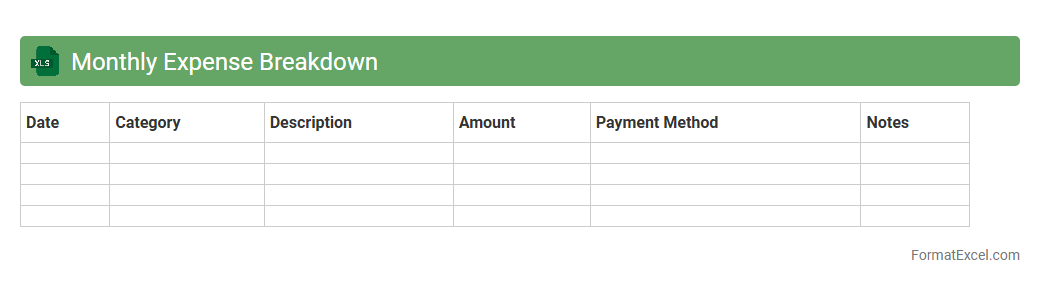

Monthly Expense Breakdown

A

Monthly Expense Breakdown Excel document organizes all your monthly expenditures into categories such as rent, utilities, groceries, and entertainment, providing clear visibility of spending patterns. It helps track and analyze where your money goes, enabling better budget management and financial decision-making. By identifying key spending areas, it supports cost-saving strategies and promotes effective financial planning.

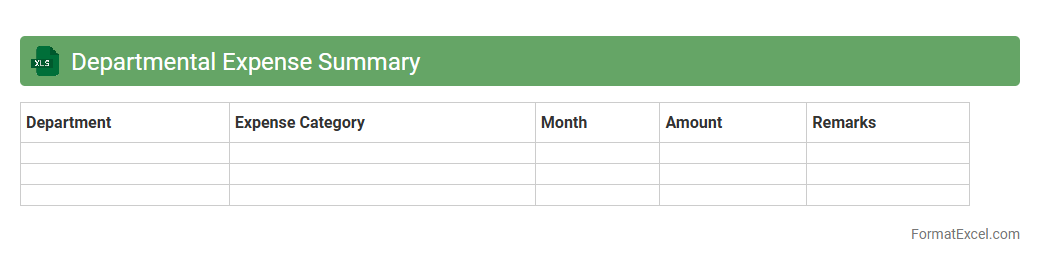

Departmental Expense Summary

The

Departmental Expense Summary Excel document consolidates all expenses within each department, providing a clear overview of spending patterns and budget adherence. It helps organizations monitor financial performance, identify cost-saving opportunities, and ensure accurate allocation of resources. This tool enhances decision-making by offering detailed insights into departmental expenditures in a structured, easily accessible format.

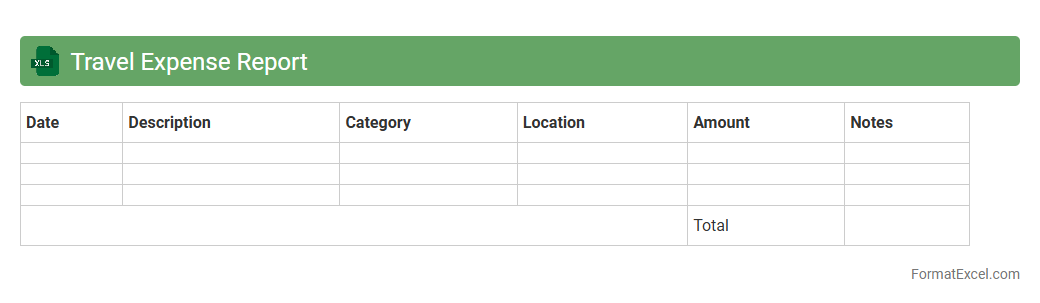

Travel Expense Report

A

Travel Expense Report Excel document is a structured spreadsheet used to record, organize, and analyze travel-related expenses such as transportation, accommodation, meals, and incidentals. This tool helps individuals and businesses track spending accurately, ensuring adherence to budgets and simplifying reimbursement processes. Utilizing such a document enhances financial transparency, streamlines expense management, and supports effective cost control during business travel.

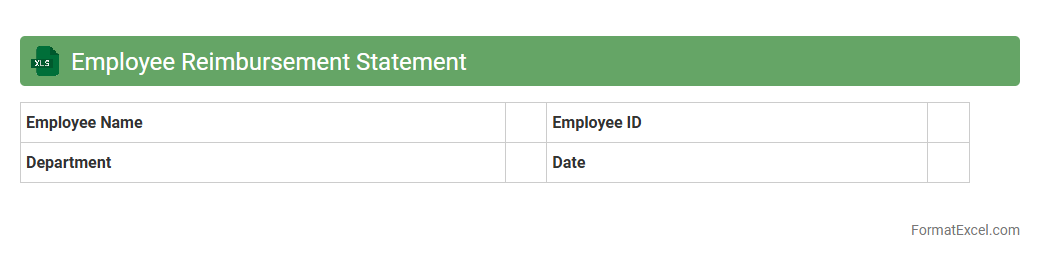

Employee Reimbursement Statement

An

Employee Reimbursement Statement Excel document is a structured template that tracks and records expenses employees incur on behalf of the company, facilitating transparent financial management. This document helps ensure accurate and timely reimbursement by itemizing costs, dates, and related project information, which supports efficient accounting and auditing processes. Utilizing this statement improves budget control and simplifies expense reconciliation between employees and finance departments.

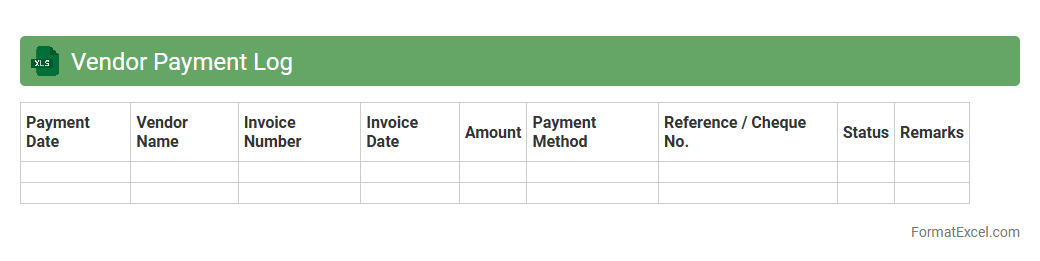

Vendor Payment Log

The

Vendor Payment Log Excel document is a detailed record that tracks all transactions made to suppliers, including payment dates, amounts, and invoice numbers. It enhances financial transparency and simplifies expense management by providing an organized overview of vendor payments. This tool is essential for maintaining accurate accounting records and facilitating timely audits or dispute resolution.

Utility Expense Tracker

A

Utility Expense Tracker Excel document is a structured spreadsheet designed to record, monitor, and analyze monthly utility bills such as electricity, water, gas, and internet expenses. It provides a clear overview of spending patterns, helping users identify areas for cost savings and budget more effectively. By maintaining accurate utility expense records, individuals and businesses can optimize resource allocation and reduce unnecessary financial burdens.

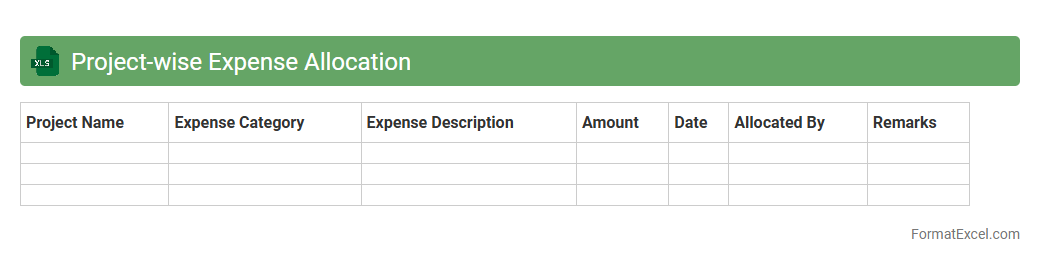

Project-wise Expense Allocation

The

Project-wise Expense Allocation Excel document is a tool designed to track and categorize expenses across multiple projects effectively. It enables precise budgeting, cost control, and financial analysis by allocating expenses to specific projects, enhancing transparency and accountability. This document helps organizations optimize resource utilization and ensures accurate financial reporting for better project management.

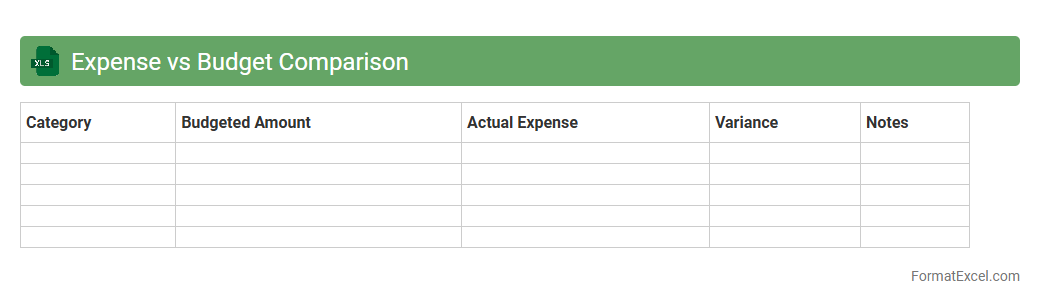

Expense vs Budget Comparison

An

Expense vs Budget Comparison Excel document is a financial tool that tracks actual spending against planned budget allocations to highlight variances. It allows individuals and businesses to monitor financial performance, control overspending, identify cost-saving opportunities, and improve future budget planning. Using this comparison enhances financial discipline and supports informed decision-making by providing clear insights into where funds are being utilized effectively or need adjustment.

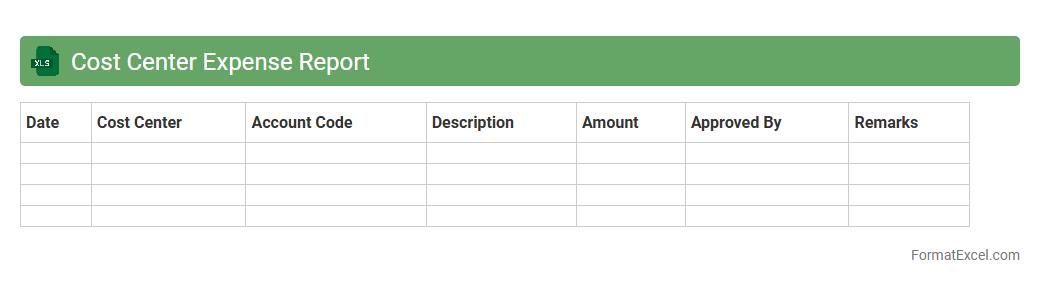

Cost Center Expense Report

The

Cost Center Expense Report excel document tracks and organizes expenses incurred by specific departments or cost centers within an organization. It enables detailed cost analysis, budget monitoring, and financial accountability by providing accurate expense data categorized by department. This report aids managers in making informed decisions to control spending and optimize resource allocation.

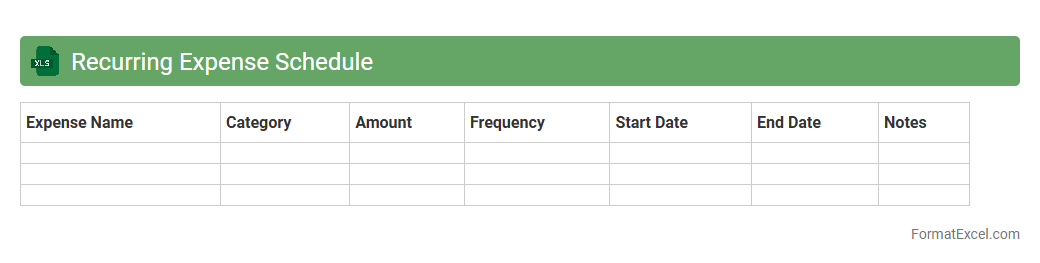

Recurring Expense Schedule

A

Recurring Expense Schedule Excel document is a spreadsheet designed to track and manage recurring payments such as rent, subscriptions, and utility bills. It helps users maintain a clear overview of upcoming expenses, ensuring timely payments and improved budgeting accuracy. By organizing recurring costs, this tool supports better financial planning and cash flow management.

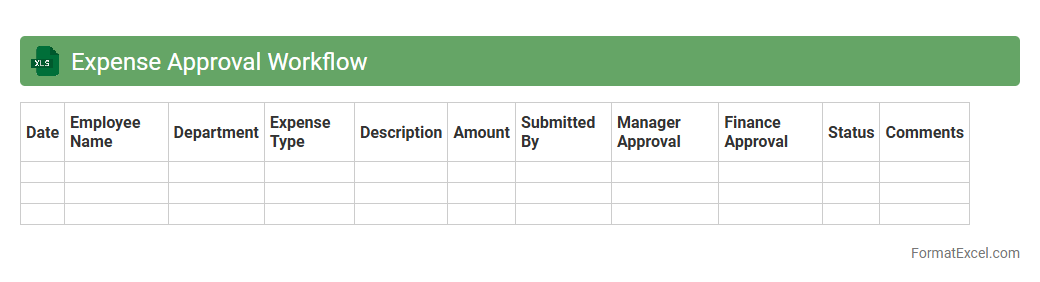

Expense Approval Workflow

An

Expense Approval Workflow Excel document streamlines the process of managing and authorizing business expenses by providing a clear, organized framework for submitting, reviewing, and approving costs. It helps reduce errors, ensures compliance with company policies, and accelerates financial operations by tracking expense statuses and approvals in real time. This tool increases transparency and accountability, making it easier for finance teams to monitor budgets and control expenditures effectively.

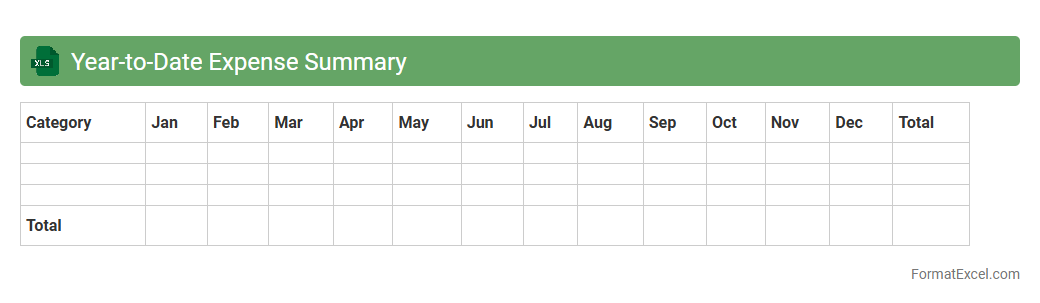

Year-to-Date Expense Summary

A

Year-to-Date Expense Summary Excel document consolidates all financial expenditures from the beginning of the fiscal year to the current date, providing a clear overview of spending patterns and budget adherence. It enables businesses and individuals to track expenses across various categories, identify cost-saving opportunities, and make informed financial decisions. This summary enhances financial transparency and aids in accurate forecasting and budgeting throughout the year.

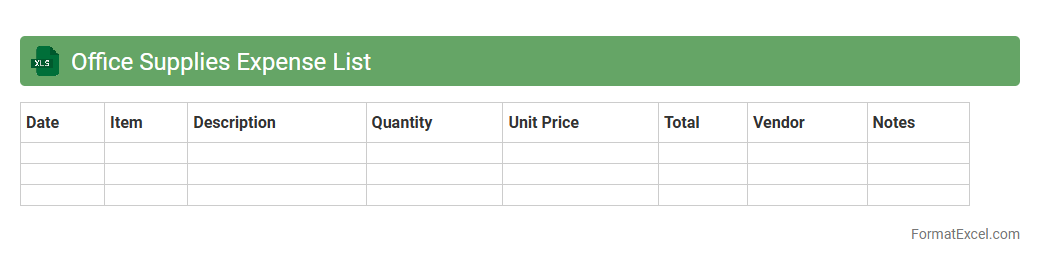

Office Supplies Expense List

An

Office Supplies Expense List Excel document is a detailed record that tracks the purchasing and usage costs of office materials such as paper, pens, printer ink, and other consumables. It helps businesses manage budgets effectively by providing clear insights into spending patterns and identifying opportunities for cost savings. This tool enhances financial organization and streamlines expense reporting for accounting and operational efficiency.

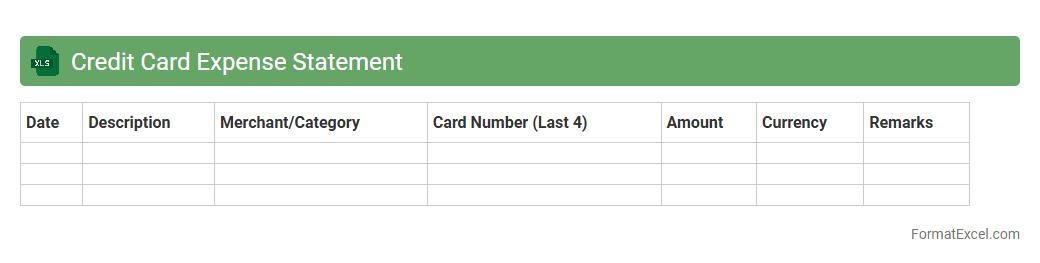

Credit Card Expense Statement

A

Credit Card Expense Statement Excel document is a detailed financial record that tracks all credit card transactions, including purchases, payments, and fees, organized in a systematic and easily accessible format. It helps individuals and businesses monitor spending patterns, verify charges, reconcile accounts, and ensure accurate budgeting. This tool enhances financial management by providing clear visibility into credit card usage and aiding in timely payment and expense control.

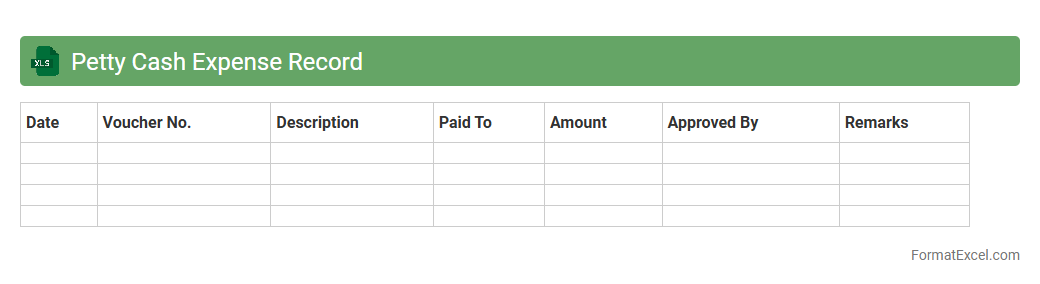

Petty Cash Expense Record

A

Petty Cash Expense Record Excel document is a financial tool used to track small, everyday business expenditures that are paid out of the petty cash fund. It helps maintain accurate records of cash disbursements, ensuring transparent management and accountability of minor expenses. This document is useful for budgeting, auditing, and reducing errors by providing a clear, organized overview of all petty cash transactions.

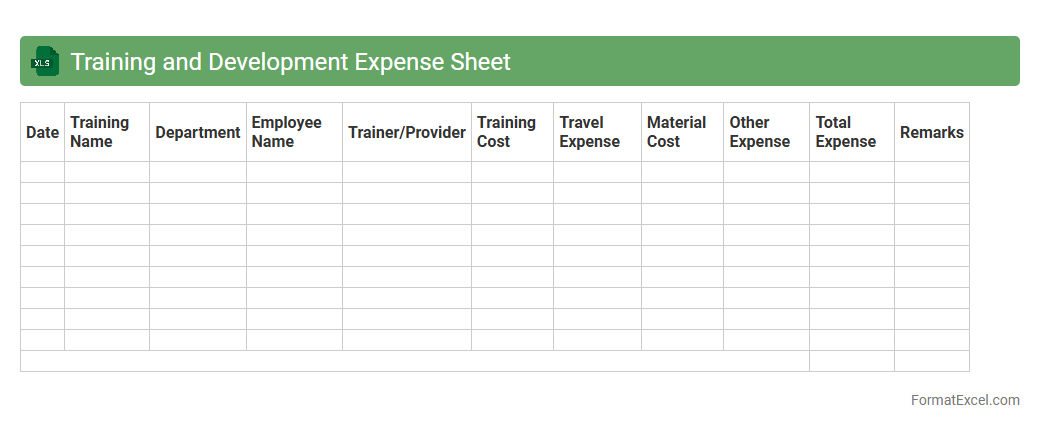

Training and Development Expense Sheet

A

Training and Development Expense Sheet in Excel is a detailed document that tracks all costs related to employee learning initiatives, including course fees, materials, travel, and instructor salaries. It helps organizations monitor their investment in workforce skill enhancement, ensuring budget adherence and facilitating cost analysis. By maintaining this sheet, companies can make informed decisions on future training programs, optimizing resource allocation and improving overall employee development strategies.

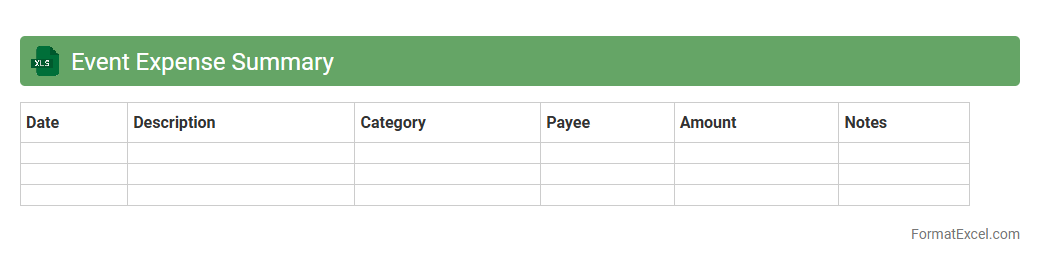

Event Expense Summary

An

Event Expense Summary Excel document consolidates all costs related to an event into a clear and organized format, enabling precise tracking of expenses such as venue, catering, and equipment. This summary helps in budgeting effectively by identifying overspending areas and ensuring all financial aspects are accounted for. Using this tool enhances financial transparency and supports informed decision-making for future event planning.

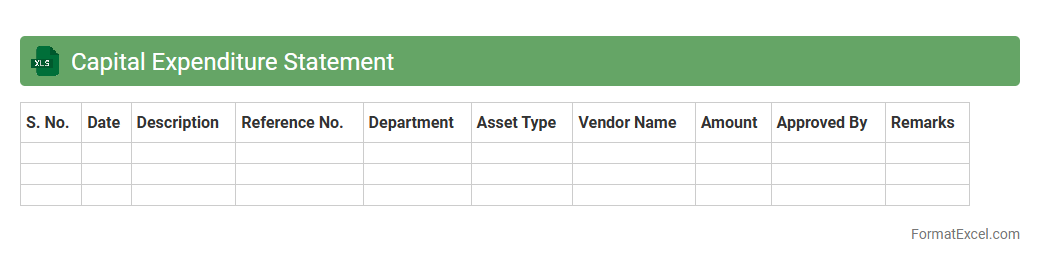

Capital Expenditure Statement

The

Capital Expenditure Statement Excel document is a financial tool used to track and manage investments in long-term assets such as property, equipment, and infrastructure. It provides a detailed record of planned and actual capital spending, helping businesses monitor budget adherence and make informed decisions on asset allocation. By offering clear visibility into expenditure patterns, the statement aids in strategic planning and optimizing cash flow management.

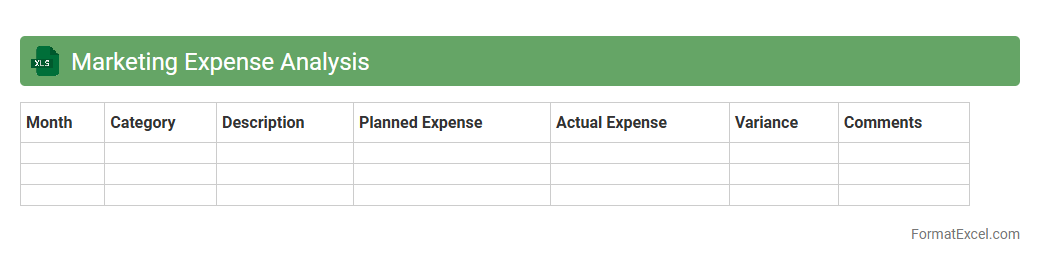

Marketing Expense Analysis

A

Marketing Expense Analysis Excel document systematically tracks and categorizes all marketing costs, enabling businesses to monitor spending patterns and ROI effectively. It provides detailed insights into budget allocation across campaigns, channels, and timelines, facilitating data-driven decisions for optimizing marketing strategies. By identifying high-performing activities and cost inefficiencies, this tool enhances financial control and improves overall marketing performance.

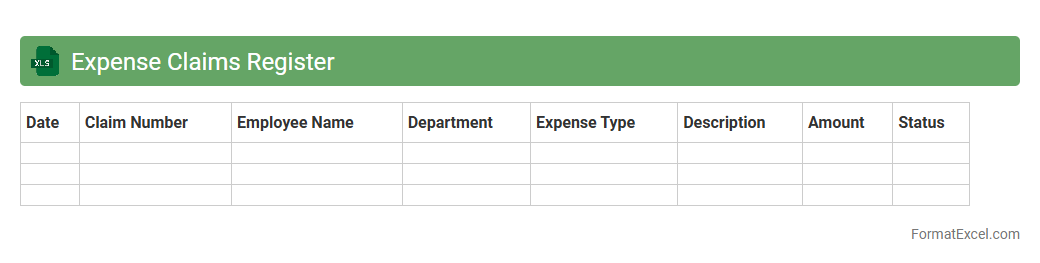

Expense Claims Register

An

Expense Claims Register Excel document is a structured spreadsheet used to record, track, and manage employee expense reimbursements efficiently. It provides a detailed log of individual claims, dates, amounts, approval statuses, and payment records, enabling organizations to maintain accurate financial accountability. Using this register simplifies audit processes, reduces errors, and ensures timely processing of expense claims for better financial control.

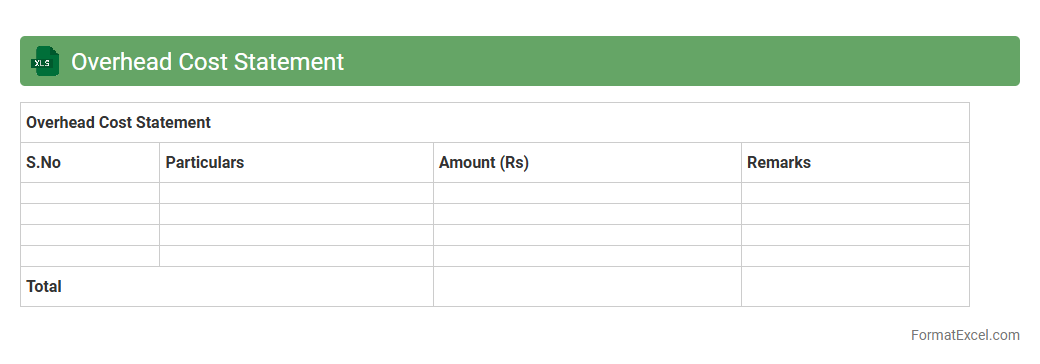

Overhead Cost Statement

An

Overhead Cost Statement Excel document is a financial tool used to track and analyze indirect expenses incurred during business operations. It helps in categorizing costs such as utilities, rent, and administrative salaries, enabling accurate allocation of overheads to various departments or projects. This statement is essential for budgeting, cost control, and improving overall financial planning and decision-making.

Maintenance Expense Tracker

A

Maintenance Expense Tracker Excel document is a tool designed to record, categorize, and monitor all costs associated with the upkeep and repair of equipment, vehicles, or property. It enables users to identify spending patterns, forecast future maintenance budgets, and improve cost management efficiency. By maintaining organized and up-to-date expense data, businesses and individuals can make informed decisions to reduce unnecessary expenditures and extend asset lifespans.

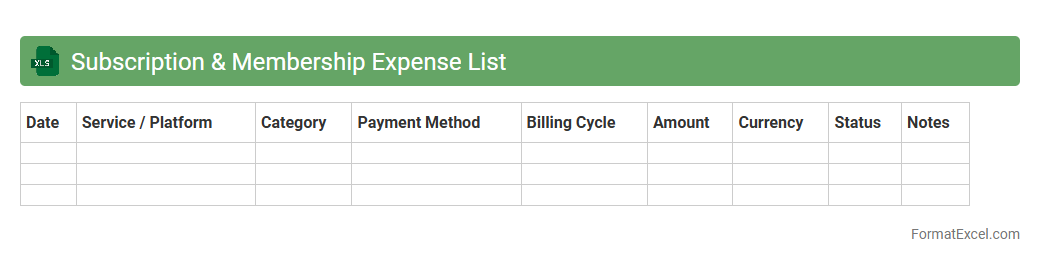

Subscription & Membership Expense List

The

Subscription & Membership Expense List Excel document is a detailed spreadsheet designed to track and manage recurring costs related to various subscriptions and memberships. It helps users organize payments, monitor due dates, and analyze spending patterns to maintain budget control. By providing a clear overview of ongoing financial commitments, this tool supports efficient financial planning and prevents unexpected charges.

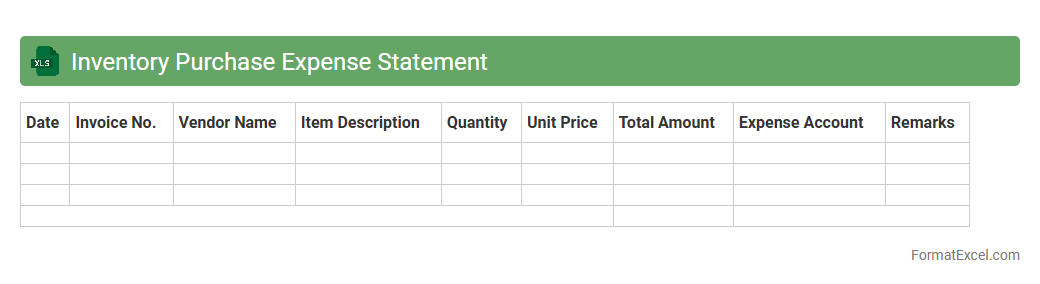

Inventory Purchase Expense Statement

An

Inventory Purchase Expense Statement Excel document is a detailed financial record that tracks all costs associated with purchasing inventory, including item costs, taxes, shipping fees, and supplier discounts. This document helps businesses monitor and manage their inventory expenditure efficiently, enabling accurate budgeting and cost control. By providing a clear overview of purchase expenses, it supports informed decision-making and enhances financial transparency in inventory management.

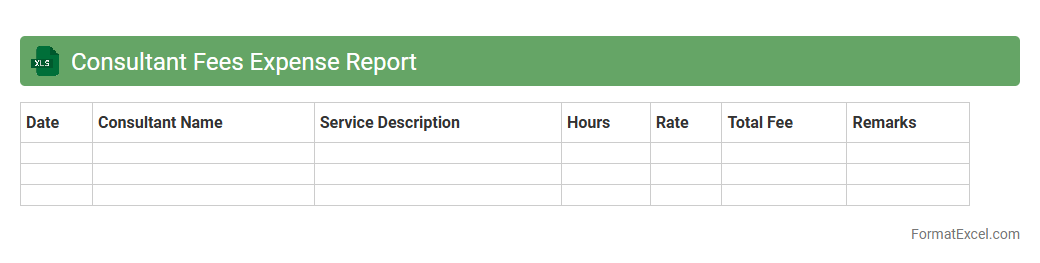

Consultant Fees Expense Report

A

Consultant Fees Expense Report excel document is a structured spreadsheet designed to track and organize payments made to consultants for their services. It helps businesses maintain accurate financial records, monitor budget adherence, and facilitate timely reimbursements or audits. Using this report enhances transparency and simplifies the process of managing consultant-related expenses efficiently.

Introduction to Expense Statement Formats

An expense statement format organizes financial expenditure details for clarity and analysis. It helps individuals and businesses monitor spending effectively. Using a standardized format ensures consistency in recording costs.

Importance of Using Excel for Expense Statements

Microsoft Excel offers powerful tools for creating detailed expense statements. It facilitates data entry, calculations, and visualization with ease. Excel templates save time and reduce errors in financial tracking.

Key Components of an Expense Statement

A comprehensive expense statement includes date, description, category, amount, and payment method. These elements provide a complete overview of each transaction. Accurate components enable transparent financial reporting.

Step-by-Step Guide to Creating an Expense Statement in Excel

Start by setting up columns for essential expense details, then input data systematically. Use Excel formulas to calculate totals and subtotals automatically. Customize your sheet with filters and conditional formatting for better clarity.

Essential Columns for an Expense Statement Template

Key columns include Date, Expense Description, Category, Amount, Payment Mode, and Notes. These fields cover all necessary information for expense tracking. Having a structured template improves data consistency.

Customizing Expense Statement Layouts in Excel

Adapt your expense statement by changing fonts, colors, and column widths to match your branding or preferences. Use Excel's table features for dynamic sorting and filtering. Custom layouts enhance readability and user experience.

Tips for Ensuring Accuracy in Your Expense Statement

Double-check all entries and use Excel's data validation to limit incorrect inputs. Regularly reconcile statement totals with receipts to maintain accuracy. Consistent auditing prevents costly financial mistakes.

Downloadable Excel Expense Statement Templates

Many websites offer free or paid Excel expense statement templates for quick adoption. Choose templates that suit your reporting needs and customize them as necessary. Templates streamline the expense management process.

Common Mistakes to Avoid in Expense Statements

Avoid omitting receipts, mixing personal with business expenses, and incorrect data entry. Ensure each expense is properly categorized for accurate financial analysis. Preventing these errors maintains reliable expense reporting.

Finalizing and Sharing Your Excel Expense Statement

Review all data for completeness and protect your Excel file with passwords if needed. Export your expense statement as PDF or share via email for easy distribution. Proper sharing ensures stakeholders stay informed about expenses.