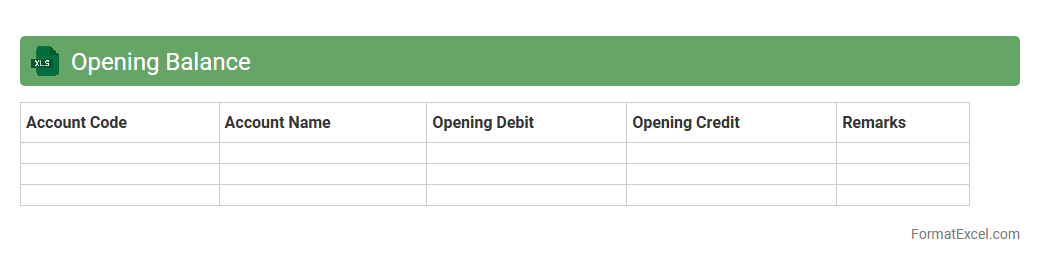

Opening Balance

An

Opening Balance Excel document records the initial amounts of assets, liabilities, or equity at the start of an accounting period, providing a clear financial snapshot. This document is essential for accurate bookkeeping, helping businesses track their financial position and reconcile subsequent transactions. Using an Opening Balance sheet ensures consistency and precision in financial reporting and decision-making.

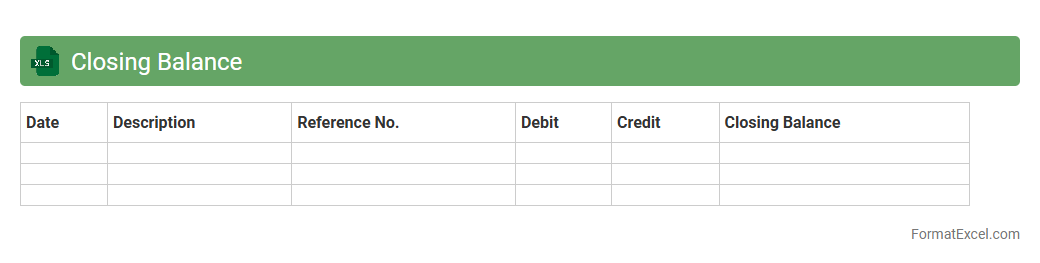

Closing Balance

The

Closing Balance Excel document is a financial tool that records the ending amount in an account after all transactions within a specific period have been accounted for. It helps businesses and individuals track their financial position by showing the net balance, facilitating accurate budgeting, and cash flow analysis. This document enhances financial planning by providing a clear snapshot of available funds, enabling better decision-making and efficient management of resources.

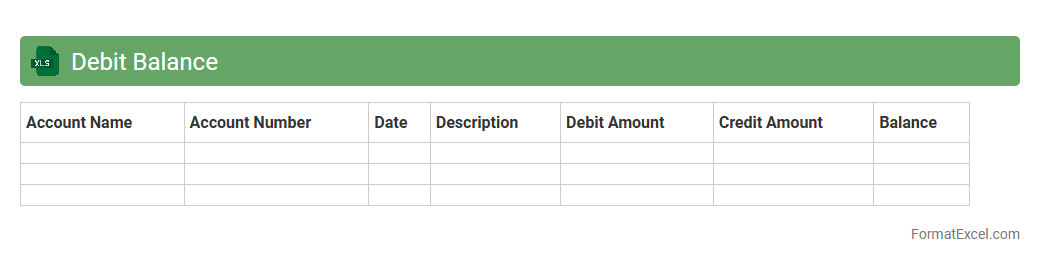

Debit Balance

A

Debit Balance Excel document is a spreadsheet used to track and manage debit transactions, showing amounts owed by customers or accounts with negative balances. It helps businesses maintain accurate financial records, monitor outstanding payments, and streamline accounting processes for improved cash flow management. This tool is essential for ensuring transparency in financial reporting and enhancing decision-making based on up-to-date debit data.

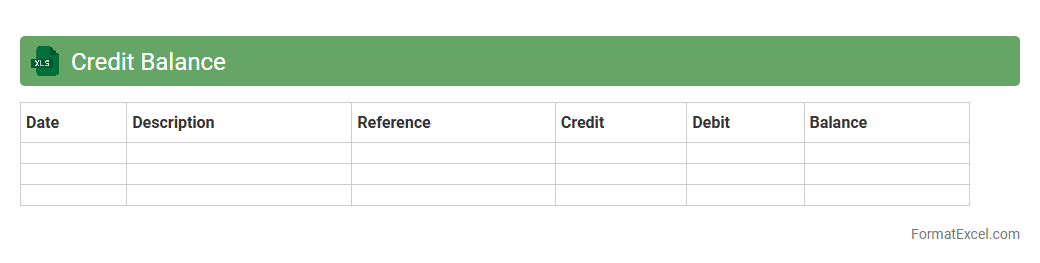

Credit Balance

A

Credit Balance Excel document is a spreadsheet that tracks and manages credit balances across multiple accounts or customers, allowing businesses to monitor outstanding credits efficiently. It provides a clear overview of amounts owed, helping to reconcile accounts, prevent errors, and streamline financial reporting. Using this document enhances accuracy in tracking credit transactions and supports informed decision-making in financial management.

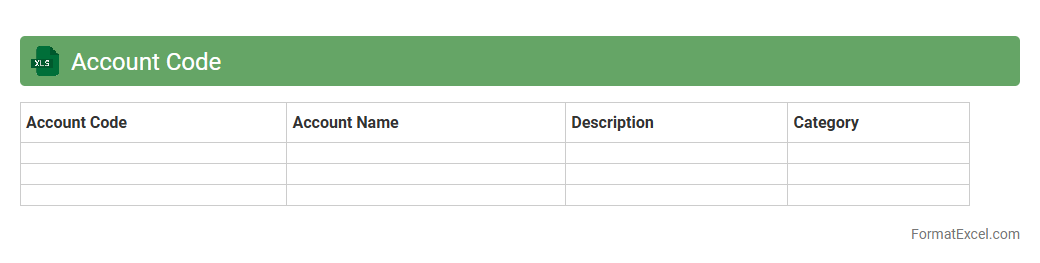

Account Code

An

Account Code Excel document is a structured spreadsheet that categorizes financial transactions using unique account codes to facilitate accurate tracking and reporting. It enables businesses to organize expenses, revenues, and other financial data for streamlined accounting processes and clear financial analysis. By using this document, organizations can improve budgeting, ensure compliance, and generate detailed financial statements efficiently.

Account Name

An

Account Name Excel document is a structured spreadsheet used to organize and track account names alongside relevant financial or business data. It enhances data management by allowing easy sorting, filtering, and updating of account information, which improves accuracy and efficiency in financial reporting or client management. This tool is essential for businesses to maintain clear records and streamline account reconciliation processes.

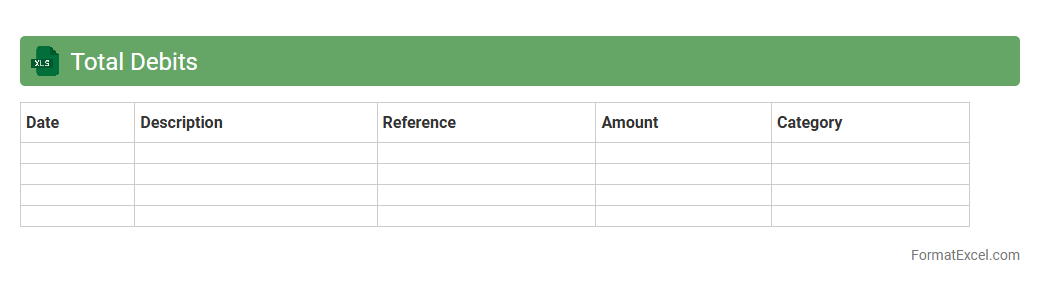

Total Debits

The

Total Debits Excel document is a detailed record of all debit transactions within a specified period, consolidating financial data for accurate tracking and analysis. It helps businesses monitor cash outflows, manage budgets, and identify trends in expenses to improve financial decision-making. Using this document streamlines accounting processes, reduces errors, and enhances transparency in financial reporting.

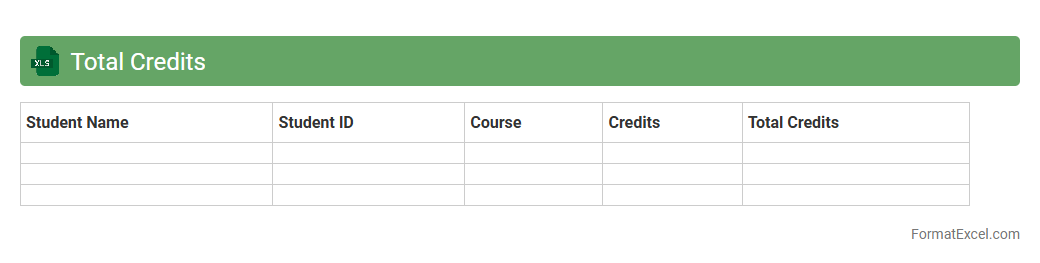

Total Credits

The

Total Credits Excel document is a comprehensive tool designed to track and sum all credit transactions across various accounts or projects efficiently. It allows users to monitor financial inflows, manage budgets, and generate detailed reports that facilitate informed decision-making. By consolidating credit data in one place, this document enhances transparency and accuracy in financial management processes.

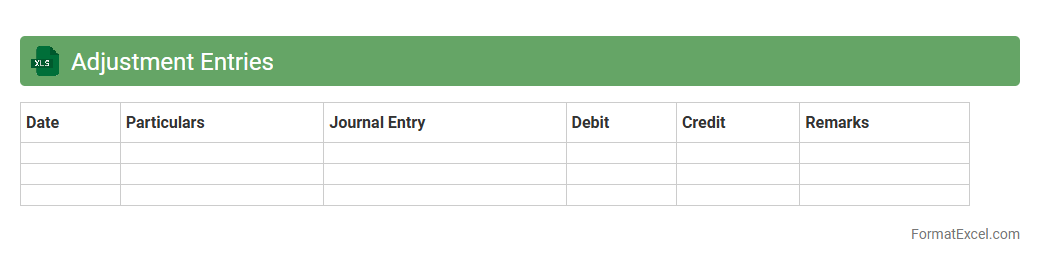

Adjustment Entries

An

Adjustment Entries Excel document is a financial tool designed to record and track corrections or modifications in accounting records, ensuring accuracy in financial statements. It is useful for identifying discrepancies, updating account balances, and maintaining compliance with accounting standards. This document streamlines audit processes and supports precise financial reporting by providing a clear log of all necessary adjustments.

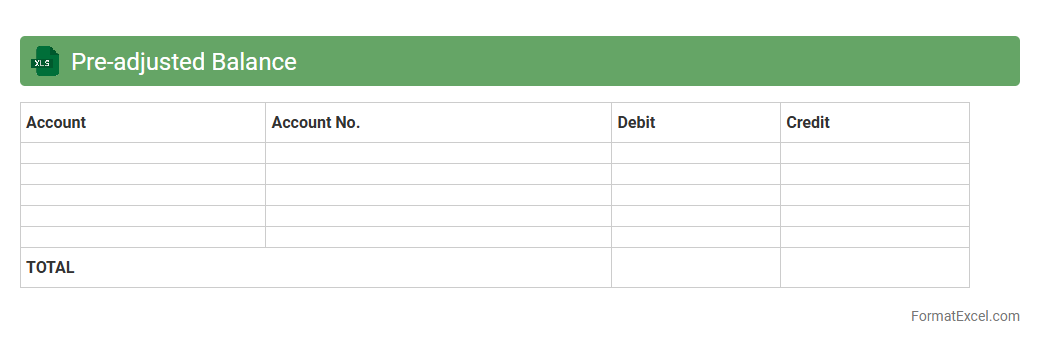

Pre-adjusted Balance

A

Pre-adjusted Balance Excel document serves as a preliminary financial record that shows the balances of all accounts before any adjustments are made at the end of an accounting period. It helps accountants identify discrepancies and ensures that debits and credits are balanced before preparing adjusted entries. This document is useful for maintaining accuracy in financial statements and streamlining the closing process.

Post-adjusted Balance

The

Post-adjusted Balance Excel document is a financial tool used to record and reconcile account balances after adjustments such as corrections, accruals, or reclassifications have been made. It ensures accuracy by reflecting updated figures that support accurate financial reporting and auditing processes. This document is useful for tracking changes, verifying account integrity, and preparing reliable financial statements.

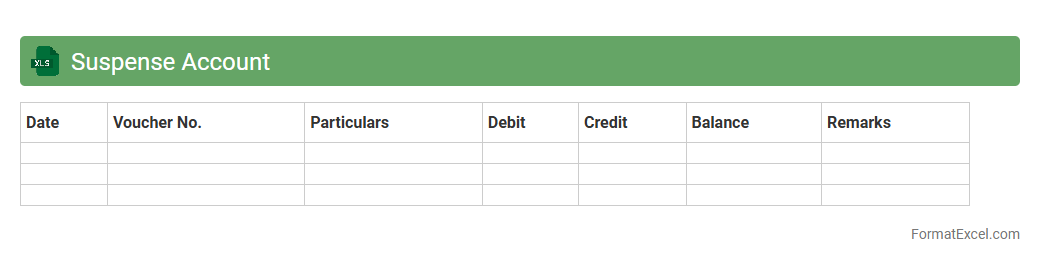

Suspense Account

A

Suspense Account Excel document is a financial tool used to temporarily record transactions when there is uncertainty about their proper classification. It helps maintain accurate accounting records by holding unclear entries until their correct accounts are identified. This document streamlines reconciliation processes and ensures organized financial management by preventing errors or misstatements in the ledger.

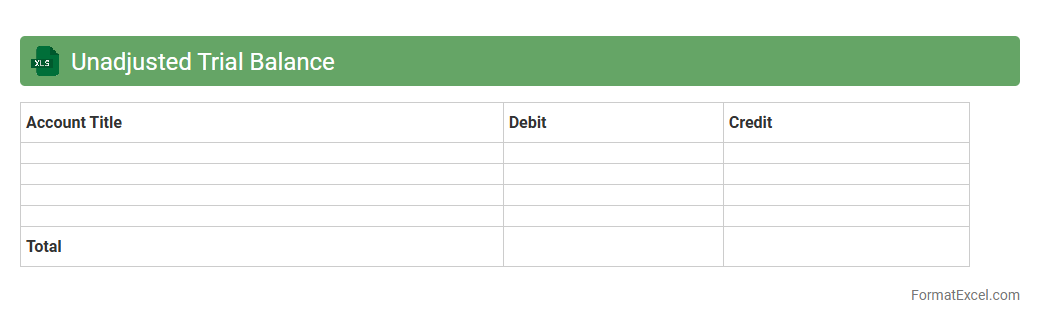

Unadjusted Trial Balance

An

Unadjusted Trial Balance Excel document is a financial report listing all ledger account balances before adjusting entries, helping ensure debits equal credits. It is useful for detecting accounting errors, organizing accounts, and providing a clear snapshot of financial data for the next step in the accounting cycle. This tool streamlines the process of preparing financial statements and maintaining accurate bookkeeping records.

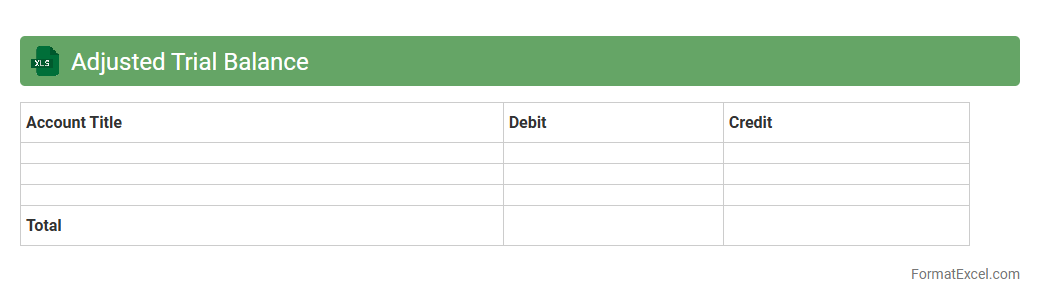

Adjusted Trial Balance

An

Adjusted Trial Balance Excel document compiles all ledger accounts with their adjusted debit and credit balances after accounting for necessary adjustments such as accruals, deferrals, and errors. This document is essential for verifying the accuracy of electrical journal entries and ensuring that the total debits equal total credits, providing a reliable foundation for preparing accurate financial statements. By organizing adjustments systematically, it enhances financial transparency and aids in error detection during the accounting cycle.

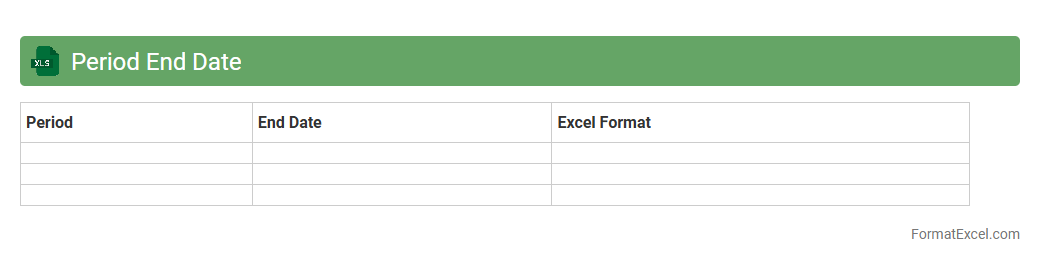

Period End Date

The

Period End Date Excel document tracks the closing dates of financial or operational periods, enabling accurate reporting and reconciliation. It helps businesses maintain consistency in data analysis, ensuring timely submission of reports and compliance with accounting standards. By organizing period end dates, companies can streamline audit processes and improve decision-making based on precise period-specific information.

Prepared By

A

Prepared By Excel document is a spreadsheet specifically designed to organize and present data compiled by an individual or team, often including details such as names, dates, and roles responsible for the content. It is useful for tracking accountability and ensuring transparency in data management, making collaboration and audit processes more efficient. This type of document facilitates clear communication and helps maintain a structured record of who prepared the information, enhancing overall project management and data integrity.

Reviewed By

A

Reviewed By Excel document is a structured spreadsheet used to track and document feedback, approvals, and revisions made by reviewers during a project or document review process. It helps organize reviewer comments, dates, and statuses in a clear format, enabling efficient collaboration and accountability. This tool enhances project transparency and ensures that all inputs are systematically captured and addressed.

Date Prepared

The

Date Prepared in an Excel document refers to the specific date when the spreadsheet was last created or updated, providing a crucial timestamp for data accuracy and version control. This information helps users track the currency of the data, ensuring decision-making is based on the most recent information. By referencing the Date Prepared, teams can coordinate workflows and maintain accountability in collaborative projects.

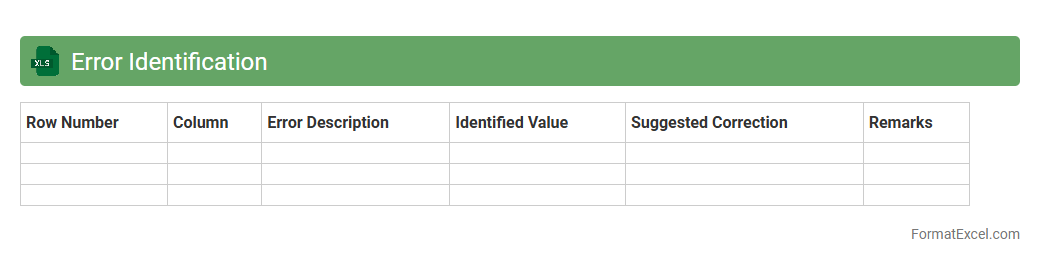

Error Identification

An

Error Identification Excel document is a specialized spreadsheet designed to systematically detect, log, and analyze errors within data sets or processes. It streamlines the process of pinpointing inconsistencies, enabling quicker resolution and improved data accuracy. This tool is essential for maintaining data integrity, enhancing workflow efficiency, and supporting better decision-making in business operations.

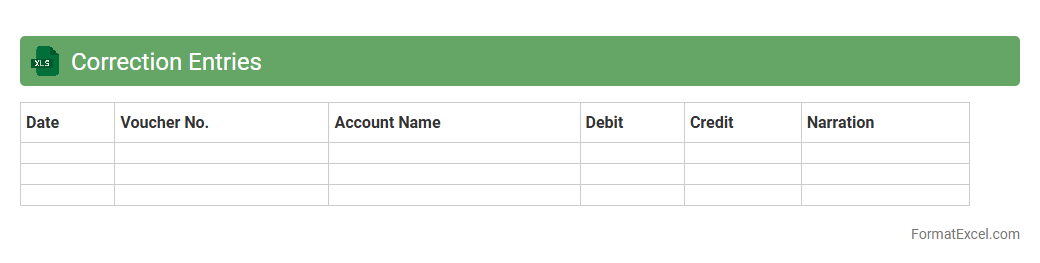

Correction Entries

Correction Entries Excel document is a structured file used to record and adjust financial transactions, ensuring accuracy in accounting records. It helps identify and rectify errors such as incorrect amounts, dates, or accounts, maintaining the integrity of financial statements. By providing a clear audit trail, the

Correction Entries Excel enhances transparency and facilitates efficient financial management.

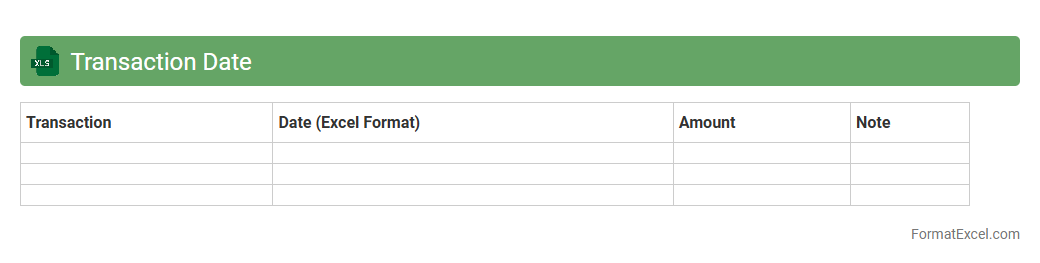

Transaction Date

A

Transaction Date Excel document records the specific dates on which financial or business transactions occur, allowing for accurate tracking and analysis of cash flow and activity. It helps businesses monitor sales, purchases, and payments, ensuring timely reconciliation of accounts and better financial management. By organizing data chronologically, it supports forecasting, auditing, and compliance processes efficiently.

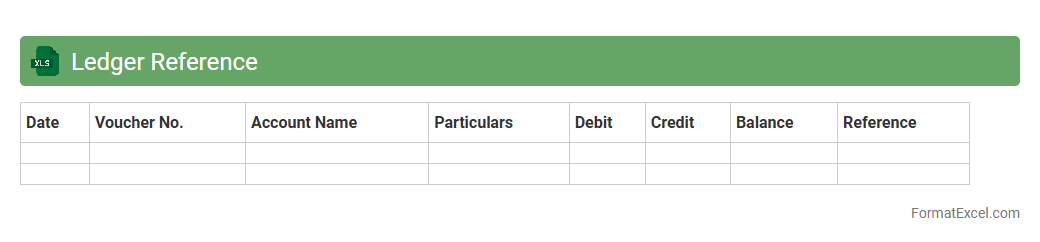

Ledger Reference

A

Ledger Reference Excel document is a structured spreadsheet that records and tracks financial transactions, enabling efficient account management. It serves as a comprehensive tool for organizing debit and credit entries, ensuring accuracy in financial reporting and simplifying reconciliation processes. Utilizing this document enhances financial transparency and aids in quick auditing and decision-making.

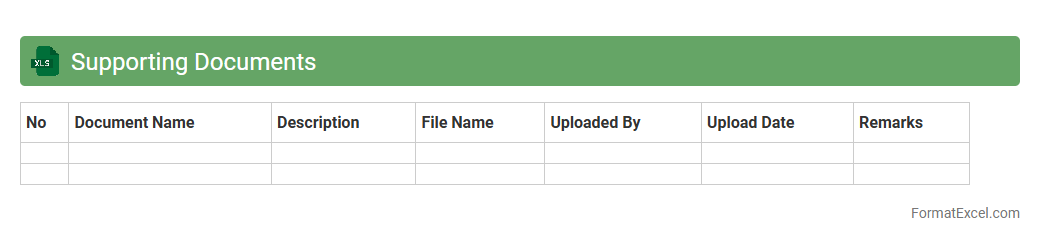

Supporting Documents

A

Supporting Documents Excel document is a structured file used to organize, track, and reference essential documents related to a project, transaction, or process. It facilitates easy access, verification, and management of files such as contracts, invoices, receipts, and certificates, ensuring compliance and audit readiness. By consolidating critical supporting documents in one location, it enhances efficiency, reduces errors, and supports transparent record-keeping.

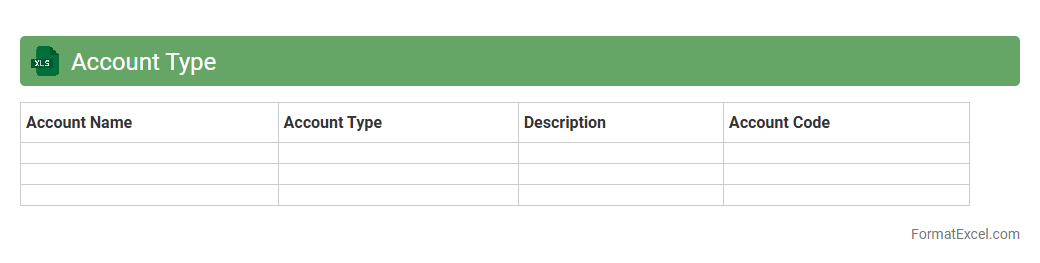

Account Type

An

Account Type Excel document categorizes financial accounts such as assets, liabilities, equity, revenue, and expenses to streamline bookkeeping and reporting processes. It helps businesses maintain organized financial records, enabling efficient tracking of transactions and easier preparation of financial statements. This structure supports accurate budgeting, auditing, and financial analysis, enhancing overall fiscal management.

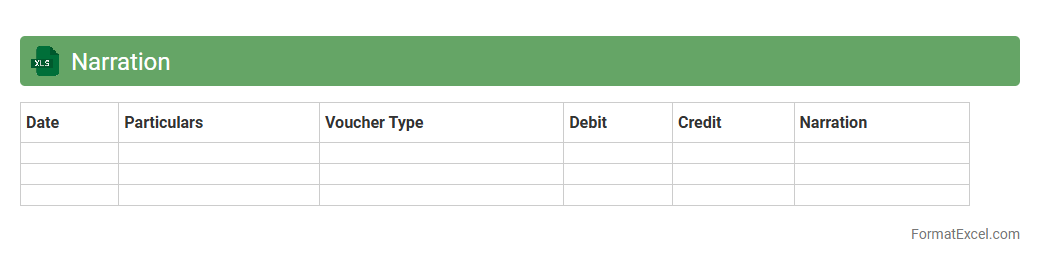

Narration

A

Narration Excel document is a spreadsheet where users input detailed descriptions or comments related to financial transactions, enhancing clarity and record-keeping. It helps in tracking the purpose of entries, facilitates auditing, and improves communication among team members by providing context to raw data. Utilizing narration in Excel ensures accurate documentation and easier reconciliation of accounts.

Introduction to Trial Balance Statement

A trial balance statement is a summary of all ledger accounts' debit and credit balances, ensuring that total debits equal total credits. It serves as a fundamental step in the accounting cycle to verify the accuracy of bookkeeping. This statement helps detect errors before preparing final financial statements.

Importance of Trial Balance in Accounting

The trial balance plays a crucial role in confirming the ledger's arithmetic accuracy and identifying discrepancies in accounts. It acts as a checkpoint, helping accountants prevent errors from affecting financial reports. Without it, compiling reliable financial statements becomes challenging.

Key Components of a Trial Balance Statement

A typical trial balance includes account names, debit balances, and credit balances arranged systematically. Each account's balance is listed, ensuring debits and credits match to maintain accounting equation integrity. It provides a clear snapshot of all accounts at a point in time.

Benefits of Using Excel for Trial Balance

Using Excel enhances accuracy and efficiency in preparing a trial balance statement. The spreadsheet's formulas automate addition and error-checking, reducing manual mistakes. Excel also allows customization, easy updates, and data visualization.

Step-by-Step Guide to Creating a Trial Balance in Excel

Start by listing all ledger accounts with their debit and credit balances in columns. Use Excel formulas like SUM to calculate totals and confirm equality of debits and credits for accuracy verification. Regularly update the sheet to reflect ledger changes during the accounting period.

Main Columns Required in the Trial Balance Format

The trial balance format in Excel commonly includes Account Name, Debit Balance, and Credit Balance columns. Additional columns like Account Number or Description can aid in detailed tracking. Proper column setup ensures clear data interpretation and error identification.

Sample Trial Balance Statement Format in Excel

A sample trial balance in Excel features account names on the left, with two columns for debit and credit balances respectively. Totals are shown at the bottom to verify that debits equal credits, indicating a balanced ledger. This structure helps accountants easily review account status.

Common Errors in Trial Balance and How to Avoid Them

Common errors include transposed numbers, incorrect entries, or forgetting ledger balances. Using Excel's formula audits to cross-verify totals and reconcile discrepancies helps prevent these mistakes. Regular reconciliations and double-checking entries further ensure data accuracy.

Tips for Automating Calculations in Excel

Use functions like SUM, IFERROR, and conditional formatting to automate trial balance calculations and highlight anomalies. Creating dynamic ranges and templates streamlines updates and reduces manual input. Automation minimizes risks of human error and saves time.

Downloadable Trial Balance Excel Template

Download a ready-made trial balance Excel template to quickly start compiling financial data accurately. These templates have pre-built formulas, standard formats, and are customizable to meet specific accounting needs. They simplify the process of maintaining ledger accuracy and financial reporting.