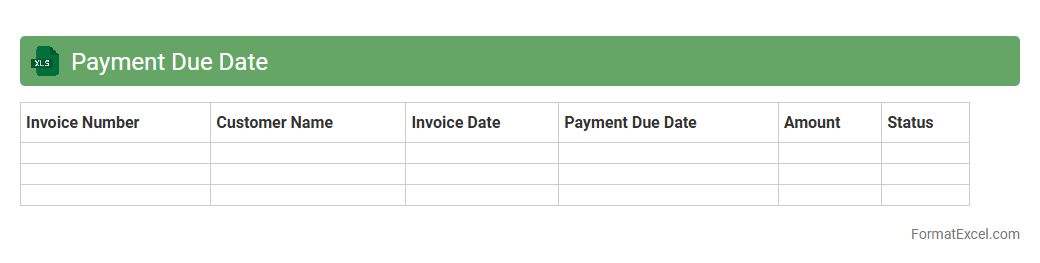

Payment Due Date

A

Payment Due Date Excel document is a spreadsheet designed to track invoice deadlines and manage payment schedules efficiently. It helps businesses and individuals avoid late fees by providing clear visibility of upcoming payments, ensuring timely settlements. This tool enhances financial organization by allowing users to sort, filter, and update payment information in one centralized location.

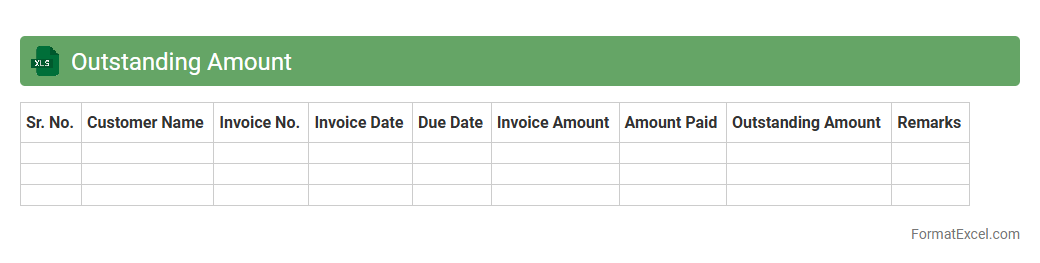

Outstanding Amount

An

Outstanding Amount Excel document is a spreadsheet that tracks pending payments or balances owed by clients, customers, or vendors. It helps businesses monitor financial liabilities, manage cash flow efficiently, and prioritize collections to maintain healthy accounts receivable or payable. By organizing outstanding amounts, this document improves accuracy in financial reporting and supports timely decision-making.

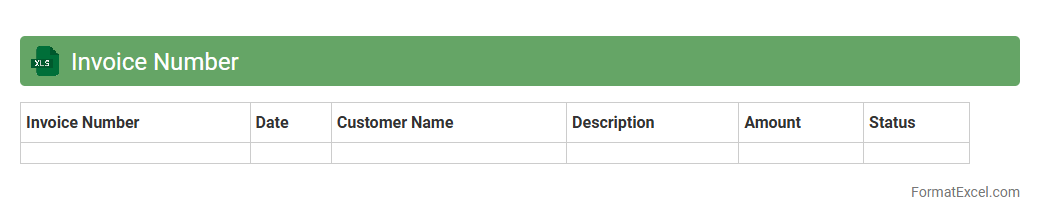

Invoice Number

An

Invoice Number Excel document is a spreadsheet designed to systematically record and manage invoice numbers along with associated transaction details such as dates, amounts, and client information. This tool enhances financial organization by enabling easy tracking, sorting, and referencing of invoices, which streamlines accounting processes and improves accuracy in billing. Utilizing such a document reduces errors and ensures compliance with auditing standards, making it essential for efficient business financial management.

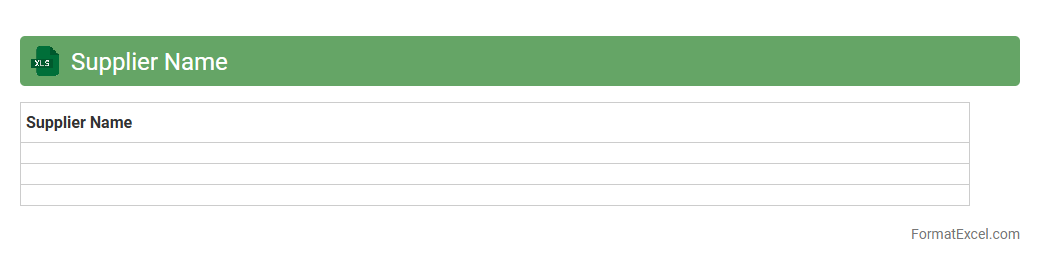

Supplier Name

A

Supplier Name Excel document is a structured spreadsheet that organizes and lists suppliers' names along with relevant details such as contact information, product categories, and transaction history. This document enhances procurement efficiency by providing quick access to reliable supplier data, facilitating better vendor management and streamlined communication. It helps businesses track supplier performance, compare pricing, and ensure compliance with procurement standards.

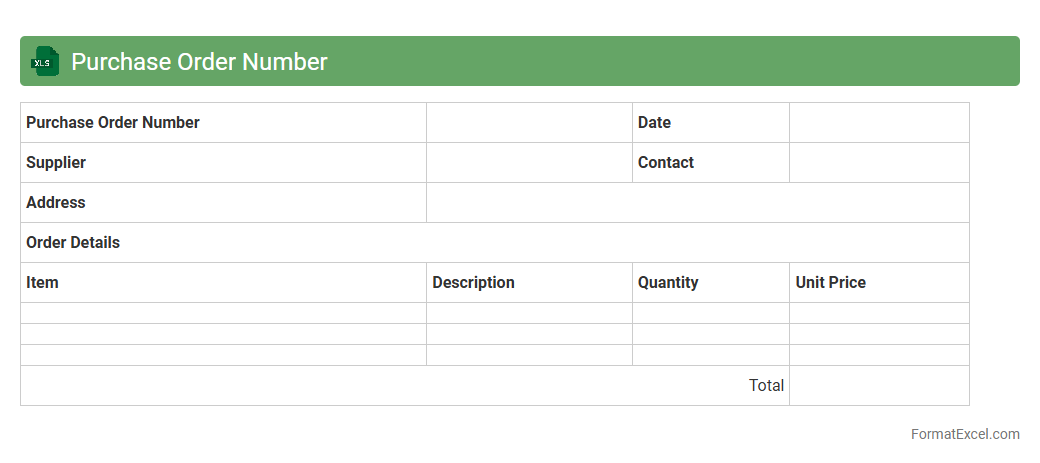

Purchase Order Number

A

Purchase Order Number Excel document is a structured spreadsheet designed to track and manage purchase order numbers efficiently. It helps businesses organize procurement data, monitor order statuses, and streamline invoice matching, reducing errors and speeding up processing times. This tool improves financial control and enhances communication between purchasing and accounting departments.

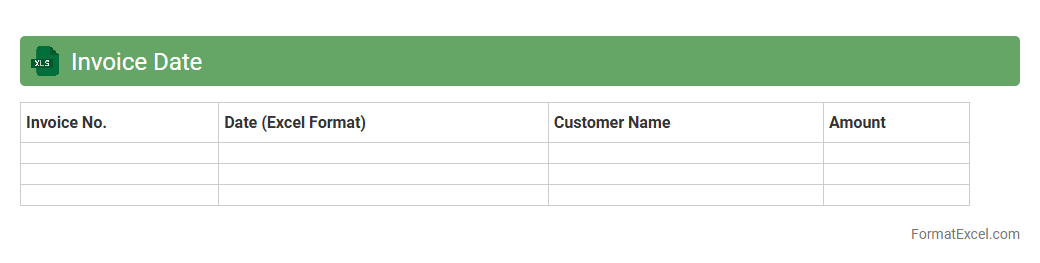

Invoice Date

The

Invoice Date in an Excel document refers to the specific date when an invoice is issued or generated, serving as a critical data point for tracking financial transactions. This information helps businesses monitor payment deadlines, manage cash flow efficiently, and maintain accurate accounting records. By organizing invoice dates in Excel, users can easily sort, filter, and analyze billing information to improve financial planning and compliance.

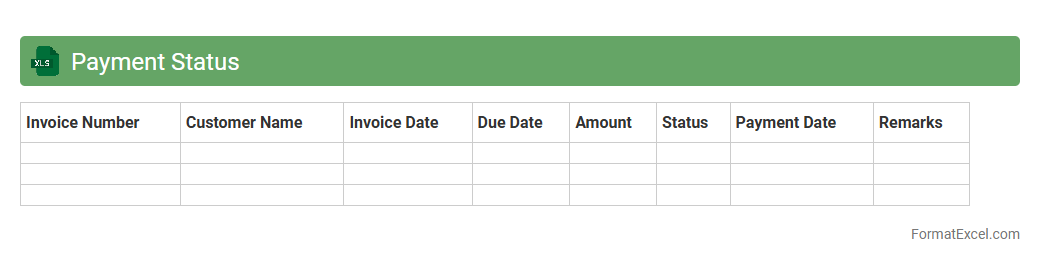

Payment Status

A

Payment Status Excel document is a structured spreadsheet that tracks and monitors the payment details of invoices, bills, or transactions for individuals or businesses. It provides real-time visibility into pending, completed, or overdue payments, enabling efficient cash flow management and financial planning. Using this document helps reduce errors, ensures timely follow-ups, and improves overall financial accountability.

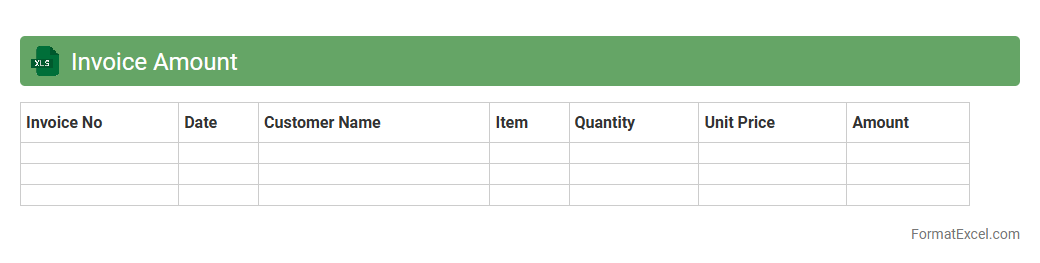

Invoice Amount

An

Invoice Amount Excel document records and calculates the total payable for goods or services, ensuring accurate financial tracking and management. It automates the summation of item costs, taxes, and discounts, which streamlines billing processes and reduces human error. This document is essential for businesses to maintain organized records, facilitate timely payments, and improve cash flow management.

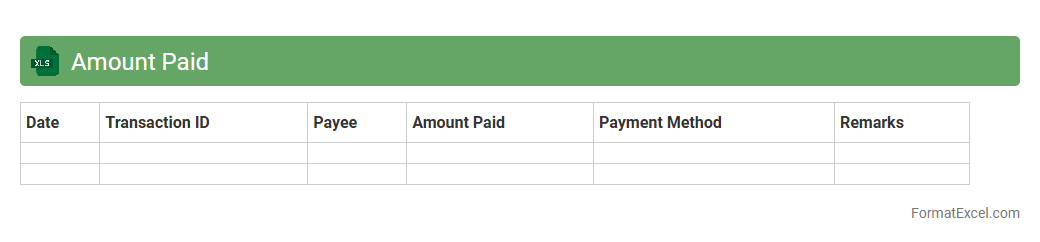

Amount Paid

The

Amount Paid Excel document is a spreadsheet used to track and record payments made for various transactions or expenses, providing a clear overview of financial outflows. It helps businesses and individuals manage budgets by organizing payment data such as dates, amounts, payees, and payment methods in a structured format. This tool improves financial transparency, aids in expense reconciliation, and ensures accurate record-keeping for auditing and reporting purposes.

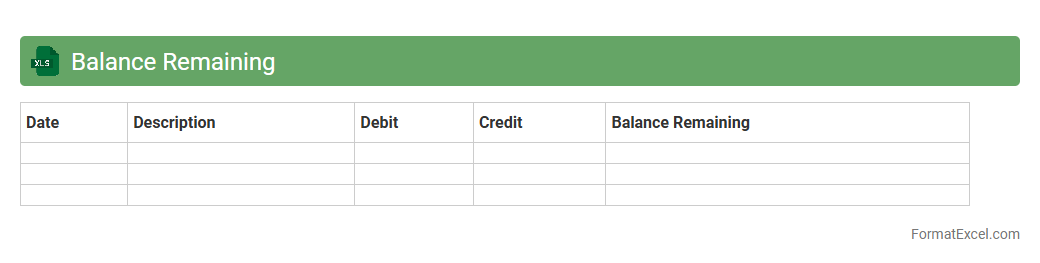

Balance Remaining

The

Balance Remaining Excel document tracks outstanding amounts in financial accounts, helping businesses monitor unpaid invoices, project budgets, or loan balances efficiently. It allows users to quickly update and analyze data, ensuring accurate financial management and timely decision-making. This tool enhances transparency and control over monetary flows, reducing the risk of errors and improving cash flow planning.

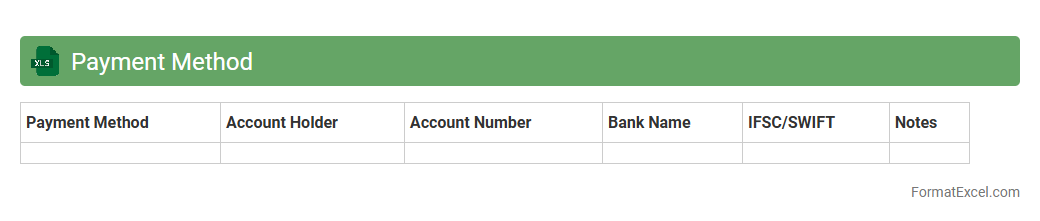

Payment Method

A

Payment Method Excel document is a structured spreadsheet that organizes various payment options, such as credit cards, bank transfers, and digital wallets, along with details like transaction fees, processing times, and vendor information. It streamlines financial management by providing a clear overview of available payment methods, helping businesses track and compare payment processes efficiently. This tool enhances decision-making and improves cash flow management by consolidating essential payment data in a single, accessible location.

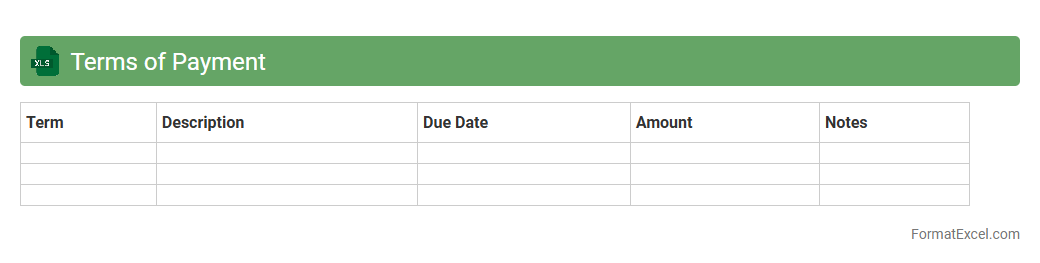

Terms of Payment

The

Terms of Payment Excel document outlines agreed payment conditions such as due dates, payment methods, and installment schedules, providing a clear financial roadmap for both buyers and sellers. It helps businesses manage cash flow efficiently by tracking payment deadlines and ensuring timely settlements, reducing the risk of late payments. Utilizing this document enhances transparency and accountability in financial transactions, improving overall business relationships.

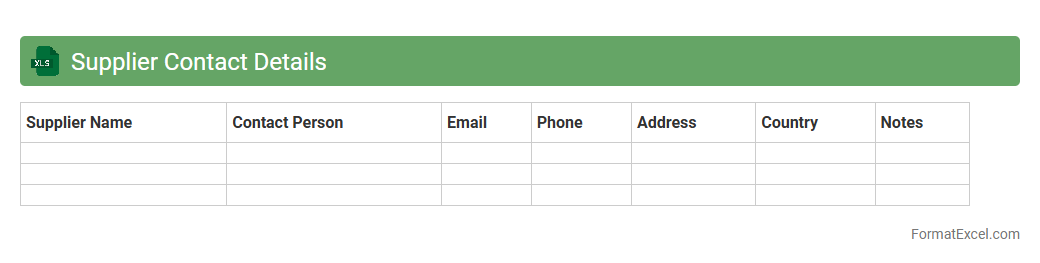

Supplier Contact Details

A

Supplier Contact Details Excel document is a structured file that stores essential information about suppliers, including names, phone numbers, email addresses, and physical addresses. This document streamlines communication, allowing quick access to supplier contacts for order placements, inquiries, or issue resolution. Maintaining an up-to-date supplier contact list enhances procurement efficiency and helps build reliable business relationships.

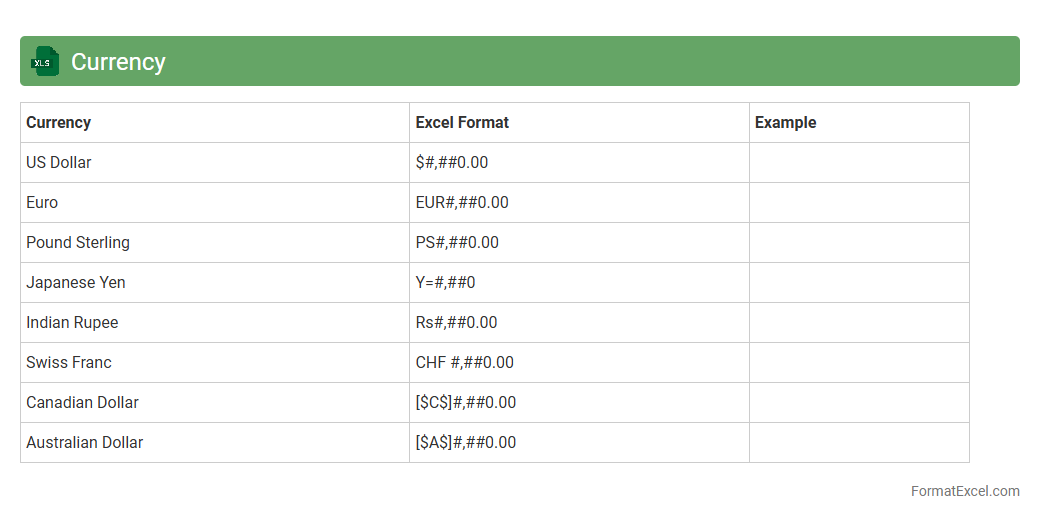

Currency

A

Currency Excel document is a spreadsheet designed to track, convert, and analyze various currencies using real-time exchange rates and historical financial data. It is useful for businesses, travelers, and investors to manage international transactions, budgeting, and financial forecasting with accuracy and efficiency. This tool simplifies complex currency calculations, making it easier to monitor market fluctuations and optimize financial decisions.

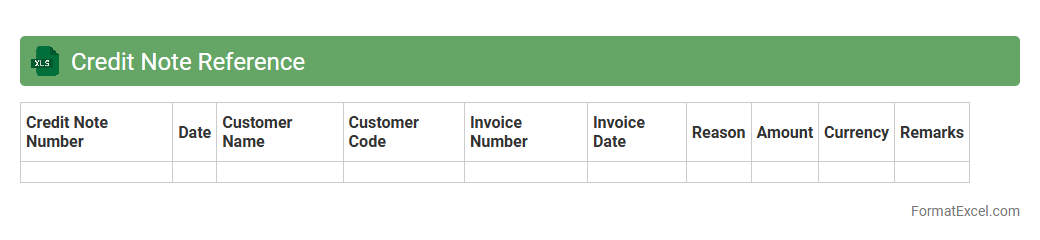

Credit Note Reference

A

Credit Note Reference Excel document is a structured spreadsheet used to record, track, and manage credit notes issued to customers for returned goods, discounts, or billing adjustments. It streamlines financial reconciliation by providing a clear audit trail, ensuring accurate accounting and quick reference during invoice verification. Utilizing this document enhances transparency and efficiency in credit management for businesses.

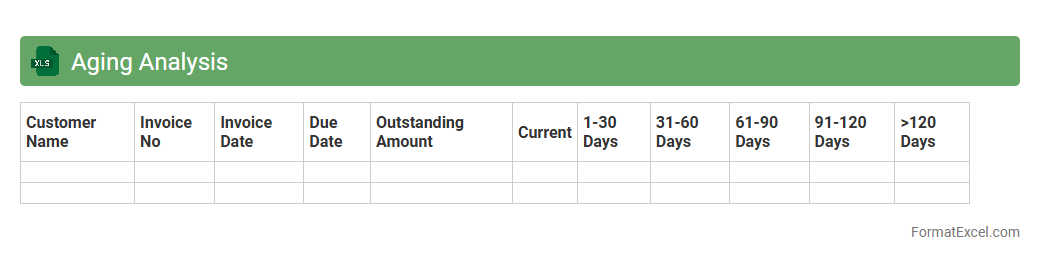

Aging Analysis

An

Aging Analysis Excel document is a financial tool used to track outstanding invoices by categorizing them based on their due dates, typically in 30-day intervals. It helps businesses monitor accounts receivable, identify overdue payments, and prioritize collection efforts to improve cash flow. Utilizing this document enables more effective credit management and reduces the risk of bad debts.

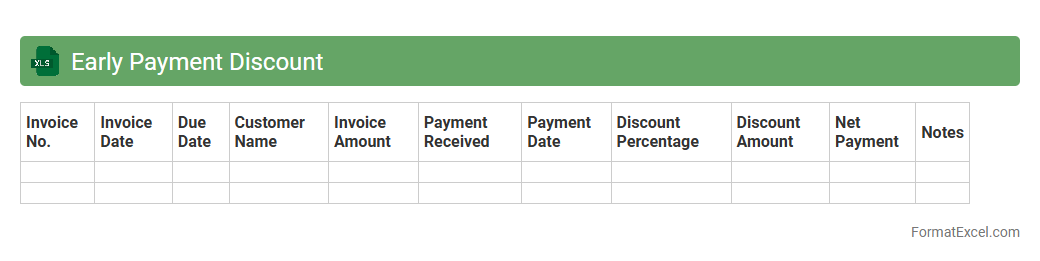

Early Payment Discount

An

Early Payment Discount Excel document is a structured spreadsheet used to calculate and track discounts offered to customers or vendors for early invoice payments. It assists businesses in managing cash flow more effectively by incentivizing quicker payments, reducing outstanding receivables, and improving working capital. This tool simplifies financial decision-making by clearly outlining discount terms, due dates, and savings, ensuring accuracy and promoting timely transactions.

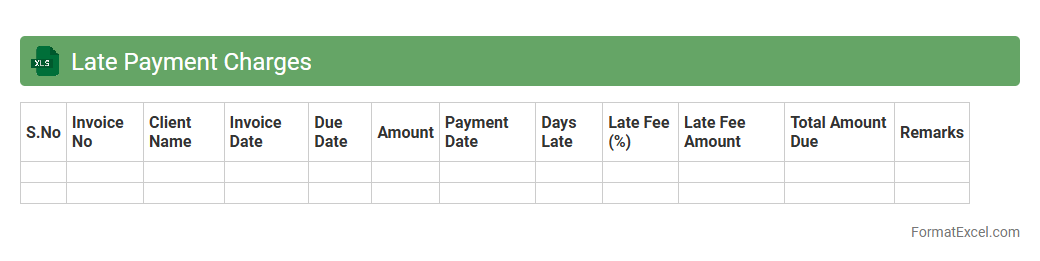

Late Payment Charges

The

Late Payment Charges Excel document is a specialized spreadsheet designed to calculate penalties incurred due to overdue payments accurately. It streamlines financial tracking by automatically computing fees based on predefined criteria such as payment dates, amounts, and interest rates. This tool is essential for businesses to enforce payment policies, maintain cash flow, and reduce the risk of delayed receivables.

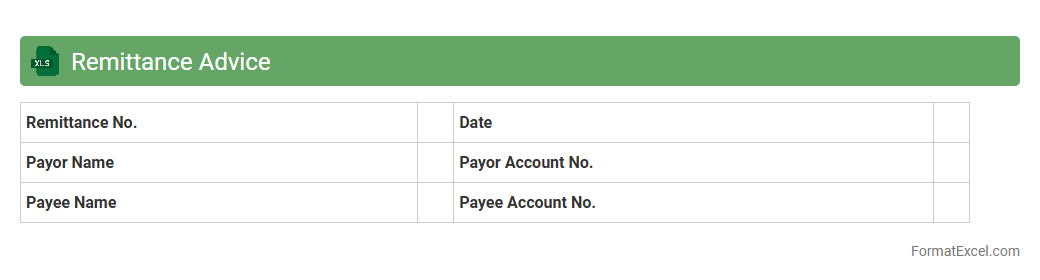

Remittance Advice

A

Remittance Advice Excel document is a structured spreadsheet that details payment information from a payer to a payee, including invoice numbers, amounts paid, and payment dates. This document streamlines the reconciliation process by matching payments to outstanding invoices, ensuring accuracy in accounting records. It enhances financial transparency, reduces errors, and speeds up the cash flow management for businesses.

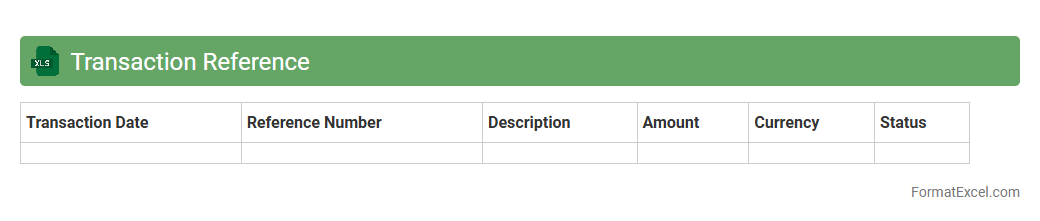

Transaction Reference

A

Transaction Reference Excel document is a detailed spreadsheet that records and organizes financial transactions, offering a clear audit trail for business activities. It enables efficient tracking, reconciliation, and reporting of payments, invoices, and transfers, which helps maintain accurate financial records. This document is essential for ensuring transparency, reducing errors, and improving overall financial management within organizations.

Comments or Notes

Comments or Notes in an Excel document are

annotations attached to specific cells that provide additional context or explanations without altering the actual data. They enhance collaboration by allowing users to leave feedback, reminders, or clarifications directly within the spreadsheet. This feature is useful for tracking changes, guiding data interpretation, and improving communication among team members working on shared documents.

Tax Amount

A

Tax Amount Excel document is a spreadsheet designed to calculate and organize various tax liabilities based on income, expenses, and applicable tax rates. It helps users efficiently track tax obligations, perform accurate tax computations, and maintain records for financial planning or filing purposes. Utilizing this tool streamlines tax management, reduces errors, and simplifies compliance with tax regulations.

Department Code

A

Department Code Excel document is a structured spreadsheet that organizes unique identifiers for various departments within an organization, facilitating clear categorization and easy reference. It enhances data management by allowing quick sorting, filtering, and analysis of department-related information, improving operational efficiency. This document is essential for maintaining consistency across financial records, HR tracking, and reporting processes.

Project Code

A

Project Code Excel document is a structured spreadsheet used to organize, track, and manage project-related codes and data efficiently. It helps teams maintain consistency by standardizing project identifiers, facilitates quick data retrieval, and enhances collaboration by providing a clear overview of project statuses and resources. This tool streamlines project management workflows and improves accuracy in reporting and analysis.

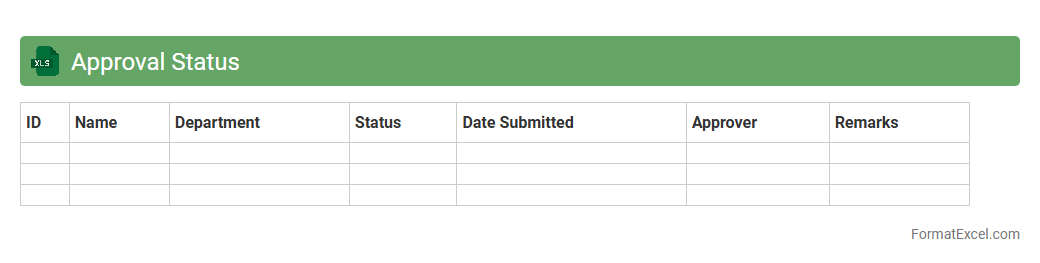

Approval Status

An

Approval Status Excel document is a structured spreadsheet designed to track and manage the approval process of various tasks, projects, or documents within an organization. It provides a clear overview of the current status, approvers involved, dates of submission and approval, and any comments or feedback, enabling efficient monitoring and accountability. Using this document streamlines communication, reduces delays, and ensures transparency in decision-making workflows.

Introduction to Creditors Statement Format

A Creditors Statement Format is a structured document used to track amounts a business owes to its suppliers. It ensures accuracy in recording credit transactions and facilitates timely payments. Excel is commonly used due to its flexibility and ease of data management.

Importance of Creditors Statement in Business

The creditors statement helps businesses monitor their outstanding liabilities and maintain healthy supplier relationships. It plays a vital role in cash flow management and financial planning. Accurate statements reduce the risk of delayed payments and disputes.

Key Components of a Creditors Statement

A typical creditors statement includes details such as creditor name, invoice number, due date, amount owed, and payment status. These components ensure clarity and transparency in financial dealings. Each element contributes to efficient tracking and reconciliation.

Benefits of Using Excel for Creditors Statements

Excel offers powerful tools like formulas, filters, and pivot tables, making it ideal for managing creditors statements. It allows for quick updates, error checking, and customized reporting. This flexibility saves time and enhances data accuracy.

Step-by-Step Guide to Creating a Creditors Statement in Excel

Begin by setting up columns for key data fields such as creditor name and invoice details. Enter transactions systematically, then apply formulas to calculate totals and balances. Finally, format the sheet for readability and ease of use.

Essential Columns to Include in the Format

Include columns for creditor name, invoice date, invoice number, due date, amount payable, amount paid, and balance due. These columns provide a comprehensive overview of outstanding debts. Proper organization aids in effective monitoring and payment scheduling.

Sample Creditors Statement Template in Excel

A sample template usually includes predefined columns, conditional formatting, and formulas to automate calculations. It serves as a practical starting point for businesses to customize according to their needs. Templates reduce setup time and improve consistency.

Tips for Customizing Your Creditors Statement Format

Customize by adding your company's branding, adjusting columns to fit your reporting style, and incorporating filters for easy navigation. Use conditional formatting to highlight overdue payments. Customization enhances usability and presentation.

Common Errors to Avoid in Creditors Statements

Avoid errors such as incorrect data entry, missing invoice details, or improper formula use. Double-check calculations and update records promptly to ensure accuracy. Errors can lead to payment delays and strained supplier relations.

Downloadable Creditors Statement Excel Templates

Many websites offer downloadable Excel templates for creditors statements that simplify record-keeping. These templates often include built-in formulas and formatting for immediate use. Utilizing them saves time and reduces manual effort.