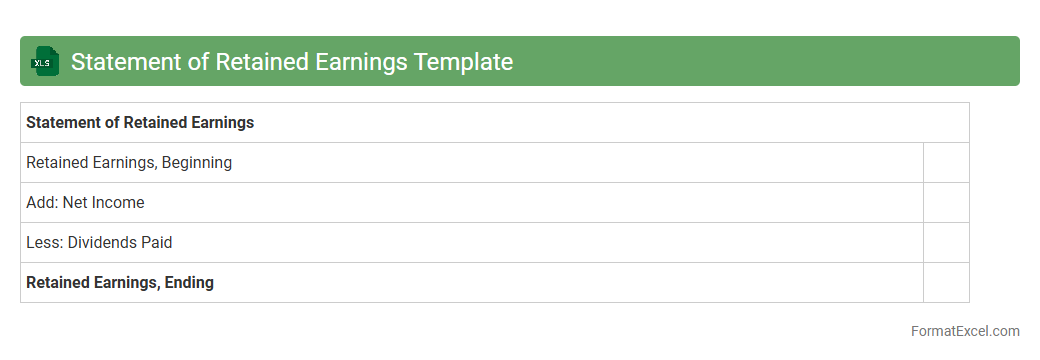

Statement of Retained Earnings Template

A

Statement of Retained Earnings Template in Excel is a structured document that tracks changes in retained earnings over a specific period, including net income and dividends paid. It helps businesses analyze accumulated profits that are reinvested rather than distributed as dividends, providing clear visibility on financial health and shareholder equity. Using this template improves accuracy, saves time on calculations, and facilitates better financial planning and reporting.

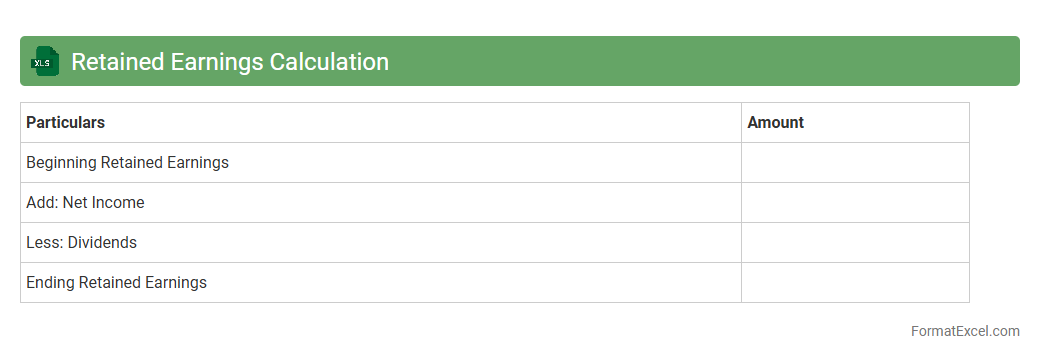

Retained Earnings Calculation

A

Retained Earnings Calculation Excel document is a spreadsheet tool designed to track and compute the portion of net income retained in a company after dividends are paid out to shareholders. It helps businesses monitor their accumulated profits over time, providing insight into financial health and informing decisions on reinvestment, debt repayment, and dividend policy. Using this document streamlines financial analysis and supports accurate reporting for internal management and external stakeholders.

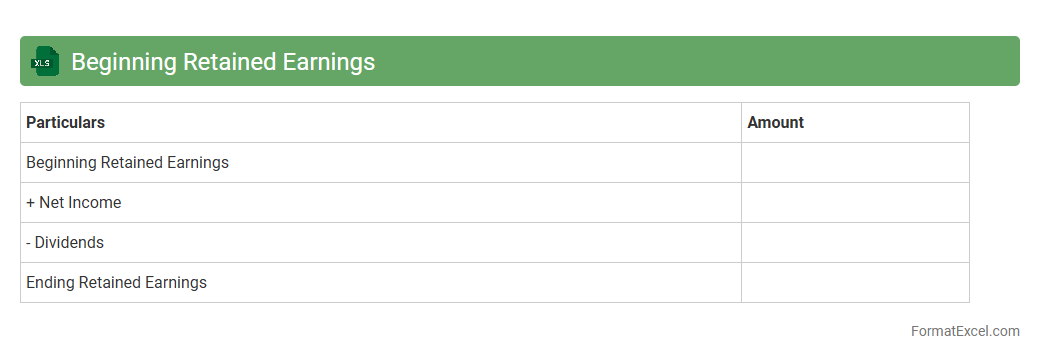

Beginning Retained Earnings

The

Beginning Retained Earnings Excel document is a financial tool used to track the starting balance of retained earnings at the beginning of an accounting period. It helps businesses accurately calculate net income, dividends, and adjustments over time, ensuring proper equity management. This document is essential for preparing financial statements and assessing company profitability and financial health.

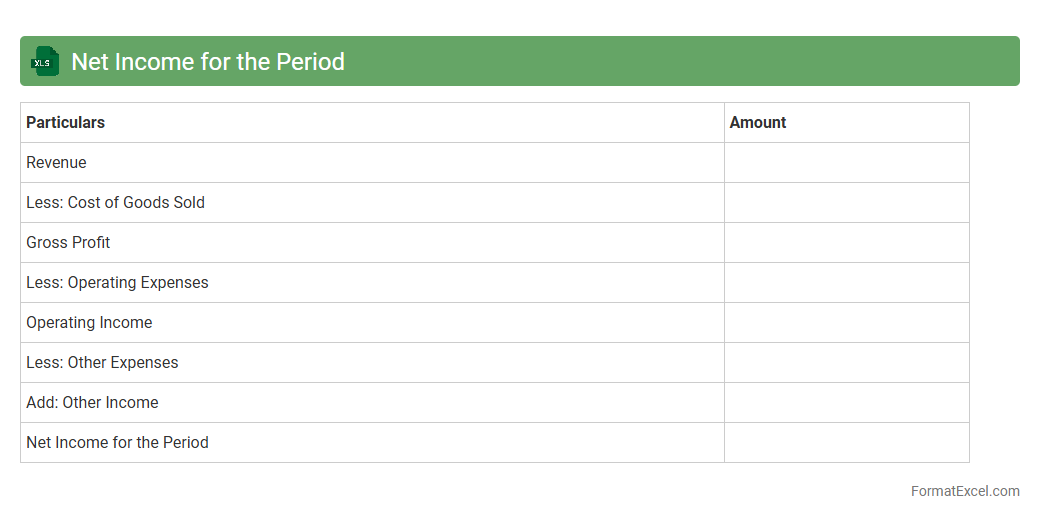

Net Income for the Period

Net Income for the Period in an Excel document represents the company's total earnings after deducting expenses, taxes, and costs from revenue within a specific timeframe. This figure is crucial for assessing financial performance, profitability, and operational efficiency. Utilizing a

Net Income for the Period Excel sheet enables accurate tracking, forecasting, and strategic decision-making in business management.

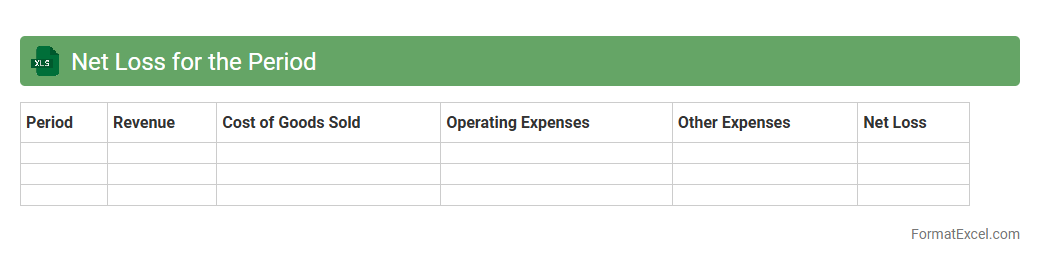

Net Loss for the Period

Net Loss for the Period in an Excel document represents the total financial deficit a company incurs during a specific timeframe, calculated by subtracting total expenses from total revenues. This metric is crucial for assessing a business's profitability, cash flow challenges, and operational efficiency. Analyzing

Net Loss for the Period helps stakeholders make informed decisions about budgeting, investment, and strategic planning to improve financial health.

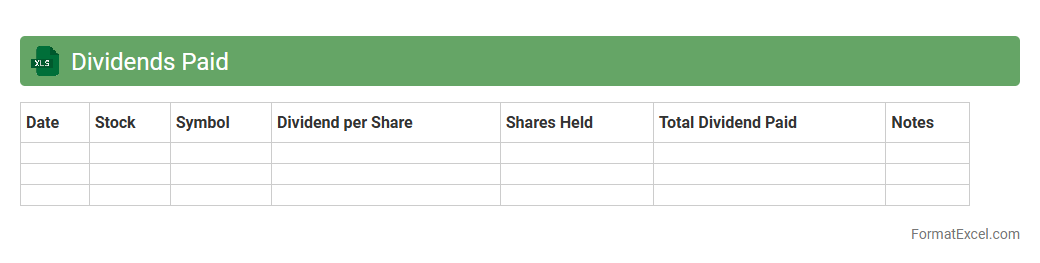

Dividends Paid

A

Dividends Paid Excel document is a financial spreadsheet designed to track and analyze dividend payments made by a company to its shareholders over a specific period. It helps investors monitor dividend income, calculate yield percentages, and assess the consistency and growth of dividend distributions. This tool is essential for portfolio management, enabling informed decision-making regarding income investments and cash flow planning.

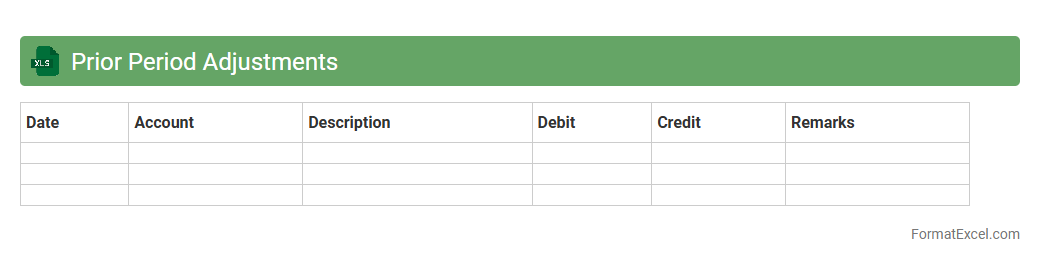

Prior Period Adjustments

A

Prior Period Adjustments Excel document records corrections to financial statements from previous accounting periods, ensuring accuracy and compliance with accounting standards. It allows businesses to transparently track and adjust discrepancies, such as errors or changes in accounting policies, without altering current period figures. This tool improves financial reporting integrity and aids auditors, accountants, and management in maintaining reliable historical financial data.

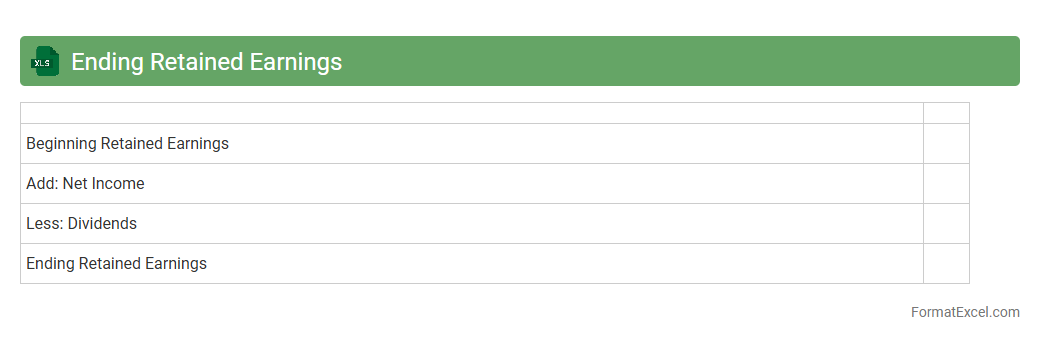

Ending Retained Earnings

The

Ending Retained Earnings Excel document calculates the final balance of retained earnings by adjusting the beginning retained earnings with net income and dividends paid during a specific period. It is useful for tracking a company's accumulated profits that are reinvested in the business instead of distributed as dividends. This helps stakeholders assess the financial health and growth potential of the company over time.

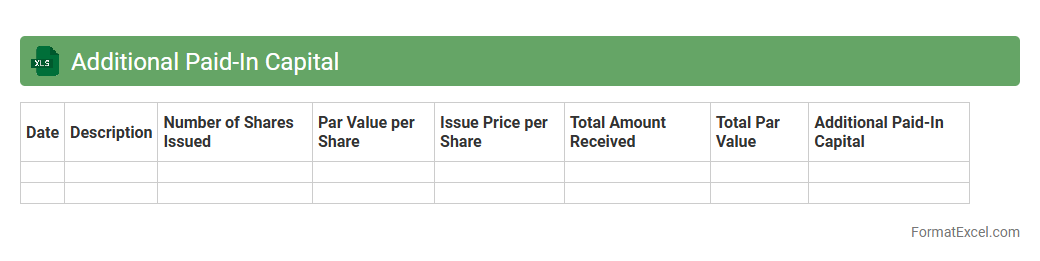

Additional Paid-In Capital

An

Additional Paid-In Capital Excel document tracks the amount investors pay above the par value of shares during equity financing, providing clear insights into the company's equity structure. This spreadsheet is useful for financial analysis, helping stakeholders understand the premium invested by shareholders beyond the nominal share value. It streamlines record-keeping and supports accurate reporting of shareholders' equity on the balance sheet.

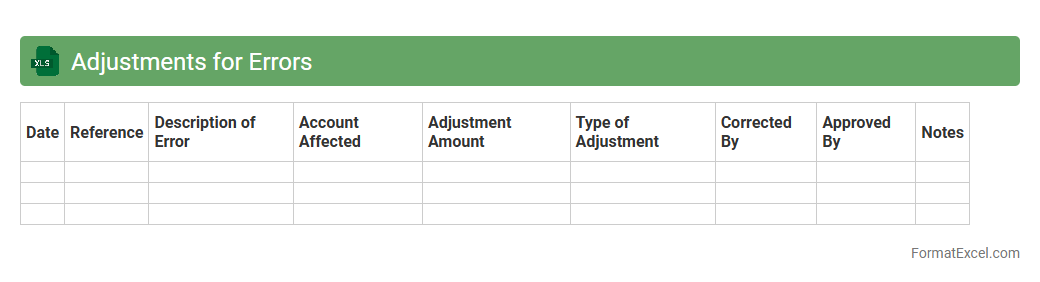

Adjustments for Errors

Adjustments for Errors Excel document is a structured spreadsheet designed to identify, track, and correct discrepancies in data entries or calculations within financial records or operational datasets. It helps maintain data accuracy by allowing users to pinpoint errors, document necessary corrections, and update records systematically. This tool is useful for ensuring data integrity, improving financial reporting accuracy, and supporting compliance with accounting standards.

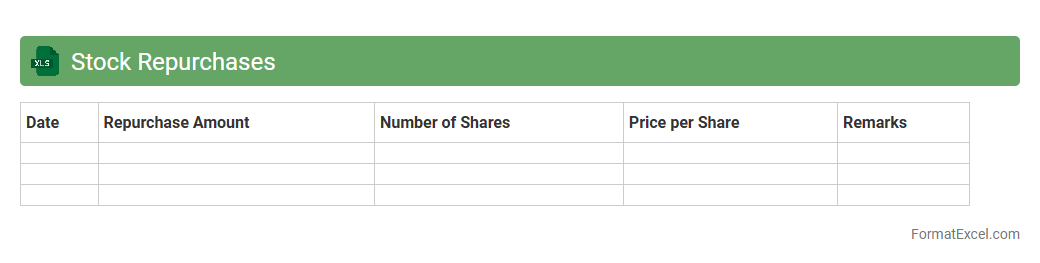

Stock Repurchases

A

Stock Repurchases Excel document is a spreadsheet designed to track and analyze company buyback activities, including details such as repurchase dates, share quantities, and prices paid. It helps investors and financial analysts monitor repurchase trends, assess the impact on earnings per share (EPS), and evaluate shareholder value creation. Using this tool improves decision-making by providing clear insights into how stock buybacks influence market performance and capital structure.

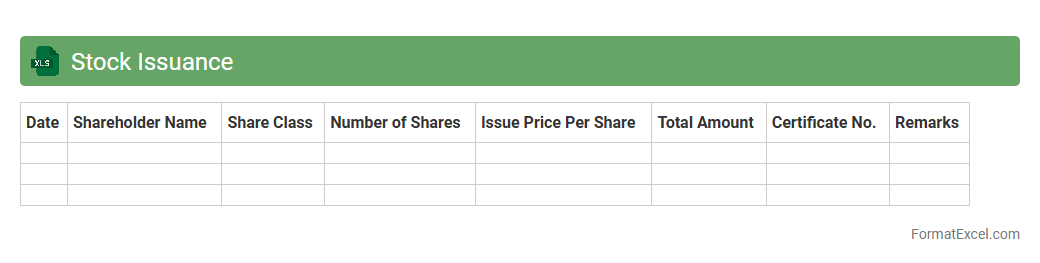

Stock Issuance

A

Stock Issuance Excel document is a spreadsheet used to track and manage the distribution of company shares to investors or employees. It helps monitor the number of shares issued, outstanding shares, and ownership percentages, providing clear data for financial reporting and compliance. This tool is essential for ensuring accurate equity management and facilitating decision-making in corporate finance.

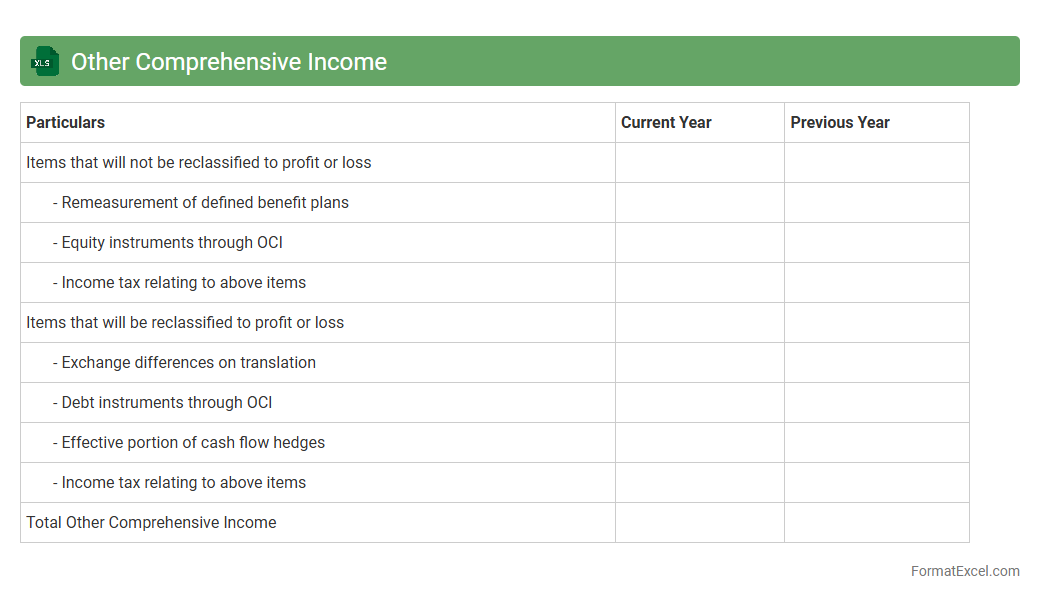

Other Comprehensive Income

Other Comprehensive Income (OCI) Excel documents track changes in equity from non-owner sources, such as unrealized gains and losses on investments, foreign currency translations, and pension adjustments. These spreadsheets provide a clear, organized way to monitor and analyze fluctuations that are not reflected in net income but impact overall financial health. Using an

Other Comprehensive Income Excel document enhances financial reporting accuracy and supports better decision-making by offering a comprehensive view of a company's performance beyond the income statement.

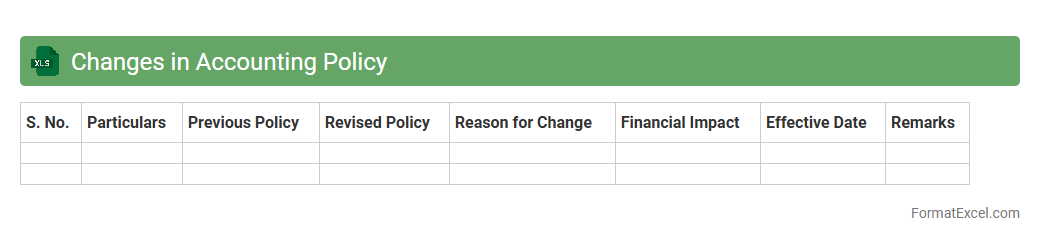

Changes in Accounting Policy

A

Changes in Accounting Policy Excel document systematically records modifications in an organization's accounting methods, ensuring compliance with financial reporting standards. This document aids in tracking the impact of policy changes on financial statements, facilitating transparent audits and informed decision-making. Maintaining such a file enhances accuracy in comparative financial analysis and supports regulatory adherence.

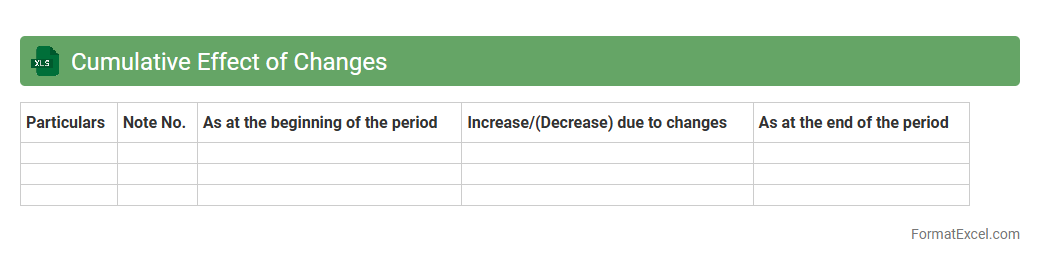

Cumulative Effect of Changes

The

Cumulative Effect of Changes Excel document tracks the aggregated impact of multiple modifications over time, enabling users to analyze trends and quantify overall changes efficiently. This tool is essential for financial modeling, project management, and performance analysis, as it consolidates data updates into a clear, visual format. Using this document helps stakeholders make informed decisions by providing a comprehensive view of incremental adjustments and their long-term effects.

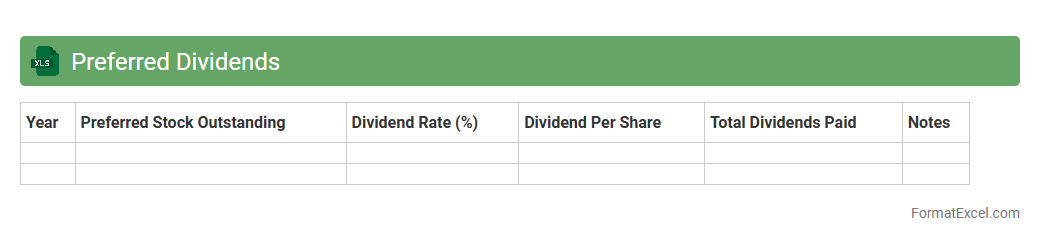

Preferred Dividends

A

Preferred Dividends Excel document is a financial tool designed to calculate and track dividends paid to preferred shareholders, facilitating accurate record-keeping and forecasting. It helps businesses manage dividend schedules, determine payout amounts based on shareholding percentages or fixed rates, and ensures compliance with dividend policies. This document enhances financial planning by providing clear visibility into dividend obligations, aiding in informed decision-making and cash flow management.

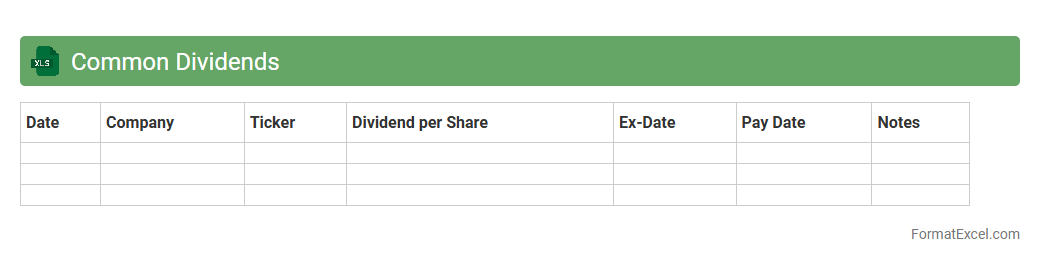

Common Dividends

The

Common Dividends Excel document is a spreadsheet tool designed to track and calculate dividend payments distributed by companies to their shareholders. It organizes dividend amounts, payment dates, and yields, allowing investors to efficiently monitor their income from stock investments. This document aids in financial planning and portfolio analysis by providing clear insights into dividend performance over time.

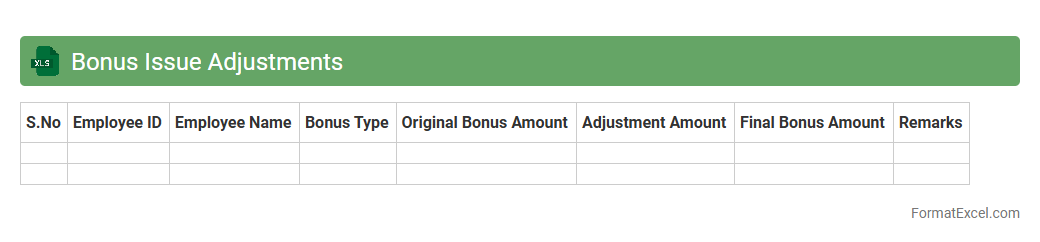

Bonus Issue Adjustments

The

Bonus Issue Adjustments Excel document is a specialized tool designed to accurately reflect changes in a company's stock structure following bonus share issues. It helps investors and analysts adjust historical stock prices and volumes, ensuring precise calculation of returns and comparative analysis over time. This document is essential for maintaining consistency in financial records and facilitating informed investment decisions.

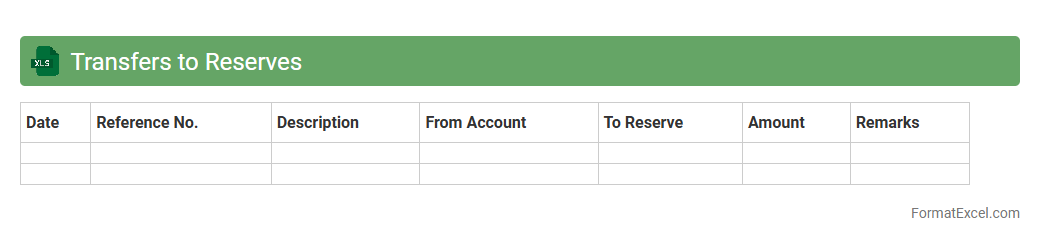

Transfers to Reserves

The

Transfers to Reserves Excel document is a financial tool used to track and manage the allocation of funds into various reserve accounts within an organization. It provides detailed insights into the movement of money, helping ensure accurate budgeting, compliance, and financial planning. This document is essential for maintaining transparency, monitoring reserve balances, and supporting strategic decision-making related to fund preservation and utilization.

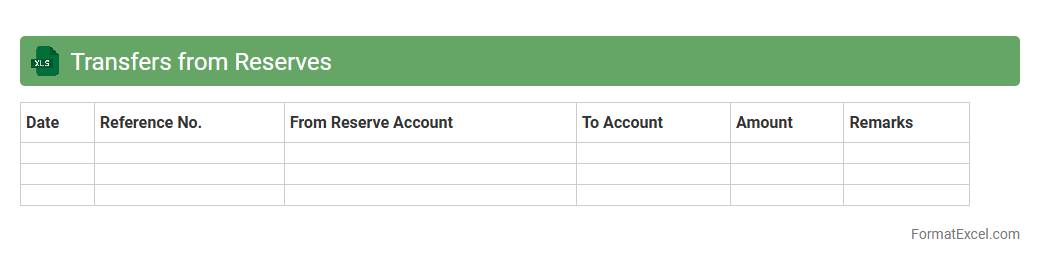

Transfers from Reserves

The

Transfers from Reserves Excel document is a financial tool that tracks the movement of funds allocated from reserve accounts to various budgetary needs. It provides a clear and organized record of reserve withdrawals, enabling efficient financial planning and transparency in resource allocation. This document helps organizations monitor reserve usage, ensuring accountability and supporting strategic decision-making for future funding requirements.

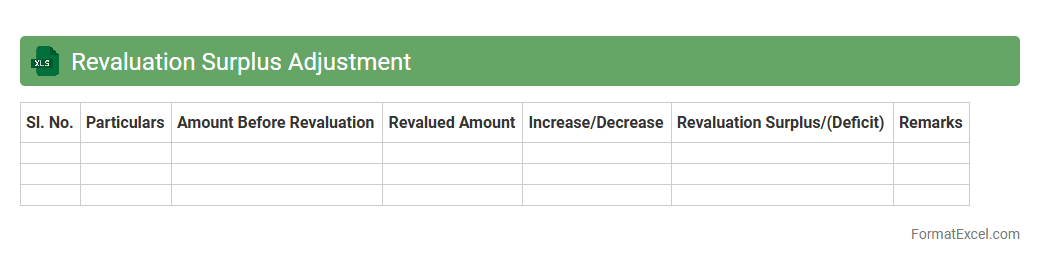

Revaluation Surplus Adjustment

The

Revaluation Surplus Adjustment Excel document is a financial tool designed to track and adjust revaluation surpluses arising from asset revaluation in compliance with accounting standards. It helps in accurately reflecting changes in asset values on the balance sheet, ensuring transparency and compliance with regulatory requirements. This document facilitates better decision-making by providing a clear view of surplus adjustments and their impact on equity.

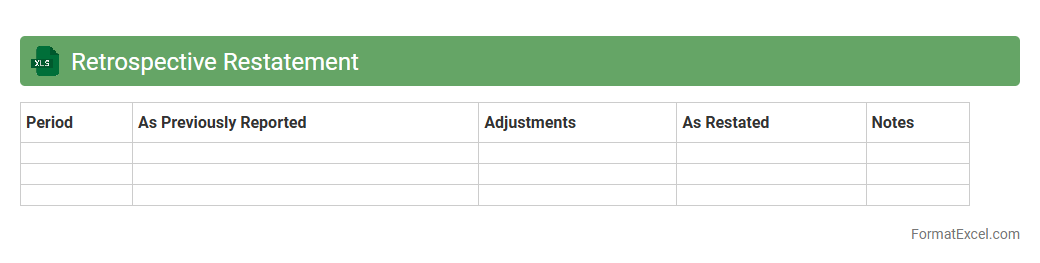

Retrospective Restatement

A

Retrospective Restatement Excel document is a financial tool used to revise previously issued financial statements to correct errors or reflect changes in accounting policies. It provides a transparent and organized format to compare original and restated figures, ensuring compliance with accounting standards like GAAP or IFRS. This document is useful for auditors, accountants, and financial analysts to maintain accuracy in financial reporting and enhance stakeholder trust.

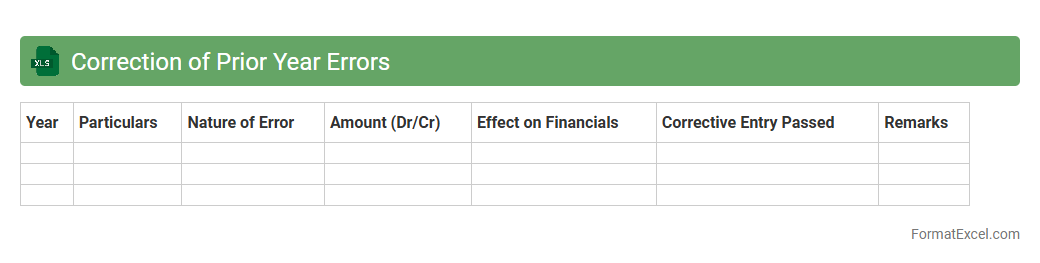

Correction of Prior Year Errors

The

Correction of Prior Year Errors Excel document is a specialized financial tool designed to identify, record, and adjust accounting errors from previous fiscal periods. It helps ensure accurate financial reporting by systematically correcting inaccuracies in financial statements, maintaining compliance with accounting standards such as GAAP or IFRS. This document is useful for auditors, accountants, and financial managers to improve the reliability of financial data and support transparent decision-making processes.

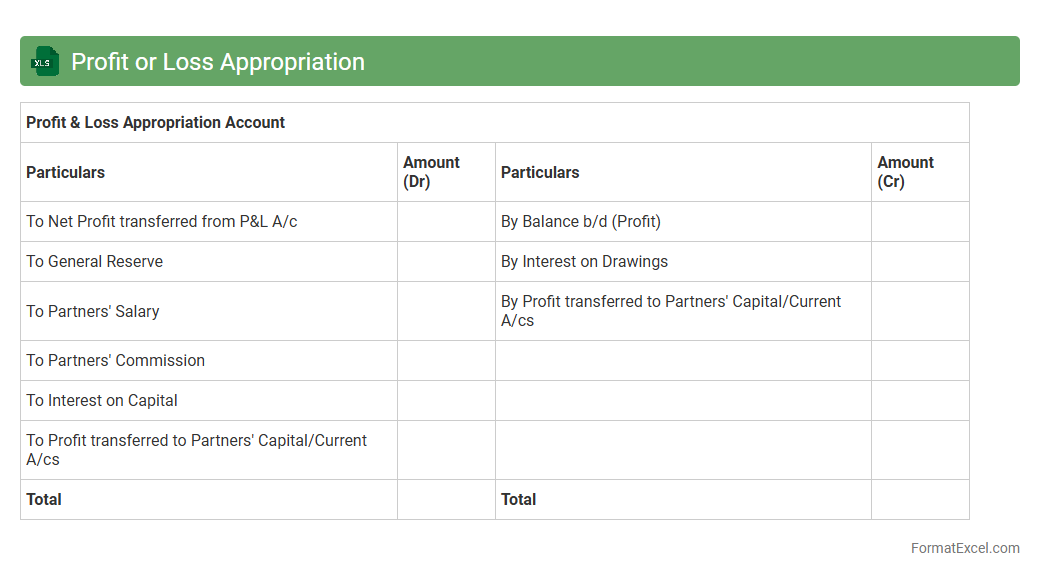

Profit or Loss Appropriation

The

Profit or Loss Appropriation Excel document is a financial tool designed to allocate net profits or losses among partners or stakeholders in a structured manner. It helps in clearly tracking the distribution of earnings, retained earnings, reserves, and dividends, ensuring transparency and accuracy in financial reporting. Businesses utilize this document to simplify complex calculations and maintain organized records for auditing and decision-making purposes.

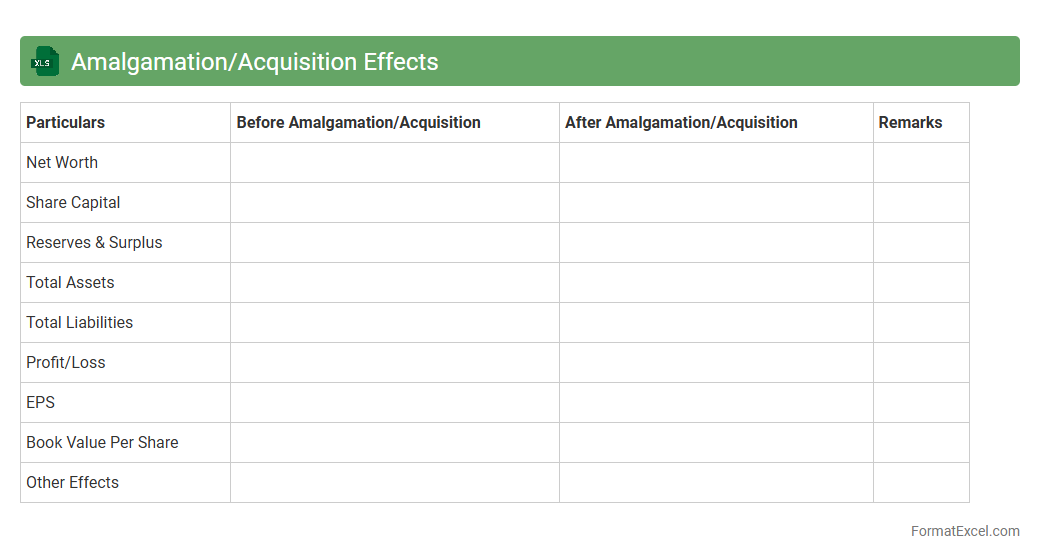

Amalgamation/Acquisition Effects

An

Amalgamation/Acquisition Effects Excel document systematically analyzes the financial impact of mergers or acquisitions by consolidating key metrics such as revenue, expenses, and synergies. This tool enables businesses to project combined financial statements, assess cost-saving opportunities, and evaluate overall transaction benefits with precision. It is essential for informed decision-making, strategic planning, and communicating the value proposition of corporate consolidations to stakeholders.

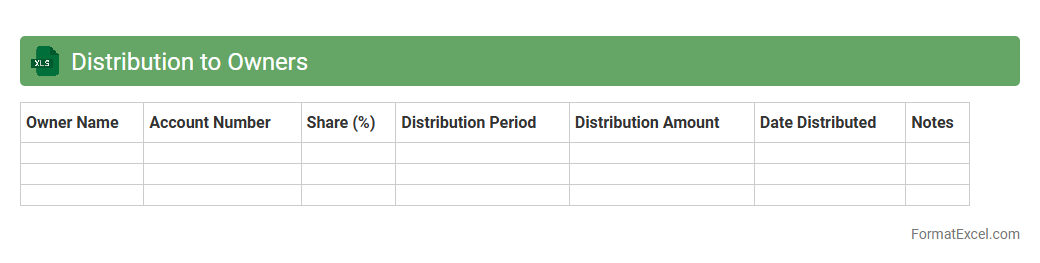

Distribution to Owners

A

Distribution to Owners Excel document is a financial tool designed to track and manage the allocation of profits or dividends to shareholders or business owners. It helps businesses maintain accurate records of ownership distributions, ensuring transparency and compliance with tax regulations. Using this document streamlines financial reporting and supports effective decision-making by clearly outlining each owner's share of the returns.

Introduction to Statement of Retained Earnings

The Statement of Retained Earnings summarizes changes in retained earnings over a specific period. It reflects profits reinvested in the business rather than distributed as dividends. This statement links the income statement and balance sheet for comprehensive financial reporting.

Importance of Retained Earnings in Financial Reporting

Retained earnings indicate a company's capacity to finance operations internally. They represent accumulated profits that enhance shareholder value and support future growth. Accurate reporting is critical for investors and management decision-making.

Key Components of the Statement of Retained Earnings

The statement typically includes beginning retained earnings, net income or loss, dividends paid, and ending retained earnings. Each component is essential for understanding changes in equity during the reporting period. Properly capturing these elements ensures clarity and accuracy.

Standard Format for Statement of Retained Earnings in Excel

The standard Excel format includes labeled rows for beginning balance, net income, dividends, and ending balance. Clear headings and consistent layout facilitate easy data entry and interpretation. Excel's grid structure supports organized financial presentation.

Step-by-Step Guide to Creating the Format in Excel

Start by labeling key sections: beginning retained earnings, additions, deductions, and ending balance. Input formulas to calculate net changes and update totals automatically. Ensure cell references are correct to maintain integrity as data changes.

Essential Excel Formulas for Retained Earnings Statement

Use SUM for aggregate calculations, and basic arithmetic formulas for net income adjustments. Cell referencing (e.g., A2+B2-C2) automates earnings computation. Conditional formatting may enhance visibility of critical figures.

Sample Statement of Retained Earnings Template in Excel

A sample template includes predefined rows and formulas for immediate use. It offers a practical model for small businesses or financial analysts. Custom templates streamline reporting and reduce setup time.

Common Mistakes to Avoid in Excel Formatting

Avoid errors such as incorrect formulas, inconsistent cell references, and unclear labeling. Neglecting data validation can cause inaccurate retained earnings calculations. Proper attention prevents misinterpretation and financial reporting issues.

Tips for Customizing Retained Earnings Statement in Excel

Customize by adding company logos, adjusting fonts, and including color coding for readability. Tailoring the layout to specific business needs improves usability. Locking formula cells protects data integrity while allowing input adjustments.

Downloadable Excel Statement of Retained Earnings Template

Many websites offer free or paid Excel templates for retained earnings statements. Downloaded templates save time and ensure professional quality. Always verify template accuracy before use in official reporting.