Cheque Number

A

Cheque Number Excel document is a digital spreadsheet used to record and track cheque numbers along with associated payment details, dates, and payees. It helps in organizing financial transactions, preventing duplicate cheque usage, and facilitating easy reconciliation of bank statements. This tool enhances accuracy in bookkeeping and improves overall financial management efficiency.

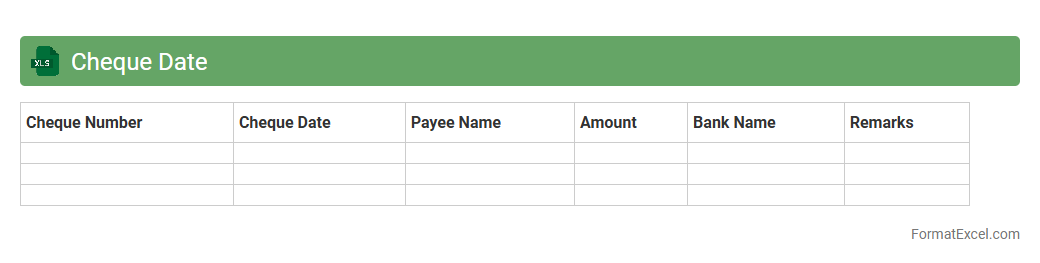

Cheque Date

A

Cheque Date Excel document is a specialized spreadsheet designed to record and track cheque issue dates, payment due dates, and clearance timelines efficiently. It helps businesses and individuals manage cash flow by providing clear visibility on cheque processing schedules, reducing the risk of missed payments or bank overdrafts. Using this tool enhances financial organization and ensures timely reconciliation of accounts.

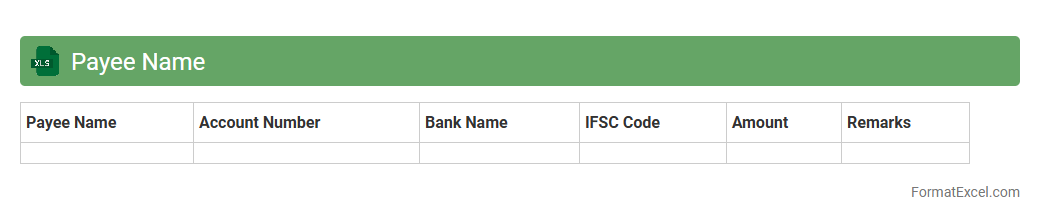

Payee Name

A

Payee Name Excel document is a spreadsheet used to systematically record and manage the names of individuals or entities receiving payments. It streamlines financial tracking by ensuring accurate payee identification, which is crucial for audits, payroll processing, and expense management. This document helps prevent payment errors and improves transparency in financial transactions.

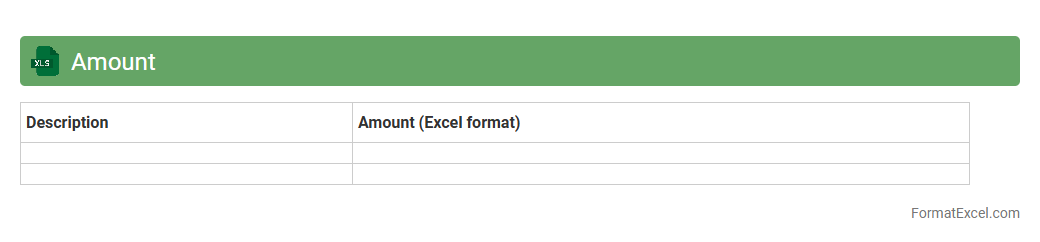

Amount

An

Amount Excel document is a spreadsheet file designed to record, calculate, and analyze numerical financial data efficiently. It helps users organize expenses, track budgets, and perform complex calculations using built-in formulas, enhancing financial management and accuracy. This tool is essential for businesses and individuals seeking to streamline monetary tracking and gain actionable insights from their financial information.

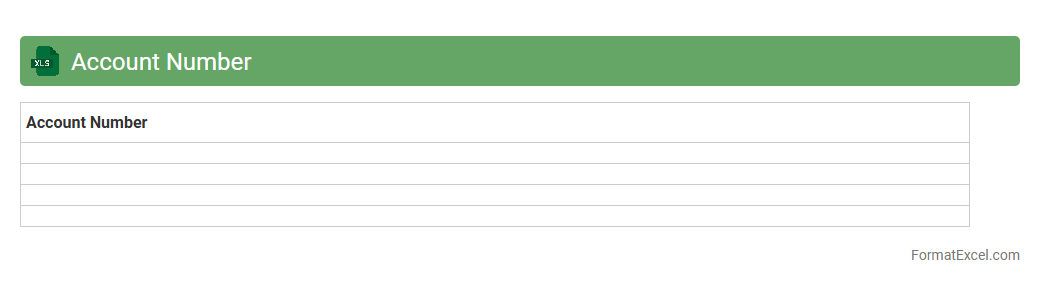

Account Number

An

Account Number Excel document is a spreadsheet that organizes and manages multiple account numbers efficiently, enabling easier tracking and retrieval of financial or client information. It allows users to perform data analysis, sorting, and filtering, which streamlines tasks like reconciliation, auditing, and reporting. This document becomes an essential tool for businesses and individuals to maintain accurate and accessible account details, improving overall financial management and decision-making.

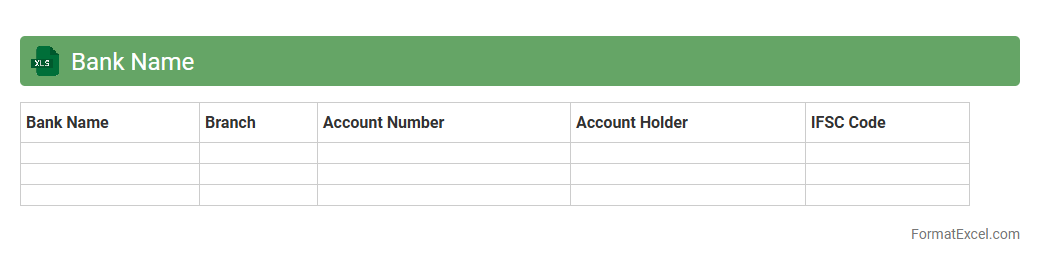

Bank Name

A

Bank Name Excel document is a spreadsheet listing various bank names along with relevant details such as branch locations, contact information, and identification codes. It serves as a centralized database that simplifies the process of verifying bank information for financial transactions, audits, and compliance checks. This document enhances accuracy and efficiency in managing banking data for individuals, businesses, and financial institutions.

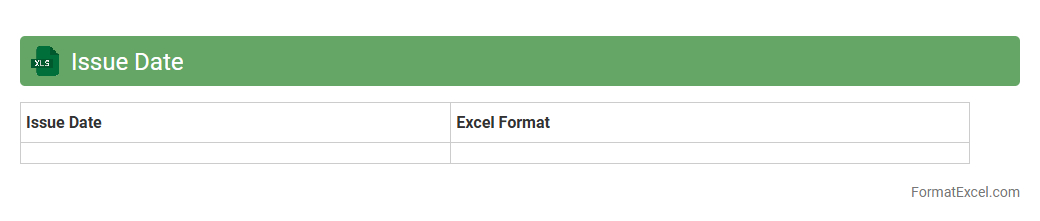

Issue Date

The

Issue Date in an Excel document refers to the specific date when a document, invoice, or project was formally released or initiated. Tracking this date allows businesses to manage deadlines, monitor project timelines, and ensure compliance with contractual obligations. Using Issue Date fields enhances data organization, facilitates timely follow-ups, and improves overall workflow efficiency.

Clearing Date

The

Clearing Date Excel document is a tool used to track the date when transactions are officially cleared or settled in financial processes. It helps businesses monitor payment statuses, reconcile accounts, and ensure accurate record-keeping by providing a clear timeline for clearing activities. This document improves cash flow management and enhances financial reporting accuracy by offering detailed insights into payment clearance.

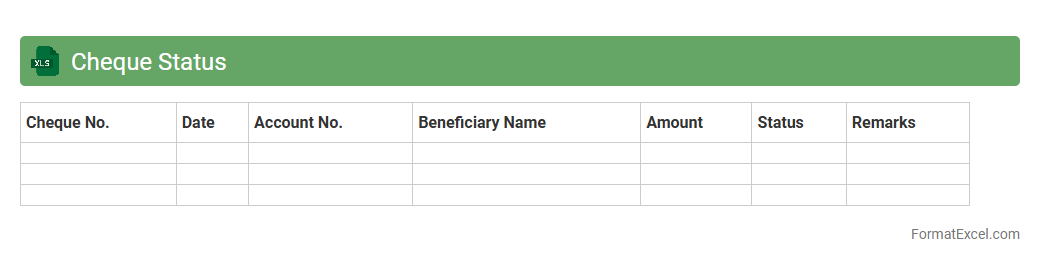

Cheque Status

A

Cheque Status Excel document is a specialized spreadsheet designed to track and manage the status of issued and received cheques systematically. It helps users monitor clearance, bounce, or pending payments efficiently, reducing the risk of financial errors and improving cash flow management. By organizing cheque details such as dates, amounts, and beneficiary information, it enhances transparency and supports timely financial decision-making.

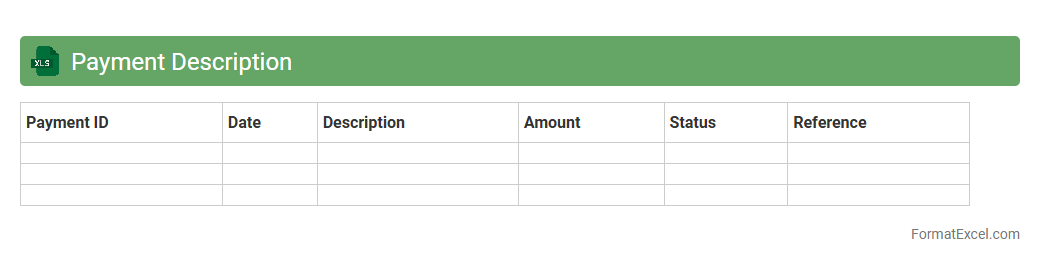

Payment Description

A

Payment Description Excel document is a structured spreadsheet that details transaction information including payment dates, amounts, payees, and payment methods. It helps businesses and individuals track financial exchanges accurately, ensuring clear records for accounting, auditing, and budgeting purposes. The document enhances transparency and simplifies the reconciliation of payments against invoices or contracts.

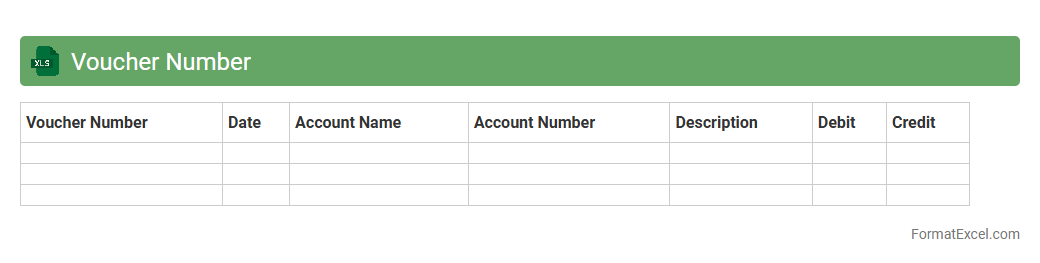

Voucher Number

A

Voucher Number Excel document is a digital file designed to systematically record and track unique voucher numbers for financial transactions or business activities. It helps in organizing payment details, ensuring accuracy in accounting, and simplifying audit processes by providing a clear reference to each voucher. This document improves efficiency in managing expenses, reducing errors, and maintaining transparent financial records.

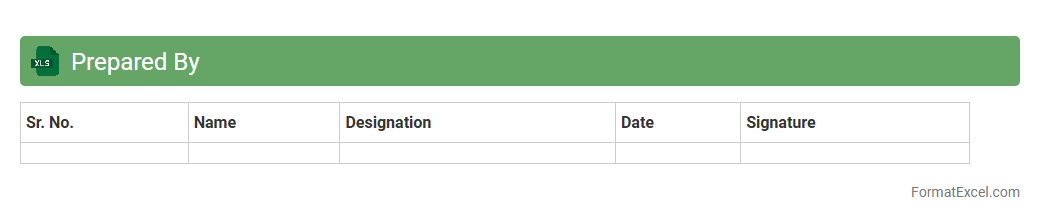

Prepared By

A

Prepared By Excel document is a file that organizes data with clear attribution to the creator or responsible person, enhancing accountability and traceability in reports or project tracking. It streamlines collaboration by providing a designated section for names, dates, and roles, making it easier to verify data sources and maintain data integrity. This document improves workflow efficiency by ensuring transparency and encouraging responsibility among team members.

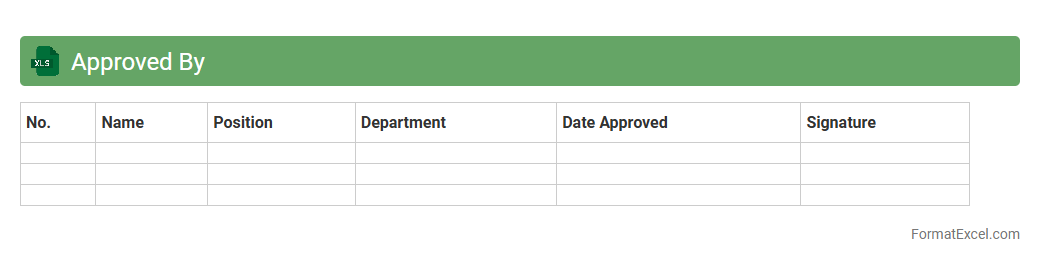

Approved By

An

Approved By Excel document serves as a formal record indicating that specific data, reports, or project stages have been reviewed and authorized by designated individuals. This document streamlines accountability and enhances transparency by clearly tracking who approved each element and when the approval occurred. Utilizing an Approved By Excel file helps organizations maintain compliance, improve workflow efficiency, and ensure quality control throughout various processes.

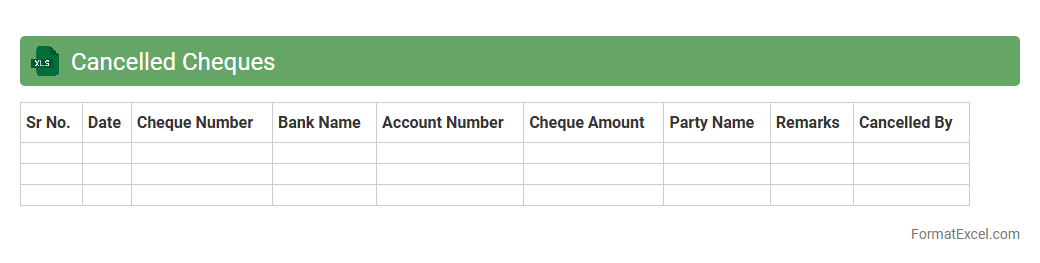

Cancelled Cheques

A

Cancelled Cheques Excel document is a digital record containing images or details of cancelled cheques, used for verification and record-keeping purposes. It helps individuals and businesses authenticate bank account information quickly, preventing fraud and ensuring accurate financial transactions. This document streamlines the process of submitting bank details for loans, KYC verification, and salary account setup.

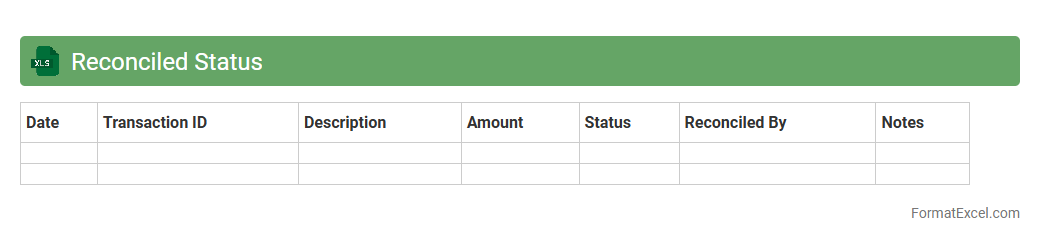

Reconciled Status

A

Reconciled Status Excel document is a detailed file used to verify and match financial records or transactions between two datasets, such as bank statements and internal accounting records. It helps identify discrepancies, ensuring accuracy and consistency in financial reporting and audits. This document streamlines the reconciliation process, saving time and reducing errors in financial management.

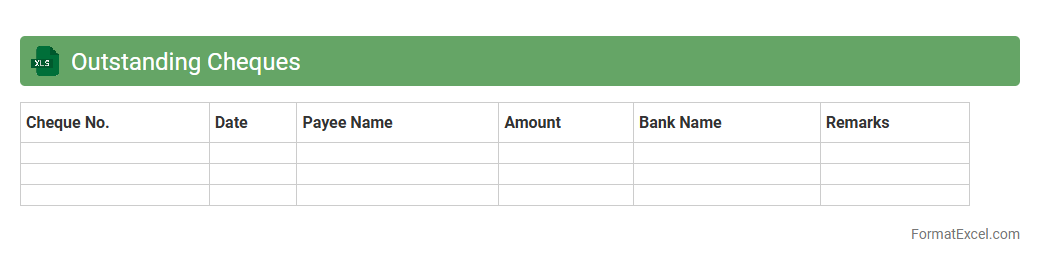

Outstanding Cheques

An

Outstanding Cheques Excel document is a financial tool used to track cheques that have been issued but not yet cleared by the bank. It helps individuals and businesses monitor pending payments, ensuring accurate cash flow management and reconciliation of bank statements. By maintaining this document, users can avoid overdrafts and detect discrepancies promptly.

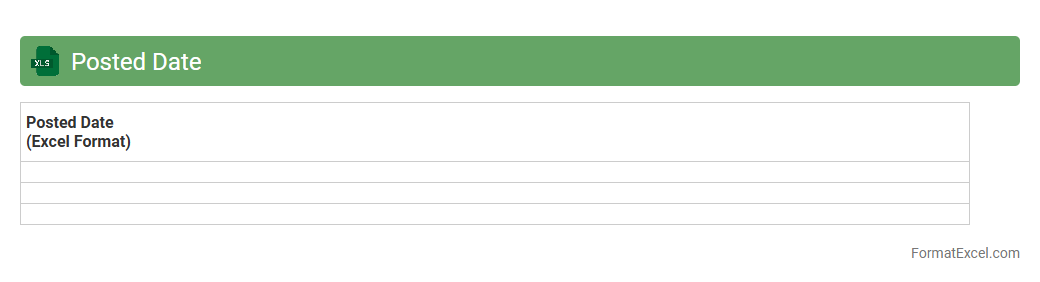

Posted Date

A

Posted Date Excel document is a spreadsheet that records the dates when transactions, entries, or activities are officially entered into a system. This document helps track the timing of financial postings, ensuring accuracy in accounting and auditing processes. By maintaining precise posted dates, businesses can streamline reconciliation, improve financial reporting, and enhance data analysis efficiency.

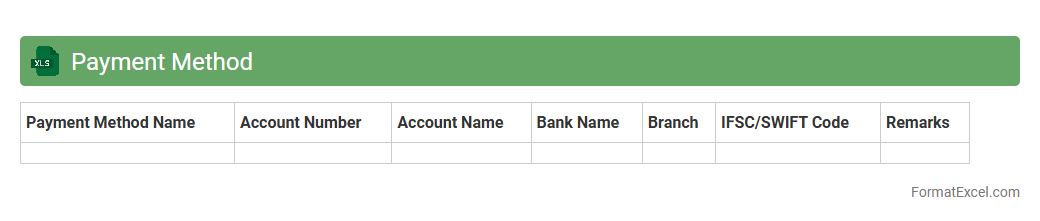

Payment Method

A

Payment Method Excel document is a structured spreadsheet used to record and track various payment options such as credit cards, bank transfers, and digital wallets. It helps businesses and individuals organize transaction data, monitor payment statuses, and streamline financial reconciliation processes. By maintaining accurate payment records, it improves cash flow management and enhances reporting accuracy.

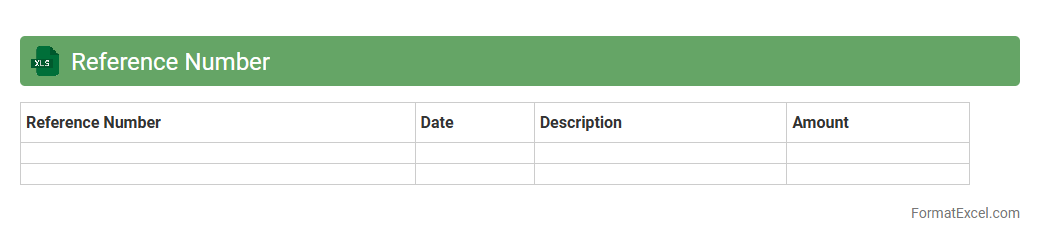

Reference Number

A

Reference Number Excel document is a spreadsheet that organizes unique identifiers for transactions, inventory, or records, streamlining data tracking and retrieval. This system enhances accuracy and efficiency in managing large datasets by minimizing errors and enabling quick cross-referencing. Businesses rely on reference number tracking to improve audit trails, customer service, and overall operational consistency.

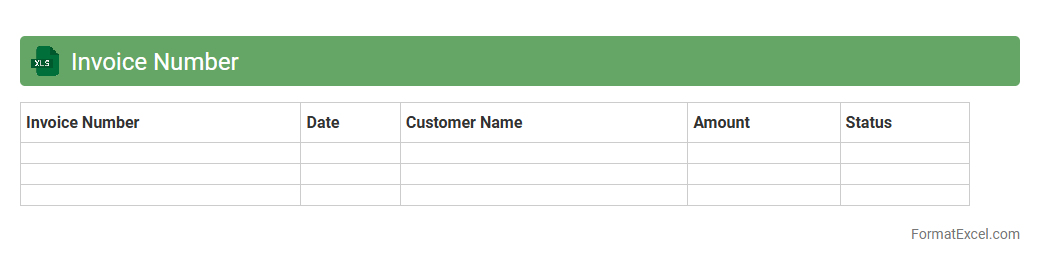

Invoice Number

An

Invoice Number Excel document is a spreadsheet used to organize and track unique invoice numbers for billing purposes. It helps businesses maintain accurate records of issued invoices, ensuring efficient payment tracking and preventing duplicate billing. This document enhances financial management by providing quick access to invoice details and streamlining the reconciliation process.

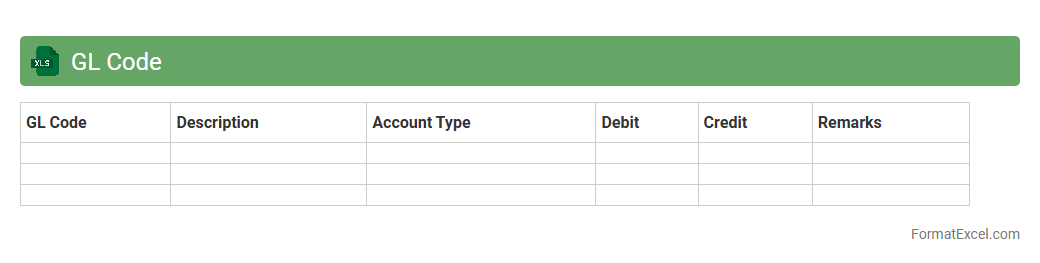

GL Code

A

GL Code Excel document is a structured spreadsheet that organizes General Ledger codes used in accounting to categorize financial transactions systematically. It facilitates accurate financial reporting, ensuring each transaction is assigned the correct account code, which simplifies auditing and budgeting processes. By using a GL Code Excel document, businesses enhance data accuracy and streamline their financial management workflows.

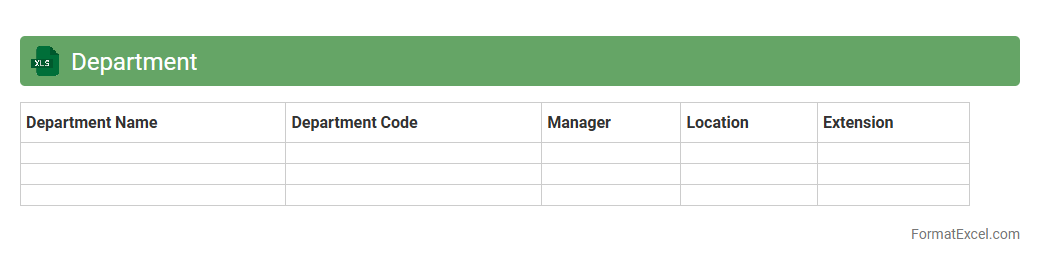

Department

A

Department Excel document is a structured spreadsheet designed to organize, track, and manage data specific to a particular department within an organization. It facilitates streamlined reporting, budgeting, resource allocation, and performance monitoring by consolidating key metrics and information in one accessible format. This tool enhances decision-making efficiency and improves operational transparency across departmental activities.

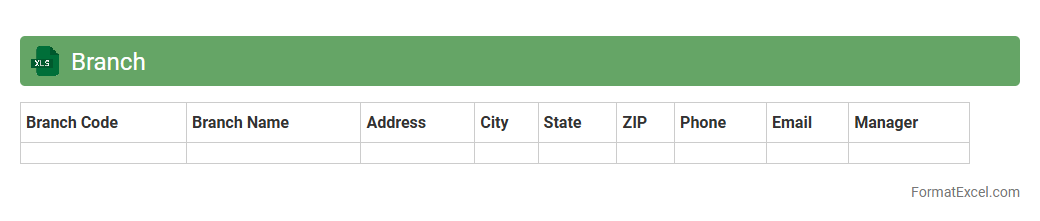

Branch

A

Branch Excel document is a structured spreadsheet used to organize and manage information related to different branches of an organization, such as sales data, employee records, or operational metrics. It allows easy comparison and analysis of branch performance, helping businesses identify trends, allocate resources efficiently, and make informed decisions. This tool enhances data accuracy, streamlines reporting processes, and supports strategic planning across multiple locations.

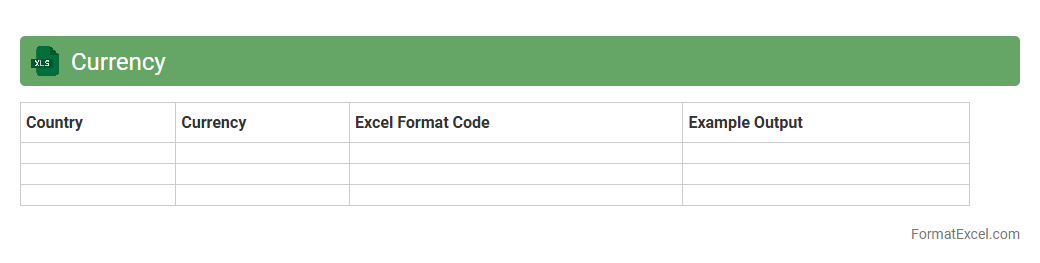

Currency

A

Currency Excel document is a spreadsheet designed to track, convert, and analyze various currency values efficiently. It is useful for managing financial transactions, budgeting in multiple currencies, and monitoring exchange rate fluctuations in real-time. This tool aids businesses and individuals in making informed decisions by providing accurate currency data and streamlined calculations.

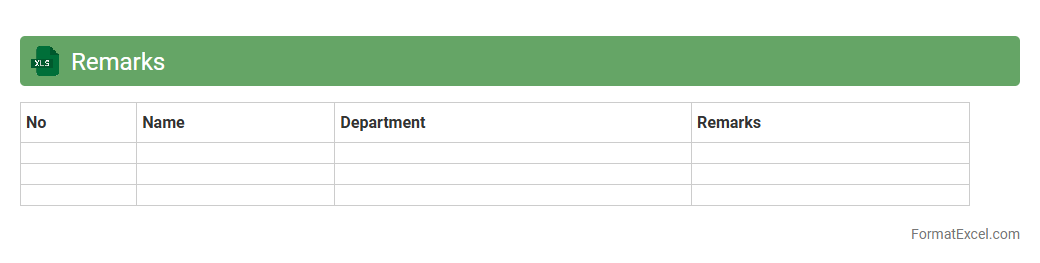

Remarks

A

Remarks Excel document is a spreadsheet used to record, organize, and analyze comments or notes related to data entries, making it easier to track feedback and observations. It enhances collaboration by providing a centralized location for team members to leave insights and suggestions, improving the overall accuracy and quality of information. This tool is especially valuable for project management, quality control, and reporting purposes, enabling efficient decision-making and streamlined communication.

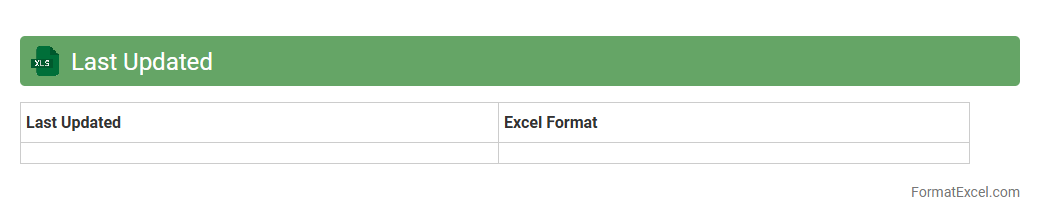

Last Updated

The

Last Updated Excel document tracks the most recent changes made to a spreadsheet, including timestamps and user modifications, ensuring data accuracy and transparency. It is useful for monitoring file revisions, preventing data conflicts, and maintaining version control in collaborative environments. This feature enhances productivity by enabling users to quickly identify the latest updates and streamline workflow management.

Introduction to Cheque Register in Excel

A Cheque Register in Excel is a digital tool used to record and track all cheque transactions efficiently. It helps in maintaining a clear record of issued and cleared cheques. Excel offers flexibility for customization and real-time updates.

Importance of Maintaining a Cheque Register

Maintaining a Cheque Register ensures accurate tracking of payments and avoids overdrafts. It provides a transparent financial record for auditing purposes. Regular updates help in reconciling bank statements effectively.

Key Components of a Cheque Register Format

A typical cheque register includes Cheque Number, Date, Payee Name, Amount, and Status columns. These components help in organizing transaction details systematically. Proper structuring aids in quick reference and verification.

Step-by-Step Guide to Creating a Cheque Register in Excel

Start by labeling columns with headings like Cheque Number, Date, and Amount. Use Excel's table features to format data neatly and enable sorting. Add data validation to minimize entry errors and maintain consistency.

Essential Columns for an Effective Cheque Register

Include columns such as Cheque Number, Date, Payee, Amount, and Status to cover all transaction details. Additional columns like Bank Name and Remarks enhance clarity. These columns facilitate smooth record-keeping and analysis.

Sample Cheque Register Template in Excel

A sample template contains predefined columns and formulas for automatic balance calculations. It serves as a practical starting point for customizing your register. Using templates saves time and enforces accuracy in data entry.

Tips for Customizing Your Cheque Register Format

Tailor your register by adding columns relevant to your business, such as Project or Department. Utilize Excel's conditional formatting to highlight cleared or bounced cheques. Consistent formatting improves readability and management.

Automating Calculations in Cheque Register Excel Sheet

Excel formulas like SUM and IF can automate calculations of total amounts and balance tracking. Use dropdown lists for cheque status to reduce errors. Automation simplifies updates and improves efficiency.

Common Mistakes to Avoid in Cheque Register Management

Avoid skipping entries or incorrect cheque numbers as it can cause reconciliation errors. Regularly update the register to prevent missed transactions. Double-check data for consistency to maintain accuracy.

Downloadable Cheque Register Excel Format Template

Download a free Cheque Register Excel Template for quick setup and efficient tracking. It includes essential columns and basic formulas to start managing your cheques effectively. Using a ready-made template streamlines your accounting process.