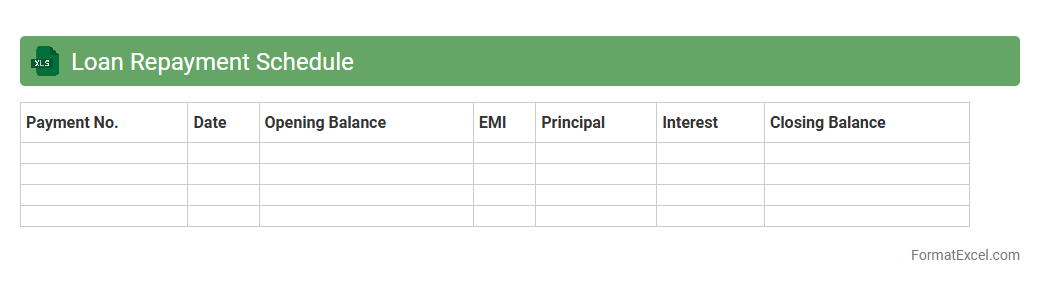

Loan Repayment Schedule

A

Loan Repayment Schedule Excel document is a spreadsheet tool designed to outline the timeline and amounts for repaying a loan, including principal and interest payments. It helps borrowers and lenders track payment due dates, remaining balances, and interest accrued, ensuring efficient financial management. This schedule is essential for budgeting, avoiding missed payments, and understanding the total cost of the loan over time.

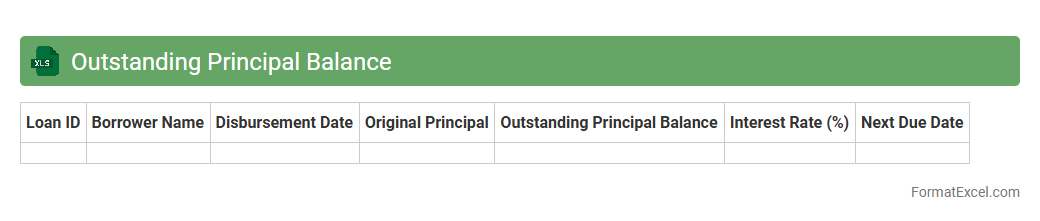

Outstanding Principal Balance

An

Outstanding Principal Balance Excel document tracks the remaining loan principal that borrowers owe at any given time, helping users monitor repayment progress accurately. This spreadsheet allows for clear visualization of amortization schedules, interest calculations, and payment history, facilitating effective loan management. It is essential for financial planning, budgeting, and ensuring timely debt reduction.

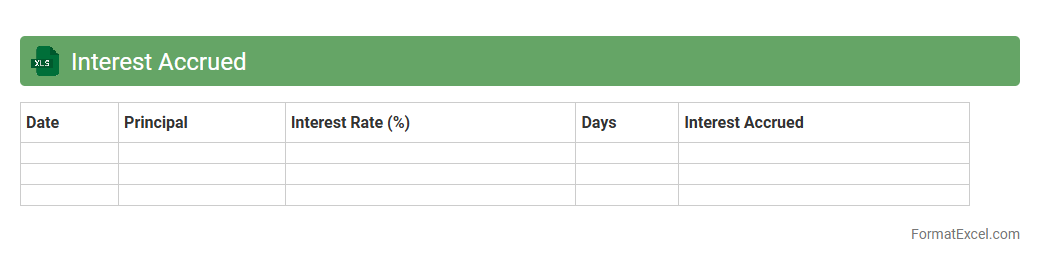

Interest Accrued

An

Interest Accrued Excel document is a financial tool designed to calculate and track the accumulated interest on investments, loans, or savings over time. It automates complex interest computations using formulas for simple or compound interest, providing accurate insights into financial growth or obligations. This document is useful for budgeting, financial planning, and ensuring timely payments or forecasting earnings, enhancing decision-making efficiency.

Total Payment Due

The

Total Payment Due Excel document is a financial tool that consolidates all outstanding payment obligations into a clear, organized format. It helps users track amounts owed across multiple invoices, deadlines, and payees, ensuring accurate and timely payments. This document enhances cash flow management by providing a comprehensive overview of upcoming financial commitments.

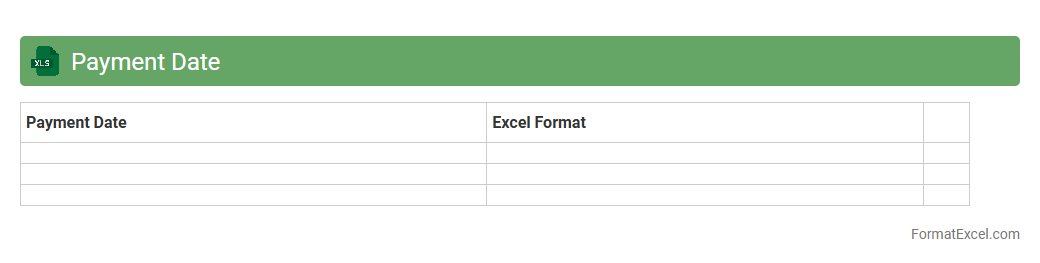

Payment Date

A

Payment Date Excel document is a structured spreadsheet that tracks due dates and records of financial transactions, helping users manage payment schedules efficiently. It allows businesses and individuals to organize invoices, monitor deadlines, and avoid late fees by providing clear visibility on payment timelines. This tool enhances cash flow management and improves financial planning by ensuring timely payments are consistently met.

Principal Paid

A

Principal Paid Excel document tracks the portion of loan payments that go directly toward reducing the original loan balance, excluding interest. It helps users analyze repayment progress, calculate remaining loan amounts, and plan financial strategies more effectively. Utilizing this document enhances budgeting accuracy and loan management by providing clear insights into principal reduction over time.

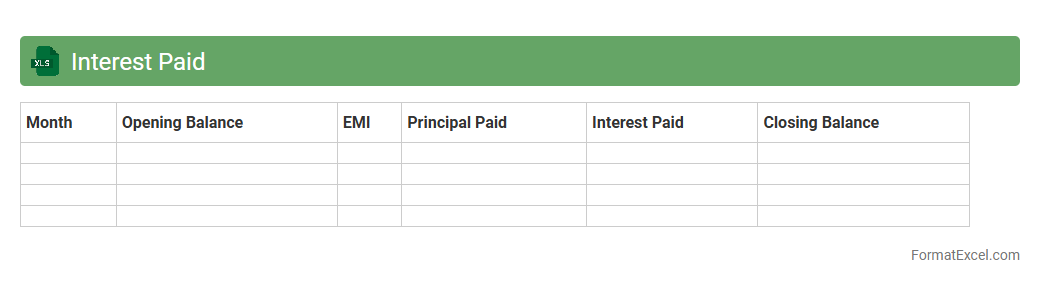

Interest Paid

An

Interest Paid Excel document is a spreadsheet designed to track and calculate the interest payments made on loans or mortgages over a specific period. It helps users monitor their financial obligations, analyze payment schedules, and forecast future interest expenses accurately. This tool is essential for budgeting, financial planning, and ensuring timely payments to minimize outstanding interest costs.

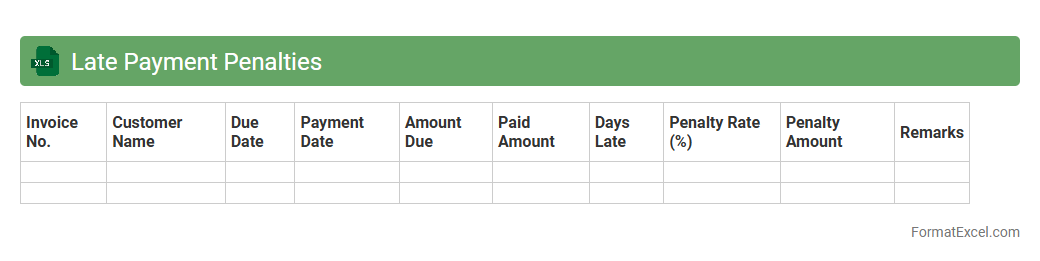

Late Payment Penalties

A

Late Payment Penalties Excel document systematically tracks overdue payments and calculates applicable penalties based on predetermined rates or terms. It helps businesses manage cash flow by promptly identifying delinquent accounts and ensuring accurate penalty assessments. Using this tool improves financial accountability and supports timely collections efforts.

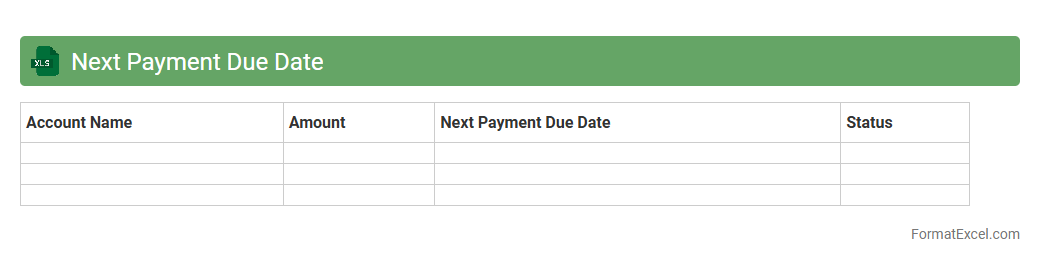

Next Payment Due Date

The

Next Payment Due Date Excel document organizes and tracks upcoming payment deadlines, ensuring timely financial management. It helps users avoid late fees by clearly displaying critical payment dates for bills, loans, or subscriptions. This tool improves cash flow planning and enhances overall budget control by providing a centralized overview of payment schedules.

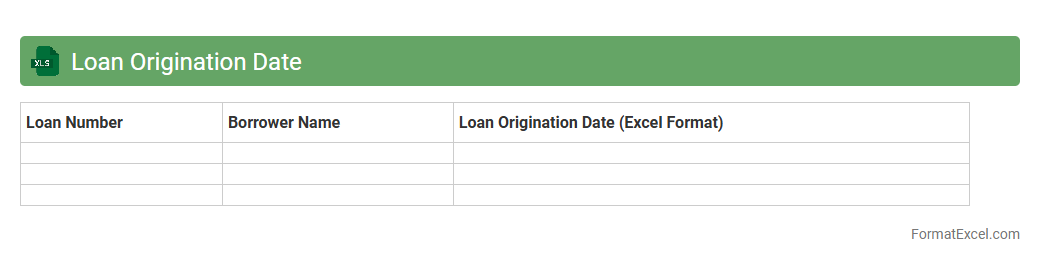

Loan Origination Date

A

Loan Origination Date Excel document records the exact date when a loan is initiated, serving as a critical reference for tracking loan timelines and managing payment schedules. This document enables financial institutions and borrowers to monitor interest accrual periods, calculate amortization accurately, and ensure compliance with lending terms. By organizing loan origination data in Excel, users can efficiently analyze loan portfolios, forecast cash flows, and improve overall financial planning.

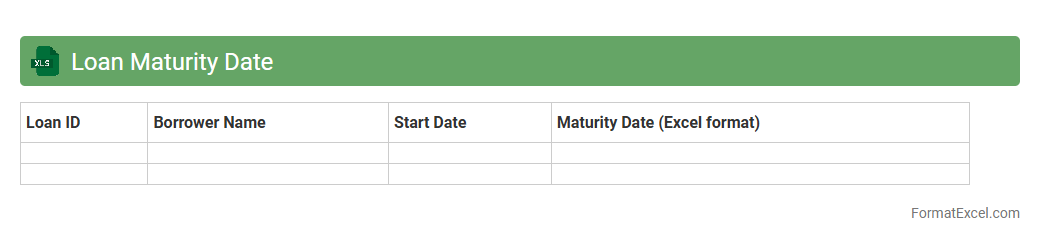

Loan Maturity Date

A

Loan Maturity Date Excel document tracks the final repayment date of a loan, helping users manage loan schedules efficiently. It allows borrowers and lenders to monitor installment deadlines, plan finances, and avoid late fees by providing clear visibility of loan timelines. This tool is essential for organizing loan information and ensuring timely loan closure.

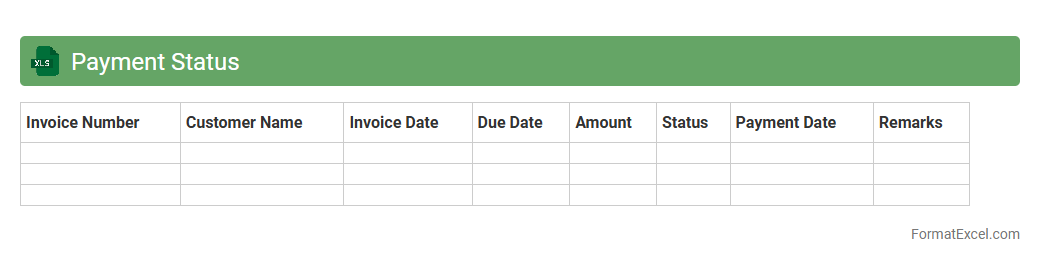

Payment Status

A

Payment Status Excel document is a structured spreadsheet that tracks and records the details of payments, including dates, amounts, recipients, and outstanding balances. It helps businesses and individuals monitor financial transactions, ensuring timely payments and effective cash flow management. This tool improves transparency, reduces errors, and simplifies financial reconciliation processes.

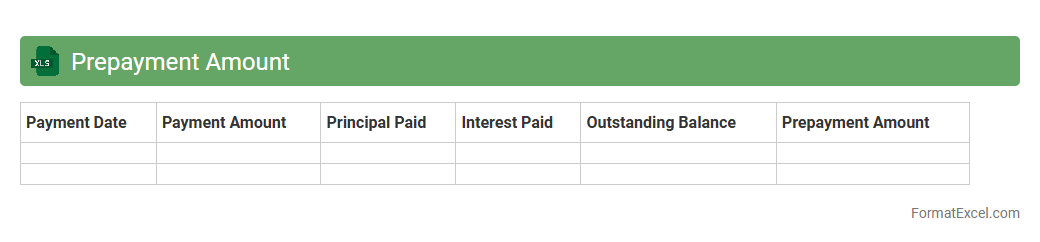

Prepayment Amount

A

Prepayment Amount Excel document is a spreadsheet designed to track and manage early payments made towards loans, bills, or other financial obligations. It helps users calculate the savings on interest and shorten loan durations by accurately recording prepayments and updating balances accordingly. This tool is essential for budgeting, financial planning, and optimizing debt repayment strategies.

Escrow Balance

The

Escrow Balance Excel document is a financial tool designed to track and manage escrow account funds, providing clear visibility into deposits, disbursements, and current balances. It helps users maintain accurate records of escrow transactions, ensuring compliance with contractual obligations and simplifying financial reconciliation. This document is essential for businesses and individuals involved in real estate, loan servicing, or any transaction requiring secure holding of funds.

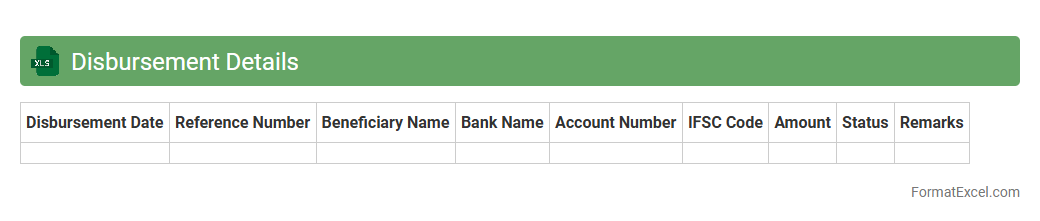

Disbursement Details

The

Disbursement Details Excel document provides a comprehensive record of funds distributed within a project or organization, listing payment dates, amounts, recipients, and purposes. This detailed financial tracking tool helps ensure transparency, accuracy in budget management, and facilitates auditing processes. By consolidating disbursement data in one accessible spreadsheet, it simplifies monitoring cash flow and supports effective financial decision-making.

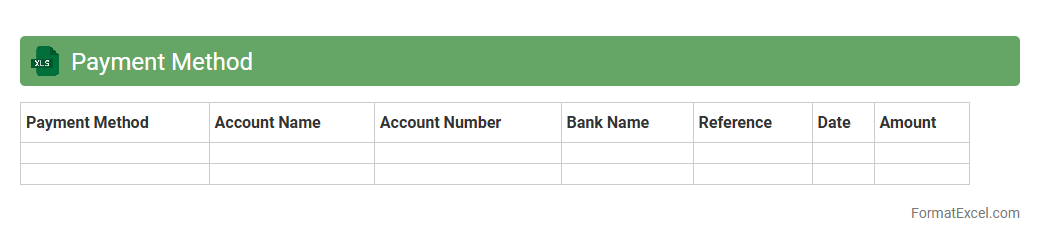

Payment Method

A

Payment Method Excel document is a structured spreadsheet that organizes various payment options, transaction details, and related financial data systematically. It allows businesses to track, analyze, and manage payment methods such as credit cards, bank transfers, digital wallets, and cash payments efficiently. This document enhances financial accuracy, simplifies reconciliation processes, and supports informed decision-making by providing clear visibility into payment patterns and preferences.

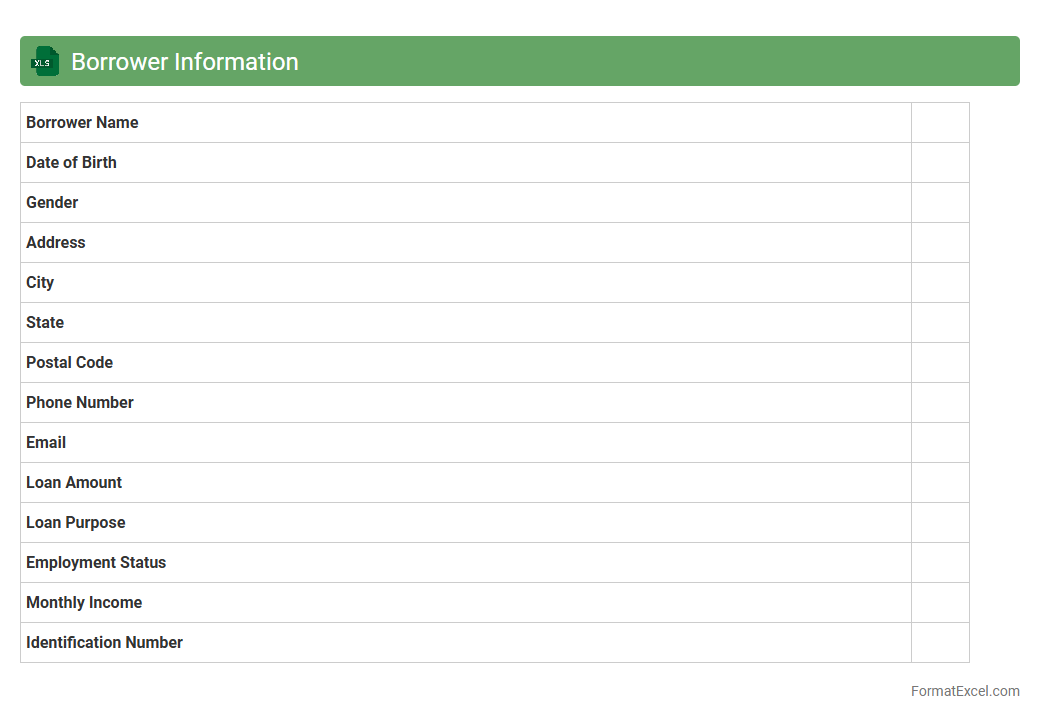

Borrower Information

The

Borrower Information Excel document is a structured spreadsheet that compiles detailed data about loan applicants, including personal details, credit history, and financial status. It enables efficient analysis and comparison of borrower profiles, facilitating informed decision-making in lending processes. This document improves accuracy, streamlines data management, and enhances communication between financial institutions and clients.

Loan Number

A

Loan Number Excel document is a spreadsheet that organizes and tracks loan details by assigning unique identification numbers to each loan entry, facilitating efficient data management and retrieval. It streamlines loan monitoring, enabling quick access to loan statuses, payment schedules, and borrower information, which enhances financial reporting and decision-making. This tool is essential for lenders, financial institutions, and individuals managing multiple loans, helping prevent errors and improve accuracy in loan processing.

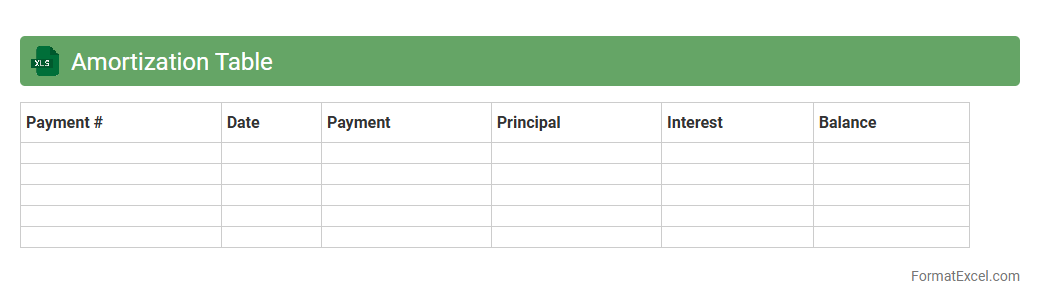

Amortization Table

An

Amortization Table Excel document is a spreadsheet that breaks down loan payments into principal and interest components over a specific period. It helps users visualize how each payment reduces the loan balance, making it easier to track progress and plan finances. This tool is essential for budgeting, forecasting loan payoff dates, and comparing different loan scenarios effectively.

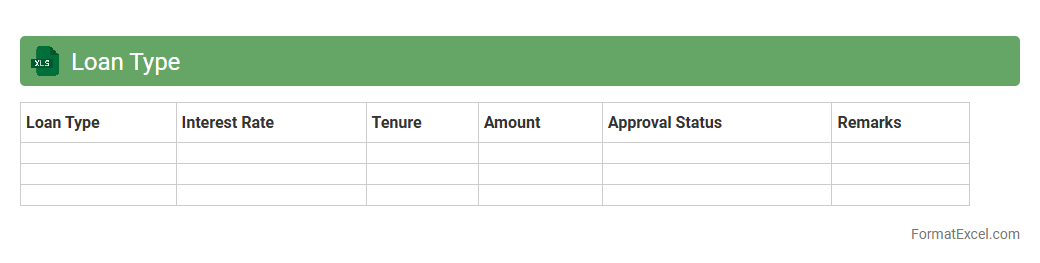

Loan Type

A

Loan Type Excel document categorizes different kinds of loans such as personal, mortgage, auto, and student loans, enabling users to organize and analyze key financial data efficiently. This structured format helps track interest rates, repayment schedules, and outstanding balances, enhancing decision-making and budgeting processes. Utilizing this document streamlines loan management, improves financial planning accuracy, and supports comparison of loan options for better financial outcomes.

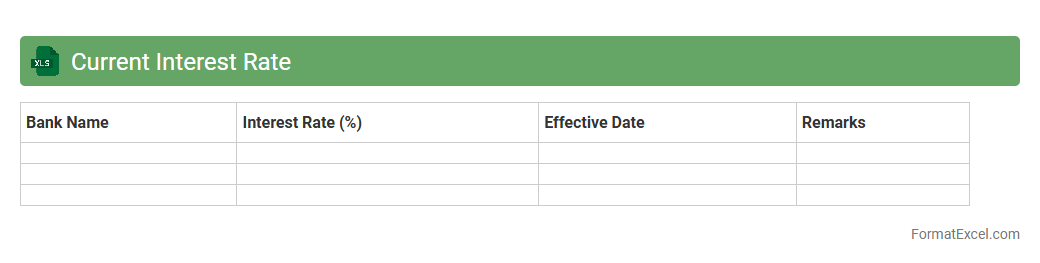

Current Interest Rate

The

Current Interest Rate Excel document serves as a dynamic tool for tracking and analyzing up-to-date interest rates from various financial institutions and loan types. It enables users to compare rates, calculate potential loan payments, and forecast financial impacts with precision. This document is essential for making informed decisions on loans, investments, and savings strategies by providing clear and organized financial data.

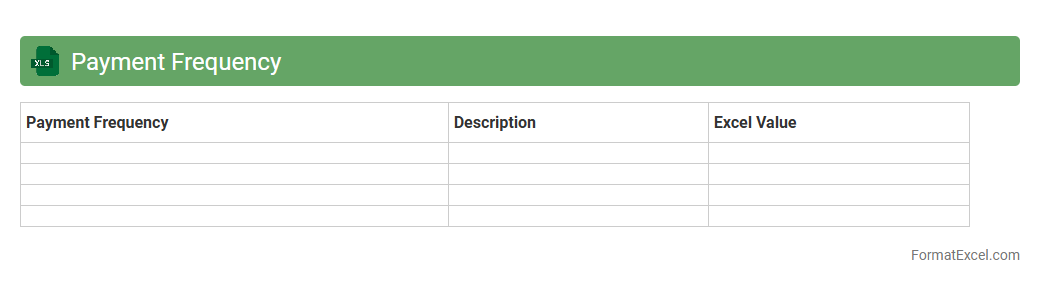

Payment Frequency

A

Payment Frequency Excel document is a spreadsheet designed to track and manage the timing and intervals of payments, such as weekly, bi-weekly, or monthly schedules. It helps businesses and individuals maintain accurate cash flow records, ensuring timely payments and reducing the risk of missed or delayed transactions. By organizing payment data systematically, this tool enhances financial planning and improves budgeting accuracy.

Fees Charged

The

Fees Charged Excel document is a structured spreadsheet that records and organizes detailed information about various fees imposed in a business or organization, enabling accurate tracking and management. It helps users analyze fee patterns, calculate total charges, and maintain transparency in financial operations, which supports better budgeting and decision-making processes. This document is especially useful for finance teams, accountants, and managers who need to monitor fee-related data efficiently and ensure compliance with pricing policies.

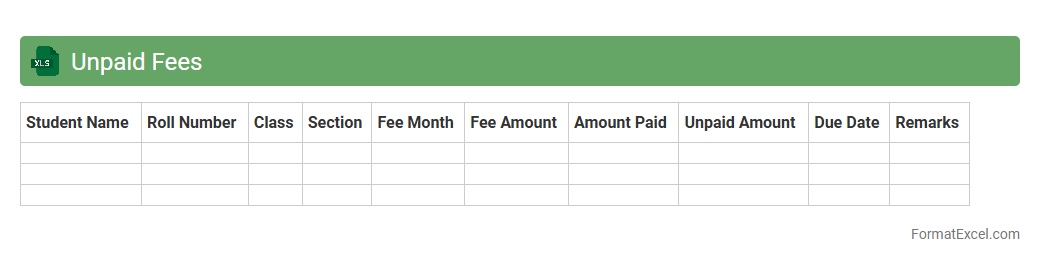

Unpaid Fees

An

Unpaid Fees Excel document is a structured spreadsheet that tracks outstanding payments owed by clients or customers, enabling efficient financial management. It organizes billing information, due dates, and payment statuses, facilitating timely follow-ups and improving cash flow monitoring. This tool enhances accountability and helps businesses identify delinquent accounts to reduce revenue loss.

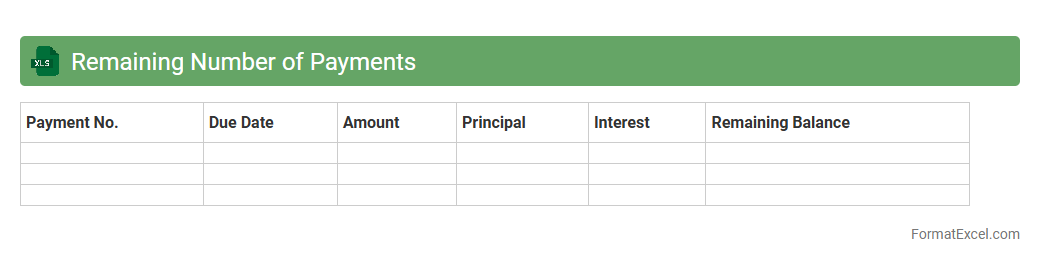

Remaining Number of Payments

The

Remaining Number of Payments Excel document calculates the outstanding payment periods on loans or mortgages, providing clear insight into the repayment timeline. By inputting loan details such as principal, interest rate, and payment amount, users can track how many payments remain, aiding in financial planning and managing debt effectively. This tool enhances budgeting accuracy and helps in forecasting loan payoff dates, empowering better decision-making.

Introduction to Loan Statement Format in Excel

The Loan Statement Format in Excel is a structured way to present loan details clearly and efficiently. Excel allows users to organize data such as principal amounts, interest rates, and payment schedules. This format simplifies tracking and analyzing loan information.

Importance of Structured Loan Statements

A well-organized loan statement is crucial for transparency and financial management. It helps both lenders and borrowers understand payment history and outstanding balances. Structured statements reduce errors and improve communication.

Key Components of a Loan Statement

The main elements include loan amount, interest rate, repayment schedule, and outstanding balance. Each component provides vital information for monitoring the loan status. Including payment dates and amounts ensures clarity.

Essential Excel Features for Loan Statements

Excel's formulas, tables, and conditional formatting are essential for loan statements. These features automate calculations and highlight important data. Using Excel ensures accuracy and easy updates.

Step-by-Step Guide: Designing Loan Statement in Excel

Start by setting up columns for date, payment, principal, interest, and balance. Use formulas to calculate totals and outstanding amounts automatically. Formatting cells properly enhances readability and professionalism of your statement.

Sample Loan Statement Template in Excel

A sample template includes predefined rows and columns to input loan details quickly. This template saves time and ensures consistency across statements. Templates often include formulas for interest and balance computations.

Automating Calculations for Loan Repayments

Automation in Excel reduces manual errors by calculating interest and principal automatically. Using formulas like PMT and IPMT simplifies repayment schedules. This improves efficiency and accuracy in reports.

Customizing Loan Statements per User Needs

Excel allows customization of loan statements based on borrower or lender requirements. Users can add or remove fields to suit specific needs. Customization enhances usability and personalizes the data presentation.

Tips for Ensuring Accuracy and Consistency

Double-check formulas and use data validation to maintain accuracy in loan statements. Consistent formatting and regular updates prevent data discrepancies. Adopting these practices ensures reliable and professional outputs.

Downloadable Loan Statement Excel Templates

Many websites offer free downloadable templates that simplify creating loan statements in Excel. These templates often come with built-in formulas and customizable layouts. Utilizing them speeds up statement preparation and improves accuracy.