment assets, including stocks, bonds, mutual funds, and other securities, providing a clear overview of holdings. It enables investors to track performance, monitor diversification, and calculate returns efficiently, enhancing informed decision-making. By organizing investment details, this tool supports risk management and financial planning with real-time data accessibility.

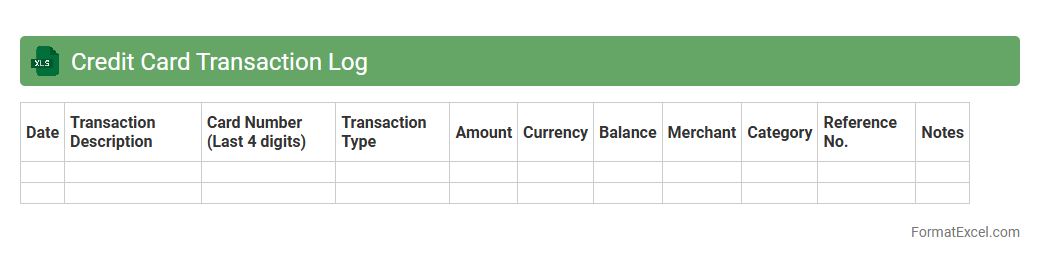

Credit Card Transaction Log

A

Credit Card Transaction Log Excel document systematically records all credit card activities, including purchases, payments, and refunds, providing a clear overview of financial transactions. This log helps users track spending patterns, detect discrepancies, and ensure timely payments, thereby aiding in effective budget management and fraud prevention. By maintaining accurate records, individuals and businesses can easily reconcile statements and optimize financial planning.

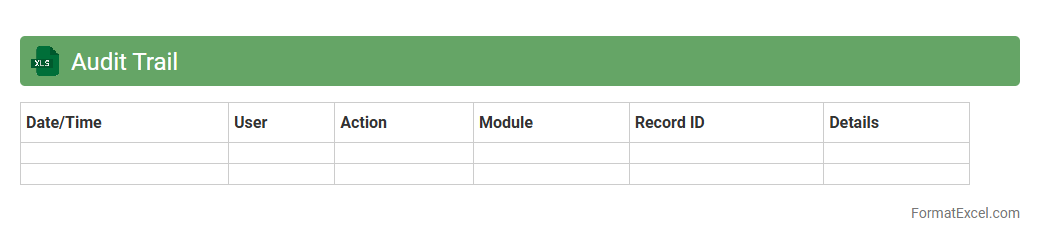

Audit Trail

An

Audit Trail Excel document is a digital record that tracks and logs all changes made to a spreadsheet, including who made the changes and when. It is useful for ensuring data integrity, enhancing accountability, and simplifying compliance with regulatory requirements across financial, operational, and project management processes. This tool enables businesses to detect errors, prevent fraud, and maintain transparent workflows by providing a clear history of all modifications.

Vendor Payment Tracker

A

Vendor Payment Tracker Excel document is a tool designed to monitor and manage payments made to suppliers efficiently. It helps businesses maintain accurate records of due dates, payment statuses, and outstanding balances, reducing the risk of late payments and improving cash flow management. This tracker enhances financial transparency and supports timely decision-making by providing a clear overview of vendor transactions.

Customer Payment Tracker

A

Customer Payment Tracker Excel document is a tool designed to monitor and record customer payments, due dates, and outstanding balances efficiently. It helps businesses maintain accurate financial records, reduce payment delays, and improve cash flow management by providing real-time insights into payment statuses. This organized approach enables timely follow-ups and better customer relationship management through clear tracking of transaction histories.

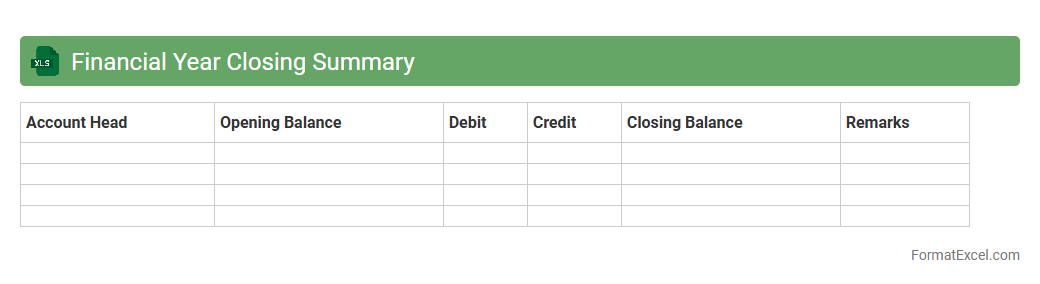

Financial Year Closing Summary

A

Financial Year Closing Summary Excel document consolidates all annual financial data, including revenues, expenses, assets, and liabilities, into a clear and organized format. It facilitates accurate assessment of the company's financial performance, ensuring compliance with accounting standards and aiding in strategic decision-making. This summary is essential for auditors, management reviews, and preparing tax filings, making it a crucial tool for business continuity and financial planning.

Introduction to Financial Record Formats in Excel

Excel is a versatile tool for managing financial records due to its flexibility and powerful calculation features. Understanding the format helps users maintain clarity and consistency in financial data. Proper formats aid in reporting, analysis, and decision-making processes.

Essential Components of Financial Records

Effective financial records should include date, description, amount, category, and balance fields to track transactions clearly. Accurate entries ensure the reliability of financial statements. Each component supports detailed analysis and audit trails.

Common Types of Financial Spreadsheets

Popular financial spreadsheets include budgeting sheets, expense trackers, income statements, and cash flow statements. Each format serves a specific purpose in monitoring financial health. Selecting the right template streamlines data entry and reporting.

Setting Up Your Excel Workbook

Create multiple sheets within a workbook to separate financial categories like expenses, income, and investments. Proper workbook organization enhances navigation and data management. This structure supports comprehensive financial oversight.

Key Columns and Data Fields

Columns such as Transaction Date, Description, Category, Amount, and Balance are critical for detailed record-keeping. Consistent field use prevents errors and simplifies analysis. Custom columns can be added to meet specific financial tracking needs.

Using Excel Templates for Financial Records

Excel templates provide pre-built structures for common financial records, saving setup time and promoting best practices. Utilizing templates encourages uniformity and minimizes manual errors. Customizable templates allow adjustments for unique financial scenarios.

Incorporating Formulas for Automated Calculations

Formulas like SUM, IF, and VLOOKUP automate totals, conditional checks, and lookups, boosting accuracy and efficiency. Automated calculations reduce manual errors in financial data. Learning key formulas enhances dynamic and interactive spreadsheets.

Tips for Data Organization and Categorization

Grouping transactions by categories and date ranges simplifies financial review and reporting. Employing filters, sorting, and color-coding aids quick data interpretation. Structured organization facilitates better financial insights.

Best Practices for Accuracy and Security

Regularly verify entries and use data validation rules to maintain accuracy. Protect sensitive financial data with password encryption and restricted access. Backup files frequently to prevent data loss.

Exporting, Sharing, and Backing Up Financial Records

Excel allows exporting financial records to PDF, CSV, or cloud services for easy sharing. Use secure platforms and proper version control when sharing files to protect data integrity. Routine backups safeguard against accidental loss or corruption.