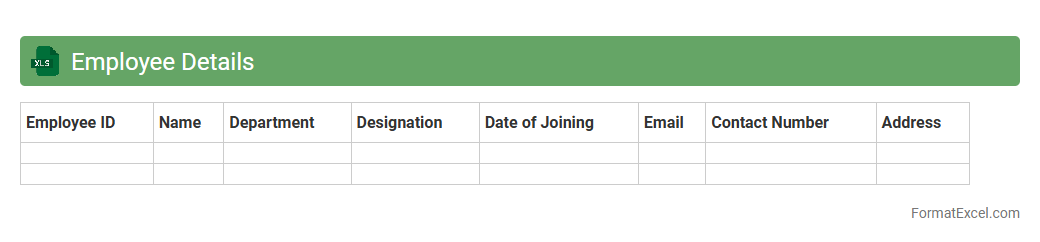

Employee Details

An

Employee Details Excel document is a structured spreadsheet that records vital information about employees, such as names, job titles, contact information, and employment dates. This document enhances organizational efficiency by consolidating employee data in one easily accessible location, facilitating quick reference and updates. It proves essential for HR management, payroll processing, and performance tracking, ensuring accurate and streamlined workforce administration.

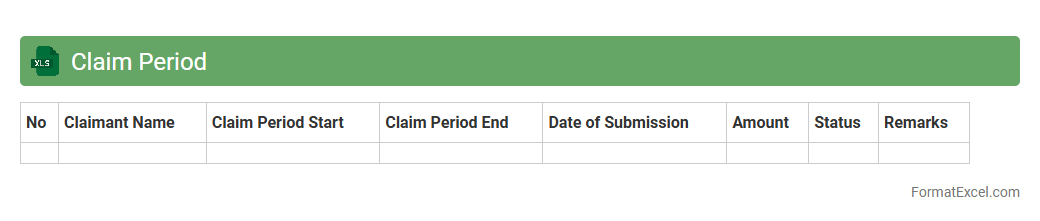

Claim Period

The

Claim Period Excel document tracks the timeframe during which claims can be submitted and processed, ensuring accurate monitoring of deadlines and compliance with policy requirements. It helps organizations organize and verify claim submissions efficiently, reducing errors and delays in reimbursement or approval processes. By consolidating claim data in one structured spreadsheet, users can analyze trends, generate reports, and maintain transparency in financial or insurance claim management.

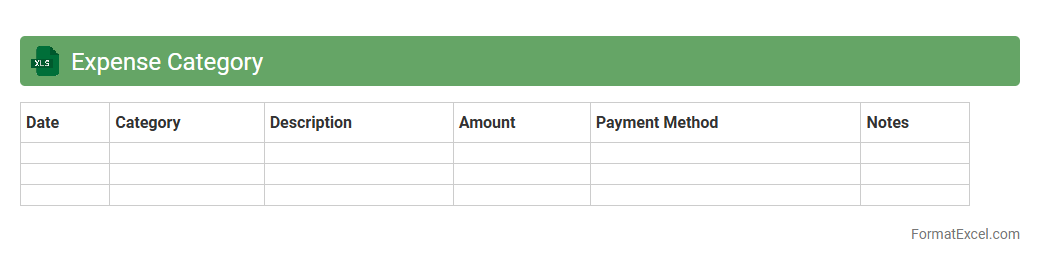

Expense Category

An

Expense Category Excel document is a structured spreadsheet used to classify and organize different types of expenses such as utilities, travel, office supplies, and salaries. It enables efficient tracking, budgeting, and financial analysis by grouping related costs, which helps businesses and individuals monitor spending patterns and identify cost-saving opportunities. This organized approach supports better financial decision-making and simplifies reporting for accounting and tax purposes.

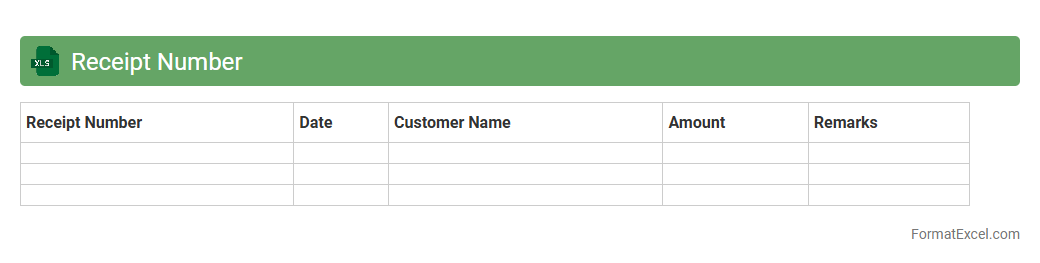

Receipt Number

A

Receipt Number Excel document is a structured spreadsheet that records unique identifiers for financial transactions or purchases, facilitating easy tracking and organization. It enables businesses or individuals to manage receipts efficiently, ensuring accurate record-keeping and quick retrieval of transaction details. This helps in auditing, expense management, and resolving payment disputes effectively.

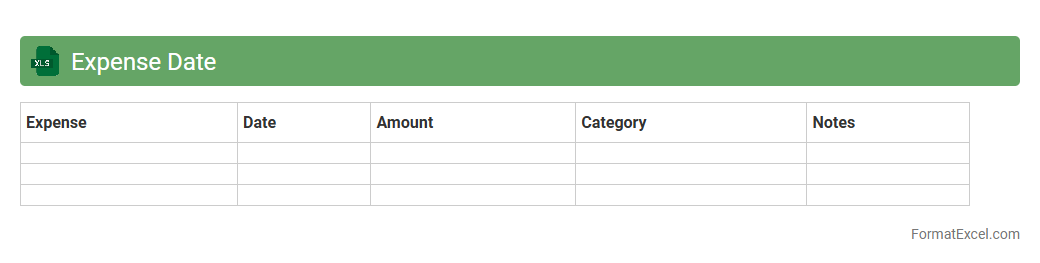

Expense Date

An

Expense Date Excel document is a spreadsheet designed to record and track dates of financial transactions and expenditures. It helps individuals and businesses organize spending chronologically, enabling accurate budgeting and financial analysis. Using this document improves expense monitoring, ensuring timely payments and better cash flow management.

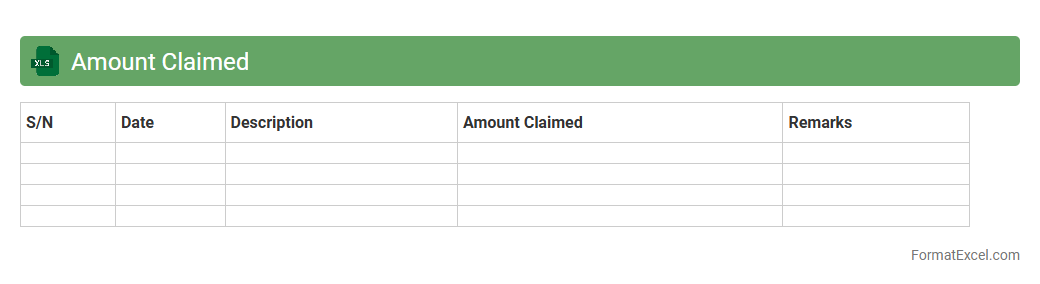

Amount Claimed

An

Amount Claimed Excel document is a spreadsheet used to systematically record and track financial claims or expenses submitted for reimbursement or payment. It helps organizations maintain accurate and transparent financial records, ensuring that all claimed amounts are properly documented and verified. This document simplifies the process of auditing and budgeting by providing a clear overview of all amounts claimed over a specific period.

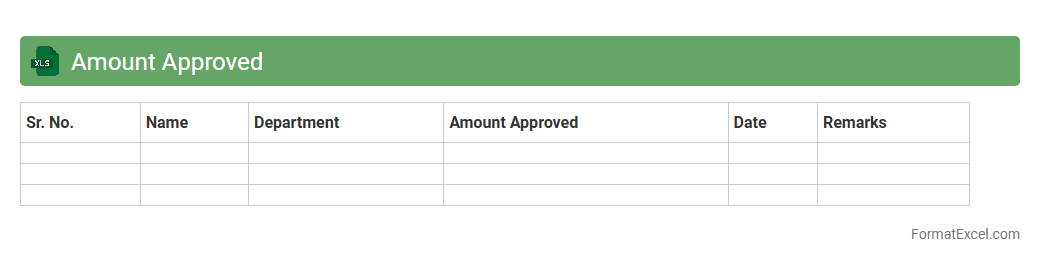

Amount Approved

The

Amount Approved Excel document is a structured spreadsheet used to record and track financial approvals for budgets, expenses, or project funds. It helps organizations maintain transparency and control by clearly documenting authorized amounts, approval dates, and related details, enabling efficient audit trails and financial management. Utilizing this document improves accuracy in budgeting processes and supports informed decision-making across departments.

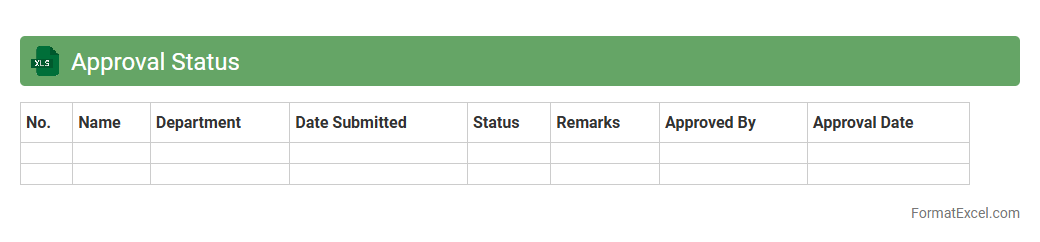

Approval Status

An

Approval Status Excel document is a tool designed to track and manage the progress of various approval processes within a project or organization. It consolidates data such as request details, approver names, dates, and current status, enabling clear visibility and accountability. This document streamlines workflow by ensuring timely decisions and reducing delays in project execution.

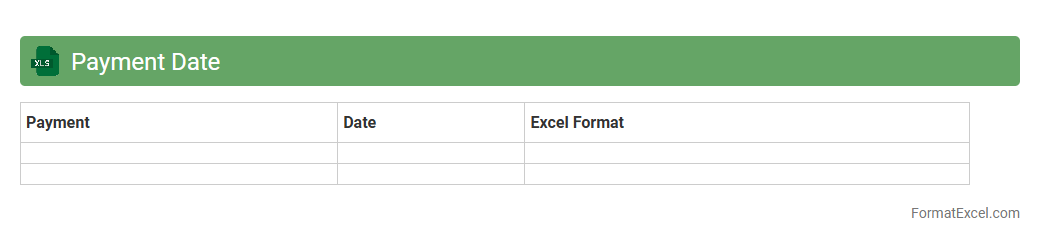

Payment Date

A

Payment Date Excel document is a spreadsheet tool designed to track and manage payment schedules, including due dates, payment amounts, and recipient details. It helps individuals and businesses maintain accurate financial records, ensuring timely payments and avoiding late fees or penalties. By providing organized and accessible payment information, it enhances budgeting, cash flow management, and financial planning efficiency.

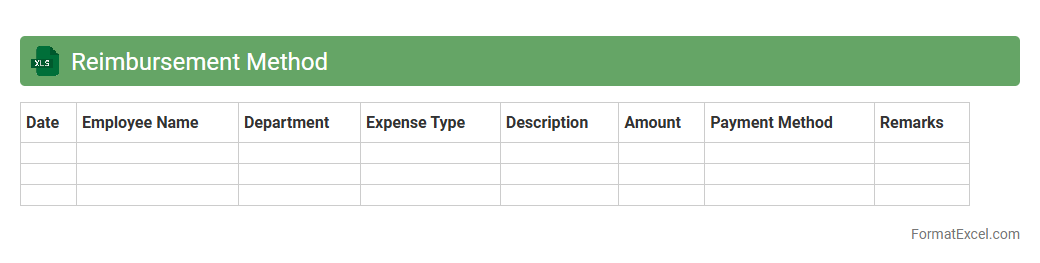

Reimbursement Method

A

Reimbursement Method Excel document is a structured spreadsheet designed to track, calculate, and manage expense reimbursements efficiently. It helps organizations or individuals systematically record expense details, payment statuses, and approval processes, ensuring accurate financial documentation. This tool streamlines reimbursement workflows, reduces errors, and facilitates transparent expense management for budgeting and auditing purposes.

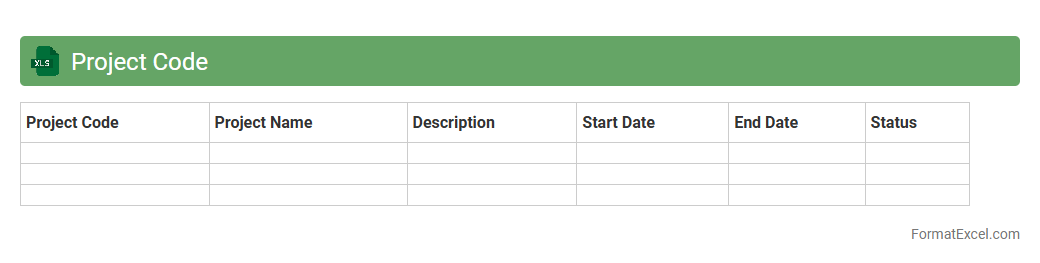

Project Code

The

Project Code Excel document serves as a centralized tool to organize and track project-specific codes, enabling streamlined project management and budgeting. It allows teams to efficiently categorize tasks, allocate resources, and monitor expenses associated with distinct project codes, enhancing accuracy and transparency. This document helps improve communication among stakeholders by providing a clear reference point for project milestones and financial tracking.

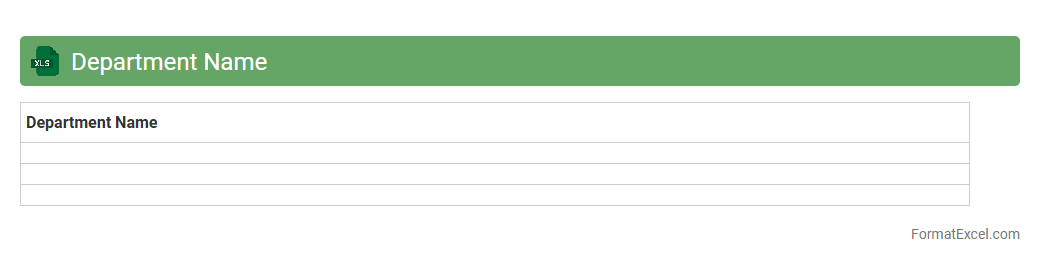

Department Name

The

Department Name Excel document is a structured spreadsheet designed to organize and manage departmental data efficiently. It allows users to track employee details, project status, budgets, and timelines in a centralized location, enhancing collaboration and decision-making. By providing clear visibility into departmental operations, this document helps improve productivity and resource allocation.

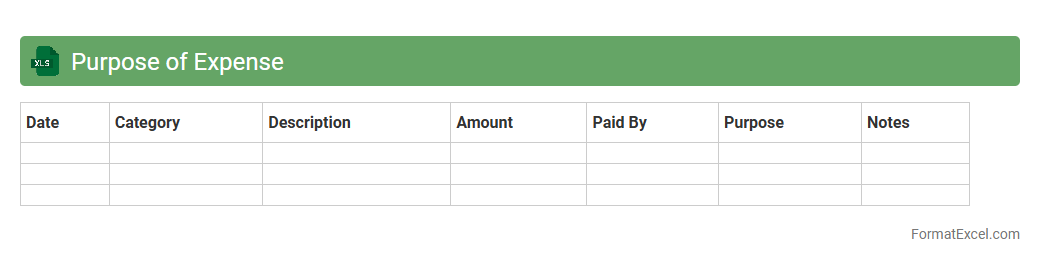

Purpose of Expense

An

Expense Excel document serves as a structured tool to record, categorize, and track financial expenditures efficiently. It helps users analyze spending patterns, manage budgets, and ensure accurate financial reporting. By maintaining detailed expense records, individuals and businesses can optimize cash flow management and make informed economic decisions.

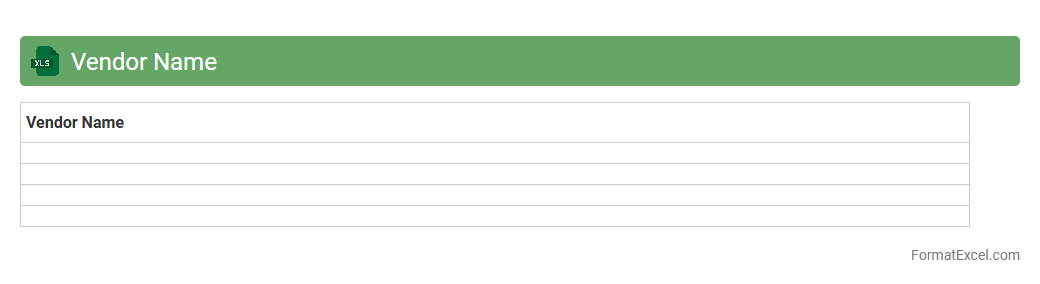

Vendor Name

A

Vendor Name Excel document is a structured spreadsheet that organizes vendor information, including company names, contact details, and services provided. It enables efficient tracking, comparison, and management of suppliers, ensuring streamlined procurement processes and improved vendor relationship management. This document is essential for maintaining accurate records, facilitating communication, and supporting strategic decision-making in purchasing and supply chain operations.

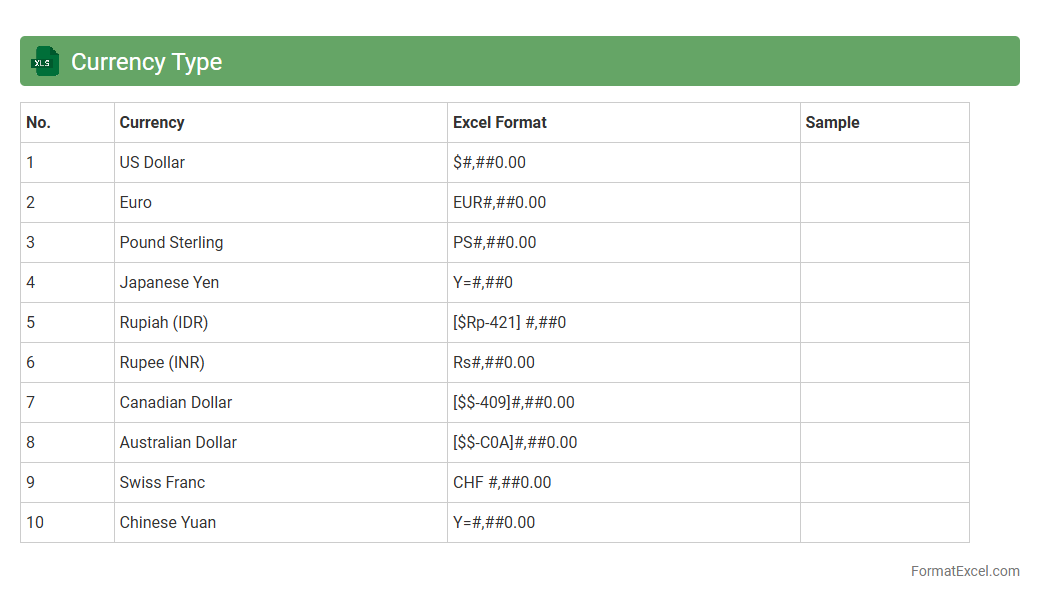

Currency Type

A

Currency Type Excel document is a spreadsheet template designed to organize and manage various currency formats, facilitating accurate financial data entry and analysis across multiple currencies. It is useful for international businesses, accountants, and financial analysts who need to track exchange rates, perform currency conversions, and generate financial reports with consistent currency formatting. By using such a document, users can ensure precision in budgeting, forecasting, and financial decision-making in multi-currency environments.

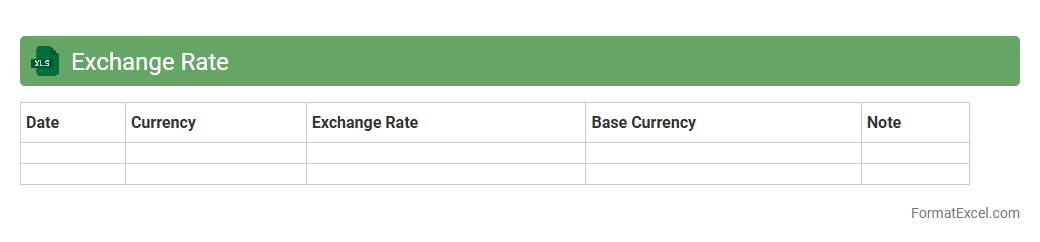

Exchange Rate

An

Exchange Rate Excel document is a spreadsheet tool that tracks and analyzes currency conversion rates between different countries. It helps businesses, travelers, and investors monitor fluctuations in foreign exchange markets for budgeting, financial planning, and risk management. Users can automate data updates, perform historical comparisons, and make informed decisions based on real-time or historical exchange rate data.

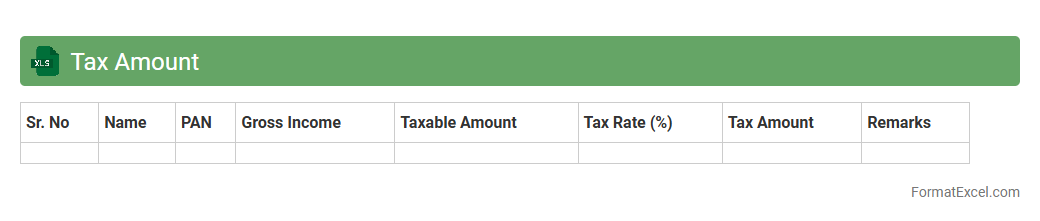

Tax Amount

A

Tax Amount Excel document is a spreadsheet designed to calculate, track, and manage tax liabilities based on income, expenses, and applicable tax rates. It streamlines tax computations, minimizes errors, and helps maintain organized financial records for individuals or businesses. This document is essential for accurate tax reporting and efficient financial planning.

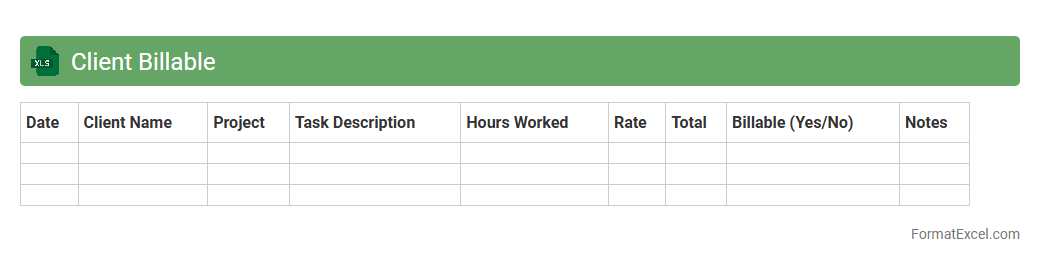

Client Billable

Client Billable excel document is a structured spreadsheet used to track and manage billable hours or expenses related to specific clients. It helps ensure accurate invoicing, timely billing, and clear record-keeping of services provided. Maintaining a

Client Billable document enhances financial transparency and improves project cost management.

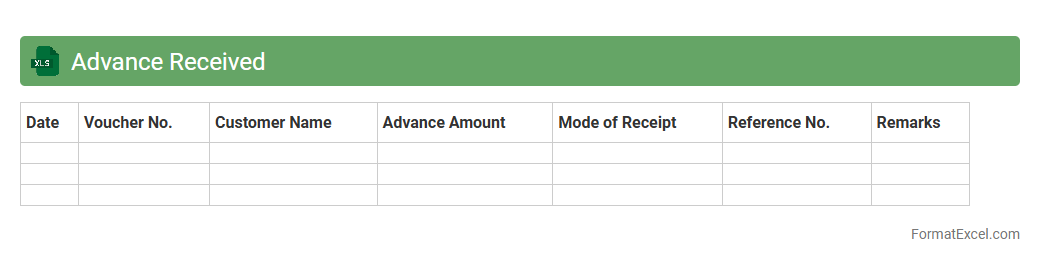

Advance Received

An

Advance Received Excel document is a financial record tool that tracks payments received before goods or services are delivered. It helps businesses maintain accurate accounting by documenting customer prepayments, ensuring transparency in cash flow management. This document streamlines reconciliation processes and supports efficient financial planning and auditing.

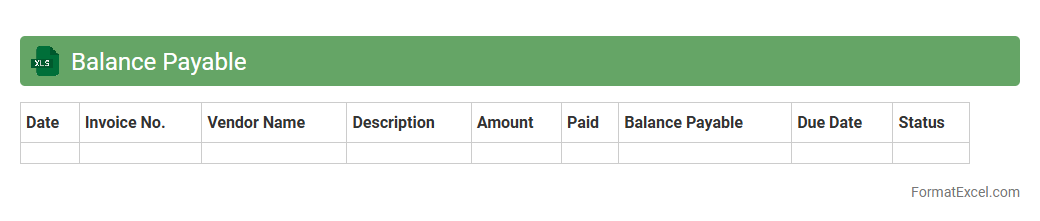

Balance Payable

The

Balance Payable Excel document is a financial tool designed to track outstanding payables, including detailed records of amounts owed to suppliers or creditors. It helps businesses maintain accurate accounts payable data, ensuring timely payments and improved cash flow management. By providing a clear overview of liabilities, it supports efficient budgeting and financial planning processes.

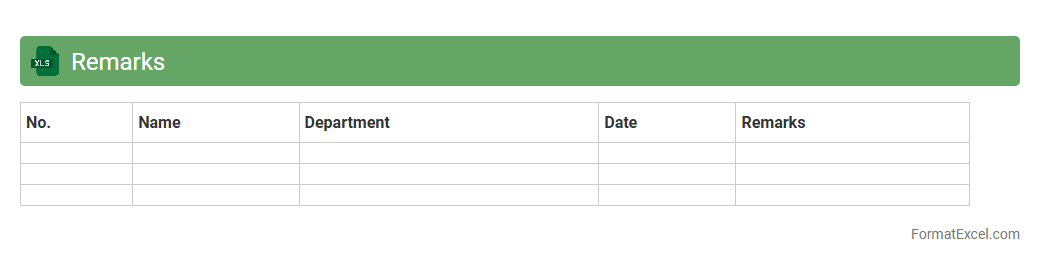

Remarks

The

Remarks Excel document serves as a structured tool for recording comments, feedback, or observations related to data entries, projects, or tasks within a spreadsheet. It enhances data analysis by providing contextual notes that clarify or explain specific figures, facilitating better decision-making and communication among team members. Utilizing remarks in Excel increases productivity by helping users track progress, identify issues, and ensure accountability throughout workflows.

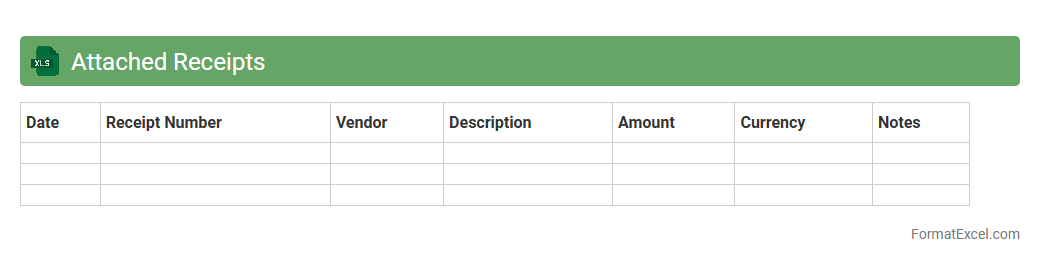

Attached Receipts

The

Attached Receipts Excel document is a spreadsheet used to organize and track receipts by attaching images or scanned copies directly within the file. This tool helps streamline expense management, ensuring easy verification and audit of transactions without the need for physical paper storage. It improves accuracy and efficiency in financial record-keeping by centralizing all receipt data in a single accessible location.

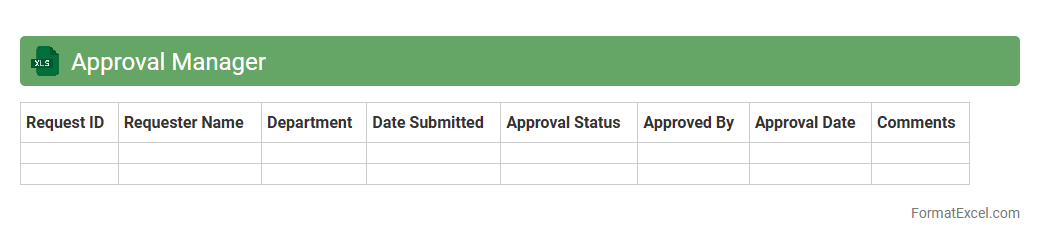

Approval Manager

The

Approval Manager Excel document is a structured spreadsheet designed to streamline and track approval workflows within organizations, enabling clear oversight of pending, approved, and rejected requests. It enhances efficiency by providing customizable templates that capture essential details such as approver names, dates, statuses, and comments, ensuring accountability and reducing delays. This tool proves invaluable for managing project proposals, budget authorizations, and compliance checks, facilitating transparent communication and timely decision-making.

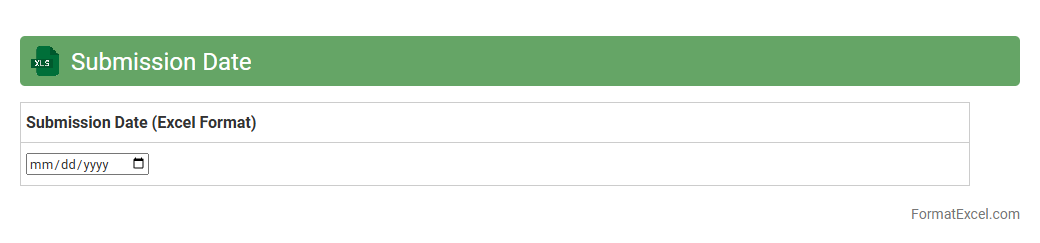

Submission Date

The

Submission Date Excel document is a spreadsheet used to track and manage deadlines for various tasks, projects, or assignments. It allows users to organize submission timelines efficiently, ensuring timely completion and reducing the risk of missed deadlines. By providing a clear overview of upcoming due dates, this document enhances productivity and improves project management within teams or individual workflows.

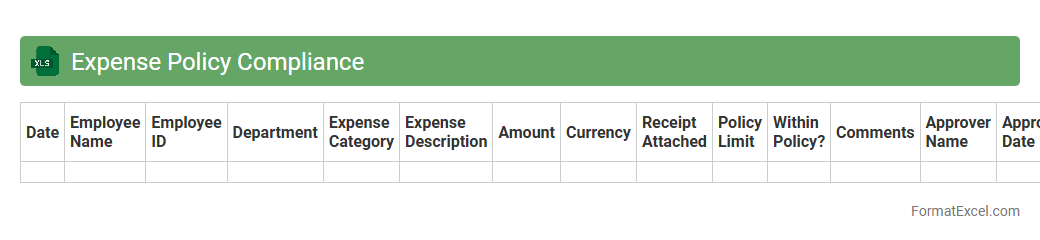

Expense Policy Compliance

An

Expense Policy Compliance Excel document is a structured spreadsheet designed to track and ensure adherence to organizational expense guidelines. It allows businesses to systematically monitor employee reimbursements, flag discrepancies, and maintain transparency in spending. This tool is essential for minimizing financial risks and promoting accountability in expense management.

Introduction to Expense Claim Reports

An expense claim report is a document submitted by employees to request reimbursement for work-related expenses. It ensures transparency and accountability in managing company funds. Properly maintained reports help track expenditures and streamline financial processes.

Importance of Using Excel for Expense Claims

Excel is widely used for expense claims due to its flexibility and powerful data management features. It allows for easy customization, calculation automation, and data analysis. Utilizing Excel enhances accuracy and efficiency in processing expense claims.

Key Components of an Expense Claim Report

Essential components include the claimant's details, date of expense, expense description, amount, and receipts attached. Including a clear approval signature section is also critical. These elements ensure a complete and verifiable expense claim report.

Standard Format for Expense Claim Report in Excel

A standard format typically includes columns for date, category, description, payment method, amount, and approvals. Using consistent data structures helps simplify review and auditing processes. Maintaining a clear format ensures the expense claim report is user-friendly.

Step-by-Step Guide to Creating Expense Reports in Excel

Start by setting up proper column headers and formatting for currency and dates. Next, input expenses with supporting details and use formulas to calculate totals. Finally, add validation rules to avoid errors and make approval workflows straightforward for expense claim reports.

Essential Columns for Expense Tracking

Important columns include Date, Expense Type, Description, Amount, Payment Mode, and Receipt ID. These columns provide a comprehensive overview of each expense entry. Incorporating these ensures completeness of your expense tracking.

Tips for Designing a User-Friendly Excel Expense Report

Use clear headers, freeze panes, and apply color coding to enhance readability. Adding drop-down lists and data validation reduces input errors. These design choices improve usability and accuracy in managing expense reports.

Best Practices for Accurate Data Entry

Ensure all expenses have attached receipts and categorize them properly. Double-check amounts and dates before submission. Consistent and precise data entry guarantees reliability in your expense claim reports.

Common Mistakes to Avoid in Expense Claim Formats

Avoid missing receipt attachments, incorrect dates, and lack of approval signatures. Overlooking these can delay reimbursements and cause compliance issues. Prevent errors by following a well-structured expense claim format.

Downloadable Excel Templates for Expense Claim Reports

Many websites offer free downloadable Excel templates for expense claims that are customizable and easy to use. These templates save time and maintain consistency across reports. Utilizing pre-designed templates simplifies the expense claim process.