GST Invoice Summary

A

GST Invoice Summary Excel document consolidates all Goods and Services Tax invoices into a single, organized file, detailing invoice numbers, dates, taxable values, and tax amounts. This summary aids businesses in accurate tax filing, easy reconciliation, and quick verification of Input Tax Credit (ITC). It enhances financial transparency and streamlines compliance with GST regulations.

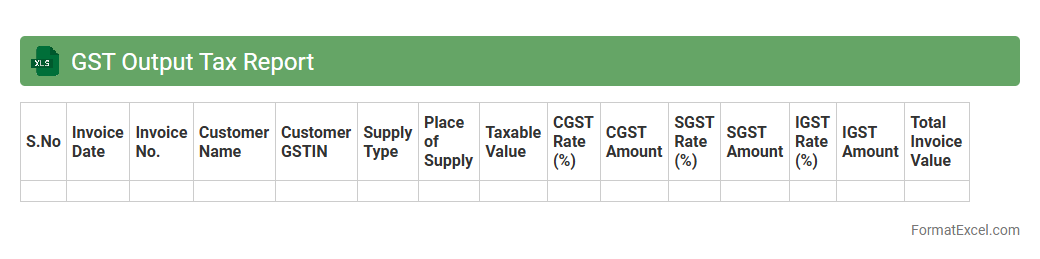

GST Output Tax Report

The

GST Output Tax Report Excel document provides a detailed summary of the Goods and Services Tax collected on sales during a specific period, helping businesses track their tax liabilities accurately. It consolidates transaction data to facilitate easy calculation of output tax, ensuring compliance with tax regulations and simplifying the filing process. This report is essential for businesses to manage cash flow effectively and avoid penalties by maintaining precise records of GST obligations.

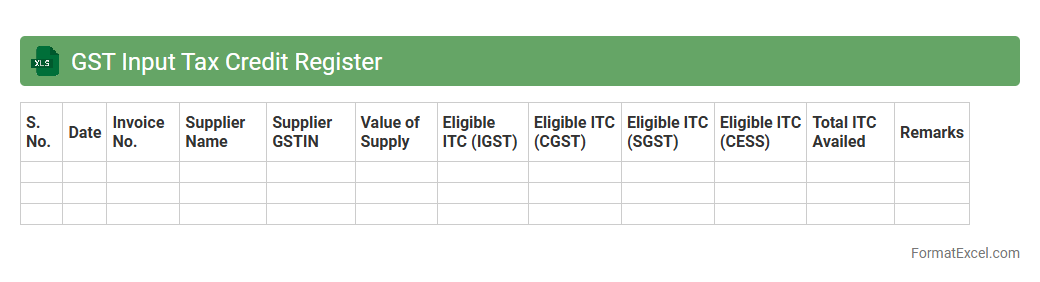

GST Input Tax Credit Register

The

GST Input Tax Credit Register Excel document is a comprehensive tool that tracks all input tax credits claimed by a business under the Goods and Services Tax regime. It helps maintain accurate records of GST paid on purchases, ensuring seamless reconciliation with GST returns and minimizing errors in tax filings. This register streamlines compliance by enabling easy verification of input credits, improving financial management and reducing the risk of penalties.

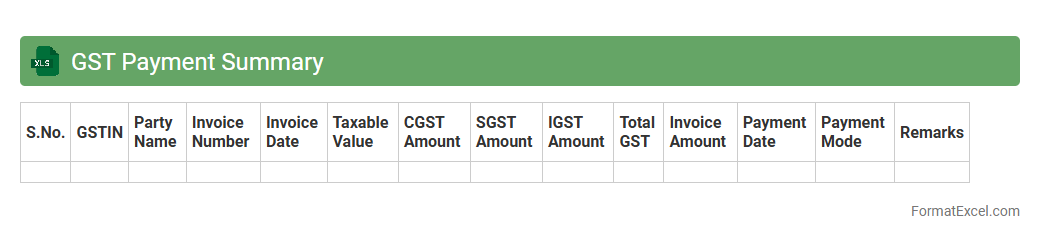

GST Payment Summary

The

GST Payment Summary Excel document provides a detailed record of all Goods and Services Tax transactions, including taxable supplies, input tax credits, and net GST payable or refundable for a specific period. It helps businesses accurately track their GST liabilities and ensures compliance with tax regulations by simplifying the calculation and reporting process. This document is essential for preparing GST returns, minimizing errors, and facilitating smooth audits by tax authorities.

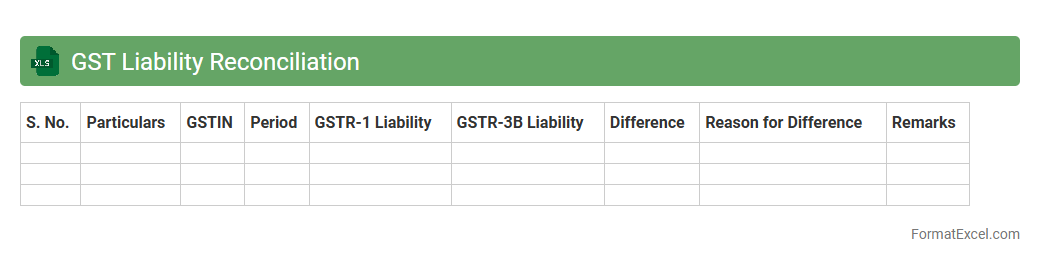

GST Liability Reconciliation

The

GST Liability Reconciliation Excel document is a vital tool used to match and verify the Goods and Services Tax liabilities recorded in accounting books with the GST returns filed. It helps businesses ensure accuracy in tax reporting, identify discrepancies between tax paid and reported, and avoid penalties by providing a clear reconciliation of input tax credits and output tax liabilities. This document streamlines GST compliance, aids in timely filing, and enhances financial transparency for auditors and tax authorities.

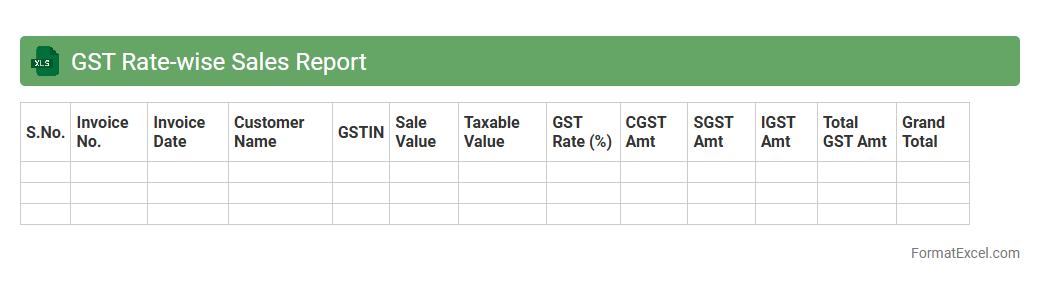

GST Rate-wise Sales Report

The

GST Rate-wise Sales Report Excel document categorizes sales transactions based on applicable GST rates, providing a detailed breakdown of taxable values and tax amounts for each rate slab. This report is essential for businesses to ensure accurate tax compliance, facilitate easier GST filing, and enable better financial analysis by identifying sales patterns across different GST rates. It helps streamline accounting processes and supports timely reconciliation of sales with GST returns.

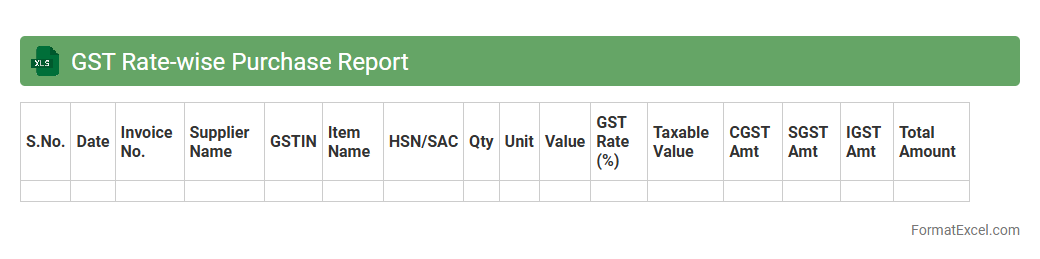

GST Rate-wise Purchase Report

The

GST Rate-wise Purchase Report Excel document categorizes purchases based on varying GST rates, providing a clear breakdown of taxes applied on different commodities or services. This report is essential for businesses to accurately track input tax credits, ensure compliance with GST regulations, and streamline financial audits. Utilizing this document helps optimize tax management and enhances the precision of accounting records.

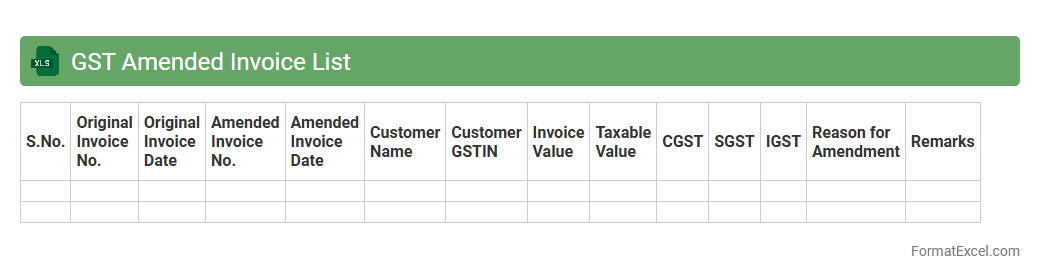

GST Amended Invoice List

The

GST Amended Invoice List Excel document is a comprehensive record of all updated or corrected invoices under the Goods and Services Tax system. It enables businesses to track modifications in invoice details such as invoice number, date, taxable value, and tax amount, ensuring accurate compliance with GST regulations. This document is essential for maintaining proper audit trails, facilitating efficient tax filing, and reducing discrepancies during GST return reconciliation.

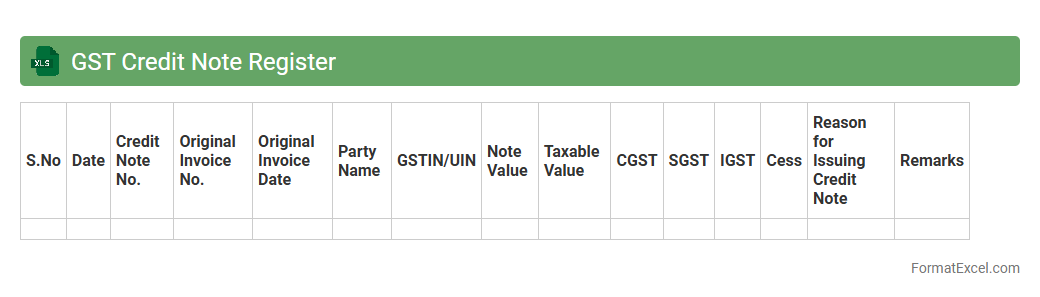

GST Credit Note Register

The

GST Credit Note Register Excel document is a detailed record of all credit notes issued and received under the Goods and Services Tax framework, capturing essential data such as credit note numbers, dates, supplier details, and taxable amounts. This register helps businesses maintain accurate GST compliance by tracking input tax credits and managing adjustments related to sales returns or invoice corrections. Utilizing this document ensures transparent audit trails, simplifies GST filing processes, and enhances financial reporting accuracy.

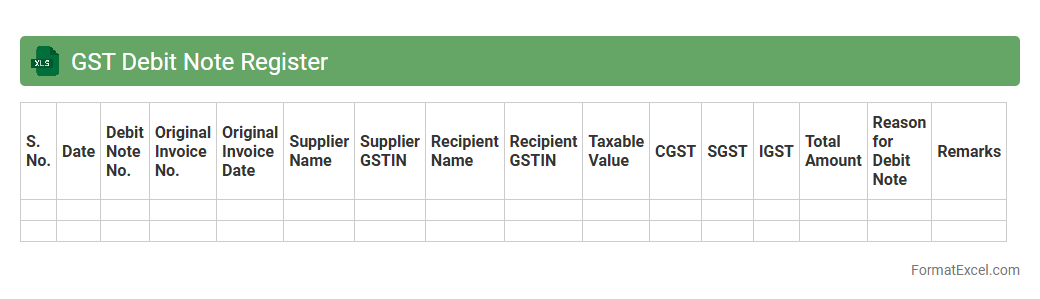

GST Debit Note Register

The

GST Debit Note Register Excel document is a comprehensive tool used to record and track all debit notes issued under the Goods and Services Tax (GST) framework. It helps businesses maintain accurate records of adjustments made to invoices, ensuring correct GST filing and compliance with tax regulations. Utilizing this register improves financial transparency and streamlines the reconciliation of GST returns.

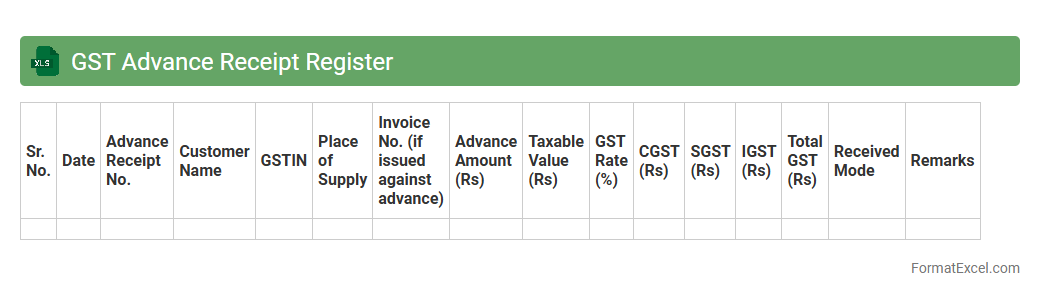

GST Advance Receipt Register

The

GST Advance Receipt Register Excel document systematically records advance payments received against goods and services, ensuring compliance with GST regulations. It helps track the date, amount, and client details for easy reconciliation during tax filing and audit processes. This register enhances financial accuracy and simplifies the preparation of GST returns by maintaining a well-organized record of all advance receipts.

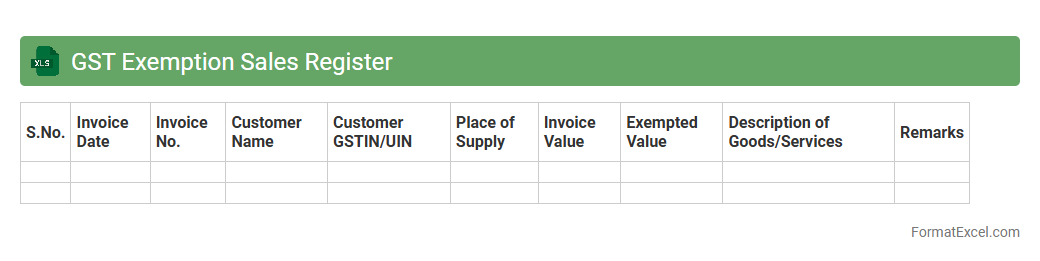

GST Exemption Sales Register

The

GST Exemption Sales Register Excel document is a detailed record that tracks all sales transactions exempt from Goods and Services Tax (GST) as per prevailing tax laws. It helps businesses maintain accurate compliance by segregating exempt sales, facilitating easier audit trails and tax reporting. This register aids in effective financial management and ensures proper documentation for GST authorities during inspections.

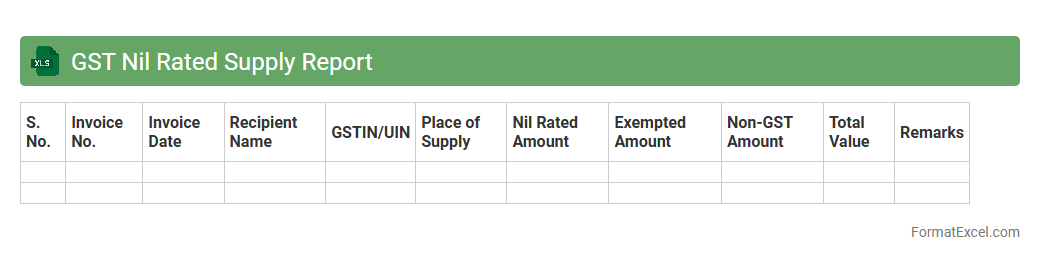

GST Nil Rated Supply Report

The

GST Nil Rated Supply Report Excel document summarizes all transactions with zero GST rate, helping businesses accurately track and report exempt supplies for tax compliance. This report ensures transparency in GST filings by segregating nil-rated goods and services, reducing errors and audit risks. It also facilitates efficient reconciliation of tax records, aiding in smooth returns submission to tax authorities.

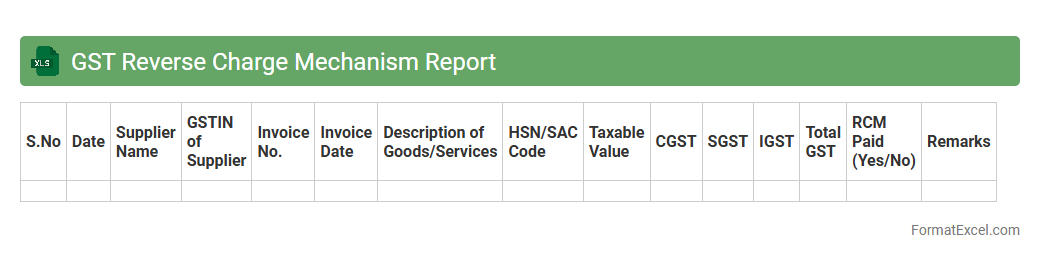

GST Reverse Charge Mechanism Report

The

GST Reverse Charge Mechanism Report Excel document is a tool designed to systematically record and track transactions subject to reverse charge under the Goods and Services Tax. It helps businesses ensure compliance by clearly documenting the tax liability shift from the supplier to the recipient, simplifying tax filing and audit processes. Utilizing this report enhances accuracy in tax reporting and aids in managing GST payments effectively.

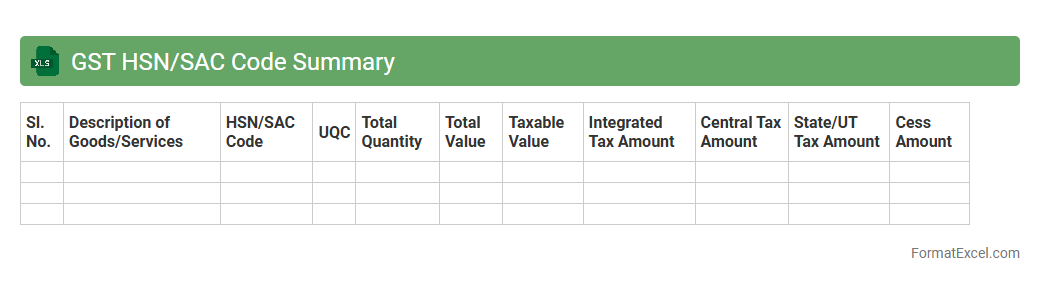

GST HSN/SAC Code Summary

The GST HSN/SAC Code Summary excel document contains a categorized list of

Harmonized System of Nomenclature (HSN) and Service Accounting Codes (SAC) used for goods and services under the Goods and Services Tax (GST) regime in India. It helps businesses streamline tax compliance by enabling accurate classification of products and services, ensuring correct GST rates are applied. This document simplifies auditing, filing returns, and enhances transparency in transaction reporting.

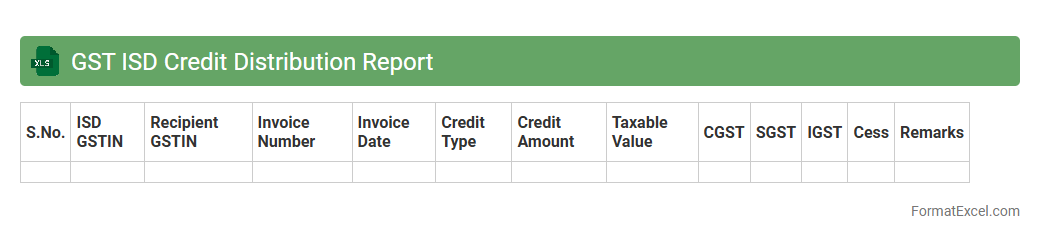

GST ISD Credit Distribution Report

The

GST ISD Credit Distribution Report Excel document provides a detailed summary of the Input Service Distributor (ISD) credit distribution under the Goods and Services Tax (GST) regime. It helps businesses track the allocation of input tax credits from a central unit to various branches, ensuring accurate tax compliance and efficient credit utilization. This report is essential for maintaining transparency in credit distribution and simplifying the reconciliation process during GST filings.

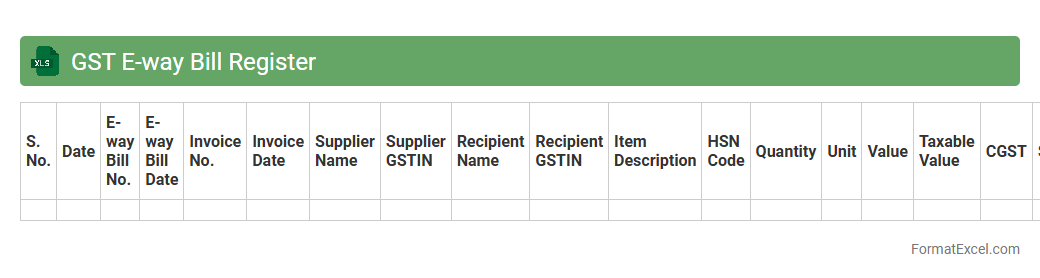

GST E-way Bill Register

The

GST E-way Bill Register Excel document is a structured tool used to record and track the movement of goods under the Goods and Services Tax (GST) regime, capturing details such as invoice number, transporter information, and E-way Bill number. It simplifies compliance by enabling businesses to maintain a systematic log of all dispatched goods, ensuring easy retrieval for audits and reducing the risk of penalties. This document enhances transparency and streamlines the reconciliation process between sales and E-way bills issued, improving overall supply chain management.

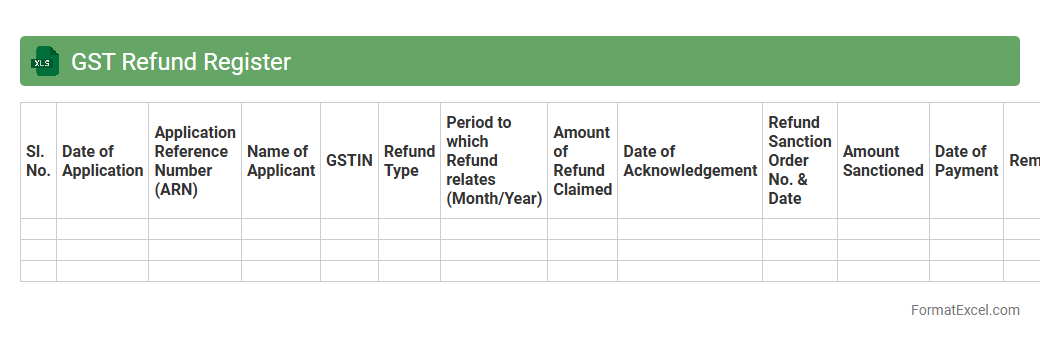

GST Refund Register

The

GST Refund Register Excel document systematically records all refund claims related to Goods and Services Tax, including details like invoice numbers, refund amounts, and application dates. This register helps businesses track the status and progress of their GST refund applications, ensuring timely follow-up and accurate reconciliation with financial statements. By maintaining comprehensive data, it facilitates compliance with tax authorities and aids in efficient cash flow management.

GST ITC Mismatch Report

The

GST ITC Mismatch Report Excel document identifies discrepancies between Purchase Register and GSTR-2A/2B data, highlighting mismatches in Input Tax Credit claims. This report helps businesses reconcile their ITC claims accurately, ensuring compliance with GST regulations and preventing potential notices or penalties from tax authorities. By using this tool, companies can optimize their tax credits and maintain transparent financial records.

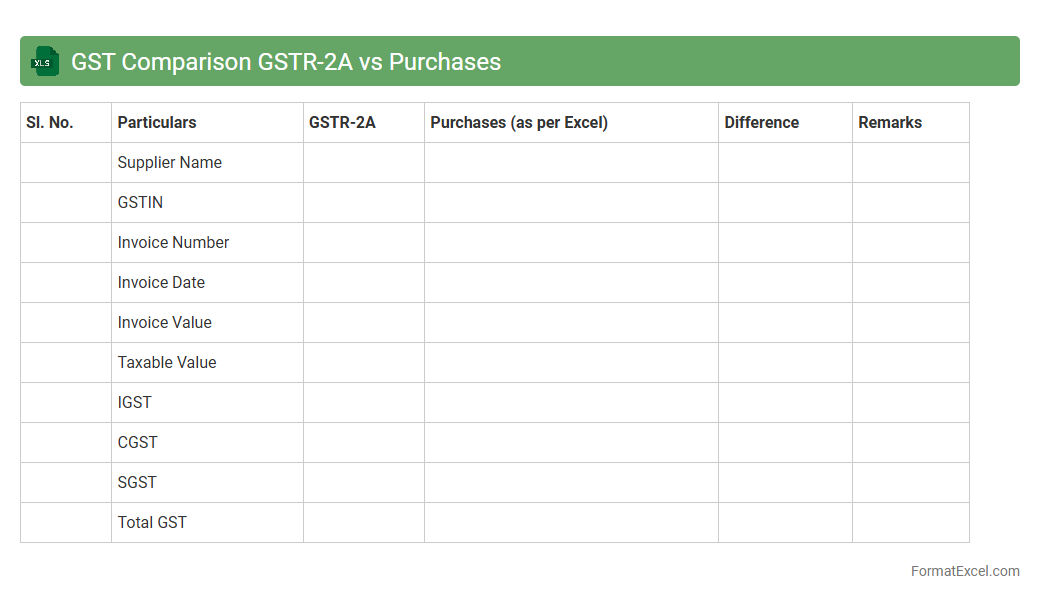

GST Comparison GSTR-2A vs Purchases

The

GST Comparison GSTR-2A vs Purchases Excel document is a tool designed to reconcile purchase data recorded in a taxpayer's books with the details available in the GSTR-2A form provided by suppliers. This comparison helps identify discrepancies such as missing invoices or incorrect tax credits, ensuring accurate tax filings and compliance with GST regulations. Using this document improves input tax credit claims and minimizes the risk of notices from tax authorities.

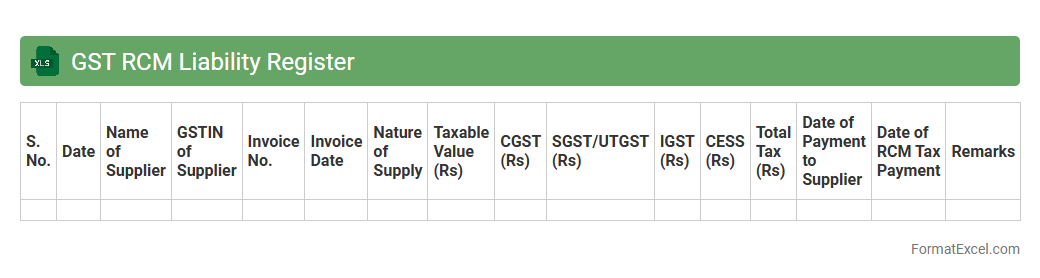

GST RCM Liability Register

The

GST RCM Liability Register Excel document is a comprehensive tool designed to track and manage Reverse Charge Mechanism (RCM) liabilities under the Goods and Services Tax (GST) system. It helps businesses accurately record RCM transactions, ensuring compliance with GST regulations and facilitating timely payment of tax liabilities. This register streamlines audit processes and enhances financial transparency by consolidating all RCM-related data in an organized, easy-to-access format.

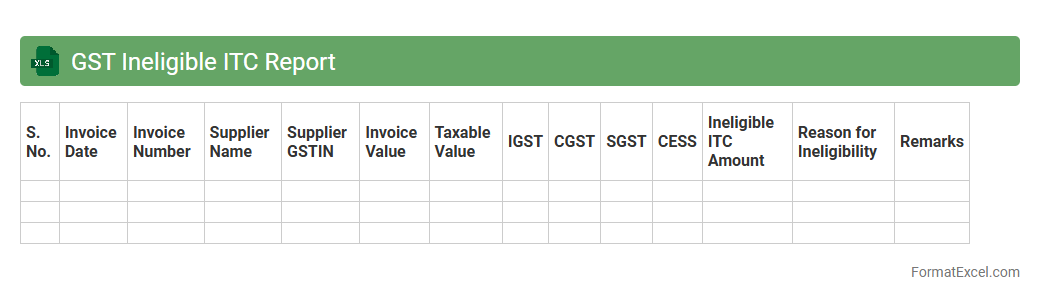

GST Ineligible ITC Report

The

GST Ineligible ITC Report Excel document is a detailed record that identifies input tax credits not eligible for claim under the Goods and Services Tax regulations. It helps businesses accurately track non-claimable expenses, ensuring compliance with GST laws and preventing financial losses due to incorrect credit claims. Utilizing this report enhances audit readiness and streamlines GST filing processes by maintaining clear segregation between eligible and ineligible ITC.

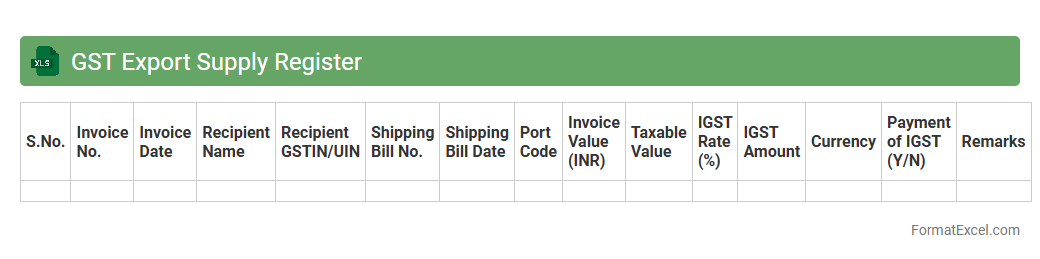

GST Export Supply Register

The

GST Export Supply Register Excel document is a detailed record that tracks all export transactions under the Goods and Services Tax system, ensuring accurate compliance and reporting. It helps businesses maintain organized data on export supplies, such as invoice details, GST rates, and tax amounts, facilitating seamless filing of GST returns and audits. Using this register streamlines tax management, reduces errors, and supports timely claims of export-related tax benefits.

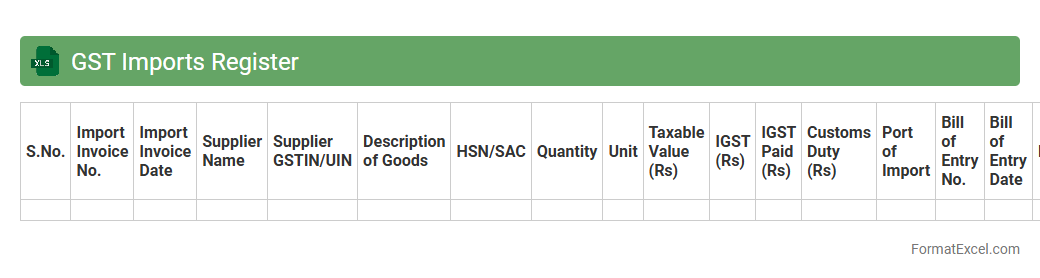

GST Imports Register

The

GST Imports Register Excel document is a detailed ledger used to record and track all imported goods subject to Goods and Services Tax (GST). It helps businesses maintain accurate records of import transactions, calculate input tax credit, and ensure compliance with GST regulations. Using this register optimizes audit processes and facilitates seamless filing of GST returns related to imports.

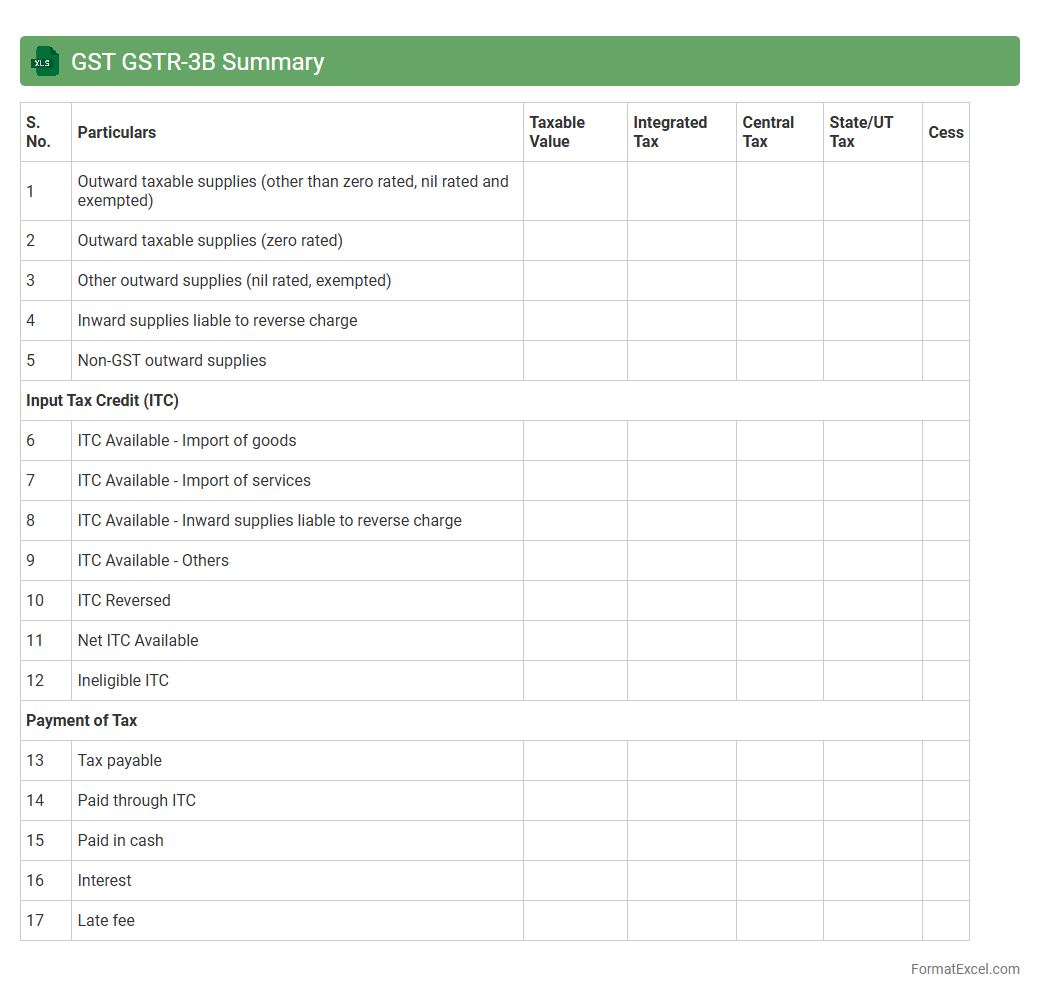

GST GSTR-3B Summary

The

GST GSTR-3B Summary Excel document consolidates monthly tax liabilities and payments under the Goods and Services Tax framework, providing a clear overview of outward supplies, inward supplies, input tax credit, and net tax payable. This summary enables businesses to accurately reconcile their tax returns, ensuring compliance with government regulations and avoiding penalties. It is useful for tracking GST payments, simplifying filing processes, and facilitating timely and error-free tax submissions.

Introduction to GST Statement Format

The GST statement format is a structured template used to report Goods and Services Tax transactions systematically. It ensures accurate data entry and easy submission of GST returns. This format is crucial for compliance with tax regulations.

Importance of GST Statement in Business

A well-maintained GST statement helps businesses track tax liabilities and input tax credits effectively. It aids in transparent financial reporting and smooth audits. Timely filing of GST statements ensures legal compliance and avoids penalties.

Key Components of a GST Statement

The key components include invoice details, taxable value, GST rates, CGST, SGST, IGST amounts, and the total tax paid. Each element plays a vital role in summarizing GST transactions. Accurate inclusion of these components guarantees precise tax calculations.

Essential Columns for GST Statement in Excel

Important columns to include are Invoice Number, Date, Customer Name, Taxable Amount, GST Rate, CGST, SGST, IGST, and Total Tax. These columns help organize data efficiently for easy analysis. Adding a remarks column can also clarify transaction specifics.

Step-by-Step Guide to Creating GST Statement in Excel

Begin by setting up column headers for all required data fields. Use formulas to calculate tax values automatically, such as GST = Taxable Amount x GST Rate. Finally, apply filters and formatting to enhance readability and data analysis.

Sample GST Statement Format in Excel

A sample GST statement typically includes all invoice and tax details arranged in tabular form. It serves as a reference for preparing your own statement. Sample formats help familiarize users with the necessary data inputs and layout.

Tips for Customizing GST Statement Templates

Adapt templates by adding your company logo and specific tax codes. Incorporate drop-down menus for GST rates to minimize entry errors. Customize columns based on the nature of your business transactions for better tracking.

Common Errors in GST Statement Preparation

Common mistakes include incorrect tax calculations, missing invoice details, and inconsistent GST rates. Data entry errors often lead to discrepancies causing compliance issues. Regular review and validation of data minimize these errors.

Best Practices for Maintaining GST Statements

Maintain accurate and timely entries to streamline filing and audits. Backup your GST statements regularly to prevent data loss. Use software tools or Excel templates to ensure consistency and reduce manual errors.

Downloadable GST Statement Excel Templates

Many websites offer free downloadable GST statement Excel templates for businesses of all sizes. These templates are customizable and designed to meet compliance requirements. Using ready-made templates saves time and improves accuracy.