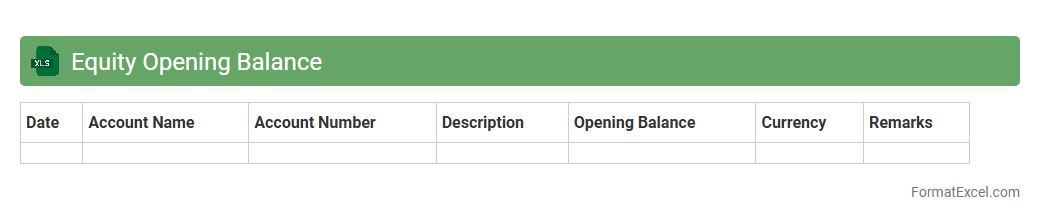

Equity Opening Balance

An

Equity Opening Balance Excel document records the initial equity amount at the start of an accounting period, serving as a foundation for tracking ownership interests and financial positions. It helps businesses maintain accurate capital accounts by clearly documenting investments, retained earnings, and adjustments. This organized approach ensures efficient financial analysis and supports informed decision-making for growth and compliance.

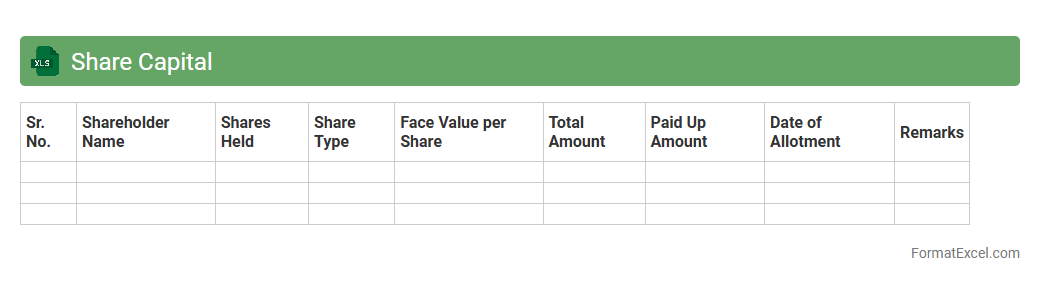

Share Capital

A

Share Capital Excel document is a spreadsheet used to record and manage the details of a company's shareholding structure, including the number of shares issued, types of shares, and shareholder information. This document helps businesses keep accurate financial records, monitor ownership percentages, and track changes in equity over time. It is essential for preparing financial reports, facilitating audits, and making informed decisions regarding fundraising or dividend distributions.

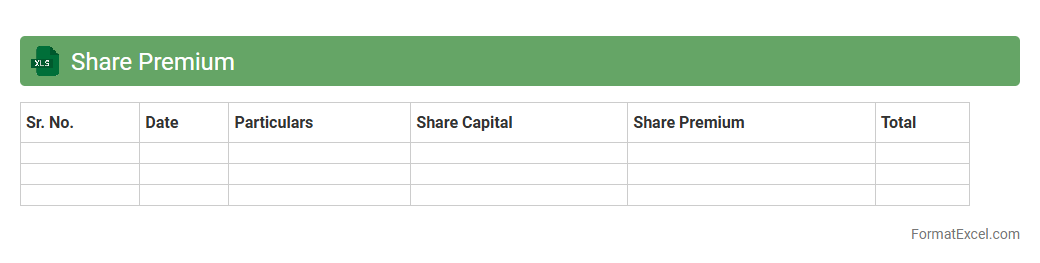

Share Premium

A

Share Premium Excel document is a financial tool used to record and manage the premium amount paid by investors over the nominal value of shares during a company's equity issuance. It helps track additional capital received, ensuring accurate accounting and compliance with corporate finance regulations. This document is essential for analyzing company equity structure, preparing financial statements, and supporting decision-making for investors and management.

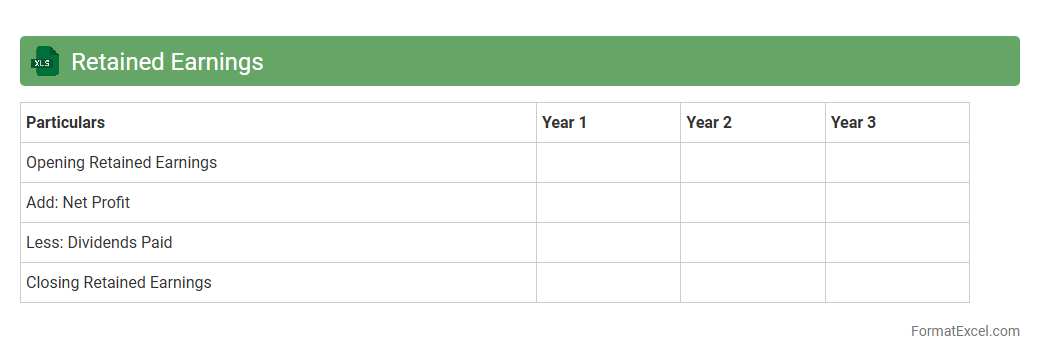

Retained Earnings

A

Retained Earnings Excel document is a financial tool used to track a company's accumulated net income that is reinvested in the business rather than distributed as dividends. It allows easy calculation and monitoring of the retained earnings balance over time, facilitating better financial planning and decision-making. This document is essential for investors and management to assess the company's growth potential and sustainability.

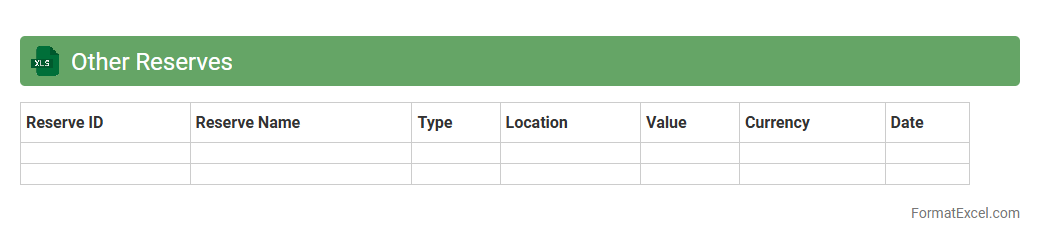

Other Reserves

The

Other Reserves Excel document is a financial record used to track and manage various reserve funds that are not classified under standard categories like capital or operating reserves. It helps organizations monitor and allocate funds for specific purposes such as contingencies, legal liabilities, or future projects, ensuring accurate financial planning and risk management. This document enhances transparency and supports strategic decision-making by providing a clear overview of all miscellaneous reserves within the organization.

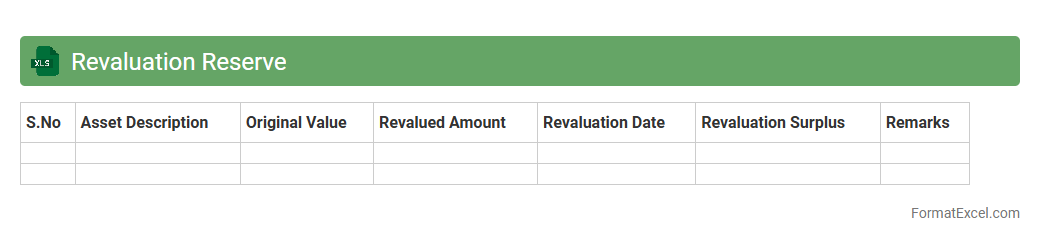

Revaluation Reserve

A

Revaluation Reserve Excel document is a financial tool used to record and track changes in the value of assets after revaluation, helping businesses maintain accurate asset valuations on their balance sheets. This document allows precise calculation of increased or decreased asset values, ensuring compliance with accounting standards. It is useful for financial analysis, auditing, and better decision-making related to asset management and capital budgeting.

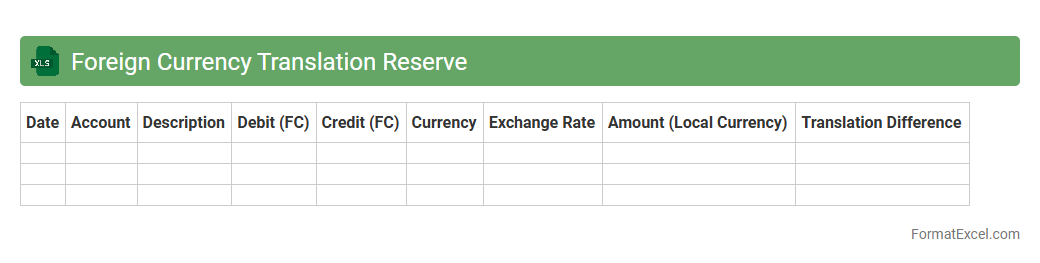

Foreign Currency Translation Reserve

The

Foreign Currency Translation Reserve Excel document tracks gains and losses arising from translating foreign subsidiaries' financial statements into the parent company's reporting currency. It helps businesses monitor currency fluctuations' impact on their consolidated financial position, ensuring accurate reporting under IFRS or GAAP standards. This tool is essential for managing exchange rate risks and making informed decisions on international investments and operations.

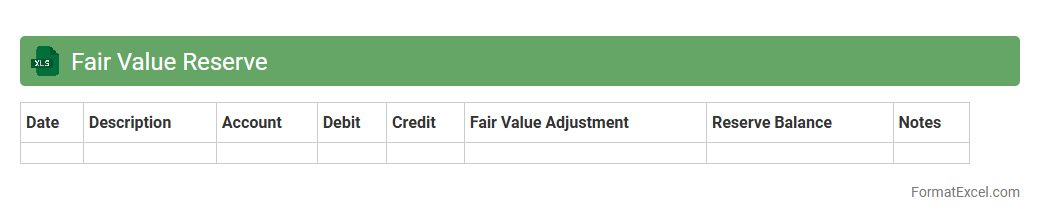

Fair Value Reserve

Fair Value Reserve excel document is a financial tool designed to track and manage the changes in the fair value of assets and liabilities within an organization. It helps in maintaining accurate records of unrealized gains and losses, ensuring compliance with accounting standards such as IFRS and GAAP. Utilizing a

Fair Value Reserve document enhances transparency in financial reporting and supports informed decision-making by providing a clear overview of market value fluctuations.

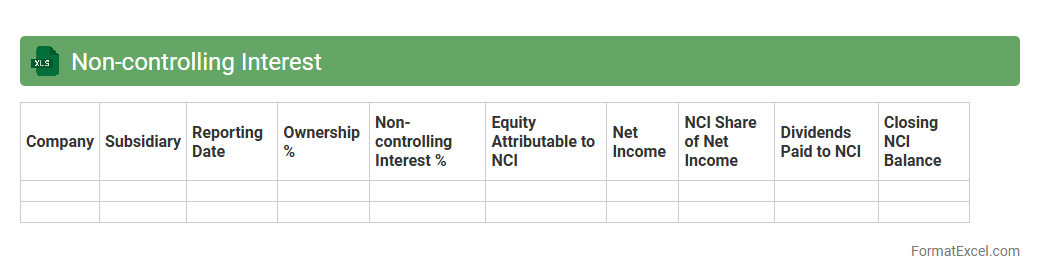

Non-controlling Interest

A

Non-controlling Interest Excel document tracks the equity stake in a subsidiary not owned by the parent company, providing clear visibility into minority ownership percentages and associated financial results. It allows accurate consolidation of financial statements by distinguishing between controlling and non-controlling shareholders' interests, enhancing transparency in earnings attribution. This tool is essential for corporate finance professionals to assess the fair value of subsidiaries and ensure compliance with accounting standards like IFRS and GAAP.

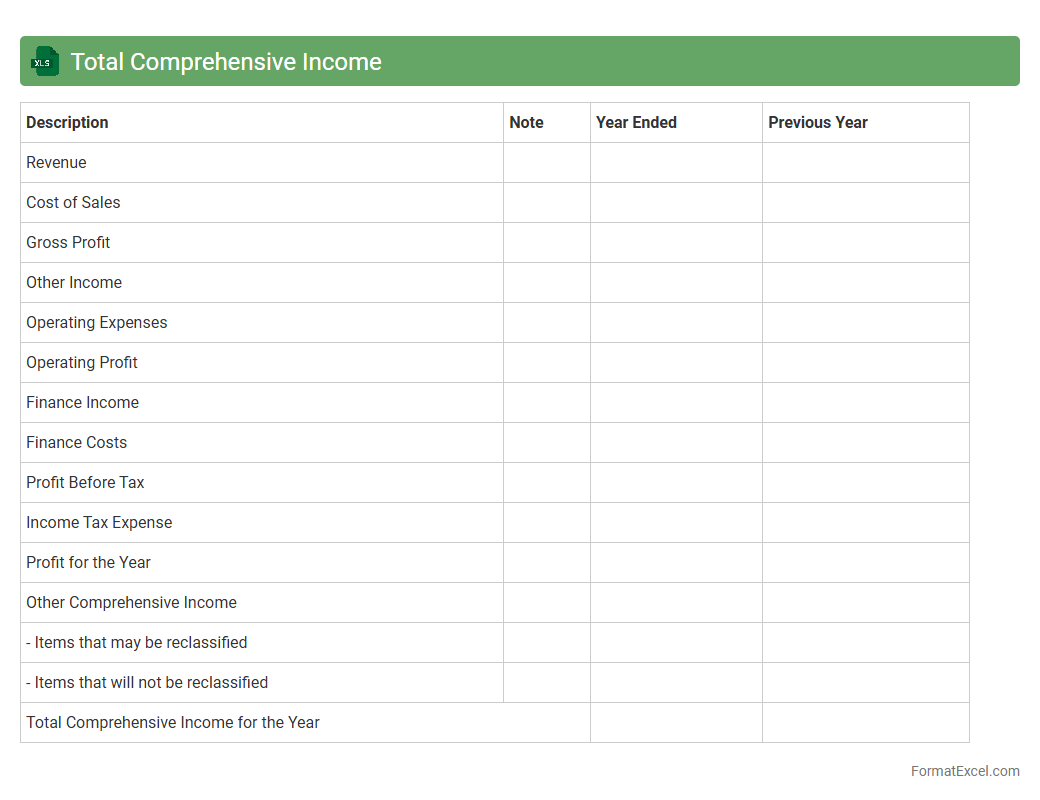

Total Comprehensive Income

The

Total Comprehensive Income Excel document captures all changes in equity during a period, including net income and other comprehensive income components like unrealized gains or losses on investments. It provides a detailed financial overview beyond traditional income statements, offering a holistic view of an organization's financial performance. This tool is essential for stakeholders to assess overall profitability, financial health, and potential future risks or opportunities.

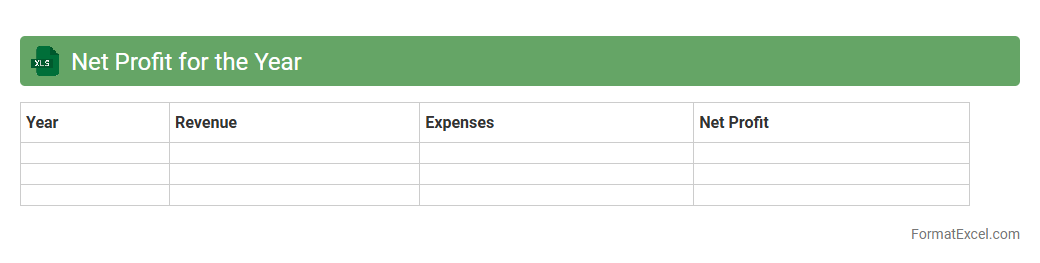

Net Profit for the Year

Net Profit for the Year Excel document is a financial tool that calculates the

net profit by subtracting total expenses from total revenue within a fiscal year. It provides a clear and concise overview of a company's profitability, aiding in financial analysis and decision-making. This document is essential for tracking business performance, budgeting, and strategic planning.

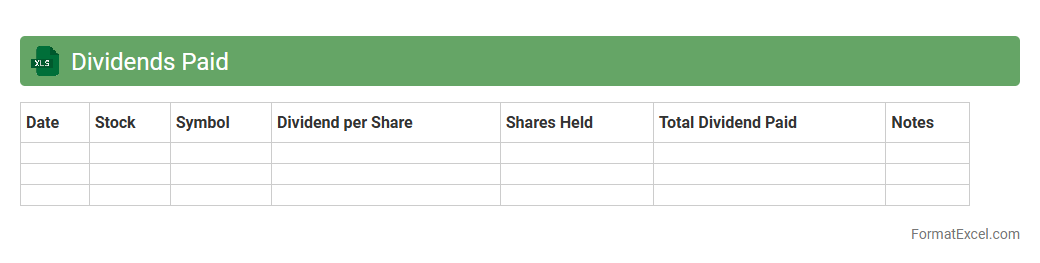

Dividends Paid

A

Dividends Paid Excel document is a financial record that tracks all dividend payments made by a company to its shareholders. It helps investors and financial analysts monitor cash outflows related to dividends, assess the consistency of dividend payments, and evaluate the company's profitability and shareholder value. This document is essential for accurate financial planning, tax reporting, and making informed investment decisions.

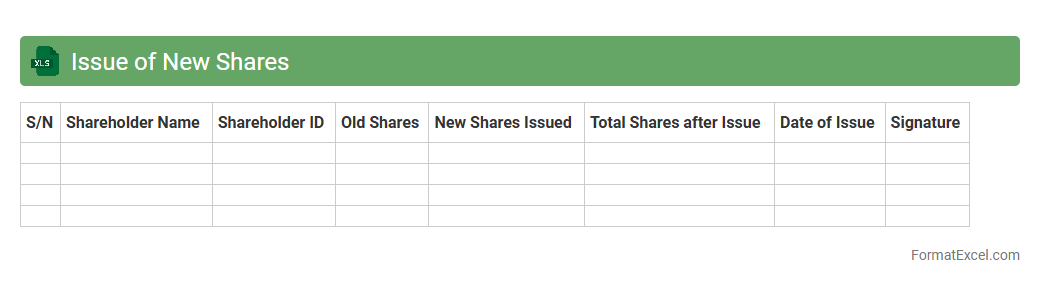

Issue of New Shares

The

Issue of New Shares Excel document is a financial tool designed to track and manage the process of issuing additional shares in a company. It helps in calculating share allotments, monitoring subscription details, and maintaining accurate records of equity changes over time. This document is useful for investors, accountants, and company management to ensure transparency and compliance during capital raising activities.

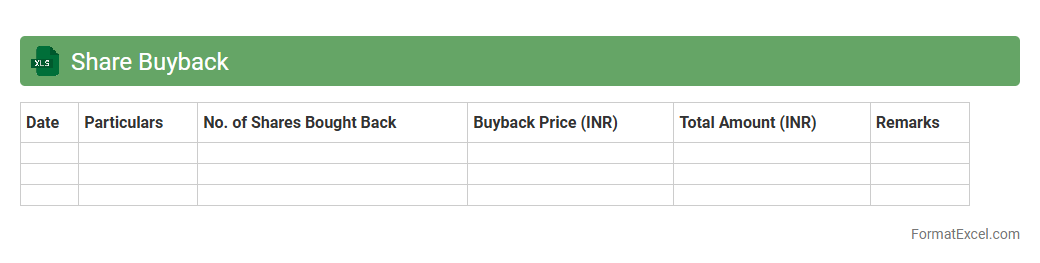

Share Buyback

A

Share Buyback Excel document is a spreadsheet tool designed to track and analyze a company's repurchase of its own shares from the market. It provides detailed calculations on buyback costs, the impact on earnings per share (EPS), and changes in shareholder equity, helping investors and financial analysts assess the financial implications. This document is useful for making informed decisions about stock valuation and evaluating the effectiveness of buyback strategies.

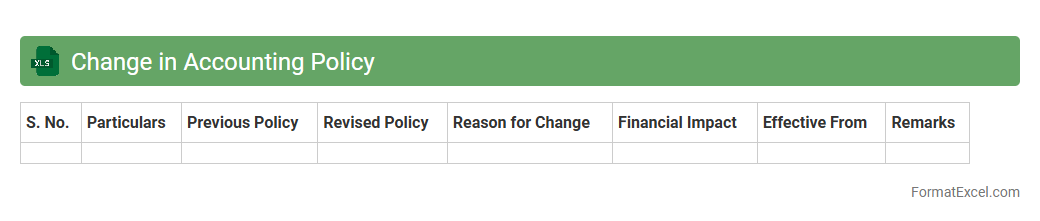

Change in Accounting Policy

A

Change in Accounting Policy Excel document is a structured tool used to systematically record, analyze, and track modifications in accounting principles or methods applied by a business. It helps ensure compliance with financial reporting standards by documenting the rationale, impact on financial statements, and comparative adjustments. This document is essential for auditors, accountants, and management to maintain transparency, facilitate accurate financial analysis, and support informed decision-making.

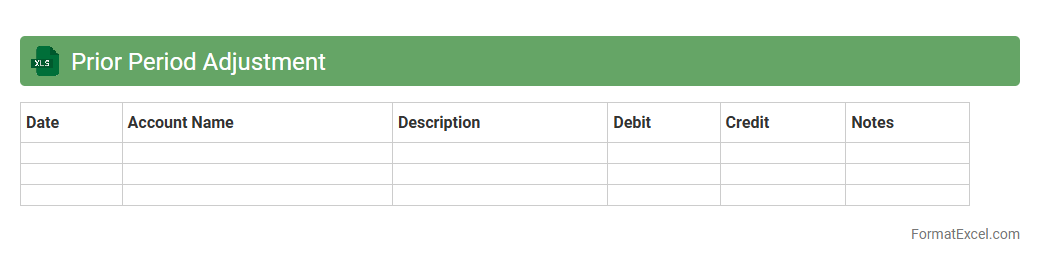

Prior Period Adjustment

A

Prior Period Adjustment Excel document is a financial tool used to correct errors or omissions found in previous accounting periods, ensuring accurate financial statements. It helps maintain compliance with accounting standards by adjusting retained earnings or other equity accounts without distorting current period results. This document is invaluable for auditors, accountants, and financial analysts to track changes and ensure transparency in financial reporting.

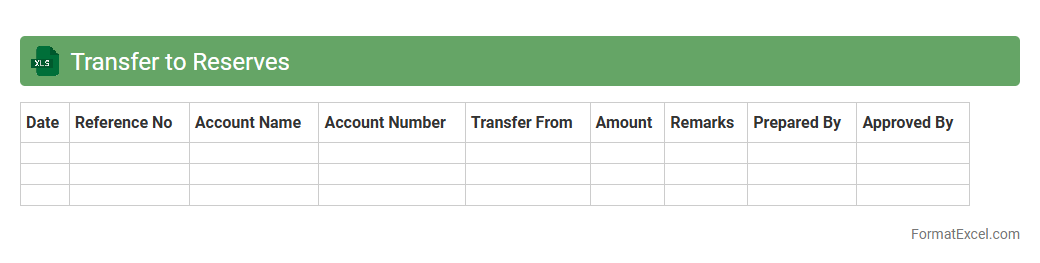

Transfer to Reserves

The

Transfer to Reserves Excel document is a financial tool designed to track and manage the allocation of funds from general accounts to reserve accounts. It helps organizations maintain transparency and accuracy in budgeting by clearly documenting each transfer, including amounts, dates, and reasons for the allocation. This document is essential for ensuring proper financial planning and compliance with accounting standards.

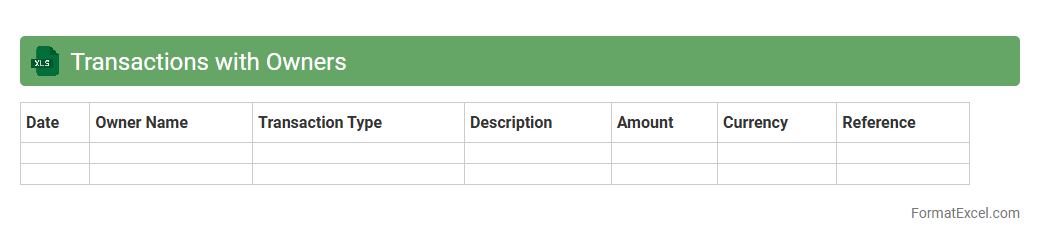

Transactions with Owners

The

Transactions with Owners Excel document records financial exchanges between a business and its owners, such as equity contributions, dividend payments, and withdrawals. It helps track changes in ownership equity over time, ensuring accurate accounting and clear financial reporting. This document is essential for monitoring investment inflows and outflows, supporting informed decision-making and compliance with regulatory standards.

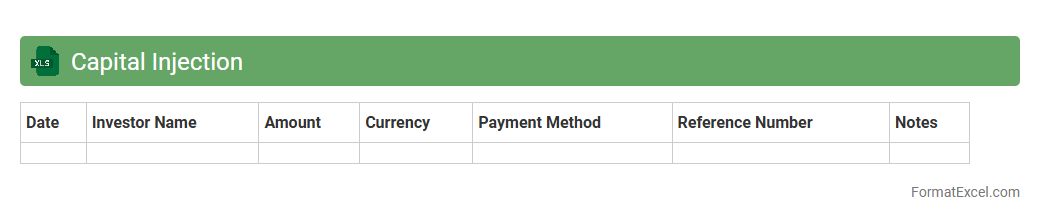

Capital Injection

A

Capital Injection Excel document is a financial tool designed to track and manage the inflow of funds into a business or project, allowing users to record details such as amounts, dates, sources, and purposes of capital injections. It helps in monitoring the equity or debt funding received, ensuring accurate financial planning and analysis. Businesses can use this document to maintain transparency, improve cash flow management, and support strategic decision-making processes.

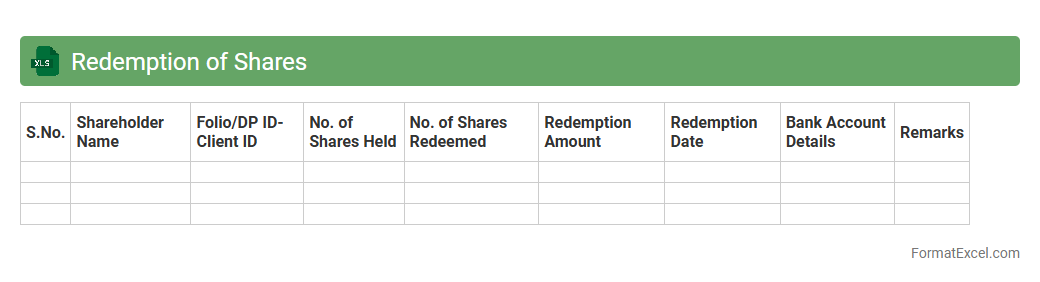

Redemption of Shares

A Redemption of Shares Excel document is a

financial tool designed to track and manage the process of buying back shares from shareholders. It helps businesses calculate redemption amounts, deadlines, and tax implications efficiently, ensuring compliance with corporate regulations. Using this document streamlines decision-making and maintains accurate records for audit and reporting purposes.

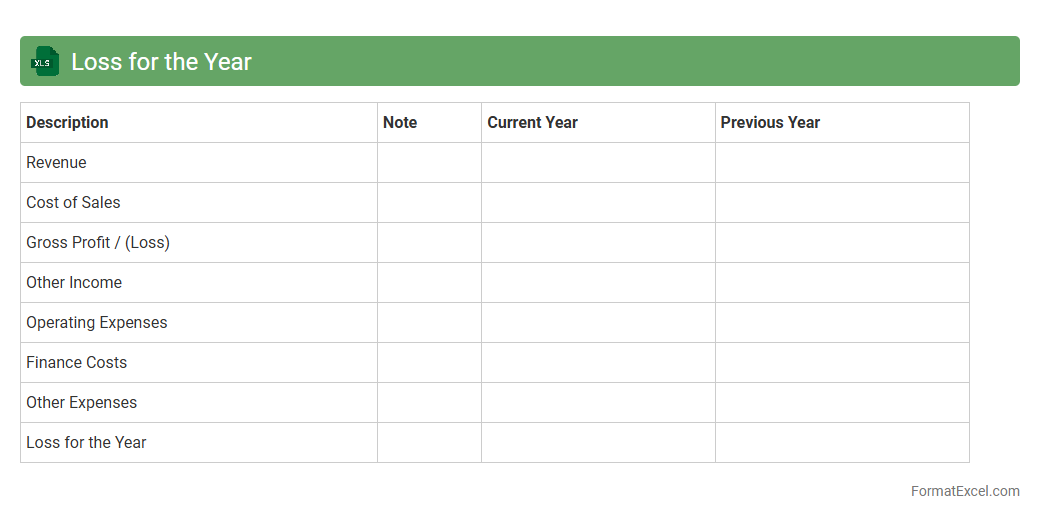

Loss for the Year

The

Loss for the Year Excel document tracks the financial deficit a business incurs over a fiscal year, detailing expenses exceeding revenues. It is crucial for analyzing financial health, identifying trends, and guiding strategic decisions to improve profitability. Using this document helps businesses implement cost control measures and plan for sustainable growth.

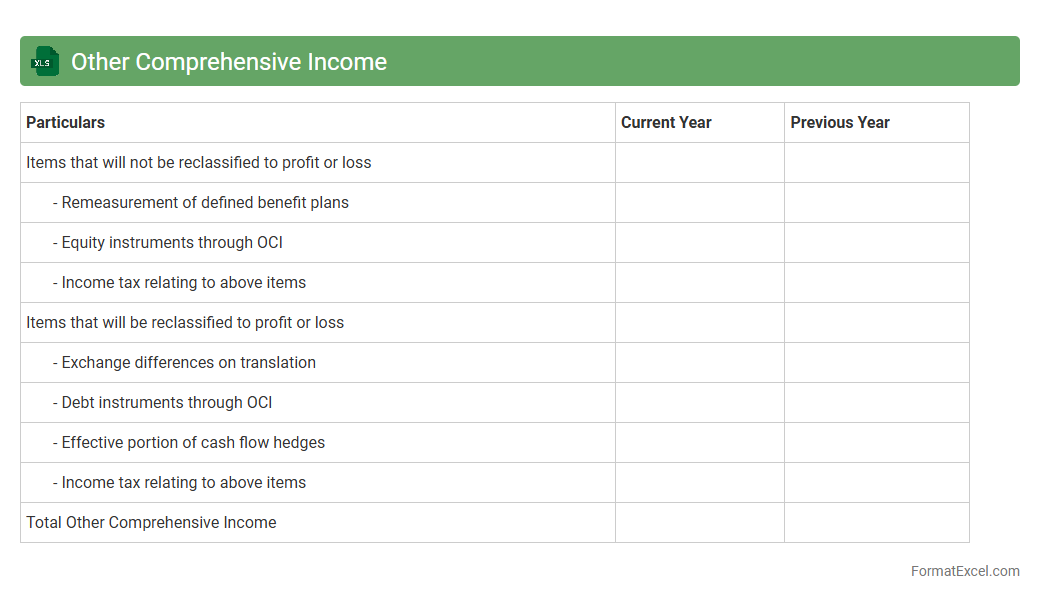

Other Comprehensive Income

An

Other Comprehensive Income (OCI) Excel document is a financial tool that captures gains and losses not reflected in net income, such as foreign currency translation adjustments, unrealized gains/losses on securities, and pension liabilities. This document is useful for investors and analysts to gain a comprehensive view of a company's financial health beyond traditional income statements, helping in better decision-making and risk assessment. It streamlines the tracking and analysis of OCI components, enhancing transparency and accuracy in financial reporting.

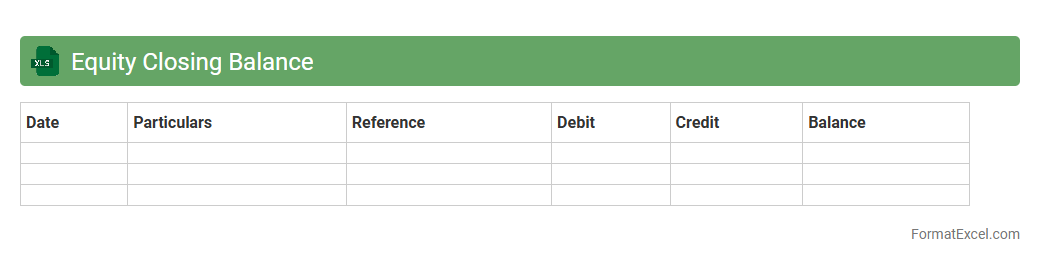

Equity Closing Balance

The

Equity Closing Balance Excel document tracks the ending equity balance for a specific period, providing a clear and organized view of shareholders' equity changes. It consolidates data such as retained earnings, stock issuance, and dividends, allowing accurate financial analysis and decision-making. This document is essential for accountants and investors to assess the company's financial health and equity fluctuations over time.

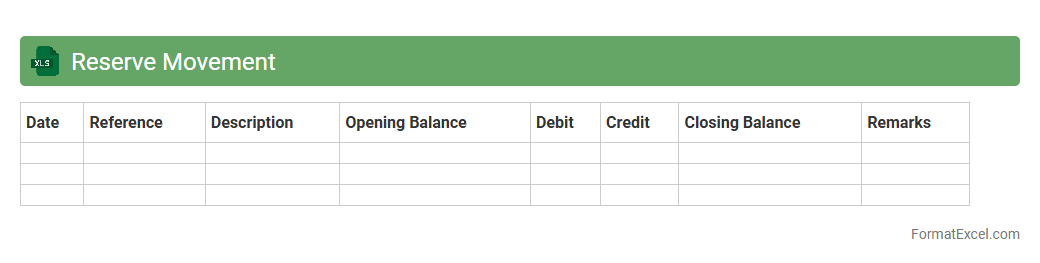

Reserve Movement

The

Reserve Movement Excel document is a detailed spreadsheet used to track the inflow and outflow of reserve assets over a specific period. It helps organizations monitor liquidity, manage financial stability, and make informed decisions by providing clear visibility into reserve changes. This document is essential for maintaining accurate financial records and supporting strategic planning.

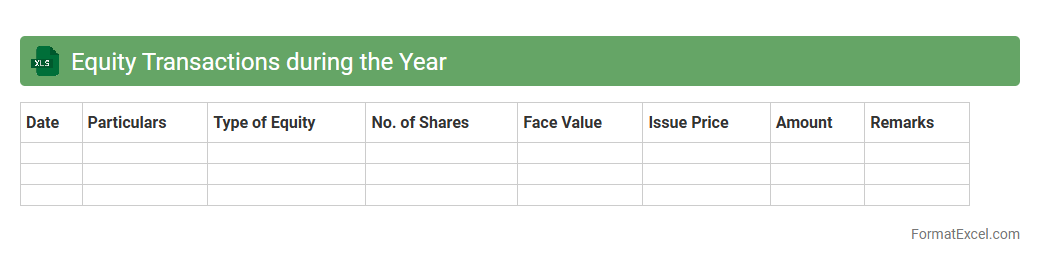

Equity Transactions during the Year

The

Equity Transactions during the Year Excel document tracks all changes in shareholders' equity, including issuing shares, buybacks, and dividend payments. It helps investors, analysts, and accountants monitor ownership structure and assess the company's financial health over time. This document enhances transparency and supports informed decision-making by consolidating key equity-related activities in one accessible format.

Introduction to Statement of Changes in Equity

The Statement of Changes in Equity summarizes the movements in equity accounts over a reporting period. It reflects changes in share capital, reserves, and retained earnings. This statement is vital for understanding the ownership value and financial health of a company.

Importance of the Statement in Financial Reporting

The Statement of Changes in Equity provides transparency regarding equity changes for investors and stakeholders. It highlights capital contributions, distributions, and profit or loss impact on equity. Accurate reporting ensures compliance with accounting standards.

Key Components of Equity Statement

The primary components include opening equity balance, net income or loss, dividends paid, and other comprehensive income. Changes in share capital and reserves are also detailed. Together, these segments show the detailed equity movement during the period.

Standard Format of Statement of Changes in Equity

The standard format includes columns for each equity component with rows displaying opening balance, transactions, and closing balance. The tabular layout aids in easy comparison and analysis. Consistency in format improves readability and reporting accuracy.

Steps to Create the Statement in Excel

Start by setting up headers for equity components and date ranges. Enter opening balances, then add rows for profit, dividends, and other adjustments. Use formulas to calculate ending balances to maintain accuracy.

Essential Excel Functions for Formatting

Use SUM for aggregating values and IF for conditional entries. Applying cell styles and borders enhances the visual clarity of the statement. Freeze panes and filter functions improve navigation and usability.

Sample Statement of Changes in Equity Template

A sample template contains predefined columns for capital, reserves, retained earnings, and totals. It includes formula cells for automatic calculations. This template serves as a practical starting point for preparing customized statements.

Tips for Customizing the Format in Excel

Adjust column widths and use color coding to differentiate sections. Add comments or notes for clarifying unusual entries. Custom filters and pivot tables can provide dynamic analysis of equity changes.

Common Mistakes to Avoid in Excel Reporting

Avoid manual calculations that lead to errors; rely on formulas for accuracy. Ensure all equity components are included to present a complete picture. Avoid inconsistent date formats and unnecessary data clutter for clarity.

Conclusion and Best Practices

Maintaining an accurate and well-formatted Statement of Changes in Equity is essential for quality financial reporting. Utilize Excel's powerful functions to automate and validate data. Regular reviews and updates ensure compliance and reliability.