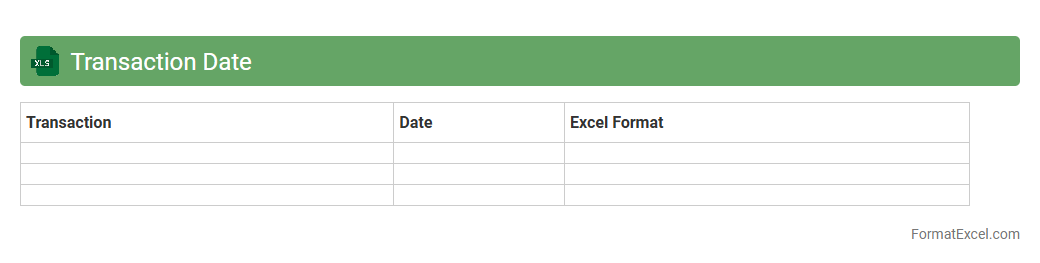

Transaction Date

The

Transaction Date in an Excel document refers to the specific date on which a financial or business transaction occurs, serving as a critical data point for tracking and analyzing activity over time. This information is essential for accounting, auditing, and financial reporting, enabling users to organize transactions chronologically and identify trends or discrepancies. By accurately recording transaction dates, businesses can improve cash flow management, reconcile accounts, and generate precise financial statements.

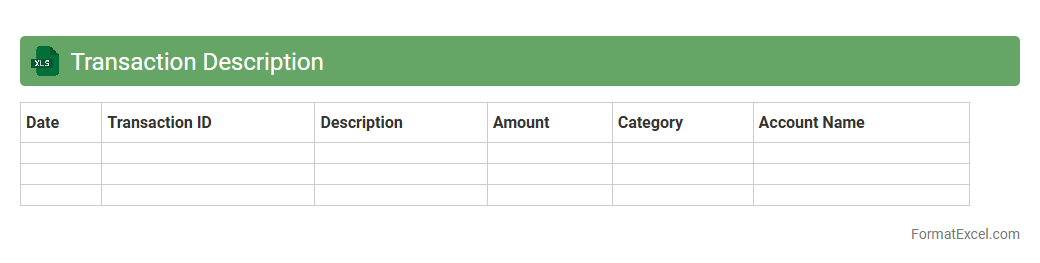

Transaction Description

A

Transaction Description Excel document serves as a detailed record of financial transactions, capturing essential data such as dates, amounts, payees, and transaction types. It is useful for tracking spending patterns, reconciling accounts, and generating financial reports for better decision-making. This organized format enhances accuracy and simplifies audit processes by providing clear and accessible transaction histories.

Deposit Amount

A

Deposit Amount Excel document is a spreadsheet used to record and track monetary deposits systematically. It helps organize financial transactions by date, amount, and source, providing clear visibility into cash flow and account balances. This tool is essential for managing budgets, reconciling accounts, and ensuring accurate financial reporting in businesses or personal finance.

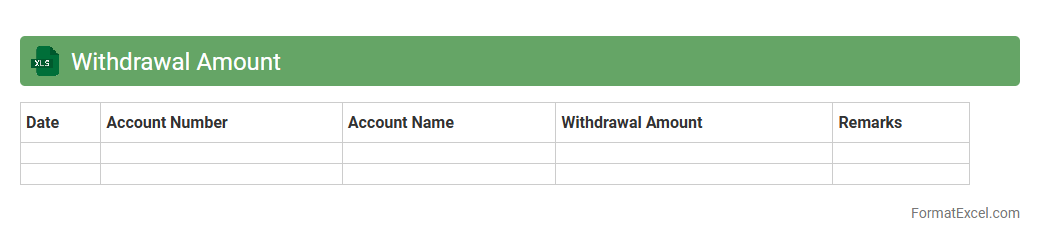

Withdrawal Amount

The

Withdrawal Amount Excel document is a financial tracking tool designed to record and manage cash withdrawals systematically. It helps users maintain accurate records of funds taken out from accounts, providing clarity on spending patterns and cash flow management. This document is essential for budgeting, auditing, and ensuring transparency in financial transactions.

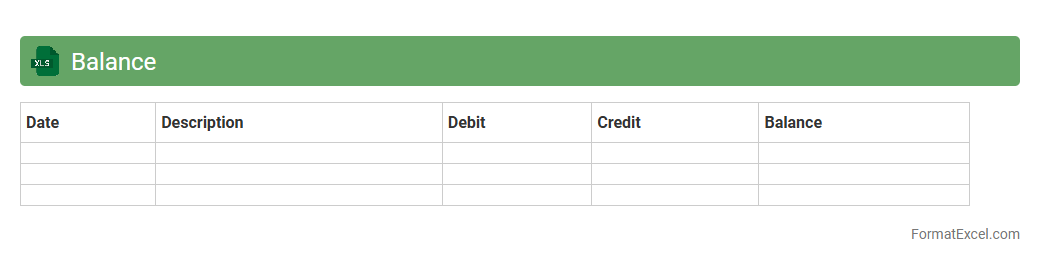

Balance

A

Balance Excel document is a financial tool used to organize and track assets, liabilities, and equity to provide a clear picture of an individual's or organization's financial standing. It helps ensure accurate budgeting, financial planning, and decision-making by presenting data systematically through formulas and tables. Using this document enhances transparency in financial management and supports strategic growth and risk assessment.

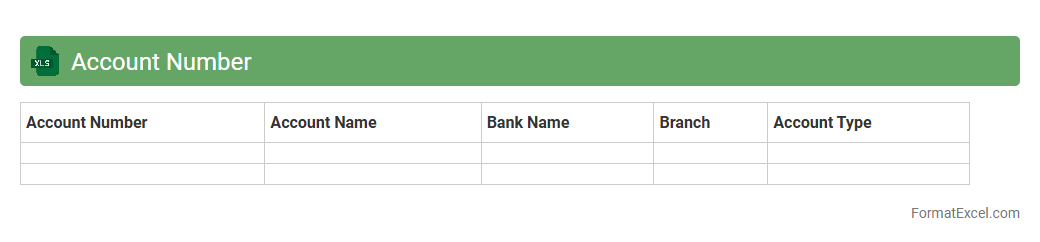

Account Number

An

Account Number Excel document is a structured spreadsheet containing unique identifiers assigned to individual accounts, often used for financial tracking, customer management, or payroll processing. This document allows for easy organization, sorting, and analysis of account-related data, enhancing accuracy and efficiency in record-keeping. It is essential for maintaining clear transactional histories and facilitating quick access to specific account information.

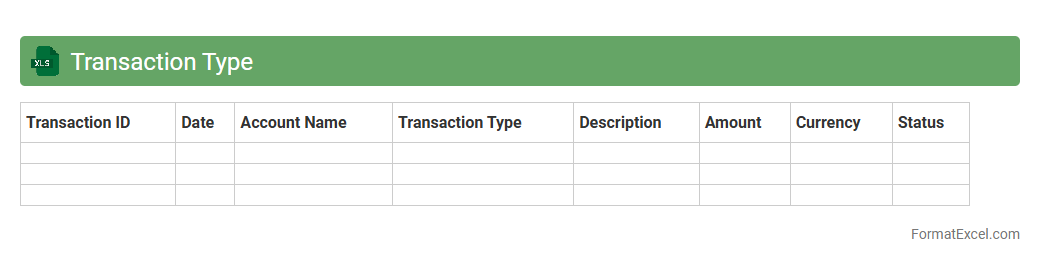

Transaction Type

A

Transaction Type Excel document organizes and categorizes various financial transactions, making it easier to track income, expenses, and transfers. This structured format improves financial analysis by allowing users to filter and sort transaction data efficiently. It helps in maintaining accurate records for budgeting, auditing, and decision-making processes.

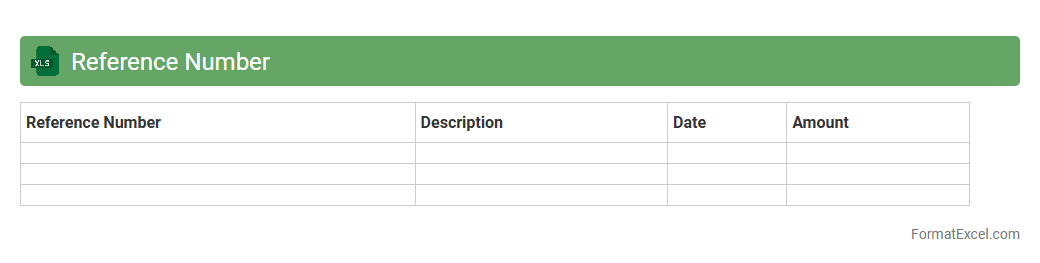

Reference Number

A

Reference Number in an Excel document is a unique identifier assigned to each record or entry, enabling efficient tracking and retrieval of data. It streamlines data management by preventing duplication and facilitating quick searches, especially in large datasets or complex spreadsheets. Using reference numbers enhances accuracy in reporting and auditing processes by linking related information across different sheets or systems.

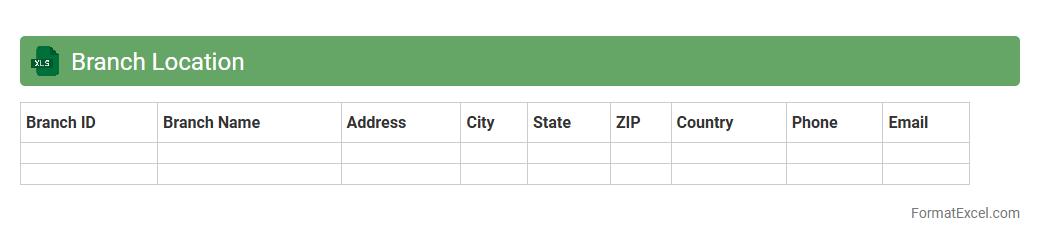

Branch Location

A

Branch Location Excel document organizes detailed information about various company branches, including addresses, contact numbers, and operational hours. It streamlines data management and facilitates quick access for decision-making, logistics, and customer service. This tool enhances efficiency by enabling easy updates, comparisons, and reporting of branch-related information across multiple locations.

Payee/Payer Name

A

Payee/Payer Name Excel document is a structured spreadsheet that records the names of individuals or entities involved in financial transactions, categorized as payees (receivers) or payers (senders). This tool facilitates accurate tracking of payments, streamlining accounting processes and enhancing financial transparency. It is especially useful for businesses and organizations to maintain clear records for auditing, budgeting, and ensuring timely payments.

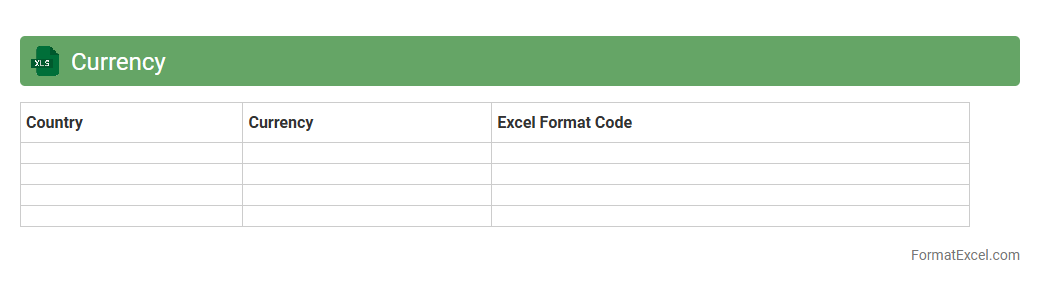

Currency

A

Currency Excel document is a spreadsheet designed to track, analyze, and convert different currencies efficiently using built-in formulas and real-time exchange rate data. It streamlines financial calculations by automating currency conversion and enabling budget management, expense tracking, and investment analysis in multiple currencies. This tool is essential for businesses, travelers, and financial analysts who deal with international transactions or monitor currency fluctuations.

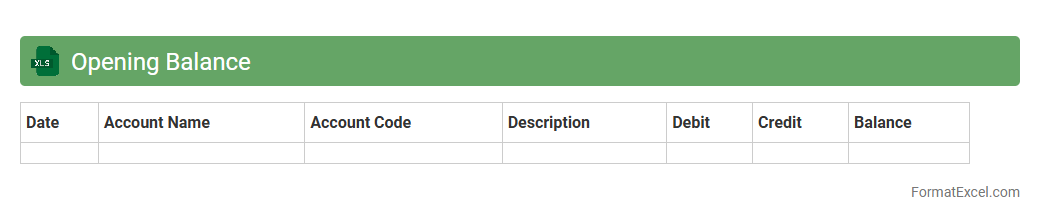

Opening Balance

An

Opening Balance Excel document records the initial financial amounts carried forward at the start of an accounting period, capturing assets, liabilities, and equity balances. It serves as a foundational reference for maintaining accurate financial records, ensuring consistency and accuracy in bookkeeping, and facilitating seamless reconciliation in accounting processes. This document is essential for businesses to track their financial position and helps in forecasting cash flow and budgeting effectively.

Closing Balance

A

Closing Balance Excel document records the final amount in accounts, cash, or inventory at the end of a specific period, helping track financial performance and resource status. It provides precise data for reconciling accounts, preparing financial statements, and making informed budgeting decisions. This document enhances accuracy in financial management by consolidating daily transactions into a clear, summarized balance.

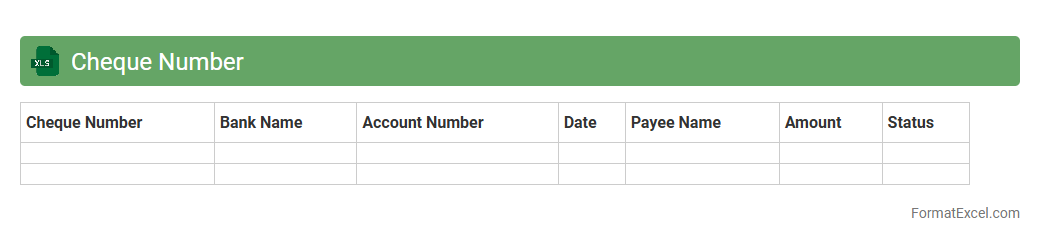

Cheque Number

A

Cheque Number Excel document is a spreadsheet designed to record and track cheque numbers along with associated transaction details, ensuring accurate financial management and reconciliation. It helps prevent errors, monitor payments, and maintain organized records for auditing and budgeting purposes. Using such a document enhances transparency and accountability in managing cheque-based transactions.

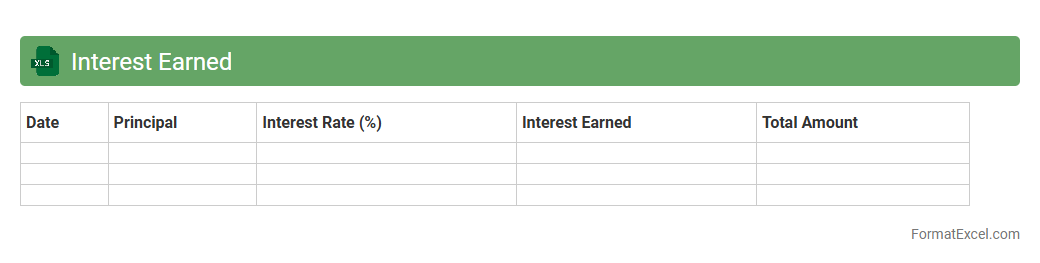

Interest Earned

An

Interest Earned Excel document is a financial tool designed to track and calculate the interest income generated from various investments or savings accounts over time. It helps users monitor their earnings, compare interest rates, and forecast future gains based on different principal amounts and interest rates. This document is essential for budgeting, financial planning, and making informed decisions about where to allocate funds for maximum return.

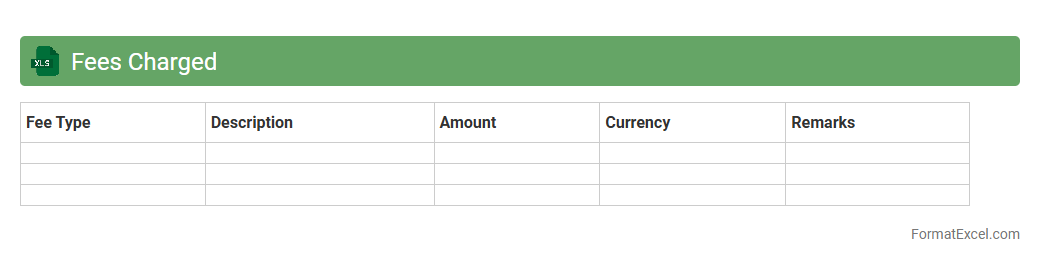

Fees Charged

The

Fees Charged Excel document is a structured spreadsheet designed to track and manage various fees associated with transactions, services, or products. It helps businesses and individuals monitor fee breakdowns, calculate totals, and analyze cost patterns efficiently. Using this document enhances financial transparency, simplifies accounting processes, and supports accurate budgeting decisions.

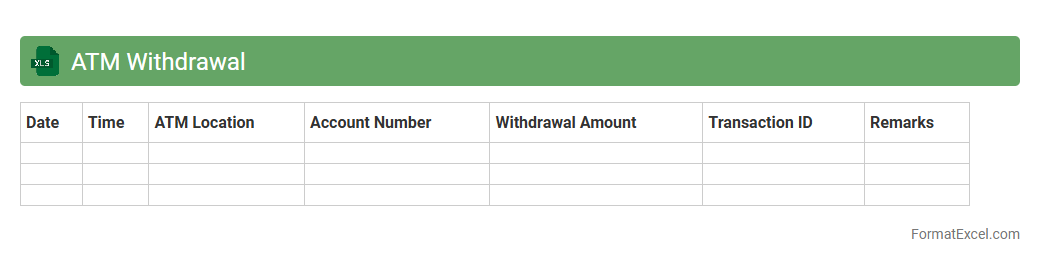

ATM Withdrawal

An

ATM Withdrawal Excel document is a digital spreadsheet designed to record and track cash withdrawals made from automated teller machines. It helps users monitor their spending patterns, maintain accurate financial records, and manage their budget effectively by providing clear insights into ATM usage. This tool is essential for avoiding overspending and ensuring better control over personal or business cash flow.

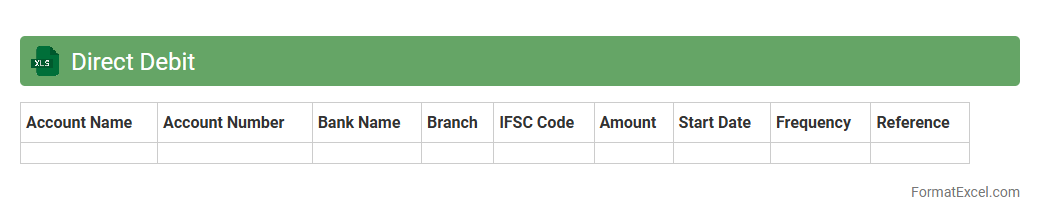

Direct Debit

A

Direct Debit Excel document is a structured spreadsheet used to organize and manage direct debit transactions, allowing businesses to efficiently record payment instructions from customers. It streamlines the process of tracking payment dates, amounts, and bank details, reducing errors and improving cash flow management. This tool enhances financial accuracy and saves time by automating data entry for recurring payments.

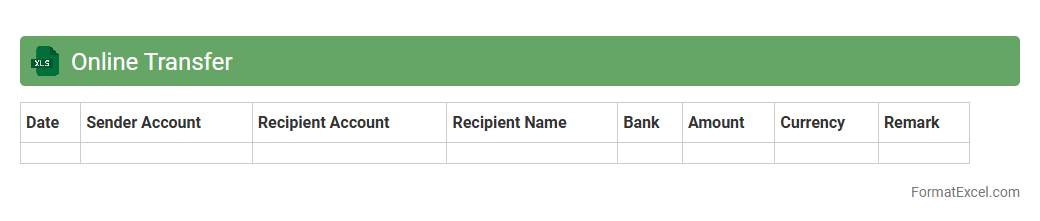

Online Transfer

An

Online Transfer Excel document is a digital spreadsheet designed to facilitate the seamless transfer of data between systems or users via internet platforms. It streamlines the process of managing financial transactions, inventory updates, or data sharing by organizing critical information in a structured and accessible format. This tool enhances efficiency, accuracy, and collaboration, reducing errors commonly associated with manual data entry and enabling real-time updates.

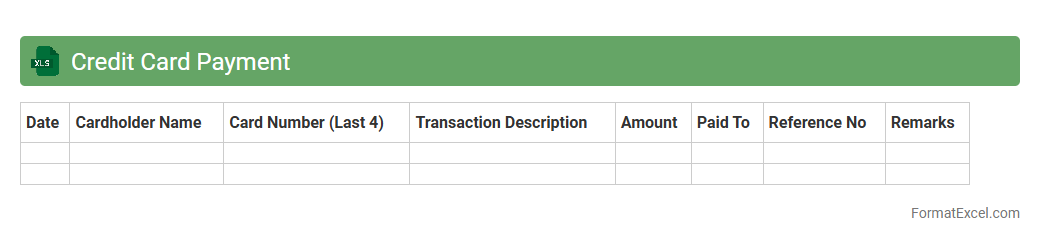

Credit Card Payment

A

Credit Card Payment Excel document is a spreadsheet tool designed to track, organize, and manage credit card transactions and payments efficiently. It helps users monitor outstanding balances, due dates, and payment history, reducing the risk of missed payments and late fees. This document enhances financial planning by providing a clear overview of credit card expenses and facilitates budgeting efforts.

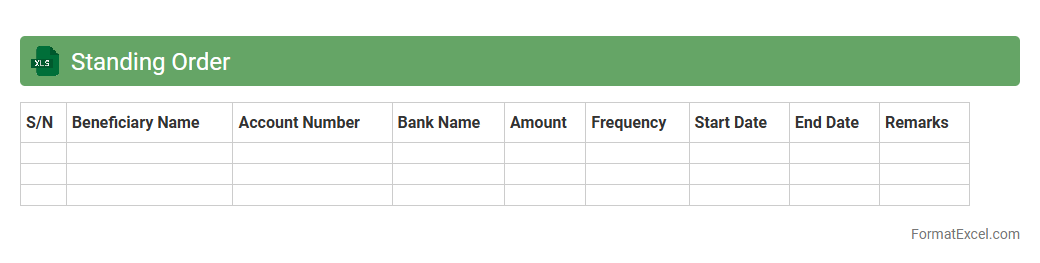

Standing Order

A

Standing Order Excel document is a structured spreadsheet used to automate and record recurring payment instructions, ensuring consistent financial transactions without repeated manual input. It helps businesses and individuals manage cash flow effectively, reducing errors and saving time by maintaining accurate and up-to-date payment schedules. This tool streamlines financial processes, enhances transparency, and supports compliance by providing a clear audit trail for all standing orders.

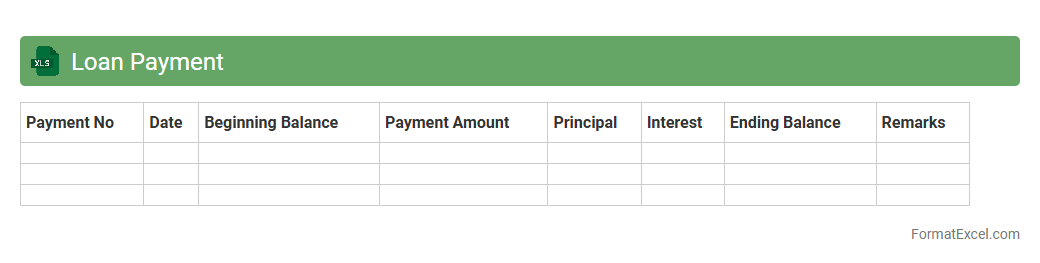

Loan Payment

A

Loan Payment Excel document is a spreadsheet tool designed to calculate and track loan repayments, including interest, principal, and remaining balance over time. It helps users visualize payment schedules, manage budgets effectively, and plan for loan payoff by providing clear amortization details. Utilizing this document reduces errors in manual calculations and ensures better financial decision-making.

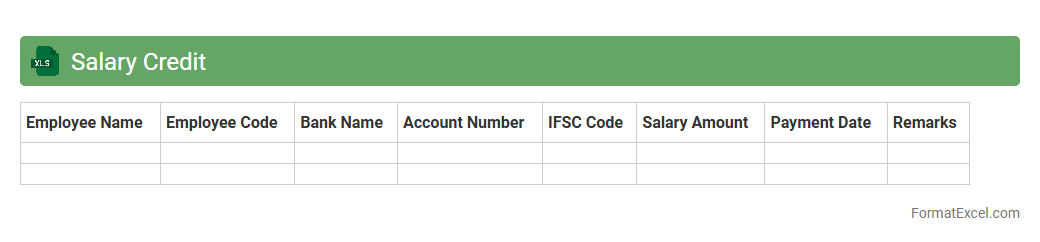

Salary Credit

A

Salary Credit Excel document is a structured spreadsheet that records employee salary payments, including components like basic pay, allowances, deductions, and net salary. It helps organizations maintain accurate payroll data, streamline salary processing, and generate financial reports efficiently. Using this document ensures transparency, eases audit processes, and supports timely salary disbursements.

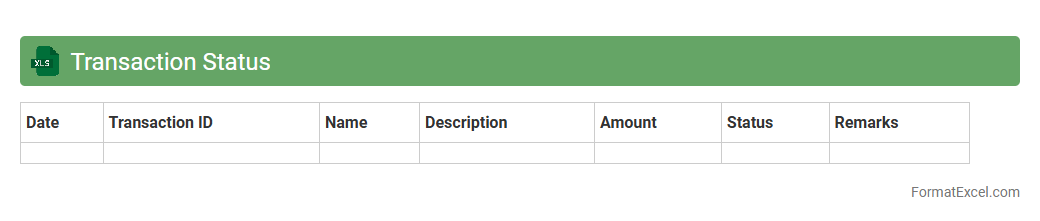

Transaction Status

The

Transaction Status Excel document is a structured spreadsheet that tracks and records the progress of financial or operational transactions in real time. It allows businesses to monitor payment confirmations, pending approvals, and completed deals efficiently, reducing errors and delays. This tool enhances transparency, improves workflow management, and provides quick access to transaction details for informed decision-making.

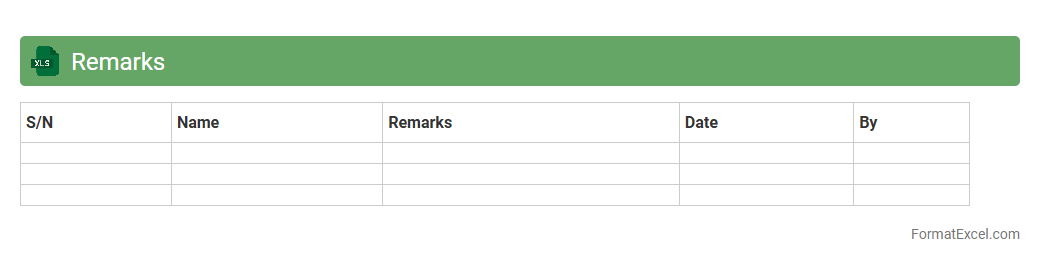

Remarks

Remarks Excel document is a

digital spreadsheet tool used for organizing, analyzing, and storing data efficiently. It enables users to add comments, notes, or annotations directly within cells, improving collaboration and clarity during data review processes. This feature is especially useful for tracking changes, providing feedback, and enhancing communication in team projects or data reporting.

Introduction to Bank Statement Formats

A bank statement format organizes financial transactions systematically for easy review and reconciliation. It typically includes details such as dates, descriptions, debit/credit amounts, and balances. Using a structured format ensures clarity and accuracy in financial record-keeping.

Benefits of Using Excel for Bank Statements

Excel offers flexibility and powerful tools to create and manage bank statements efficiently. Users can customize layouts, apply formulas, and automate calculations, saving time and reducing errors. It also allows easy data manipulation and visualization for better financial analysis.

Essential Components of a Bank Statement

Key components of a bank statement include the account holder's details, transaction dates, descriptions, transaction amounts (debit/credit), and running balances. The balance column helps track the account status after each transaction. Accurate component inclusion is vital for financial accuracy and auditing.

Step-by-Step Guide to Creating a Bank Statement in Excel

Start by setting up columns for date, description, debit, credit, and balance. Enter sample transactions, then use Excel formulas to calculate the running balance automatically. This step-by-step approach ensures an accurate and professional bank statement layout.

Sample Bank Statement Layout in Excel

A basic bank statement includes headers such as Date, Description, Debit, Credit, and Balance arranged in rows and columns. Excel's grid structure supports easy insertion of data and formulas for dynamic updating. Using this sample layout helps organize financial data clearly and efficiently.

Customization Tips for Excel Bank Statements

Use cell formatting, conditional formatting, and filters to enhance readability and highlight important transactions. You can also insert charts and graphs to visualize account activity for better insights. Customizing your Excel bank statement improves usability and financial tracking.

Common Formulas Used in Bank Statement Templates

Key formulas include SUM for totaling transactions and IF statements for conditional formatting. The running balance can be calculated using a formula to add credits and subtract debits sequentially. Mastering these formulas ensures an accurate and automated bank statement.

Ensuring Security and Privacy in Excel Bank Statements

Protect sensitive information by using password protection and cell lock features available in Excel. Avoid sharing raw data and always keep backups to maintain privacy and security. Proper security practices prevent unauthorized access to financial information.

Downloadable Excel Bank Statement Templates

Many websites offer free and premium bank statement templates compatible with Excel to accelerate your setup process. These templates come with predefined layouts and formulas for instant use. Downloading ensures you have a professional starting point for your financial tracking.

Frequently Asked Questions on Excel Bank Statement Formats

Common questions include how to automate calculations, customize layouts, and ensure data security in Excel bank statements. Understanding best practices helps users create accurate and secure statements. FAQs provide quick solutions to frequent challenges encountered during setup.