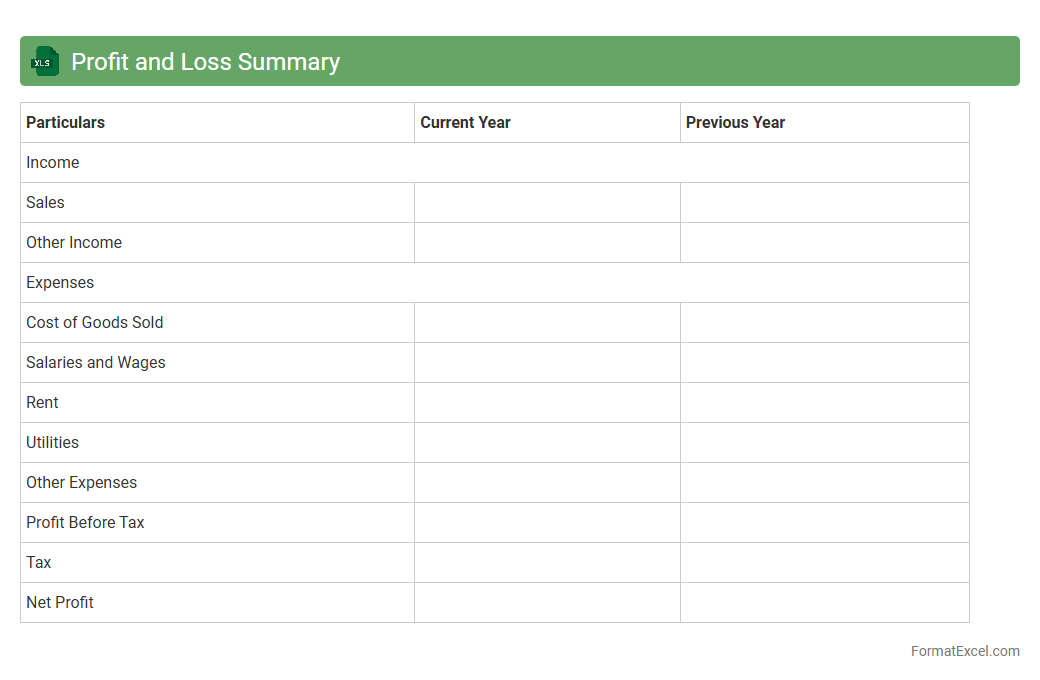

Profit and Loss Summary

A

Profit and Loss Summary Excel document consolidates revenue, expenses, and net income into a clear, organized format that enables quick financial review. This tool simplifies tracking business performance over specific periods, helping identify cost-saving opportunities and revenue trends. By using this summary, users can make informed decisions based on accurate financial data and enhance overall financial management.

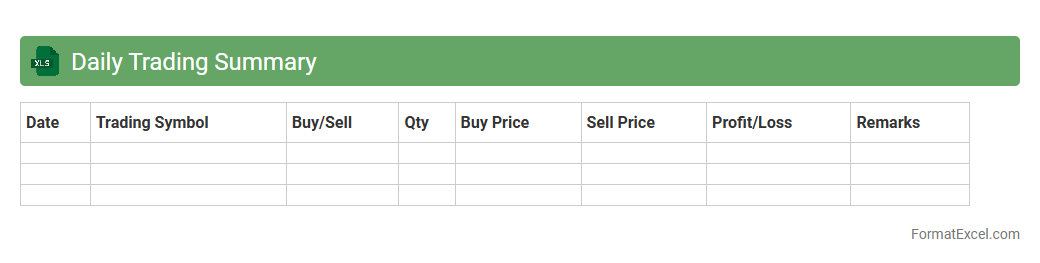

Daily Trading Summary

The

Daily Trading Summary Excel document consolidates essential market data, including trade volumes, price fluctuations, and transaction details, to provide a comprehensive overview of daily trading activity. This tool aids traders and analysts in tracking performance, identifying trends, and making data-driven decisions with accuracy. Efficient organization and automatic calculations within the spreadsheet enhance productivity and ensure timely insights for optimizing trading strategies.

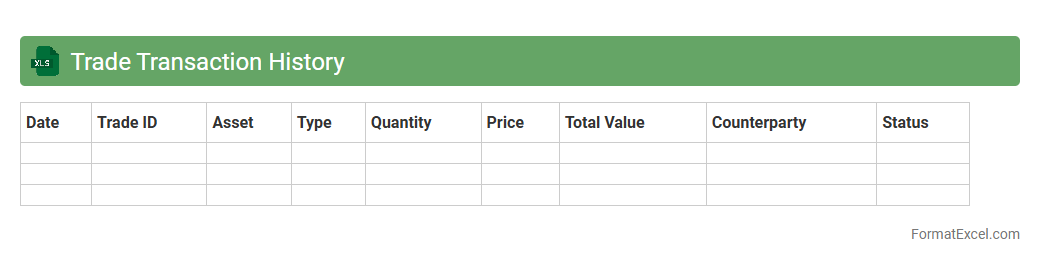

Trade Transaction History

A

Trade Transaction History Excel document records detailed information of all trading activities including dates, asset types, quantities, prices, and transaction values. This document is essential for tracking investment performance, conducting audits, and preparing accurate tax reports. By organizing transaction data in a structured format, it enables easy analysis, reconciliation, and decision-making in financial management.

Brokerage Charges Report

The

Brokerage Charges Report Excel document provides a detailed breakdown of brokerage fees incurred during financial transactions, helping investors and traders track their expenses accurately. This report consolidates charges from multiple trades, allowing users to analyze cost patterns and optimize their investment strategies. It is essential for maintaining transparent financial records and ensuring compliance with accounting or tax regulations.

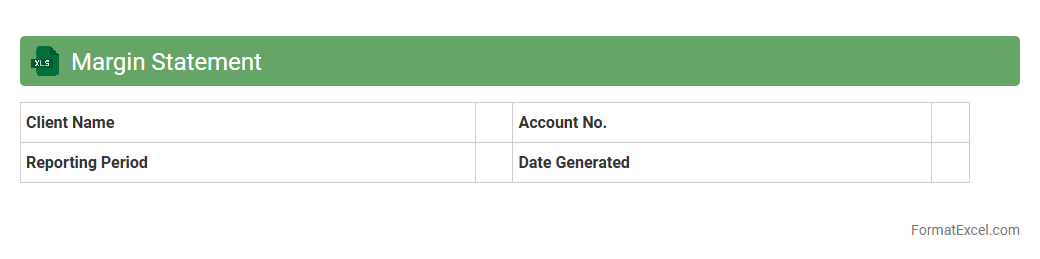

Margin Statement

A

Margin Statement Excel document is a detailed financial report that tracks profitability by comparing revenue against costs and expenses. It helps businesses analyze their profit margins on various products or services, enabling more informed decision-making and cost control. By organizing margin data systematically, it provides clear insights into areas where efficiency can be improved and profits maximized.

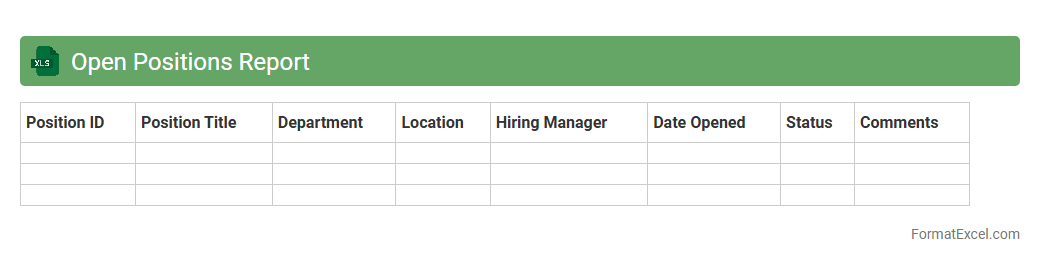

Open Positions Report

An

Open Positions Report Excel document systematically tracks all job vacancies within an organization, including details such as job titles, departments, hiring managers, and status updates. This report facilitates efficient workforce planning by providing real-time visibility into recruitment needs and enabling data-driven decisions for talent acquisition. It enhances collaboration between HR teams and management by centralizing critical hiring information and streamlining the recruitment process.

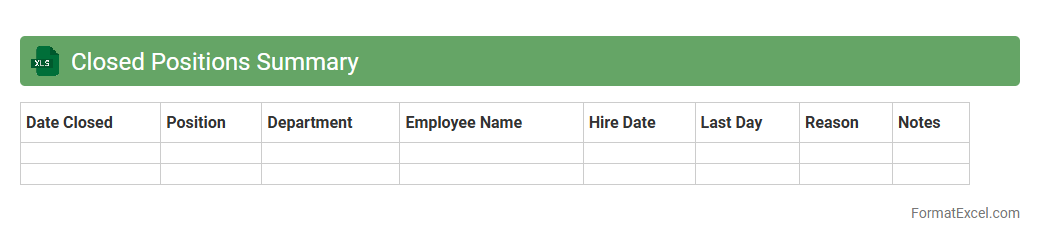

Closed Positions Summary

A

Closed Positions Summary Excel document compiles detailed records of all finalized trades or job roles, presenting key metrics such as entry and exit points, profit or loss, and duration. This summary enables stakeholders to analyze past performance, identify trends, and make data-driven decisions for future positions. By consolidating historical data in a clear, structured format, it enhances strategic planning and risk management.

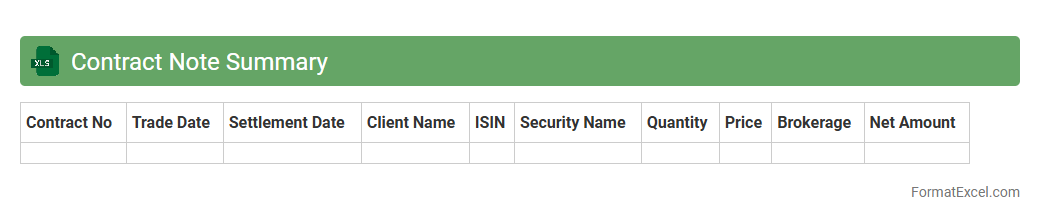

Contract Note Summary

A

Contract Note Summary Excel document consolidates transaction details from multiple contract notes into a single, organized spreadsheet, enabling quick analysis of trades, dates, quantities, and values. It helps investors and traders track their trading activity, monitor portfolio performance, and simplify tax reporting by providing a clear summary of all executed transactions. This tool enhances decision-making by offering an easy-to-navigate format that highlights key financial data and trade metrics.

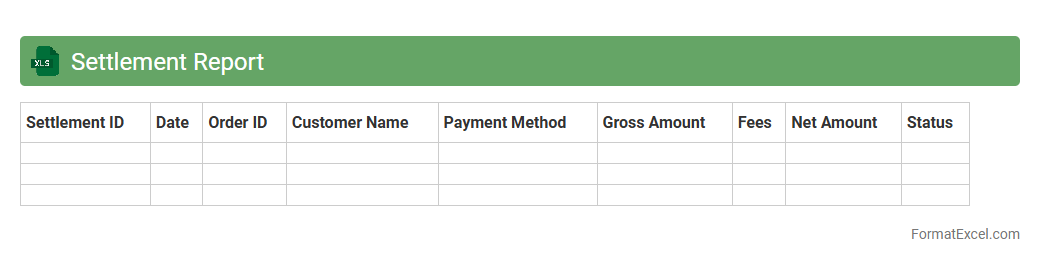

Settlement Report

A

Settlement Report Excel document is a detailed financial record that summarizes transactions, payments, and outstanding balances between parties over a specific period. It helps businesses track reconciliations, identify discrepancies, and ensure accurate financial settlements with vendors or clients. This tool enhances transparency, streamlines accounting processes, and supports informed decision-making.

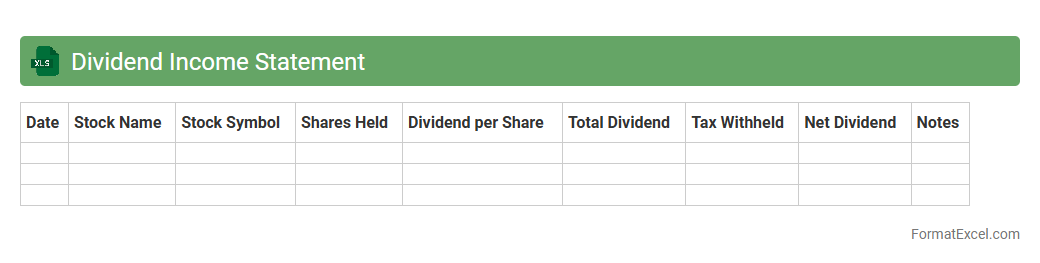

Dividend Income Statement

A

Dividend Income Statement Excel document is a financial tool designed to track and analyze dividend payments from investments accurately. It helps investors monitor income streams, calculate total earnings, and assess dividend yield over specific periods, enabling better portfolio management and informed decision-making. Using this document ensures precise record-keeping and simplifies tax reporting related to dividend income.

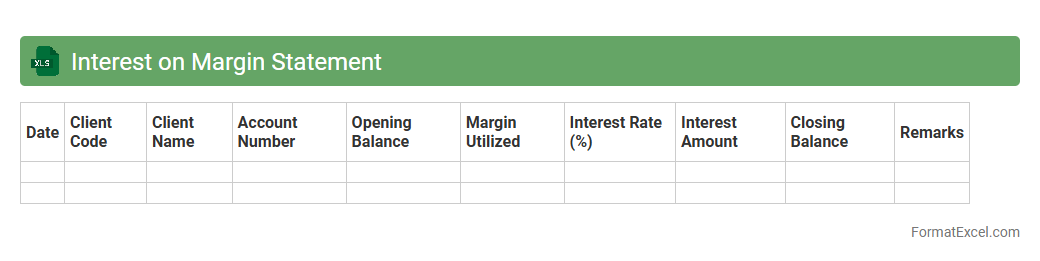

Interest on Margin Statement

The

Interest on Margin Statement Excel document provides a detailed record of interest charges incurred on borrowed funds used for margin trading. It helps investors track and manage the cost of borrowing by breaking down interest rates, periods, and principal amounts. This document is essential for accurate financial planning and ensuring transparent reporting of margin-related expenses.

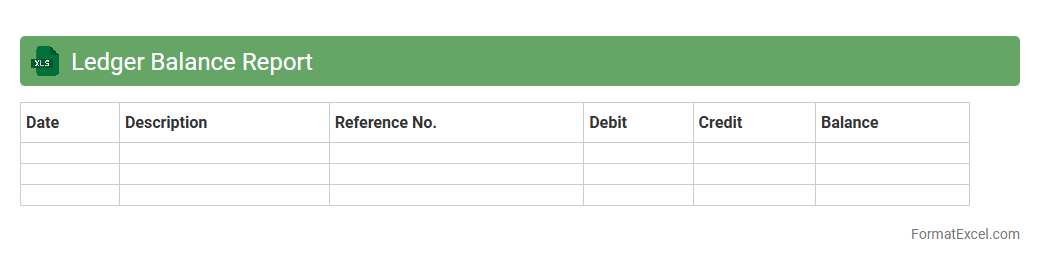

Ledger Balance Report

The

Ledger Balance Report Excel document provides a detailed summary of all account balances within a specific ledger, capturing transactions over a defined period. This report is essential for financial analysis, enabling users to quickly verify account statuses, track debit and credit movements, and ensure accurate reconciliation of accounts. Its organized format simplifies auditing processes and supports informed decision-making by presenting comprehensive financial data in an accessible manner.

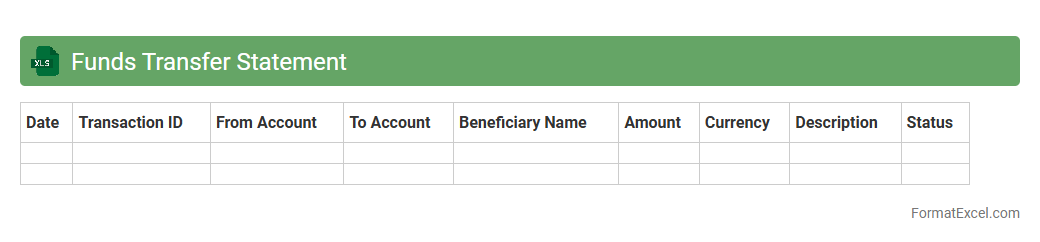

Funds Transfer Statement

A

Funds Transfer Statement Excel document provides a detailed record of money movements between accounts, including dates, amounts, and transaction references. It helps organizations track cash flow accurately, ensuring transparency and accountability in financial management. This tool is essential for reconciling accounts, auditing transactions, and maintaining precise financial reports.

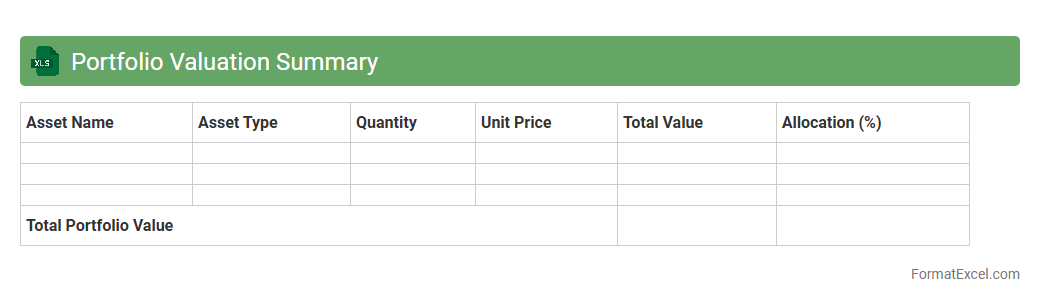

Portfolio Valuation Summary

A

Portfolio Valuation Summary Excel document provides a consolidated overview of investment assets, showing current values, historical performance, and asset allocation in a structured format. This summary helps investors and financial managers track portfolio growth, assess risk exposure, and make informed decisions based on up-to-date market valuations. The ability to visualize and analyze diverse investment data in one place enhances strategic planning and financial reporting efficiency.

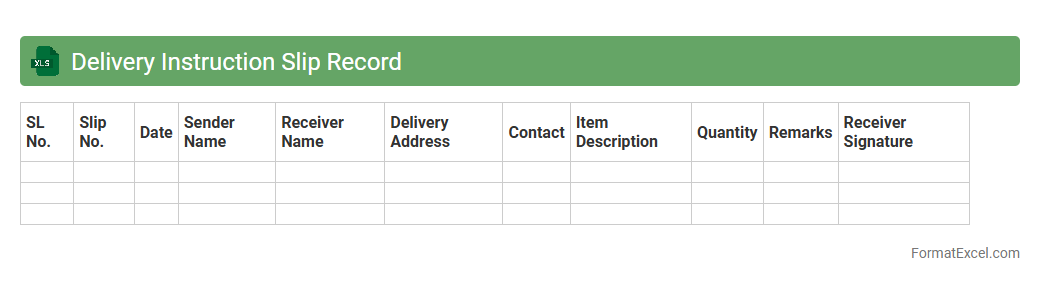

Delivery Instruction Slip Record

A

Delivery Instruction Slip Record Excel document is a detailed log that tracks the instructions for product deliveries, including customer details, delivery addresses, and item specifications. This document helps streamline the shipment process by ensuring accurate fulfillment of orders according to the specified requirements. It is useful for maintaining organized records, reducing delivery errors, and improving communication between logistics teams and customers.

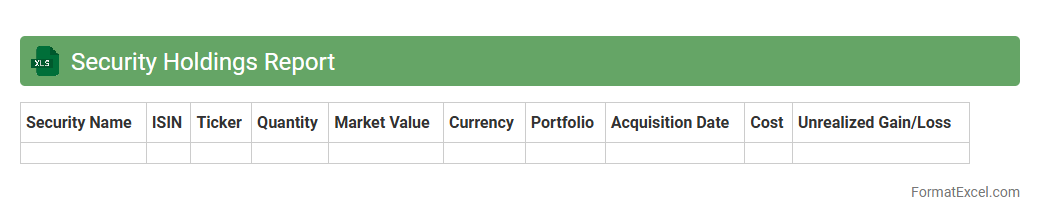

Security Holdings Report

The

Security Holdings Report Excel document provides a detailed overview of an individual's or organization's investment portfolio, including information about securities owned, quantities, cost basis, and current market values. This report is essential for tracking asset allocation, monitoring investment performance, and ensuring compliance with regulatory requirements. By analyzing this data, users can make informed decisions to optimize portfolio management and mitigate financial risks.

Realized Gain/Loss Statement

A

Realized Gain/Loss Statement Excel document records the financial outcomes of asset sales by calculating the difference between the sale price and the purchase price. It helps investors and accountants track actual profits or losses from transactions, ensuring accurate tax reporting and informed decision-making. This spreadsheet streamlines portfolio management by providing a clear, organized summary of realized gains and losses over a specified period.

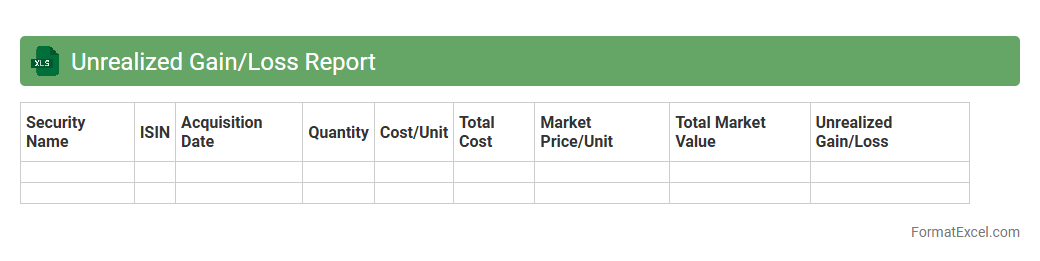

Unrealized Gain/Loss Report

The

Unrealized Gain/Loss Report Excel document tracks the fluctuation in value of investments that have not yet been sold, showing potential profit or loss based on current market prices. This report is essential for accurately assessing portfolio performance and making informed decisions about holding or selling assets. By providing real-time insights, it helps investors manage risk and optimize investment strategies effectively.

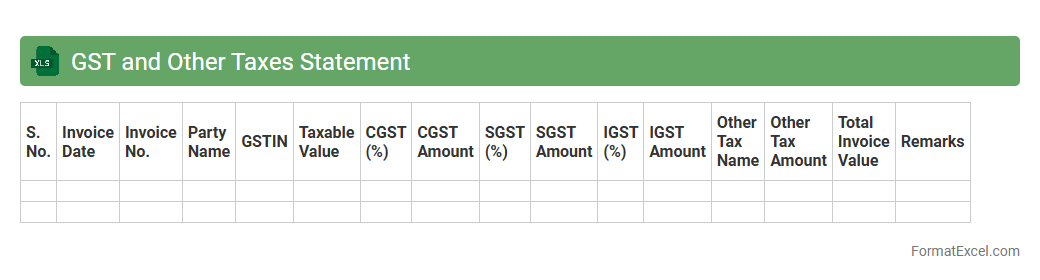

GST and Other Taxes Statement

The

GST and Other Taxes Statement Excel document is a comprehensive tool used to record, calculate, and reconcile Goods and Services Tax (GST) alongside other applicable taxes in a structured manner. It provides detailed breakdowns of tax liabilities, input tax credits, and payment schedules, making tax compliance and filing more efficient and error-free. This document is essential for businesses to maintain accurate tax records, ensure timely submissions to tax authorities, and facilitate financial auditing and reporting.

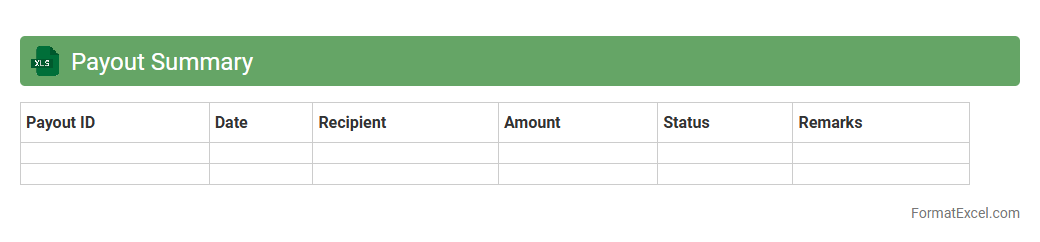

Payout Summary

A

Payout Summary Excel document consolidates detailed records of payments made to individuals or vendors, organizing data such as dates, amounts, and payment methods in a structured format. This document is useful for tracking financial transactions, reconciling accounts, and ensuring accurate and timely disbursements. It enhances transparency and simplifies the audit process by providing a clear overview of all payout activities.

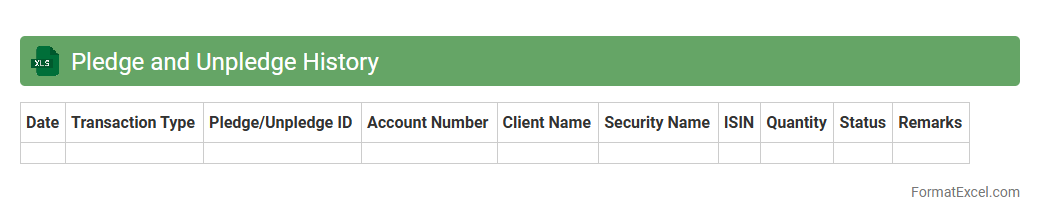

Pledge and Unpledge History

The

Pledge and Unpledge History Excel document records detailed transactions of securities pledged as collateral and subsequently released, providing a clear audit trail of ownership and borrowing activities. It is essential for tracking historical changes in share pledges, assessing financial risks, and ensuring regulatory compliance. This document helps investors and analysts evaluate company stability and creditor confidence through transparent monitoring of pledged assets.

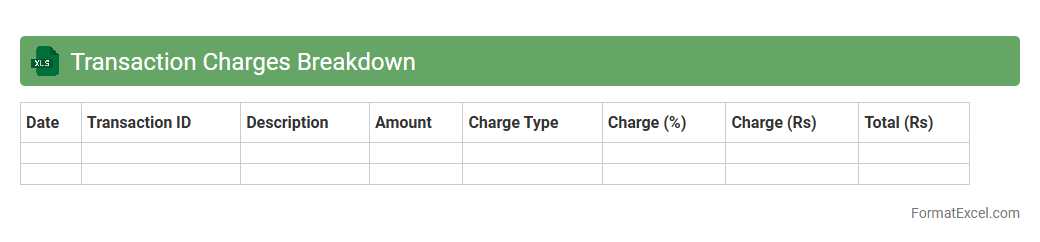

Transaction Charges Breakdown

The

Transaction Charges Breakdown Excel document provides a detailed analysis of fees associated with various financial transactions, categorizing costs by type, date, and amount to enhance transparency and control. It allows businesses to identify charge patterns, optimize expense management, and ensure accurate budgeting by tracking each transaction's specific fees. Utilizing this breakdown helps reduce unexpected charges and supports strategic decision-making regarding payment methods and service providers.

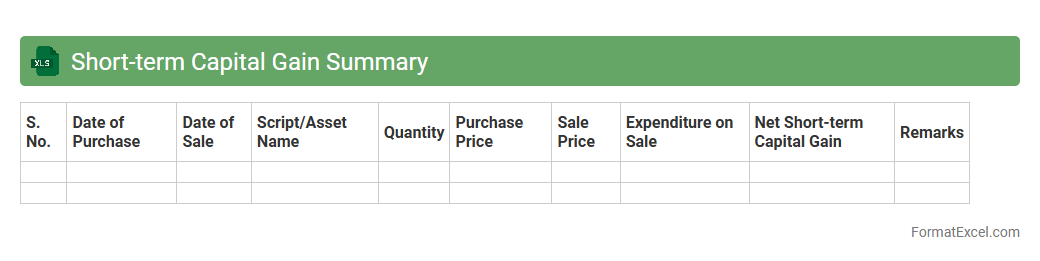

Short-term Capital Gain Summary

The

Short-term Capital Gain Summary excel document is a financial tool designed to track and analyze profits from the sale of assets held for less than one year. It provides a clear breakdown of transaction dates, purchase and sale prices, and the resulting gains, facilitating accurate tax reporting and compliance. This summary helps investors make informed decisions by offering a comprehensive overview of short-term capital gains, aiding in optimized portfolio management and tax planning.

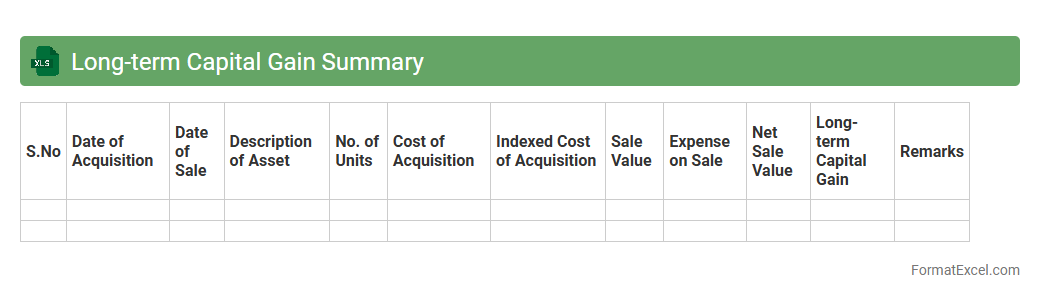

Long-term Capital Gain Summary

A

Long-term Capital Gain Summary Excel document consolidates all transactions involving assets held for more than one year, calculating profits from the sale or transfer of investments like stocks, bonds, or real estate. It helps investors and tax professionals accurately track gains, apply relevant tax rates, and prepare tax returns efficiently. This summary reduces errors and ensures compliance with tax regulations, optimizing financial planning and reporting.

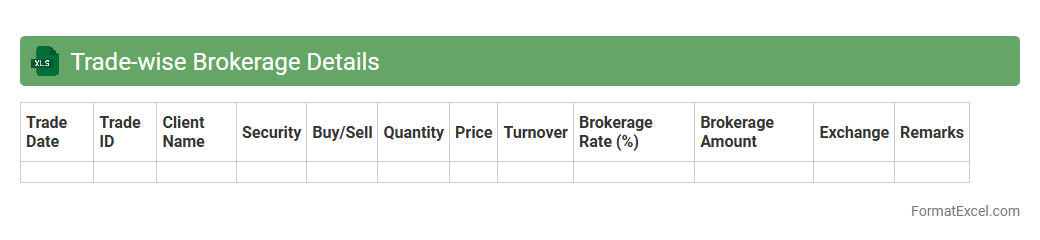

Trade-wise Brokerage Details

The

Trade-wise Brokerage Details Excel document organizes and tracks brokerage fees associated with individual trades, providing clear insights into transaction costs. This detailed record enables traders and financial analysts to monitor brokerage expenses, optimize trading strategies, and ensure accurate financial reporting. By analyzing trade-wise brokerage data, users can identify cost-saving opportunities and improve overall portfolio profitability.

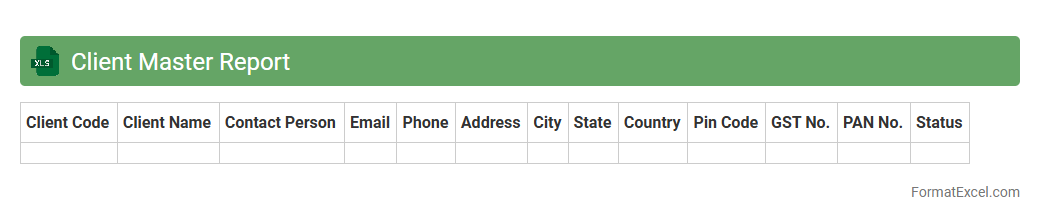

Client Master Report

The

Client Master Report Excel document is a comprehensive file that consolidates detailed information about clients, including contact details, transaction history, and service preferences. It enables businesses to efficiently manage client data, track interactions, and analyze trends to improve customer relationship management. Utilizing this report enhances decision-making processes and supports targeted marketing strategies.

Introduction to Trading Account Statements

A Trading Account Statement is a detailed record of all transactions and holdings within a trading account. It helps traders track profits, losses, and portfolio performance. Accurate statements are essential for financial analysis and tax reporting.

Importance of Statement Formats for Traders

Using the correct statement format ensures clarity and consistency in presenting trading data. Well-structured formats make it easier to analyze transaction history and account balances. This improves decision-making and auditing processes.

Key Components of a Trading Account Statement

Critical components include transaction dates, security names, quantities, prices, and net amounts. A comprehensive statement also lists fees, dividends, and running balances. These elements provide a complete overview of trading activity.

Setting Up Excel for Trading Account Statements

Excel can be configured with predefined templates for efficient statement preparation. Setting up proper columns, formulas, and formatting enhances accuracy. This setup minimizes manual errors and streamlines data entry.

Standard Columns and Data Fields in Excel Format

Essential columns in Excel include Date, Transaction Type, Symbol, Quantity, Price, and Amount. Consistent data fields allow automated calculations like profit/loss and total holdings. Proper labeling ensures easy filtering and sorting.

Step-by-Step Guide to Creating Trading Account Statements in Excel

Start by designing column headers based on required components. Next, enter transaction details and utilize formulas to calculate totals and balances. Finally, apply formatting and validate data for accuracy in the Excel sheet.

Sample Trading Account Statement Template in Excel

A sample template typically includes sections for trade entries, fees, and summary totals. This template can be customized with conditional formatting and charts to visualize performance. Templates save time and improve data consistency.

Tips for Customizing Your Excel Statement Format

Customize your Excel statement by adding filters, drop-down lists, and conditional highlights. Use pivot tables and charts for interactive data analysis. Tailoring the format enhances usability and insight extraction.

Common Mistakes to Avoid in Excel Trading Statements

Avoid manual entry errors, inconsistent date formats, and missing transaction data. Ensure formulas are correctly linked to prevent incorrect calculations. Regularly backup your statements to avoid data loss.

Downloadable Trading Account Statement Excel Templates

Many free and paid Excel templates are available online for quick setup. These templates offer pre-built formulas and layouts tailored for trading accounts. Downloading templates accelerates statement creation and ensures professionalism.