Assets

An

Assets Excel document is a structured spreadsheet designed to track and manage valuable items such as equipment, property, and financial resources. It allows users to organize asset details, monitor depreciation, and maintain accurate records, enhancing efficient asset management. This tool supports better decision-making by providing clear visibility into asset status, location, and value over time.

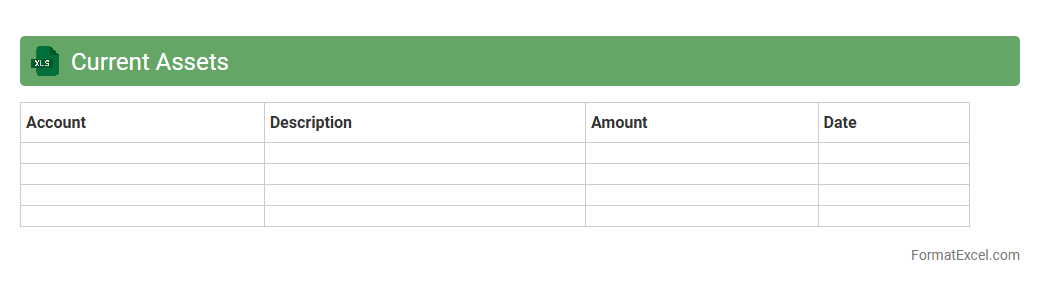

Current Assets

A

Current Assets Excel document is a spreadsheet used to track and manage assets that a company expects to convert into cash within one year, such as cash, accounts receivable, and inventory. This tool helps businesses maintain accurate financial records, enabling better cash flow management and informed decision-making. By organizing and analyzing current assets, companies can optimize liquidity and ensure operational efficiency.

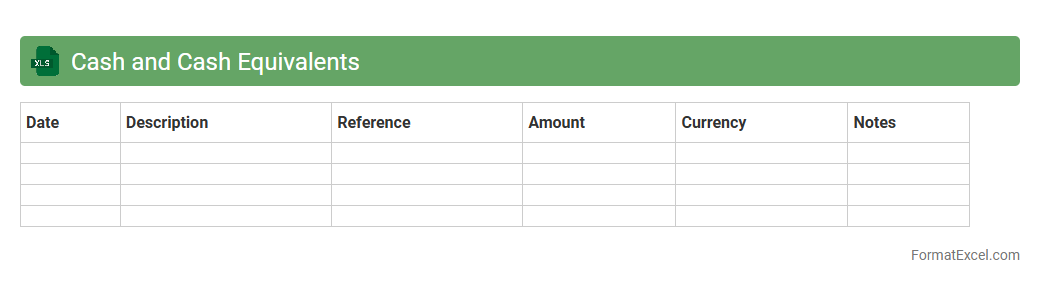

Cash and Cash Equivalents

A

Cash and Cash Equivalents Excel document is a financial tool used to track and manage short-term assets that are highly liquid, including cash on hand and investments that can be quickly converted to cash. This document helps businesses maintain accurate records of their immediate liquidity, ensuring they have sufficient funds available for operational expenses and emergency needs. By providing a clear overview of cash flow and accessible assets, it supports informed decision-making and effective cash management.

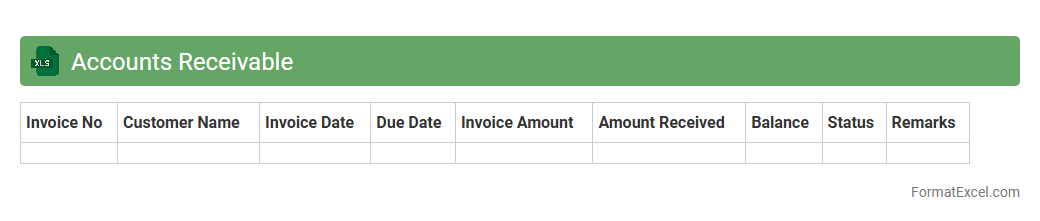

Accounts Receivable

An

Accounts Receivable Excel document is a spreadsheet tool designed to track and manage money owed to a business by its customers. It helps monitor outstanding invoices, due dates, and payment status, ensuring efficient cash flow management. By organizing receivables data, this document improves financial accuracy and supports timely collections.

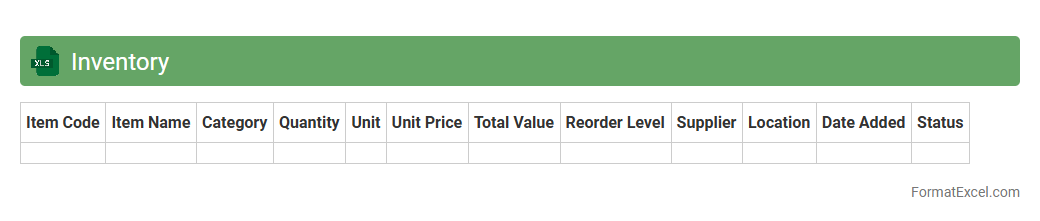

Inventory

An

Inventory Excel document is a structured spreadsheet used to track and manage stock levels, product details, and reorder dates efficiently. It helps businesses maintain accurate records, reduce errors, and optimize stock control processes with real-time data updates. This tool supports informed decision-making by providing clear insights into inventory status, helping prevent stockouts and overstock situations.

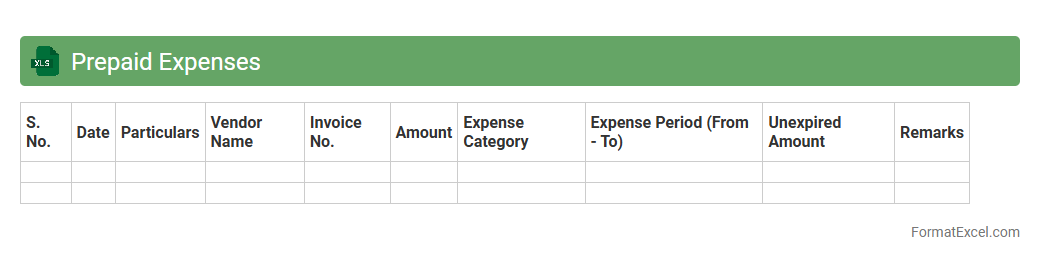

Prepaid Expenses

A

Prepaid Expenses Excel document is a financial tool used to track and manage payments made in advance for goods or services, such as insurance or rent, before the related benefits are received. It helps businesses accurately allocate expenses over the appropriate accounting periods, ensuring proper financial reporting and compliance with accrual accounting principles. This document improves cash flow management and aids in budgeting by providing clear visibility into upcoming expense obligations.

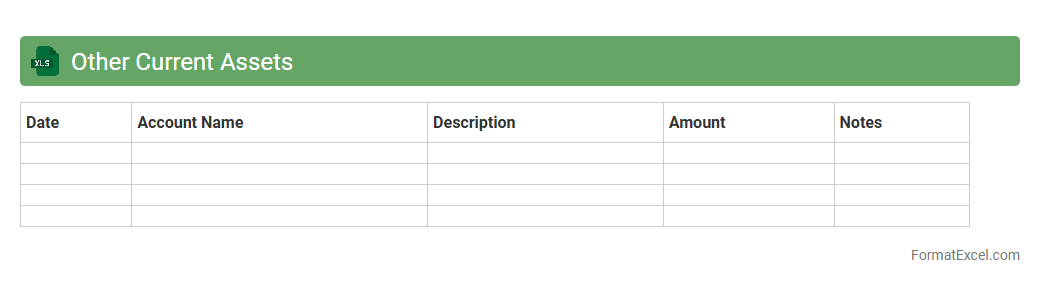

Other Current Assets

An

Other Current Assets Excel document organizes short-term assets that do not fit into typical categories like cash or accounts receivable, helping businesses track items such as prepaid expenses and advances. This detailed record improves financial analysis by providing clear insight into less obvious components of working capital. Utilizing such a document enhances budgeting accuracy and supports effective cash flow management.

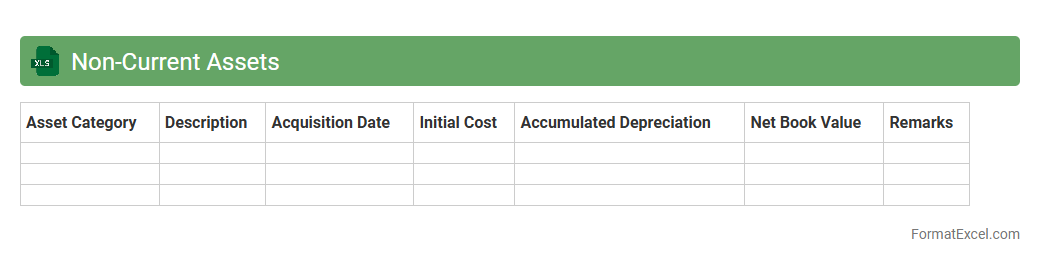

Non-Current Assets

A

Non-Current Assets Excel document is a structured spreadsheet used to record, track, and analyze long-term assets such as property, plant, equipment, and intangible assets. It helps businesses maintain accurate asset valuation, depreciation schedules, and asset lifecycle management, ensuring compliance with accounting standards. This document provides valuable insights for financial reporting, budgeting, and strategic investment decisions.

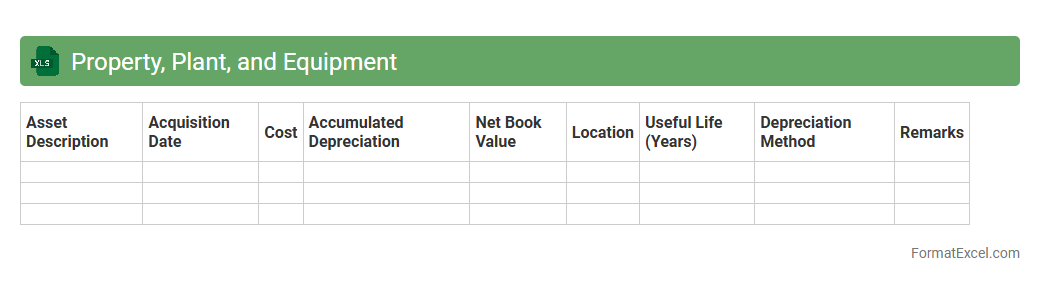

Property Plant and Equipment

A

Property Plant and Equipment (PPE) Excel document is a structured spreadsheet used to track and manage the acquisition, depreciation, and disposal of an organization's fixed assets. It helps ensure accurate financial reporting by providing detailed records of asset values, useful lives, and accumulated depreciation. This document is essential for budgeting, audit compliance, and optimizing asset utilization within any business.

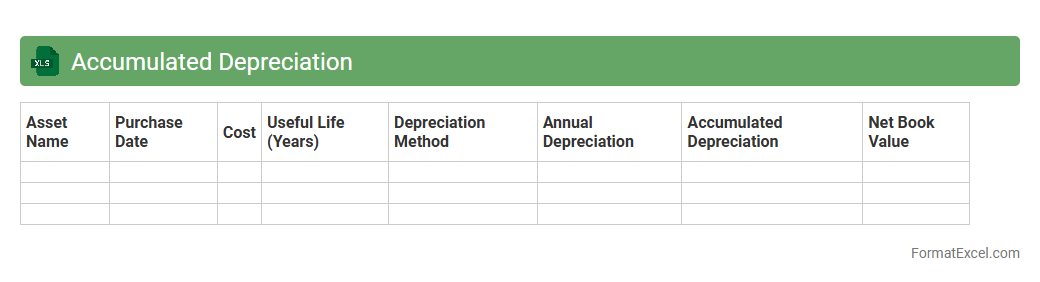

Accumulated Depreciation

An

Accumulated Depreciation Excel document tracks the total depreciation expense recorded against an asset over time, providing a clear view of the asset's declining value. This tool helps businesses accurately calculate book value, manage fixed assets, and improve financial reporting by ensuring that depreciation is systematically accounted for. Using such a document enhances budgeting, tax preparation, and asset management accuracy.

Intangible Assets

An

Intangible Assets Excel document is a spreadsheet tool designed to track, manage, and analyze non-physical assets such as patents, trademarks, copyrights, and goodwill. It helps businesses maintain accurate records of asset values, amortization schedules, and impairment tests, ensuring compliance with accounting standards. This document enhances financial planning and decision-making by providing clear insights into the company's intangible asset portfolio.

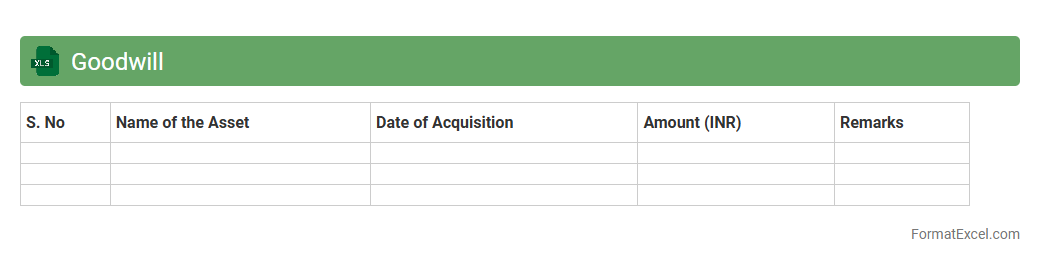

Goodwill

A

Goodwill Excel document is a financial tool designed to record, calculate, and analyze the intangible asset of goodwill during business acquisitions or mergers. It helps businesses accurately track the premium paid over the fair market value of net identifiable assets, ensuring proper accounting and compliance with financial reporting standards like IFRS or GAAP. By using this document, companies can efficiently manage goodwill amortization, impairment testing, and provide clear insights into the value derived from reputation, customer relationships, and brand strength.

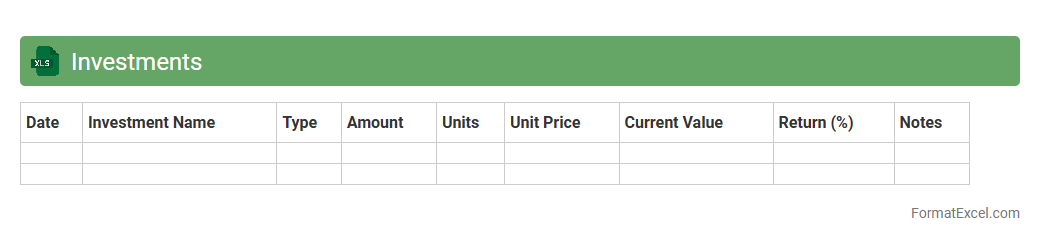

Investments

An

Investments Excel document is a spreadsheet tool designed to track, analyze, and manage various financial assets, including stocks, bonds, mutual funds, and real estate. It allows users to monitor portfolio performance, calculate returns, assess risk, and make informed decisions based on real-time data and historical trends. Utilizing this document enhances financial planning by providing clear insights and fostering disciplined investment strategies.

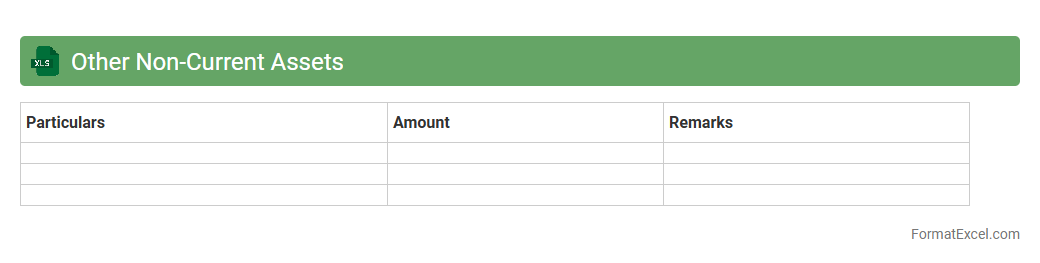

Other Non-Current Assets

The

Other Non-Current Assets Excel document is a financial tool used to record and track long-term resources that do not fit into standard asset categories like property or equipment. It helps businesses monitor items such as deferred charges, long-term investments, and intangible assets, ensuring accurate financial reporting and analysis. This document is essential for maintaining a clear overview of all non-current assets, aiding in strategic planning and compliance with accounting standards.

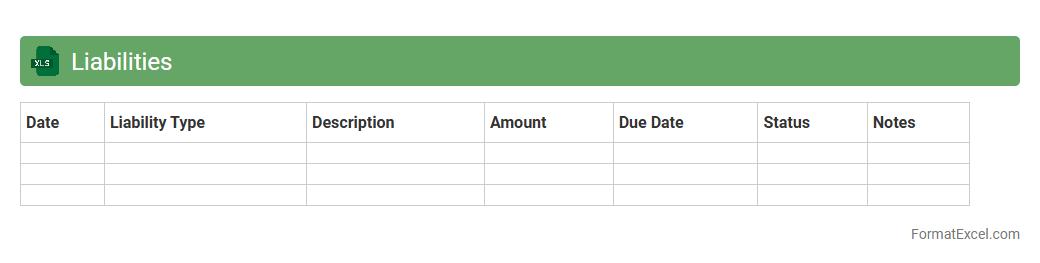

Liabilities

A

Liabilities Excel document is a structured spreadsheet used to record and manage financial obligations, including debts, loans, and other payable amounts. It enables individuals and businesses to monitor outstanding liabilities, track payment schedules, and analyze overall financial health with accuracy. Utilizing such a document improves financial planning, ensures timely payments, and supports better decision-making in managing cash flow and budgeting.

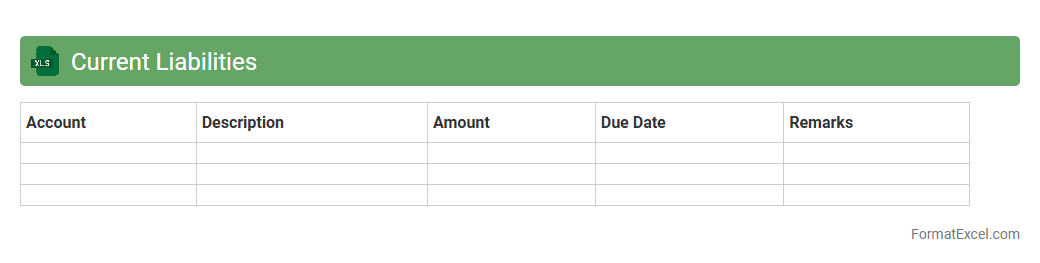

Current Liabilities

A

Current Liabilities Excel document is a spreadsheet tool used to track short-term financial obligations due within one year, such as accounts payable, accrued expenses, and short-term loans. It helps businesses manage cash flow efficiently by providing a clear overview of impending debts, enabling timely payments and avoiding penalties. This document supports accurate financial planning and auditing processes by organizing liabilities in a structured, easy-to-analyze format.

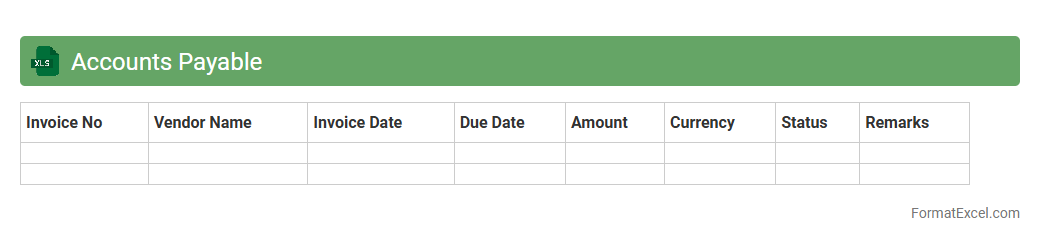

Accounts Payable

An

Accounts Payable Excel document is a spreadsheet used to track and manage a company's outstanding bills and invoices owed to suppliers and vendors. It helps streamline financial record-keeping by organizing payment due dates, amounts, and vendor details in one accessible location. This tool improves cash flow management, ensures timely payments, and supports accurate financial reporting.

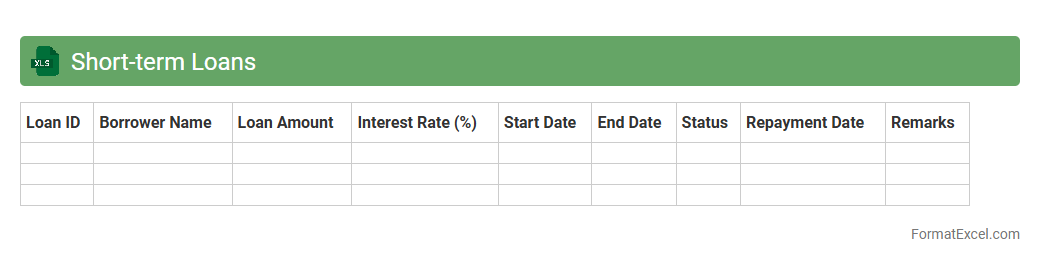

Short-term Loans

The

Short-term Loans Excel document is a financial tool designed to track and manage loan amounts, interest rates, repayment schedules, and due dates for short-term borrowing. It helps users maintain clear records, analyze cash flow impact, and ensure timely repayments to avoid penalties. By organizing loan data efficiently, it supports better budgeting and financial planning for individuals and businesses.

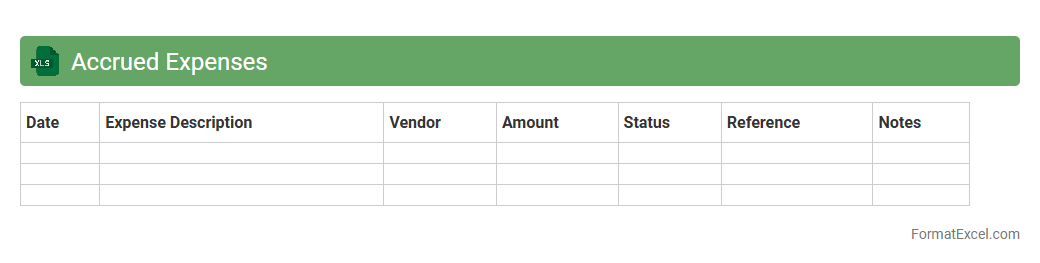

Accrued Expenses

An

Accrued Expenses Excel document is a financial tool used to track expenses that have been incurred but not yet paid, helping businesses maintain accurate accounting records. It allows companies to record liabilities in real-time, ensuring financial statements reflect current obligations and improving budget management. This document aids in cash flow forecasting and ensures compliance with accounting standards by capturing expenses within the relevant period.

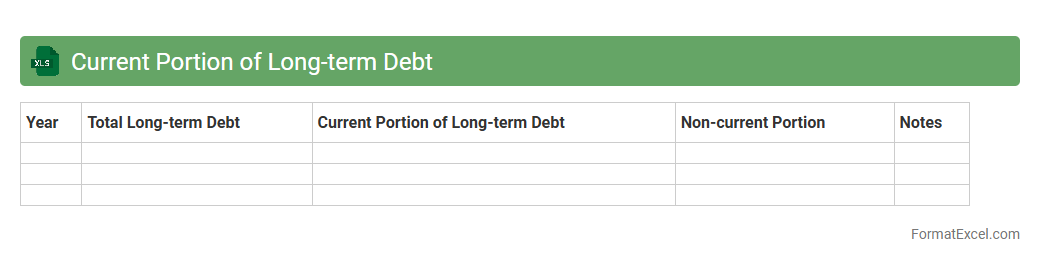

Current Portion of Long-term Debt

The

Current Portion of Long-term Debt Excel document tracks the amount of long-term debt that is due within the next 12 months, helping businesses accurately manage and forecast short-term liabilities. This spreadsheet enables precise financial planning by isolating upcoming debt payments from the total long-term obligations, improving cash flow analysis and budgeting. Using this tool enhances the clarity of a company's current debt commitments, facilitating better decision-making for creditors, investors, and management.

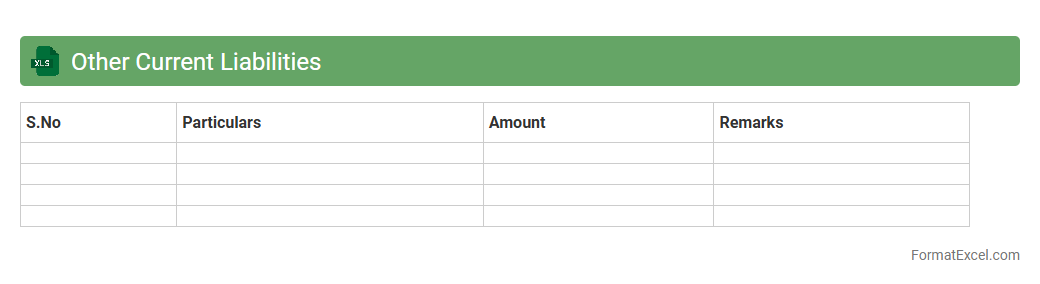

Other Current Liabilities

The

Other Current Liabilities Excel document is a financial tool that organizes short-term obligations a company must settle within one year, such as accrued expenses, wages payable, and taxes owed. This document helps businesses maintain a clear overview of their immediate debts, ensuring accurate cash flow management and financial reporting. Utilizing this Excel sheet enables efficient tracking and analysis of current liabilities, supporting better decision-making and compliance with accounting standards.

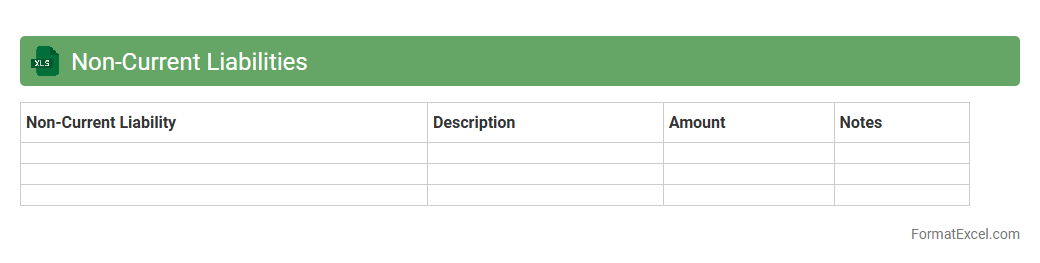

Non-Current Liabilities

A

Non-Current Liabilities Excel document is a spreadsheet used to systematically track long-term financial obligations such as loans, bonds, and lease liabilities that a company must pay beyond one year. This tool helps businesses manage their future debt commitments, analyze financial stability, and improve strategic decision-making by providing clear visibility into outstanding liabilities. By organizing these liabilities efficiently, companies can optimize cash flow planning and assess risks associated with long-term debt.

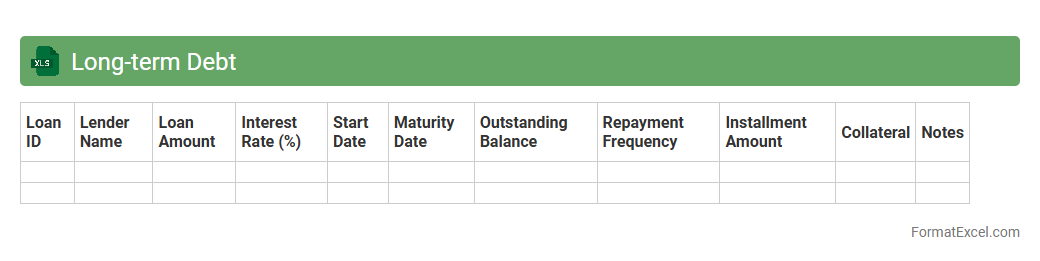

Long-term Debt

A

Long-term Debt Excel document is a financial tool that tracks and manages obligations owed by a company or individual, typically repayable over a period longer than one year. It helps monitor payment schedules, interest rates, outstanding balances, and amortization, providing a clear overview of debt status. Utilizing this document enhances financial planning, cash flow management, and decision-making by ensuring accurate tracking of liabilities.

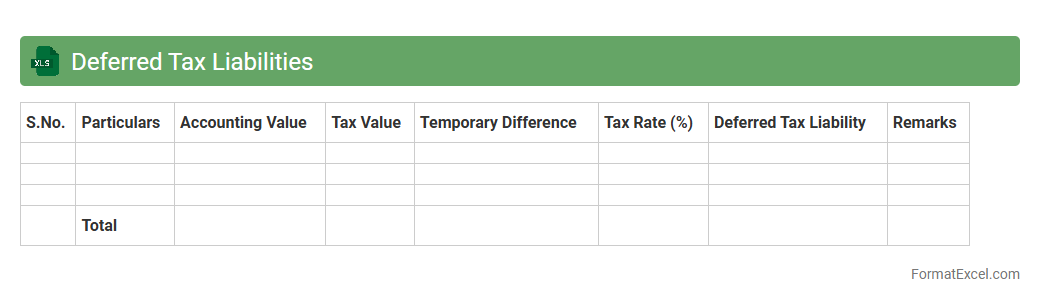

Deferred Tax Liabilities

A

Deferred Tax Liabilities Excel document is a financial tool that helps track the differences between book accounting and tax accounting, reflecting future tax payments owed by a company. It organizes data related to temporary differences, ensuring accurate tax expense reporting and compliance with accounting standards like IFRS or GAAP. Using this document improves financial forecasting, tax planning, and aids in making informed business decisions by clearly identifying potential tax obligations.

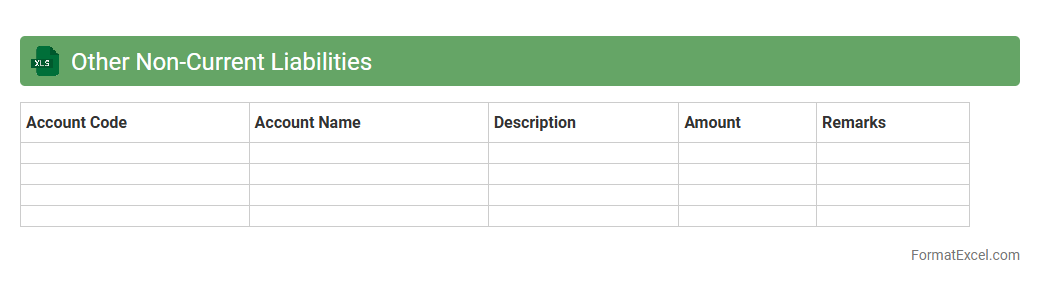

Other Non-Current Liabilities

An

Other Non-Current Liabilities Excel document categorizes long-term financial obligations not classified under standard liabilities like loans or bonds, including deferred tax liabilities, pension obligations, and lease liabilities. This document is essential for financial analysis, enabling businesses to accurately assess their long-term financial commitments and maintain transparent accounting records. Using this Excel sheet helps improve forecasting, budgeting, and compliance with accounting standards such as IFRS and GAAP.

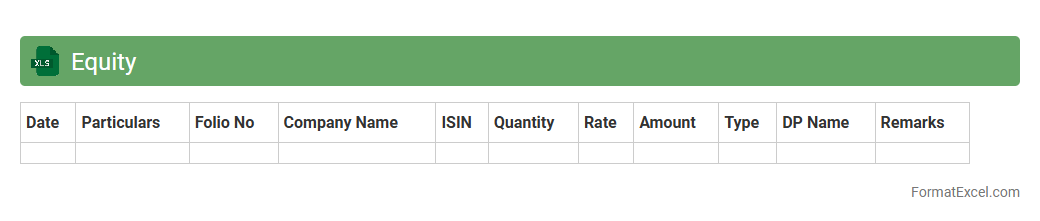

Equity

An

Equity Excel document is a spreadsheet tool designed to track, analyze, and manage ownership shares and investment performance within a company or portfolio. It helps users calculate equity distribution, monitor stock options, and assess shareholder value efficiently. This document enhances financial decision-making by providing clear insights into equity stakes and their fluctuations over time.

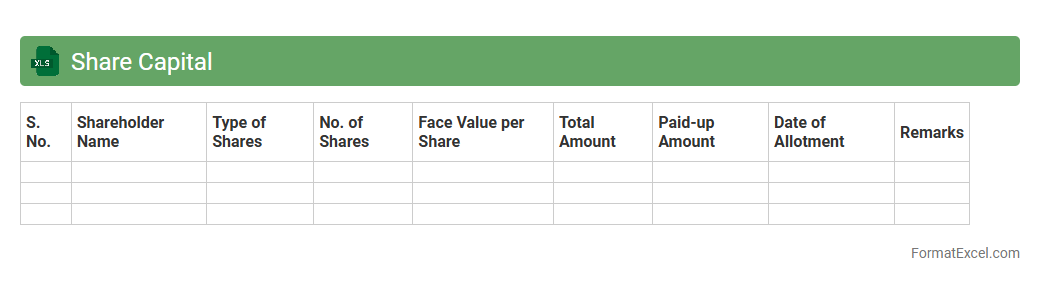

Share Capital

A

Share Capital Excel document is a financial tool used to record and analyze the amount of equity investment made by shareholders in a company. It helps track the number of shares issued, their nominal value, and total capital raised, providing clear visibility into the company's ownership structure. This document is essential for financial planning, compliance reporting, and making informed decisions about fundraising and shareholder equity management.

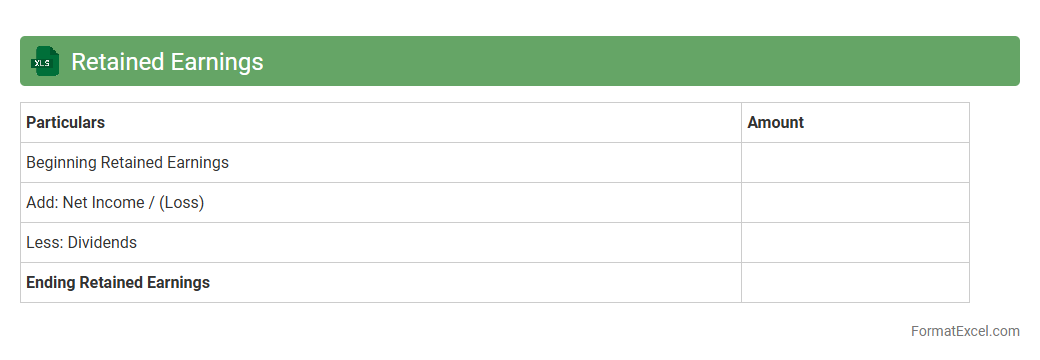

Retained Earnings

A

Retained Earnings Excel document is a spreadsheet tool that tracks a company's accumulated net income retained for reinvestment rather than distributed as dividends. It helps businesses analyze profit reinvestment, monitor financial health, and make informed decisions about future growth and dividend policies. Using this document allows efficient management of earnings and improved accuracy in financial reporting.

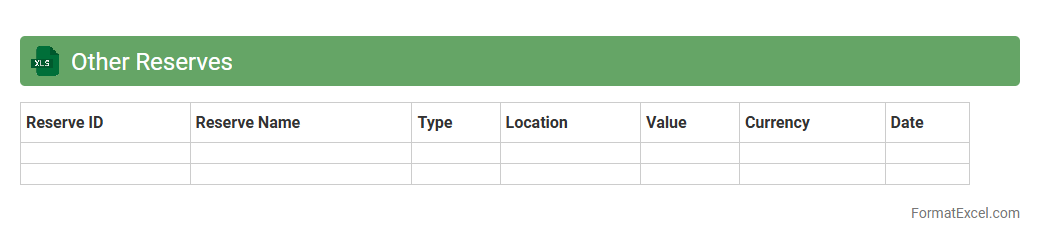

Other Reserves

The

Other Reserves Excel document serves as a comprehensive tool for tracking and managing various financial reserves that are not categorized under primary accounts or major reserve types. It allows users to systematically record, analyze, and forecast reserve balances, improving budget accuracy and financial planning. This document enhances transparency and control over less prominent but essential reserves, ensuring better resource allocation and compliance with organizational financial policies.

Introduction to Balance Sheet Statement

A balance sheet statement provides a snapshot of a company's financial position at a specific point in time. It summarizes assets, liabilities, and shareholders' equity. This document is vital for stakeholders to assess financial stability.

Importance of Balance Sheet in Financial Reporting

The balance sheet plays a crucial role in financial reporting by offering insights into a company's liquidity and financial health. It helps investors and creditors make informed decisions. Accurate reporting ensures compliance with accounting standards.

Key Components of a Balance Sheet

A balance sheet consists of three main components: assets, liabilities, and equity. Assets represent what the company owns, liabilities denote what it owes, and equity reflects owners' stake. Proper categorization aids in clear financial analysis.

Understanding the Balance Sheet Equation

The balance sheet is governed by the fundamental equation: Assets = Liabilities + Equity. This ensures that the company's resources are balanced against claims from creditors and owners. Maintaining this balance is essential for accurate financial statements.

Steps to Prepare a Balance Sheet in Excel

To prepare a balance sheet in Excel, begin by listing assets, followed by liabilities and equity, using separate sections. Use formulas to total categories and ensure the balance sheet equation balances. Excel aids in organizing and automating calculations for accuracy.

Essential Columns and Rows for Balance Sheet Format

Essential columns in an Excel balance sheet include item descriptions, current period values, and comparison periods. Rows should clearly separate current and non-current assets, liabilities, and equity. This structure enhances clarity and readability.

Sample Balance Sheet Template in Excel

A sample Excel balance sheet template provides a ready-made format with predefined categories for assets, liabilities, and equity. It simplifies data entry and ensures standardized reporting. Using templates saves time and reduces errors.

Tips for Designing a Clear Balance Sheet Layout

Design a clear balance sheet by using consistent formatting, bold headings, and adequate spacing. Highlight totals and subtotals with bold or colored fonts to improve visibility. Clear labels and alignment aid quick understanding.

Common Mistakes to Avoid in Excel Balance Sheets

Common mistakes include misclassifying accounts, forgetting to update figures, and incorrect formula usage. Ensure all amounts balance to avoid errors in the balance sheet equation. Double-check entries to maintain accuracy.

Downloadable Balance Sheet Statement Excel Templates

Downloadable templates offer convenient starting points for creating balance sheets in Excel with built-in formulas and formatting. These templates help streamline financial reporting and maintain consistency. They are useful for businesses of all sizes.