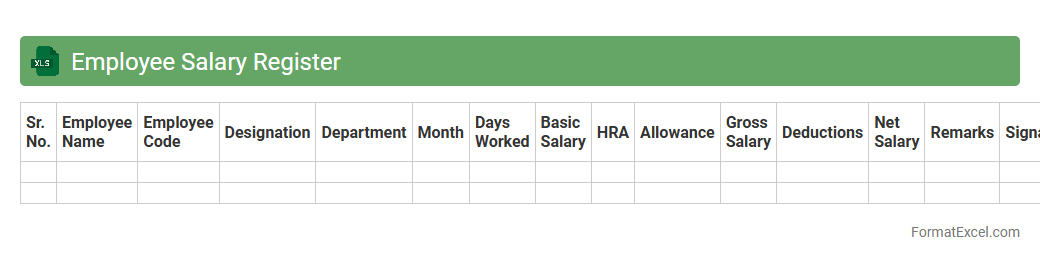

Employee Salary Register

An

Employee Salary Register Excel document systematically records detailed salary information for each employee, including basic pay, allowances, deductions, and net salary. This register enables businesses to maintain accurate payroll records, ensure compliance with tax regulations, and facilitate financial auditing. It also helps HR teams track salary trends, manage budgets, and generate reports efficiently.

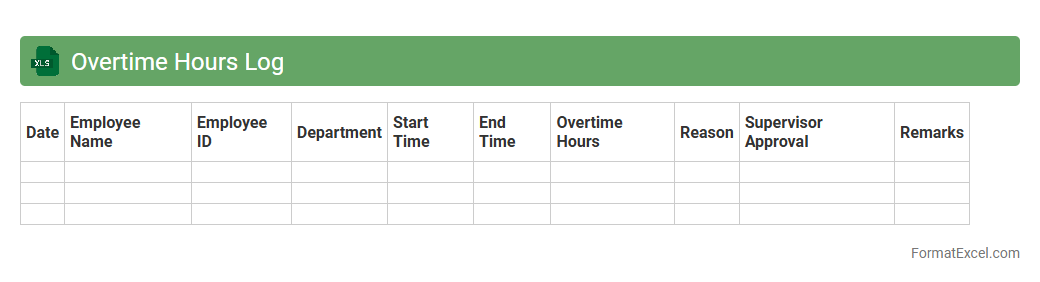

Overtime Hours Log

An

Overtime Hours Log Excel document is a detailed spreadsheet used to record and track extra hours worked beyond regular schedules. It enables accurate calculation of overtime pay, ensuring compliance with labor laws and company policies. Utilizing this log improves payroll accuracy and helps manage employee workload effectively.

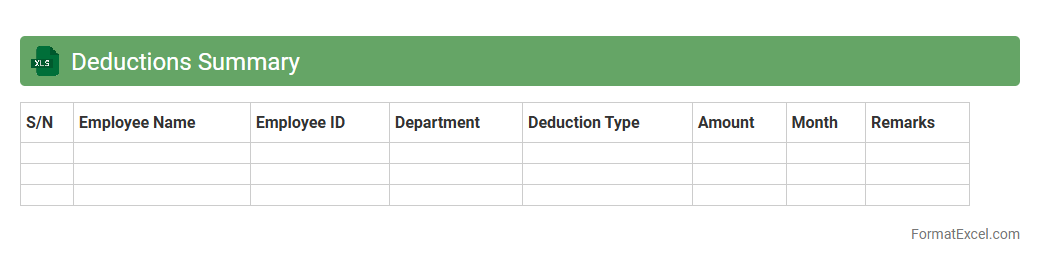

Deductions Summary

A

Deductions Summary Excel document consolidates all payroll deductions including taxes, insurance premiums, retirement contributions, and other withholdings into a single, organized format. It helps businesses maintain accurate financial records, ensures compliance with tax regulations, and simplifies the reconciliation of employee paychecks. Using this summary enhances transparency and efficiency in payroll management by providing a clear overview of all deductions at a glance.

Bonuses and Incentives Tracker

The

Bonuses and Incentives Tracker Excel document organizes employee rewards, allowing clear tracking of bonus eligibility, amounts, and payment dates. This tool enhances transparency and accountability in compensation management, helping businesses maintain accurate records and streamline payroll processes. By using this tracker, companies can motivate staff effectively and ensure timely distribution of bonuses and incentives.

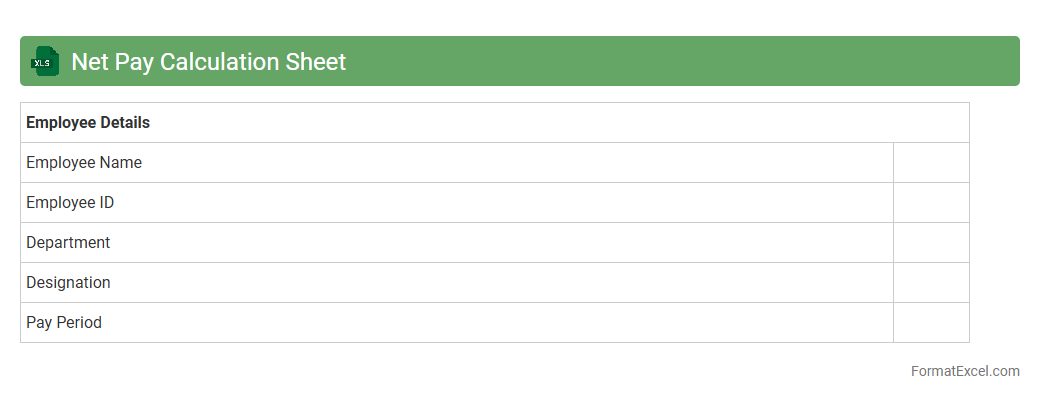

Net Pay Calculation Sheet

A

Net Pay Calculation Sheet Excel document is a structured tool designed to accurately calculate an employee's take-home salary after deductions such as taxes, insurance, and retirement contributions. It streamlines payroll processing by automating complex calculations, reducing errors, and ensuring compliance with tax laws and company policies. This document is essential for HR departments and accountants to efficiently manage salary disbursements and maintain transparent financial records.

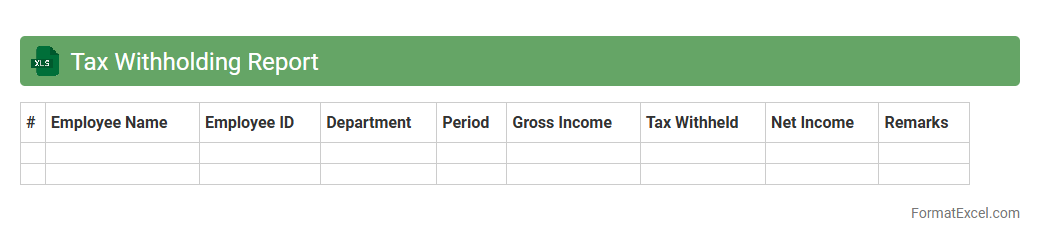

Tax Withholding Report

A

Tax Withholding Report Excel document summarizes the amount of income tax withheld from employees' wages or payments made to contractors throughout a specific period. It helps businesses accurately track withholding compliance, facilitate timely tax filings, and ensure proper financial record-keeping. This report streamlines reconciliation with tax authorities and supports effective payroll management.

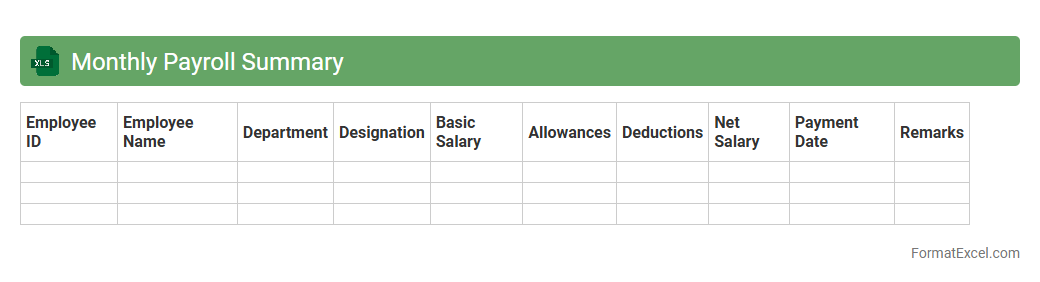

Monthly Payroll Summary

A

Monthly Payroll Summary Excel document consolidates employee salary details, deductions, taxes, and net pay into one organized sheet for easy tracking and management. It helps businesses maintain accurate financial records, ensures compliance with tax regulations, and simplifies payroll processing. Using this summary enhances transparency and aids in budgeting and auditing payroll expenses effectively.

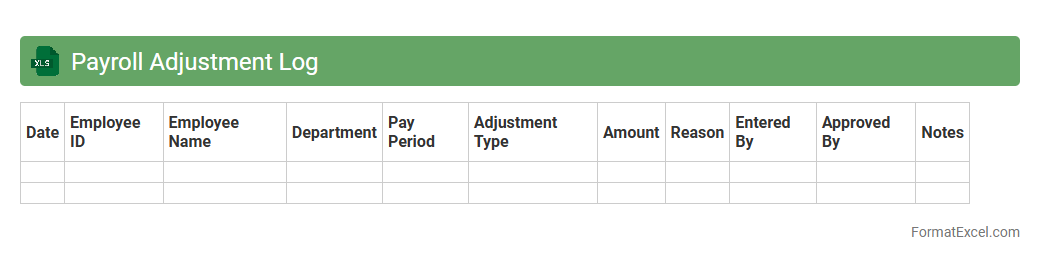

Payroll Adjustment Log

The

Payroll Adjustment Log Excel document is a detailed record used to track changes made to employee payroll data, including corrections for hours worked, salary updates, tax adjustments, and bonuses. This log ensures accuracy and transparency in the payroll process by providing a clear audit trail for all modifications, helping to prevent discrepancies and errors. Employers and payroll managers rely on this tool to maintain compliance with labor regulations and improve financial reporting efficiency.

Leave and Absence Tracker

A

Leave and Absence Tracker Excel document is a tool designed to record, monitor, and manage employee leave and absences systematically. It helps organizations maintain accurate attendance records, streamline payroll processing, and ensure compliance with labor regulations. Utilizing this tracker improves workforce management by providing clear visibility into employee availability and leave balances.

Payslip Generation Sheet

The

Payslip Generation Sheet Excel document automates the process of creating individual employee payslips by organizing salary details, tax deductions, and bonuses in one place. It streamlines payroll management, reduces errors, and saves time for HR departments by generating accurate, customized payslips quickly. This tool enhances transparency and record-keeping, ensuring employees receive clear and detailed salary breakdowns.

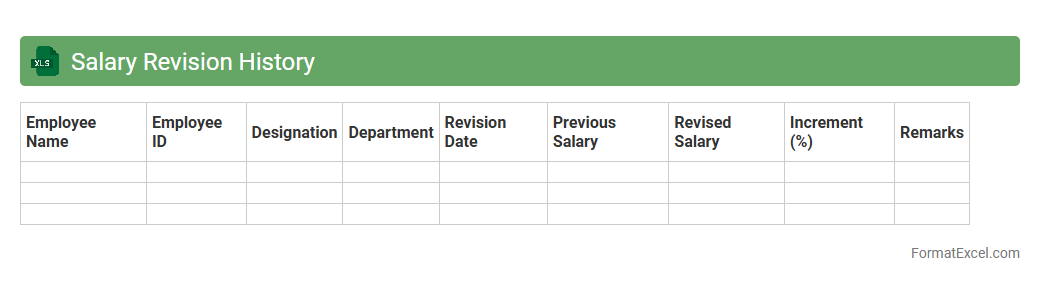

Salary Revision History

A

Salary Revision History Excel document systematically tracks employee salary changes over time, recording key details such as revision dates, previous and revised salary amounts, and reasons for adjustments. This organized data aids HR and management in analyzing compensation trends, ensuring fair pay practices, and maintaining accurate payroll records. Access to a clear salary revision history enhances decision-making for future salary negotiations and budgeting processes.

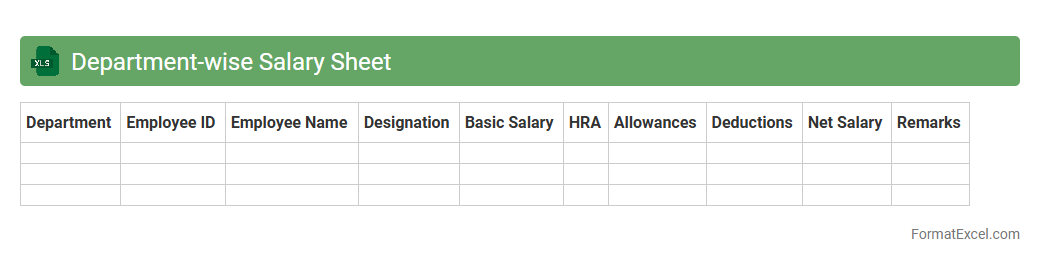

Department-wise Salary Sheet

A

Department-wise Salary Sheet Excel document organizes employee salary details categorized by each department, enabling efficient payroll management and budgeting. It helps track total compensation expenses departmentally, facilitating accurate financial reporting and resource allocation. Employers can use this tool to compare salary distributions, identify discrepancies, and streamline salary disbursement processes.

Payroll Journal Entries

A

Payroll Journal Entries Excel document systematically records employee compensation transactions, including salaries, wages, taxes, and deductions. It streamlines the accounting process by organizing payroll data into easily reviewable entries, ensuring accuracy and compliance with financial regulations. This tool enhances financial reporting efficiency and supports the reconciliation of payroll accounts within accounting systems.

Loan and Advance Recovery Tracker

The

Loan and Advance Recovery Tracker Excel document is a powerful tool designed to monitor outstanding loans and advances systematically, ensuring timely recovery. It helps organizations and individuals maintain accurate records of borrower details, repayment schedules, and recovery status, reducing the risk of missed payments and financial discrepancies. By providing clear visibility into recovery progress, this tracker enhances financial management and decision-making efficiency.

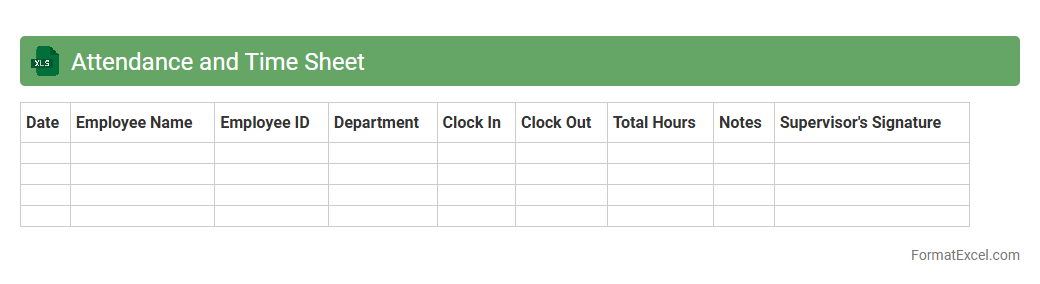

Attendance and Time Sheet

A

Attendance and Time Sheet Excel document is a structured spreadsheet used to record employee work hours, attendance, and breaks systematically. It streamlines tracking labor hours, ensuring accurate payroll processing and compliance with labor laws. This tool enhances productivity management by providing clear insights into workforce attendance patterns and time utilization.

Provident Fund Contribution Tracker

The

Provident Fund Contribution Tracker Excel document is a financial management tool designed to record and monitor employee contributions towards their provident fund systematically. It helps track monthly deposits, calculate interest accrued, and ensure compliance with statutory requirements, making it easier to manage retirement savings accurately. This tracker enhances transparency and simplifies the reconciliation process for both employers and employees, ensuring timely updates and financial planning efficiency.

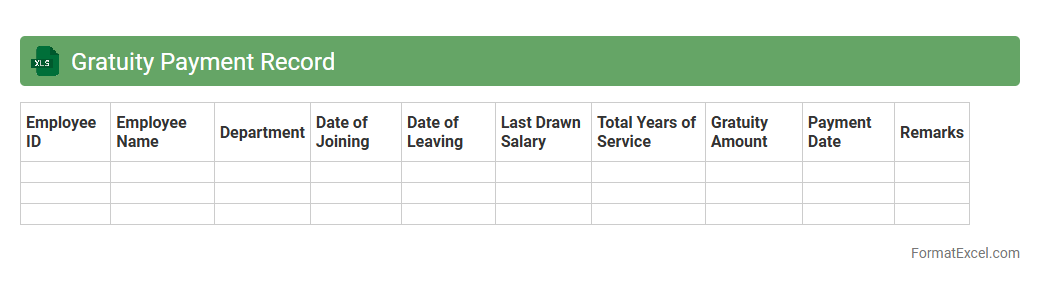

Gratuity Payment Record

The

Gratuity Payment Record Excel document systematically tracks employee gratuity payments, ensuring accurate and timely settlements in accordance with company policies and legal requirements. It consolidates critical details such as employee tenure, gratuity amounts, payment dates, and approval status, facilitating transparent financial management and audit readiness. This organized record helps HR and finance teams efficiently calculate payouts, avoid discrepancies, and maintain compliance with labor laws.

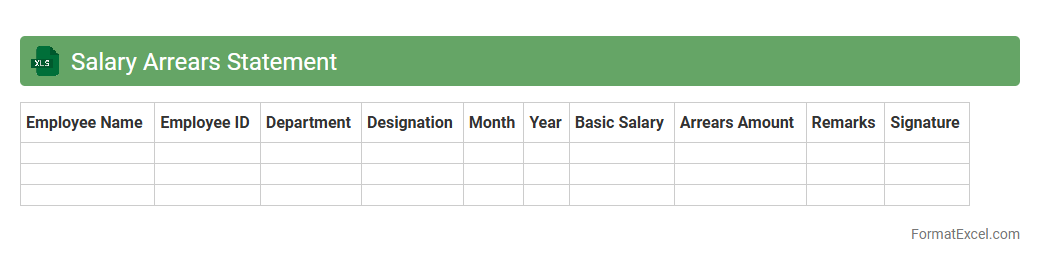

Salary Arrears Statement

A

Salary Arrears Statement Excel document is a detailed report that records outstanding salary payments owed to employees, including amounts, dates, and reasons for the arrears. It helps organizations track unpaid wages accurately, ensuring timely settlements and compliance with payroll regulations. This document simplifies payroll reconciliation, aids audit processes, and enhances financial transparency within the company.

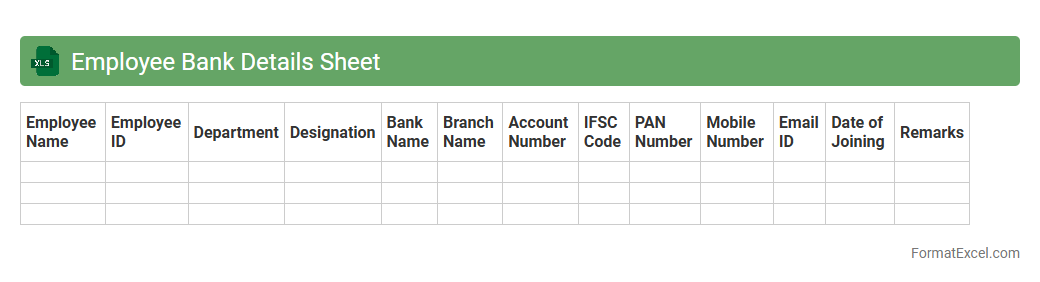

Employee Bank Details Sheet

The

Employee Bank Details Sheet Excel document is a structured spreadsheet used to record and manage employees' bank account information, including account numbers, bank names, IFSC codes, and branch details. It ensures accurate and secure payroll processing by facilitating direct salary deposits, minimizing errors, and streamlining financial transactions. This document proves essential for HR and finance departments to maintain organized records, support audits, and enhance payroll efficiency.

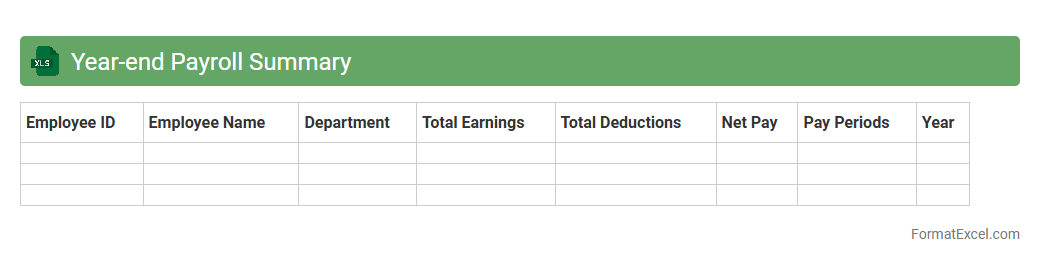

Year-end Payroll Summary

The

Year-end Payroll Summary Excel document consolidates all employee salary, bonuses, tax deductions, and other payroll data for an entire fiscal year into one comprehensive file. It facilitates accurate tax reporting, simplifies compliance with government regulations, and aids in financial auditing by providing a clear overview of total payroll expenses. Employers use this summary to generate employee tax forms, calculate benefits, and make informed budgeting decisions for upcoming years.

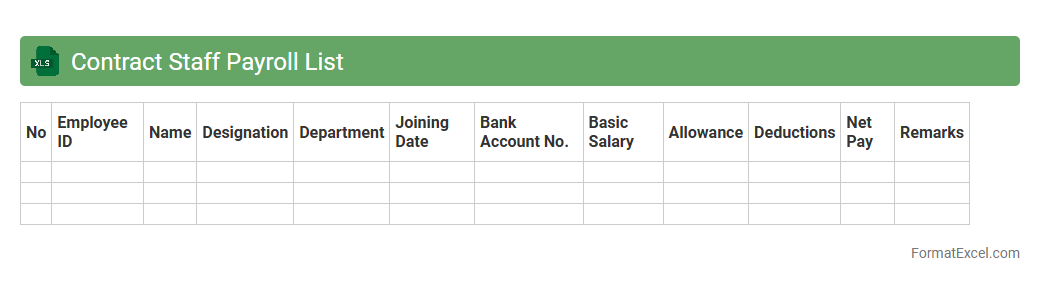

Contract Staff Payroll List

The

Contract Staff Payroll List Excel document is a comprehensive tool designed to record and manage payment details for temporary or contract employees, including wages, tax deductions, and bonuses. It helps streamline payroll processing by ensuring accurate tracking of salary disbursements and compliance with labor regulations. This document enhances financial transparency and simplifies reporting, making payroll administration more efficient and error-free.

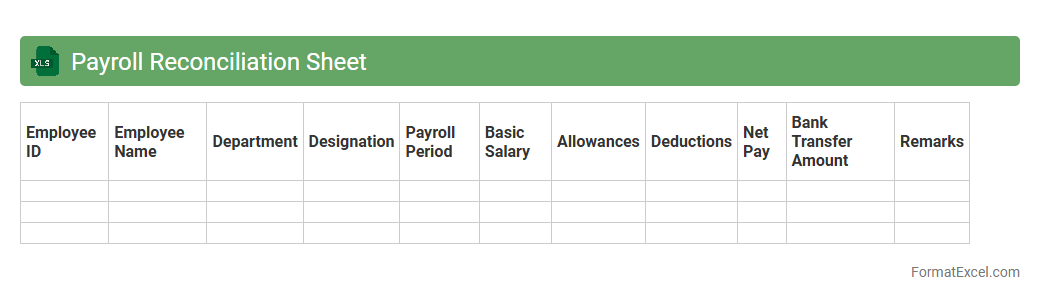

Payroll Reconciliation Sheet

A

Payroll Reconciliation Sheet Excel document is a detailed financial tool used to compare and verify payroll transactions against company records for accuracy. It helps identify discrepancies in employee payments, tax deductions, and benefits, ensuring compliance with statutory requirements and internal policies. This document streamlines auditing processes, reduces errors, and supports transparent payroll management for effective financial control.

Pay Period Tracker

A

Pay Period Tracker Excel document is a spreadsheet tool designed to record and monitor employee work hours, pay periods, and payroll data accurately. It helps businesses ensure timely and precise compensation by organizing pay dates, calculating total hours worked, and tracking overtime or leave days. This tool streamlines payroll processing, reduces errors, and enhances financial management efficiency.

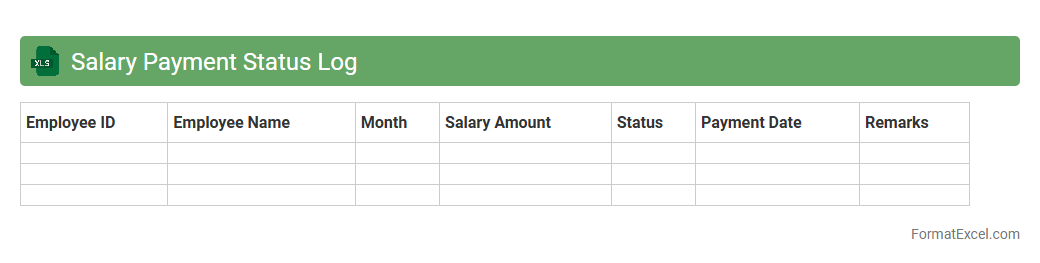

Salary Payment Status Log

The

Salary Payment Status Log Excel document tracks employee salary disbursements, recording payment dates, amounts, and outstanding balances to ensure accurate financial management. It facilitates payroll reconciliation, prevents payment errors, and supports timely salary processing by providing a clear overview of payment statuses. This tool enhances transparency, accountability, and efficient payroll audits within organizations.

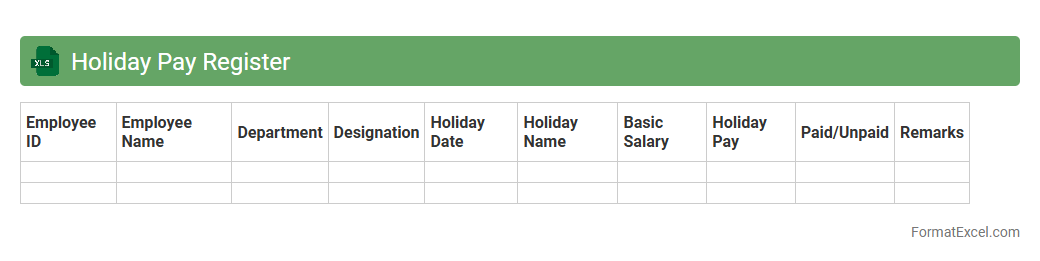

Holiday Pay Register

The

Holiday Pay Register Excel document is a comprehensive tool designed to track and manage employee holiday pay details efficiently. It helps organizations calculate accurate holiday entitlements, monitor leave balances, and ensure compliance with labor regulations. By providing clear records and automated calculations, this register minimizes payroll errors and streamlines the holiday pay management process.

Introduction to Payroll Tracker Formats in Excel

A Payroll Tracker in Excel is a powerful tool designed to streamline employee salary management and payment tracking. It allows businesses to maintain organized, accurate records of wages, taxes, bonuses, and deductions. Using Excel ensures flexibility and easy customization for various payroll needs.

Key Features of an Effective Payroll Tracker

An effective payroll tracker integrates automated calculations, error detection, and comprehensive data entry options. It should accommodate tax deductions, benefits, and overtime pay to ensure accurate payroll processing. Real-time updates and clear summaries make it easier for HR managers to review payroll data.

Essential Columns to Include in Your Payroll Sheet

Your payroll sheet must include columns for Employee Name, ID, Basic Salary, Deductions, Taxes, Bonuses, and Net Pay. Adding columns like Attendance and Overtime improves payroll accuracy. Each element contributes to a complete and transparent payroll record.

Step-by-Step Guide to Setting Up a Payroll Tracker

Start by defining your payroll elements and creating corresponding columns in Excel. Use formulas to calculate totals and deductions automatically. Finally, apply data validation and conditional formatting to improve accuracy and visualization.

Customizing Payroll Tracker Templates for Your Business

Customize your payroll template by tailoring columns, formulas, and data fields to fit your specific business needs. Incorporate company-specific tax rules and benefit schemes to enhance relevance. This flexibility ensures the tracker matches your payroll policies precisely.

Automating Calculations with Excel Formulas

Excel formulas such as SUM, IF, and VLOOKUP automate salary calculations, tax deductions, and overtime pay. This reduces manual errors and saves time during payroll processing. Automation enhances the accuracy and efficiency of payroll management.

Integrating Attendance and Overtime Data

Linking attendance records and overtime data to the payroll tracker ensures correct salary adjustments for hours worked. This integration helps calculate bonuses and penalties accurately. Proper data connections improve the overall payroll precision.

Ensuring Data Security and Confidentiality

Protect payroll data with password encryption and restricted access permissions in Excel. Maintaining confidentiality boosts employee trust and complies with legal requirements. Securing your payroll tracker safeguards sensitive financial information.

Troubleshooting Common Payroll Tracker Issues

Common issues include formula errors, data entry mistakes, and version conflicts. Regularly auditing the tracker and using Excel's error checking functions can resolve these problems. Consistent maintenance ensures reliable and error-free payroll processing.

Downloadable Payroll Tracker Excel Templates

Various downloadable Excel templates are available online for immediate use and customization. These templates can save setup time while offering structured formats suitable for diverse payroll needs. Choose templates that match your business size and complexity for best results.