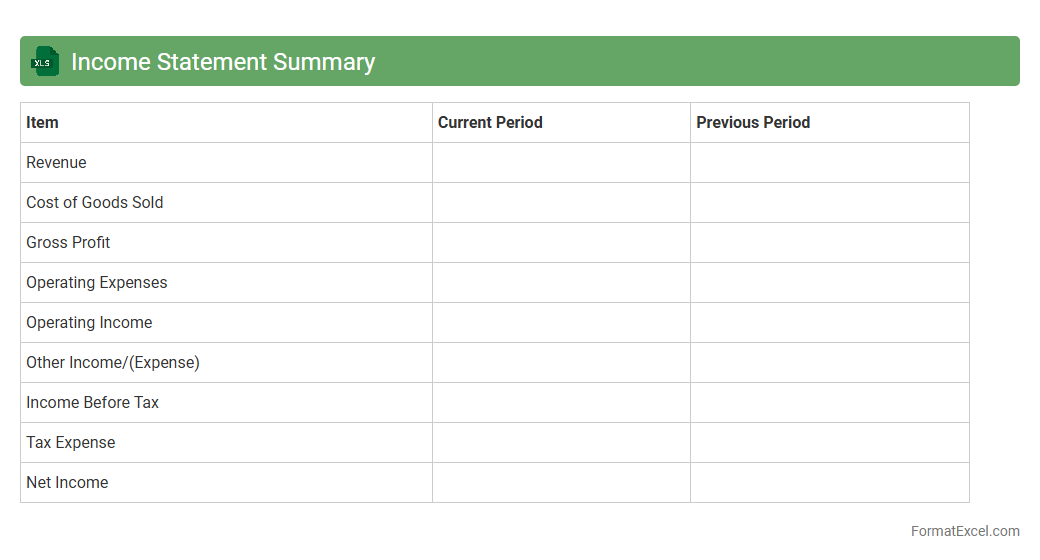

Income Statement Summary

An

Income Statement Summary Excel document provides a concise overview of a company's revenues, expenses, and net profit over a specific period. It helps users quickly assess financial performance, track profitability trends, and identify key cost drivers for informed decision-making. This tool streamlines financial analysis by organizing data into a clear, accessible format ideal for budgeting and strategic planning.

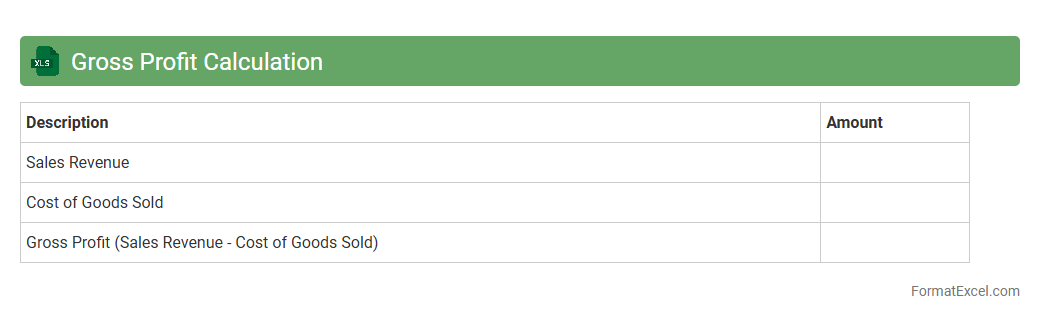

Gross Profit Calculation

A

Gross Profit Calculation Excel document is a spreadsheet designed to compute the difference between total revenue and cost of goods sold, providing a clear view of a business's profitability before operating expenses. It helps track sales performance, identify cost trends, and make informed decisions to improve financial health. This tool is essential for small businesses and accountants aiming to maintain accurate profit analysis efficiently.

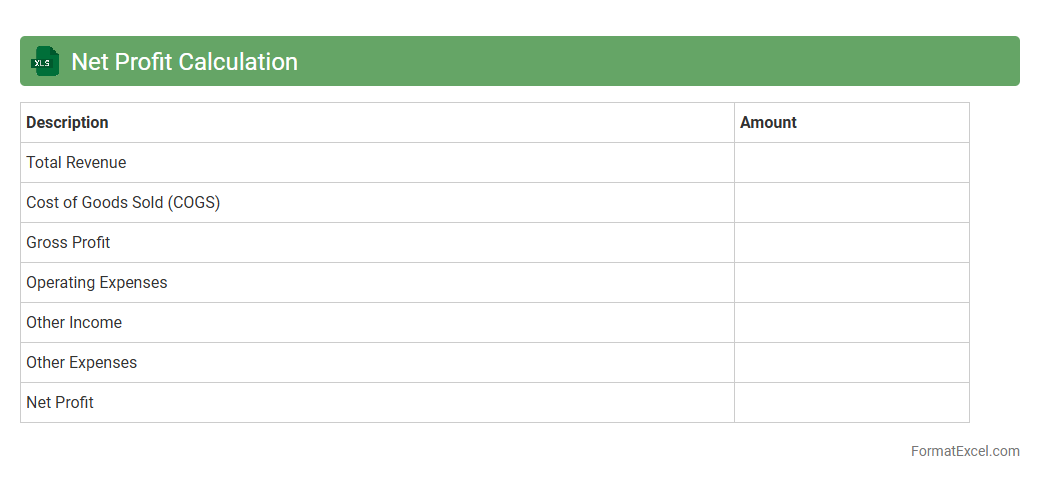

Net Profit Calculation

Net Profit Calculation Excel document is a financial tool designed to help businesses accurately compute their net profit by organizing revenue, expenses, and other financial data in a structured format. It allows users to analyze profitability, make informed budget decisions, and monitor financial health efficiently. Using a

Net Profit Calculation Excel sheet streamlines financial management by providing clear insights into cost control and revenue optimization.

Operating Expenses Breakdown

An

Operating Expenses Breakdown Excel document itemizes all costs related to a company's daily business operations, such as rent, utilities, payroll, and supplies, enabling clear visibility into where funds are allocated. It helps businesses monitor spending patterns, identify cost-saving opportunities, and maintain budget control by providing detailed, categorized expense data. This tool supports financial analysis, decision-making, and reporting, ultimately improving overall operational efficiency.

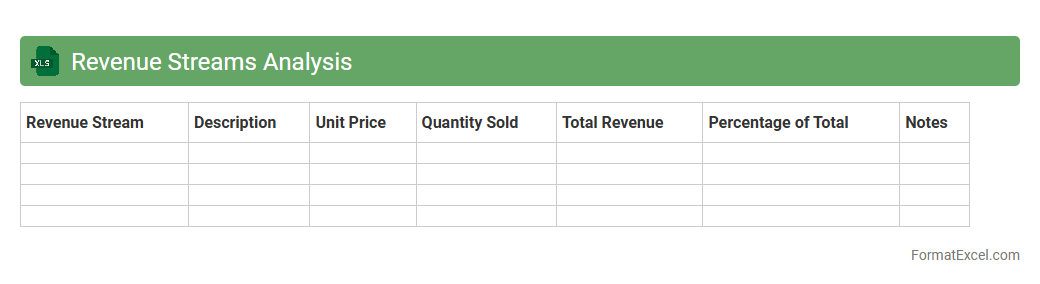

Revenue Streams Analysis

Revenue Streams Analysis excel document is a powerful tool designed to systematically track and evaluate various income sources within a business, enabling clear identification of the most profitable channels. By organizing data into easily interpretable formats, this document aids in forecasting revenue trends, allocating resources effectively, and making informed financial decisions. Utilizing a

Revenue Streams Analysis excel ensures improved strategic planning and enhanced business growth potential.

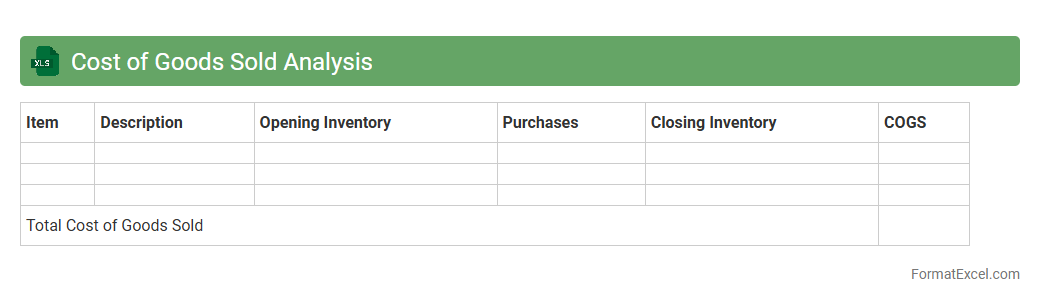

Cost of Goods Sold Analysis

Cost of Goods Sold Analysis Excel document is a detailed spreadsheet used to calculate and evaluate the direct costs involved in producing goods sold by a company. It helps businesses track expenses like raw materials, labor, and manufacturing overhead, enabling accurate profit margin calculations. By analyzing this data, companies can identify cost-saving opportunities, improve budgeting accuracy, and optimize overall inventory management.

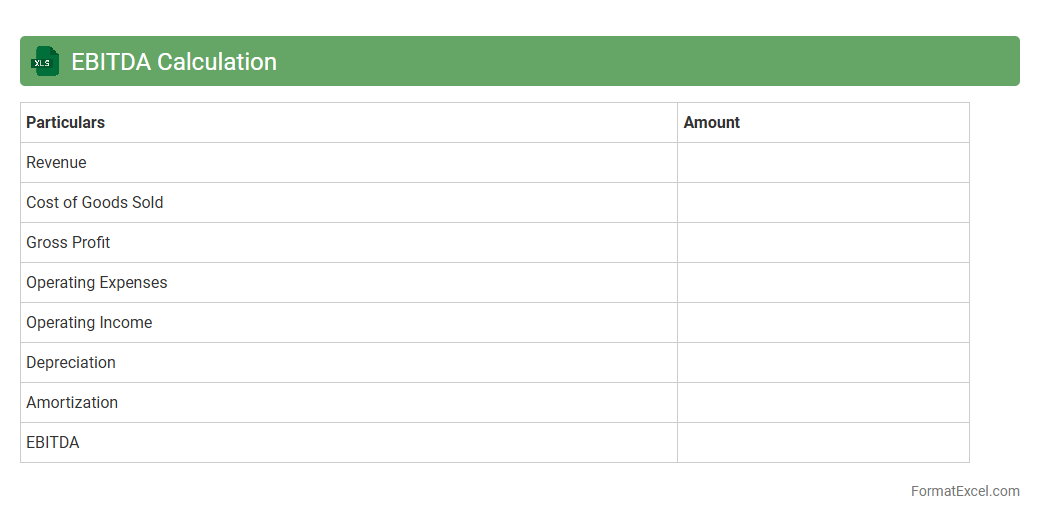

EBITDA Calculation

An

EBITDA Calculation Excel document is a financial tool used to compute Earnings Before Interest, Taxes, Depreciation, and Amortization, providing a clear view of a company's operational profitability. It simplifies complex financial data, enabling businesses to analyze cash flow, compare performance across periods, and make informed decisions on investments and cost management. This document is essential for accountants, investors, and management teams seeking accurate, real-time insights into a company's financial health.

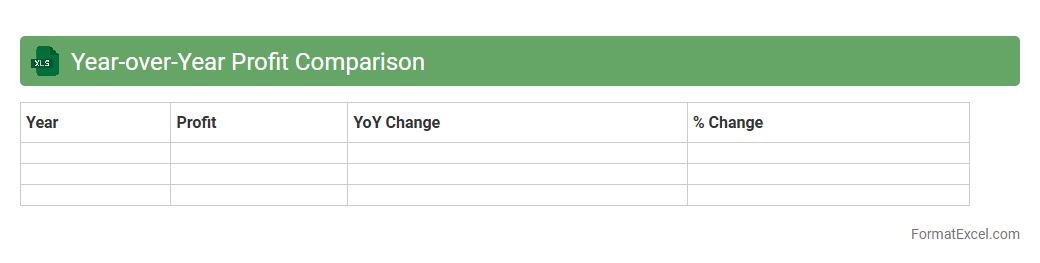

Year-over-Year Profit Comparison

A

Year-over-Year Profit Comparison Excel document systematically tracks and compares profit figures from consecutive years to identify growth patterns and financial trends. This tool helps businesses assess performance changes, make informed budgeting decisions, and set realistic financial goals based on historical profit data. By visually analyzing yearly profit variations, companies can pinpoint successful strategies and areas needing improvement for sustained financial health.

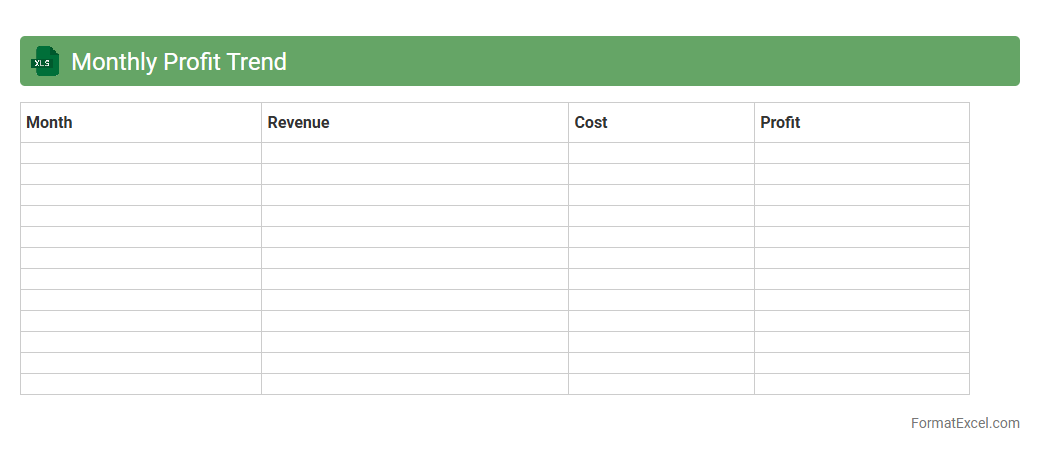

Monthly Profit Trend

The

Monthly Profit Trend Excel document tracks and visualizes profit fluctuations over consecutive months, enabling businesses to identify patterns and seasonal variations effectively. This tool supports informed decision-making by highlighting periods of strong performance and potential downturns, facilitating strategic planning and resource allocation. Utilizing trend analysis in the spreadsheet empowers companies to optimize profitability and forecast future financial outcomes accurately.

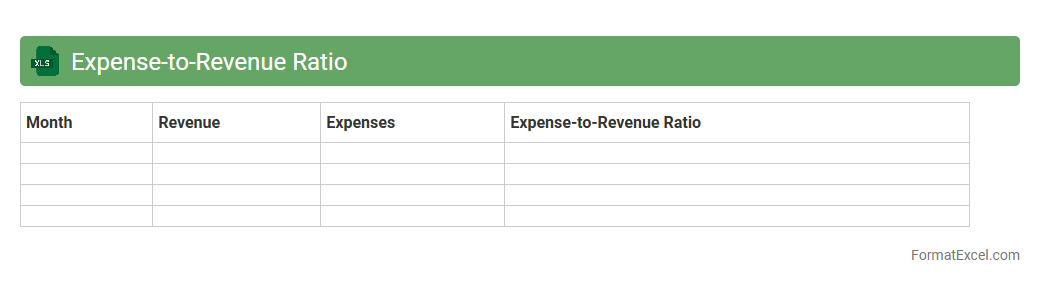

Expense-to-Revenue Ratio

An

Expense-to-Revenue Ratio Excel document is a financial tool designed to calculate and visualize the proportion of expenses relative to revenue, helping businesses assess operational efficiency. It enables users to track trends over time, identify cost management issues, and make data-driven decisions to improve profitability. This ratio is crucial for budgeting, forecasting, and ensuring sustainable financial health.

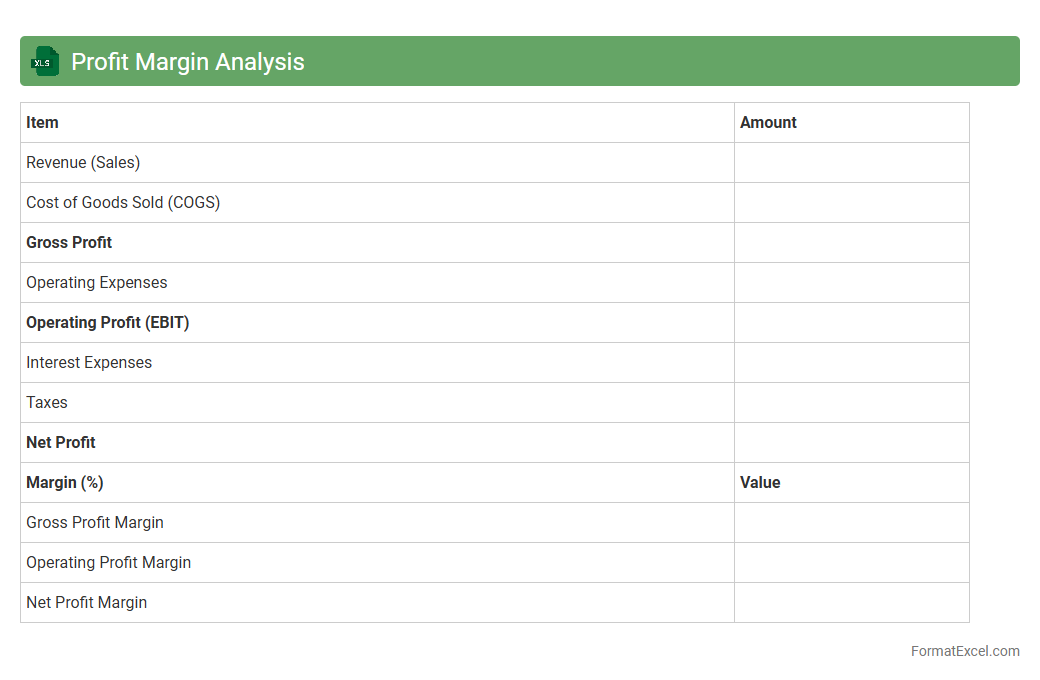

Profit Margin Analysis

Profit Margin Analysis Excel document is a

financial tool designed to calculate and visualize profit margins by comparing revenues against costs, helping businesses identify profitability at various levels such as gross, operating, and net margin. It allows users to input sales data and expenses to automatically generate insights on cost control and pricing strategies, enabling informed decisions to maximize profits. This analysis aids in tracking financial performance over time and benchmarking against industry standards for sustained business growth.

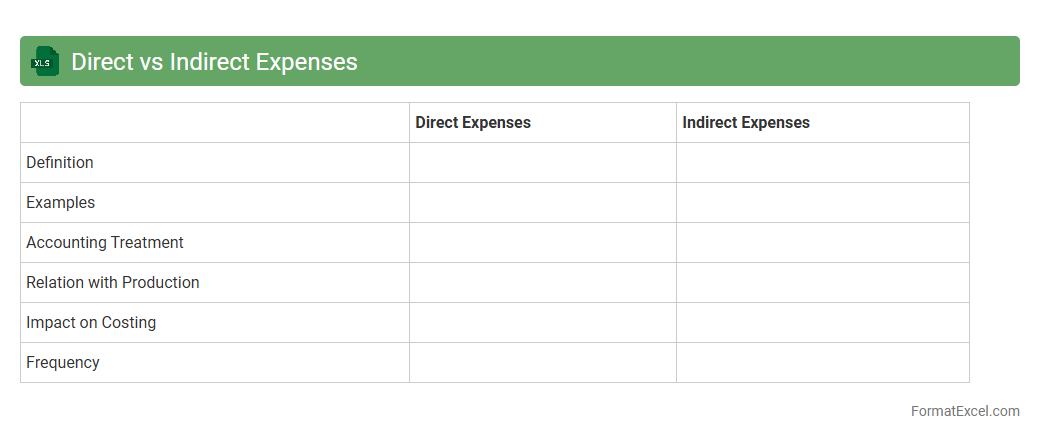

Direct vs Indirect Expenses

A

Direct vs Indirect Expenses Excel document categorizes and tracks costs directly tied to production, such as raw materials and labor, separately from indirect costs like utilities and administrative expenses. This separation aids in accurate cost allocation, budgeting, and financial analysis, helping businesses optimize resource management and improve profitability. Utilizing this spreadsheet enhances transparency in expense reporting and supports strategic decision-making by providing clear insights into cost behavior.

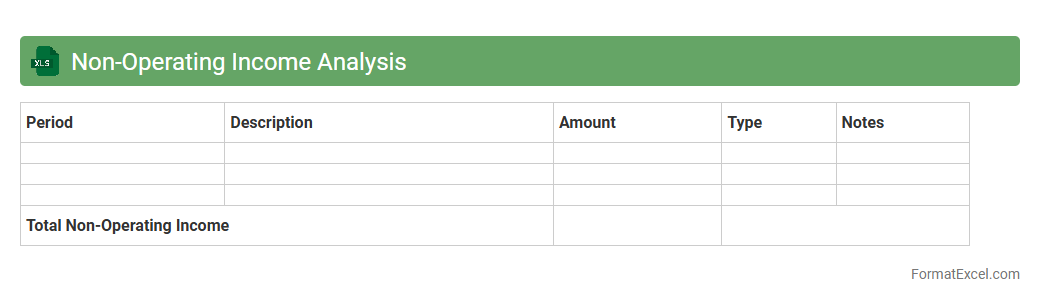

Non-Operating Income Analysis

Non-Operating Income Analysis Excel document is a tool designed to track and evaluate revenues and expenses that are not related to the core business operations, such as investment earnings, interest income, or gains from asset sales. It allows businesses to gain clear insights into the impact of

non-operating income on overall financial performance, helping to isolate and understand these elements separately from operational results. This analysis supports better financial planning and decision-making by providing a detailed breakdown of income sources outside regular business activities.

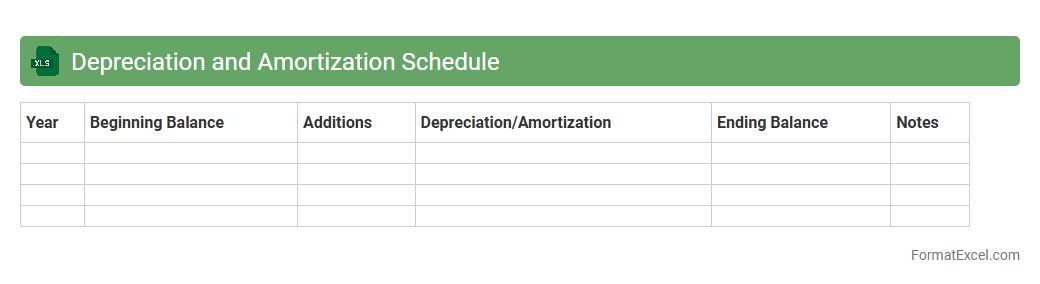

Depreciation and Amortization Schedule

A

Depreciation and Amortization Schedule Excel document systematically tracks the reduction in value of tangible assets and intangible assets over time. It helps businesses allocate asset costs accurately across accounting periods, ensuring compliance with financial reporting standards and aiding in tax calculations. This schedule provides clear visibility into asset lifespans, improves budgeting accuracy, and supports informed decision-making regarding asset management and capital expenditures.

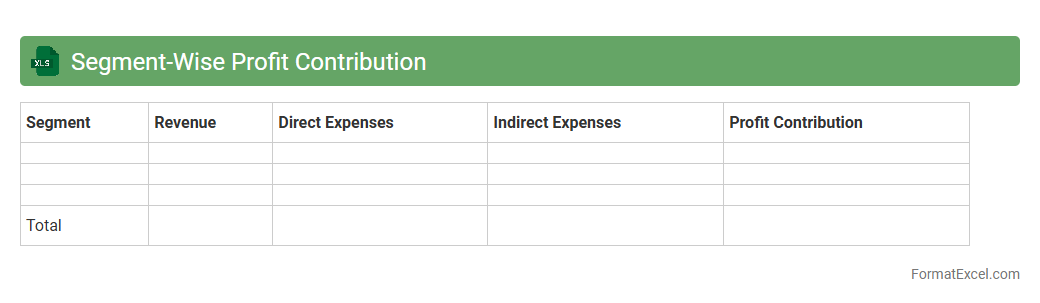

Segment-Wise Profit Contribution

Segment-Wise Profit Contribution is an Excel document designed to break down and analyze the profitability of different business segments, such as products, regions, or customer groups. This tool helps identify which segments generate the

highest profit margins and where resources can be optimized for better financial performance. By using this analysis, companies can make informed strategic decisions to enhance overall profitability and allocate budgets more effectively.

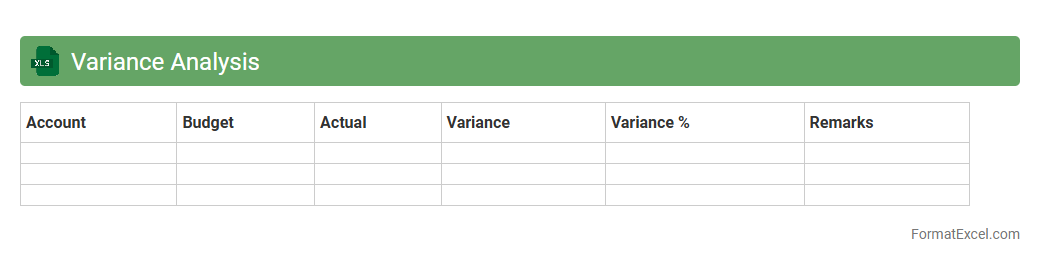

Variance Analysis

Variance Analysis Excel document is a powerful tool designed to compare actual financial performance against budgeted or standard figures, helping identify deviations or discrepancies. By highlighting

variance in costs, revenues, or other key metrics, it enables businesses to pinpoint inefficiencies and make informed decisions to improve financial management. This analysis supports effective budgeting, forecasting, and operational control through clear visualization and detailed breakdowns.

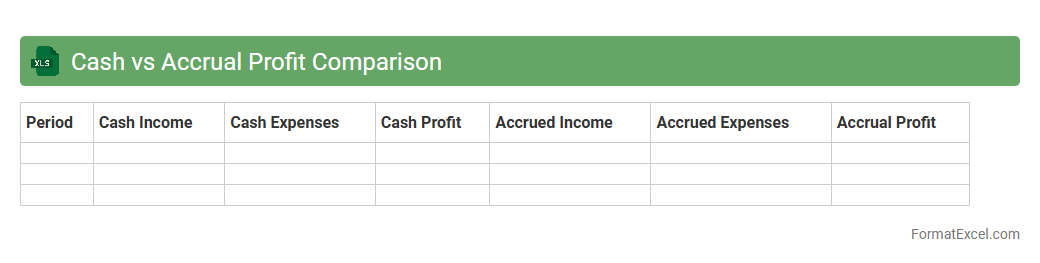

Cash vs Accrual Profit Comparison

The

Cash vs Accrual Profit Comparison Excel document is designed to help businesses analyze the differences between cash basis and accrual basis accounting profits. It enables clear visualization of revenue and expenses timing, highlighting when cash is actually received or paid versus when income and expenses are recognized. This tool is useful for improving financial decision-making, cash flow management, and providing a comprehensive understanding of a company's true profitability.

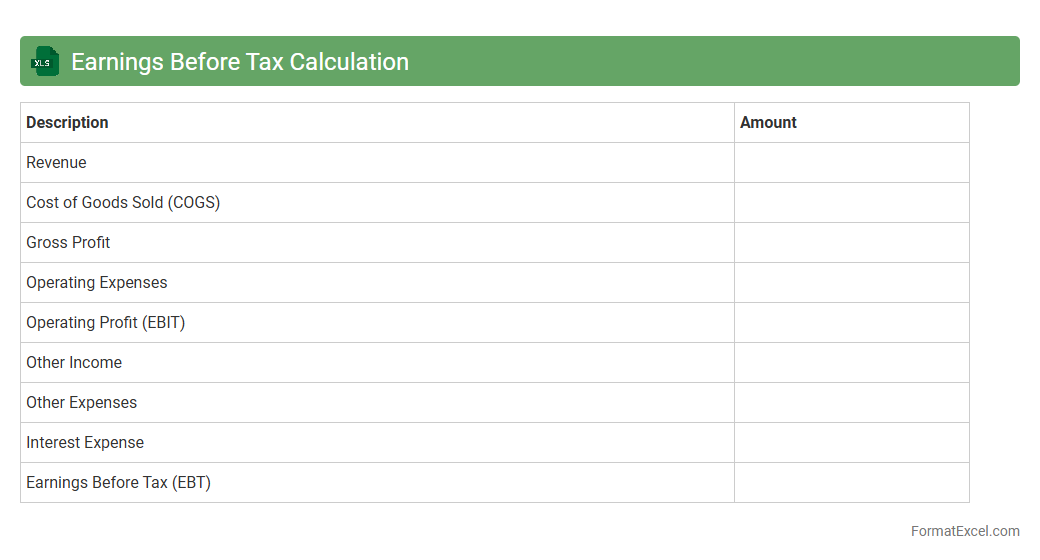

Earnings Before Tax Calculation

An

Earnings Before Tax (EBT) Calculation Excel document is a financial tool designed to compute a company's profitability before tax expenses by organizing revenue, cost, and expense data into a structured format. It helps users, including accountants and financial analysts, quickly assess operational efficiency and compare pre-tax earnings across different periods or companies. This document streamlines tax planning and decision-making by providing clear visibility into earnings unaffected by tax variations.

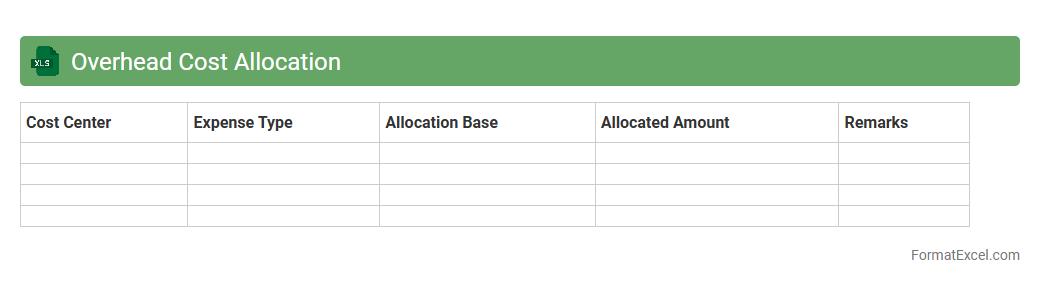

Overhead Cost Allocation

Overhead Cost Allocation Excel document is a financial tool designed to systematically distribute indirect expenses across various departments or products, ensuring accurate cost tracking and budgeting. By inputting overhead costs such as utilities, rent, and administrative salaries, this document helps businesses allocate expenses proportionally based on predefined criteria like labor hours or machine usage. Using this tool enhances financial transparency and aids in strategic decision-making by identifying true product or department profitability.

Overhead Cost Allocation is essential for optimizing resource management and improving cost control.

Break-Even Analysis

A

Break-Even Analysis Excel document is a financial tool that helps businesses determine the point at which total costs equal total revenues, indicating no net loss or gain. By organizing fixed costs, variable costs, and sales data, it provides a clear visual representation of how much product must be sold to cover expenses. This analysis is essential for budgeting, pricing strategies, and making informed decisions to ensure profitability.

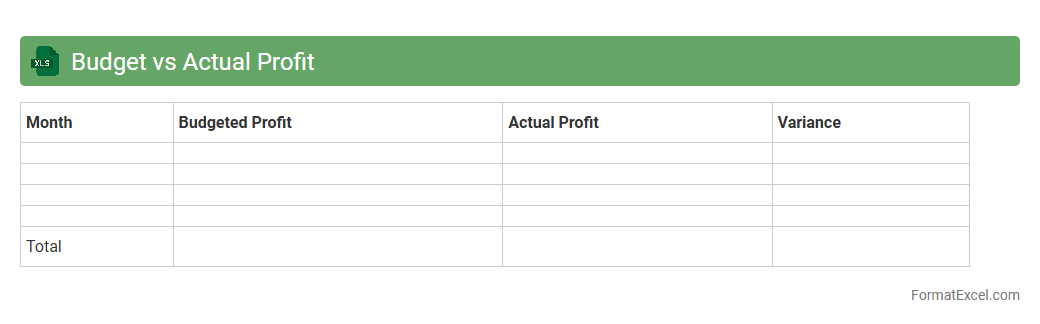

Budget vs Actual Profit

A

Budget vs Actual Profit Excel document is a financial tool used to compare projected earnings against real income within a specific period. It helps businesses identify variances, control expenses, and improve future budgeting accuracy. By analyzing these insights, companies can make informed decisions to optimize profitability and resource allocation.

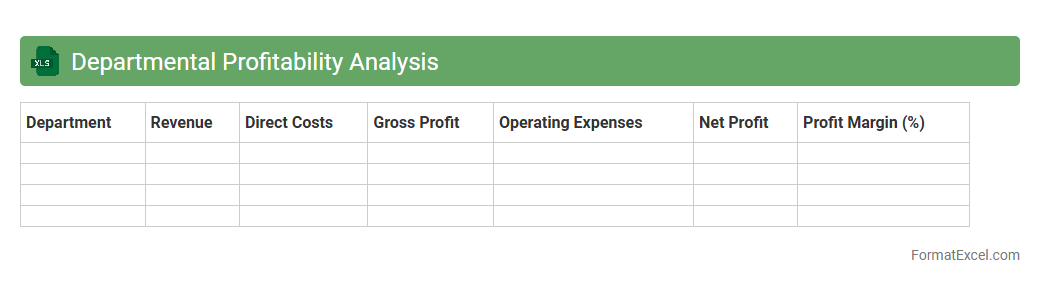

Departmental Profitability Analysis

The

Departmental Profitability Analysis Excel document is a financial tool designed to evaluate the revenue, expenses, and profit margins of individual departments within an organization. It helps businesses identify high-performing units and areas requiring cost control, enabling data-driven decisions for resource allocation and strategic planning. By clearly breaking down departmental financials, this analysis supports improved budgeting, operational efficiency, and overall profitability enhancement.

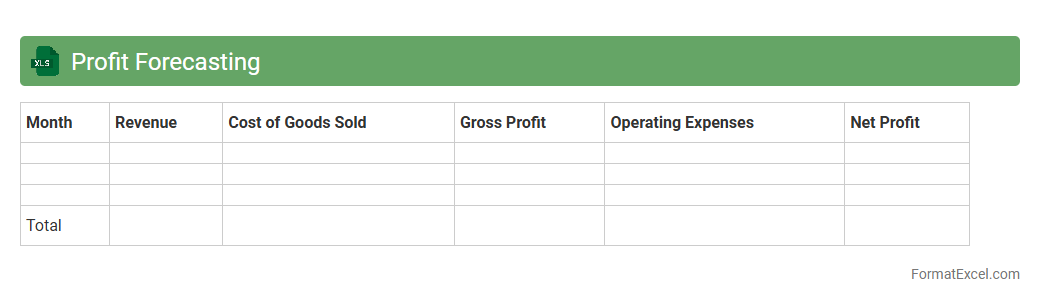

Profit Forecasting

A

Profit Forecasting Excel document is a financial tool designed to project future earnings by analyzing revenue streams, costs, and market trends. It helps businesses anticipate profits, manage budgets, and make informed strategic decisions to enhance financial performance. Utilizing this document improves accuracy in planning and supports goal setting for sustainable growth.

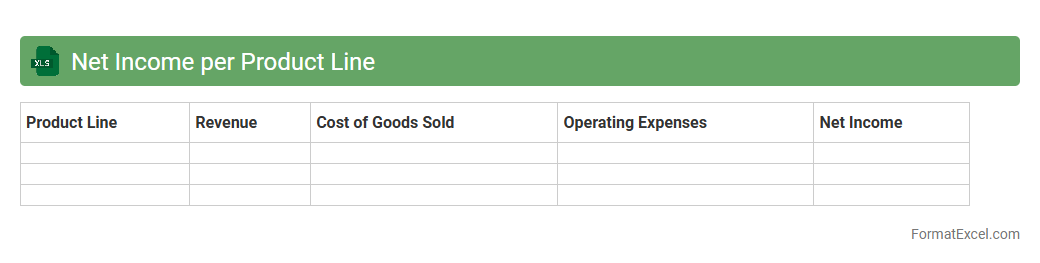

Net Income per Product Line

Net Income per Product Line Excel document is a financial tool that breaks down profitability by individual products, allowing businesses to identify which products contribute most to overall earnings. By analyzing this data, companies can optimize pricing strategies, manage resources efficiently, and make informed decisions on product development or discontinuation. This document provides a clear view of

net income distribution across product lines, enhancing financial transparency and strategic planning.

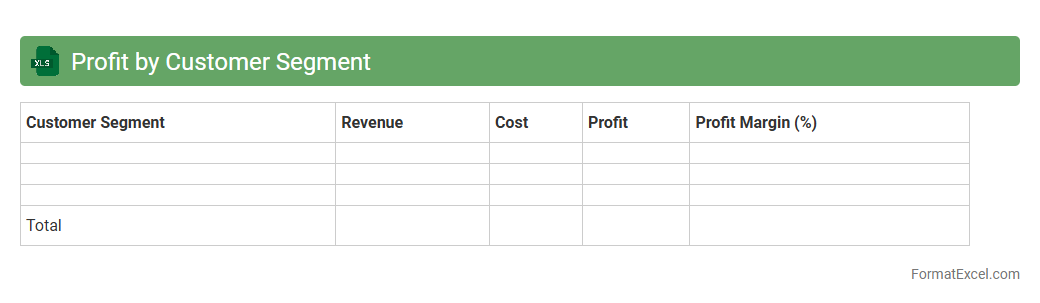

Profit by Customer Segment

The

Profit by Customer Segment Excel document breaks down revenue and costs according to distinct customer groups, enabling targeted analysis of profitability. This tool helps businesses identify which segments generate the highest returns and where resources can be allocated more effectively. Leveraging this analysis supports strategic decision-making to optimize marketing efforts and improve overall financial performance.

Introduction to Profit and Loss Analysis

Profit and Loss (P&L) analysis helps businesses understand their financial performance over a period. It summarizes revenues, costs, and expenses to determine net profit or loss. The P&L statement is fundamental for strategic decision-making.

Importance of Profit and Loss Statements

P&L statements provide a clear picture of business profitability and cost management. They enable stakeholders to assess financial health and plan for growth. Accurate financial reporting ensures informed business decisions.

Key Components of a P&L Statement

The main components include revenue, cost of goods sold (COGS), gross profit, operating expenses, and net profit. Each element reflects a different aspect of business performance. Understanding these components is crucial for effective analysis.

Setting Up a Profit and Loss Template in Excel

Start by defining rows for revenues and expenses and columns for time periods such as months or quarters. Use clear labels and structured formatting for clarity. A well-organized template simplifies ongoing financial tracking.

Essential Excel Functions for P&L Analysis

Functions like SUM, IF, and VLOOKUP facilitate dynamic calculations and data validation. These tools help automate totals, conditional checks, and data retrieval across sheets. Mastering these functions increases analysis efficiency.

Step-by-Step Guide to Creating a P&L Format

Begin by entering revenue and expense categories, then input corresponding values by period. Use formulas to calculate subtotals and net profits automatically. This step-by-step approach ensures accuracy and consistency.

Customizing Your Profit and Loss Report

Tailor your report by adding charts, conditional formatting, and filters to highlight key trends. Customize headings and ranges to meet specific business needs. A personalized P&L report enhances data interpretation.

Best Practices for Accurate P&L Analysis

Maintain reliable data sources, review calculations regularly, and keep your template updated. Reconcile figures with other financial statements to ensure consistency. Adhering to best practices improves report credibility.

Common Mistakes to Avoid in Excel P&L

Avoid hardcoding numbers that should be formula-driven, mixing data types, and neglecting backups. Incorrect references and omitted expenses can distort results. Prevent these common mistakes to maintain data integrity.

Downloadable Profit and Loss Excel Templates

Ready-made P&L templates provide a time-saving starting point with built-in formulas and formatting. Choosing templates compatible with your industry and size ensures relevance. Utilize downloadable templates to jumpstart your financial analysis.