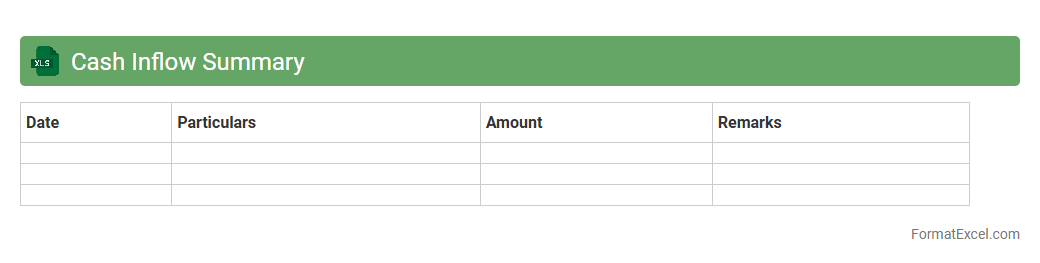

Cash Inflow Summary

A

Cash Inflow Summary Excel document consolidates all sources of incoming cash, such as sales revenue, loans, and investments, into a clear and organized format for easy analysis. This summary helps businesses monitor liquidity, forecast cash availability, and make informed financial decisions. By tracking cash inflows efficiently, it supports maintaining positive cash flow and ensuring that operational expenses can be met without interruptions.

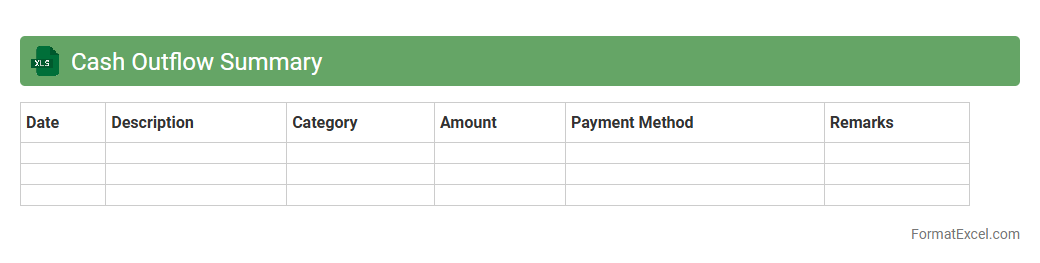

Cash Outflow Summary

A

Cash Outflow Summary Excel document consolidates all expenditures within a specified period, providing a clear overview of where money is being spent. It helps in tracking and managing expenses, ensuring better budget control and financial planning. This tool supports businesses and individuals in identifying cost-saving opportunities and maintaining cash flow stability.

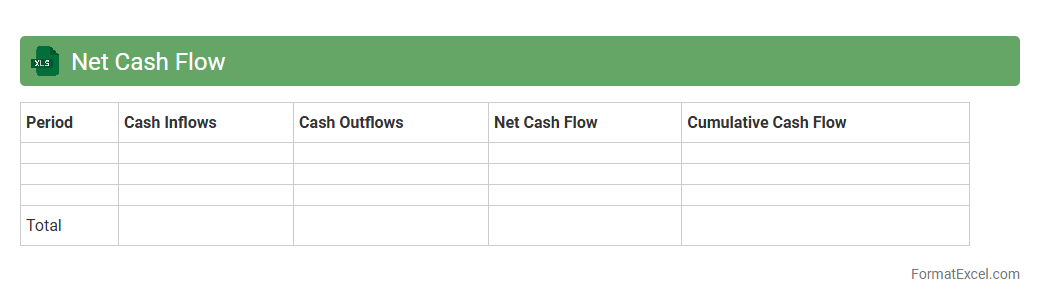

Net Cash Flow

A

Net Cash Flow Excel document is a financial tool designed to track and analyze the inflows and outflows of cash within a business over a specific period. It helps users monitor liquidity, forecast future cash positions, and make informed decisions regarding investments, expenses, and budgeting. By providing a clear overview of cash movement, it ensures better financial management and operational efficiency.

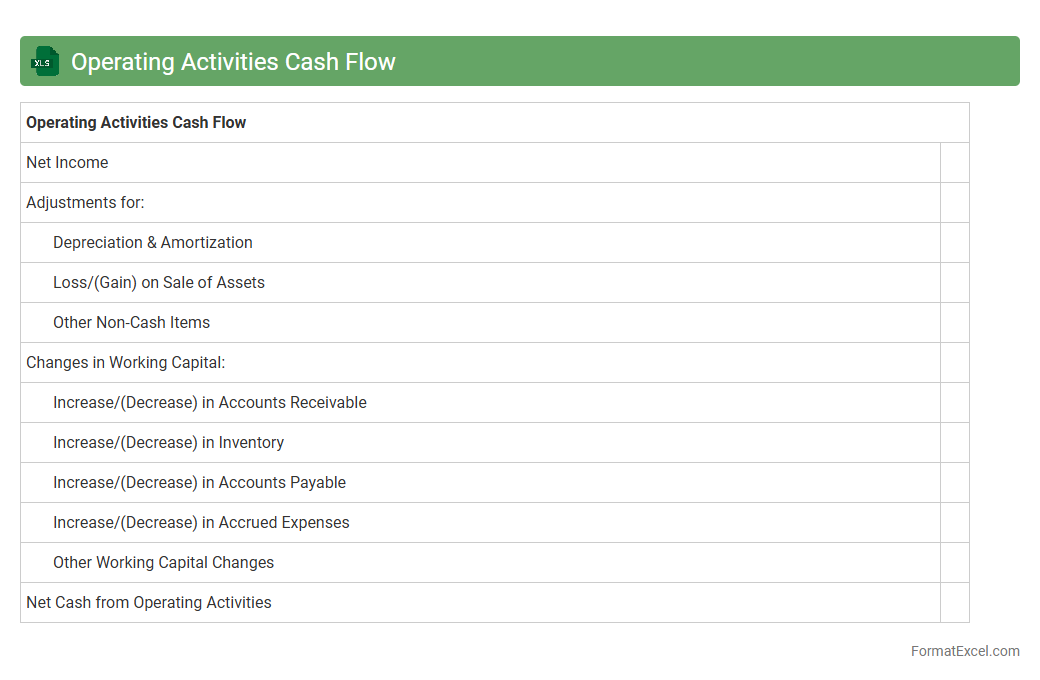

Operating Activities Cash Flow

Operating Activities Cash Flow Excel document is a financial tool that tracks cash inflows and outflows from a company's core business operations. It helps analyze the company's ability to generate sufficient cash to maintain and grow its operations, highlighting its liquidity and operational efficiency. Utilizing this document enables better cash management, informed decision-making, and improved financial planning by providing clear insights into the

cash flow from operating activities.

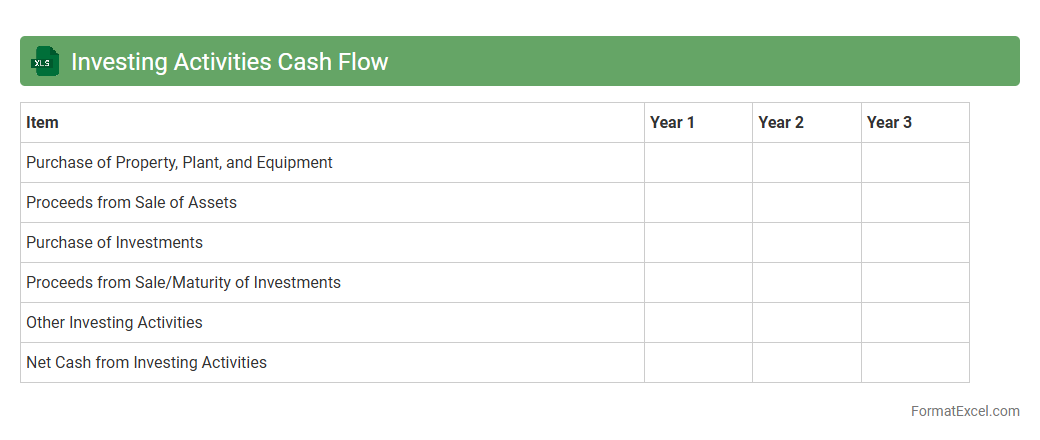

Investing Activities Cash Flow

Investing Activities Cash Flow Excel document tracks cash inflows and outflows related to acquisition and disposal of long-term assets such as property, equipment, and investments. This document provides critical insights into a company's capital expenditure and investment strategy, helping stakeholders evaluate financial health and future growth potential. Using a well-structured Excel sheet enhances accuracy in financial analysis and supports informed decision-making by reflecting real-time changes in

investing activities cash flow.

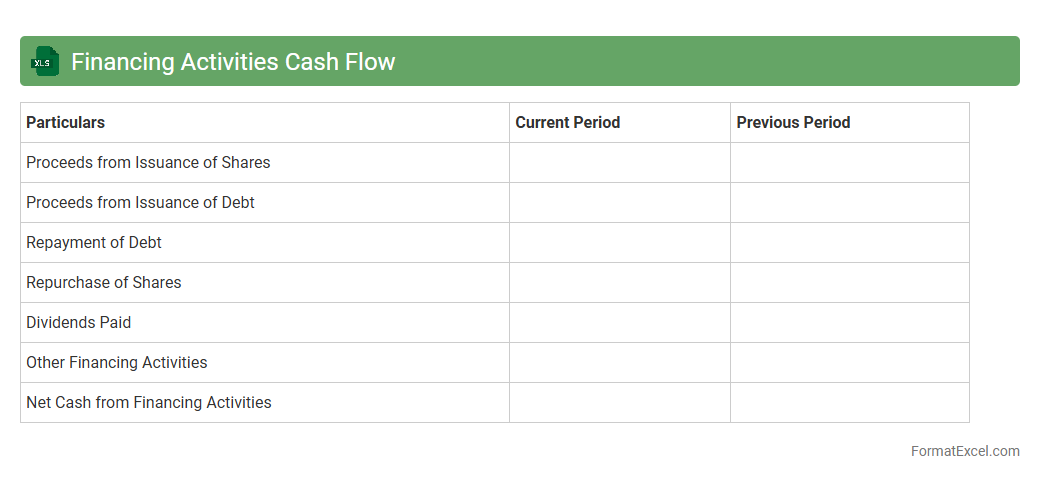

Financing Activities Cash Flow

A

Financing Activities Cash Flow Excel document tracks cash inflows and outflows related to borrowing, repaying debt, issuing stock, and paying dividends. It provides critical insights into a company's capital structure and funding strategies, enabling accurate financial planning and decision-making. By analyzing this cash flow, businesses can optimize their financing methods and ensure sustainable growth.

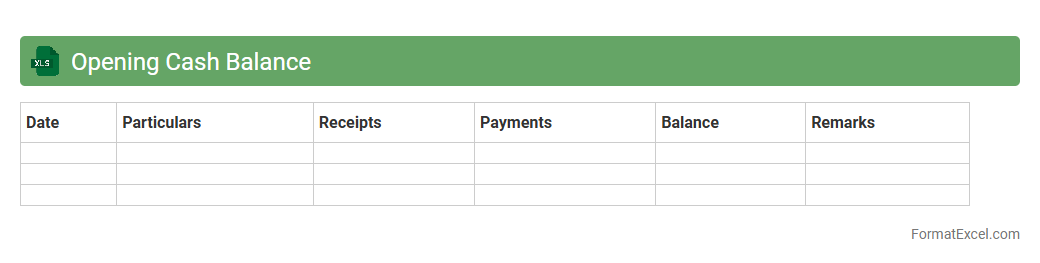

Opening Cash Balance

The

Opening Cash Balance Excel document records the initial cash available at the start of a financial period, serving as a critical foundation for accurate cash flow management. It helps businesses monitor liquidity by tracking incoming and outgoing cash movements, ensuring precise financial planning and budgeting. This document is essential for maintaining transparency and supporting informed decision-making in accounting and financial reporting.

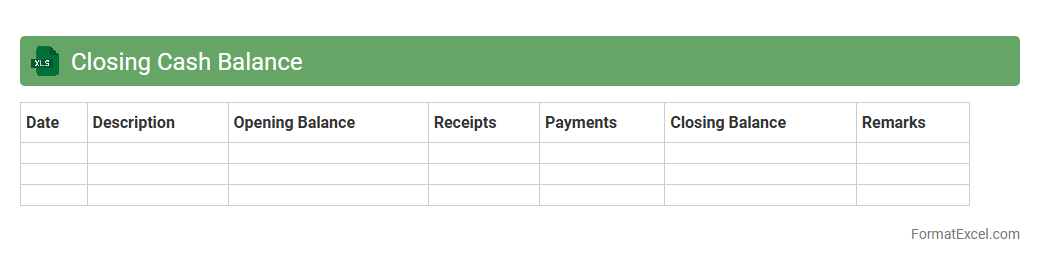

Closing Cash Balance

The

Closing Cash Balance Excel document tracks the amount of cash a business has at the end of a specific period, providing a clear picture of liquidity. It consolidates cash inflows and outflows to help businesses manage their cash flow effectively and make informed financial decisions. This tool is essential for budgeting, forecasting, and ensuring sufficient funds for operations.

Monthly Cash Flow Comparison

The

Monthly Cash Flow Comparison Excel document tracks and analyzes inflows and outflows of cash across different months, providing clear insights into financial performance and liquidity trends. This tool helps identify periods of surplus or deficit, enabling better budgeting, forecasting, and financial planning. By comparing monthly cash flows, businesses and individuals can make informed decisions to optimize expenses, enhance savings, and maintain healthy cash reserves.

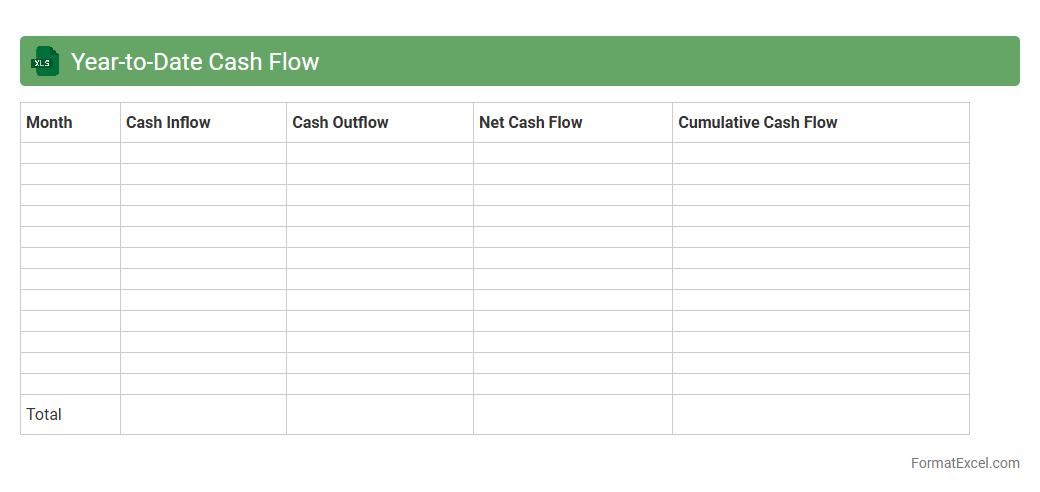

Year-to-Date Cash Flow

A

Year-to-Date Cash Flow Excel document tracks all cash inflows and outflows from the beginning of the year to the current date, providing a detailed overview of financial performance. This document helps businesses and individuals monitor liquidity, manage expenses, and plan budgets effectively by offering real-time insights into cash availability. Utilizing Year-to-Date Cash Flow spreadsheets enhances decision-making and ensures better control over financial health throughout the year.

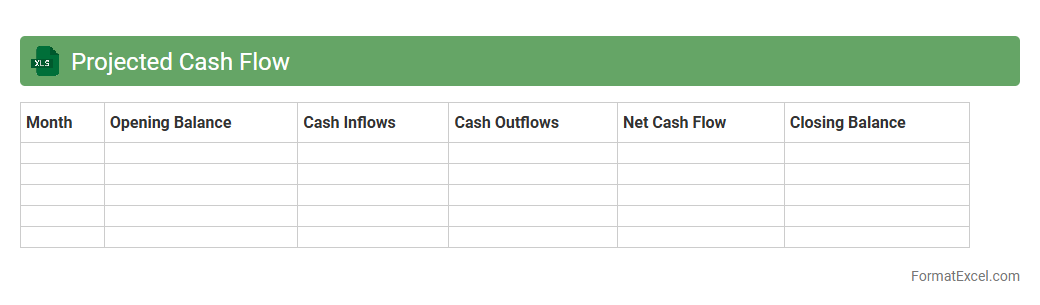

Projected Cash Flow

A

Projected Cash Flow Excel document is a financial tool used to estimate future cash inflows and outflows over a specific period, helping individuals or businesses manage liquidity and plan expenses effectively. It enables tracking of expected revenues and costs, allowing for better forecasting and decision-making to avoid cash shortages. This document is essential for budgeting, securing investments, and ensuring sustainable financial health by providing a clear picture of anticipated cash movements.

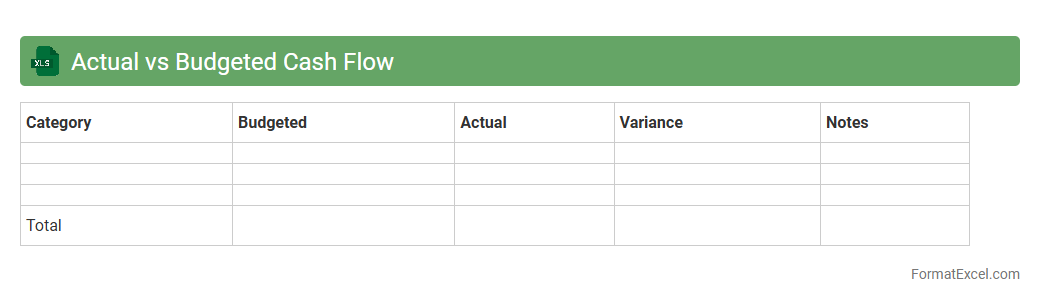

Actual vs Budgeted Cash Flow

An

Actual vs Budgeted Cash Flow Excel document tracks and compares the real cash inflows and outflows against planned figures, providing a clear view of financial performance. It helps identify variances between expected and actual cash movements, enabling better budget management and decision-making. This tool is essential for optimizing liquidity, preventing cash shortages, and improving financial forecasting accuracy.

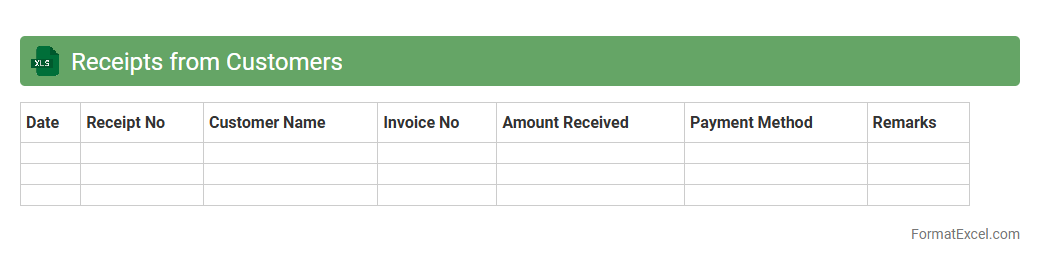

Receipts from Customers

The

Receipts from Customers Excel document records all payments received from clients, enabling accurate tracking of cash inflows. This document helps maintain organized financial records, ensuring timely reconciliation of accounts receivable and effective cash flow management. Using this file, businesses can quickly monitor outstanding invoices, streamline collection processes, and generate reliable financial reports.

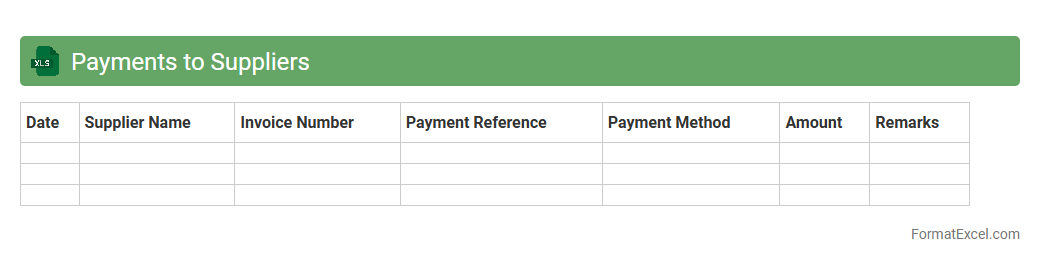

Payments to Suppliers

The

Payments to Suppliers Excel document is a detailed financial record that tracks all payments made to vendors and suppliers, ensuring accurate monitoring of cash outflows. It helps businesses maintain transparency and control over their expenditures by providing clear visibility into payment schedules, amounts, and outstanding balances. Utilizing this document improves budgeting, financial planning, and supplier relationship management by preventing missed or duplicate payments.

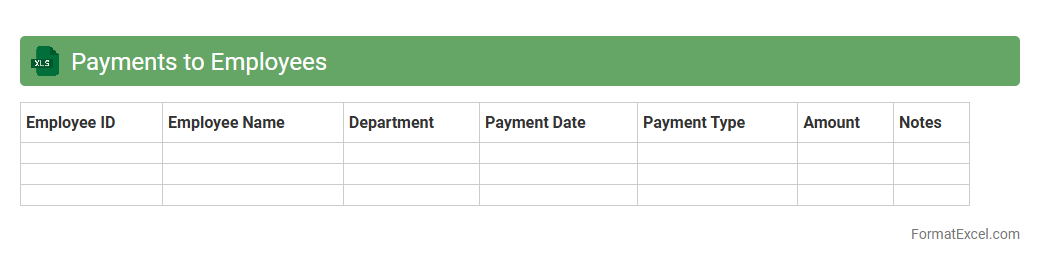

Payments to Employees

The

Payments to Employees Excel document serves as a detailed record of salary disbursements, bonuses, deductions, and tax withholdings for employees within an organization. This spreadsheet enhances financial accuracy by organizing payroll data, simplifying tax reporting, and tracking payment history for auditing purposes. Maintaining this document helps ensure compliance with labor laws and supports efficient management of employee compensation.

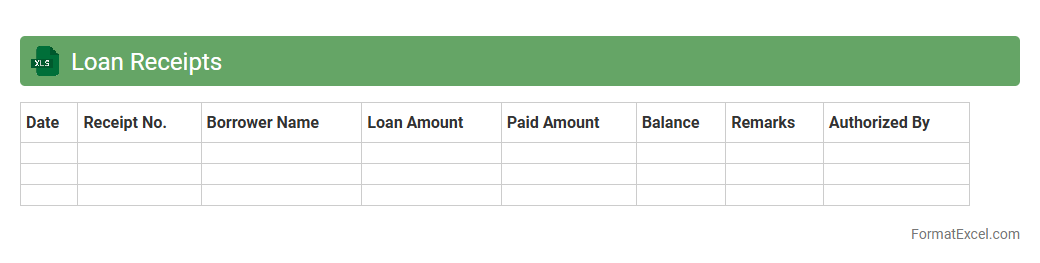

Loan Receipts

A

Loan Receipts Excel document is a digital record that tracks all loan payments received, detailing borrower information, payment dates, amounts, and outstanding balances. It helps maintain accurate financial records, simplify loan management, and generate reports for accounting or auditing purposes. This organized approach enhances transparency and supports efficient loan tracking and reconciliation.

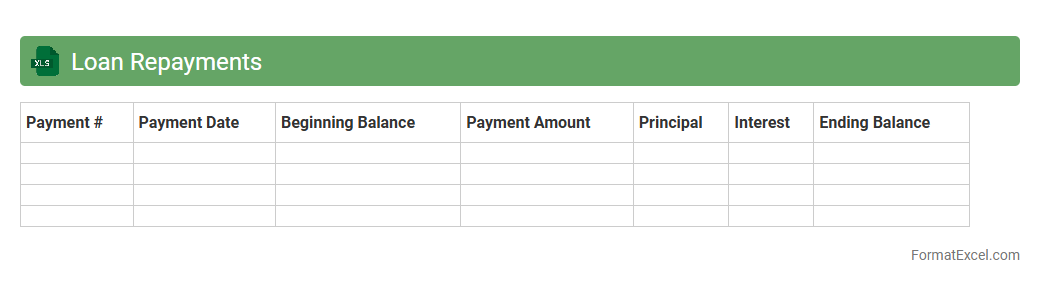

Loan Repayments

A

Loan Repayments Excel document is a spreadsheet designed to track and manage loan schedules, including principal amounts, interest rates, payment due dates, and outstanding balances. It helps users accurately calculate monthly payments, monitor repayment progress, and avoid missed deadlines by organizing all essential loan details in one place. This tool enhances financial planning and provides clear insights into debt management for individuals and businesses.

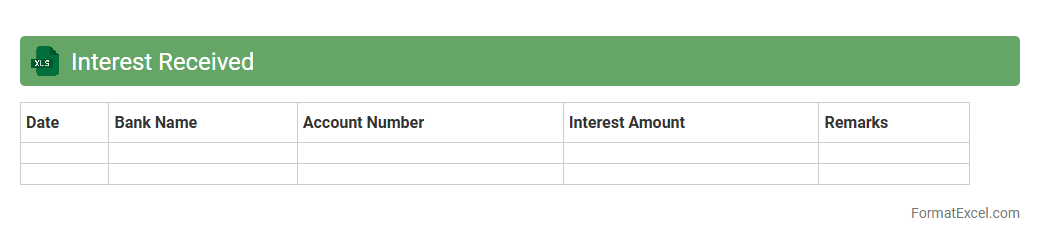

Interest Received

The

Interest Received Excel document is a detailed financial record that tracks all interest payments received from investments, loans, or savings accounts over a specific period. It helps users monitor cash inflows, calculate total interest earned, and support accurate financial reporting and tax filings. This document is valuable for maintaining transparency, analyzing investment performance, and making informed financial decisions.

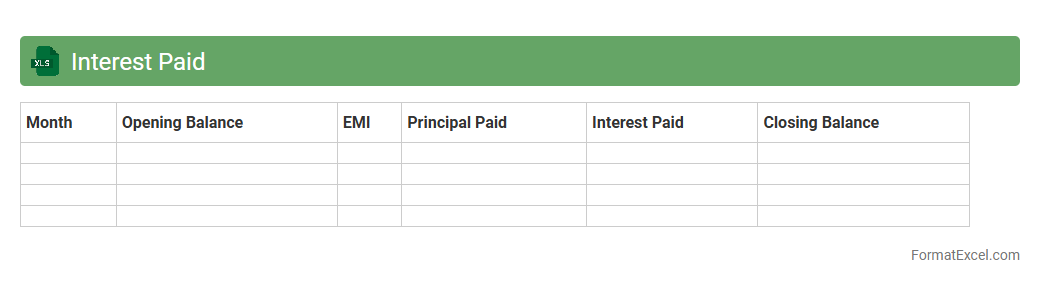

Interest Paid

An

Interest Paid Excel document is a spreadsheet designed to track and calculate the interest expenses paid on loans, mortgages, or other debt obligations over a specified period. It helps users monitor their financial commitments, manage budgets effectively, and make informed decisions about debt repayment strategies. By providing a clear overview of interest payments, this tool enhances financial planning and ensures better control over personal or business finances.

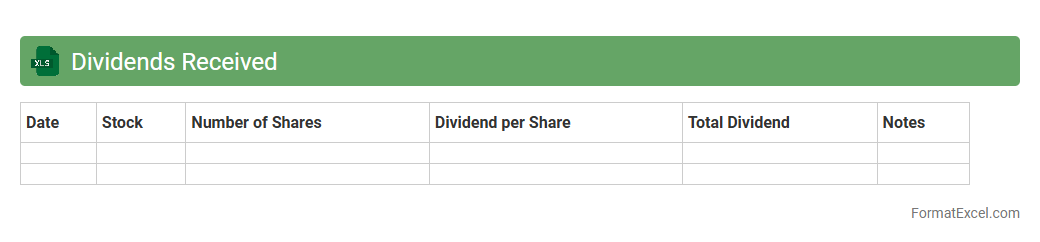

Dividends Received

The

Dividends Received Excel document is a structured spreadsheet used to track dividend income from various investments systematically. This tool helps investors organize dividend payment dates, amounts, and sources, enabling accurate financial analysis and tax reporting. It enhances decision-making by providing a clear overview of dividend trends and cash flow generated from shares.

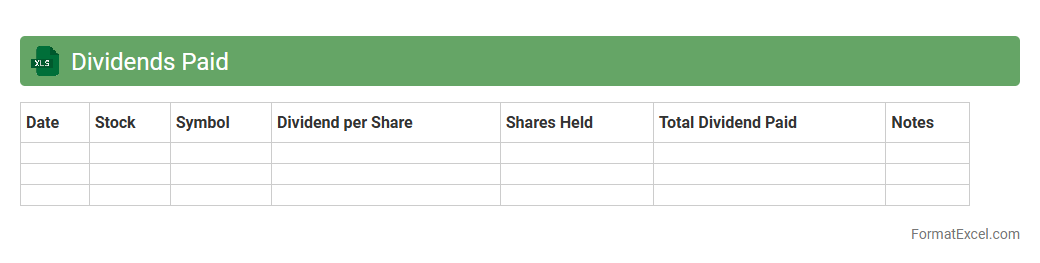

Dividends Paid

A

Dividends Paid Excel document is a financial tool used to record and track dividend payments made by a company to its shareholders over a specific period. It helps investors and financial analysts monitor cash flow distributions, calculate dividend yield, and assess the company's financial health. By organizing dividend data systematically, this document facilitates better investment decisions and portfolio management.

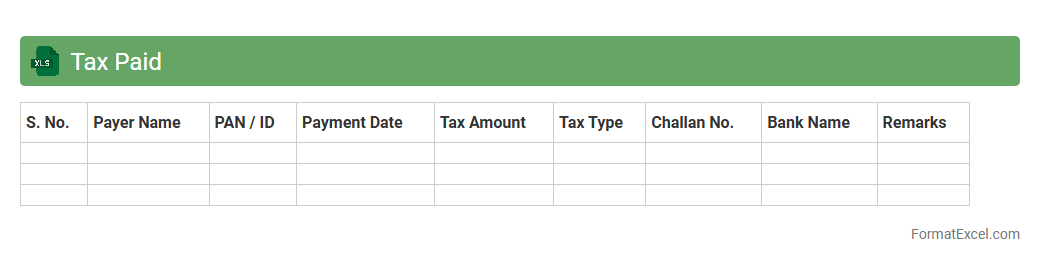

Tax Paid

The

Tax Paid Excel document is a financial tool designed to track and record all taxes paid over a specific period, enabling users to maintain accurate tax compliance and financial records. It helps individuals and businesses organize tax payments, deadlines, and relevant amounts, reducing errors and simplifying tax reporting processes. Utilizing this document improves tax audit preparedness and assists in financial planning by providing clear visibility of tax expenditures.

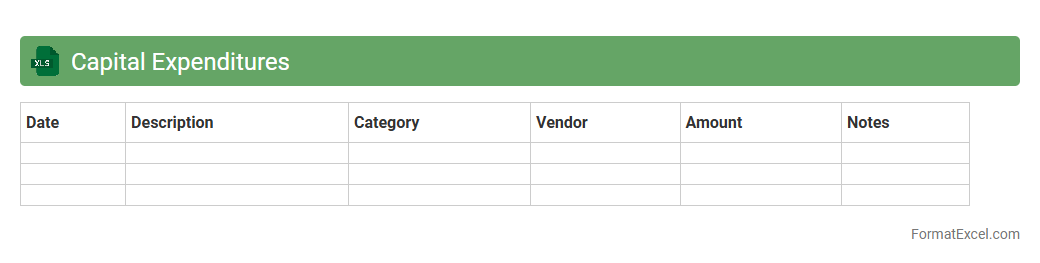

Capital Expenditures

A

Capital Expenditures Excel document is a tool designed to track and manage investments in long-term assets such as property, equipment, and infrastructure. It helps businesses forecast cash flow needs, allocate budget efficiently, and monitor depreciation schedules. Using this document enhances financial planning, ensures compliance with accounting standards, and supports strategic decision-making.

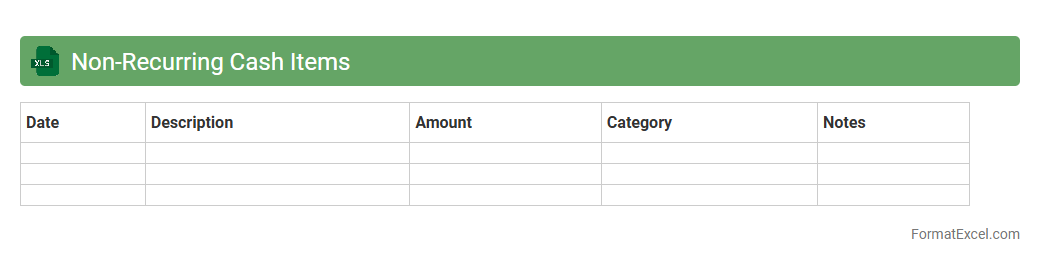

Non-Recurring Cash Items

A

Non-Recurring Cash Items Excel document tracks one-time cash transactions that do not happen regularly, such as asset sales or lawsuit settlements. This tool helps businesses clearly separate unusual cash flows from regular operations, providing a more accurate picture of ongoing financial performance. By identifying these items, companies can make better-informed budgeting, forecasting, and investment decisions.

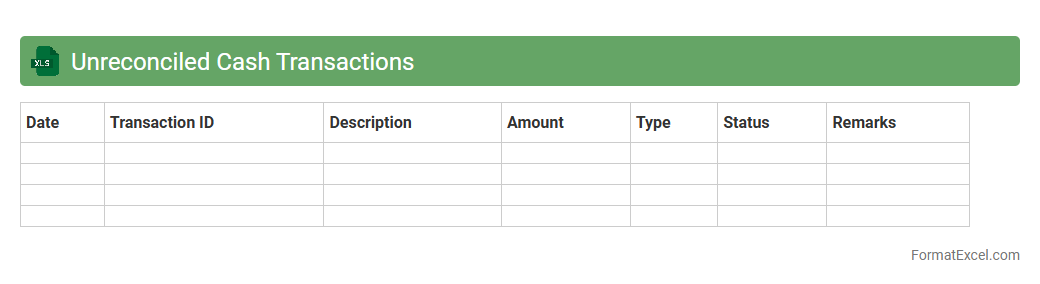

Unreconciled Cash Transactions

An

Unreconciled Cash Transactions Excel document tracks cash entries that have not been matched with corresponding bank statements, helping to identify discrepancies in financial records. It is useful for businesses and accountants to ensure accuracy in cash flow management and detect potential errors or fraudulent activities. Regular review of this document supports timely reconciliation and improved financial control.

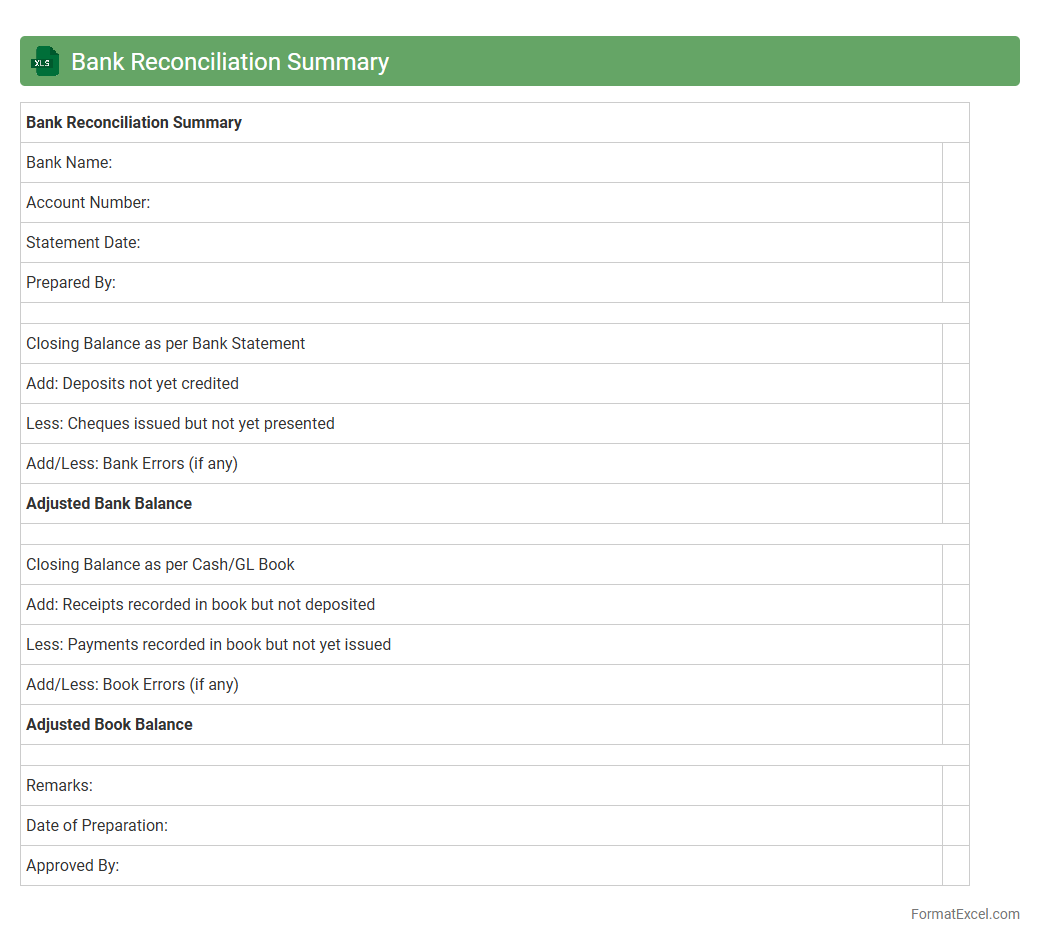

Bank Reconciliation Summary

A

Bank Reconciliation Summary Excel document is a financial tool that compares and matches the company's cash records with the bank statement to identify discrepancies such as outstanding checks or deposits in transit. It helps maintain accurate accounting records by highlighting errors or unauthorized transactions promptly. This tool is essential for ensuring financial accuracy, preventing fraud, and facilitating effective cash flow management.

Introduction to Cash Flow Report in Excel

A cash flow report in Excel is a financial document that tracks the inflows and outflows of cash in a business. It helps monitor liquidity and ensures sufficient funds for operations. Excel provides a flexible platform to organize and analyze cash flow data efficiently.

Importance of Cash Flow Reporting

Accurate cash flow reporting is crucial for maintaining business solvency and planning future expenses. It enables managers to identify potential cash shortages and make informed financial decisions. The cash flow report is a key tool for sustaining business health.

Key Components of a Cash Flow Report

A typical cash flow report includes sections for operating, investing, and financing activities. It details cash receipts and payments to provide a clear view of net cash changes. The net cash flow figure summarizes overall liquidity.

Setting Up Your Excel Cash Flow Template

Begin by defining rows for cash sources and uses, and columns for time periods like months or quarters. Input headers clearly to separate operating, investing, and financing cash activities. Establish a structured template for easy data entry and review.

Step-by-Step Guide to Formatting in Excel

Use cell styles and borders to create distinct sections within your sheet. Apply conditional formatting to highlight negative cash flow and critical values. A clean formatted layout improves readability and reduces errors.

Essential Formulas for Cash Flow Tracking

Utilize formulas like SUM to calculate total inflows and outflows, and SUBTOTAL for filtering data. The formula for net cash flow typically subtracts total outflows from inflows. Mastering these Excel formulas is vital for accurate tracking.

Customizing Cash Flow Layout for Your Business

Adapt the template to reflect your business's unique cash flow cycles and categories. Include additional rows or columns for specific revenue streams or expense groups. Customization enhances the relevance of the report.

Tips for Accurate Cash Flow Data Entry

Regularly update the report with actual cash transactions to avoid discrepancies. Double-check entries for accuracy and consistency in dates and amounts. Consistent data accuracy ensures reliable cash flow insights.

Visualizing Cash Flow with Excel Charts

Use line or bar charts to illustrate cash trends over time clearly. Charts help stakeholders quickly understand liquidity patterns and forecast needs. Visual representation is a powerful tool for decision-making.

Downloadable Sample Cash Flow Report Template

Accessing a pre-designed Excel template can save time and provide a great starting point for your financial tracking. Many free templates include built-in formulas and formatting for convenience. A sample template streamlines report creation and ensures professionalism.