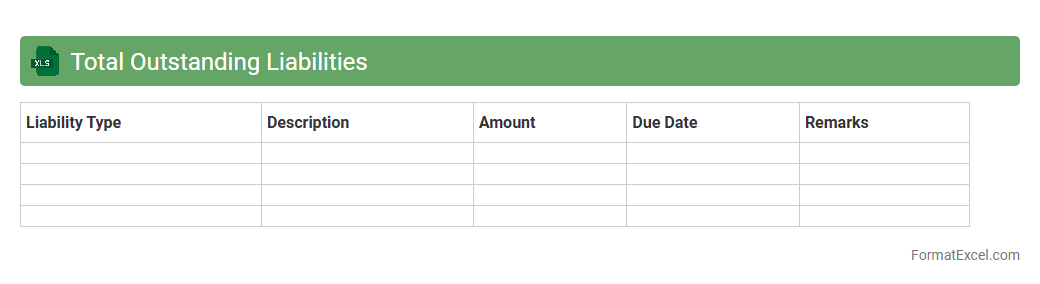

Total Outstanding Liabilities

The

Total Outstanding Liabilities Excel document is a financial tool that consolidates all unpaid debts and obligations owed by an individual or organization, providing a clear snapshot of current financial liabilities. This document is crucial for effective debt management, budget planning, and financial analysis as it helps identify the total amount due to creditors and supports strategic decision-making. By maintaining updated records, it improves transparency and aids in prioritizing payments to avoid defaults and financial penalties.

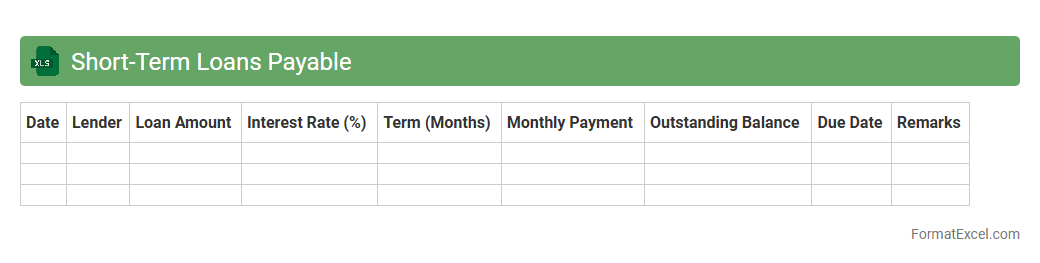

Short-Term Loans Payable

A

Short-Term Loans Payable Excel document is a financial tool designed to track and manage debts due within one year, providing a clear overview of obligations such as bank loans or credit lines. It helps businesses and individuals monitor repayment schedules, interest expenses, and outstanding balances, ensuring accurate cash flow planning. By organizing loan data systematically, this document simplifies financial decision-making and supports timely payments to avoid default risks.

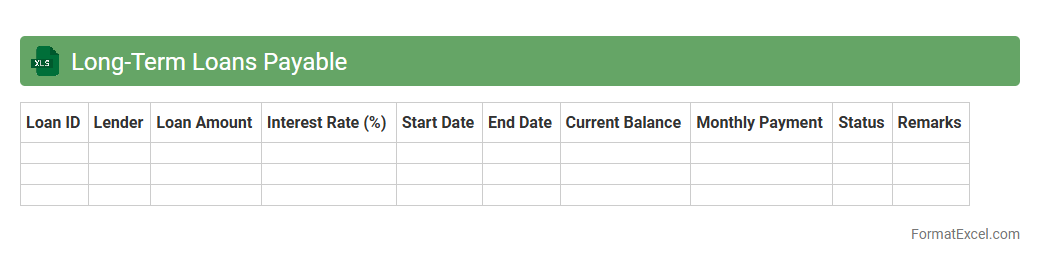

Long-Term Loans Payable

A

Long-Term Loans Payable Excel document is a financial tool that tracks obligations a company must settle beyond one year, including principal and interest payments. This document allows for clear visualization of payment schedules, outstanding balances, and interest expenses, helping businesses manage debt efficiently. It is useful for budgeting, forecasting cash flow, and ensuring compliance with loan covenants to maintain financial stability.

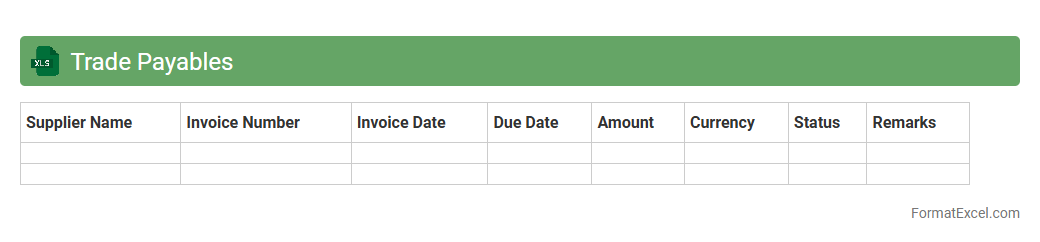

Trade Payables

A

Trade Payables Excel document is a spreadsheet used to track amounts a business owes to its suppliers for goods and services received. It helps manage outstanding invoices, monitor payment deadlines, and maintain accurate financial records, ensuring better cash flow management and improved supplier relationships. This tool enables businesses to avoid late payments and optimize working capital efficiently.

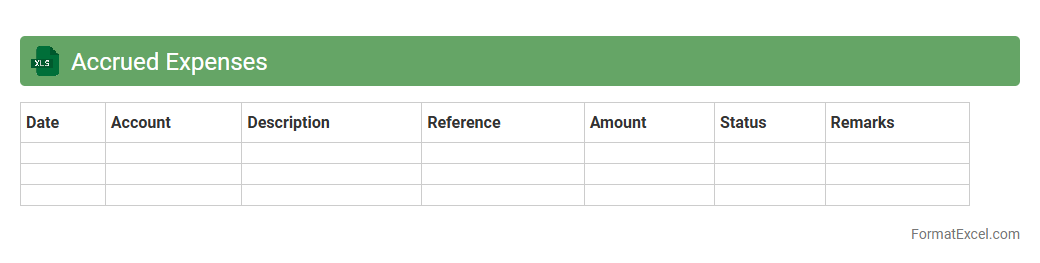

Accrued Expenses

An

Accrued Expenses Excel document is a financial tool used to record and track expenses that have been incurred but not yet paid. It helps businesses maintain accurate financial statements by ensuring liabilities are recognized in the correct accounting period. This document is essential for effective cash flow management and financial reporting compliance.

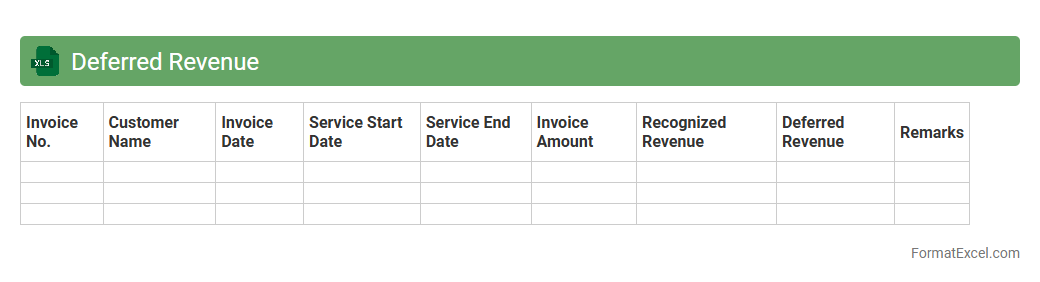

Deferred Revenue

A

Deferred Revenue Excel document is a financial tool used to track and manage income that has been received but not yet earned, reflecting liabilities on the balance sheet. It helps businesses accurately record revenue recognition over time, ensuring compliance with accounting standards like GAAP or IFRS. Using this document improves cash flow management and provides clear visibility into future earnings by organizing deferred income schedules and payment terms.

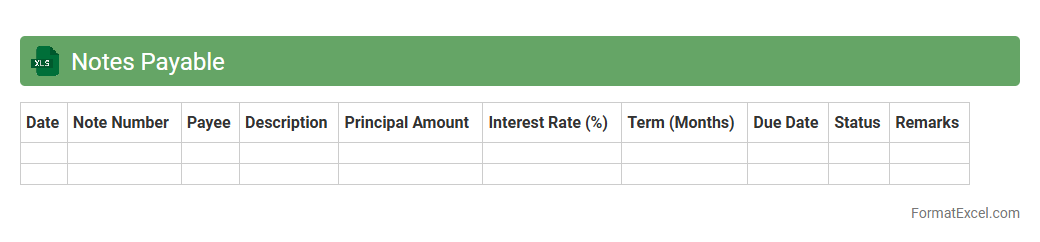

Notes Payable

A

Notes Payable Excel document is a spreadsheet tool used to record and track promissory notes that a company owes to creditors or lenders, detailing amounts, interest rates, payment schedules, and maturity dates. This document helps businesses manage their liabilities efficiently by providing clear visibility into upcoming payments and outstanding debt. Using Notes Payable Excel improves financial planning, ensures timely payments, and aids in accurate accounting for long-term and short-term obligations.

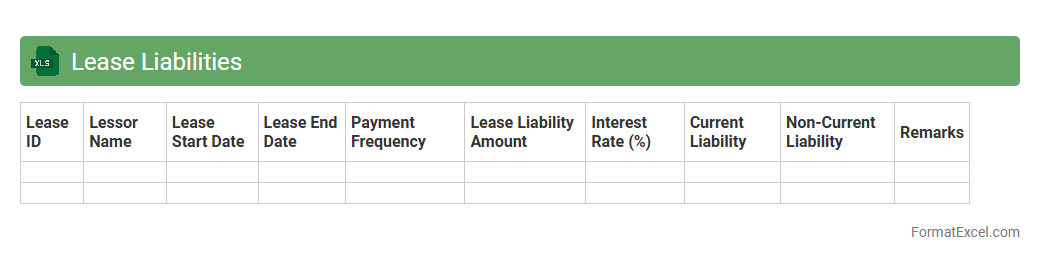

Lease Liabilities

The

Lease Liabilities Excel document is a financial tool designed to track and manage lease obligations, detailing payment schedules, interest expenses, and outstanding balances. It helps users maintain accurate records for compliance with accounting standards like IFRS 16 and ASC 842. This document streamlines lease management, enabling better cash flow forecasting and informed decision-making regarding lease commitments.

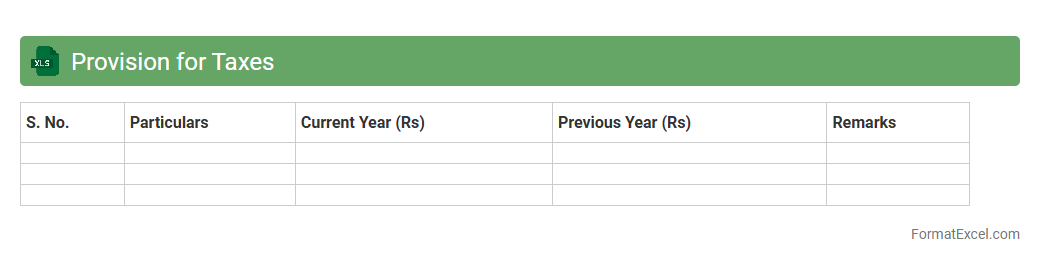

Provision for Taxes

A

Provision for Taxes Excel document is a financial tool used to estimate and record the amount of tax liability a business expects to pay for a given period. It helps in accurate financial reporting by aligning tax expenses with the appropriate accounting period, ensuring compliance with tax regulations. This document is useful for budgeting, forecasting tax payments, and avoiding unexpected financial burdens by maintaining clear visibility on tax obligations.

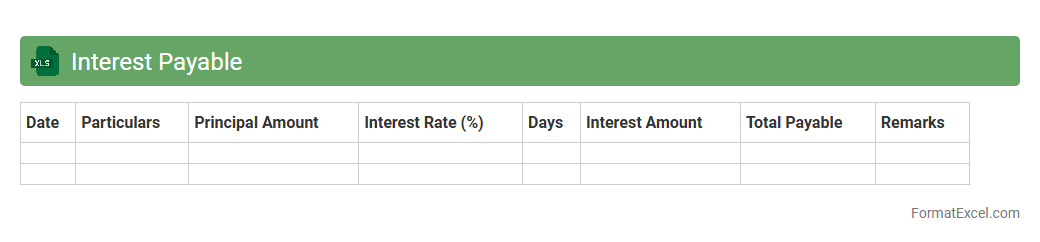

Interest Payable

An

Interest Payable Excel document is a financial spreadsheet designed to track and calculate the interest liabilities a business or individual owes on borrowed funds. It helps users monitor due interest payments, manage cash flow effectively, and ensure timely fulfillment of debt obligations. By automating calculations and organizing payment schedules, this tool enhances financial accuracy and planning efficiency.

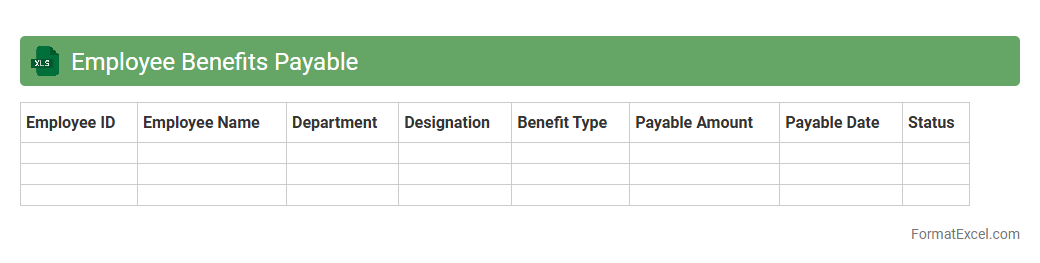

Employee Benefits Payable

An

Employee Benefits Payable Excel document tracks outstanding employee benefits liabilities such as vacation accruals, bonuses, and retirement contributions. It provides clear visibility into the company's obligations, enabling accurate financial reporting and budgeting. This tool helps businesses ensure timely payments and maintain compliance with accounting standards and labor regulations.

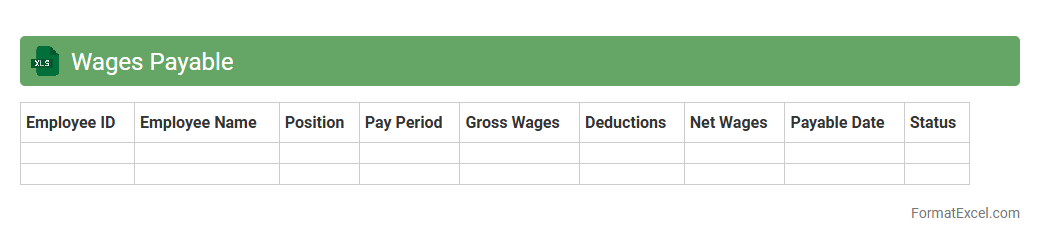

Wages Payable

A

Wages Payable Excel document is a financial tool used to track and manage employees' unpaid wages owed by a company. It helps businesses maintain accurate records of salary liabilities, ensuring timely payments and compliance with payroll regulations. This document also aids in budgeting and financial forecasting by providing a clear overview of outstanding wage obligations.

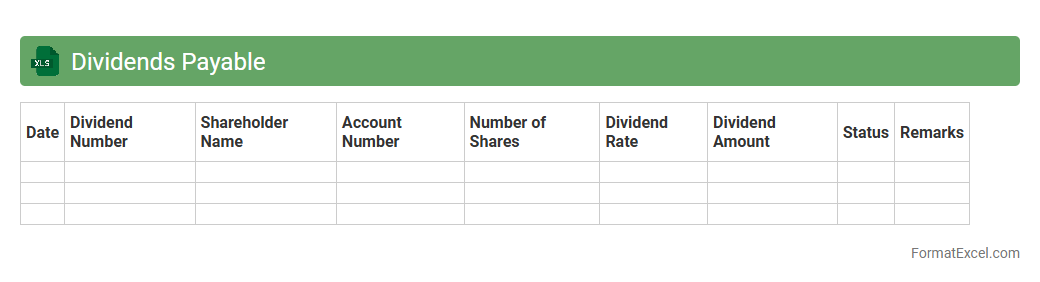

Dividends Payable

A

Dividends Payable Excel document is a financial tool used to track and manage outstanding dividend payments that a company owes to its shareholders. It helps ensure accurate recording of dividend obligations, facilitates timely payments, and supports clear communication with stakeholders. Utilizing this document enhances cash flow management and compliance with corporate financial policies.

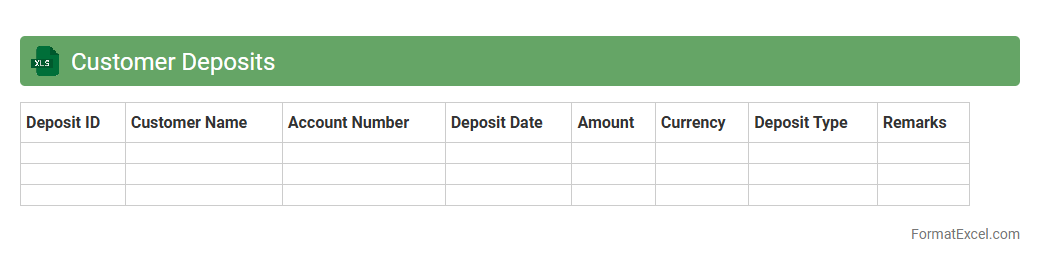

Customer Deposits

The

Customer Deposits Excel document is a structured financial record that tracks all deposits made by customers, including dates, amounts, and payment methods. It helps businesses monitor cash flow, ensure accurate accounting, and reconcile bank statements efficiently. By maintaining this document, companies can improve financial transparency and support better decision-making regarding customer transactions.

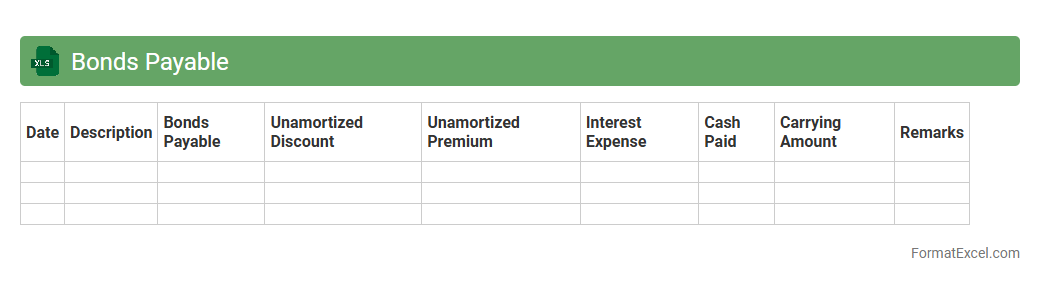

Bonds Payable

A

Bonds Payable Excel document is a financial spreadsheet designed to track and manage bond liabilities, including details such as issue dates, maturity dates, coupon rates, and outstanding balances. This tool helps in accurately calculating interest expenses, amortizing bond premiums or discounts, and forecasting cash flows related to bond payments. Businesses and investors use it for improved financial planning, compliance reporting, and decision-making regarding debt management.

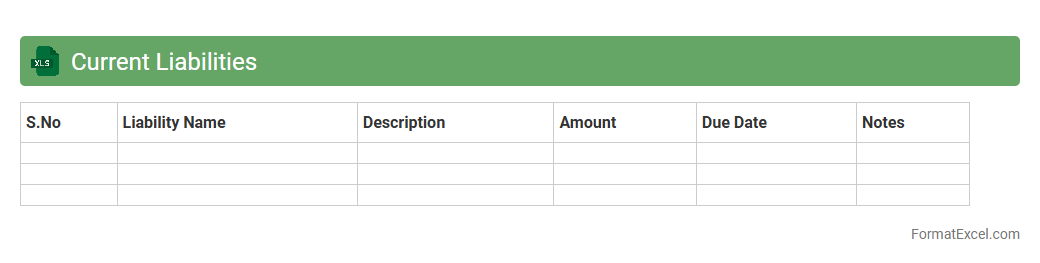

Current Liabilities

A

Current Liabilities Excel document is a financial tool designed to track and manage short-term debts and obligations that a company must settle within a fiscal year. It helps businesses organize data on accounts payable, accrued expenses, and other immediate financial responsibilities, enabling accurate cash flow management and financial planning. Utilizing this document ensures timely payments, supports budgeting processes, and improves overall financial health analysis.

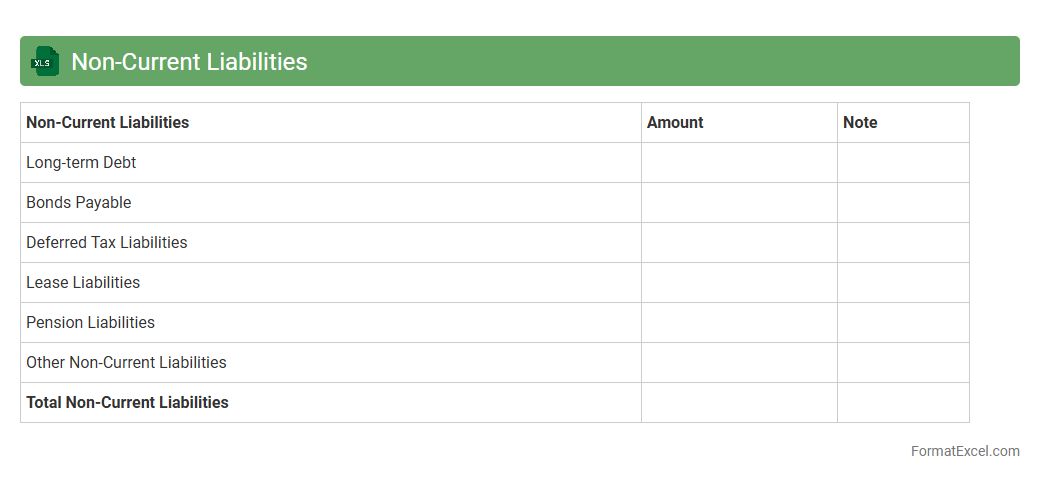

Non-Current Liabilities

A

Non-Current Liabilities Excel document is a spreadsheet tool used to track and manage long-term financial obligations such as loans, bonds, and leases that are not due within the current accounting year. This document helps businesses maintain accurate records of their debt structure, facilitating better financial planning, risk assessment, and compliance reporting. By organizing and analyzing non-current liabilities, companies can improve cash flow management and make informed decisions about capital investments and debt servicing.

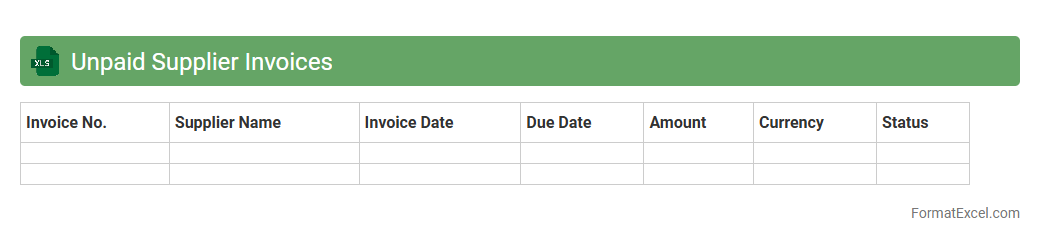

Unpaid Supplier Invoices

The

Unpaid Supplier Invoices Excel document is a detailed record of all outstanding invoices from suppliers, allowing businesses to track payment obligations efficiently. It helps manage cash flow by highlighting overdue payments and pending liabilities, enabling prompt financial planning and vendor relationship management. This document is essential for ensuring transparency and accountability in accounts payable.

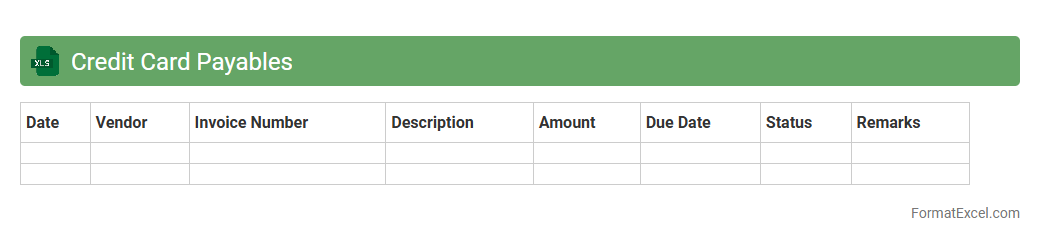

Credit Card Payables

A

Credit Card Payables Excel document is a financial tool designed to track and manage outstanding credit card balances, due dates, and payment statuses. It helps users monitor their liabilities, avoid late fees, and maintain accurate financial records for budgeting and expense control. By organizing credit card payables in a clear, structured format, this document enhances financial planning and improves cash flow management.

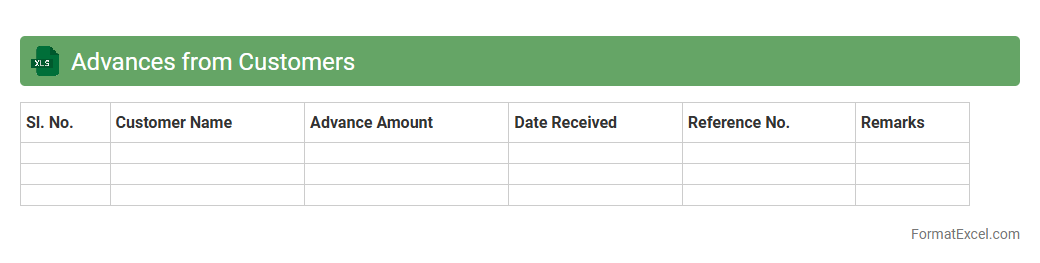

Advances from Customers

The

Advances from Customers Excel document records prepayments or deposits made by customers before delivery of goods or services, ensuring accurate tracking of outstanding liabilities. This document helps finance teams monitor cash flow, reconcile customer accounts, and facilitate transparent financial reporting. By maintaining detailed advance records, businesses can improve customer relationship management and prevent revenue recognition errors.

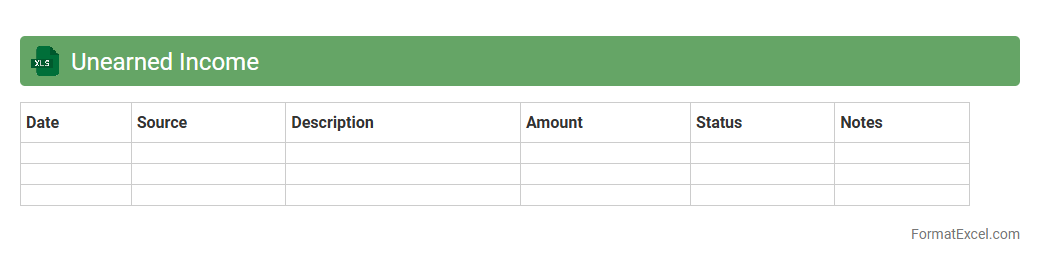

Unearned Income

An

Unearned Income Excel document is a structured spreadsheet designed to track income received from sources other than employment, such as dividends, interest, rental income, or royalties. It helps users organize and calculate their total unearned earnings efficiently, ensuring accurate financial records and better tax preparation. This tool is essential for managing passive income streams and optimizing personal or business financial planning.

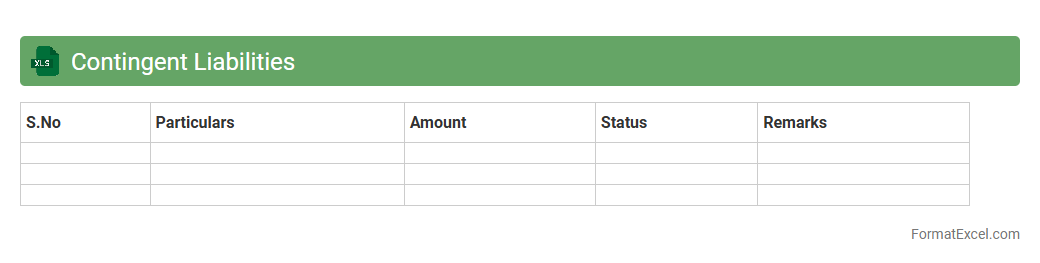

Contingent Liabilities

A

Contingent Liabilities Excel document is a financial tool used to record and analyze potential obligations that may arise from uncertain future events, such as lawsuits or warranty claims. It helps organizations estimate the financial impact of these liabilities, aiding in risk management and accurate financial reporting. By tracking contingent liabilities systematically, businesses can make informed decisions and maintain transparency with stakeholders.

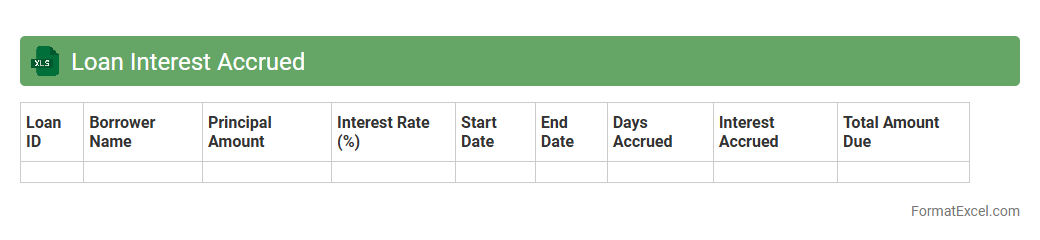

Loan Interest Accrued

A

Loan Interest Accrued Excel document is a financial tool designed to track and calculate the interest accumulating on loans over time. It helps users monitor interest expenses accurately, enabling better budgeting and financial planning. By organizing loan data and interest rates, the document streamlines the management of loan payments and ensures timely tracking of accrued interest.

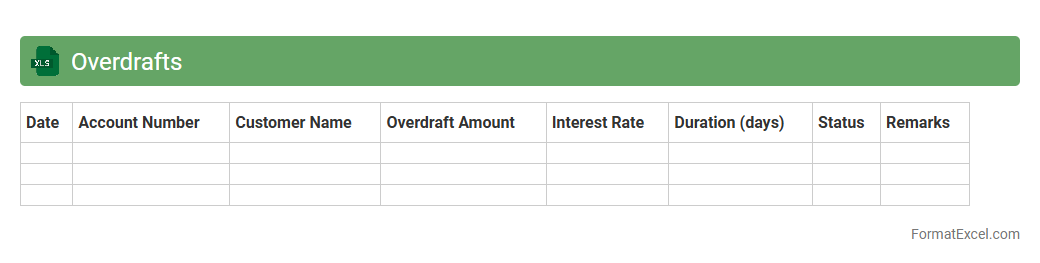

Overdrafts

An

Overdrafts Excel document is a specialized spreadsheet used to track and manage overdraft transactions and balances efficiently. It helps users monitor their account activity, predict overdraft occurrences, and avoid unnecessary fees by maintaining real-time financial oversight. Businesses and individuals can leverage this tool for better cash flow management and accurate financial reporting.

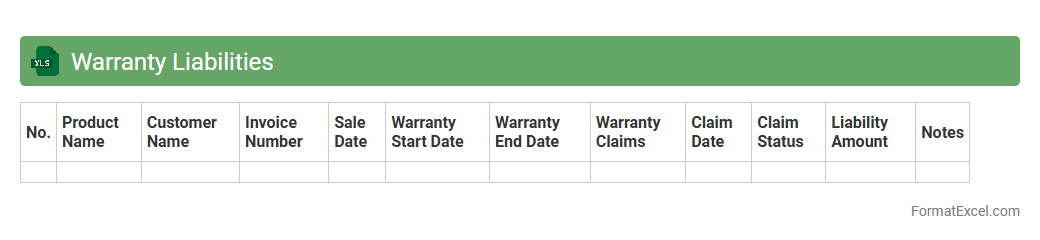

Warranty Liabilities

Warranty Liabilities excel document is a comprehensive financial tool designed to track and manage the obligations a company recognizes related to product warranties. It helps in accurately estimating future costs that may arise from product defects or repairs, ensuring compliance with accounting standards such as GAAP or IFRS. By using this document, businesses can improve financial forecasting, enhance transparency in reporting, and optimize reserve funds for potential warranty claims, making it an essential asset for effective warranty management.

Introduction to Liabilities Statement

A Liabilities Statement is a financial document that outlines an organization's debts and obligations. It provides a clear snapshot of what the company owes at a specific point in time. Understanding this helps businesses manage their financial responsibilities effectively.

Importance of Liabilities Statement in Accounting

The Liabilities Statement is crucial for assessing a company's financial health and liquidity. It helps accountants and stakeholders evaluate the company's ability to meet short-term and long-term debts. Accurate liabilities reporting supports informed decision-making and compliance.

Key Components of a Liabilities Statement

Core elements include current liabilities like accounts payable, accrued expenses, and long-term liabilities such as loans and mortgages. Each component contributes to the overall financial obligations presented in the Liabilities Statement. Proper categorization ensures clarity and accuracy.

Standard Format for Liabilities Statement in Excel

The standard format uses rows for each liability type and columns for description, amount, and due date. Excel's tabular structure makes it simple to input and update data efficiently. Organizing a Liabilities Statement in Excel ensures transparency and easy analysis.

Step-by-Step Guide to Creating Liabilities Statement in Excel

Start by listing all liabilities, categorize them, then input amounts and due dates. Use Excel tables to manage data and sum totals automatically. This step-by-step method makes creating a Liabilities Statement straightforward and error-free.

Essential Excel Functions for Liabilities Statement

Functions like SUM, IF, and VLOOKUP enhance accuracy and automate calculations in your liabilities sheet. These tools help track totals and verify data consistency within the Liabilities Statement. Mastering these functions streamlines financial reporting.

Sample Liabilities Statement Format in Excel

A typical sample includes a header, detailed liability items, individual amounts, and total liabilities at the bottom. This format provides a clear, concise view of financial obligations. Referencing a Liabilities Statement sample aids in proper organization and presentation.

Common Mistakes to Avoid in Liabilities Statement

Errors such as omitting liabilities, misclassification, or incorrect calculations can distort financial reports. Avoiding these common pitfalls maintains the integrity of the Liabilities Statement. Regular reviews and audits help catch and correct mistakes early.

Tips for Maintaining Accurate Liabilities Records

Keep liabilities updated in real-time and reconcile with supporting documents regularly. Use Excel features like data validation and conditional formatting to minimize errors. Consistent management ensures accurate and reliable Liabilities Statement records.

Downloadable Liabilities Statement Excel Template

Using a pre-designed, Liabilities Statement Excel template saves time and enhances consistency. Templates often include built-in formulas and formatting ideal for tracking liabilities. Downloadable files provide a practical starting point for efficient financial documentation.