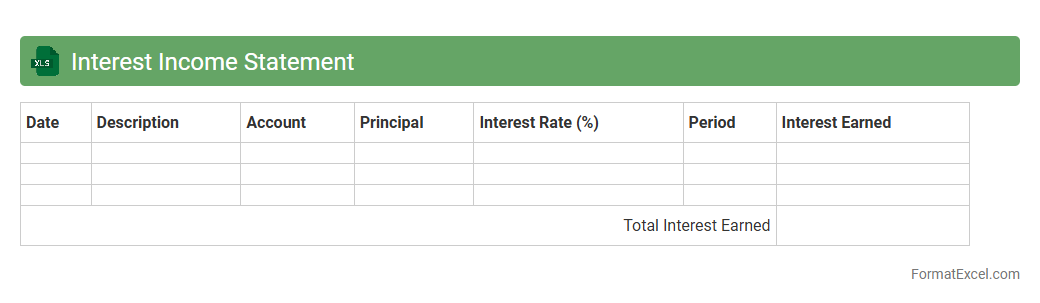

Interest Income Statement

An

Interest Income Statement Excel document is a financial tool designed to track and calculate interest earned on various investments or accounts over a specified period. It provides a clear breakdown of interest revenues, helping individuals or businesses monitor their income streams and assess financial performance. Using this Excel sheet enhances accuracy in reporting and supports effective financial planning and decision-making.

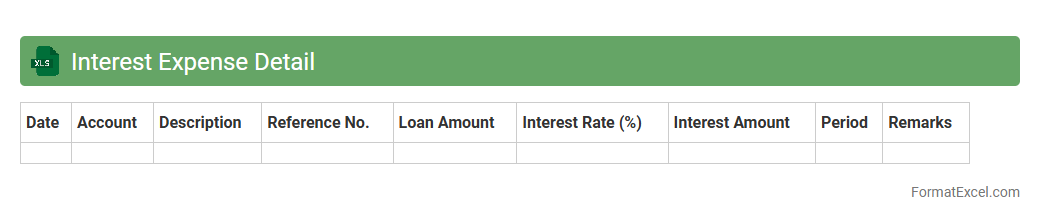

Interest Expense Detail

An

Interest Expense Detail Excel document comprehensively tracks and itemizes interest costs incurred on loans, credit lines, or other financial obligations over a specified period. This detailed record enables businesses and individuals to accurately monitor and analyze interest payments, facilitating precise financial reporting and budgeting. Utilizing this document improves transparency in financial management and supports strategic decision-making by highlighting trends in borrowing costs.

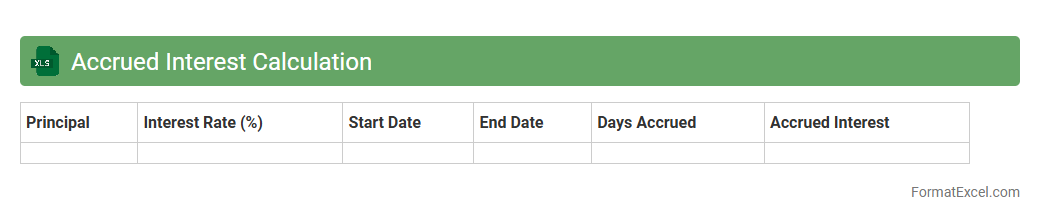

Accrued Interest Calculation

An

Accrued Interest Calculation Excel document is a financial tool designed to compute the interest accumulated on loans, bonds, or investments over a specific period without payments being made. It helps users accurately track interest obligations, ensuring precise financial reporting and budgeting. This document is essential for professionals managing fixed-income securities, loan portfolios, or accounting for interest income and expenses.

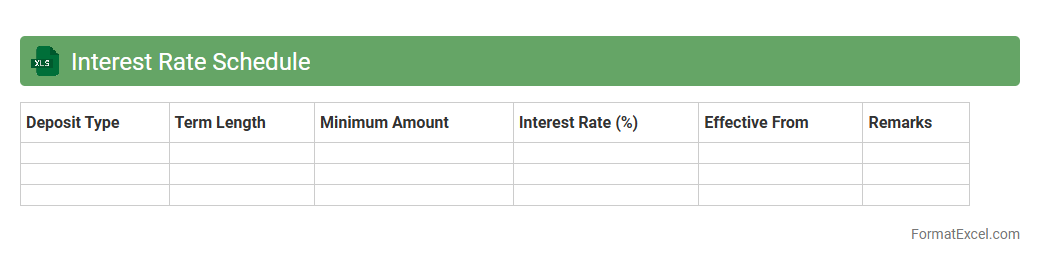

Interest Rate Schedule

An

Interest Rate Schedule Excel document outlines varying interest rates applied over specific periods for loans or investments, helping users track and calculate accurate interest charges or earnings. It provides a clear, organized format to analyze rate changes, project financial outcomes, and make informed decisions regarding debt repayment or investment strategies. This tool enhances financial planning by consolidating complex rate information into an actionable and easy-to-update spreadsheet.

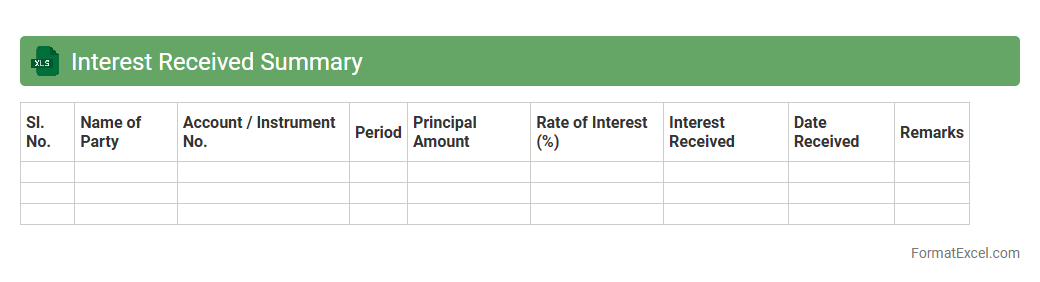

Interest Received Summary

The

Interest Received Summary Excel document compiles detailed records of interest income earned over a specific period, consolidating data from multiple accounts or investments. It is useful for accurately tracking earnings, simplifying financial analysis, and assisting in tax reporting by providing a clear, organized summary of interest payments. This document enhances financial decision-making by enabling users to monitor trends and optimize investment strategies effectively.

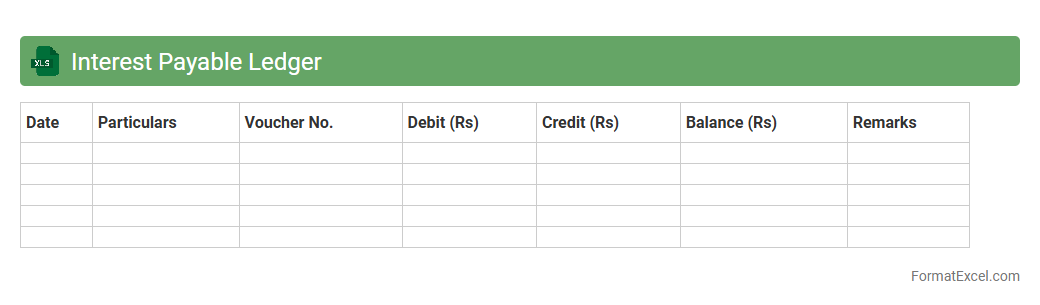

Interest Payable Ledger

The

Interest Payable Ledger Excel document is a comprehensive financial tool designed to record and track interest expenses owed on loans or credit. It enables users to monitor due dates, calculate accruals, and maintain accurate records for timely payments, ensuring effective cash flow management. This ledger enhances transparency and simplifies the reconciliation process for businesses and individuals managing multiple interest obligations.

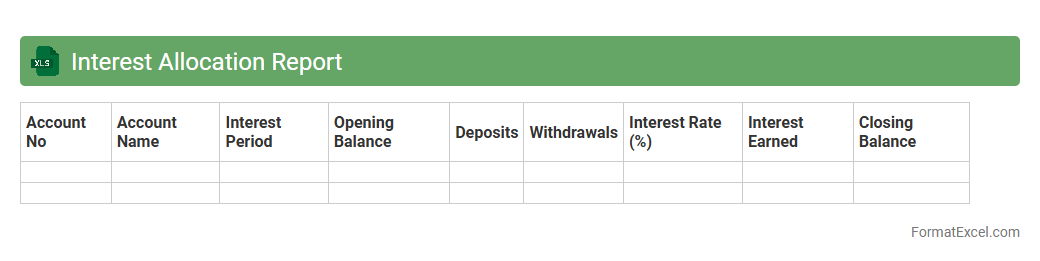

Interest Allocation Report

An

Interest Allocation Report Excel document details how interest income or expenses are distributed across various accounts or projects within an organization. It helps in tracking, analyzing, and managing interest costs or earnings accurately, ensuring proper financial reporting and budgeting. This report supports better decision-making by providing clear insights into the allocation of interest, enhancing transparency and financial control.

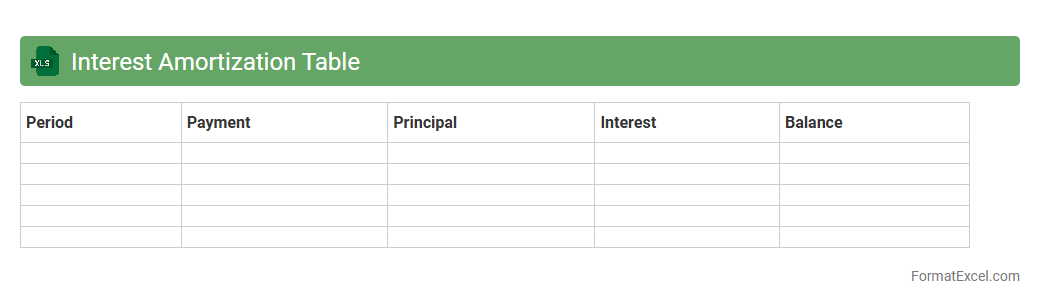

Interest Amortization Table

An

Interest Amortization Table Excel document breaks down each loan payment into interest and principal components over the life of the loan, providing a clear schedule of how debt decreases over time. This tool is essential for understanding the exact amounts paid toward interest versus principal in each installment, helping users manage their finances and plan repayment strategies effectively. It also aids in forecasting total interest costs and evaluating the impact of extra payments or refinancing options on loan duration and expenses.

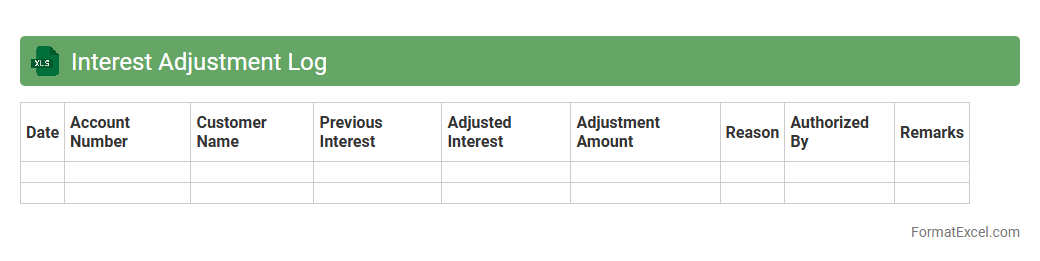

Interest Adjustment Log

The

Interest Adjustment Log Excel document is a specialized tool designed to track and calculate interest rate changes on loans, investments, or accounts over time. It helps users accurately record adjustments, ensuring precise financial reporting and aiding in budget management. This log enhances decision-making by providing clear insight into accrued interest and payment modifications, improving overall financial control.

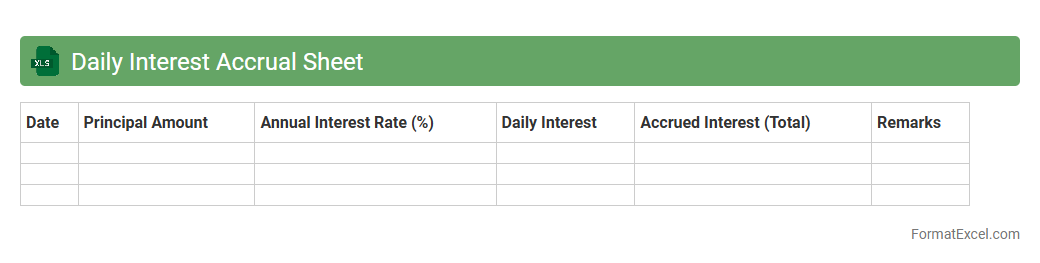

Daily Interest Accrual Sheet

The

Daily Interest Accrual Sheet Excel document tracks and calculates accumulated interest on a daily basis for loans, savings, or investments, providing precise financial insights. It automates the process of interest computation, ensuring accuracy and saving time compared to manual calculations. This tool is essential for financial analysts, accountants, and investors to monitor accrued interest, manage cash flows accurately, and make informed financial decisions.

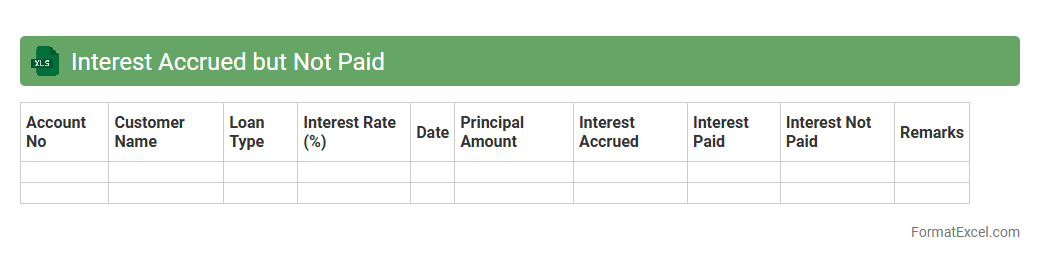

Interest Accrued but Not Paid

An

Interest Accrued but Not Paid Excel document tracks the interest expense that has accumulated on loans or investments but has not yet been disbursed or received. This document is essential for accurate financial reporting, as it helps businesses recognize interest liabilities or income in the correct accounting period under accrual accounting principles. It also aids in cash flow management by providing clear visibility into pending interest payments, ensuring better financial planning and compliance.

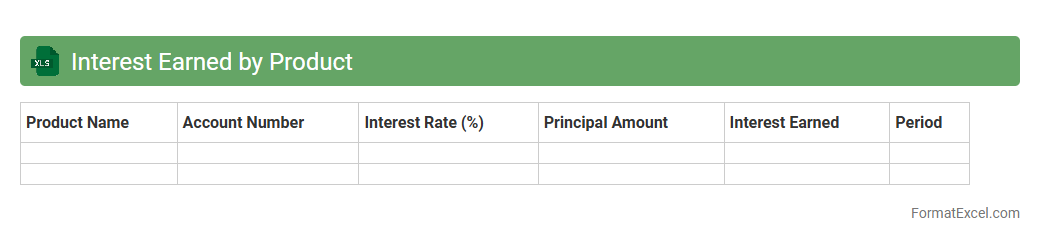

Interest Earned by Product

The

Interest Earned by Product Excel document tracks the interest income generated from various financial products, allowing for detailed analysis of revenue streams. This tool helps businesses identify the most profitable products and optimize their portfolio by comparing interest yields over specific periods. Companies can use this data-driven insight to make informed decisions on product development, pricing strategies, and resource allocation for maximizing returns.

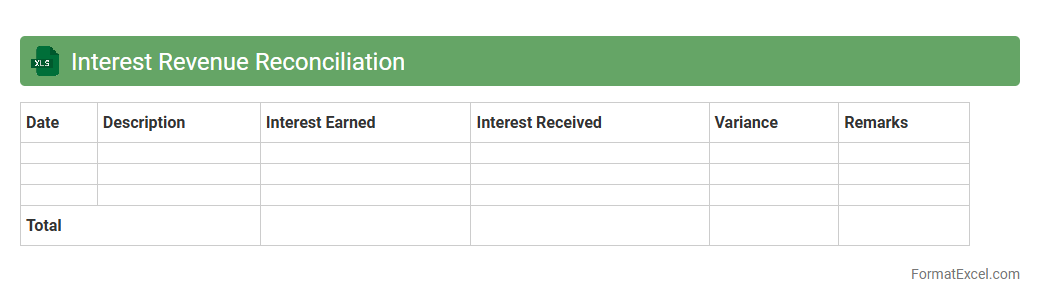

Interest Revenue Reconciliation

Interest Revenue Reconciliation Excel documents are specialized tools designed to track and verify the accuracy of interest income earned from various financial instruments. This document systematically compares recorded interest revenue with actual payments received, identifying discrepancies and ensuring compliance with accounting standards. Using this

Interest Revenue Reconciliation sheet enhances financial accuracy, supports audit readiness, and facilitates informed decision-making for better financial management.

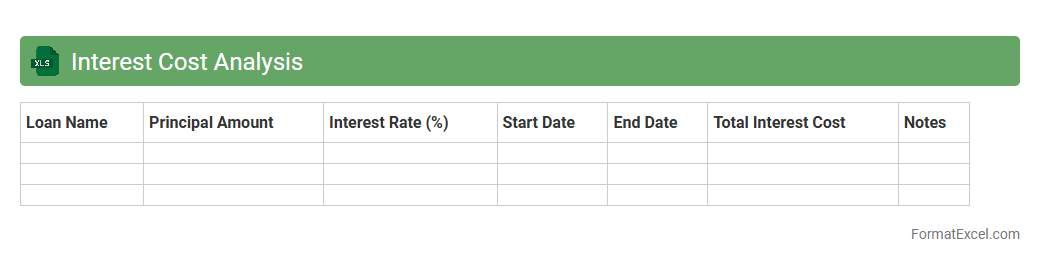

Interest Cost Analysis

Interest Cost Analysis excel document calculates and tracks the total interest expenses incurred on loans or debts over a specified period. It helps businesses and individuals compare different loan options, understand the impact of interest rates, and plan repayments effectively. This tool enhances financial decision-making by providing clear insights into

interest cost management and optimizing debt strategies.

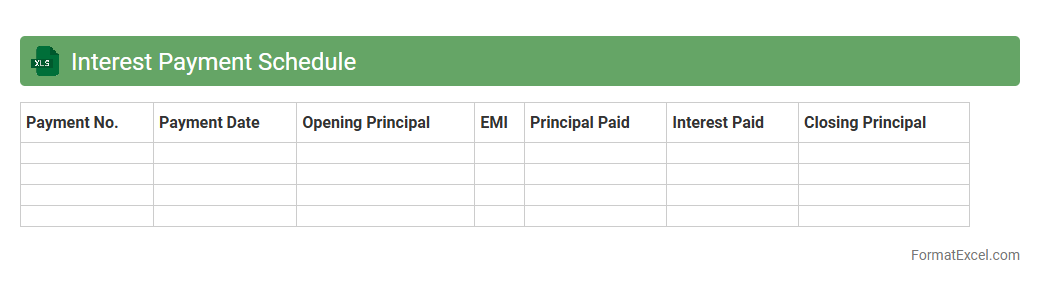

Interest Payment Schedule

An

Interest Payment Schedule Excel document systematically outlines the timing and amount of interest payments over a loan or investment period. It helps users accurately track due dates, calculate payment amounts, and manage cash flow efficiently. This document is essential for financial planning, ensuring transparency and avoiding missed or incorrect interest payments.

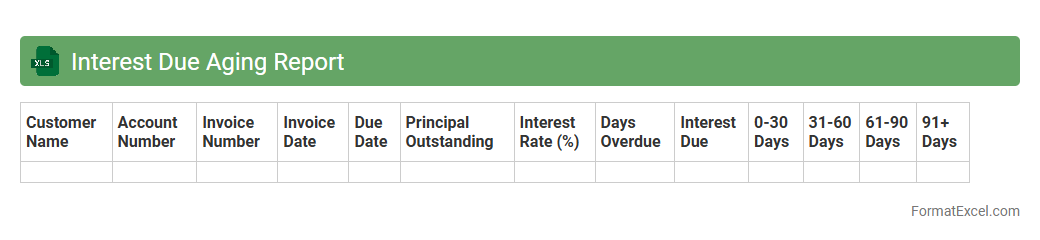

Interest Due Aging Report

An

Interest Due Aging Report in Excel is a financial document that categorizes and tracks outstanding interest payments based on their due dates, typically segmented into aging periods such as 30, 60, and 90 days past due. This report helps businesses monitor overdue interest on loans or receivables, enabling timely follow-up actions to improve cash flow management. Using this report, organizations can reduce financial risk by identifying delinquent accounts and prioritizing collections efficiently.

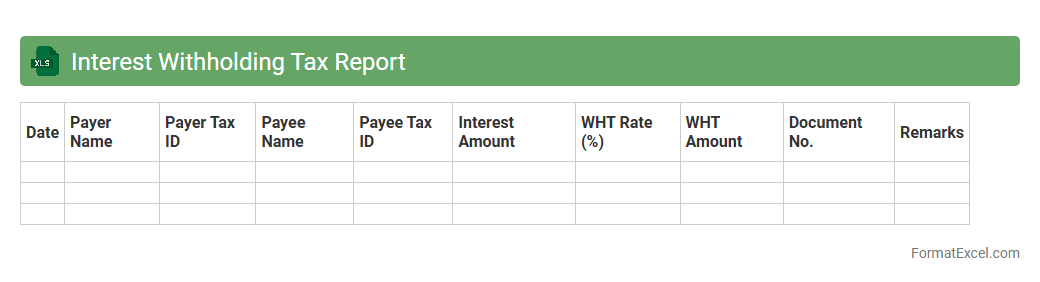

Interest Withholding Tax Report

An

Interest Withholding Tax Report Excel document systematically records all interest payments subject to withholding tax, facilitating accurate tax calculations and compliance. This report enables efficient tracking of tax deductions on interest income, ensuring timely remittance to tax authorities and minimizing the risk of penalties. It also serves as a valuable tool for financial audits and detailed financial analysis related to interest tax liabilities.

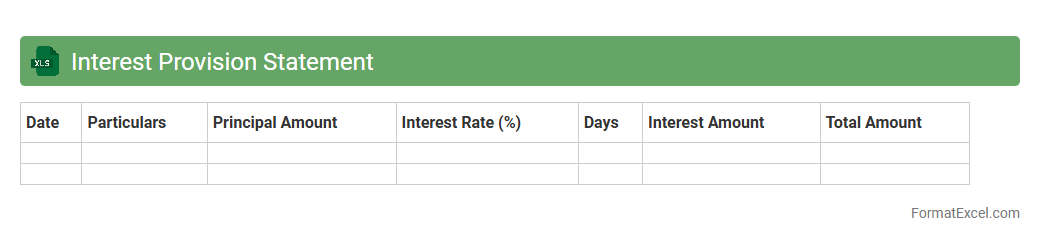

Interest Provision Statement

An

Interest Provision Statement Excel document is a financial tool used to calculate and record the interest accrued on loans or investments over a specific period. It helps businesses and individuals accurately track interest expenses or income, ensuring proper financial reporting and compliance with accounting standards. This document streamlines the interest calculation process, reducing errors and saving time in financial management tasks.

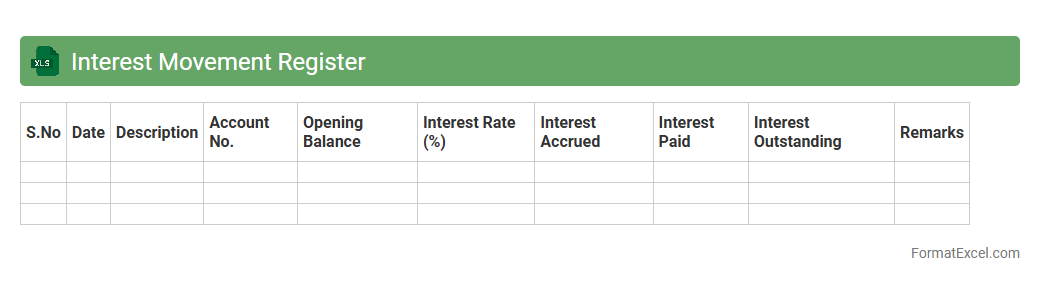

Interest Movement Register

The

Interest Movement Register Excel document tracks the accrual and payment of interest on various financial instruments over time, allowing precise monitoring of interest income and expenses. It provides a detailed, organized record of interest calculations, dates, and related transactions, enhancing accuracy in financial reporting and compliance. Utilizing this register helps businesses manage cash flow effectively and ensures transparency in interest-related financial activities.

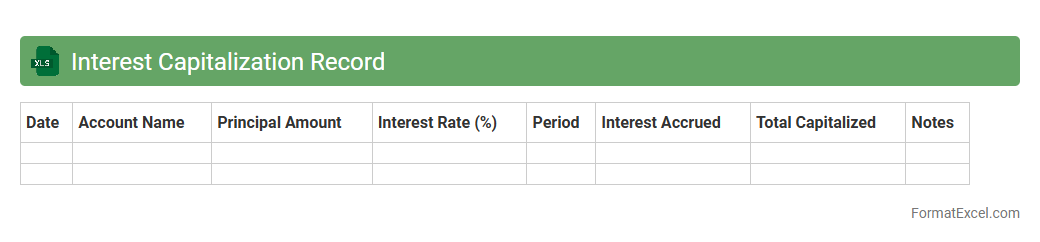

Interest Capitalization Record

An

Interest Capitalization Record Excel document systematically tracks accrued interest on loans or investments, allowing precise calculation of interest added to the principal balance over time. This tool enhances financial accuracy by providing a clear history of interest capitalizations, aiding in effective loan management and repayment planning. Businesses and individuals use it to ensure compliance with accounting standards and to optimize cash flow by monitoring capitalized interest expenses.

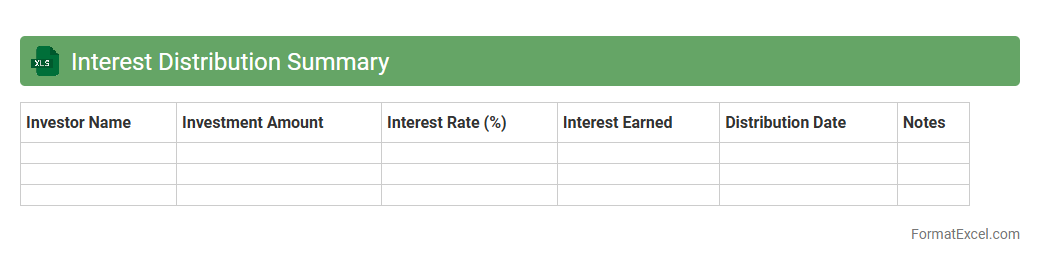

Interest Distribution Summary

An

Interest Distribution Summary Excel document consolidates and organizes interest income data from various investments, providing a clear overview of earned interest over a specified period. This summary helps investors and accountants track earnings efficiently, ensure accurate reporting for tax purposes, and make informed financial decisions. By automating calculations and consolidating data, it enhances accuracy and saves time in managing multiple interest sources.

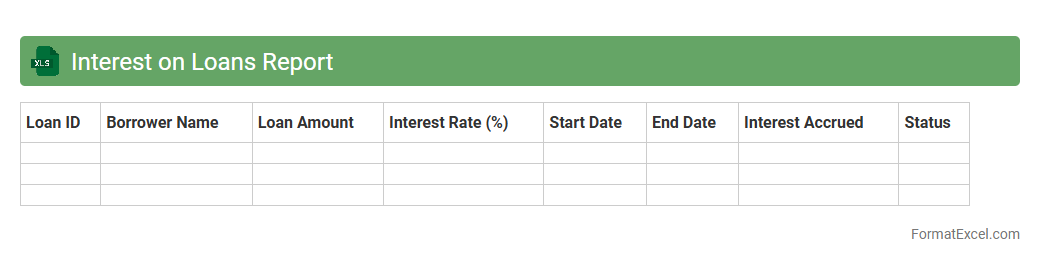

Interest on Loans Report

The

Interest on Loans Report Excel document provides a detailed summary of interest accrued on various loan accounts over a specific period. It enables users to track loan costs, analyze repayment schedules, and forecast future interest expenses accurately. This report is essential for financial planning, budgeting, and ensuring compliance with accounting standards.

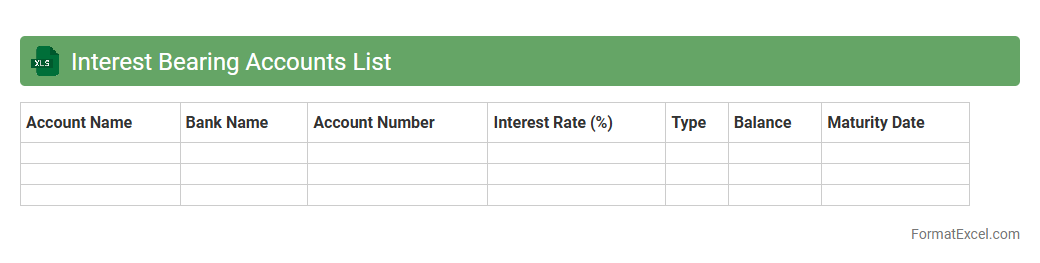

Interest Bearing Accounts List

An

Interest Bearing Accounts List Excel document organizes various bank accounts that generate interest, detailing account types, interest rates, balances, and maturity dates. This tool helps users efficiently track and compare returns on savings, certificates of deposit, and money market accounts, enabling informed financial decisions. It streamlines monitoring of accrued interest and aids in optimizing portfolio performance.

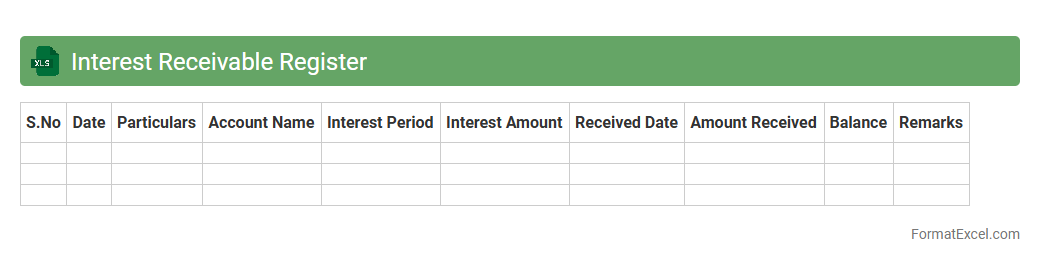

Interest Receivable Register

The

Interest Receivable Register Excel document is a detailed financial tool used to track and record interest income that is expected but not yet received. It helps businesses and individuals monitor accrued interest on loans, investments, or deposits, ensuring accurate accounting and timely follow-up on payments. This register provides organized data for better cash flow management, financial reporting, and audit preparedness.

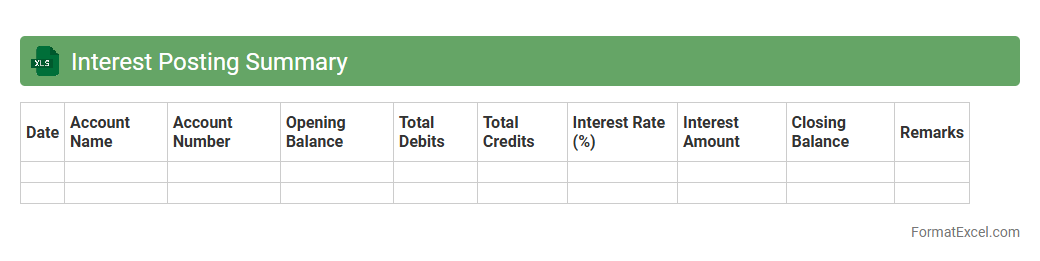

Interest Posting Summary

The

Interest Posting Summary Excel document consolidates all interest transactions within a specified period, providing a clear overview of accrued and posted interest amounts. It helps in tracking interest income or expense accurately, supporting financial reconciliation and audit processes. By offering detailed insights into interest activities, the summary enhances financial reporting and decision-making efficiency.

Understanding the Interest Statement Format in Excel

An interest statement in Excel is a structured document that tracks the interest accrued on loans or investments. It helps users visualize financial data clearly and make informed decisions. Mastering this format improves accuracy and efficiency in financial reporting.

Key Components of an Interest Statement

The critical elements of an interest statement include principal amount, interest rate, period, and calculated interest. Each component plays a vital role in determining the total interest accrued over time. Properly setting these elements ensures precise financial calculations.

Step-by-Step Guide to Creating an Interest Statement in Excel

Start by entering principal, interest rate, and time periods in separate columns. Use formulas to calculate interest for each period and summarize totals at the bottom. This step-by-step process creates a clear and functional interest statement template.

Essential Excel Formulas for Calculating Interest

Common formulas include simple interest = Principal x Rate x Time, and compound interest formulas like =P*(1+R)^T. Utilizing these Excel functions automates the interest calculation, reducing manual errors and saving time. Accurate formula usage is key to reliable financial data.

Customizing the Interest Statement Template

You can change column headers, formatting, and formulas to fit specific loan or investment scenarios. Adding conditional formatting highlights key data such as overdue interest or thresholds. Customization makes the template more usable and relevant for your needs.

Common Mistakes to Avoid in Excel Interest Statements

Errors like incorrect formulas, inconsistent date formats, and missing data can compromise accuracy. Always double-check cell references and ensure that rate and time units match. Avoiding these mistakes maintains the integrity of your interest statements.

Sample Interest Statement Template (Downloadable Excel File)

A downloadable template typically includes fields for principal, rates, periods, and a summary of interest accrued. Using a sample file helps users quickly set up their own statements with reliable defaults. These templates serve as a practical starting point for interest tracking.

Tips for Presenting Interest Data Clearly in Excel

Use tables, headers, and charts to make interest data easy to interpret. Clear labeling and consistent formatting enhance readability. Good presentation improves stakeholder understanding and decision-making.

Automating Interest Calculations Using Excel Functions

Functions like PMT, FV, and IPMT allow for more complex interest and payment computations. Automating these calculations saves time and reduces human error in financial management. Mastering Excel functions increases productivity and accuracy.

Best Practices for Maintaining Accurate Interest Records in Excel

Regularly update data, back up files, and audit formulas to ensure record integrity. Maintaining accuracy prevents costly financial misstatements and supports compliance. Good record-keeping with Excel is essential for financial management.