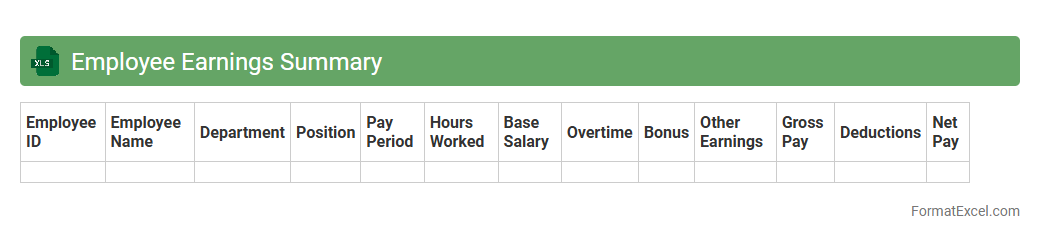

Employee Earnings Summary

The

Employee Earnings Summary Excel document is a detailed record that consolidates individual employee wages, bonuses, deductions, and net pay within a specific pay period. It enables HR professionals and payroll managers to efficiently track compensation data, ensuring accuracy in financial reporting and compliance with tax regulations. By providing a clear overview of earnings, this document supports budget planning, payroll audits, and employee compensation analysis.

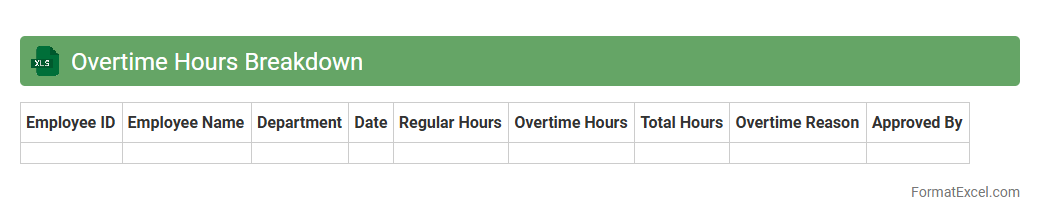

Overtime Hours Breakdown

The

Overtime Hours Breakdown Excel document provides a detailed analysis of extra hours worked by employees beyond their regular schedule, organized by date, department, and individual. It allows managers to monitor labor costs, ensure compliance with labor regulations, and identify patterns in workforce productivity. This tool is essential for optimizing staffing decisions, budgeting accurately, and improving overall operational efficiency.

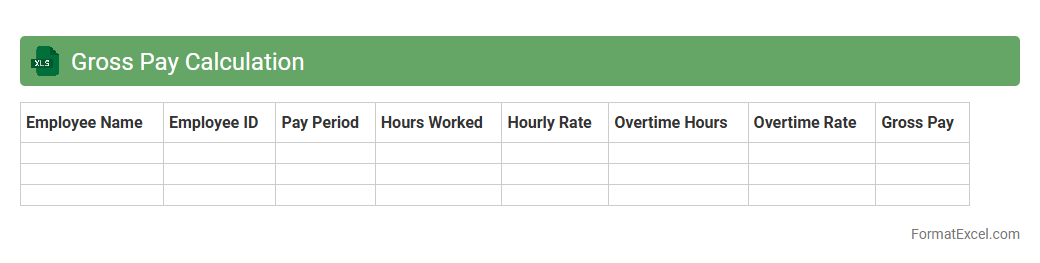

Gross Pay Calculation

A

Gross Pay Calculation Excel document is a spreadsheet tool designed to automatically compute an employee's total earnings before deductions such as taxes and benefits. It streamlines payroll processing by inputting hours worked, pay rates, and overtime, ensuring accurate and efficient salary calculations. This document is essential for businesses to manage employee compensation, maintain financial accuracy, and simplify record-keeping.

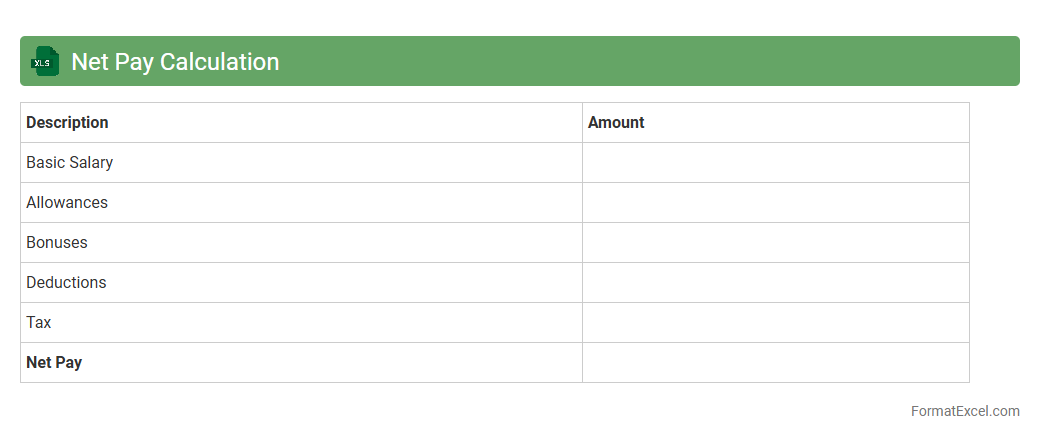

Net Pay Calculation

A

Net Pay Calculation Excel document is a spreadsheet tool designed to compute an employee's take-home salary after deducting taxes, insurance, and other contributions from the gross pay. It streamlines payroll processing by accurately calculating net wages, ensuring compliance with tax regulations and reducing manual errors. This document is useful for HR professionals and finance teams to efficiently manage salary disbursements and maintain transparent payroll records.

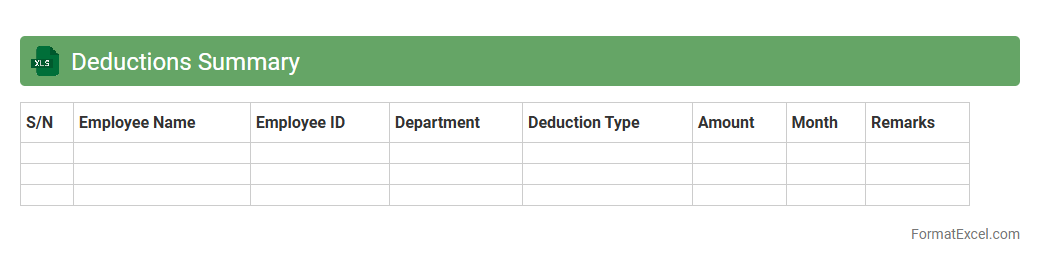

Deductions Summary

A

Deductions Summary Excel document consolidates all employee deductions such as taxes, insurance, and retirement contributions into a clear and organized format. It helps payroll departments ensure accuracy in withholding amounts and provides a quick reference for financial reporting and auditing. This summary enables efficient tracking and management of employee benefits and compliance with regulatory requirements.

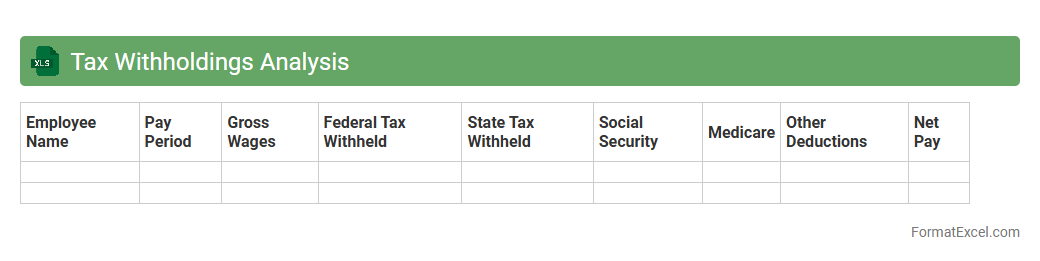

Tax Withholdings Analysis

The

Tax Withholdings Analysis Excel document is a detailed tool designed to track and evaluate the accuracy of income tax withholdings from salaries or payments. It helps identify discrepancies between actual withholdings and expected tax liabilities, ensuring compliance and avoiding underpayment penalties. By providing clear insights into withheld amounts, this document supports better financial planning and cash flow management for individuals and businesses.

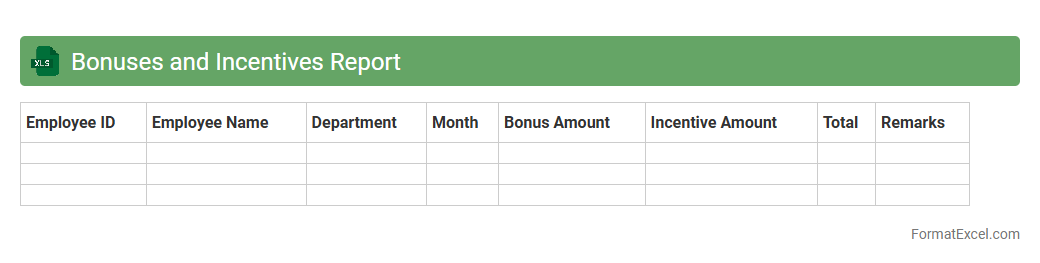

Bonuses and Incentives Report

The

Bonuses and Incentives Report Excel document systematically tracks employee rewards, linking performance metrics to financial incentives and bonuses. It enables organizations to analyze compensation distribution, identify trends, and ensure equitable and motivating reward systems. This report facilitates data-driven decisions, optimizing employee motivation and aligning incentives with company goals.

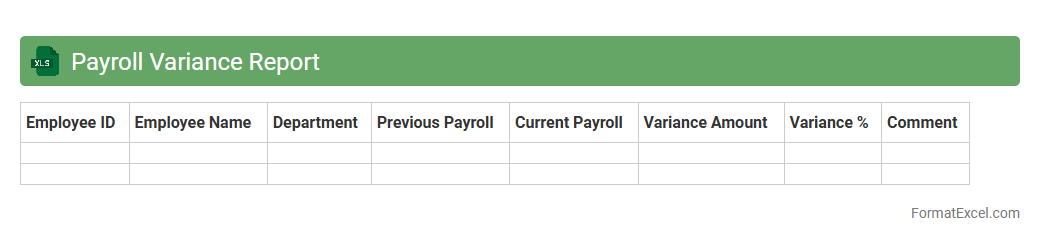

Payroll Variance Report

A

Payroll Variance Report Excel document tracks differences between actual payroll expenses and budgeted amounts, allowing businesses to identify discrepancies in labor costs. This report highlights variances in employee hours, wages, and benefits, enabling accurate financial control and informed decision-making. It is crucial for monitoring workforce expenses, ensuring budget adherence, and optimizing payroll management efficiency.

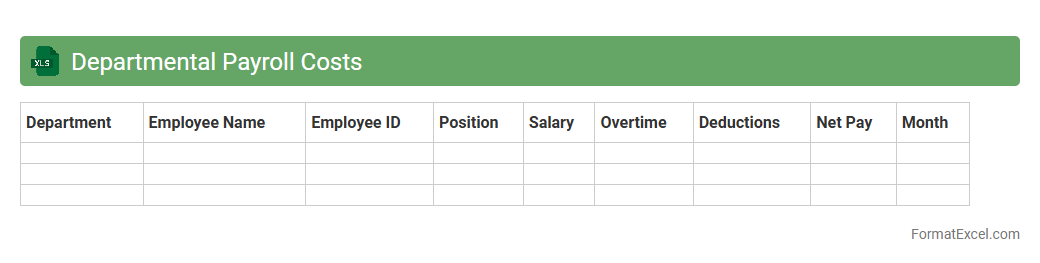

Departmental Payroll Costs

The

Departmental Payroll Costs Excel document is a detailed financial tool designed to track and analyze payroll expenses across different departments within an organization. It enables management to monitor labor costs, allocate budgets accurately, and identify areas for cost optimization. By providing clear visibility into department-specific payroll data, this document supports informed decision-making and enhances overall financial control.

Payroll Accruals Tracking

Payroll Accruals Tracking Excel document is a

financial management tool designed to monitor and record payroll expenses that have been incurred but not yet paid. It helps businesses ensure accurate accounting by capturing accrued salaries, wages, bonuses, and related liabilities within specific accounting periods. This document aids in maintaining compliance with financial reporting standards, improving cash flow forecasting, and enhancing budget management efficiency.

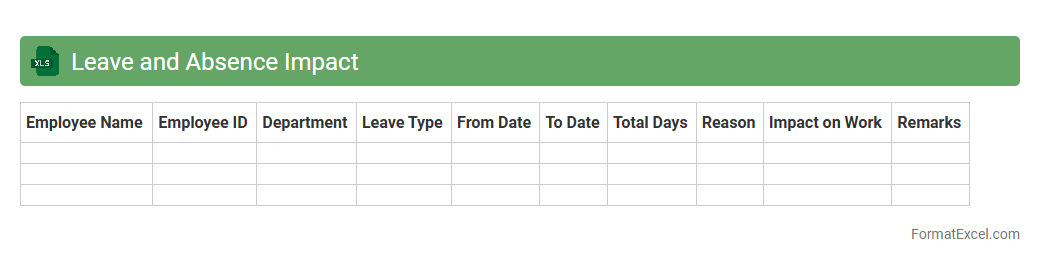

Leave and Absence Impact

The

Leave and Absence Impact Excel document is a comprehensive tool that tracks employee leave patterns and calculates their effects on workforce productivity and project timelines. It helps managers analyze absence trends, forecast staffing needs, and optimize resource allocation by visualizing data such as leave types, durations, and frequency. This efficient monitoring supports better decision-making and maintains operational continuity in organizations.

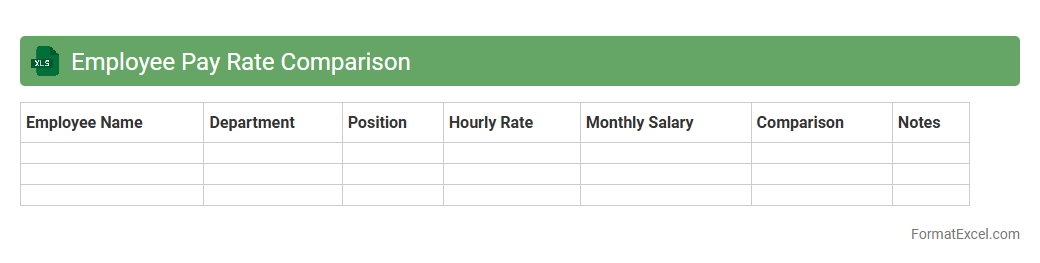

Employee Pay Rate Comparison

The

Employee Pay Rate Comparison Excel document is a tool designed to systematically analyze and contrast salary rates across various roles and departments within an organization. By consolidating pay data, it enables businesses to identify discrepancies, ensure equitable compensation, and make informed decisions on salary adjustments. This document supports maintaining competitive pay structures, enhancing employee satisfaction, and optimizing budget allocation.

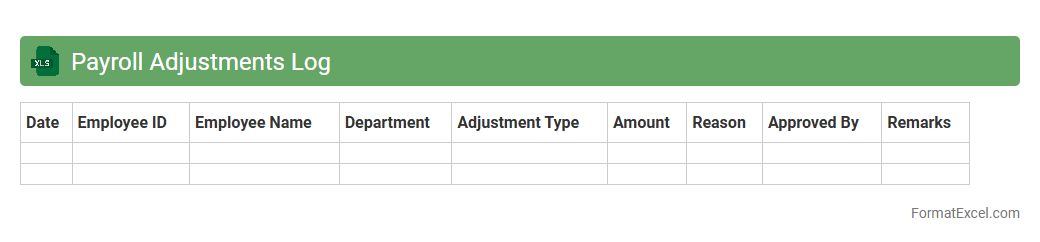

Payroll Adjustments Log

The

Payroll Adjustments Log Excel document is a detailed record used to track changes or corrections made to payroll data such as salary modifications, tax adjustments, and benefit deductions. It helps ensure accuracy in employee compensation by providing a transparent, organized history of all payroll alterations. This log is essential for auditing purposes, compliance with labor laws, and maintaining financial accountability within a company.

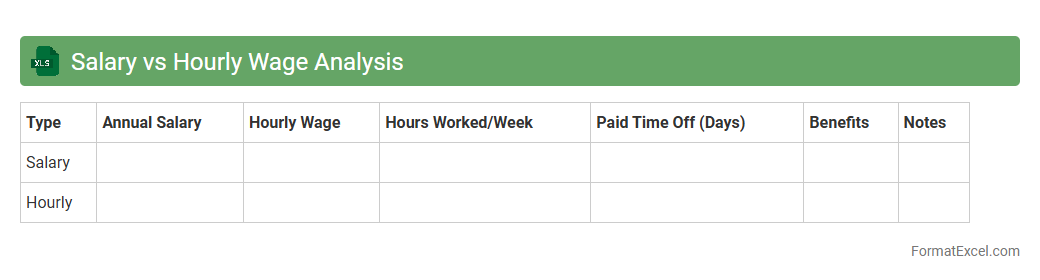

Salary vs Hourly Wage Analysis

A

Salary vs Hourly Wage Analysis Excel document compares the total earnings based on fixed salaries and hourly wages, helping to identify the most cost-effective compensation method. This analysis enables businesses to forecast labor costs accurately, optimize payroll budgets, and ensure fair pay structures aligned with work hours. Utilizing this tool improves financial planning and supports strategic decision-making in human resource management.

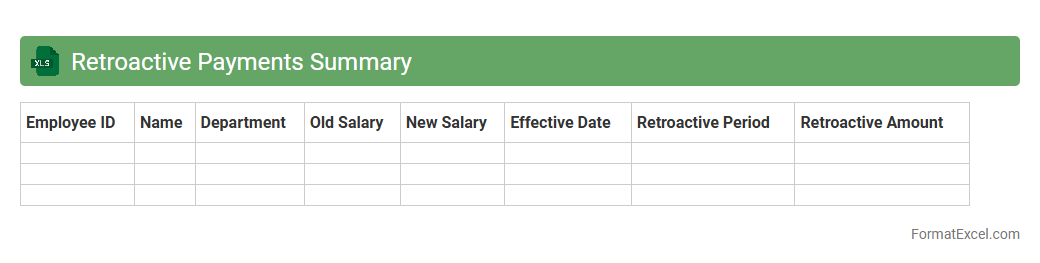

Retroactive Payments Summary

The

Retroactive Payments Summary Excel document consolidates all delayed or backdated payment transactions in one comprehensive report, facilitating accurate payroll and financial reconciliation. It helps track adjustments for salary increases, benefits, or corrections effective from previous periods, reducing errors and ensuring compliance with payroll regulations. This document supports timely auditing and transparent communication between employers and employees regarding payment updates.

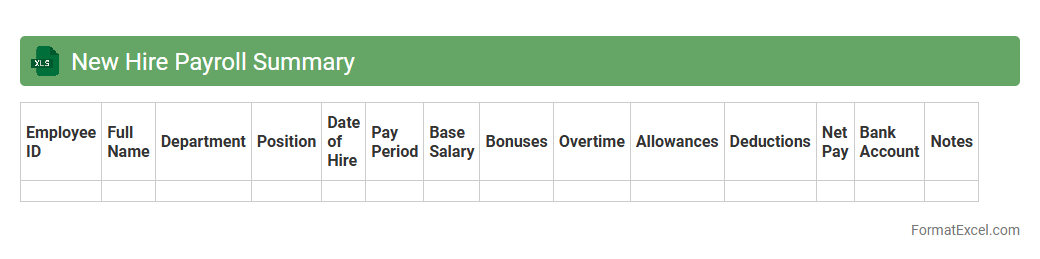

New Hire Payroll Summary

The

New Hire Payroll Summary Excel document consolidates critical employee compensation details, including hire dates, salaries, tax withholdings, and benefits deductions, in a structured and accessible format. This payroll summary facilitates accurate payroll processing, compliance with regulatory requirements, and efficient tracking of new employee financial data. Leveraging this document helps HR and finance teams minimize errors, streamline payroll workflows, and maintain up-to-date records for auditing and reporting purposes.

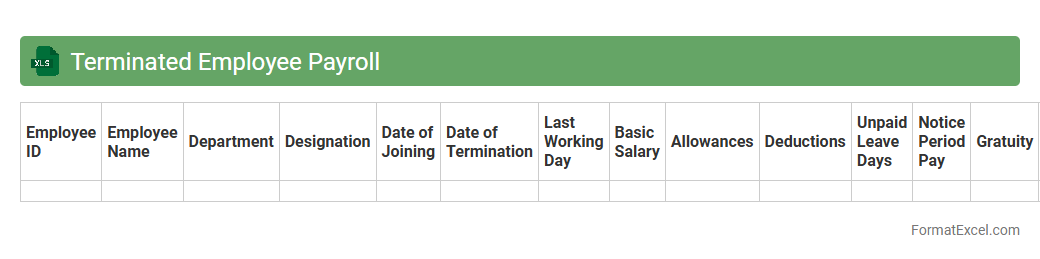

Terminated Employee Payroll

A

Terminated Employee Payroll Excel document is a specialized spreadsheet designed to track and manage payroll details of employees who have left the organization. It includes key data such as final salary payments, accrued leave balances, severance packages, tax deductions, and benefits reconciliation. This document is useful for ensuring accurate financial settlements, maintaining compliance with labor laws, and facilitating smooth payroll audits and reporting.

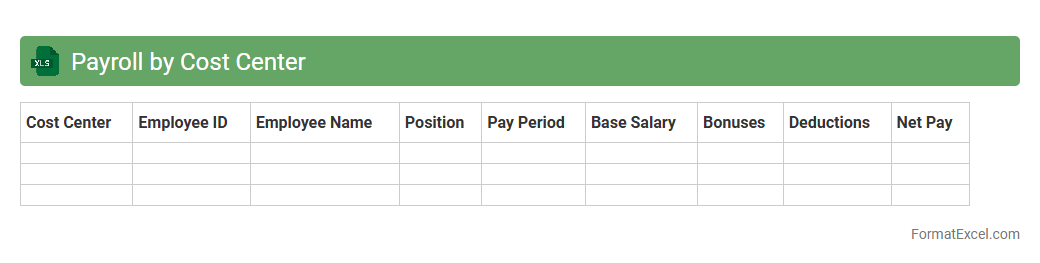

Payroll by Cost Center

A

Payroll by Cost Center excel document organizes employee salary expenses according to specific cost centers, enabling precise tracking of labor costs within different departments or projects. This detailed allocation facilitates budgeting, financial analysis, and cost control by providing clear visibility into how payroll expenses impact each segment of the organization. Using this document helps optimize resource management and ensures accurate financial reporting aligned with organizational goals.

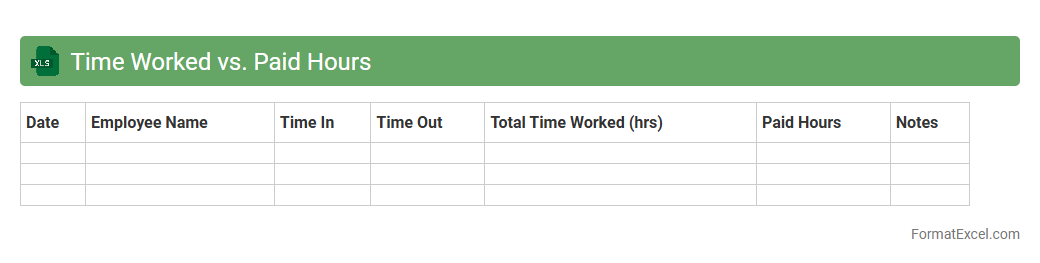

Time Worked vs. Paid Hours

The

Time Worked vs. Paid Hours Excel document serves as a comprehensive tool to track and compare the actual hours employees worked against the hours they were compensated for. This analysis helps identify discrepancies in payroll, ensures accurate wage calculations, and supports compliance with labor laws. By maintaining precise records, organizations can optimize workforce management and control labor costs effectively.

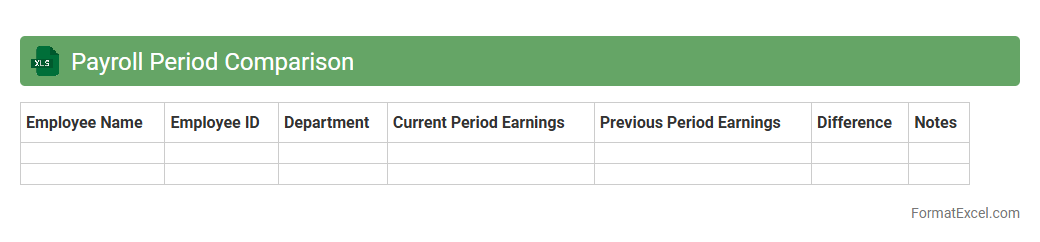

Payroll Period Comparison

Payroll Period Comparison Excel document is a crucial tool for analyzing employee compensation over different payroll cycles by comparing wages, deductions, and benefits systematically. This document enables HR and finance teams to identify discrepancies, track payment trends, and ensure accuracy in salary disbursement. Utilizing this

payroll period comparison helps maintain compliance with financial regulations and supports strategic decision-making in workforce management.

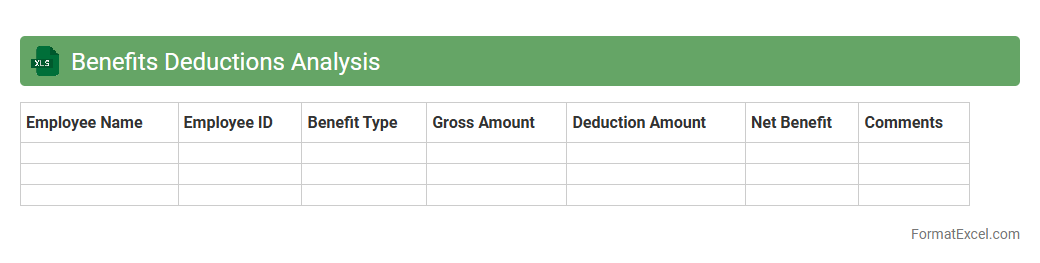

Benefits Deductions Analysis

The

Benefits Deductions Analysis Excel document helps organizations systematically track and evaluate employee benefit contributions and deductions. It provides detailed insights into payroll deductions for benefits such as health insurance, retirement plans, and other voluntary contributions, enabling accurate financial planning and compliance. This tool is essential for ensuring transparency, minimizing errors, and optimizing employee compensation management.

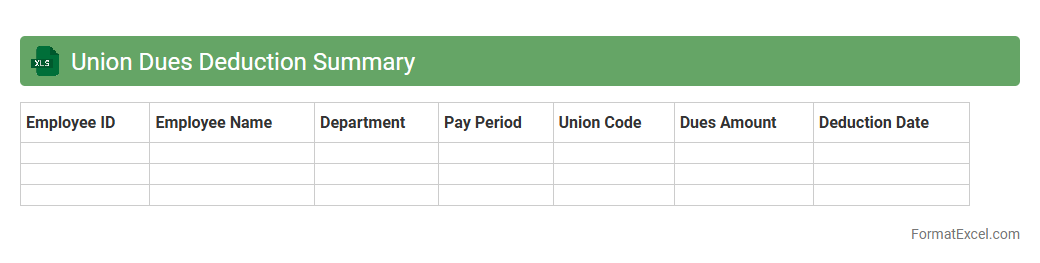

Union Dues Deduction Summary

The

Union Dues Deduction Summary Excel document consolidates employee contributions toward union fees, providing a clear overview of amounts deducted over a specific period. It streamlines payroll processing by ensuring accurate tracking and reconciliation of union dues, reducing errors and administrative workload. This summary also supports transparent reporting for both management and union representatives, enhancing financial accountability.

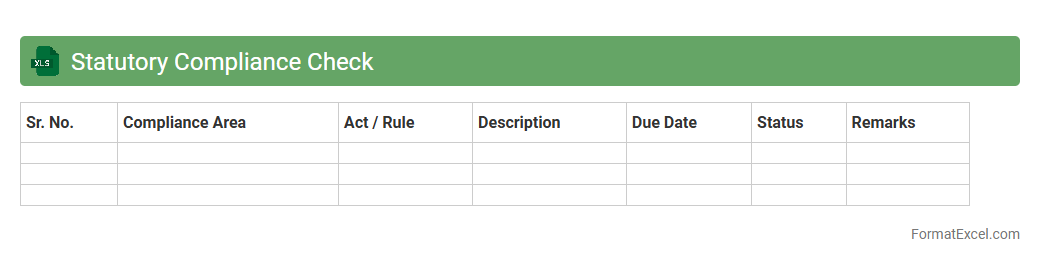

Statutory Compliance Check

A

Statutory Compliance Check Excel document is a structured tool designed to track and monitor an organization's adherence to legal regulations and statutory requirements. It helps businesses ensure all necessary filings, licenses, and compliance deadlines are met systematically, reducing the risk of penalties and legal issues. By providing a centralized overview, this document enhances accountability and streamlines regulatory management processes.

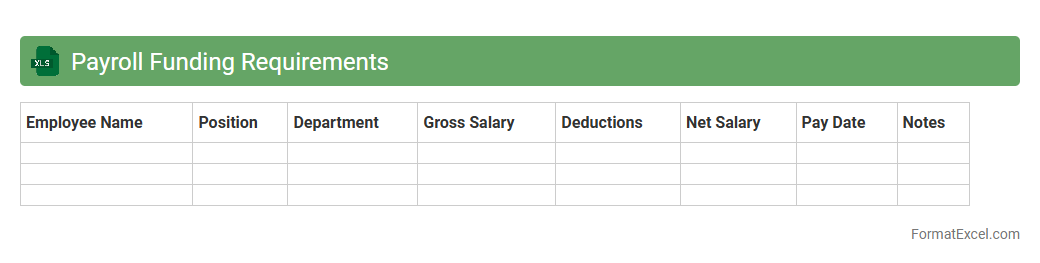

Payroll Funding Requirements

The

Payroll Funding Requirements Excel document is a tool designed to calculate and track the necessary funds needed to cover employee wages, taxes, and benefits accurately. It enables businesses to forecast payroll obligations, manage cash flow efficiently, and ensure timely payment cycles. By consolidating payroll data into an organized, automated format, this document reduces errors and streamlines financial planning for HR and accounting departments.

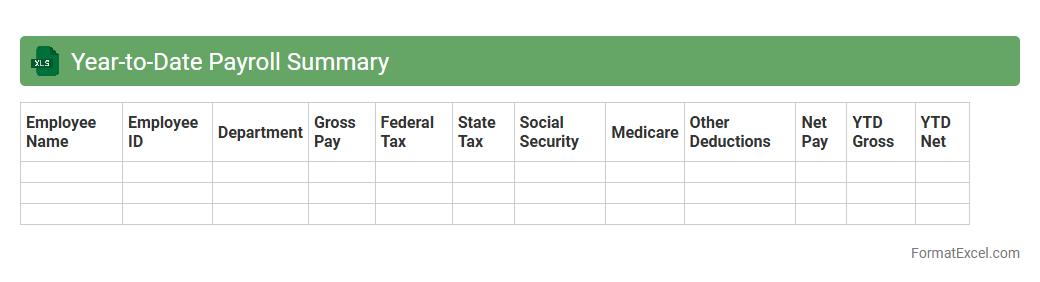

Year-to-Date Payroll Summary

The

Year-to-Date Payroll Summary Excel document consolidates all employee earnings, taxes, and deductions from the beginning of the fiscal year to the current date, providing a comprehensive overview of payroll data. This summary helps businesses track cumulative payroll expenses, ensure compliance with tax regulations, and facilitate accurate financial reporting and auditing. Having this information readily available enables efficient payroll management and supports strategic budget planning throughout the year.

Introduction to Payroll Analysis in Excel

Payroll analysis in Excel is the process of reviewing employee compensation data to ensure accuracy and compliance. Utilizing Excel's tools allows for efficient management of salary, bonuses, and deductions. Understanding the payroll system is critical for successful business financial planning.

Key Components of Payroll Analysis

Core elements include employee wages, tax withholdings, benefits, and overtime payments. These components must be accurately recorded and analyzed to prevent discrepancies. Mastery of payroll data components drives effective financial decision-making.

Setting Up Payroll Data Structure

Organizing payroll data begins with defining rows for employees and columns for payroll elements such as hours worked and salary rates. A clean, logical structure simplifies analysis and reporting in Excel. Establishing an organized payroll data structure reduces errors and enhances readability.

Essential Excel Functions for Payroll

Functions like SUM, IF, VLOOKUP, and DATE are vital in automating pay calculations and deductions. These formulas help calculate gross pay, taxes, and net salary accurately. Knowing essential Excel functions optimizes payroll processing efficiency.

Creating a Payroll Analysis Template

A payroll template standardizes data entry and analysis processes, improving accuracy over time. It should include pre-set fields for earnings, taxes, and deductions that update automatically. Developing a robust payroll analysis template saves time and ensures consistency.

Categorizing Employee Information

Sorting employees by department, position, or employment status helps identify cost centers and payroll trends. This categorization enables targeted financial insights and better resource allocation. Effective employee categorization enhances payroll transparency.

Automating Calculations and Deductions

Using Excel formulas to calculate taxes, benefits, and other deductions eliminates manual errors. Automation ensures payroll compliance with tax regulations and company policies. Incorporating automated calculations improves payroll accuracy and speed.

Visualizing Payroll Data with Charts

Charts like bar graphs and pie charts help represent payroll distributions and trends visually. Visual aids assist stakeholders in quickly understanding payroll expenses. Employing visual payroll representations facilitates better decision-making.

Ensuring Data Accuracy and Compliance

Regular audits, error checks, and updates align payroll data with legal standards. Consistency in data entry and formula integrity prevents costly mistakes. Maintaining data accuracy and compliance is crucial for regulatory adherence.

Best Practices for Payroll Reporting in Excel

Consistently backing up data, protecting sheets, and using clear labels maximize report reliability. Regularly updating templates keeps reports relevant and compliant with law changes. Following payroll best practices ensures reliable and streamlined reporting.