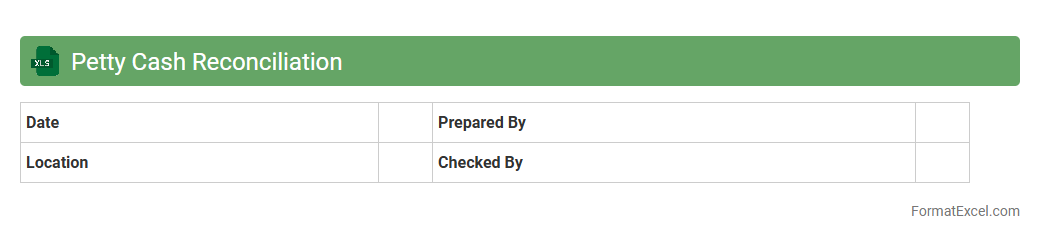

Petty Cash Reconciliation

A

Petty Cash Reconciliation Excel document is a vital tool for tracking small cash expenses within an organization. It helps in accurately recording disbursements, comparing actual cash on hand with recorded transactions, and identifying discrepancies. This ensures proper financial control, minimizes the risk of errors or fraud, and maintains transparency in managing petty cash funds.

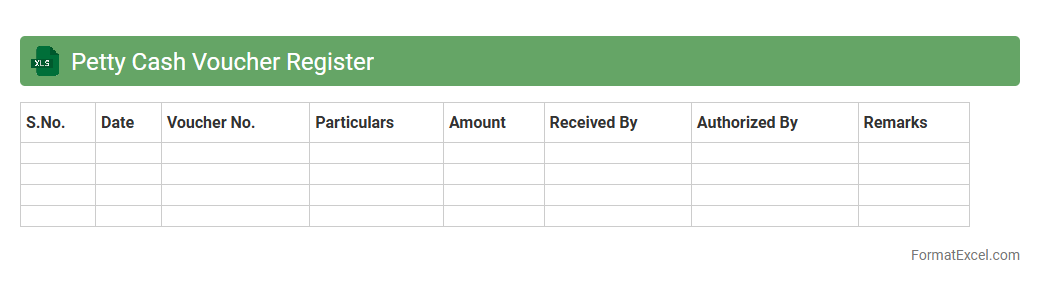

Petty Cash Voucher Register

The

Petty Cash Voucher Register Excel document is a structured record-keeping tool designed to track small cash transactions within an organization. It helps maintain accountability by documenting details such as voucher numbers, amounts, dates, purposes, and approvals, ensuring transparency in petty cash management. Using this register simplifies reconciliation, prevents discrepancies, and supports efficient financial auditing processes.

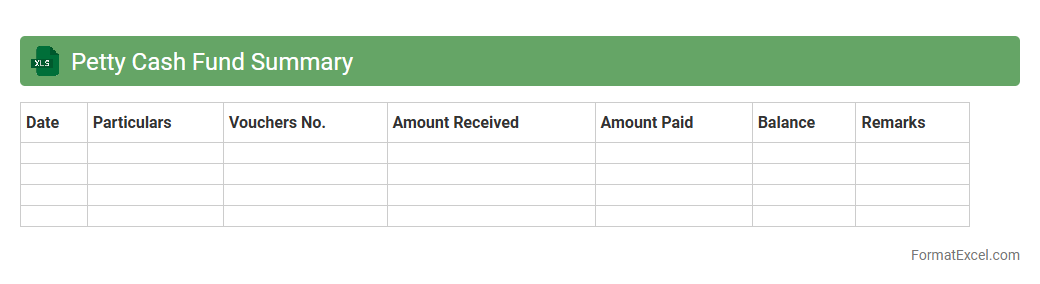

Petty Cash Fund Summary

A

Petty Cash Fund Summary Excel document tracks all small cash transactions within a business, ensuring accurate record-keeping of expenses like office supplies and minor repairs. This summary helps maintain financial transparency and control by providing a clear overview of cash inflows and outflows, preventing discrepancies. Using this document enhances budgeting accuracy and simplifies auditing processes by consolidating petty cash data in one accessible location.

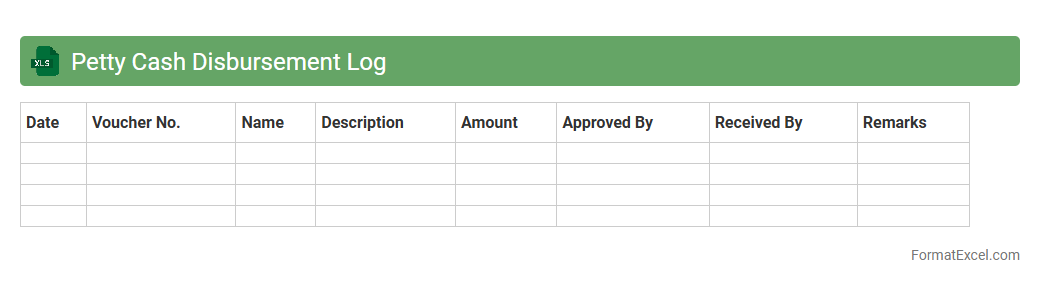

Petty Cash Disbursement Log

A

Petty Cash Disbursement Log Excel document systematically records small cash expenses, providing an organized way to track all petty cash transactions. It helps maintain accurate financial records, simplifies reconciliation processes, and prevents unauthorized use of funds. By using this log, businesses can ensure transparency and accountability in managing day-to-day cash expenditures.

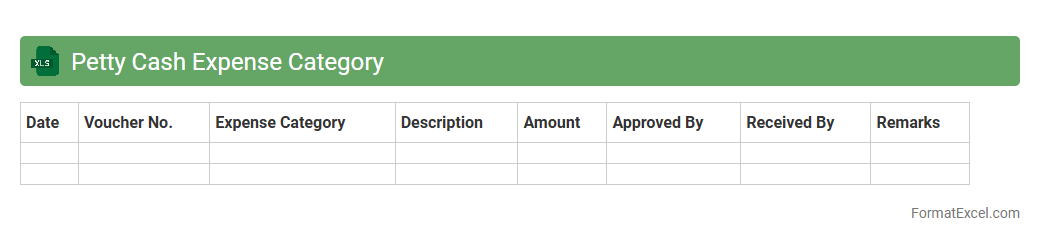

Petty Cash Expense Category

The

Petty Cash Expense Category Excel document organizes small, incidental business expenses into specific categories for easy tracking and management. This helps maintain accurate financial records by ensuring all minor expenditures, such as office supplies or refreshments, are accounted for without confusion. Using this tool enhances budget control and simplifies the reimbursement process by providing clear documentation of petty cash usage.

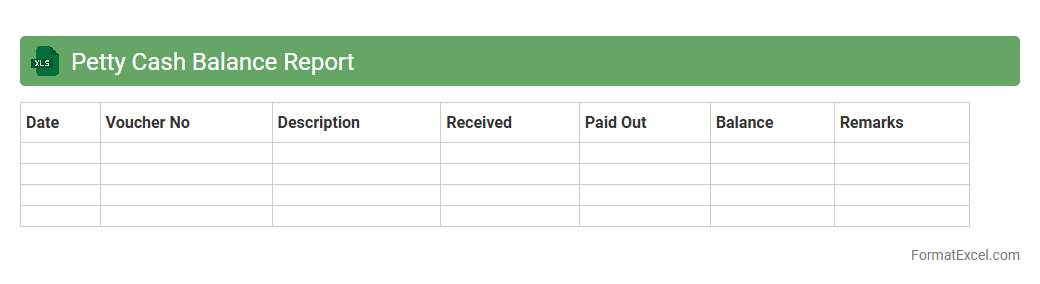

Petty Cash Balance Report

The

Petty Cash Balance Report Excel document is a financial tool that tracks small cash expenses and remaining balances within an organization. It provides a clear overview of daily cash inflows and outflows, helping maintain accurate records for auditing and budgeting purposes. This report enhances transparency and ensures effective management of petty cash funds, preventing discrepancies and unauthorized use.

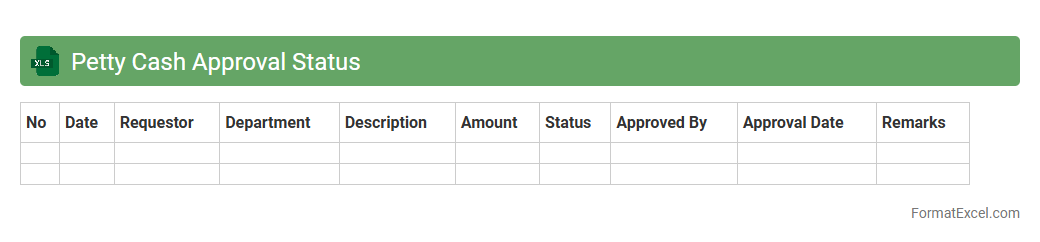

Petty Cash Approval Status

The

Petty Cash Approval Status Excel document tracks and monitors small cash expenditures within an organization, ensuring all petty cash requests are properly reviewed and authorized. It helps maintain transparency by recording approval dates, approvers' names, and transaction details, reducing the risk of unauthorized spending. This tool streamlines the reconciliation process and facilitates accurate financial reporting for petty cash management.

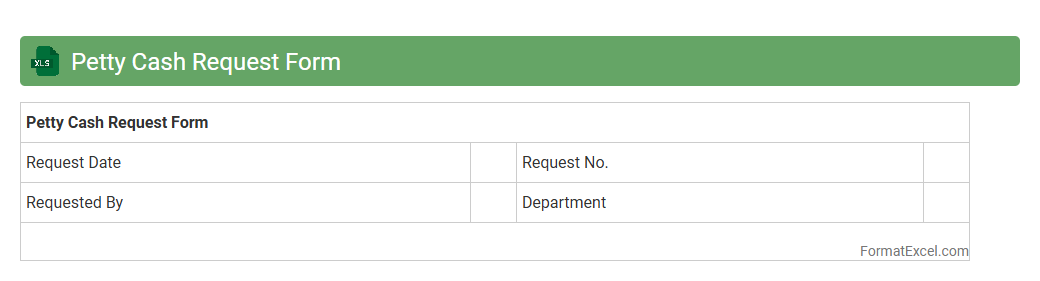

Petty Cash Request Form

A

Petty Cash Request Form Excel document is a structured template designed to record and manage small cash expenditures within an organization. It helps track requests for petty cash reimbursements, ensuring accurate documentation of amounts, purposes, and approvals. This form streamlines financial control, reduces errors, and enhances transparency in handling minor operational expenses.

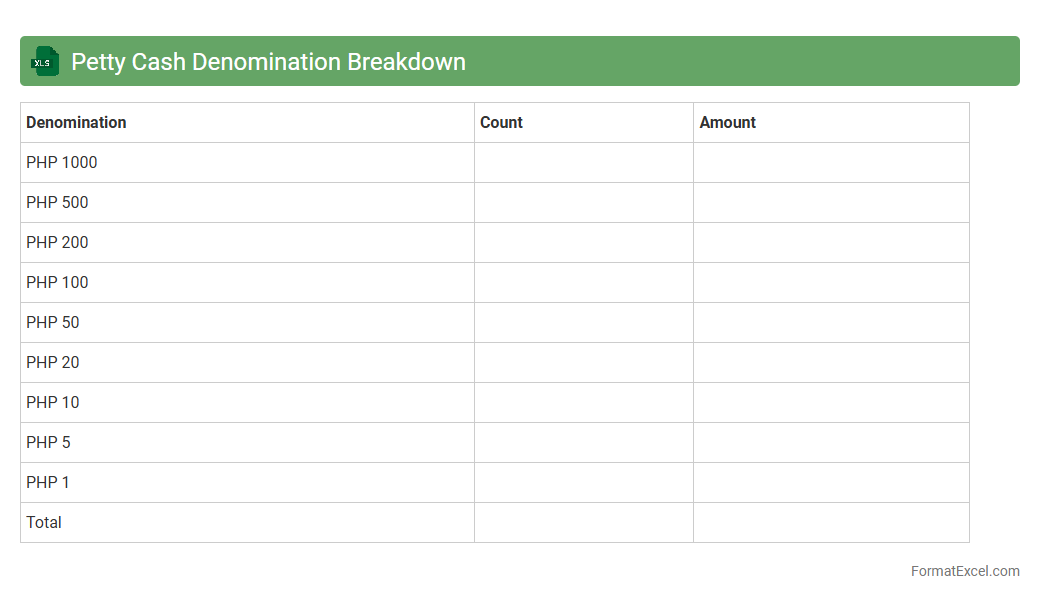

Petty Cash Denomination Breakdown

A

Petty Cash Denomination Breakdown Excel document itemizes small cash amounts by currency denominations, facilitating precise tracking and management of petty cash. This breakdown helps businesses maintain accurate records, simplifies cash reconciliation, and ensures transparency in minor transactions. Using this tool improves financial accountability and reduces discrepancies in daily cash handling.

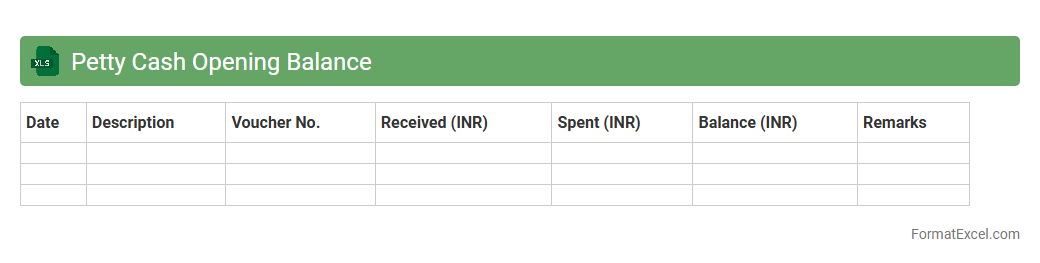

Petty Cash Opening Balance

A

Petty Cash Opening Balance Excel document records the initial amount of cash available for small, everyday business expenses. It helps track cash flow, ensuring accurate accounting and preventing discrepancies in petty cash management. This organized record improves financial transparency and simplifies reconciliation processes for businesses.

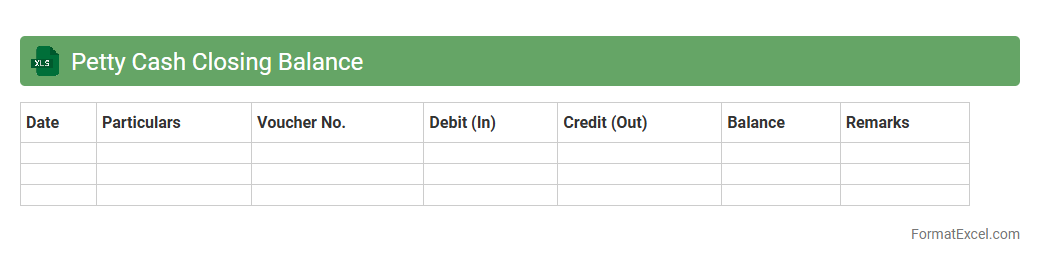

Petty Cash Closing Balance

The

Petty Cash Closing Balance Excel document tracks the remaining cash amount after all petty cash transactions within a specific period. It helps businesses maintain accurate financial records by ensuring that expenditures are accounted for and cash on hand is properly balanced. This document is essential for effective cash flow management and internal audit purposes.

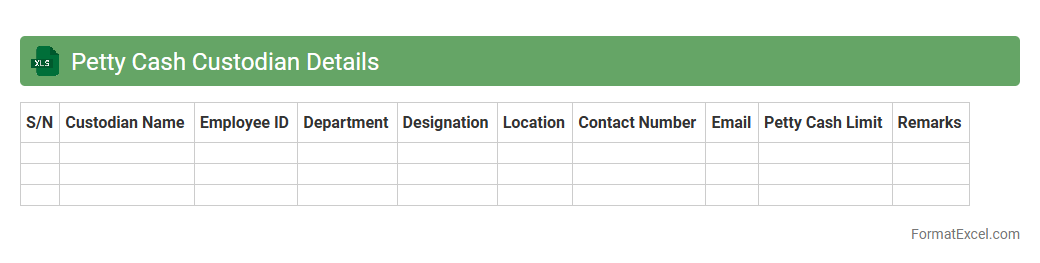

Petty Cash Custodian Details

The

Petty Cash Custodian Details Excel document tracks the responsible individuals managing small cash funds within an organization, ensuring accountability and transparency. It records custodian names, cash disbursements, replenishments, and balances, aiding in accurate financial monitoring and audit preparation. Using this document helps maintain proper control over petty cash expenses, minimizing the risk of misuse or discrepancies.

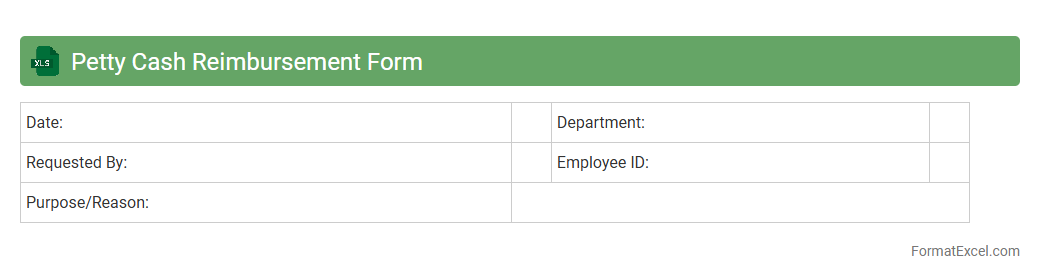

Petty Cash Reimbursement Form

A

Petty Cash Reimbursement Form Excel document is a structured template used to record and manage small, everyday business expenses typically paid out of petty cash. It helps ensure accurate tracking of expenditures by providing fields for date, amount, purpose, and approval, streamlining the reimbursement process. Utilizing this form enhances financial accountability and simplifies reconciliation of petty cash accounts within an organization.

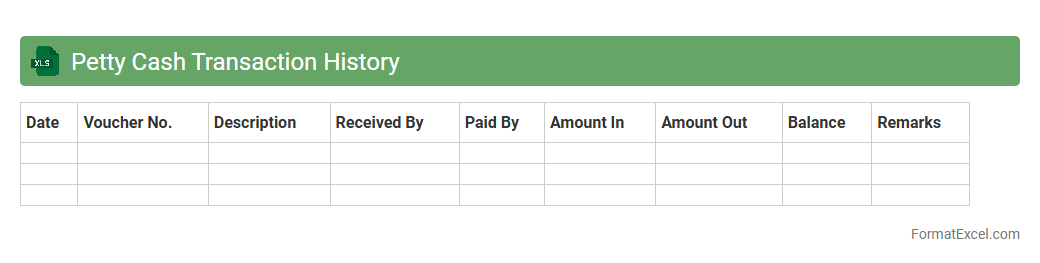

Petty Cash Transaction History

A

Petty Cash Transaction History Excel document records all small cash expenditures and replenishments within an organization, providing a clear, chronological log of petty cash usage. This document helps maintain accurate financial tracking, supports auditing processes, and ensures accountability by detailing dates, amounts, purposes, and approvers of each transaction. It simplifies budget monitoring and improves cash flow management by offering an organized overview of minor but essential cash activities.

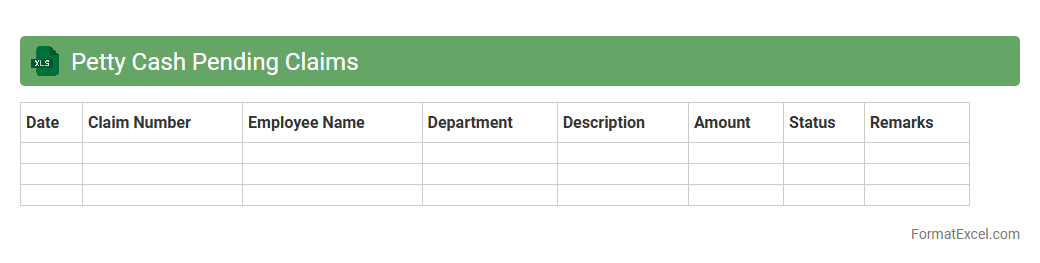

Petty Cash Pending Claims

The

Petty Cash Pending Claims Excel document is a detailed record used to track all outstanding reimbursements and expenses awaiting approval or payment within petty cash management. It helps ensure accurate financial oversight by listing pending claims, their amounts, dates, and relevant descriptions, facilitating timely follow-up and controls. This document streamlines cash flow tracking and supports efficient budget management by preventing overlooked or delayed reimbursements.

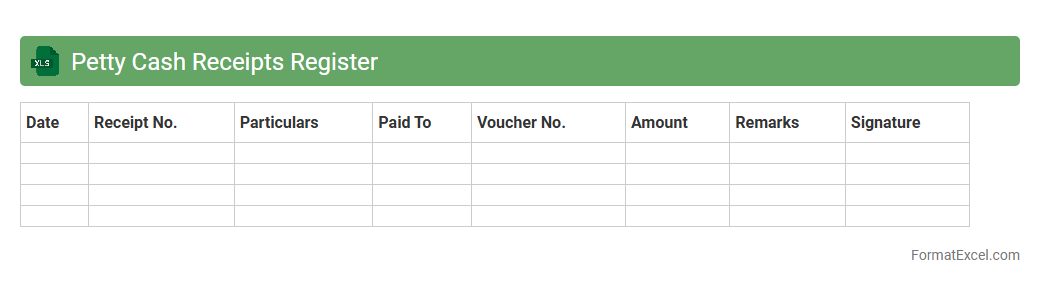

Petty Cash Receipts Register

A

Petty Cash Receipts Register Excel document is a ledger used to track all small cash transactions made from a petty cash fund, providing clear records of receipts and expenditures. It helps maintain accurate financial control by organizing details such as date, amount, purpose, and receipt numbers, ensuring transparency and accountability. This tool is essential for businesses to efficiently monitor petty cash flows and simplify auditing processes.

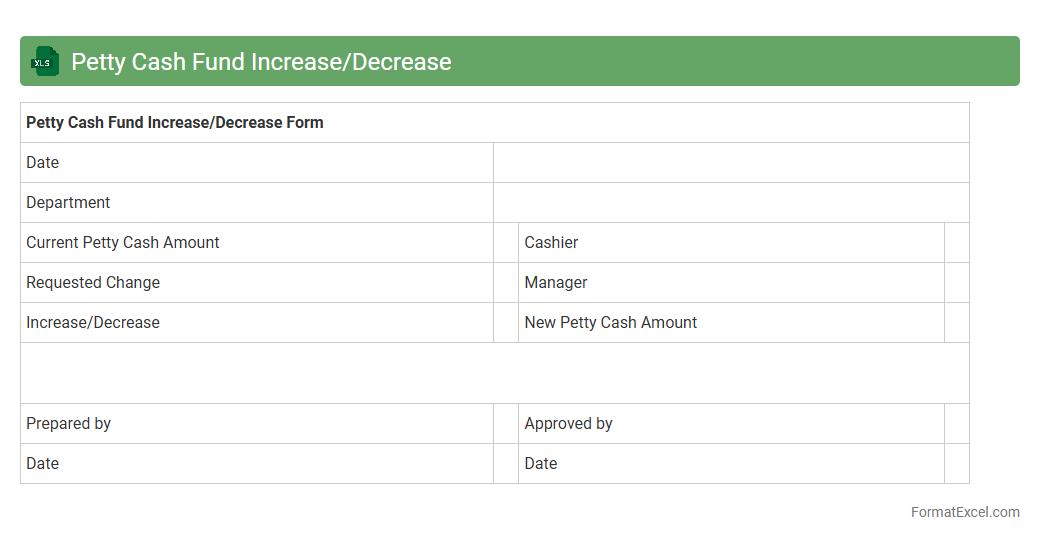

Petty Cash Fund Increase/Decrease

The

Petty Cash Fund Increase/Decrease Excel document is a financial tool designed to track adjustments in petty cash balances by recording all increments and decrements systematically. It helps maintain accurate records of small cash transactions, ensuring transparency and accountability in cash management. This document is useful for monitoring cash flow, preventing discrepancies, and facilitating budgeting and auditing processes within organizations.

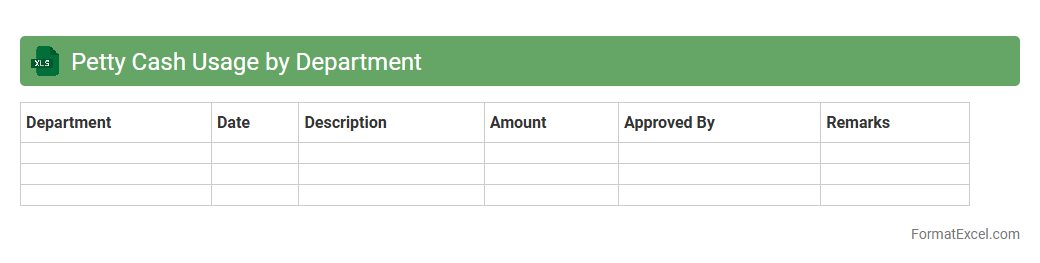

Petty Cash Usage by Department

The

Petty Cash Usage by Department Excel document tracks small, everyday expenses across various departments, enabling precise monitoring of cash disbursements. This detailed record helps identify spending patterns, prevent misuse, and maintain budget control within each department. By organizing data systematically, it supports accurate financial reporting and streamlines reconciliation processes.

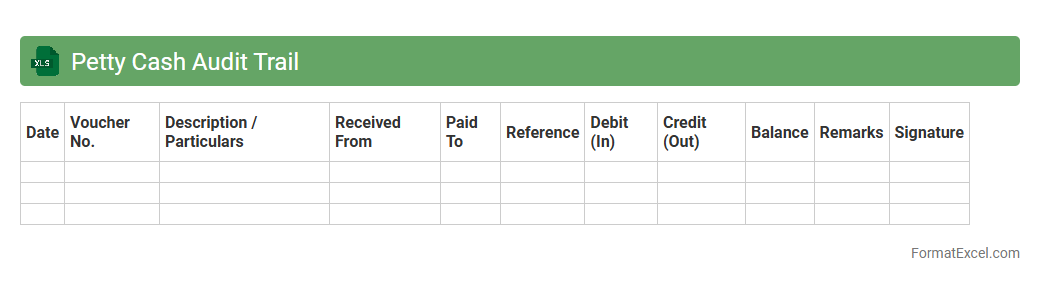

Petty Cash Audit Trail

A

Petty Cash Audit Trail Excel document is a detailed record-keeping tool designed to track all petty cash transactions systematically. It helps organizations maintain transparency by documenting every cash inflow and outflow with dates, descriptions, and approval status, ensuring accountability. This tool is essential for identifying discrepancies, simplifying financial audits, and supporting effective cash management.

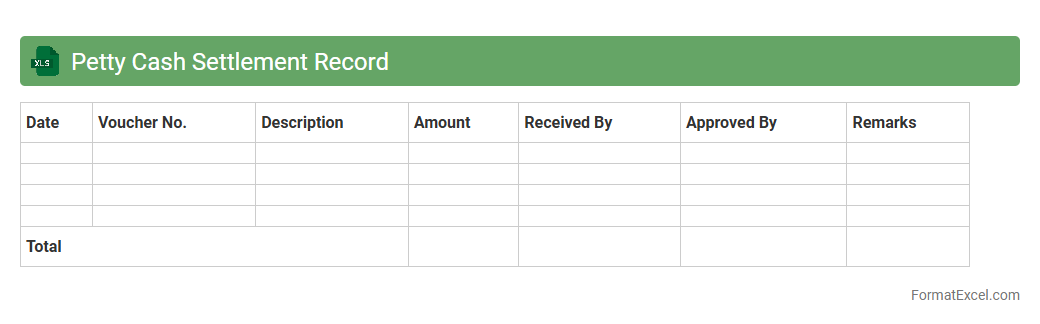

Petty Cash Settlement Record

A

Petty Cash Settlement Record Excel document is a financial tool used to track and reconcile small cash expenses within an organization. It helps maintain transparency by documenting vouchers, receipts, and reimbursements, ensuring accurate accounting and easy auditing. This record improves cash management efficiency, reduces discrepancies, and supports budget monitoring for minor operational costs.

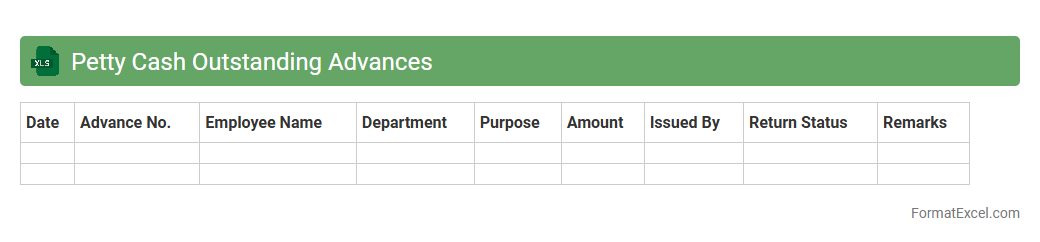

Petty Cash Outstanding Advances

A

Petty Cash Outstanding Advances Excel document is a financial tool designed to track small cash advances given to employees for minor business expenses that are not charged through formal purchase orders. It helps maintain accurate records of disbursed amounts, outstanding balances, and reimbursements, ensuring transparency and control over petty cash usage. This document streamlines expense management, reduces errors, and facilitates timely reconciliation of cash advances, supporting effective budget monitoring.

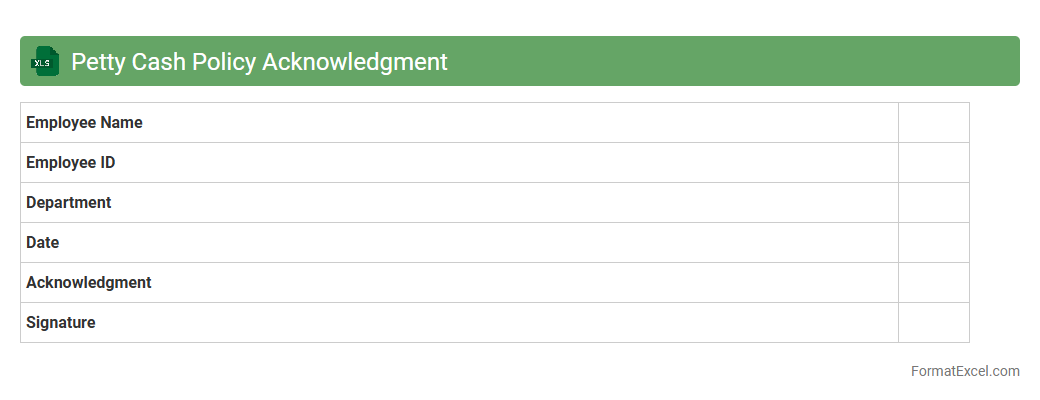

Petty Cash Policy Acknowledgment

The

Petty Cash Policy Acknowledgment Excel document serves as a formal record where employees confirm their understanding and compliance with the company's petty cash usage guidelines. This document helps streamline financial controls by ensuring that all staff are aware of the rules governing small cash expenditures, reducing the risk of misuse or errors. By maintaining an organized acknowledgment record, organizations can enhance accountability and facilitate internal audits effectively.

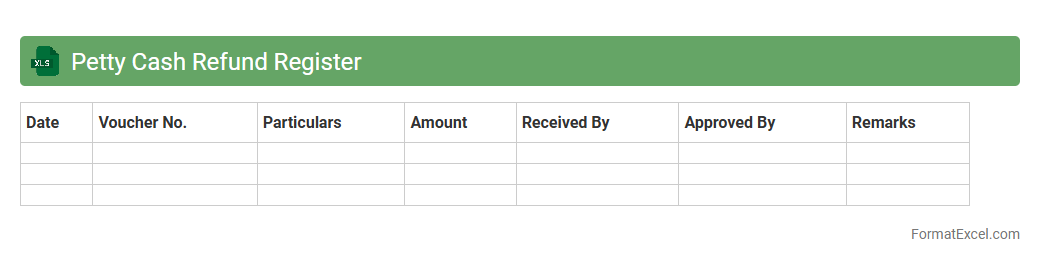

Petty Cash Refund Register

The

Petty Cash Refund Register Excel document is a systematic record that tracks reimbursements made from petty cash expenses, ensuring accurate monitoring of small cash disbursements. It helps maintain transparency and control by documenting refund dates, amounts, vendors, and approval status, facilitating efficient financial auditing and budget management. This register improves accountability and simplifies the reconciliation process, reducing errors in petty cash handling within an organization.

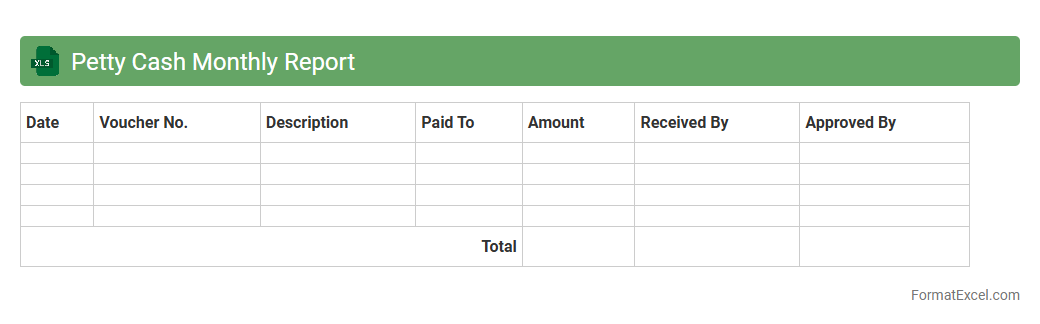

Petty Cash Monthly Report

The

Petty Cash Monthly Report Excel document serves as a detailed ledger tracking small cash expenses within an organization over a month. It enables accurate monitoring and reconciliation of petty cash transactions, helping to prevent discrepancies and maintain financial transparency. This report is essential for budgeting, auditing, and ensuring compliance with company financial policies.

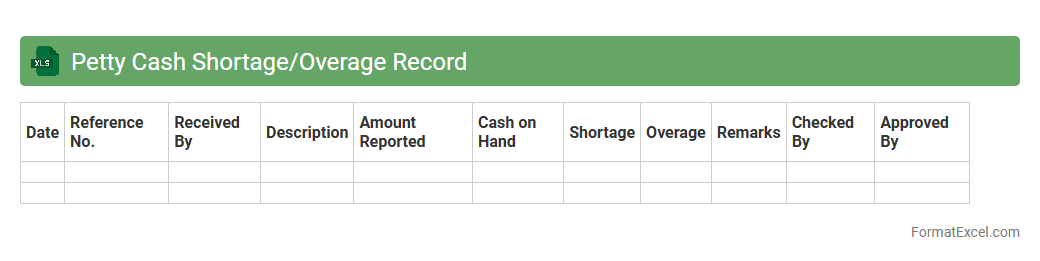

Petty Cash Shortage/Overage Record

The

Petty Cash Shortage/Overage Record Excel document is a financial tool used to track discrepancies between actual cash on hand and recorded amounts in petty cash funds. It helps organizations identify and document instances of cash shortages or overages, ensuring accountability and accuracy in petty cash management. This record is useful for maintaining transparent financial controls and facilitating audits by providing a clear, organized log of petty cash transactions and variances.

Introduction to Petty Cash Statement

A Petty Cash Statement is a financial document that tracks small cash expenses. It helps businesses monitor daily minor purchases that don't require formal invoicing. This statement ensures transparency and accountability in cash handling.

Importance of Petty Cash Management

Effective petty cash management prevents misuse of funds and maintains financial accuracy. Proper tracking allows for easier reconciliation and budget control. It supports smooth business operations by covering incidental expenses promptly.

Key Components of a Petty Cash Statement

The core elements include date, description, amount spent, and remaining balance. Each entry must be clearly documented to provide a transparent cash flow record. A well-structured statement aids in easy tracking and auditing.

Benefits of Using Excel for Petty Cash

Excel offers flexibility and customization for managing petty cash data. It enables automatic calculations and real-time updates for accuracy. Utilizing Excel also simplifies data organization and reporting.

Standard Petty Cash Statement Format in Excel

The typical format includes columns for date, voucher number, description, amount spent, and balance. This layout ensures clarity and consistency in recording expenses. A standard format helps maintain professionalism and transparency.

Step-by-Step Guide to Creating a Petty Cash Statement in Excel

Start by setting up columns for all necessary fields, then input opening balance. Record each expense chronologically and update the remaining balance automatically. Using formulas in Excel streamlines the process.

Essential Columns and Fields to Include

Important fields are date, voucher/reference number, payee, description, amount, and balance. These help track the source and purpose of each transaction. Including a balance column ensures continuous monitoring of funds.

Tips for Maintaining Accurate Petty Cash Records

Make timely entries and retain all receipts to support each transaction. Regular reconciliation helps catch discrepancies early. Maintaining accurate records increases trust and ensures financial integrity.

Common Mistakes to Avoid in Petty Cash Statements

Avoid delayed recording, missing receipts, and inconsistent data entries. These errors can cause inaccurate financial reporting and audit challenges. Preventing mistakes ensures a reliable cash management system.

Free Petty Cash Statement Excel Templates

Many websites provide free downloadable templates tailored to business needs. These templates come pre-formatted with formulas and fields ready to use. Utilizing free templates saves time and enhances efficiency.