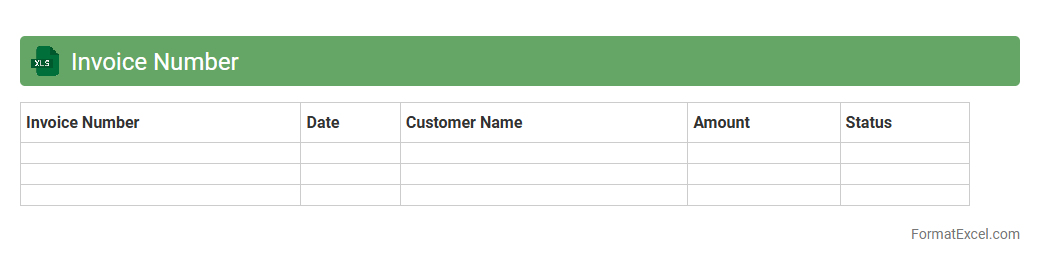

Invoice Number

An

Invoice Number Excel document is a spreadsheet used to organize, track, and manage invoice numbers systematically. It helps businesses maintain accurate financial records, streamline billing processes, and quickly retrieve invoice information for audits or customer inquiries. Using this document enhances efficiency in accounting and ensures consistency in invoice referencing.

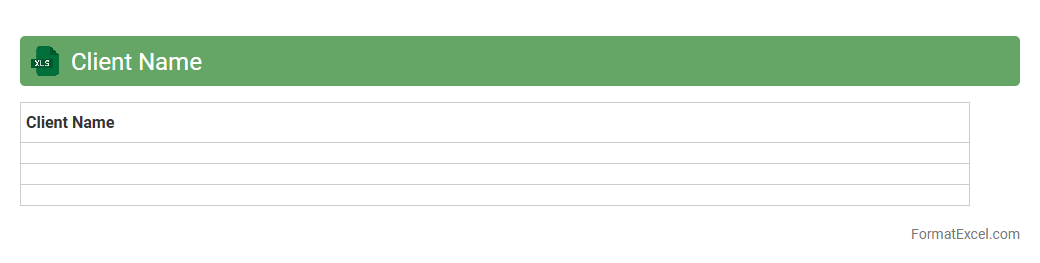

Client Name

The

Client Name Excel document is a structured spreadsheet that organizes and stores essential client information such as contact details, transaction history, and communication logs. This document enables efficient client management by providing quick access to relevant data, improving customer relationship tracking, and facilitating targeted marketing strategies. Utilizing this tool can enhance data accuracy, streamline workflows, and support informed decision-making for business growth.

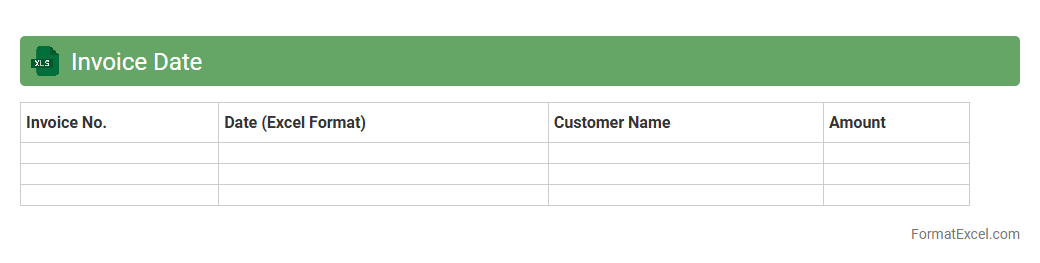

Invoice Date

The

Invoice Date in an Excel document refers to the specific date when an invoice is issued or created, serving as a critical reference point for tracking payment deadlines and financial records. This date helps businesses manage accounts receivable by monitoring due dates, calculating payment terms, and analyzing cash flow timelines effectively. Utilizing the Invoice Date in Excel streamlines financial reporting and enhances accuracy in accounting processes.

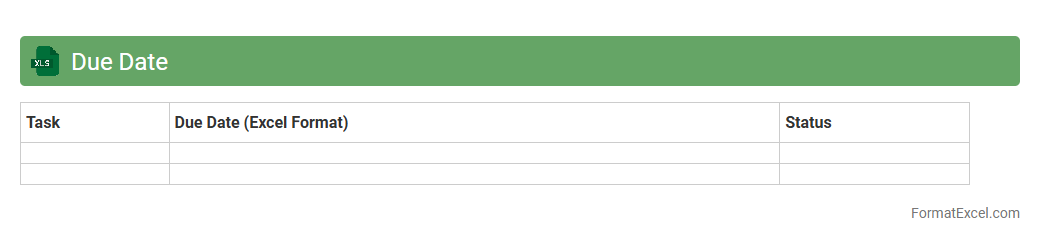

Due Date

A

Due Date Excel document is a spreadsheet designed to track and manage deadlines for tasks, projects, or payments effectively. It allows users to organize important dates, set reminders, and prioritize work, enhancing productivity and time management. This tool is essential for businesses and individuals aiming to avoid missed deadlines and maintain efficient workflow control.

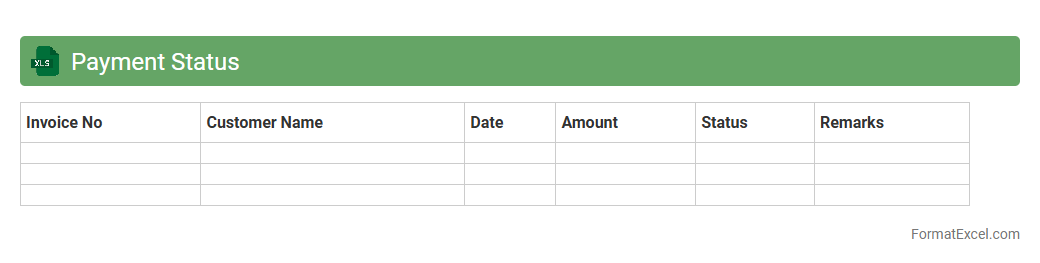

Payment Status

A

Payment Status Excel document is a spreadsheet used to track and manage the details of financial transactions, including payment dates, amounts, and statuses such as pending, completed, or overdue. It helps businesses monitor cash flow, ensure timely payments, and identify outstanding invoices, thereby streamlining financial management. This tool enhances accuracy in record-keeping and supports decision-making by providing a clear overview of payment histories and current obligations.

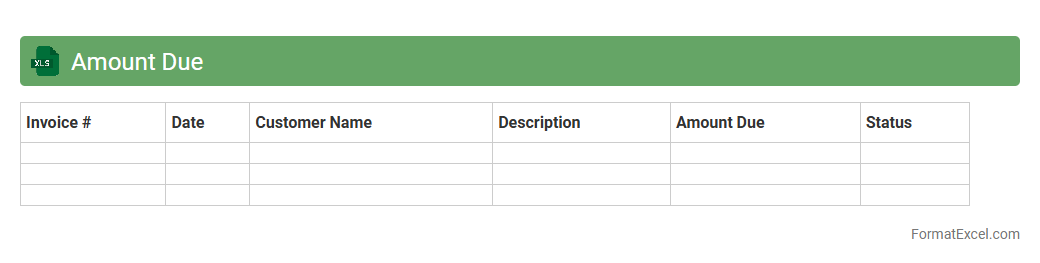

Amount Due

An

Amount Due Excel document is a spreadsheet designed to track outstanding payments and manage invoices efficiently. It allows users to organize billing information, calculate totals automatically, and monitor payment deadlines, reducing errors and enhancing financial accuracy. This tool is essential for businesses and individuals to maintain clear records of dues and streamline their cash flow management.

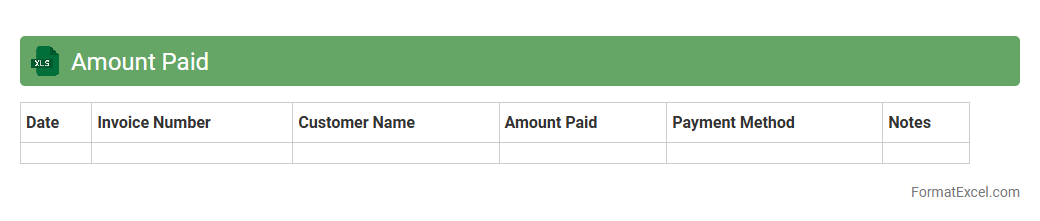

Amount Paid

The

Amount Paid Excel document is a financial tracking tool that records payments made for various expenses or invoices, allowing for organized and accurate expense management. It helps businesses and individuals monitor cash flow, reconcile accounts, and ensure timely payments to vendors or service providers. By systematically documenting all payments, the Excel sheet enhances budget planning and financial reporting efficiency.

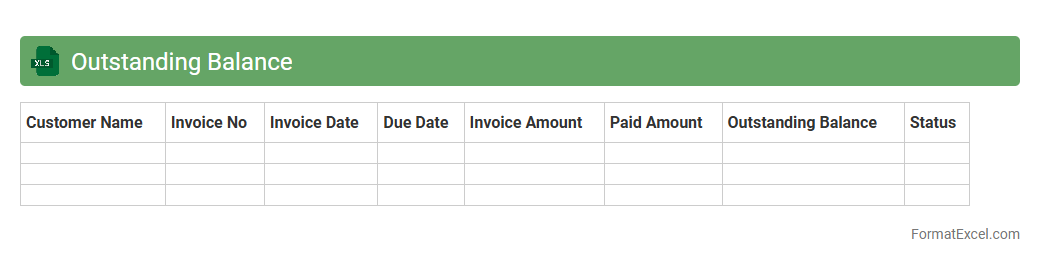

Outstanding Balance

An

Outstanding Balance Excel document is a detailed spreadsheet used to track unpaid amounts owed by customers or clients, helping businesses manage their receivables efficiently. It organizes financial data such as invoice dates, payment terms, and due balances, making it easier to monitor overdue payments and identify cash flow issues. This document is essential for maintaining accurate financial records and improving credit control processes.

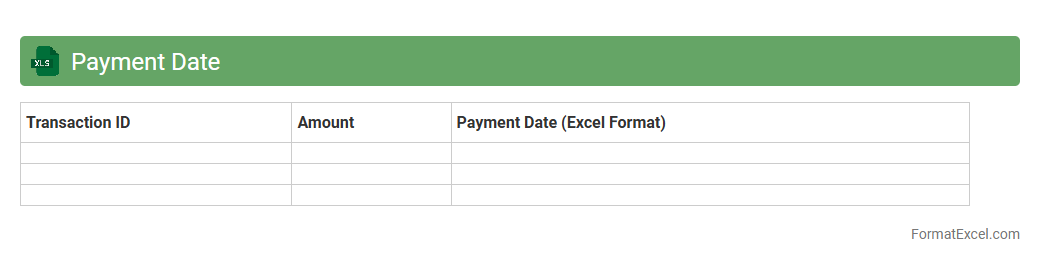

Payment Date

A

Payment Date Excel document is a spreadsheet designed to track and manage payment schedules, due dates, and transaction records efficiently. It helps businesses and individuals organize financial obligations, ensuring timely payments and better cash flow management. By automating reminders and consolidating payment details, this tool reduces errors and enhances financial planning accuracy.

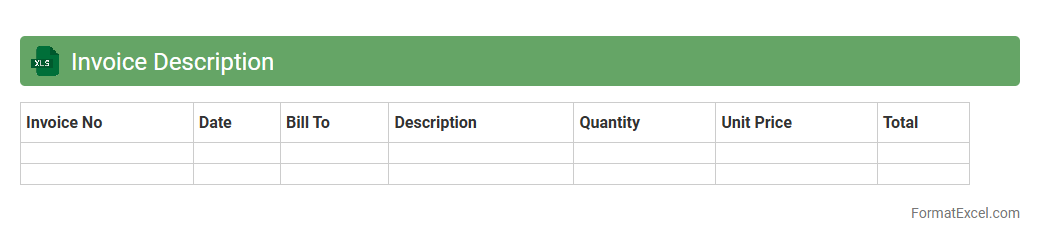

Invoice Description

An

Invoice Description Excel document is a detailed spreadsheet that itemizes products or services, including quantities, prices, and descriptions, facilitating accurate billing and financial tracking. It helps businesses maintain organized records, streamline invoicing processes, and ensure transparency with clients by providing clear payment details. Using this document improves cash flow management and simplifies auditing or tax preparation tasks.

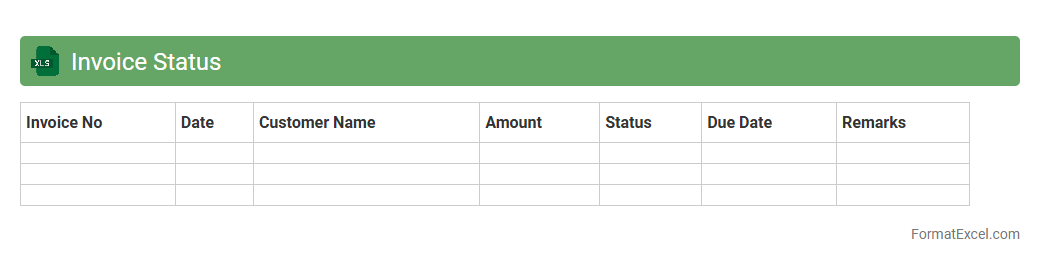

Invoice Status

An

Invoice Status Excel document is a structured spreadsheet used to track and manage the progress of invoices, including payment status, due dates, and client information. It helps businesses maintain accurate financial records, identify overdue payments, and streamline accounts receivable processes. Using this tool improves cash flow management and ensures timely follow-up on outstanding invoices.

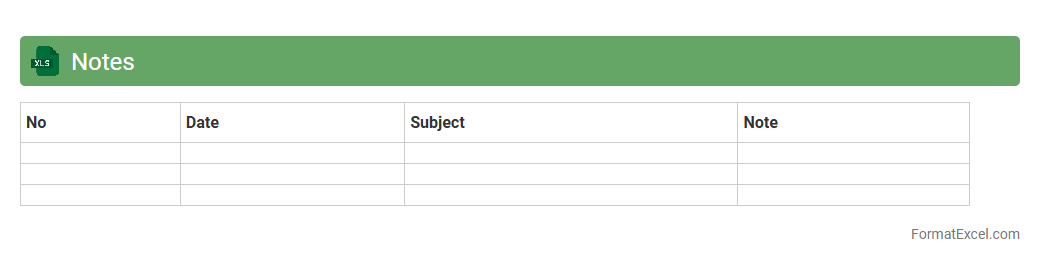

Notes

An

Excel Notes document is a feature within Microsoft Excel that allows users to add detailed annotations or comments to specific cells, helping to clarify data entries, provide context, or explain calculations. These notes enhance collaboration by offering valuable insights directly alongside the data, making complex spreadsheets easier to understand and review. Utilizing Excel Notes improves data accuracy, communication, and overall productivity in both personal and professional workflows.

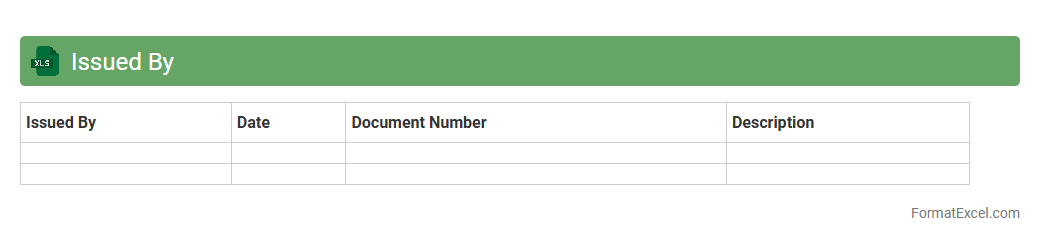

Issued By

Issued By Excel document is a

spreadsheet tool used to record and track the origin or issuer of items, documents, or transactions within an organization. It helps maintain accountability and transparency by clearly identifying the responsible party for each entry, streamlining audit processes and internal controls. This document improves operational efficiency by organizing data for quick reference and reporting.

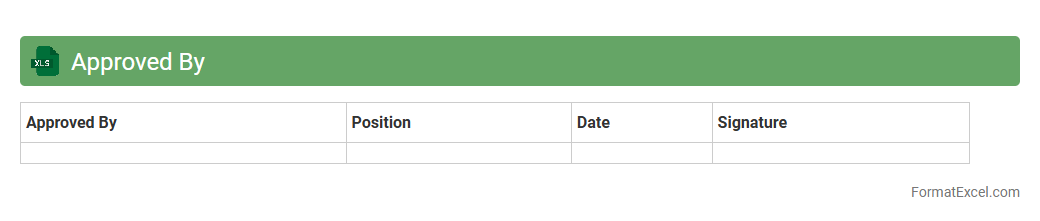

Approved By

An

Approved By Excel document is a spreadsheet used to track and verify authorized approvals within a project, process, or organization. It helps streamline workflow by clearly identifying who has granted approval, ensuring accountability and reducing the risk of errors or unauthorized actions. This document is essential for maintaining compliance, improving communication, and enhancing overall operational efficiency.

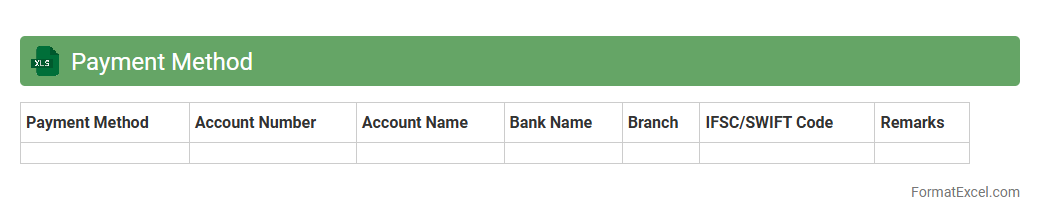

Payment Method

A

Payment Method Excel document is a structured spreadsheet that organizes various payment options, transaction details, and related financial data for easy management and analysis. It helps businesses track payment methods like credit cards, bank transfers, and digital wallets, ensuring accurate recording and reconciliation of payments. Using this document improves financial transparency and streamlines payment processing workflows.

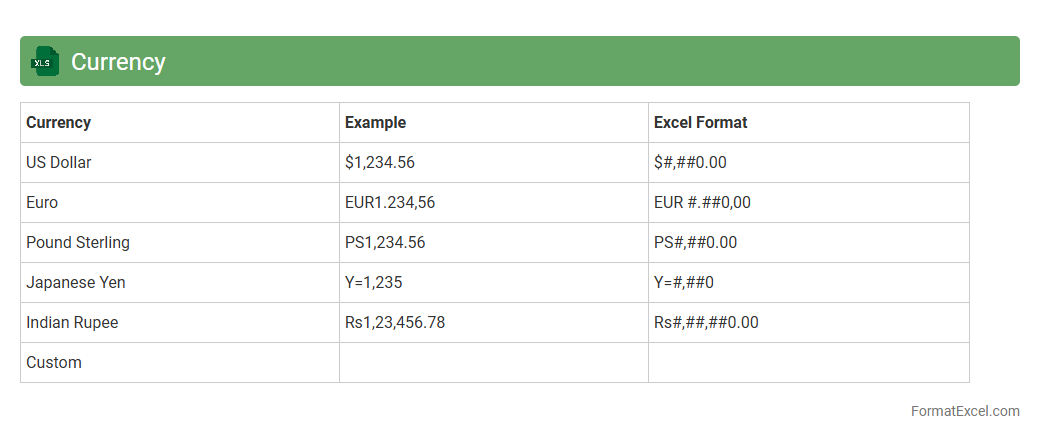

Currency

A

Currency Excel document is a spreadsheet tool designed to track, convert, and analyze various global currencies efficiently. It helps users manage financial data by providing real-time exchange rates, automatic calculations, and customizable templates for budgeting, forecasting, and reporting in multiple currencies. This document is especially valuable for businesses and individuals involved in international trade or investments to ensure accurate financial planning and decision-making.

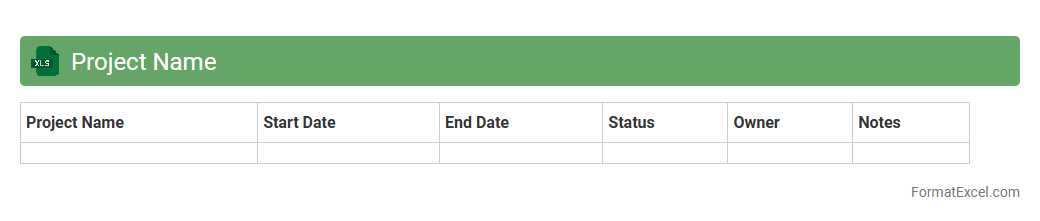

Project Name

A

Project Name Excel document is a structured spreadsheet used to organize and track the details, timelines, and progress of a specific project. It helps teams manage tasks, allocate resources, and monitor milestones efficiently by providing a centralized platform for data entry and analysis. This tool enhances project visibility, communication, and decision-making, ensuring successful project execution and timely delivery.

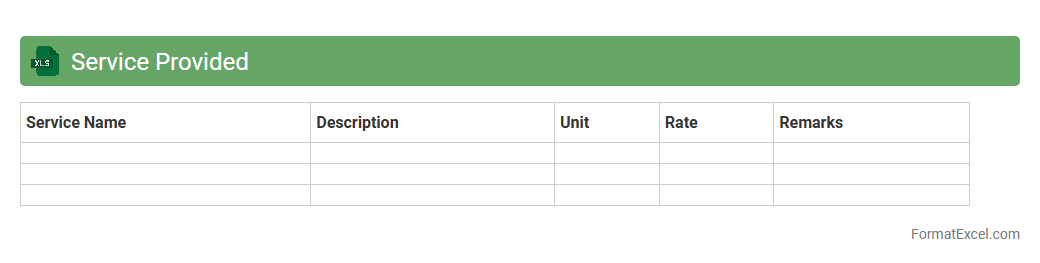

Service Provided

A

Service Provided Excel document is a structured spreadsheet used to track and organize details of services delivered to clients or customers. It helps businesses monitor service dates, descriptions, costs, and client information, enabling efficient management and accurate billing. This document improves transparency, simplifies reporting, and supports decision-making by providing a clear record of service activities.

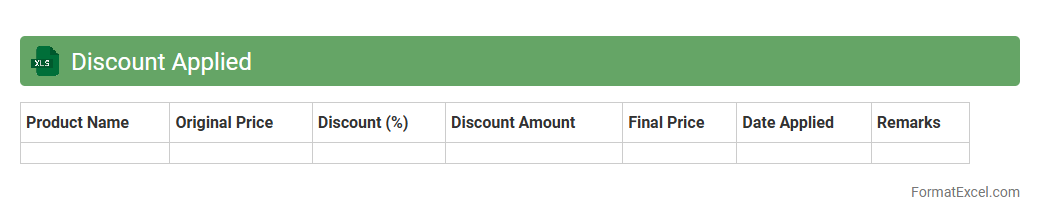

Discount Applied

The

Discount Applied Excel document is a spreadsheet designed to track and manage discounts applied to products or services, allowing businesses to analyze pricing strategies effectively. It helps in monitoring discount patterns, calculating the impact on revenue, and ensuring accurate financial reporting. Utilizing this tool improves decision-making by providing clear insights into promotional effectiveness and customer savings.

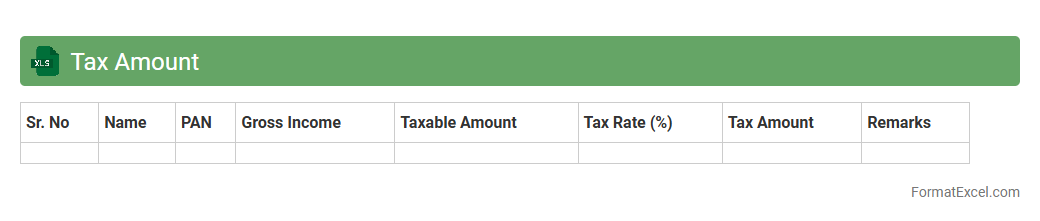

Tax Amount

The

Tax Amount Excel document is a specialized spreadsheet designed to calculate, organize, and analyze various tax-related figures for individuals or businesses. It allows users to input income, deductions, tax rates, and other financial data to automatically compute accurate tax liabilities, ensuring compliance and financial planning. This tool streamlines tax management, reduces errors, and aids in budgeting by providing clear visibility into tax obligations.

Total Amount

The

Total Amount Excel document is a spreadsheet designed to calculate and summarize the overall sum of multiple financial entries, such as expenses, revenues, or budgets. It helps users quickly determine the aggregate value of data points, improving accuracy and efficiency in financial analysis and reporting. By automating total calculations, this document reduces manual errors and saves time, making it an essential tool for business, accounting, and personal finance management.

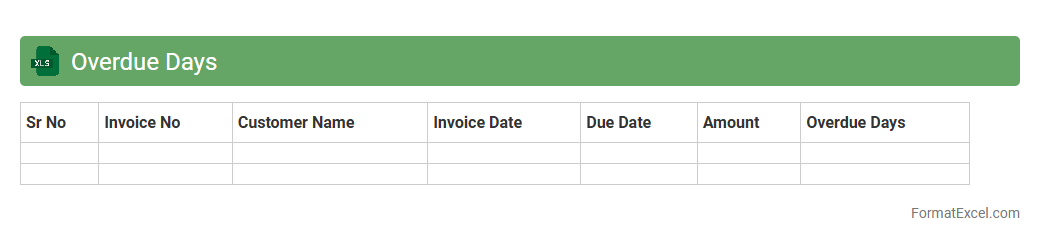

Overdue Days

The

Overdue Days Excel document is a powerful tool used to track the number of days that payments, invoices, or project tasks are past their due date. This spreadsheet helps businesses monitor outstanding receivables, prioritize follow-ups, and improve cash flow management by visually highlighting delays and aging debts. It enhances decision-making by providing clear insights into the financial health and operational efficiency of an organization.

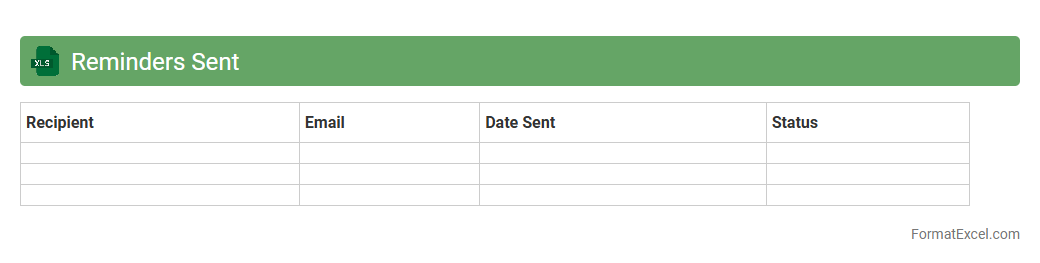

Reminders Sent

The

Reminders Sent Excel document is a structured file used to track and manage reminders sent to clients, employees, or stakeholders regarding important deadlines, appointments, or tasks. It helps organizations maintain timely follow-ups, improve communication efficiency, and reduce the risk of missed obligations by providing a clear record of all sent reminders. Utilizing this document ensures accountability and enhances workflow management through organized data tracking.

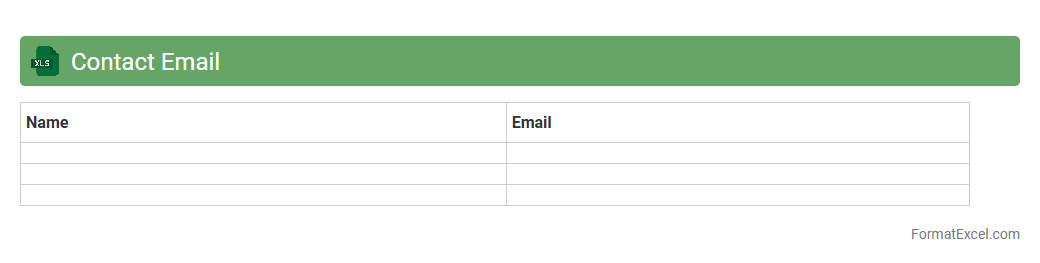

Contact Email

A Contact Email Excel document is a structured spreadsheet containing organized lists of email addresses, often paired with names, phone numbers, or company details. This tool is essential for managing communication efficiently, enabling bulk emailing, marketing campaigns, and customer relationship management. Utilizing a

Contact Email Excel document helps streamline outreach and enhances productivity by providing quick access to contact information.

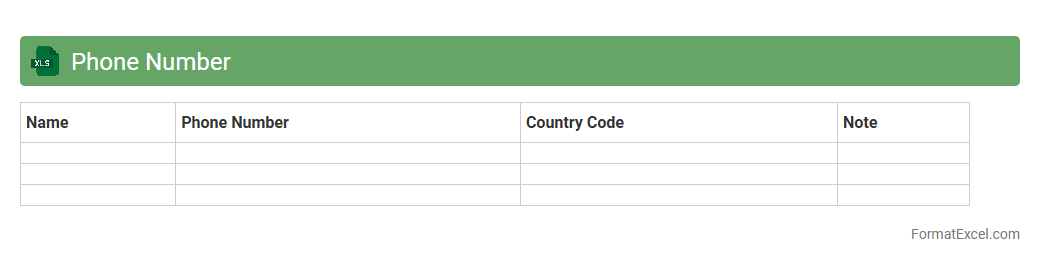

Phone Number

A

Phone Number Excel document is a structured spreadsheet that organizes contact numbers for individuals or businesses, allowing easy access and management. It is useful for efficiently storing, sorting, and retrieving phone numbers, which enhances communication workflows and aids in marketing, customer service, and networking efforts. This document can be customized with additional columns like names, addresses, and email addresses to create a comprehensive contact database.

Introduction to Invoice Tracker Formats

An Invoice Tracker format in Excel is a structured template that helps businesses monitor their invoices efficiently. It organizes financial transactions, ensuring accurate and up-to-date records. Utilizing these formats simplifies managing payment statuses and deadlines.

Benefits of Using Excel for Invoice Tracking

Excel offers flexibility, ease of use, and widespread accessibility, making it ideal for invoice tracking. Its powerful functions allow users to automate calculations and streamline data entry. Most importantly, Excel promotes better financial control through organized invoice management.

Essential Columns for an Invoice Tracker

Key columns include Invoice Number, Date, Client Name, Amount, Due Date, and Payment Status. These fields capture essential details needed for tracking payments and outstanding invoices. Including a Payment Status column is crucial for monitoring overdue accounts.

Step-by-Step Guide to Creating an Invoice Tracker in Excel

Start by setting up a table with labeled columns for all necessary invoice information. Use data validation and conditional formatting to improve accuracy and visual alerts. Finally, incorporate formulas to calculate totals and highlight due dates automatically.

Customizing Your Excel Invoice Tracker

Tailor your tracker by adding columns for taxes, discounts, or additional notes relevant to your billing process. Adjust formatting and design to enhance readability and usability. Customized features ensure the invoice tracker aligns with your specific business needs.

Sample Invoice Tracker Template in Excel

A well-designed sample template includes all essential columns with pre-set formulas and filters. It serves as a practical starting point that can be easily modified according to the business's requirements. Using a template saves time and reduces errors.

Tips for Automating Invoice Tracking with Excel

Leverage Excel functions like IF statements, VLOOKUP, and macros to automate data processing and reminders. Set up alerts for overdue invoices using conditional formatting to stay on top of payments. Automation enhances efficiency and prevents missed payments.

Common Mistakes to Avoid in Excel Invoice Trackers

Avoid inconsistent data entry, lack of backups, and ignoring overdue invoices in the tracker. Not maintaining regularly updated records can cause financial discrepancies. Ensuring data accuracy and regular updates is essential for effective tracking.

Integrating Excel Invoice Trackers with Other Tools

Connecting Excel trackers with accounting software or cloud storage improves workflow and data accessibility. Tools like Power Query or APIs enable seamless data sync between platforms. Integration ensures up-to-date information across all financial systems.

Best Practices for Maintaining Invoice Tracker Records

Regularly update the tracker immediately after transactions to keep records current. Back up files and control access to protect sensitive financial data. Following these best practices guarantees reliable and secure invoice management.